Isbank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isbank Bundle

Isbank faces a dynamic competitive landscape shaped by the bargaining power of its customers and the constant threat of new entrants. Understanding these forces is crucial for navigating the Turkish banking sector.

The complete report reveals the real forces shaping Isbank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Depositors, from individuals with savings accounts to major corporations, are Isbank's main source of capital. Their ability to negotiate is shaped by the competitive interest rates prevalent in Turkey's banking landscape and the appeal of other investment options. In 2024, the Central Bank of the Republic of Turkey's (CBRT) monetary policy adjustments and its push for de-dollarization directly influenced the appeal of Turkish Lira deposits, consequently affecting the leverage depositors hold.

Isbank's reliance on advanced IT infrastructure, including digital banking platforms and robust cybersecurity, grants considerable leverage to technology and IT service providers. The specialized nature of these critical services, coupled with the substantial expenses and complexities involved in migrating core banking systems, significantly strengthens the suppliers' bargaining position.

The constant evolution of digital channels necessitates Isbank's dependence on these vendors for maintaining a competitive edge and ensuring operational efficiency. For instance, the global IT services market was valued at approximately $1.3 trillion in 2023, with a projected growth rate of around 7% annually, highlighting the significant economic power of these providers.

The availability of skilled human capital, especially in digital transformation, data analytics, and cybersecurity, significantly affects Isbank's operational efficiency. A shortage of specialized talent in these crucial banking sectors empowers employees, driving up recruitment and retention expenses for the bank.

Regulatory Bodies and Compliance Frameworks

Regulatory bodies like Turkey's Central Bank (CBRT) and the Banking Regulation and Supervision Agency (BRSA) significantly influence Isbank's operational landscape, acting as powerful suppliers of the regulatory framework. Their directives on capital adequacy, lending practices, and risk management directly impact the bank's cost of doing business and strategic maneuverability.

These agencies set the rules of engagement, dictating how Isbank can operate, lend, and manage its capital. For instance, the BRSA's prudential regulations, such as those concerning loan loss provisioning and capital requirements, can increase operational costs and limit the bank's ability to pursue certain growth strategies.

- Capital Adequacy Ratios: Isbank, like other Turkish banks, must adhere to Basel III standards, requiring specific capital-to-risk-weighted assets ratios. As of Q1 2024, the Turkish banking sector's average capital adequacy ratio stood at approximately 17.5%, a figure influenced by BRSA's oversight.

- Lending Limits and Restrictions: Regulations often impose limits on sector-specific lending or large exposures, constraining a bank's portfolio diversification and potential returns.

- Compliance Costs: Meeting the stringent reporting and operational requirements mandated by these bodies incurs significant compliance costs, adding to Isbank's overhead.

Wholesale Funding and Interbank Market

For major financial institutions like Isbank, securing wholesale funding from interbank markets and international channels is crucial for maintaining liquidity. The strength of these suppliers' bargaining power hinges on several factors, including global liquidity levels, Isbank's own financial standing and credit rating, and the broader interest rate landscape, which is significantly shaped by the Central Bank of the Republic of Turkey's (CBRT) monetary policy decisions. These policies are primarily geared towards controlling inflation and managing the pace of credit expansion within the economy.

In 2024, the Turkish banking sector, including Isbank, continued to navigate a complex monetary policy environment. The CBRT's efforts to combat inflation, which remained a primary concern throughout the year, directly influenced interbank lending rates. For instance, the policy rate, a key benchmark, saw adjustments in response to inflation data. In early 2024, the policy rate was around 42.5%, and by mid-year, it had been raised further to manage persistent inflationary pressures. This environment meant that the cost of wholesale funding could fluctuate considerably, impacting Isbank's profitability and operational flexibility.

- Global Liquidity Conditions: In 2024, global liquidity remained a mixed bag. While some major economies saw tightening monetary policies, others maintained more accommodative stances, creating regional variations in funding costs for Turkish banks.

- Isbank's Creditworthiness: Isbank's credit ratings, assessed by international agencies, played a pivotal role. A strong credit profile generally translates to better access to funding and more favorable terms, even in a challenging market.

- CBRT Monetary Policy: The CBRT's policy rate decisions directly impacted the cost of borrowing in the domestic interbank market. For example, a higher policy rate generally leads to higher interbank rates, increasing wholesale funding costs for banks like Isbank.

Isbank faces supplier power from various sources, including depositors, IT service providers, and regulatory bodies. Depositors' leverage is influenced by competitive interest rates and alternative investments, with 2024's de-dollarization efforts by the CBRT impacting their negotiating strength. Specialized IT providers hold significant sway due to the critical nature and migration costs of core banking systems, a sector valued at $1.3 trillion globally in 2023. Regulatory agencies like the CBRT and BRSA act as powerful suppliers of the operational framework, imposing compliance costs and capital requirements that affect Isbank's strategic flexibility.

| Supplier Type | Key Factors Influencing Power | Impact on Isbank |

|---|---|---|

| Depositors | Interest rates, alternative investments, CBRT de-dollarization policy (2024) | Affects cost of capital and funding strategy |

| IT Service Providers | Specialized services, migration costs, global IT market growth (~7% annually) | Increases operational costs, dependence on technology |

| Regulatory Bodies (CBRT, BRSA) | Capital adequacy ratios (e.g., ~17.5% sector average Q1 2024), lending limits, compliance costs | Dictates operational parameters, increases overhead, limits growth strategies |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Isbank's banking operations in Turkey.

Isbank's Porter's Five Forces Analysis offers a visual, actionable roadmap to navigate competitive pressures, transforming complex market dynamics into clear strategic insights.

Customers Bargaining Power

Individual Isbank customers are significantly more empowered today, thanks to readily available information and sophisticated digital banking tools. This increased transparency, coupled with low switching costs for many standard banking services, allows consumers to easily compare offerings and switch providers. For instance, in 2024, the number of active digital banking users in Turkey continued its upward trend, with many consumers actively seeking out the best rates and user experiences.

Small and Medium-sized Enterprises (SMEs) represent a crucial customer base for Isbank, frequently seeking bespoke and adaptable financial products. Their concentrated need for attractive interest rates and personalized offerings, particularly when banks face growth limitations, amplifies their leverage in negotiations.

Large corporate clients, by their very nature, wield considerable influence over Isbank. Their substantial transaction volumes and intricate service requirements, spanning areas like investment banking and global trade finance, give them significant leverage.

Isbank finds itself in a competitive arena, striving to win and keep these crucial customers. This often means tailoring services and providing special pricing, a direct response to the bargaining power these clients possess.

For instance, in 2024, major Turkish corporations engaging in cross-border transactions or requiring complex financial instruments would likely negotiate fees and service levels aggressively, knowing their business is highly sought after by multiple financial institutions.

Influence of Service Quality and Multi-Channel Access

Isbank's extensive multi-channel presence, including over 600 branches and a robust ATM network, coupled with its advanced digital banking platforms, significantly influences customer expectations. This comprehensive accessibility means customers can easily compare service quality and digital features across institutions.

Customers' power is amplified by the ease with which they can switch banking providers. If Isbank's service quality or digital offerings fall short of expectations, customers can readily move their business, compelling the bank to maintain high standards.

- Customer Expectations: Isbank's multi-channel strategy, featuring over 600 branches and advanced digital platforms, sets a high bar for service quality and seamless user experience.

- Switching Costs: Low perceived switching costs empower customers to demand superior service and digital innovation, as they can easily move to competitors.

- Digital Engagement: As of Q1 2024, Isbank reported a significant increase in digital transaction volumes, highlighting the growing importance of its online and mobile platforms in meeting customer demand and influencing their bargaining power.

Availability of Non-Bank Alternatives

The rise of non-bank financial services, often powered by fintech, significantly boosts customer bargaining power against traditional banks like Isbank. These alternatives, including payment apps, peer-to-peer lending, and direct investment platforms, offer customers more choices and reduce their dependence on established institutions.

This increased competition forces Isbank to be more competitive on pricing and service quality. For instance, the global fintech market was valued at over $2.4 trillion in 2023 and is projected to grow substantially, indicating a strong shift towards these alternative providers.

- Fintech Adoption: In 2024, a significant portion of consumers are actively using or considering fintech solutions for payments and investments, directly challenging traditional banking models.

- Reduced Switching Costs: Digital platforms make it easier and faster for customers to switch providers, increasing pressure on Isbank to maintain customer loyalty through superior offerings.

- Price Sensitivity: The availability of transparently priced fintech services makes customers more sensitive to fees and interest rates charged by incumbent banks.

- Innovation Demands: Isbank must continuously innovate its digital services and product portfolio to match the agility and customer-centricity of fintech challengers.

Customers hold considerable sway over Isbank, driven by increased access to information and user-friendly digital tools. This transparency, coupled with low switching costs for many basic banking needs, allows consumers to easily compare and move between providers. In 2024, the number of active digital banking users in Turkey continued to rise, with many actively seeking the best rates and user experiences.

The bank's extensive multi-channel presence, including over 600 branches and a robust ATM network, alongside advanced digital platforms, shapes customer expectations. This accessibility enables customers to readily compare service quality and digital features across different financial institutions, further amplifying their bargaining power.

The growing popularity of fintech alternatives, offering payment apps and investment platforms, significantly enhances customer leverage against traditional banks like Isbank. These alternatives provide more choices and reduce reliance on established institutions, forcing Isbank to remain competitive on pricing and service quality.

| Customer Segment | Leverage Factors | Impact on Isbank |

|---|---|---|

| Individual Consumers | Information access, digital tools, low switching costs | Pressure on standard product pricing, demand for superior digital experience |

| SMEs | Need for tailored products, price sensitivity | Negotiation on loan rates, customized service packages |

| Large Corporations | High transaction volumes, complex needs | Significant influence on fees, service level agreements, and product development |

| Fintech Users | Alternative offerings, ease of switching | Increased competition, need for innovation in digital services and pricing |

Preview Before You Purchase

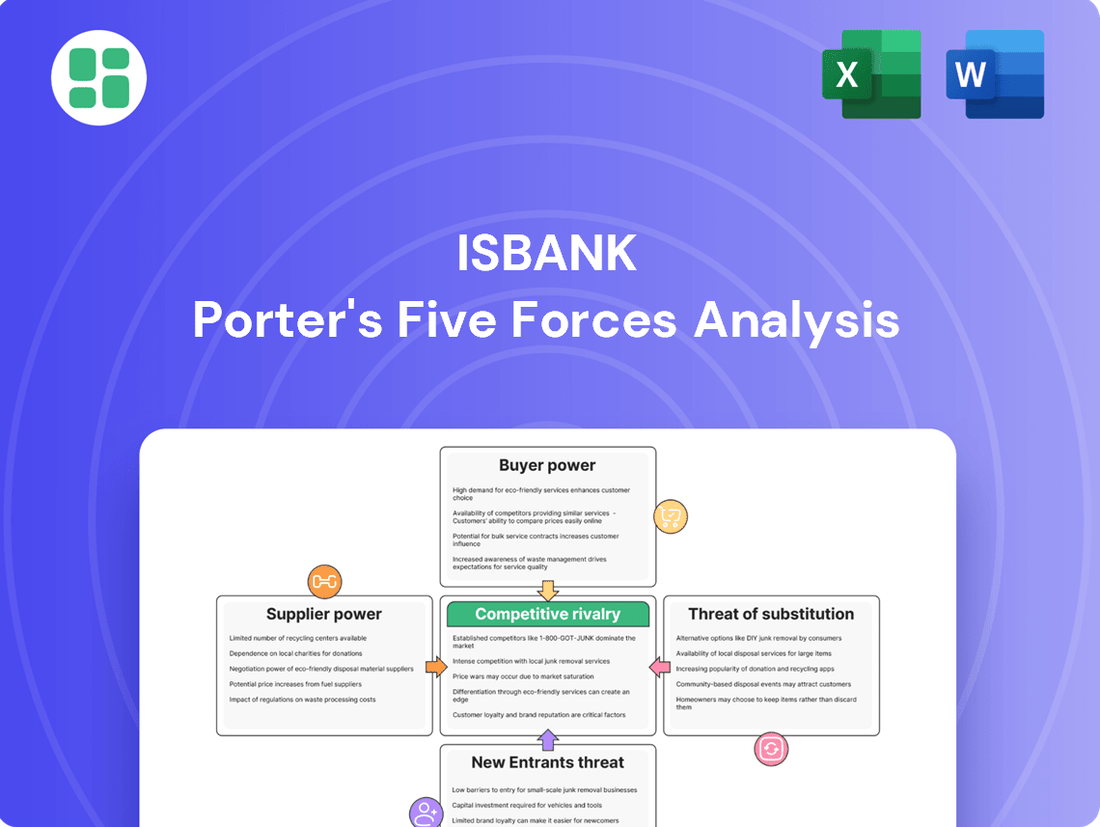

Isbank Porter's Five Forces Analysis

This preview showcases the comprehensive Isbank Porter's Five Forces Analysis, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into the Turkish banking sector's competitive landscape.

Rivalry Among Competitors

The Turkish banking sector is a crowded arena, with Isbank facing off against a multitude of competitors. This includes formidable state-owned banks, agile private domestic players, and established foreign institutions.

As the largest private bank in Turkey by total assets, loans, and deposits, Isbank navigates a mature market where the battle for market share is relentless. For instance, as of the first quarter of 2024, the Turkish banking sector's total assets reached approximately 27.4 trillion Turkish Lira, highlighting the sheer scale and competitive intensity.

This intense rivalry compels banks like Isbank to constantly innovate and refine their pricing strategies to attract and retain customers, ensuring they remain competitive in a dynamic environment.

The Central Bank of the Republic of Turkey's (CBRT) tight monetary policy, including elevated interest rates and caps on loan growth, has significantly shaped the competitive landscape for banks like Isbank. This environment forces banks to meticulously manage funding costs and actively seek out profitable lending avenues within these regulatory constraints, intensifying rivalry.

For instance, in early 2024, Turkey's benchmark interest rate stood at 45%, a stark indicator of the tight monetary stance. This policy directly impacts a bank's cost of funds and influences the pricing of loans, making efficient capital management and strategic lending crucial for maintaining profitability amidst heightened competition.

In the banking sector, core products like savings accounts and loans are increasingly becoming commodities, making it difficult for institutions like Isbank to stand out solely on product features. This commoditization means competition often shifts to the quality of service provided, the sophistication of digital platforms, and the availability of niche or specialized financial solutions.

Isbank's strategy involves utilizing its broad physical branch network and expanding digital presence to reach a wide customer base. However, to truly differentiate in this competitive landscape, continuous and significant investment in cutting-edge technology and enhancing the overall customer experience is paramount. For instance, in 2023, Isbank reported a 78.3% increase in digital banking transactions compared to the previous year, highlighting the growing importance of their digital channels.

Disruption from Digital Banking and Fintech

The Turkish banking landscape is experiencing a significant shift due to digital banking and fintech. This disruption intensifies competition, forcing established players like Isbank to adapt quickly. New digital-only banks and agile fintech firms are entering the market with innovative, often lower-cost, offerings.

Isbank's strong digital customer base, exceeding 14 million active digital users as of early 2024, is a crucial advantage. However, to stay ahead, the bank must continuously invest in technology and digital services to counter the rapid innovation cycles of these new entrants. This means a constant focus on user experience and the development of new digital products.

- Digitalization Trend: By the end of 2023, digital channels accounted for approximately 90% of Isbank's transaction volume.

- Fintech Growth: The number of fintech companies operating in Turkey has seen a substantial increase, with over 500 active players by mid-2024, many focusing on payments and lending.

- Customer Expectations: Consumers increasingly expect seamless, mobile-first banking experiences, putting pressure on traditional banks to match the agility of digital-native competitors.

Economic Volatility and Asset Quality Pressures

Isbank faces intense competitive rivalry, particularly amplified by economic volatility in Turkey. Fluctuations in inflation and interest rates directly impact the profitability and asset quality of all banks operating in the market, creating a challenging environment for sustained performance.

The accelerating trend of non-performing loans (NPLs), especially within retail segments, exerts significant pressure. For instance, in Q1 2024, the NPL ratio for Turkish banks saw an upward tick, reflecting these broader economic headwinds. This necessitates robust risk management frameworks and resilient loan portfolios as key differentiators.

- Economic Volatility: Turkish inflation reached 69.8% year-on-year in May 2024, impacting consumer spending and loan repayment capacity.

- Asset Quality Pressure: The cost of risk (CoR) for the Turkish banking sector increased in early 2024, indicating higher provisions needed for potential loan losses.

- Competitive Imperative: Banks demonstrating superior risk assessment and capital adequacy are better positioned to navigate these pressures and gain market share.

Isbank operates in a highly competitive Turkish banking sector, facing pressure from state-owned, private domestic, and foreign banks. This intense rivalry, evident in the sector's 27.4 trillion Turkish Lira in total assets by Q1 2024, forces constant innovation in pricing and service to attract and retain customers.

The market's commoditization of core products like loans and savings accounts means differentiation relies heavily on digital platforms and customer experience. Isbank's digital transaction volume surge, up 78.3% in 2023, highlights the importance of this shift, especially with over 500 fintechs active by mid-2024.

Economic volatility, with inflation at 69.8% in May 2024, further intensifies competition by impacting asset quality and loan repayment capacity. Banks with robust risk management, like Isbank, are better positioned to navigate these challenges and maintain market share.

| Competitor Type | Key Characteristics | Impact on Isbank |

|---|---|---|

| State-Owned Banks | Large market share, government backing | Price competition, broad reach |

| Private Domestic Banks | Agile, strong customer relationships | Innovation in digital services, niche offerings |

| Foreign Banks | Global expertise, specialized products | Competition for high-net-worth individuals and corporate clients |

| Fintech Companies | Digital-first, lower cost structures | Disruption of traditional banking services, focus on user experience |

SSubstitutes Threaten

The growing popularity of fintech payment solutions presents a substantial threat to Isbank's established payment services. Applications like digital wallets and various online payment platforms offer users simpler and often faster ways to conduct transactions, bypassing traditional banking channels.

These fintech alternatives can siphon off transaction volumes that would otherwise generate fee income for Isbank, impacting revenue streams from card processing and interbank transfers. For instance, in 2024, the global digital payments market was projected to reach over $10 trillion, highlighting the scale of this shift away from traditional methods.

The rise of peer-to-peer (P2P) lending and crowdfunding platforms presents a significant threat of substitutes for Isbank's traditional lending services. These platforms directly connect borrowers, including individuals and small to medium-sized enterprises (SMEs), with a pool of lenders, bypassing the need for conventional banking channels for various loan types.

In 2024, the global P2P lending market was projected to reach over $140 billion, with crowdfunding also experiencing robust growth. This indicates a substantial and expanding alternative for financing that directly competes with Isbank's core business, offering potentially faster access to capital and different borrower experiences.

The rise of direct investment and wealth management platforms presents a significant threat of substitutes for Isbank. Online brokerage accounts, robo-advisors, and direct investment apps empower individuals to manage their own portfolios, bypassing traditional bank offerings. For instance, the global robo-advisor market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in how individuals approach wealth management.

This accessibility diverts investment capital away from Isbank's traditional channels, directly impacting its wealth management and investment banking revenues. As more investors opt for these user-friendly, often lower-cost digital solutions, Isbank faces increased pressure to innovate and offer competitive alternatives or risk losing market share in its advisory services.

Emergence of Digital Currencies and Decentralized Finance (DeFi)

The rise of digital currencies, including potential Central Bank Digital Currencies (CBDCs) like a Digital Turkish Lira, and the expansion of decentralized finance (DeFi) built on blockchain technology, represent significant potential substitutes for conventional banking services. These evolving financial technologies could reshape how transactions are conducted, potentially bypassing traditional financial intermediaries. For instance, by mid-2024, global DeFi total value locked (TVL) surpassed $100 billion, indicating substantial user adoption and a growing alternative financial ecosystem.

The ongoing development and potential adoption of CBDCs, coupled with the rapid growth of DeFi platforms, pose a threat by offering alternative avenues for saving, lending, and transacting. This disintermediation risk could impact traditional banks' revenue streams and market share. For example, the Bank for International Settlements (BIS) reported in 2024 that 90% of central banks were exploring or developing CBDCs, highlighting the global momentum behind these digital alternatives.

- Digital Currencies (CBDCs): Offer a government-backed digital alternative to cash and traditional bank deposits.

- Decentralized Finance (DeFi): Provides peer-to-peer financial services like lending and borrowing without traditional banks, often leveraging blockchain technology.

- Potential Impact: These substitutes could reduce reliance on traditional banking infrastructure, affecting transaction fees and customer relationships.

- Market Trends: The increasing global exploration and development of CBDCs and the growing TVL in DeFi signal a significant shift in the financial landscape.

Non-Bank Financial Institutions and Captive Finance

Specialized non-bank financial institutions, such as leasing and factoring companies, present a significant threat by offering highly focused credit services that can directly substitute traditional bank loans for businesses. These entities often cater to specific industry needs or provide more flexible terms, potentially drawing clients away from Isbank.

The rise of captive finance divisions within large corporations also intensifies this threat. By managing their own funding or extending credit to their customers, these corporations reduce their reliance on external banking partners like Isbank for corporate lending. For instance, in 2023, the global captive finance market was valued at over $1.5 trillion, indicating a substantial portion of financing that bypasses traditional banks.

- Leasing and Factoring Companies: Offer specialized credit solutions that compete with traditional bank loans.

- Captive Finance Divisions: Large corporations internalize financing, reducing dependence on external banks.

- Market Size: The global captive finance market exceeded $1.5 trillion in 2023, highlighting a significant alternative to bank lending.

The increasing adoption of digital payment solutions, from mobile wallets to online platforms, offers consumers and businesses convenient alternatives to traditional banking transactions. These fintech innovations can directly compete with Isbank's payment processing services, potentially reducing fee-based revenue. By 2024, the global digital payments market was expected to exceed $10 trillion, underscoring the significant shift towards these substitutes.

Peer-to-peer lending and crowdfunding platforms provide alternative avenues for individuals and businesses to secure financing, bypassing conventional bank loans. This trend directly challenges Isbank's core lending business. The global P2P lending market alone was projected to surpass $140 billion in 2024, demonstrating the substantial scale of these substitute financial channels.

The proliferation of robo-advisors and direct investment apps empowers individuals to manage their wealth independently, posing a threat to Isbank's wealth management services. The global robo-advisor market, valued at approximately $2.5 billion in 2023, is a clear indicator of this growing trend. These platforms offer accessible, often lower-cost alternatives to traditional advisory services.

Emerging digital currencies, including potential Central Bank Digital Currencies (CBDCs) and the growing Decentralized Finance (DeFi) ecosystem, represent significant substitutes for traditional banking functions. By mid-2024, the total value locked in DeFi surpassed $100 billion, showcasing a rapidly expanding alternative financial landscape. This disintermediation risk could impact Isbank's transaction and deposit-based revenues.

| Substitute Type | Description | Market Indicator (2024 Projections/Recent Data) | Potential Impact on Isbank |

| Fintech Payment Solutions | Digital wallets, online payment platforms | Global digital payments market > $10 trillion | Reduced transaction fee income |

| P2P Lending & Crowdfunding | Direct lending and fundraising platforms | Global P2P lending market > $140 billion | Loss of loan origination and interest income |

| Robo-Advisors & Direct Investment Apps | Automated and self-directed investment platforms | Global robo-advisor market ~$2.5 billion (2023) | Decreased assets under management and advisory fees |

| Digital Currencies & DeFi | CBDCs, blockchain-based financial services | DeFi Total Value Locked > $100 billion (mid-2024) | Disintermediation of traditional banking services |

Entrants Threaten

Entering Turkey's full-service banking sector requires immense capital, creating a formidable barrier for newcomers. Even digital banks need significant funds for licensing, infrastructure, and establishing credibility.

The Turkish banking sector is heavily regulated by bodies such as the Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT). These authorities enforce intricate licensing processes, demanding compliance with numerous regulations and subjecting banks to ongoing supervision. For instance, in 2023, the BRSA continued its rigorous oversight, with new banking licenses being exceptionally rare, underscoring the difficulty for new players to enter the market.

Established brand loyalty and trust are significant barriers for new entrants looking to compete with incumbents like Isbank. Isbank, having served customers for decades, has cultivated deep-rooted brand recognition and a strong sense of trust, which are invaluable in the financial sector. For instance, Isbank's customer base in Turkey is substantial, reflecting years of consistent service and relationship building.

Economies of Scale and Network Effects

Isbank's formidable presence, boasting over 1,000 branches and ATMs, alongside a substantial digital footprint of 16.7 million customers as of early 2024, creates a powerful barrier to entry. This extensive physical and digital network generates significant economies of scale, allowing Isbank to spread operational costs over a vast customer base, thereby lowering its average cost per transaction. Newcomers find it incredibly challenging and capital-intensive to establish a comparable level of reach and accessibility, directly impacting their ability to compete on price or service breadth.

Furthermore, the network effects inherent in Isbank's large customer base act as a deterrent. As more customers use Isbank's services, the value of those services increases for all users, whether through enhanced digital platforms, wider ATM availability, or more robust peer-to-peer transaction capabilities. This creates a self-reinforcing cycle that new entrants struggle to break into, as they lack the critical mass of users needed to offer a similarly attractive proposition.

- Economies of Scale: Isbank's vast infrastructure reduces per-unit costs, making it difficult for new banks to match pricing.

- Network Effects: A large customer base enhances service value, creating a loyalty loop that new entrants must overcome.

- Capital Requirements: Replicating Isbank's physical and digital reach demands substantial upfront investment, deterring smaller competitors.

- Customer Inertia: Existing customers are less likely to switch from a well-established and convenient banking ecosystem.

Costly Technological Infrastructure and Cybersecurity

The immense cost of building and maintaining advanced technological infrastructure, especially robust cybersecurity, presents a formidable barrier for new entrants in the banking sector. For instance, in 2024, global spending on cybersecurity solutions for financial services was projected to reach hundreds of billions of dollars, reflecting the critical need for secure digital operations. New players must invest heavily to match the digital capabilities and regulatory compliance standards of established institutions.

This high entry cost is further amplified by the constant need for upgrades and innovation to stay competitive. Consider that major banks are continuously investing billions annually in digital transformation initiatives, a significant portion of which is allocated to technology and security. Without such substantial capital, new entrants would struggle to offer the seamless, secure, and feature-rich digital banking experiences that customers now expect.

- Substantial upfront investment in secure, scalable IT infrastructure.

- Ongoing high costs for cybersecurity measures and technology upgrades.

- Need for specialized IT and cybersecurity expertise, adding to operational expenses.

- Regulatory compliance demands significant technological investment for new entrants.

The threat of new entrants into Turkey's banking sector, particularly concerning Isbank, is significantly low due to substantial barriers. These include immense capital requirements for licensing and infrastructure, stringent regulatory hurdles overseen by entities like the BRSA, and the powerful brand loyalty and trust Isbank has cultivated over decades. The sheer scale of Isbank's physical and digital presence, coupled with network effects, creates a formidable challenge for any new player aiming to compete effectively.

| Barrier Type | Description | Impact on New Entrants | Isbank's Position |

|---|---|---|---|

| Capital Requirements | High upfront investment for licensing, infrastructure, and operations. | Deters smaller or less-funded entities. | Established capital base and access to funding. |

| Regulatory Hurdles | Strict licensing, compliance, and ongoing supervision by BRSA and CBRT. | Slows down market entry and increases initial costs. | Proven track record of regulatory compliance. |

| Brand Loyalty & Trust | Decades of service build strong customer relationships and confidence. | Makes customer acquisition difficult for new players. | Extensive, loyal customer base built over time. |

| Economies of Scale & Network Effects | Vast branch/ATM network and large digital customer base (16.7 million as of early 2024) reduce per-unit costs and increase service value. | Challenges new entrants in matching pricing and service breadth. | Significant cost advantages and enhanced service offerings due to scale. |

Porter's Five Forces Analysis Data Sources

Our Isbank Porter's Five Forces analysis is built upon comprehensive data from Isbank's annual reports, investor presentations, and official company disclosures. We also incorporate insights from reputable financial news outlets and industry-specific publications that cover the Turkish banking sector.