IR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IR Bundle

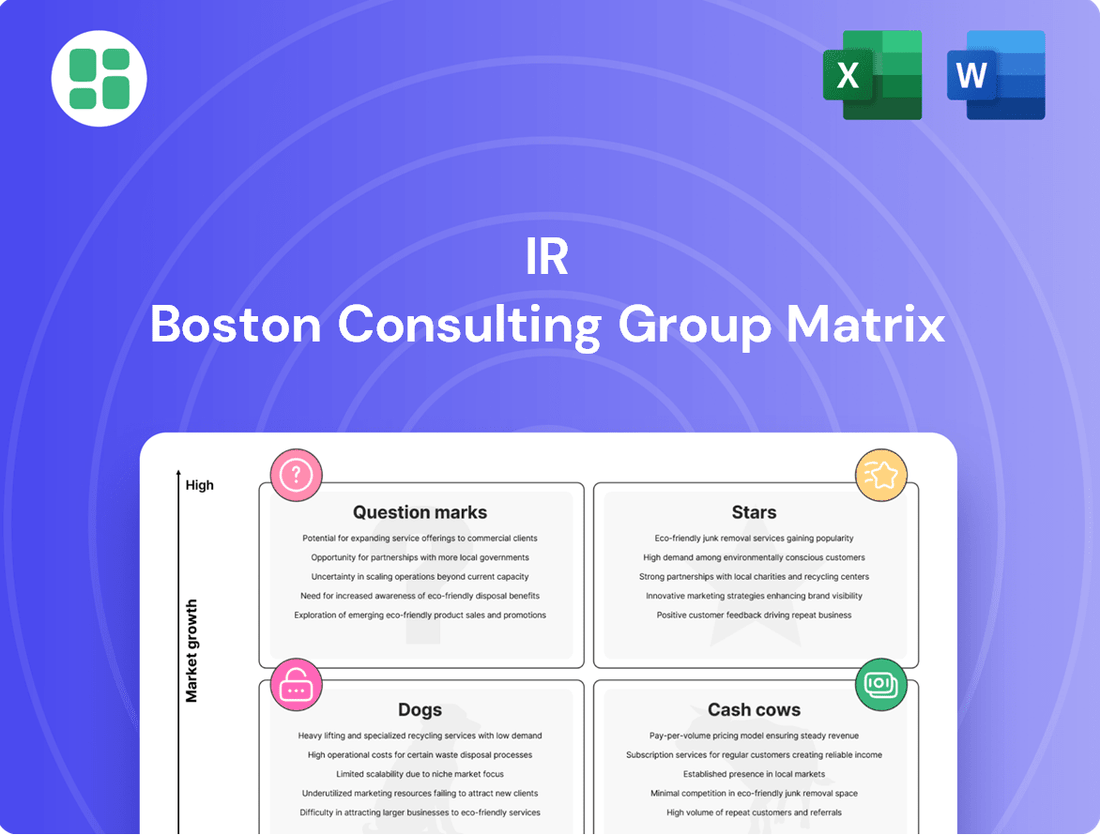

The IR BCG Matrix is a powerful tool that categorizes a company's products or business units based on market share and market growth rate. Understanding whether your offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for effective resource allocation and strategic planning.

This preview offers a glimpse into the strategic positioning of key products. To unlock the full potential of the IR BCG Matrix and gain actionable insights for optimizing your portfolio, purchase the complete report now.

Get the full IR BCG Matrix to receive a detailed breakdown of each quadrant, including data-backed recommendations and a clear roadmap for investment decisions, ensuring you can strategize with confidence and drive business growth.

Stars

Ingersoll Rand's acquisition of Lead Fluid in June 2025 positions its Life Sciences Fluid Management segment as a strong contender in a rapidly expanding market. This strategic move targets a critical area within the life sciences, expected to grow at an 8% annual rate within a substantial $1.2 trillion global market.

The company's deliberate effort to build a dedicated life science platform underscores its ambition to capture significant market share in advanced fluid handling solutions, a vital component for various life science applications.

Ingersoll Rand's acquisition of Termomeccanica Industrial Compressor S.p.A. (TMIC) in July 2025 positions it strongly within the burgeoning Renewable Natural Gas (RNG) market. This sector is expected to see a robust 12% compound annual growth rate (CAGR) through 2035, highlighting significant expansion potential.

This strategic integration directly supports global decarbonization initiatives, offering Ingersoll Rand a high-growth avenue and solidifying its presence in sustainable energy technologies. The company is actively pursuing market share in this area through calculated acquisitions.

Ingersoll Rand's focus on digital and IoT solutions for industrial operations, though not a standalone segment, aligns with the high-growth potential of Industry 4.0. These advanced offerings, incorporating smart controls and edge analytics, are designed to boost energy efficiency and streamline operations. The company is actively integrating sophisticated software into its core products to secure a strong position in this rapidly expanding market.

Specialized Vacuum and Blower Systems (e.g., Wastewater Treatment)

Ingersoll Rand's strategic acquisition of SSI Aeration in February 2025 underscores its commitment to specialized, high-growth segments within the environmental services industry, particularly wastewater treatment. This move positions Ingersoll Rand to capitalize on significant infrastructure spending and the escalating demand for energy-efficient municipal solutions. The company is actively broadening its footprint in this vital application, signaling robust growth prospects and a clear ambition to capture greater market share.

The specialized vacuum and blower systems market, exemplified by wastewater treatment, is experiencing a significant upswing. For instance, global spending on water and wastewater infrastructure is projected to reach trillions of dollars in the coming decade, driven by aging systems and population growth. Ingersoll Rand's investment in SSI Aeration, a key player in this space, demonstrates a targeted approach to leverage these macro trends.

- Market Growth: The global wastewater treatment market alone was valued at approximately $70 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 6% through 2030.

- Infrastructure Investment: In the United States, the Bipartisan Infrastructure Law allocated billions for water infrastructure improvements, directly benefiting companies like Ingersoll Rand that supply essential equipment.

- Energy Efficiency Focus: Municipalities are increasingly prioritizing energy-efficient solutions to reduce operational costs, a key selling point for advanced blower and vacuum technologies.

- Strategic Acquisition: SSI Aeration's expertise in aeration systems, crucial for biological wastewater treatment, complements Ingersoll Rand's existing portfolio and strengthens its offering in this niche.

High-Performance Cordless Power Tools

Ingersoll Rand's high-performance cordless power tools represent a significant opportunity within the IR BCG Matrix. The cordless tool market is booming, driven by a strong consumer preference for portability and enhanced efficiency. Ingersoll Rand launched the award-winning 2236QTiMAX DXS® 1/2' Impact Wrench and the H3111 20V Cordless Heat Gun in July 2024, showcasing their commitment to innovation in this rapidly expanding sector.

This segment is poised for substantial growth, with industry analysts projecting the global cordless power tool market to reach over $30 billion by 2027, growing at a CAGR of approximately 7%. Ingersoll Rand's investment in advanced battery technology and ergonomic designs positions them to capitalize on this trend.

- Market Growth: The cordless power tool market is experiencing robust expansion, fueled by demand for convenience and improved productivity.

- Product Innovation: Recent launches like the 2236QTiMAX DXS® Impact Wrench highlight Ingersoll Rand's focus on high-performance cordless solutions.

- Competitive Edge: Ingersoll Rand's advanced technology and product pipeline are key differentiators in capturing market share.

- Future Potential: The company is well-positioned to benefit from the ongoing shift towards battery-powered tools across various industries.

Stars in the BCG Matrix represent high-growth, high-market-share business units. Ingersoll Rand's Life Sciences Fluid Management, powered by the Lead Fluid acquisition, is a prime example. The company's strategic focus on this segment, targeting an 8% annual growth rate in a $1.2 trillion market, clearly aligns with Star characteristics.

Similarly, their investment in the Renewable Natural Gas (RNG) sector via the TMIC acquisition positions them for rapid expansion. With the RNG market projected for 12% CAGR growth through 2035, Ingersoll Rand is tapping into a high-growth area where their market share is expected to increase.

Ingersoll Rand's cordless power tools also fit the Star profile. The market is expanding at approximately 7% annually, projected to exceed $30 billion by 2027. Their recent product innovations, like the 2236QTiMAX DXS® Impact Wrench, demonstrate their commitment to capturing significant share in this dynamic segment.

| Business Unit | Market Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| Life Sciences Fluid Management | 8% annually | High (post-acquisition) | Star |

| Renewable Natural Gas (RNG) | 12% CAGR (through 2035) | Growing | Star |

| Cordless Power Tools | ~7% annually (projected to 2027) | Growing | Star |

What is included in the product

The IR BCG Matrix categorizes business units by industry growth and relative market share.

It guides strategic decisions on investment, divestment, or maintenance for each unit.

Instantly visualize your portfolio's strategic position, alleviating the pain of complex analysis.

Cash Cows

Ingersoll Rand's standard industrial air compressors represent a classic Cash Cow within the BCG matrix. This segment benefits from Ingersoll Rand's established market leadership in a mature yet indispensable industry.

The consistent generation of substantial cash flow is driven by a vast installed base and robust brand loyalty, further bolstered by recurring aftermarket services that made up 37% of total revenue in Q2 2025. Despite a modest organic growth rate of -4% for the broader IT&S segment in Q2 2025, the high market share guarantees enduring profitability.

Ingersoll Rand's general-purpose pumps are classic cash cows within the IR BCG Matrix. The global pump market, exceeding $60 billion in 2024, provides a substantial foundation for these established products.

These pumps hold a significant market share in a mature industry, ensuring a predictable and stable revenue stream for Ingersoll Rand. Their widespread application across diverse sectors means consistent demand, requiring minimal incremental investment to maintain sales.

The mature nature of the general-purpose pump market, coupled with Ingersoll Rand's strong brand recognition and existing customer base, means these products generate substantial and consistent cash flow with relatively low marketing spend.

Ingersoll Rand's aftermarket services and parts represent a significant portion of its business, accounting for 37% of total revenue in Q2 2025. This segment is characterized by its stability and profitability, largely due to the company's extensive installed base of equipment globally. The consistent demand for maintenance, repairs, and spare parts makes it a resilient revenue source, even during economic downturns.

This segment fits the Cash Cow profile within the IR BCG Matrix due to its high market share in a relatively low-growth industry. The aftermarket business generates a predictable and high-margin cash flow stream, which can be reinvested in other areas of the company or used to fund dividends and share buybacks.

Material Handling Systems

Ingersoll Rand's material handling systems, encompassing lifting equipment, represent a strong Cash Cow within the IR BCG Matrix. This segment thrives in mature industrial sectors, leveraging a substantial existing customer base and the continuous need for dependable equipment in manufacturing and logistics operations.

While the growth rate for material handling systems may not be explosive, its expansive market penetration and consistent demand for maintenance and spare parts solidify its position as a reliable revenue stream. For instance, the global industrial automation market, which includes material handling, was projected to reach $316.7 billion in 2024, indicating a stable demand environment for Ingersoll Rand's offerings in this space.

- Dominant Market Share: Ingersoll Rand benefits from a well-entrenched position in mature industrial markets, ensuring a steady demand for its material handling solutions.

- Recurring Revenue: The need for ongoing maintenance, repairs, and replacement parts for lifting equipment generates consistent and predictable cash flow.

- Established Customer Base: A large and loyal customer base in manufacturing and logistics provides a solid foundation for sustained sales and service revenue.

- Stable Industry Demand: Mature industrial sectors rely heavily on efficient material handling, creating a consistent need for the company's products and services.

Legacy Power Tools and Lifting Equipment

Ingersoll Rand's legacy power tools and lifting equipment, while not experiencing rapid expansion, represent a stable cash cow within its product portfolio. These established offerings, including pneumatic and corded tools, are recognized for their robust build and dependable performance, ensuring a steady stream of revenue from both initial purchases and ongoing maintenance needs.

This segment is characterized by its maturity, meaning growth is modest but predictable. For example, in 2023, Ingersoll Rand reported that its Industrial Technologies and Services segment, which encompasses many of these legacy products, continued to be a significant contributor to overall revenue, demonstrating consistent demand. The focus here is on maximizing profitability from existing market share rather than aggressive expansion.

- Stable Revenue: These products generate consistent sales due to their established reputation and replacement demand.

- Predictable Cash Flow: Lower reinvestment needs allow for predictable cash generation.

- Mature Market: While growth is limited, market share is generally well-defended.

- Durability Focus: The inherent reliability of these tools supports their long-term value proposition.

Cash Cows are business units or products with a high market share in a mature, low-growth industry. They generate more cash than they consume, allowing for investment in other areas or shareholder returns.

Ingersoll Rand's aftermarket services and parts exemplify a Cash Cow, contributing 37% of total revenue in Q2 2025. This segment benefits from a vast installed base, ensuring consistent demand for maintenance and repairs.

Similarly, their standard industrial air compressors and general-purpose pumps operate in established markets with significant brand loyalty, providing stable and predictable cash flows with minimal need for further investment.

These segments, along with legacy power tools and material handling systems, consistently deliver strong profitability due to their dominant market share and the recurring revenue generated from essential services and parts.

| Product Segment | BCG Classification | Key Characteristics | Illustrative Data |

|---|---|---|---|

| Aftermarket Services & Parts | Cash Cow | High market share, stable demand, recurring revenue | 37% of total revenue (Q2 2025) |

| Standard Industrial Air Compressors | Cash Cow | Established market leadership, strong brand loyalty | Mature industry with consistent demand |

| General-Purpose Pumps | Cash Cow | Significant market share, predictable revenue stream | Global pump market > $60 billion (2024) |

| Legacy Power Tools & Lifting Equipment | Cash Cow | Robust build, dependable performance, stable revenue | Consistent contributor to segment revenue (2023) |

Full Transparency, Always

IR BCG Matrix

The IR BCG Matrix preview you see is the definitive, unwatermarked version you will receive immediately after purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering a clear, actionable analysis of your business portfolio.

Dogs

Ingersoll Rand's Industrial Technologies and Services (IT&S) segment saw a 4% organic revenue drop in Q2 2025, despite overall segment growth fueled by acquisitions. This suggests specific legacy product lines are struggling, with minimal organic order growth of just 0.9% for the segment.

These underperforming legacy products, likely in mature or declining markets and not bolstered by recent M&A or innovation, are probably contributing little to profitability. Their continued presence may warrant a strategic review, potentially leading to divestiture or significant operational restructuring if their performance trajectory doesn't shift.

Ingersoll Rand may have some industrial solutions catering to niche markets that are experiencing decline. These could be older technologies or specialized equipment facing obsolescence due to new innovations or shifts in core industries. Without specific product data, these are generally considered Dogs in the BCG matrix, holding a low market share in slow-growing or shrinking sectors.

Products in this category often struggle to generate significant profits and might even consume cash if they aren't efficiently managed or strategically divested. For instance, if Ingersoll Rand still produces certain legacy components for industries like traditional manufacturing or older energy infrastructure that are being phased out, these would fit the Dog profile. A hypothetical example could be a line of specialized pumps for an outdated industrial process that has been largely replaced by more efficient, modern systems.

Ingersoll Rand's active acquisition approach, with 11 deals finalized in 2025, means some newly acquired companies, particularly smaller ones, may initially show weaker performance. These bolt-on acquisitions, often with low market share and growth prospects pre-integration, could be viewed as question marks in the short term. Their immediate financial contribution might be negligible or even negative, necessitating strategic oversight to prevent them from becoming drains on resources.

High-Pressure Solutions (Divested Majority Interest)

Ingersoll Rand's decision to divest a majority stake in its high-pressure solutions segment in 2021 marked a strategic shift. This move aimed to lessen the company's direct involvement with the fluctuating upstream oil and gas sector, a market known for its inherent volatility.

The divestiture, while simplifying Ingersoll Rand's overall business structure, positions the remaining minority interest in this segment as a potential 'Dog' within the BCG framework. This classification stems from the company's deliberate strategy to reduce its focus on this area due to its perceived low alignment with future growth objectives and the persistent risk of market unpredictability.

- Divestiture Rationale: Ingersoll Rand sold a majority interest in its high-pressure solutions segment in 2021 to reduce exposure to the volatile upstream oil and gas market.

- Strategic Re-alignment: This divestiture was a strategic move to simplify the company's portfolio and focus on core, higher-growth areas.

- 'Dog' Classification: The remaining minority interest or residual exposure is considered a 'Dog' due to low strategic growth alignment and potential for volatility.

- Market Context: In 2023, the oil and gas sector experienced significant price fluctuations, with Brent crude averaging around $82 per barrel, underscoring the volatility Ingersoll Rand sought to mitigate.

Certain Regional Offerings in Stagnant Industrial Economies

Ingersoll Rand's portfolio may include certain product lines or operations situated within industrial economies facing extended periods of stagnation. These segments, characterized by low market share and minimal growth prospects, align with the 'Dog' quadrant of the BCG Matrix. An example of this can be seen in the IT&S segment's adjusted EBITDA margin, which was negatively impacted by organic volume declines in China during Q4 2024. Such underperforming regional businesses, if they lack a clear recovery path or strategic significance, are categorized as Dogs.

These 'Dog' segments represent areas where Ingersoll Rand might need to consider divestiture, consolidation, or a significant strategic shift to avoid draining resources. For instance, if a specific product line in a declining industrial region consistently underperforms, it would occupy the Dog quadrant. The company must carefully evaluate these units to determine if continued investment is warranted or if resources could be better allocated to more promising growth areas.

- Stagnant Market Presence: Products or regions within industrial economies experiencing prolonged economic slowdowns.

- Low Growth and Share: These segments exhibit minimal market growth and hold a low market share.

- Impact on Margins: As seen in Q4 2024, organic volume declines in China impacted the IT&S segment's adjusted EBITDA margin, illustrating the financial drag of such underperformers.

- Strategic Re-evaluation: Potential for divestiture or resource reallocation from these 'Dog' segments to more profitable ventures.

Dogs in the BCG matrix represent business units or products with low market share in slow-growing or declining industries. For Ingersoll Rand, these could be legacy product lines or operations in economically stagnant regions. These units often struggle to generate profits and may consume resources without significant returns.

The company’s Q4 2024 results showed that organic volume declines in China negatively impacted the IT&S segment's adjusted EBITDA margin. This situation exemplifies a 'Dog' scenario, where regional underperformance drags down overall segment profitability. Such units require careful strategic evaluation for potential divestiture or restructuring.

Ingersoll Rand's divestiture of a majority stake in its high-pressure solutions segment in 2021, due to the volatile oil and gas sector, highlights a strategic move away from potential 'Dogs'. The remaining minority interest in this segment is considered a 'Dog' due to low strategic growth alignment and persistent market unpredictability.

Identifying and managing these 'Dog' assets is crucial for resource allocation. Focusing on core, higher-growth areas while strategically divesting or restructuring underperforming units allows Ingersoll Rand to optimize its portfolio for long-term value creation.

Question Marks

Ingersoll Rand's acquisition of ILC Dover in 2024 brought in strong growth potential, particularly in flexible materials for aerospace and life sciences. However, the Aerospace & Defense segment within ILC Dover experienced reduced volumes in late 2024, which negatively affected its EBITDA margins.

Further compounding these challenges, Ingersoll Rand recorded a substantial non-cash goodwill impairment in Q2 2025, specifically impacting the Biopharma and Aerospace/Defense units. This indicates that while the market itself is seen as high-growth, Ingersoll Rand's current market share in this specific segment is considered low or facing difficulties.

The situation points to ILC Dover's Aerospace & Defense division being in a position that requires considerable investment to capture its full market potential, aligning with the characteristics of a question mark in the BCG matrix.

Ingersoll Rand's strategic focus on renewable energy, exemplified by its acquisition of TMIC for Renewable Natural Gas (RNG), highlights a commitment to established growth areas. However, the company is also exploring broader clean energy frontiers.

Emerging technologies like advanced hydrogen compression and novel energy storage solutions represent significant, high-growth potential markets. These are areas where Ingersoll Rand might currently hold a low market share or be investing heavily in research and development, aligning with the characteristics of 'question marks' in the BCG matrix.

These investments are crucial as they require cash for development and market penetration, but they offer substantial future upside if market adoption accelerates. Ingersoll Rand's success in these nascent sectors will depend on its ability to secure a strong competitive position.

Ingersoll Rand's acquisition of Lead Fluid significantly bolsters its presence in the high-growth life sciences sector, particularly with advanced fluid handling solutions. This strategic move positions the company to capitalize on increasing demand for precise and sterile fluid transfer in biopharmaceutical manufacturing and research.

The integration of Lead Fluid's advanced peristaltic pump technologies places these specific product lines in the 'Question Mark' quadrant of the BCG matrix. While the life sciences market itself is experiencing robust expansion, these newly acquired, sophisticated pump technologies require substantial investment in marketing, sales, and distribution to achieve widespread adoption and secure a leading market position.

New Battery-Powered Industrial Tools on 20V Platform

Ingersoll Rand is broadening its 20V cordless platform by introducing new industrial tools, such as a cordless grease gun and reciprocating saw. This expansion targets the growing cordless industrial tool market, where these specific new offerings are currently building market share against established players.

These new battery-powered tools are positioned as question marks within Ingersoll Rand's product portfolio. The company is actively investing in their promotion and market placement to secure a more significant position in this dynamic and evolving sector. The global cordless power tool market was valued at approximately USD 22.5 billion in 2023 and is projected to grow substantially.

- Market Growth: The cordless industrial tool segment is experiencing robust expansion, driven by demand for efficiency and portability.

- New Entrants: Ingersoll Rand's recent additions, like the cordless grease gun and reciprocating saw, are new to the market and are in the process of establishing their presence.

- Investment Focus: Significant promotional and placement efforts are being made to drive adoption and capture market share for these 20V platform tools.

- Competitive Landscape: These tools face competition from established brands with a longer history in the cordless industrial tool space.

Strategic Bolt-on Acquisitions in Early Integration Phase

Ingersoll Rand's active acquisition strategy, evidenced by 8 letters of intent and a funnel of over 200 potential targets, consistently places new businesses in the early integration phase. These bolt-on acquisitions, often targeting high-growth segments, begin with a modest market share within Ingersoll Rand's expansive portfolio.

These newly acquired entities, while promising in their niche markets, necessitate substantial post-acquisition investment and dedicated strategic oversight. The objective is to cultivate their market presence and financial performance, guiding them towards becoming either high-growth Stars or established Cash Cows within the company's BCG matrix.

- Strategic Focus: Smaller bolt-on acquisitions require focused integration efforts to align with Ingersoll Rand's operational and financial goals.

- Growth Potential: These businesses often operate in high-growth niches, offering significant upside potential if successfully integrated and scaled.

- Investment Needs: Initial post-acquisition investment is critical for optimizing operations, expanding market reach, and achieving profitability.

- BCG Matrix Transition: The goal is to transition these acquired entities from question marks to Stars or Cash Cows through effective integration and strategic management.

Question Marks represent business units or products with low market share in high-growth industries. Ingersoll Rand's strategic acquisitions and new product launches in emerging sectors like advanced hydrogen compression and cordless industrial tools exemplify this category. These ventures require significant investment to gain traction and establish a competitive foothold.

The company's approach to integrating recent acquisitions, such as Lead Fluid in life sciences, also places these new offerings in the Question Mark quadrant. Despite the high-growth nature of the life sciences market, these specialized fluid handling solutions need substantial marketing and sales efforts to achieve widespread adoption.

Ingersoll Rand's focus on developing its 20V cordless platform, including new tools like a cordless grease gun and reciprocating saw, further illustrates the Question Mark strategy. The global cordless power tool market, valued at approximately USD 22.5 billion in 2023, offers substantial growth, but these new entries are actively working to build market share against established competitors.

These investments are critical for capturing future market potential, with the success of these question marks hinging on Ingersoll Rand's ability to effectively scale operations and secure strong market positions in these dynamic, high-growth areas.

| Business Unit/Product Area | Market Growth Rate | Market Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| ILC Dover - Aerospace & Defense | High | Low | High | Question Mark |

| Advanced Hydrogen Compression | High | Low | High | Question Mark |

| Lead Fluid (Life Sciences) | High | Low | High | Question Mark |

| 20V Cordless Industrial Tools | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our IR BCG Matrix is constructed using a blend of internal company financial reports, investor relations disclosures, and publicly available market research to provide a comprehensive view of our portfolio's performance.