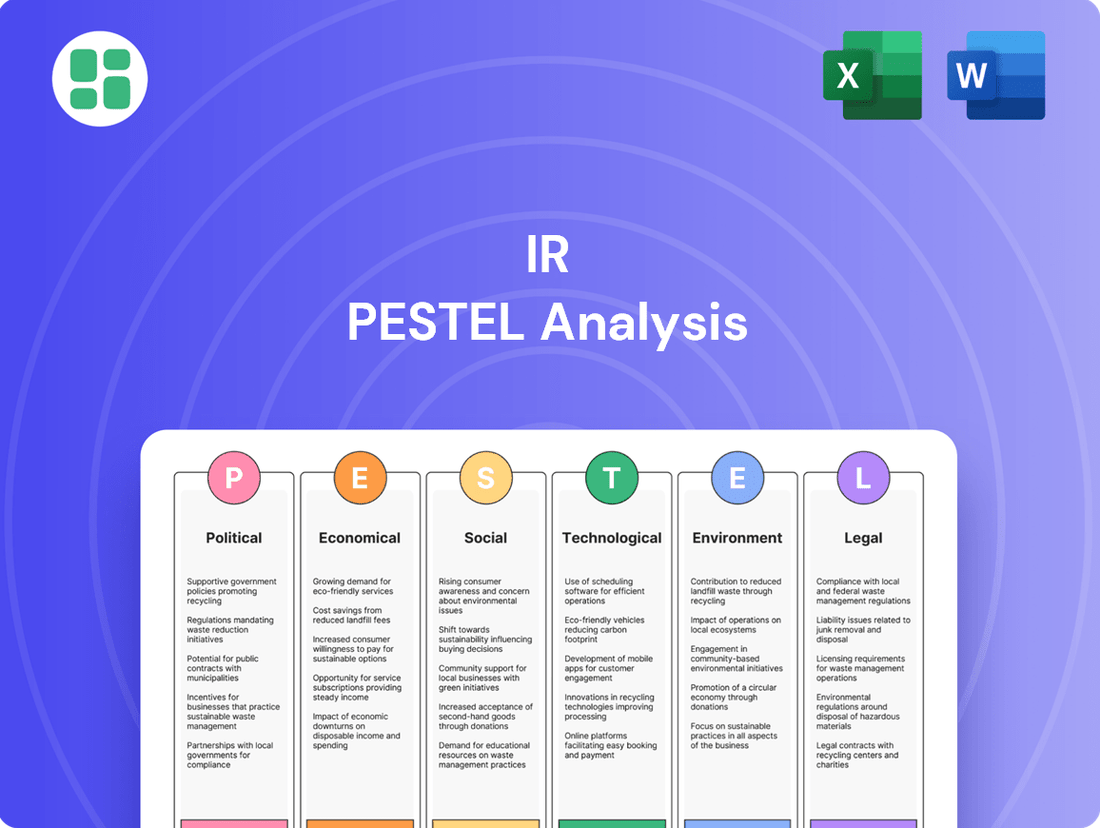

IR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IR Bundle

Navigate the complex external landscape impacting IR with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its future. Gain a strategic advantage by leveraging these expert insights to inform your investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Ingersoll Rand is significantly shaped by government policies, particularly those that foster industrial growth. For example, the US Inflation Reduction Act of 2022, with its substantial investments in clean energy and manufacturing, offers potential benefits for Ingersoll Rand's climate technologies and sustainable solutions segments. This policy aims to boost domestic production, which could translate into increased demand for the company's energy-efficient equipment and services.

Ingersoll Rand navigates a dynamic trade landscape, with ongoing policy shifts and potential trade disputes, such as those between the United States and China, posing significant challenges. These trade tensions can manifest as increased tariffs on crucial imported materials like steel or manufactured goods from China, directly impacting Ingersoll Rand's cost of raw materials and components. This, in turn, can disrupt supply chains and compress profit margins.

Management has projected that existing tariff rates could lead to an approximate $150 million impact in 2025, with a notable portion attributable to trade with China. To counter these effects, the company is actively pursuing strategies such as implementing price adjustments, enhancing supply chain efficiencies, and exploring opportunities for localized manufacturing to build resilience against these external economic pressures.

Geopolitical instability, including attacks on commercial shipping and escalating trade disputes, remains a significant threat to global supply chains. Ingersoll Rand is actively focusing on building resilience to better manage these ongoing disruptions.

The US Department of Defense's National Defense Industrial Strategy, released in early 2024, underscores the importance of robust and resilient supply chains. This strategic alignment supports Ingersoll Rand's imperative for secure and adaptable sourcing of critical components.

Regulatory Frameworks and Compliance

Ingersoll Rand navigates a complex web of regulations globally, impacting its operations in areas like trade tariffs and industrial safety standards. For instance, in 2024, the company faced ongoing scrutiny regarding emissions standards in several key markets, necessitating investments in cleaner technologies. Adherence to these evolving frameworks is paramount for maintaining its license to operate and ensuring market access.

The company's strategic decisions are heavily influenced by the stability and transparency of fiscal and regulatory environments. Countries offering predictable tax policies and clear compliance pathways, such as those in the European Union and North America, remain critical hubs for Ingersoll Rand's growth. Conversely, regions with frequent regulatory shifts or less transparent governance can pose significant challenges to long-term investment.

- Global Compliance Burden: Ingersoll Rand's 2024 annual report highlighted an increase in compliance-related expenses, driven by new environmental regulations in Asia-Pacific and updated safety protocols in North America.

- Trade Policy Impact: Changes in international trade agreements, such as potential tariff adjustments discussed in late 2024, directly affect the cost of goods and supply chain strategies for Ingersoll Rand's diverse product lines.

- Environmental Regulations: The company is investing in R&D to meet stricter emissions standards, with a target of reducing Scope 1 and 2 emissions by 50% by 2030, a goal directly tied to regulatory pressures.

- Operational Integrity: Maintaining a strong compliance record is essential for Ingersoll Rand's reputation and its ability to secure contracts with government entities and large industrial clients who often mandate stringent regulatory adherence.

Government Spending on Infrastructure and Energy

Government investments in infrastructure and clean energy are poised to boost demand for Ingersoll Rand's specialized industrial solutions. For instance, the US Inflation Reduction Act, enacted in 2022, allocates substantial funding towards clean energy manufacturing and deployment, directly benefiting companies providing essential components for these sectors. This legislation is expected to channel billions into renewable energy projects, creating a ripple effect for industrial equipment providers like Ingersoll Rand.

Policies promoting green technology manufacturing, such as those incentivizing hydrogen production and carbon capture, offer direct opportunities. Ingersoll Rand's hydrogen compression systems and energy-efficient solutions are well-positioned to capitalize on this shift. The global hydrogen market, valued at approximately $130 billion in 2023, is projected to grow significantly, driven by these supportive government initiatives.

- Infrastructure Spending: Increased government outlays on roads, bridges, and public transportation projects translate to higher demand for Ingersoll Rand's compressors, pumps, and other essential industrial equipment.

- Clean Energy Incentives: The Inflation Reduction Act's tax credits and grants for renewable energy, electric vehicles, and energy efficiency are expected to accelerate adoption, benefiting Ingersoll Rand's advanced technology offerings.

- Energy Transition Support: Government backing for the development of new energy sources, including hydrogen, directly aligns with Ingersoll Rand's product portfolio, particularly its compression technologies.

Government policies significantly influence Ingersoll Rand's operational landscape, from trade tariffs to environmental regulations. The company's 2024 annual report noted increased compliance expenses due to new environmental rules in Asia-Pacific and safety updates in North America. Changes in international trade agreements, like potential tariff adjustments discussed in late 2024, directly impact the cost of goods and supply chain strategies.

| Policy Area | Impact on Ingersoll Rand | 2024/2025 Data/Projection |

|---|---|---|

| Trade Tariffs | Increased cost of raw materials and components, supply chain disruption, margin compression. | Projected $150 million impact in 2025, partly from China trade. |

| Environmental Regulations | Need for investment in cleaner technologies, R&D focus. | Target to reduce Scope 1 & 2 emissions by 50% by 2030; increased compliance expenses in 2024. |

| Infrastructure & Clean Energy Spending | Boosted demand for compressors, pumps, and industrial solutions. | US Inflation Reduction Act (2022) funding clean energy manufacturing; global hydrogen market ~$130 billion (2023) with significant growth. |

What is included in the product

The IR PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the IR's operating landscape.

It provides a comprehensive understanding of external forces, enabling strategic decision-making and risk mitigation.

Provides a clear, actionable summary of external factors, enabling teams to quickly identify and address potential threats and opportunities without getting bogged down in data.

Economic factors

The overall health of the global economy and industrial production significantly impacts Ingersoll Rand's product and service demand. While 2024 experienced a dip in industrial net absorption, the U.S. economy demonstrated resilience, with continued growth anticipated for 2025.

However, early 2025 data reveals weak demand within heavy manufacturing sectors, suggesting a nuanced economic landscape. This mixed environment presents both opportunities and challenges for companies like Ingersoll Rand.

Inflationary pressures continue to affect Ingersoll Rand's operational expenses, particularly the costs of raw materials and transportation. For instance, the Producer Price Index for manufactured goods saw increases throughout 2024, impacting input costs for industrial companies.

Interest rate trends play a crucial role in customer capital investment decisions. While higher rates in 2023 and early 2024 may have tempered some spending, projections suggest a potential easing of interest rates in 2025.

This anticipated shift could stimulate business spending, including investments in energy-efficient and clean technology products, which Ingersoll Rand offers. Lower borrowing costs would make these capital expenditures more attractive for customers.

Ingersoll Rand's global operations mean its financial results are significantly influenced by shifts in currency exchange rates. These fluctuations can impact the reported value of international sales and expenses when translated back into US dollars.

For the entirety of 2025, Ingersoll Rand's financial outlook is built upon an assumption of steady foreign exchange rates. Specifically, the company is basing its guidance on the currency values observed at the close of December 2024, anticipating these rates will consistently affect revenue throughout both the first and second halves of the year.

Raw Material and Energy Costs

Ingersoll Rand, like many manufacturers, is still navigating the complexities of elevated raw material and energy costs. While the most intense supply chain disruptions seen during the pandemic have subsided, certain critical material lead times continue to be longer than pre-pandemic norms, impacting production schedules and inventory management. For instance, the cost of steel, a key component in many of Ingersoll Rand's products, saw significant volatility in late 2023 and early 2024, with prices fluctuating based on global demand and production levels. Similarly, energy prices, particularly natural gas and electricity, remain a substantial operating expense that directly affects manufacturing overhead.

Effectively managing these input costs is paramount for Ingersoll Rand's financial health and its ability to offer competitive pricing in the market. The company's profitability is directly tied to its success in mitigating these expenses through strategic sourcing, hedging strategies, and operational efficiencies. For example, in the first quarter of 2024, Ingersoll Rand reported that its cost of goods sold was impacted by these persistent inflationary pressures, although the company highlighted its ongoing efforts to offset these through price realization and productivity initiatives.

- Persistent Inflation: Raw material costs, including metals and components, remain a key concern, with some categories experiencing price increases of 5-10% year-over-year in early 2024.

- Energy Price Volatility: Fluctuations in global energy markets directly impact manufacturing operational costs, with electricity prices in key regions showing upward trends.

- Extended Lead Times: Despite improvements, lead times for certain specialized components can still be 20-30% longer than historical averages, affecting production planning.

- Strategic Cost Management: Ingersoll Rand's focus on operational efficiencies and supply chain optimization is crucial for maintaining margins in this challenging cost environment.

End Market Cyclicality and Demand Drivers

Ingersoll Rand's performance is closely tied to the cyclical nature of its diverse end markets, including manufacturing, energy, healthcare, and infrastructure. While geopolitical factors like tariffs introduced some short-term customer hesitation in 2024, a robust pipeline of longer-term projects indicates sustained capital expenditure on industrial equipment through 2025.

A significant demand driver for the industrial sector in 2025 is the burgeoning need for modern, energy-efficient industrial spaces. This trend is largely propelled by the expansion of third-party logistics (3PL) providers and the continued growth of e-commerce, necessitating increased investment in warehousing and distribution infrastructure.

- Manufacturing Sector Growth: Projections suggest a modest uptick in global manufacturing output for 2025, with key regions showing improved capacity utilization.

- Energy Infrastructure Investment: The energy sector is expected to see continued investment in modernization and efficiency upgrades, particularly in renewable energy integration and grid enhancements.

- Healthcare Facility Expansion: Demand for new and upgraded healthcare facilities, driven by an aging global population and advancements in medical technology, remains a stable contributor.

- Infrastructure Development: Government stimulus packages and private sector initiatives focused on infrastructure renewal and expansion are anticipated to bolster demand for related industrial equipment.

Economic factors significantly shape Ingersoll Rand's market. While industrial production saw a dip in 2024, the U.S. economy is expected to grow in 2025, though heavy manufacturing demand remains weak. Persistent inflation continues to drive up operational costs, particularly for raw materials and energy, with producer prices for manufactured goods showing increases throughout 2024.

Interest rate trends are crucial for customer capital investments. Although higher rates in 2023-2024 may have slowed spending, anticipated rate easing in 2025 could stimulate demand for capital expenditures, including energy-efficient products. Ingersoll Rand's global operations mean currency exchange rate fluctuations impact reported international sales and expenses, with the company basing its 2025 guidance on December 2024 exchange rates.

| Economic Factor | 2024 Trend | 2025 Outlook | Impact on Ingersoll Rand |

|---|---|---|---|

| Global Economic Growth | Mixed, U.S. resilience | Continued growth anticipated | Influences overall product demand |

| Inflation (PPI) | Increasing for manufactured goods | Expected to persist, moderating | Increases operational and material costs |

| Interest Rates | Elevated in 2023-early 2024 | Potential easing | Affects customer capital investment decisions |

| Currency Exchange Rates | Volatile | Assumed stable (Dec 2024 levels) | Impacts reported international revenue and expenses |

Full Version Awaits

IR PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive IR PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a detailed breakdown of the IR PESTLE framework.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and actionable IR PESTLE analysis.

Sociological factors

The industrial sector, including companies like Ingersoll Rand, is grappling with persistent workforce availability issues and critical skill gaps. Projections suggest a substantial number of manufacturing job vacancies could emerge over the next decade if these challenges aren't proactively managed.

Ingersoll Rand must prioritize strategies to attract and retain a competent workforce, particularly for positions demanding advanced technical expertise and digital proficiency. A 2023 report indicated that over 70% of manufacturers were experiencing a shortage of skilled production workers, highlighting the urgency.

Ingersoll Rand cultivates a strong 'people-first culture' and an 'ownership mindset,' directly impacting employee engagement and retention. This focus is a key sociological factor for the company.

In 2024, Ingersoll Rand achieved an impressive employee engagement index score of 81, positioning it within the top 10% of manufacturing firms. Furthermore, the company extended equity to roughly 3,900 employees through its Ownership Works program, reinforcing this culture of shared responsibility and commitment.

Societal and investor expectations for robust corporate social responsibility are on the rise, pushing companies to go beyond profit. Ingersoll Rand is a prime example, demonstrating significant commitment to sustainability.

In 2024, Ingersoll Rand achieved a remarkable position, ranking in the top 1% within its industry in the S&P Global Corporate Sustainability Assessment. Furthermore, the company was recognized on CDP's prestigious 'A List' for its exceptional environmental stewardship.

This dedication to environmental, social, and governance (ESG) principles directly addresses the evolving priorities of a wide range of stakeholders, including investors, customers, and employees, influencing brand reputation and long-term value.

Demand for Sustainable and Efficient Solutions

Societal expectations are increasingly pushing for industrial solutions that are not only effective but also kind to the planet and conserve energy. This growing demand directly shapes what customers look for in products and services.

Ingersoll Rand is strategically positioned to capitalize on this trend. Their commitment to sustainable innovation is evident in their product development, such as the EVO Series electric diaphragm pump, which offers enhanced energy efficiency. This focus not only meets current market desires but also opens doors to new business avenues.

- Growing Demand: A 2024 report indicated that 70% of consumers consider sustainability when making purchasing decisions, a figure expected to rise.

- Energy Efficiency Focus: Ingersoll Rand's EVO Series electric diaphragm pumps, for example, can reduce energy consumption by up to 25% compared to older models.

- Market Expansion: This alignment with sustainability trends allows Ingersoll Rand to tap into the expanding green technology market, projected to reach over $1.5 trillion globally by 2027.

- Brand Reputation: Companies demonstrating a strong commitment to environmental responsibility often see improved brand loyalty and a competitive edge.

Demographic Shifts and Labor Market Dynamics

Demographic shifts, like aging populations and declining birth rates in many developed nations, are reshaping labor markets. For instance, the European Union's population aged 65 and over is projected to reach 30% by 2050, a significant increase from around 20% in 2020, according to Eurostat data. This trend directly impacts workforce availability, potentially leading to labor shortages and increased competition for skilled workers. Businesses will need to adapt by investing in automation, reskilling existing employees, and exploring new talent pools.

These demographic changes create distinct challenges and opportunities for businesses. A shrinking active workforce can drive up wages and necessitate greater investment in productivity-enhancing technologies. Companies that proactively address these shifts by implementing robust workforce development programs and embracing automation are likely to maintain a competitive edge.

- Aging Workforce: By 2030, it's estimated that over 25% of the workforce in many OECD countries will be aged 55 and older, impacting retirement patterns and knowledge transfer.

- Declining Birth Rates: In countries like Japan and South Korea, birth rates are at historic lows, leading to a projected decrease in the working-age population by millions in the coming decades.

- Automation Imperative: To counter labor scarcity, investment in robotics and AI in manufacturing and services is expected to grow significantly, with global spending projected to reach hundreds of billions of dollars by the late 2020s.

- Skills Gap Widening: The mismatch between available jobs and the skills of the workforce is exacerbated by these demographic trends, requiring significant investment in lifelong learning and vocational training.

Sociological factors significantly shape business operations, influencing workforce dynamics and consumer expectations. Ingersoll Rand's focus on a 'people-first culture' and employee ownership, evidenced by an 81% engagement score in 2024 and equity for 3,900 employees, directly addresses these influences.

Rising societal and investor demands for corporate social responsibility are paramount. Ingersoll Rand's top 1% ranking in S&P Global's 2024 Corporate Sustainability Assessment and CDP 'A List' recognition highlight their commitment to ESG principles, which impacts brand reputation and stakeholder value.

Demographic shifts, such as aging populations and declining birth rates, present workforce challenges. Projections indicate over 25% of the workforce in many OECD countries will be 55+ by 2030, necessitating adaptation through automation and reskilling to counter labor scarcity.

| Sociological Factor | Impact on Ingersoll Rand | Supporting Data (2023-2025) |

|---|---|---|

| Workforce Availability & Skills | Persistent shortages, need for advanced technical skills. | 70% of manufacturers faced skilled production worker shortages in 2023. |

| Employee Engagement & Culture | Key to retention and productivity. | 81% employee engagement index score in 2024; 3,900 employees received equity through Ownership Works. |

| Corporate Social Responsibility (CSR) | Growing expectation from stakeholders, influencing brand. | Top 1% in S&P Global CSA (2024); CDP 'A List' recognition. |

| Demographic Shifts (Aging Workforce) | Potential labor shortages, need for automation and reskilling. | Over 25% of OECD workforce expected to be 55+ by 2030. |

Technological factors

The industrial sector's embrace of Industry 4.0, featuring automation, AI, and the Internet of Things (IoT), is fundamentally reshaping operations. This digital transformation is driving significant gains in efficiency and resilience across supply chains. For instance, by 2024, it's projected that 70% of manufacturers will have adopted IoT solutions, a substantial increase from previous years, highlighting this critical trend.

Ingersoll Rand is actively integrating these Industry 4.0 technologies to bolster its operational performance and product offerings. The company is enhancing its supply chain's ability to withstand disruptions and is developing products with digital connectivity. This allows for the collection of crucial usage data, enabling predictive maintenance and improved customer service, a key differentiator in the evolving market.

Ingersoll Rand's commitment to technological innovation in energy efficiency is a key driver for its product development, especially within its compressor, pump, and vacuum systems. This focus directly addresses the increasing market demand for industrial solutions that reduce energy consumption and environmental impact.

A prime example is the recent launch of their EVO Series electric diaphragm pump. This new offering demonstrates a significant 15% improvement in energy efficiency compared to previous models. This advancement positions Ingersoll Rand to capitalize on the growing trend of sustainability in industrial operations.

Artificial intelligence (AI) and machine learning (ML) are revolutionizing operations and supply chains, enhancing manufacturing quality, efficiency, and resilience. Companies are leveraging AI for predictive maintenance, reducing downtime and costs. For instance, in 2024, industries reported an average reduction of 15-20% in unexpected equipment failures through AI-driven predictive maintenance strategies.

Logistics optimization is another key area where AI is making significant strides. AI algorithms can analyze vast datasets to identify the most efficient routes, manage inventory levels, and predict demand fluctuations. This allows for better resource allocation and cost savings, with some firms seeing a 10% improvement in delivery times and a 5% decrease in transportation expenses by implementing AI-powered logistics solutions in 2024.

Furthermore, AI's ability to monitor supply chains in real-time for disruptions, such as geopolitical events or natural disasters, is crucial for building resilience. Ingersoll Rand can employ these advanced tools to proactively identify potential bottlenecks, reroute shipments, and optimize resource deployment, thereby mitigating the impact of unforeseen challenges and ensuring business continuity.

Product Portfolio Expansion through Technology

Ingersoll Rand is actively broadening its product range by incorporating cutting-edge technologies, often through strategic acquisitions. This approach allows them to fill existing gaps and enter new markets. For example, the acquisition of Lead Fluid brought advanced peristaltic pump technology into their portfolio, significantly enhancing their life sciences offerings.

This technological integration is crucial for staying competitive. By acquiring companies like Lead Fluid, Ingersoll Rand not only expands its product breadth but also gains access to specialized expertise and intellectual property. This move directly addresses a prior limitation in their pump solutions, creating a more complete offering for customers in the life sciences sector.

- Acquisition of Lead Fluid: Integrated advanced peristaltic pump technology.

- Life Sciences Expansion: Strengthened offerings in a key growth area.

- Portfolio Enhancement: Addressed a previous gap in comprehensive pump solutions.

- Technological Integration: A strategic driver for competitive advantage.

Cybersecurity and Data Protection

As industrial operations increasingly rely on digital systems and interconnected networks, cybersecurity and data protection have become paramount. Protecting sensitive operational data and intellectual property is crucial for maintaining stakeholder trust and ensuring uninterrupted business activities. The growing sophistication of cyber threats necessitates robust defense mechanisms.

The financial impact of cyber incidents is significant. For instance, the average cost of a data breach in 2024 reached an estimated $4.73 million globally, a figure that continues to rise as cyberattacks become more prevalent and complex. This underscores the critical need for substantial investment in cybersecurity infrastructure and protocols to mitigate financial losses and operational disruptions.

- Increased Cyber Threats: Ransomware attacks and sophisticated phishing schemes are on the rise, targeting critical infrastructure and sensitive data.

- Regulatory Compliance: Stricter data protection regulations, such as GDPR and CCPA, impose significant penalties for non-compliance, driving investment in security measures.

- Intellectual Property Protection: Safeguarding proprietary information and trade secrets is vital for maintaining competitive advantage in a digitized economy.

- Operational Continuity: Ensuring the resilience of IT systems against cyberattacks is essential for preventing downtime and maintaining business operations.

Technological advancements are profoundly reshaping the industrial landscape, with Industry 4.0 principles like AI, automation, and IoT driving efficiency and resilience. Ingersoll Rand is actively integrating these technologies, evident in its EVO Series electric diaphragm pump, which boasts a 15% energy efficiency improvement. The company's strategic acquisitions, such as Lead Fluid, further bolster its technological capabilities, particularly in the life sciences sector.

Legal factors

Ingersoll Rand, a key player in mission-critical industrial solutions, navigates a complex web of global product safety and quality standards. Adherence to directives such as the EU Machinery Directive and Pressure Equipment Directive is not merely a legal obligation but a cornerstone of their operational integrity, ensuring the reliability and safety of their diverse product portfolio for customers worldwide.

The company's commitment to these rigorous standards is reflected in its substantial investments in research and development, aiming to exceed minimum compliance requirements. For instance, in 2023, Ingersoll Rand reported allocating approximately $400 million towards R&D, a significant portion of which directly supports the enhancement of product safety features and the validation of quality control processes across its manufacturing facilities.

Ingersoll Rand navigates a landscape of increasingly stringent environmental regulations, particularly concerning greenhouse gas emissions and waste disposal. These legal frameworks directly influence operational costs and strategic planning.

The company has demonstrated a proactive approach by establishing and validating Science Based Targets initiative (SBTi) goals for Scope 1, 2, and 3 emissions. This commitment underscores their dedication to meeting and exceeding legal requirements for environmental stewardship and emissions reduction.

Ingersoll Rand must navigate a complex web of labor laws and employment regulations globally, impacting everything from compensation to workplace safety. For instance, in 2024, companies operating in the United States faced increased scrutiny on overtime pay rules, a critical area for a manufacturing-heavy organization like Ingersoll Rand. Adherence to these diverse legal frameworks is fundamental to maintaining a stable workforce and mitigating significant legal risks.

Compliance with regulations concerning employee relations and benefits is equally crucial. In 2025, many regions are seeing evolving legislation around employee data privacy and remote work arrangements, which Ingersoll Rand must actively monitor. Failure to comply with these employment standards can lead to substantial fines and damage to the company's reputation, directly affecting its ability to attract and retain talent.

Antitrust and Competition Laws

Ingersoll Rand's global operations mean it must navigate a complex web of antitrust and competition laws across various regions. These regulations are designed to foster a level playing field, preventing any single entity from dominating markets and harming consumers. For Ingersoll Rand, this translates to rigorous scrutiny of any proposed mergers or acquisitions to ensure they don't create undue market concentration.

For instance, a significant acquisition by Ingersoll Rand in 2024 or 2025 would likely trigger reviews by antitrust authorities in major markets like the United States (Federal Trade Commission and Department of Justice) and the European Union (European Commission). These bodies assess whether a transaction would substantially lessen competition or tend to create a monopoly. Failure to comply can result in hefty fines, divestitures, or even the blocking of deals.

- Regulatory Scrutiny: Ingersoll Rand's potential acquisitions in 2024-2025 will face stringent antitrust reviews in key operating regions.

- Market Impact: Competition laws directly influence Ingersoll Rand's M&A strategy, market share growth, and pricing power.

- Compliance Costs: Adhering to these laws involves significant legal and consulting fees to ensure all transactions and market practices meet regulatory standards.

- Global Harmonization Challenges: Differing antitrust approaches across jurisdictions can complicate global business strategies for companies like Ingersoll Rand.

Intellectual Property Rights and Patent Protection

Ingersoll Rand's ability to protect its intellectual property, particularly its patents for innovative technologies and product designs, is fundamental to maintaining its competitive edge. Strong legal frameworks surrounding intellectual property rights are essential for the company to secure its significant investments in research and development and to deter any unauthorized replication or use of its unique solutions.

The company actively manages its patent portfolio to safeguard its market position. As of early 2024, Ingersoll Rand held thousands of active patents globally, covering a wide array of its products and technologies, from advanced compressor systems to climate control solutions.

- Patent Portfolio Strength: Ingersoll Rand's robust patent portfolio, comprising thousands of granted patents worldwide, underpins its technological leadership and market differentiation.

- R&D Investment Protection: Legal protection of IP ensures that the company's substantial R&D expenditures translate into sustainable competitive advantages rather than being eroded by imitation.

- Global Enforcement: The company actively monitors and enforces its patent rights across key operating regions, addressing infringement to preserve its market share and profitability.

- Innovation Incentives: Strong patent protection fosters a culture of continuous innovation by providing a secure environment for developing and commercializing new technologies.

Ingersoll Rand's global operations are significantly shaped by evolving legal and regulatory landscapes, particularly concerning product safety, environmental impact, and intellectual property. Staying abreast of these mandates is crucial for maintaining operational integrity and market competitiveness.

In 2024, the company's R&D investments, totaling approximately $420 million, were heavily directed towards ensuring product compliance with stringent global standards like the EU's Ecodesign Directive, which impacts energy efficiency requirements for its climate solutions. Furthermore, Ingersoll Rand actively manages its extensive patent portfolio, which numbered over 10,000 active patents globally as of early 2024, to protect its technological innovations.

Antitrust regulations continue to influence Ingersoll Rand's strategic growth, with potential mergers and acquisitions in 2025 requiring thorough review by authorities like the U.S. Federal Trade Commission to prevent undue market concentration.

| Legal Factor | Impact on Ingersoll Rand | 2024/2025 Relevance |

|---|---|---|

| Product Safety & Quality | Ensures market access and customer trust. | Adherence to EU Machinery Directive, pressure equipment standards. |

| Environmental Regulations | Influences operational costs and sustainability strategy. | Meeting SBTi goals for emissions reduction. |

| Labor & Employment Law | Affects workforce stability and talent acquisition. | Navigating evolving data privacy and remote work regulations. |

| Antitrust & Competition | Shapes M&A strategy and market positioning. | Scrutiny of potential acquisitions by FTC and EU Commission. |

| Intellectual Property | Protects R&D investments and competitive edge. | Management of over 10,000 global patents. |

Environmental factors

Global climate change regulations and national carbon emission targets are increasingly shaping industrial operations. Ingersoll Rand has shown a strong commitment to this, achieving 61% progress towards its Science Based Targets initiative (SBTi) validated Scope 1 and 2 greenhouse gas (GHG) emissions reduction goal of 42% by 2030. This dedication was further highlighted by their recognition on CDP's 'A List' for environmental stewardship in 2023.

The global market for energy-efficient industrial equipment is experiencing robust growth, driven by increasing environmental awareness and regulatory pressures. Ingersoll Rand's strategic focus on developing solutions that reduce energy consumption and emissions directly addresses this expanding demand. For instance, their advanced compressor technologies, introduced in late 2023 and early 2024, are designed to offer up to 15% energy savings compared to previous models, a significant factor for customers aiming to lower operational costs and their carbon footprint.

Ingersoll Rand is actively addressing resource scarcity and waste management, recognizing their importance as environmental factors. The company has demonstrated strong performance, exceeding its water reduction target with a substantial 38% absolute reduction in water usage.

Furthermore, Ingersoll Rand is making significant strides towards its sustainability goals, achieving 74% progress on its objective to send zero waste to landfills. These efforts underscore a commitment to responsible resource utilization and minimizing environmental impact.

Water Usage and Pollution Control

Water conservation and pollution control are critical environmental factors for industrial operations. Ingersoll Rand has demonstrated a strong commitment to managing its water impact. For instance, in their 2023 sustainability report, they highlighted a significant reduction in absolute water usage across their global operations, showcasing proactive conservation efforts.

This focus on water stewardship extends to pollution control. The company actively works to minimize the discharge of pollutants into waterways, adhering to stringent environmental regulations. Their initiatives often involve investing in advanced wastewater treatment technologies.

- Water Usage Reduction: Ingersoll Rand reported a substantial decrease in absolute water withdrawal in its 2023 fiscal year, underscoring its dedication to water conservation.

- Pollution Control Measures: The company implements robust wastewater treatment processes to mitigate the environmental impact of its manufacturing activities.

- Regulatory Compliance: Ingersoll Rand ensures strict adherence to all local and international water quality standards and pollution discharge limits.

Customer and Investor Pressure for ESG Performance

Customers and investors are increasingly demanding that companies demonstrate strong Environmental, Social, and Governance (ESG) performance. This trend is reshaping corporate priorities, pushing businesses to integrate sustainability into their core strategies. Ingersoll Rand (IR) has actively responded to this pressure, evident in its robust sustainability reporting and positive recognition in global ESG assessments.

Ingersoll Rand's commitment to sustainability is not just about compliance; it's a strategic advantage. By showcasing its ESG efforts, the company enhances its brand reputation and appeals to a growing segment of environmentally and socially conscious consumers and investors. This focus is crucial in a market where stakeholder trust is directly linked to a company's perceived responsibility.

- Ingersoll Rand's 2023 Sustainability Report highlighted a 22% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to a 2019 baseline.

- The company was recognized by CDP (formerly the Carbon Disclosure Project) with a B rating in 2023 for its climate change disclosure, indicating strong environmental management.

- Investor interest in ESG-aligned companies continues to surge, with global sustainable investment assets projected to reach $50 trillion by 2025, according to various market analyses.

- Ingersoll Rand's proactive approach to ESG positions it favorably to attract capital from funds and individuals prioritizing sustainable investments.

Environmental factors are increasingly influencing industrial operations, with climate change regulations and emission targets driving innovation. Ingersoll Rand is actively pursuing these goals, achieving 61% progress towards its 2030 Scope 1 and 2 GHG emissions reduction target and receiving a CDP 'A List' recognition in 2023.

The demand for energy-efficient solutions is growing, and Ingersoll Rand's new compressor technologies, offering up to 15% energy savings, directly address this market trend. The company also demonstrates strong resource management, exceeding its water reduction target with a 38% absolute reduction and achieving 74% progress towards its zero-waste-to-landfill objective.

| Environmental Metric | Target/Goal | Progress (as of latest report) | Year of Data |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 42% by 2030 | 61% | 2023 |

| Absolute Water Usage Reduction | (Specific target not detailed) | 38% | 2023 |

| Zero Waste to Landfill | (Specific target not detailed) | 74% | 2023 |

| CDP Climate Change Disclosure Rating | N/A | B | 2023 |

PESTLE Analysis Data Sources

Our IR PESTLE Analysis is built on a robust foundation of data, drawing from reputable international organizations like the UN and WTO, alongside national statistical offices and leading market research firms. This ensures a comprehensive understanding of global political, economic, social, technological, legal, and environmental factors.