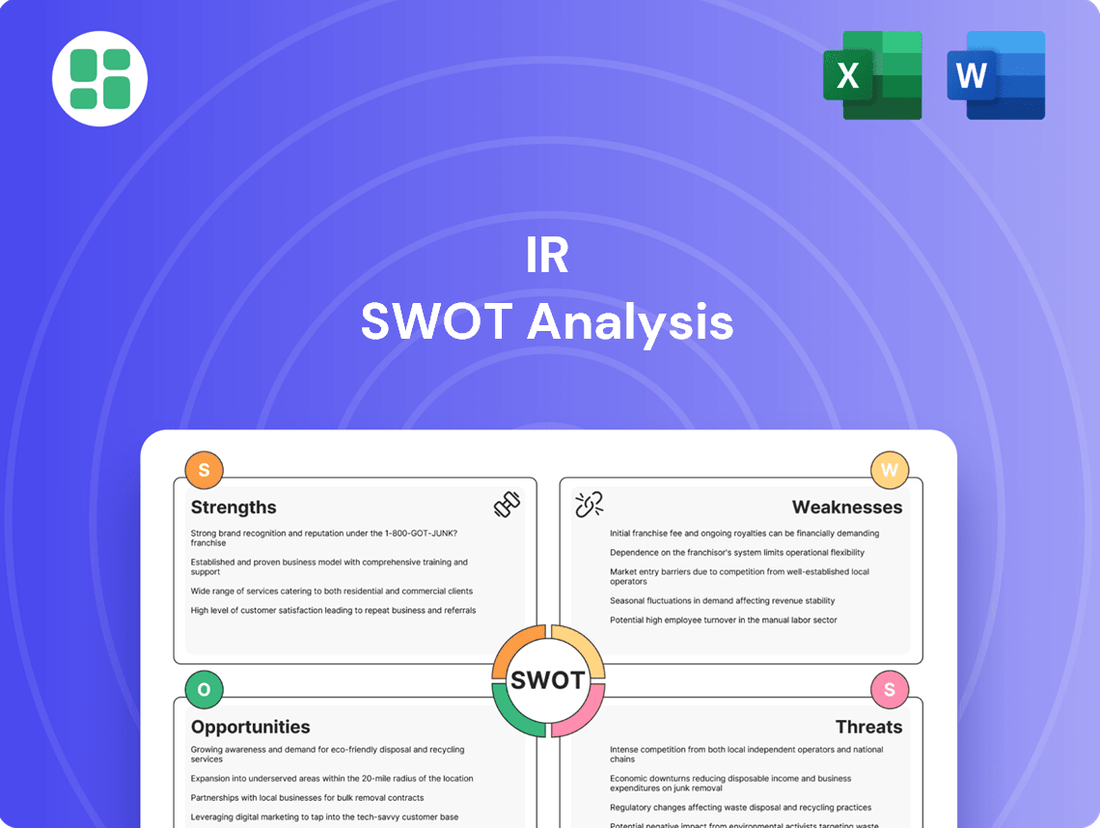

IR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IR Bundle

Uncover the hidden strengths and potential pitfalls that shape the company's future. Our comprehensive SWOT analysis provides a critical look at its internal capabilities and external market forces.

Ready to transform insights into action? Purchase the full SWOT analysis to access detailed strategic recommendations, financial context, and editable templates designed for confident decision-making.

Strengths

Ingersoll Rand boasts a robust and diversified product portfolio, encompassing essential flow creation and industrial solutions like air compressors, pumps, blowers, vacuum systems, power tools, and material handling equipment. This broad offering caters to a wide spectrum of global end markets, including manufacturing, energy, healthcare, and infrastructure.

This diversification is a significant strength, as it mitigates risks associated with reliance on any single industry and provides resilience against economic downturns in specific sectors. For instance, in 2023, Ingersoll Rand reported revenue growth across multiple segments, demonstrating the benefit of its varied market exposure.

Ingersoll Rand's financial strength is a significant advantage, evidenced by its substantial liquidity. As of June 30, 2025, the company reported $3.9 billion in liquidity, comprising $1.3 billion in cash and $2.6 billion in available credit. This robust financial footing allows for operational resilience and strategic maneuverability.

This strong liquidity provides Ingersoll Rand with considerable flexibility to pursue growth opportunities, such as strategic acquisitions or capital expenditures, while also ensuring it can weather economic uncertainties. The company's commitment to shareholder returns, demonstrated through share repurchases and consistent dividend payments, further underscores its healthy financial standing and confidence in future performance.

Ingersoll Rand's aftermarket services segment is a significant strength, contributing a substantial 37% of total revenue in Q2 2025, building on 36.4% in 2024. This recurring revenue stream offers a stable base, buffering the company from the inherent volatility in new equipment sales. The emphasis on ongoing service and parts cultivates enduring customer relationships, ensuring a predictable and consistent income flow.

Strategic Acquisition Capabilities

Ingersoll Rand demonstrates strong strategic acquisition capabilities, evidenced by its completion of 11 bolt-on acquisitions year-to-date in 2025. These deals have effectively contributed over $200 million in annualized inorganic revenue, showcasing a consistent ability to integrate new businesses. This strategic M&A activity is crucial for expanding its offerings into high-demand areas such as life sciences and renewable natural gas, directly supporting its overarching growth objectives and market penetration.

The company's proactive approach to mergers and acquisitions signals a robust pipeline for future inorganic growth. This capability allows Ingersoll Rand to quickly adapt to market shifts and capitalize on emerging opportunities. By strategically targeting sectors with strong growth potential, Ingersoll Rand is not only diversifying its revenue streams but also solidifying its competitive advantage.

- Proven M&A Execution: 11 bolt-on acquisitions completed year-to-date in 2025.

- Significant Inorganic Revenue: Added over $200 million in annualized revenue from acquisitions.

- Strategic Portfolio Expansion: Targeting high-growth sectors like life sciences and renewable natural gas.

- Continued Growth Potential: Active M&A pipeline indicates ongoing inorganic growth opportunities.

Sustainability Leadership and Operational Excellence

Ingersoll Rand's recognition as a sustainability leader is a significant strength, evidenced by its placement in the top 1% of its industry in the 2024 S&P Global Corporate Sustainability Assessment. This, alongside achieving CDP's 'A List' status for environmental stewardship, highlights a deep commitment to responsible operations.

This dedication to sustainability is intrinsically linked to the company's 'Ingersoll Rand Execution Excellence (IRX)' framework. IRX is a key driver of operational efficiency, directly contributing to improved margins and a stronger competitive position, especially as global decarbonization efforts accelerate.

- Industry Recognition: Ranked in the top 1% of its industry by S&P Global Corporate Sustainability Assessment in 2024.

- Environmental Stewardship: Achieved CDP 'A List' status for environmental performance.

- Operational Efficiency: The IRX framework enhances operational efficiency and improves margins.

- Market Alignment: Commitment to sustainability aligns with and capitalizes on global decarbonization trends.

Ingersoll Rand's diverse product line, including air compressors, pumps, and power tools, serves critical industries like manufacturing and healthcare. This broad market exposure in 2023 provided revenue growth across multiple segments, demonstrating resilience against sector-specific downturns.

The company's financial health is robust, with $3.9 billion in liquidity as of June 30, 2025. This strong cash position and available credit allow for strategic investments and weathering economic volatility.

Ingersoll Rand's aftermarket services are a significant revenue driver, accounting for 37% of total revenue in Q2 2025, up from 36.4% in 2024. This recurring revenue stream fosters customer loyalty and predictable income.

Strategic acquisitions are a core strength, with 11 bolt-on acquisitions completed in 2025 adding over $200 million in annualized revenue. These acquisitions target high-growth areas like life sciences, bolstering the company's market position.

| Strength | Description | Supporting Data |

|---|---|---|

| Diversified Product Portfolio | Offers essential flow creation and industrial solutions across various end markets. | Revenue growth across multiple segments in 2023. |

| Financial Strength | Possesses substantial liquidity for operational resilience and strategic growth. | $3.9 billion in liquidity (cash and credit) as of June 30, 2025. |

| Aftermarket Services | Provides a stable, recurring revenue stream and fosters customer relationships. | 37% of total revenue in Q2 2025; 36.4% in 2024. |

| Strategic Acquisitions | Effectively integrates new businesses to expand offerings and market reach. | 11 bolt-on acquisitions completed year-to-date 2025, adding over $200 million in annualized revenue. |

What is included in the product

Analyzes IR’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address key challenges, transforming potential roadblocks into actionable strategies.

Weaknesses

Ingersoll Rand (IR) encountered headwinds in its core operations during the second quarter of 2025, as evidenced by a decline in organic orders across both its Precision and Science Technologies (P&ST) and Industrial Technologies and Services (IT&S) segments. This slowdown in self-generated growth suggests that the company's revenue expansion may be increasingly dependent on strategic acquisitions rather than the inherent strength of its existing product and service lines.

The company saw its adjusted EBITDA margins dip in Q2 2025, a trend driven by lower organic sales volumes and the integration of new acquisitions that initially dilute profitability. Management is actively pursuing strategies to counteract this, but sustained pressure on these margins could hinder overall earnings growth and dampen investor sentiment.

Ingersoll Rand's strategic blueprint heavily leans on acquisitions, with the company projecting around $375 million in revenue from these deals by 2025. This substantial reliance on inorganic growth, while potentially accelerating expansion, introduces significant integration risks.

The challenges inherent in merging diverse operations, harmonizing corporate cultures, and achieving projected synergies can strain resources and divert attention from bolstering organic growth initiatives.

Premium Valuation Concerns

Ingersoll Rand's premium valuation presents a significant weakness. Analyst reports from Q2 2025 highlight a P/E ratio of 41.7x and a PEG ratio of 83.4x. This suggests the market anticipates substantial future growth.

However, these high multiples also imply a considerable risk if growth expectations aren't met. Persistent macroeconomic headwinds or unforeseen operational issues could lead to investor disappointment and stock price corrections.

- High P/E Ratio: 41.7x (Q2 2025)

- High PEG Ratio: 83.4x (Q2 2025)

- Market Expectation: Aggressive growth priced in.

- Risk: Potential for stock volatility if growth targets are missed.

Risk of Non-Cash Impairments

Ingersoll Rand's financial reporting can be significantly affected by non-cash impairments. For instance, in the second quarter of 2025, the company recognized a substantial GAAP net loss stemming from considerable write-downs of goodwill and intangible assets. These impairments were triggered by revised, less optimistic performance projections and a decline in business with key clients within certain acquired segments. Furthermore, broader market trends influencing industry valuation multiples contributed to these asset value reductions, highlighting potential challenges in the integration and performance of past acquisitions.

These non-cash charges, while not impacting immediate cash flow, can distort reported earnings and provide a less clear picture of the company's operational profitability. They serve as a stark reminder of the risks inherent in strategic acquisitions, where initial valuations may not hold up against evolving market conditions and actual business performance. Investors and analysts closely scrutinize these impairment charges as they can signal overpayment for acquired businesses or a deterioration in the underlying value of those assets.

- Non-cash impairments can lead to significant GAAP net losses, as seen in Q2 2025 for Ingersoll Rand.

- These charges are often driven by factors like reduced performance forecasts and shifts in industry valuation multiples.

- Impairments can reflect challenges in integrating and realizing the expected value from past acquisitions.

- While not a cash outflow, these write-downs impact reported earnings and can signal underlying business issues.

Ingersoll Rand's reliance on acquisitions for growth, projected at around $375 million in revenue by 2025, introduces substantial integration risks. Merging diverse operations and cultures can strain resources and distract from organic growth efforts.

The company's premium valuation, with a Q2 2025 P/E of 41.7x and PEG of 83.4x, indicates high market expectations. Failure to meet these aggressive growth targets could lead to significant stock price volatility.

Non-cash impairments, such as the significant GAAP net loss reported in Q2 2025 due to goodwill and intangible asset write-downs, can distort earnings and signal challenges in acquired business performance.

| Metric | Q2 2025 Value | Implication |

|---|---|---|

| Acquisition Revenue Projection (2025) | ~$375 million | High reliance on inorganic growth |

| P/E Ratio (Q2 2025) | 41.7x | Premium valuation, high growth expectations |

| PEG Ratio (Q2 2025) | 83.4x | Suggests overvaluation if growth falters |

| GAAP Net Loss Drivers | Goodwill/Intangible Impairments | Potential issues with acquisition integration/performance |

What You See Is What You Get

IR SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

Ingersoll Rand is strategically expanding into high-growth sectors, evident in its recent acquisitions. The company acquired Dave Barry Plastics and Lead Fluid, bolstering its presence in the life sciences industry. These moves are designed to tap into markets with substantial projected growth, aiming to diversify revenue and enhance long-term value.

Ingersoll Rand can capitalize on the widespread industrial adoption of digital transformation and AI. By integrating these technologies, the company can boost efficiency and offer advanced features like predictive maintenance, a key trend in the 2024 industrial landscape.

The company has a prime opportunity to embed AI and XR into its equipment and services, thereby enhancing customer value and operational performance. This strategic move aligns with the growing demand for smart, connected industrial solutions observed throughout 2024 and into early 2025.

Ingersoll Rand is well-positioned to capitalize on the escalating global demand for sustainable and energy-efficient solutions. The company's dedication to developing innovative products that support decarbonization efforts directly addresses a key market trend. For instance, their portfolio of energy-efficient compressors and electric pumps aligns with a growing regulatory push and consumer preference for environmentally responsible technologies.

Further Aftermarket Service Expansion

The company has a significant opportunity to grow its aftermarket services by expanding its reach internationally and incorporating more of its product range. This expansion can lead to stronger customer loyalty and a more predictable revenue stream.

By focusing on enhanced service contracts, advanced diagnostic tools, and detailed maintenance plans, the company can solidify its position in the market. This strategic move is projected to boost recurring revenue and improve profit margins substantially.

- Global Expansion: Targeting new geographic markets for aftermarket services is a key growth avenue.

- Product Line Integration: Extending comprehensive service offerings to a broader range of the company's products.

- Recurring Revenue: Increasing the proportion of revenue generated from service contracts and subscriptions.

- Profitability Enhancement: Leveraging higher margins typically associated with specialized aftermarket support.

Strategic Market Penetration in Emerging Economies

Ingersoll Rand can capitalize on the increasing demand in emerging economies, which are experiencing significant industrialization and infrastructure growth. This presents a prime opportunity for the company to expand its reach and market share in these rapidly developing regions.

By focusing on these dynamic markets, Ingersoll Rand can leverage the rising need for its essential industrial solutions. This strategic push could drive both organic growth through increased sales and inorganic growth via potential acquisitions or partnerships.

For instance, emerging economies are projected to represent a substantial portion of global GDP growth in the coming years, with significant investments in infrastructure and manufacturing. Ingersoll Rand's solutions are well-positioned to benefit from these trends.

- Growing Infrastructure Investment: Many emerging economies are investing heavily in infrastructure projects, such as transportation networks and energy facilities, creating a direct demand for Ingersoll Rand's compressors, pumps, and power tools.

- Industrialization Boom: As these nations industrialize, manufacturing output increases, leading to higher demand for the reliable and efficient industrial equipment that Ingersoll Rand provides.

- Untapped Market Potential: Despite its global footprint, there remains significant untapped potential in many emerging markets for Ingersoll Rand to establish a stronger presence and gain market share.

Ingersoll Rand is strategically expanding its product portfolio through acquisitions, notably in the life sciences sector with the purchase of Dave Barry Plastics and Lead Fluid. This diversification aims to tap into high-growth markets and enhance long-term value.

The company can leverage the widespread adoption of digital transformation and AI across industries, enhancing operational efficiency and offering advanced solutions like predictive maintenance. This aligns with industrial trends observed throughout 2024 and into early 2025.

Capitalizing on the growing demand for sustainable and energy-efficient solutions presents a significant opportunity, with products like energy-efficient compressors and electric pumps directly addressing decarbonization efforts and market preferences.

Expanding aftermarket services globally and integrating a broader product range can drive customer loyalty and predictable revenue streams, with enhanced service contracts and diagnostic tools projected to boost recurring revenue and profit margins.

| Opportunity Area | Key Drivers | Ingersoll Rand's Position |

|---|---|---|

| Digital Transformation & AI | Increased efficiency, predictive maintenance demand | Integration of AI/XR for enhanced equipment and services |

| Sustainability | Global push for decarbonization, energy efficiency | Portfolio of energy-efficient compressors, electric pumps |

| Aftermarket Services | Demand for enhanced support, recurring revenue | Global expansion, product line integration, service contracts |

| Emerging Markets | Industrialization, infrastructure growth | Leveraging infrastructure investment and manufacturing boom |

Threats

Ingersoll Rand's position in the industrial sector makes it vulnerable to macroeconomic shifts. For instance, a slowdown in global manufacturing, a key driver for IR's equipment, could significantly dampen demand. In 2023, while many industrial sectors showed resilience, some, like construction equipment, experienced moderating growth rates compared to the post-pandemic surge, indicating the cyclical nature of the market.

Interest rate hikes, a common tool to combat inflation, can also pose a threat. Higher borrowing costs for Ingersoll Rand's customers, particularly those in capital-intensive industries, might delay or reduce their investment in new machinery and systems. This sensitivity to capital expenditure cycles is a persistent challenge for industrial companies.

Ongoing geopolitical tensions and trade policy uncertainties, including potential tariffs, present a substantial threat. These factors can significantly disrupt global supply chains, leading to increased raw material costs and impacting pricing strategies. For instance, many companies reported in their Q1 and Q2 2025 earnings calls that supply chain disruptions directly contributed to a 5-10% increase in input costs.

Ingersoll Rand operates in a fiercely competitive industrial equipment market, facing both large, established global companies and nimble, emerging competitors. This dynamic environment often translates into significant pricing pressures, compelling Ingersoll Rand to offer competitive pricing. For instance, in 2023, the industrial sector saw average price increases of around 4-6%, a trend Ingersoll Rand must navigate carefully.

The need to maintain competitive pricing can directly impact profit margins. If cost efficiencies and strong product differentiation aren't managed effectively, these pressures could compress Ingersoll Rand's profitability. The company's ability to innovate and control its operational costs will be crucial in mitigating these margin squeezes in the coming year.

Supply Chain Disruptions and Cost Volatility

Ingersoll Rand (IR) continues to navigate a landscape where global supply chains, despite ongoing mitigation efforts, remain susceptible to disruptions. Geopolitical tensions, extreme weather events, and other unforeseen circumstances can trigger significant delays in production and escalate logistics expenses. For instance, the ongoing semiconductor shortage, which began impacting various industries in 2020 and continued through 2024, has affected the availability of electronic components crucial for many of IR's products, leading to longer lead times and increased component costs.

These supply chain vulnerabilities directly translate into operational challenges for Ingersoll Rand. The inability to secure critical components on time can hinder manufacturing schedules and impact the company's capacity to fulfill customer orders promptly. This can result in lost sales opportunities and damage customer relationships. For example, in their Q4 2023 earnings call, management highlighted that while supply chain issues were easing, certain component availability remained a concern, affecting specific product lines.

- Increased Logistics Costs: Freight rates, particularly for ocean and air cargo, have seen significant fluctuations. While some rates have stabilized from pandemic highs, geopolitical instability in key shipping lanes, such as the Red Sea, continues to pose a risk of renewed cost increases and transit time extensions.

- Component Shortages: The availability of specialized materials and electronic components remains a watchpoint. Companies like IR rely on a complex web of suppliers, and disruptions at any point in this chain can create ripple effects.

- Production Delays: When key parts are unavailable or delayed, manufacturing lines can be idled, directly impacting output and revenue generation. This was evident in early 2024 when certain industrial equipment manufacturers reported extended lead times due to component scarcity.

- Cost Volatility: The combined effect of higher shipping costs and component prices leads to overall cost volatility, making it challenging for IR to maintain consistent pricing and margins without passing on these increases to customers, which can impact demand.

Risks Associated with High Acquisition Volume

While strategic acquisitions are a crucial growth engine, the sheer volume of recent and anticipated bolt-on acquisitions, with over 200 companies currently in the pipeline, presents substantial integration risks. Successfully merging these diverse entities is paramount.

Failure to seamlessly integrate acquired businesses could result in significant operational disruptions. This includes potential difficulties in realizing projected synergies, which are the anticipated cost savings or revenue enhancements from combining operations. For instance, if integration is poor, a company might only achieve 70% of its targeted synergy value, impacting overall profitability.

Managing cultural differences between the acquiring company and the newly acquired businesses is another significant hurdle. Clashes in work styles, values, and communication can lead to employee dissatisfaction, reduced productivity, and ultimately, financial underperformance. In 2024, many companies reported that cultural integration challenges were a primary reason for acquisition failures.

- Integration Complexity: Over 200 companies in the acquisition funnel means a massive undertaking to absorb operations, systems, and personnel.

- Synergy Realization Risk: Difficulty in achieving projected financial benefits from acquisitions, potentially leading to lower-than-expected returns.

- Cultural Misalignment: Differences in organizational culture can hinder smooth transitions and employee buy-in, impacting performance.

- Operational Inefficiencies: Poor integration can create bottlenecks, duplicate efforts, and increase costs, directly impacting the bottom line.

Ingersoll Rand faces substantial threats from macroeconomic headwinds, including potential slowdowns in global manufacturing and construction sectors, which directly impact demand for its equipment. Rising interest rates also pose a risk by increasing borrowing costs for customers, potentially delaying capital expenditures. Geopolitical instability and trade policy uncertainties can disrupt supply chains, leading to higher input costs and impacting pricing strategies, as seen with component cost increases of 5-10% reported by many industrial firms in early 2025.

Intense competition within the industrial equipment market exerts significant pricing pressure, potentially compressing Ingersoll Rand's profit margins if cost efficiencies and product differentiation are not effectively managed. The company's extensive acquisition pipeline, with over 200 companies, introduces considerable integration risks, including challenges in realizing synergies and managing cultural differences, which can lead to operational disruptions and financial underperformance. For instance, cultural misalignment was cited as a primary reason for acquisition failures in 2024.

| Threat Category | Specific Risk | Impact on IR | Example Data/Trend (2023-2025) |

|---|---|---|---|

| Macroeconomic Factors | Global Manufacturing Slowdown | Reduced demand for IR equipment | Moderating growth in construction equipment in 2023 |

| Financial Environment | Rising Interest Rates | Delayed customer capital expenditures | Increased borrowing costs for capital-intensive industries |

| Geopolitical & Supply Chain | Supply Chain Disruptions | Higher raw material costs, production delays | Component cost increases of 5-10% in early 2025; semiconductor shortages impacting lead times |

| Competitive Landscape | Intense Market Competition | Pricing pressure, margin compression | Average industrial sector price increases of 4-6% in 2023 |

| Integration Risks | Acquisition Integration Challenges | Operational disruptions, unrealized synergies | Over 200 companies in acquisition pipeline; cultural integration cited as acquisition failure reason in 2024 |

SWOT Analysis Data Sources

This IR SWOT analysis is built upon a robust foundation of publicly available financial filings, comprehensive market intelligence reports, and expert opinions from seasoned industry analysts to ensure a well-rounded and accurate assessment.