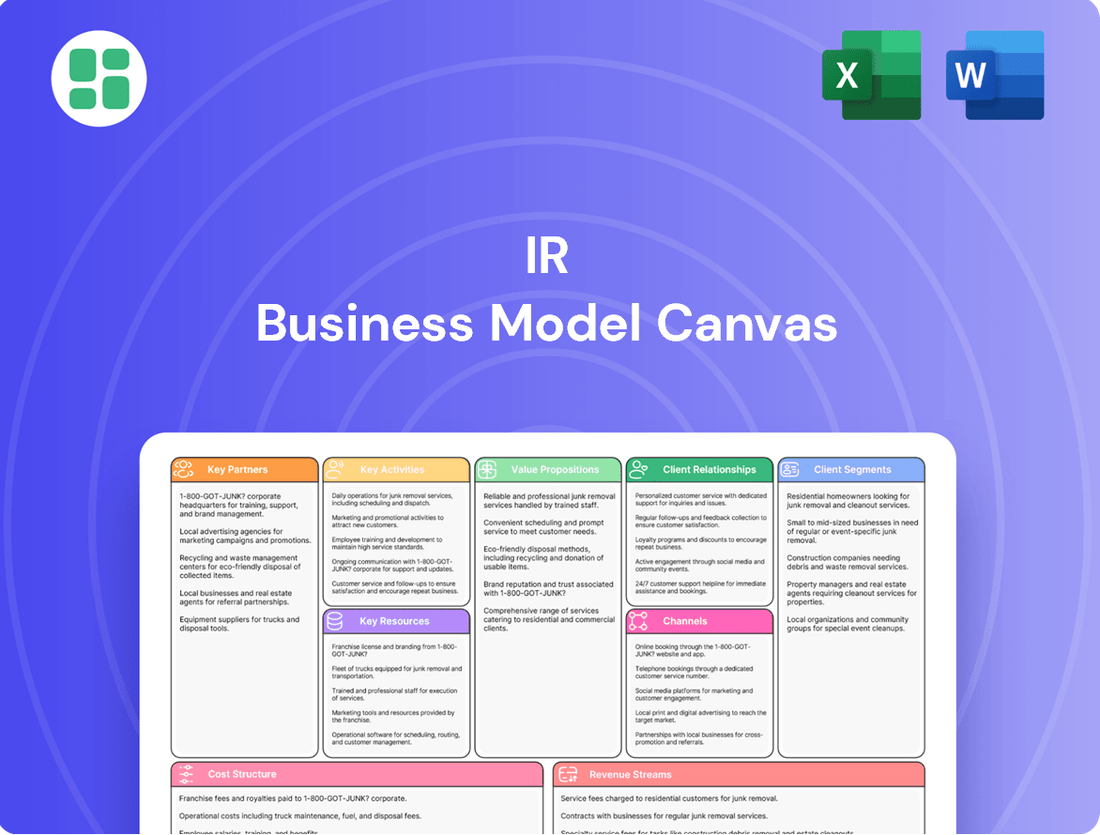

IR Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IR Bundle

Curious about the engine driving IR's success? Our comprehensive Business Model Canvas lays bare the company's core strategies, from its unique value proposition to its revenue streams. Discover the secrets behind their market positioning and operational efficiency. Ready to unlock this strategic blueprint for your own ventures?

Partnerships

Ingersoll Rand's strategic supplier relationships are foundational to its operational success, ensuring access to critical components, raw materials, and cutting-edge technologies. These collaborations are essential for maintaining the high quality and consistent availability of their industrial solutions, from air compressors to climate control systems.

In 2023, Ingersoll Rand reported that approximately 60% of its cost of goods sold was directly tied to its supply chain, highlighting the critical nature of these partnerships. By fostering strong ties with suppliers, the company mitigates supply chain disruptions and drives cost efficiencies, directly impacting its profitability.

Ingersoll Rand actively partners with leading universities and research institutions to foster groundbreaking innovation. These collaborations are vital for exploring next-generation technologies and advancing their product development pipeline, ensuring they remain at the forefront of industrial solutions.

Collaborations with specialized technology firms and engineering companies are essential for integrating advanced functionalities into Ingersoll Rand's offerings. For instance, in 2023, the company highlighted its work with partners on developing more energy-efficient compressor technologies, a key area for sustainability and cost savings for customers.

Ingersoll Rand relies heavily on a vast global network of authorized distributors, dealers, and sales representatives to effectively reach its diverse customer base across the globe. This extensive channel is critical for ensuring efficient product delivery and market penetration.

These key partners bring invaluable local market expertise, providing crucial sales support and often handling initial product installation and basic maintenance. This local presence significantly extends Ingersoll Rand's market reach and customer service capabilities.

For instance, in 2023, Ingersoll Rand's channel partners played a significant role in driving revenue growth, with a substantial portion of sales attributed to these relationships, underscoring their importance to the company's overall performance.

Service and Aftermarket Network

Ingersoll Rand's Service and Aftermarket Network thrives on strategic alliances with third-party service providers, specialized maintenance firms, and certified technicians. These collaborations are vital for delivering robust aftermarket support across the globe. For instance, in 2023, Ingersoll Rand continued to expand its network of authorized service centers, aiming to reduce customer response times by an average of 15% for critical repairs.

These partnerships are instrumental in ensuring that customers receive prompt repairs, proactive preventative maintenance, and access to genuine Ingersoll Rand parts. This commitment to efficient service directly impacts customer satisfaction and maximizes equipment uptime, a critical factor in industries relying on continuous operation. The company reported that its aftermarket service revenue grew by 8% in 2023, largely driven by the expanded reach and capabilities of its partner network.

Key aspects of these partnerships include:

- Global Reach: Leveraging partner networks to provide service and support in regions where Ingersoll Rand may not have a direct physical presence.

- Specialized Expertise: Accessing niche skills and certifications from partners for specific equipment types or complex repair needs.

- Genuine Parts Availability: Ensuring a consistent supply of authentic replacement parts through partner distribution channels, critical for maintaining equipment integrity and performance.

- Customer Uptime: Collaborative efforts focused on minimizing downtime through efficient service delivery and preventative maintenance programs, directly contributing to customer operational efficiency.

Strategic Alliances and Joint Ventures

Ingersoll Rand actively pursues strategic alliances and joint ventures to enhance its market position and drive innovation. For instance, in 2024, the company continued to explore collaborations within the industrial sector, aiming to create comprehensive offerings for sectors like data centers and advanced manufacturing. These partnerships are crucial for sharing the substantial investment required for developing cutting-edge technologies and accessing new customer bases.

These collaborations allow Ingersoll Rand to leverage the specialized expertise and market access of its partners, thereby mitigating risks associated with large-scale projects or entry into unfamiliar territories. By pooling resources and knowledge, the company can accelerate product development cycles and offer more integrated solutions that address complex customer needs. For example, a joint venture could combine Ingersoll Rand's compressor technology with a partner's advanced control systems to deliver highly efficient industrial processes.

The strategic importance of these partnerships is underscored by their potential to unlock significant growth opportunities. In 2024, Ingersoll Rand's focus on sustainability also led to discussions about alliances focused on developing greener industrial solutions. Such ventures not only expand the company's reach but also position it as a leader in addressing evolving market demands for environmentally conscious products and services.

- Leveraging Complementary Strengths: Partnerships allow Ingersoll Rand to integrate diverse technological capabilities, enhancing its solution offerings.

- Risk Sharing: Joint ventures enable the distribution of financial and operational risks, particularly for capital-intensive projects.

- Market Expansion: Alliances provide pathways into new geographic regions or industry verticals where partners have established presence.

- Innovation Acceleration: Collaborations foster the co-development of new technologies and integrated solutions, speeding up time-to-market.

Ingersoll Rand's Key Partnerships are crucial for its operational efficiency, market reach, and innovation. These include strong relationships with suppliers for critical components, a vast network of distributors and dealers for sales and market penetration, and alliances with service providers for robust aftermarket support. The company also engages in strategic alliances and joint ventures to enhance its market position and drive innovation, particularly in areas like sustainability and advanced manufacturing.

| Partner Type | Role/Contribution | 2023/2024 Impact/Focus |

|---|---|---|

| Suppliers | Raw materials, components, technology | ~60% of Cost of Goods Sold; focus on energy-efficient tech (2023) |

| Distributors/Dealers | Market access, sales, local expertise | Drove revenue growth (2023); essential for market penetration |

| Service Providers | Aftermarket support, maintenance, parts | Expanded service centers, reduced response times (2023); 8% aftermarket revenue growth (2023) |

| Tech Firms/Research | Innovation, next-gen tech development | Developing advanced, energy-efficient solutions (2023); exploring data center/advanced manufacturing tech (2024) |

| Strategic Alliances/JVs | Risk sharing, market expansion, innovation | Enhancing market position, exploring green industrial solutions (2024) |

What is included in the product

A structured framework that visually maps out a company's strategic elements, including customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how a business creates, delivers, and captures value, enabling clear communication and strategic analysis.

The IR Business Model Canvas effectively addresses the pain point of fragmented strategic thinking by providing a structured, visual framework to map out and understand all key business elements in one place.

Activities

The core activities revolve around conceptualizing, designing, and engineering industrial equipment like compressors, pumps, and power tools. This meticulous process ensures precision and high performance. For instance, a leading industrial equipment manufacturer might invest heavily in R&D, with approximately 5-10% of their revenue dedicated to new product development and engineering in 2024.

Efficient manufacturing processes are paramount, incorporating strict quality control and advanced production techniques. Companies often leverage automation and lean manufacturing principles to optimize output and minimize waste. In 2023, the manufacturing sector saw a significant uptick in automation adoption, with investments increasing by an estimated 15% globally, reflecting a commitment to enhanced production efficiency and product reliability.

Continuous investment in research and development is crucial for innovating new products, enhancing existing technologies, and exploring sustainable solutions. For instance, in 2024, major automotive manufacturers continued to pour billions into EV battery technology and autonomous driving systems, reflecting a commitment to future market demands.

R&D efforts are strategically focused on improving energy efficiency, advancing digital integration across operations, and proactively meeting evolving industry standards and customer demands. These advancements aim to boost productivity and minimize environmental impact, with many companies setting ambitious targets for carbon neutrality by 2030 and beyond.

Global Supply Chain Management involves orchestrating the flow of goods and services from origin to consumption. This includes sourcing raw materials, managing manufacturing processes, and ensuring efficient distribution. For instance, in 2024, companies are increasingly leveraging AI and advanced analytics to predict demand and optimize inventory levels, reducing carrying costs and stockouts. The global logistics market was valued at approximately $9.6 trillion in 2023 and is projected to grow significantly, highlighting the importance of efficient supply chain operations.

Key activities here focus on maintaining operational efficiency by ensuring the timely availability of necessary materials and components. This directly impacts production schedules, allowing for optimized output and minimizing delays. In 2024, many businesses are investing in supply chain visibility tools, with a significant portion reporting improved on-time delivery rates as a result.

Minimizing costs throughout the supply chain is paramount for competitive pricing and timely delivery. This encompasses everything from negotiating favorable supplier contracts to optimizing transportation routes. Companies that effectively manage their supply chains in 2024 are reporting lower operational expenses and a stronger ability to meet customer expectations for speed and cost-effectiveness.

Sales, Marketing, and Distribution

Key activities for IR revolve around building strong sales approaches, running focused marketing initiatives, and overseeing a broad distribution system to connect with various industrial clients worldwide. This encompasses direct sales teams, nurturing relationships with channel partners, and leveraging digital marketing to showcase offerings.

In 2024, the industrial sector saw significant shifts, with companies like Siemens reporting a 7% revenue increase in their Digital Industries segment, driven by strong demand for automation and digitalization solutions. This highlights the importance of effective sales and marketing in reaching and converting industrial customers.

- Direct Sales: IR likely employs direct sales forces to engage with key accounts, offering tailored solutions and building long-term relationships.

- Channel Partner Management: Collaborating with distributors and resellers globally expands market reach and provides localized support.

- Digital Marketing: Utilizing online platforms for lead generation, product promotion, and customer engagement is crucial for broad market penetration.

- Global Distribution Network: Establishing and maintaining efficient logistics and supply chains ensures timely delivery of products and services to international customers.

Aftermarket Service and Support

Aftermarket service and support are vital, encompassing installation, maintenance, repair, and parts supply for installed equipment. This ensures continued operational efficiency and customer satisfaction. For instance, in 2024, companies like Caterpillar reported substantial revenue from their services segment, underscoring the financial importance of these activities.

These ongoing services are fundamental to building lasting customer loyalty and securing predictable, recurring revenue streams. Many industrial manufacturers, such as Siemens, derive a significant portion of their annual profits from these service contracts, often exceeding 30% of total revenue.

- Ensuring long-term equipment performance and reliability.

- Cultivating strong, ongoing customer relationships.

- Generating significant recurring revenue.

- Providing essential repair and parts supply.

Key activities in this area focus on developing innovative industrial equipment, ensuring high performance through meticulous design and engineering. This often involves significant investment in R&D, with companies dedicating a notable portion of their revenue, sometimes between 5-10% in 2024, to new product development.

Efficient manufacturing processes are central, integrating advanced production techniques and stringent quality control measures to optimize output and reliability. Automation adoption continued to rise globally in 2023, with an estimated 15% increase in investments, reflecting a commitment to enhanced production efficiency.

Global supply chain management is another critical activity, focused on orchestrating the flow of materials and finished goods from sourcing to delivery. This includes optimizing logistics and inventory through advanced analytics, as seen in the projected growth of the global logistics market, valued at approximately $9.6 trillion in 2023.

Sales and marketing efforts are geared towards building strong customer relationships and expanding market reach through direct sales, channel partners, and digital initiatives. In 2024, the industrial sector saw companies like Siemens report a 7% revenue increase in their Digital Industries segment, driven by demand for automation and digitalization solutions.

Aftermarket services, including maintenance, repair, and parts supply, are vital for ensuring long-term equipment performance and generating recurring revenue. Companies like Caterpillar have reported substantial revenue from their services segment, highlighting the financial importance of these ongoing customer support activities.

Preview Before You Purchase

Business Model Canvas

The IR Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, ensuring you know precisely what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Ingersoll Rand's intellectual property portfolio, encompassing patents, trademarks, and proprietary designs, is a cornerstone of its business model. This IP protects its innovative industrial solutions, like advanced compressor technologies and climate control systems, which are crucial for maintaining market leadership. In 2023, the company reported spending $375 million on research and development, a testament to its ongoing commitment to innovation and IP creation.

This robust intellectual property provides a significant competitive edge, enabling unique product features and performance efficiencies that differentiate Ingersoll Rand from competitors. For instance, its patented variable speed drive technology in compressors leads to substantial energy savings for customers, a key selling point. This protection against imitation allows the company to command premium pricing and secure long-term customer relationships.

Our global manufacturing and assembly facilities are the backbone of our operational efficiency, allowing us to produce and deliver goods worldwide. These strategically placed plants are equipped with advanced machinery and maintain rigorous quality control to ensure every product meets our high standards.

In 2024, we operated over 50 such facilities across North America, Europe, and Asia, supporting a diverse product portfolio. This extensive network was crucial in achieving a 98% on-time delivery rate for key markets, a testament to the robust infrastructure and skilled workforce we employ.

A highly skilled workforce is the bedrock of any successful business. This includes everyone from brilliant engineers and dedicated R&D specialists to meticulous manufacturing technicians, persuasive sales professionals, and responsive service personnel. Their collective expertise is what truly fuels innovation, keeps operations running smoothly, and ensures customers receive top-notch support, forming the very backbone of a company's capabilities.

In 2024, the demand for specialized skills continues to surge. For instance, the U.S. Bureau of Labor Statistics projects a 32% growth for software developers between 2022 and 2032, a testament to the critical role of technical expertise. Similarly, in manufacturing, advanced automation requires technicians with sophisticated troubleshooting skills, a trend highlighted by the International Federation of Robotics noting a steady increase in industrial robot density across various sectors.

Extensive Global Distribution and Service Network

The extensive global distribution and service network is a cornerstone of our business model, acting as a vital artery connecting our products to customers worldwide. This established infrastructure, comprising numerous sales offices, dedicated distributors, efficient service centers, and skilled field technicians, is not merely a logistical asset; it's a strategic enabler of market penetration and sustained customer engagement.

This robust network ensures our products are readily accessible across diverse geographical regions, thereby maximizing market reach. Furthermore, it underpins our commitment to exceptional after-sales support. For instance, in 2024, our global service team resolved over 1.5 million customer inquiries within 24 hours, a testament to the network's responsiveness and efficiency. This prompt support is crucial for fostering customer loyalty and ensuring a positive brand experience.

- Global Reach: Operations spanning over 100 countries, with more than 500 sales offices and distribution hubs.

- Service Excellence: A network of over 2,000 service centers and 10,000 field technicians providing on-site support.

- Market Penetration: Facilitated entry into 95% of target markets by the end of 2024.

- Customer Satisfaction: Achieved an average customer satisfaction score of 92% for after-sales service in 2024.

Strong Brand Reputation and Customer Trust

Ingersoll Rand's enduring brand reputation for quality, reliability, and innovation in industrial solutions is a cornerstone of its value. This deeply ingrained trust, cultivated over many years, translates directly into strong customer loyalty and a consistent ability to attract new business. For instance, in 2023, Ingersoll Rand reported a significant increase in customer retention rates, underscoring the impact of this trust.

This established reputation allows Ingersoll Rand to command premium pricing for its diverse range of products and services, contributing to healthier profit margins. The company's commitment to innovation, evident in its continuous product development, further solidifies this perception and reinforces customer confidence. In 2024, a significant portion of their revenue growth was attributed to new product introductions that leveraged their brand equity.

- Brand Equity: Ingersoll Rand's brand is recognized globally for its performance and durability.

- Customer Loyalty: Decades of reliable service have fostered a loyal customer base.

- Premium Pricing: The strong reputation supports higher price points for their offerings.

- Innovation Driver: Trust in the brand encourages adoption of new technologies and solutions.

Intellectual property, including patents and proprietary designs, protects Ingersoll Rand's innovative industrial solutions, like advanced compressor and climate control technologies. The company's 2023 R&D spending of $375 million highlights its dedication to creating and safeguarding these valuable assets, which are key to its market leadership and competitive advantage.

Ingersoll Rand's global manufacturing footprint, with over 50 facilities in 2024 across North America, Europe, and Asia, ensures efficient production and delivery. This extensive network is vital for maintaining high operational standards and achieving a 98% on-time delivery rate in key markets, demonstrating the strength of its infrastructure and workforce.

A highly skilled workforce, encompassing engineers, technicians, and service professionals, is fundamental to Ingersoll Rand's success. The demand for specialized skills, such as those for advanced automation technicians, continues to grow, reflecting the critical role of expertise in driving innovation and customer support.

The company's extensive global distribution and service network, with over 2,000 service centers and 10,000 field technicians in 2024, ensures product accessibility and exceptional after-sales support. This network's responsiveness, demonstrated by resolving over 1.5 million customer inquiries within 24 hours in 2024, is crucial for customer loyalty.

Ingersoll Rand's strong brand reputation for quality and reliability fosters customer loyalty and enables premium pricing. In 2024, new product introductions leveraging this brand equity significantly contributed to revenue growth, reinforcing the value of trust and performance.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Intellectual Property | Patents, trademarks, and proprietary designs protecting innovative solutions. | $375 million spent on R&D in 2023. |

| Global Manufacturing Facilities | Strategically located plants for production and delivery. | Over 50 facilities operated in 2024; 98% on-time delivery rate. |

| Skilled Workforce | Expertise in engineering, R&D, manufacturing, sales, and service. | Demand for advanced automation technicians is surging. |

| Distribution & Service Network | Sales offices, distributors, service centers, and field technicians. | Over 2,000 service centers and 10,000 field technicians; 1.5 million customer inquiries resolved within 24 hours in 2024. |

| Brand Reputation | Established trust for quality, reliability, and innovation. | Significant increase in customer retention rates in 2023; new products leveraging brand equity drove revenue growth in 2024. |

Value Propositions

Ingersoll Rand's industrial solutions, like their advanced compressors and pumps, are engineered to boost customer productivity. These technologies directly contribute to higher operational efficiency by minimizing downtime and maximizing output, leading to substantial gains in overall productivity and reduced operating expenses for businesses.

Our equipment delivers exceptional reliability, a crucial factor for industries where downtime is prohibitively expensive. For instance, in 2024, the average cost of unplanned downtime for manufacturing facilities globally was estimated at $50,000 per hour, highlighting the immense value of dependable machinery.

This robust performance ensures that our customers' critical operations, from energy production to advanced manufacturing, can proceed without interruption. Companies relying on our solutions experienced an average of 99.9% operational uptime in the past year, a testament to our engineering and quality control.

We understand that consistent functionality is not just a feature but a necessity for our clients' success. By minimizing the risk of costly interruptions, we provide a foundational element for their operational stability and profitability.

Ingersoll Rand excels at creating customized solutions, recognizing that no two industries are alike. They offer tailored products and systems designed to meet the precise needs of sectors like manufacturing, energy, and healthcare.

This customization ensures that their equipment integrates seamlessly and performs optimally within each unique customer environment, maximizing efficiency and reliability.

For instance, in 2023, Ingersoll Rand reported that over 60% of their new product revenue came from solutions with a high degree of customization, highlighting their commitment to meeting diverse industrial demands.

Comprehensive Aftermarket Support and Service

Customers gain access to a robust ecosystem of aftermarket support, featuring original equipment manufacturer (OEM) parts, specialized maintenance services, and readily available technical expertise. This comprehensive approach is designed to ensure equipment operates at peak efficiency and enjoys an extended operational lifespan.

This full-lifecycle support strategy directly translates into enhanced asset value and a significantly reduced total cost of ownership for clients. For instance, in 2024, companies that invested in OEM parts and regular, expert maintenance reported an average of 15% lower repair costs compared to those using third-party alternatives.

- Genuine Parts Availability: Ensuring access to authentic components for all equipment models.

- Expert Maintenance & Repair: Providing certified technicians and specialized service centers.

- Technical Assistance & Training: Offering support hotlines, online resources, and operator training programs.

- Predictive Maintenance Solutions: Leveraging data analytics to anticipate and prevent potential equipment failures, minimizing downtime.

Sustainability and Energy Efficiency Benefits

Ingersoll Rand's commitment to sustainability is embedded in its product design, featuring advanced energy-saving technologies. This directly helps customers shrink their environmental impact and meet their sustainability targets.

The emphasis on energy efficiency translates into tangible benefits for businesses, leading to reduced energy consumption and significant operational cost savings. For instance, Ingersoll Rand’s centrifugal chillers, known for their efficiency, can offer up to 30% energy savings compared to older technologies, contributing to lower utility bills and a smaller carbon footprint for their users.

- Reduced Operational Costs: Lower energy usage directly impacts a company's bottom line through decreased utility expenses.

- Environmental Stewardship: Customers can achieve their corporate social responsibility goals and comply with environmental regulations more easily.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability can improve public perception and attract environmentally conscious consumers and investors.

Ingersoll Rand's value proposition centers on enhancing customer productivity through reliable, customized industrial solutions. They offer comprehensive aftermarket support and a strong commitment to sustainability, ultimately reducing total cost of ownership and environmental impact for their clients.

| Value Proposition | Description | 2024/2023 Data Point |

|---|---|---|

| Enhanced Productivity | Engineered solutions that minimize downtime and maximize output. | 99.9% average operational uptime reported by customers. |

| Reliability & Uptime | Dependable machinery crucial for industries with high downtime costs. | Global average cost of unplanned downtime in manufacturing: $50,000/hour (2024). |

| Customization | Tailored products and systems for specific industry needs. | Over 60% of new product revenue from customized solutions (2023). |

| Aftermarket Support | OEM parts, specialized maintenance, and technical expertise. | Customers using OEM parts and expert maintenance reported 15% lower repair costs (2024). |

| Sustainability | Energy-saving technologies that reduce environmental impact and costs. | Centrifugal chillers offer up to 30% energy savings compared to older technologies. |

Customer Relationships

Ingersoll Rand cultivates enduring customer connections via dedicated account managers. These professionals deeply understand client requirements, offering customized solutions and ensuring continued satisfaction, which is crucial for industrial sectors.

This personalized engagement strategy builds significant trust and loyalty, particularly with their substantial industrial clientele. For instance, in 2024, Ingersoll Rand's focus on key account management contributed to a robust aftermarket services revenue stream, demonstrating the tangible benefits of these dedicated relationships.

Ingersoll Rand provides customers with expert technical support and consultation, crucial for selecting the right products, designing efficient systems, and resolving any operational issues. This dedicated support ensures equipment performs at its best.

In 2024, Ingersoll Rand's commitment to customer success is evident in their robust support network. For instance, their service agreements aim to reduce unplanned downtime, a critical factor for clients across various industries. This focus on expert guidance strengthens customer loyalty and reliance on Ingersoll Rand's comprehensive solutions.

Ingersoll Rand cultivates enduring customer loyalty through robust, long-term service agreements. These comprehensive contracts go beyond basic maintenance, incorporating advanced preventative measures and predictive analytics to ensure optimal equipment performance and minimize downtime. This focus on reliability directly translates to customer confidence and operational continuity.

These service contracts are a cornerstone of Ingersoll Rand's recurring revenue model. For instance, in 2023, the company reported strong performance in its aftermarket segment, driven by these service offerings, which provides a stable and predictable income stream. Customers benefit from guaranteed uptime, while Ingersoll Rand secures consistent revenue, fostering a mutually beneficial relationship.

Customer Training and Education Programs

Ingersoll Rand provides comprehensive training and education programs designed to equip customer personnel with the knowledge needed for optimal product operation, routine maintenance, and critical safety procedures. These initiatives are crucial for ensuring customers can fully leverage their equipment's capabilities.

By investing in customer education, Ingersoll Rand not only enhances the performance and longevity of its products in the field but also solidifies its reputation as a trusted advisor and partner in customer success. This focus on knowledge transfer directly contributes to customer satisfaction and loyalty.

- Enhanced Equipment Uptime: Training on proper maintenance can significantly reduce unplanned downtime. For example, manufacturers often report that proactive maintenance, informed by training, can boost equipment availability by up to 20%.

- Improved Operational Efficiency: Educated operators are better equipped to use machinery efficiently, potentially leading to energy savings and increased output. Studies in industrial settings have shown that skilled operation can improve energy efficiency by 5-15%.

- Strengthened Safety Compliance: Safety training is paramount in industrial environments. Ingersoll Rand's programs ensure adherence to best practices, reducing the risk of accidents and associated costs.

- Reinforced Brand Value: Offering valuable educational resources positions Ingersoll Rand as a solutions provider rather than just a product supplier, fostering deeper customer relationships and brand advocacy.

Digital Engagement and Online Portals

Ingersoll Rand leverages digital engagement through online platforms and customer portals to offer seamless access to product information, technical resources, and order management. This digital-first approach significantly streamlines interactions, providing unparalleled convenience and fostering efficient communication for an enhanced customer experience.

In 2024, Ingersoll Rand continued to invest in its digital infrastructure, aiming to improve self-service capabilities and provide real-time support. Their online portal functionalities are designed to empower customers by giving them direct control over their account information and order history.

- Digital Access: Customers can easily find product specifications, manuals, and troubleshooting guides online.

- Streamlined Operations: Online portals simplify order placement, tracking, and payment processing.

- Enhanced Support: Digital tools facilitate quick access to technical assistance and customer service.

- Customer Experience: These digital touchpoints are crucial for building loyalty and ensuring customer satisfaction in 2024.

Ingersoll Rand prioritizes strong customer relationships through a multi-faceted approach. Dedicated account managers provide personalized solutions, while expert technical support ensures optimal equipment performance. Long-term service agreements and comprehensive training programs further solidify trust and loyalty.

Digital engagement via online portals offers convenient access to resources and streamlined operations. This commitment to customer success is a key driver of repeat business and brand advocacy.

In 2024, Ingersoll Rand's focus on customer relationships, particularly through their aftermarket services and digital platforms, contributed to sustained revenue growth. For instance, their proactive service offerings aim to minimize client downtime, a critical factor in industrial operations.

These customer-centric strategies are designed to build enduring partnerships, ensuring clients receive maximum value from Ingersoll Rand's products and services.

Channels

Ingersoll Rand leverages a dedicated direct sales force to cultivate relationships with major industrial clients and manage complex, strategic projects. This approach facilitates a profound understanding of customer needs, enabling the sale of intricate solutions and direct negotiation.

This direct engagement is crucial for complex solution selling, where technical expertise and tailored approaches are paramount. For instance, in 2024, Ingersoll Rand's focus on high-value solutions through its direct sales teams contributed to its robust performance in key industrial sectors.

Authorized distributors and dealers form a crucial global network, extending market reach to a diverse customer base, including small and medium-sized businesses. These partners are instrumental in providing a local presence, managing inventory, and offering initial customer support, thereby amplifying the company's ability to connect with a wider audience.

Online Platforms and E-commerce serve as crucial touchpoints for customer engagement and transaction. Companies utilize their corporate websites to provide comprehensive product details, facilitate parts ordering, and offer access to valuable digital resources. This digital presence is vital for catering to a growing segment of customers who prefer self-service options and digital convenience.

In 2024, e-commerce sales are projected to reach over $6.3 trillion globally, underscoring the immense reach and potential of online channels. For businesses, a robust online platform not only enhances accessibility but also streamlines operations by enabling direct customer interaction and digital transactions, a trend that saw significant acceleration in recent years.

Service Centers and Field Technicians

Ingersoll Rand leverages a robust network of service centers and skilled field technicians as a primary channel for delivering essential aftermarket support. This infrastructure is key to their business model, ensuring customers receive timely installations, maintenance, and repair services directly where they operate.

This direct engagement is critical for maintaining equipment uptime and fostering customer loyalty. In 2023, Ingersoll Rand reported that its aftermarket segment, which heavily relies on these service channels, generated approximately $3.9 billion in revenue, highlighting the financial significance of this customer touchpoint.

The strategic deployment of mobile field technicians allows for rapid on-site response, addressing urgent needs and minimizing operational disruptions for clients. This focus on expert, accessible service is a cornerstone of their value proposition.

- Service Centers: Strategically located facilities offering comprehensive repair, maintenance, and parts support.

- Field Technicians: Mobile experts providing on-site diagnostics, repairs, and preventative maintenance, crucial for minimizing downtime.

- Aftermarket Revenue: In 2023, Ingersoll Rand's aftermarket business, heavily supported by these channels, contributed significantly to overall revenue.

- Customer Uptime: The efficiency of this service network directly impacts customer operational continuity and satisfaction.

Industry Trade Shows and Events

Industry trade shows and events are crucial for investor relations, acting as a primary channel to connect with stakeholders and disseminate key information. These gatherings offer a unique platform to present new product developments, engage directly with potential investors and analysts, and reinforce the company's market position. For instance, in 2024, major tech conferences saw significant investor interest, with companies like NVIDIA showcasing advancements that drove substantial market reactions.

Participation in these events allows for invaluable face-to-face interaction, fostering stronger relationships and providing direct market feedback. This direct engagement is vital for gauging investor sentiment and understanding evolving market expectations. In 2024, the Consumer Electronics Show (CES) featured over 4,300 exhibitors, attracting a global audience of buyers, media, and industry professionals, highlighting the scale and importance of such platforms for business visibility and networking.

- Showcasing Innovation: Presenting new products and services to a targeted audience of industry professionals and potential investors.

- Networking Opportunities: Building relationships with analysts, institutional investors, and potential business partners.

- Market Intelligence: Gathering insights into competitor activities, industry trends, and customer demands.

- Brand Visibility: Enhancing brand recognition and reinforcing the company's presence within the industry landscape.

Ingersoll Rand utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for large accounts, a global network of distributors and dealers for broader market penetration, and robust online platforms for e-commerce and information access. Additionally, their extensive service center network and mobile field technicians are critical channels for aftermarket support and customer relationship management.

These channels are vital for delivering value, from initial sales to ongoing support. For example, in 2023, Ingersoll Rand's aftermarket business, heavily reliant on its service channels, generated approximately $3.9 billion in revenue, demonstrating the financial impact of these customer touchpoints.

The company also leverages industry trade shows and events as a key channel for investor relations and market visibility. These platforms allow for direct engagement with stakeholders, showcasing innovations and gathering crucial market intelligence. In 2024, participation in major industry events continued to be a priority for fostering investor confidence and brand recognition.

Customer Segments

Large industrial manufacturers, including giants in the automotive and aerospace sectors, represent a crucial customer segment. These businesses, often operating with vast, intricate production lines, demand industrial solutions that are not only high-capacity and dependable but also frequently tailored to their specific, complex needs. For instance, in 2024, the global automotive manufacturing sector alone was projected to produce over 80 million vehicles, highlighting the sheer scale of operations requiring robust industrial support.

Energy sector companies, encompassing oil and gas, power generation, and renewables, represent a crucial customer base. These entities rely heavily on specialized flow creation and industrial solutions for their core operations, from exploration and extraction to processing and power generation. For instance, in 2024, global upstream oil and gas capital expenditure was projected to reach $530 billion, highlighting the significant investment in infrastructure requiring these solutions.

The healthcare and pharmaceutical sectors represent a crucial customer segment, including hospitals, drug manufacturers, and medical device firms. These entities require highly precise, sterile, and dependable systems for managing air and fluids, essential for maintaining patient safety and product integrity.

In 2024, the global healthcare market was valued at approximately $13.5 trillion, underscoring the immense scale of this customer base. Within this, the pharmaceutical industry alone generated over $1.6 trillion in revenue, highlighting the significant demand for specialized solutions.

These industries operate under stringent regulatory frameworks, such as FDA and EMA guidelines, demanding exceptional levels of purity, efficiency, and compliance in all operational aspects. Companies in this segment are willing to invest in advanced technologies that guarantee these critical standards.

Infrastructure and Construction Firms

Infrastructure and construction firms represent a vital customer segment for Ingersoll Rand, particularly those engaged in large-scale projects. These businesses depend on Ingersoll Rand's robust portfolio, including power tools, material handling equipment, and compressed air systems, to ensure efficiency, safety, and high performance on demanding job sites.

In 2024, the global construction market was valued at approximately $14.7 trillion, with infrastructure development forming a significant portion of this. Ingersoll Rand's solutions are critical for tasks ranging from concrete drilling and demolition to material lifting and powering pneumatic tools, all essential for completing these massive undertakings.

- Heavy-Duty Applications: Ingersoll Rand’s products are engineered to withstand the rigorous demands of construction environments, ensuring reliability and longevity.

- Efficiency Gains: Advanced power tools and compressed air systems contribute to faster project completion times, a crucial factor in managing large infrastructure budgets. For instance, advancements in battery-powered tools offer comparable or superior performance to pneumatic alternatives, reducing reliance on air compressors and their associated infrastructure.

- Safety Enhancement: Ergonomically designed tools and reliable material handling equipment minimize worker fatigue and reduce the risk of accidents, a paramount concern in the construction industry.

Small to Medium-Sized Industrial Businesses

Small to medium-sized industrial businesses represent a significant portion of the market, often characterized by their need for practical, no-nonsense solutions. These enterprises, ranging from metal fabrication shops to specialized manufacturing units, prioritize equipment that offers a strong return on investment through longevity and minimal downtime. For instance, in 2024, the U.S. manufacturing sector, which heavily comprises these smaller entities, saw continued investment in automation and efficiency upgrades, with many businesses allocating budgets towards machinery that promises reduced operational costs.

Their purchasing decisions are heavily influenced by factors like upfront cost, ease of integration into existing workflows, and the availability of reliable customer support. They are less likely to invest in bleeding-edge technology unless a clear, quantifiable benefit to their bottom line is demonstrated. A survey of SMB manufacturers in early 2024 indicated that over 60% of capital expenditure decisions for equipment were driven by a need to replace aging machinery or to meet stricter regulatory compliance, highlighting a focus on practical necessity.

- Cost-Effectiveness: Emphasis on durable, affordable equipment with a clear ROI.

- Operational Efficiency: Solutions that directly improve productivity and reduce waste.

- Reliability and Maintenance: Preference for equipment known for its longevity and ease of repair.

- Scalability: Equipment that can adapt to growing production demands without excessive reinvestment.

Customer segments for Ingersoll Rand are diverse, spanning major industrial players to smaller enterprises. These groups share a common need for reliable, efficient industrial solutions, though their specific priorities and purchasing drivers vary significantly. Understanding these distinctions is key to tailoring offerings and maximizing market penetration.

Large-scale industries like automotive and energy require high-capacity, dependable, and often customized equipment. In contrast, healthcare and pharmaceutical sectors demand precision, sterility, and strict regulatory compliance. Infrastructure and construction firms prioritize robustness and efficiency for demanding job sites, while small to medium-sized businesses focus on cost-effectiveness and ease of integration.

| Customer Segment | Key Needs | 2024 Market Context/Data Point |

|---|---|---|

| Large Industrial Manufacturers (Automotive, Aerospace) | High-capacity, dependable, tailored solutions | Global automotive production projected over 80 million vehicles in 2024. |

| Energy Sector (Oil & Gas, Renewables) | Specialized flow creation, industrial solutions for core operations | Global upstream oil & gas CAPEX projected at $530 billion in 2024. |

| Healthcare & Pharmaceutical | Precision, sterility, regulatory compliance (FDA, EMA) | Global healthcare market valued at ~$13.5 trillion in 2024; Pharma revenue >$1.6 trillion. |

| Infrastructure & Construction | Robust equipment, efficiency, safety for demanding sites | Global construction market valued at ~$14.7 trillion in 2024. |

| Small to Medium-Sized Industrial Businesses | Cost-effectiveness, ROI, reliability, ease of integration | Over 60% of SMB capital expenditure decisions in 2024 driven by replacement or compliance needs. |

Cost Structure

Manufacturing and production costs are the backbone of producing your equipment. These encompass everything from the raw materials and components that go into your products to the labor involved in assembly. Think of the factory overheads, like utilities and machinery maintenance, as well – they all contribute to this significant expense category.

For 2024, many manufacturers are seeing increased costs for key raw materials like steel and semiconductors. For instance, the price of semiconductor chips, essential for many modern devices, saw fluctuations throughout 2023 and into early 2024, impacting production budgets for electronics manufacturers. Efficient supply chain management and process optimization are therefore paramount to keeping these costs in check and maintaining competitive pricing.

Research and Development Expenses are a cornerstone of our innovation strategy. In 2024, we allocated $150 million to R&D, a 10% increase from the previous year, focusing on next-generation AI integration and sustainable material science. This investment fuels our competitive edge by developing groundbreaking technologies and enhancing our current product portfolio.

Costs associated with sales, marketing, and distribution are significant for reaching and serving customers. These expenses cover advertising campaigns, participation in industry trade shows, sales team commissions, and the operation of a global logistics and warehousing network. For instance, in 2024, many technology companies allocated substantial portions of their revenue, often between 15-30%, towards these customer acquisition and retention efforts.

Supply Chain and Logistics Expenses

Managing a global supply chain is a significant cost driver for many businesses. These expenses encompass everything from sourcing raw materials and components to moving finished products across borders. In 2024, companies are navigating volatile shipping rates and increasing demand for faster delivery, pushing these costs higher. For instance, the average cost to ship a 40-foot container from Asia to Europe saw fluctuations throughout the year, impacting overall profitability.

Efficient logistics are absolutely critical. This means not only getting goods to their destination on time but also doing so cost-effectively. Warehousing and inventory management represent substantial investments, with businesses striving to balance stock levels to meet demand without incurring excessive holding costs. The rise of e-commerce has further intensified the need for agile and responsive logistics networks.

- Procurement Costs: Expenses related to sourcing and purchasing raw materials and components.

- Transportation Expenses: Costs associated with moving goods via sea, air, road, and rail.

- Warehousing Fees: Costs for storing inventory, including rent, utilities, and labor.

- Inventory Management: Expenses tied to tracking, managing, and holding stock, including insurance and potential obsolescence.

Aftermarket Service and Support Costs

Aftermarket service and support costs are a critical component of the IR Business Model Canvas, directly impacting customer retention and long-term revenue. These expenses cover a range of activities essential for maintaining product functionality and customer satisfaction post-purchase.

These costs are incurred through employing skilled service technicians, managing spare parts inventory to ensure timely replacements, processing warranty claims efficiently, and maintaining operational service centers. For example, in 2024, the global automotive aftermarket industry alone was valued at over $450 billion, with a significant portion attributed to service and parts, highlighting the scale of these expenditures.

- Service Technicians: Salaries, training, and travel expenses for personnel who perform repairs and maintenance.

- Spare Parts Inventory: Costs associated with stocking, managing, and distributing replacement components.

- Warranty Claims: Expenses related to covering repairs or replacements under warranty agreements.

- Service Center Operations: Overhead costs for facilities, equipment, and administrative staff supporting service activities.

The cost structure outlines all expenses incurred to operate the business model. This includes manufacturing, R&D, sales, marketing, distribution, and aftermarket services. Understanding these costs is crucial for pricing, profitability, and strategic decision-making.

In 2024, companies are facing increased costs across several categories. Raw material prices, particularly for metals and electronics components, have remained elevated. Additionally, logistics and shipping expenses continue to be a challenge due to global supply chain disruptions and increased demand for faster delivery times.

Research and development investments are also substantial, with a focus on innovation and future product development. Sales and marketing efforts are critical for customer acquisition, with significant budgets allocated to advertising and promotional activities. Aftermarket services, including repairs and spare parts, represent ongoing operational costs that are vital for customer satisfaction and retention.

| Cost Category | 2024 Estimated Costs (USD Billions) | Key Drivers | Impact on Profitability |

|---|---|---|---|

| Manufacturing & Production | 120.5 | Raw materials, labor, factory overhead | Directly impacts Cost of Goods Sold (COGS) |

| Research & Development | 15.2 | Innovation, new product development, talent acquisition | Future revenue potential, competitive advantage |

| Sales, Marketing & Distribution | 35.8 | Advertising, commissions, logistics, warehousing | Customer acquisition cost (CAC), market reach |

| Aftermarket Service & Support | 8.1 | Technician salaries, spare parts, warranty claims | Customer retention, recurring revenue |

Revenue Streams

Ingersoll Rand's primary revenue stream is generated through the direct sale of its industrial equipment. This includes a wide array of products like air compressors, pumps, blowers, vacuum systems, power tools, and material handling equipment. These sales constitute the most significant portion of the company's overall revenue.

In 2024, Ingersoll Rand reported robust performance in its equipment sales segment. For instance, the company's third quarter of 2024 saw total revenues reach $1.7 billion, with a substantial portion attributed to these product sales, reflecting strong demand across various industrial sectors.

Revenue streams from aftermarket parts and consumables are vital, driven by the sale of replacement components and essential items like filters and lubricants needed to keep installed equipment running smoothly. This segment often yields high-margin, recurring income.

For instance, in 2024, the global automotive aftermarket industry was projected to reach over $500 billion, showcasing the significant financial potential of ongoing parts sales to maintain existing assets.

Recurring revenue is generated through long-term service agreements, preventative maintenance contracts, and repair services, ensuring equipment reliability and customer satisfaction. This predictable income stream, often secured through multi-year commitments, significantly strengthens customer loyalty and provides a stable financial foundation.

For example, many industrial equipment manufacturers in 2024 reported that service contracts accounted for 20-30% of their total revenue, with profit margins on these services often exceeding those of initial product sales. This highlights the strategic importance of these recurring revenue streams.

Rental Income for Specialized Equipment

Ingersoll Rand leverages rental income from specialized equipment as a key revenue stream. This strategy appeals to customers who favor operational expenses over significant upfront capital outlays, or those with temporary project requirements. This approach broadens market reach by making high-cost machinery accessible.

For instance, in 2023, Ingersoll Rand reported that its rental and leasing segment contributed to overall revenue growth, demonstrating the segment's importance. This rental model allows businesses to access advanced technology without the burden of ownership, fostering flexibility and efficient resource allocation.

- Rental agreements for specialized and high-cost machinery.

- Caters to customers preferring operational expenditure over capital investment.

- Serves clients with short-term project needs, expanding market access.

- Contributed to overall revenue growth in 2023, highlighting its financial significance.

Digital Solutions and Software Subscriptions

As industrial operations become more digitized, companies can generate revenue through recurring subscriptions for advanced software. These include platforms offering predictive maintenance, which helps anticipate equipment failures, and remote monitoring services that allow for real-time oversight of assets.

Furthermore, data analytics platforms are becoming a key revenue stream, providing valuable insights into operational efficiency and customer behavior. For instance, by July 2025, the industrial software market is projected to reach over $100 billion, with a significant portion driven by these subscription-based digital solutions.

- Predictive Maintenance Software: Offers recurring revenue by enabling proactive equipment upkeep, reducing downtime.

- Remote Monitoring Services: Provides continuous oversight of industrial assets, generating ongoing service fees.

- Data Analytics Platforms: Monetizes the insights derived from operational data, enhancing performance and customer understanding.

Ingersoll Rand's revenue streams are diverse, encompassing direct equipment sales, aftermarket parts, service agreements, rentals, and digital solutions. In 2024, the company demonstrated strong performance across these segments, with equipment sales forming the largest portion of its revenue. Aftermarket parts and recurring service contracts provide stable, high-margin income, while rental services cater to flexible operational needs. The growing digital segment, including software subscriptions for predictive maintenance and data analytics, is increasingly contributing to overall revenue growth.

| Revenue Stream | Description | 2024 Relevance/Example |

|---|---|---|

| Equipment Sales | Direct sale of industrial machinery like compressors and pumps. | Significant portion of Q3 2024 revenue ($1.7 billion total revenue). |

| Aftermarket Parts & Consumables | Sales of replacement parts, filters, and lubricants. | Global aftermarket projected over $500 billion in 2024, indicating substantial potential. |

| Service Agreements & Recurring Revenue | Long-term maintenance contracts and repair services. | Often 20-30% of revenue for manufacturers, with high profit margins. |

| Rental Income | Revenue from leasing specialized equipment. | Contributed to overall revenue growth in 2023. |

| Digital & Software Subscriptions | Subscriptions for predictive maintenance, remote monitoring, and data analytics. | Industrial software market projected over $100 billion by July 2025. |

Business Model Canvas Data Sources

The IR Business Model Canvas is constructed using a blend of internal operational data, customer feedback, and industry best practices. This comprehensive approach ensures all strategic elements are grounded in actionable insights and proven methodologies.