Inventec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

Inventec's robust manufacturing capabilities and strong customer relationships are key strengths, but potential supply chain disruptions and intense competition present significant challenges. Want to understand how these factors shape their future?

Discover the complete picture behind Inventec's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking a competitive edge.

Strengths

Inventec's strength lies in its diversified product portfolio, spanning servers, laptops, smartphones, and IoT devices. This broad range caters to multiple sectors like cloud computing, enterprise, and consumer electronics, mitigating risks associated with over-reliance on any single market. For instance, in 2024, Inventec reported significant growth in its server division, contributing over 30% to its revenue, while its burgeoning IoT segment also showed a 15% year-over-year increase, underscoring the benefits of this strategic diversification.

Inventec holds a strong position as a key assembly partner for major tech companies such as Dell, HP, and Lenovo, particularly within the booming AI server sector. This strategic placement allows the company to directly benefit from the escalating demand for advanced computing infrastructure.

The company is projecting significant expansion in its AI server shipments, with expectations of exceeding 60% year-on-year growth in 2025. This robust growth trajectory highlights Inventec's ability to scale production and meet the increasing needs of the AI market.

The AI server segment is poised to become an increasingly vital contributor to Inventec's total revenue. As the market for AI hardware continues its rapid expansion, Inventec is well-positioned to capture a larger share of this lucrative market.

Inventec is actively broadening its manufacturing presence worldwide to bolster supply chain resilience and navigate geopolitical uncertainties. A significant step in this strategy is the $85 million investment in a new facility located in Texas, USA.

This expansion is specifically designed to improve logistics for Inventec's burgeoning AI server business, ensuring it can meet customer delivery demands and effectively manage the impact of existing tariffs.

Established Client Relationships

Inventec's strength lies in its deeply entrenched relationships with major global brands, serving as a critical Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM). These established client connections are not just a testament to its reliability but also a significant competitive advantage.

These long-standing partnerships translate into a predictable and stable revenue stream, as key technology players consistently rely on Inventec for their product design and manufacturing needs. For instance, Inventec's role in producing devices for major tech companies ensures a robust order pipeline, underpinning its financial stability.

- Deeply Rooted Partnerships: Inventec's history as a primary ODM/OEM for leading global tech brands signifies a high level of trust and integration.

- Consistent Demand Base: These enduring relationships secure a consistent flow of orders, reducing market volatility impact.

- Strategic Importance: Clients often view Inventec as an extension of their own operations, making switching costs high.

Commitment to Innovation and R&D

Inventec demonstrates a strong commitment to innovation through significant investment in research and development. The company is actively exploring new frontiers, including automotive electronics, sophisticated IoT devices, and applications for 5G technology. This forward-looking approach ensures Inventec remains competitive and can offer cutting-edge solutions.

The company's dedication to R&D is further underscored by its robust patent portfolio, comprising both issued and pending patents. This intellectual property signifies Inventec's ability to create unique and valuable technologies, positioning it as a leader in its chosen markets. By continuously enhancing its R&D capabilities, Inventec fosters a culture of technological advancement.

- Focus on Emerging Technologies: Inventec is channeling R&D efforts into high-growth areas such as automotive electronics and advanced IoT products, aligning with market trends.

- Intellectual Property Strength: A substantial portfolio of patents, both granted and in progress, highlights Inventec's innovative output and competitive advantage.

- Sustainable Product Development: The emphasis on continuous innovation aims to develop products that are not only technologically advanced but also sustainable, meeting future market demands.

Inventec's diversified product range, including servers, laptops, and IoT devices, provides resilience across various market segments. For example, its server division saw substantial revenue growth in 2024, contributing over 30% to overall income, while its IoT segment experienced a 15% year-over-year increase, demonstrating the advantage of this broad market approach.

The company's strategic role as an assembly partner for major tech firms like Dell and HP, particularly in the rapidly expanding AI server market, positions it to capitalize on increasing demand for advanced computing infrastructure. Inventec anticipates its AI server shipments to grow by over 60% year-on-year in 2025, signaling its capacity to scale production effectively.

Inventec's established relationships as a primary Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) for leading global technology brands create a stable revenue foundation. These deep-seated partnerships ensure a consistent order flow, mitigating the impact of market fluctuations and highlighting Inventec's reliability.

What is included in the product

Delivers a strategic overview of Inventec’s internal and external business factors, highlighting its strengths in manufacturing and opportunities in emerging markets, while also addressing potential weaknesses in supply chain diversification and threats from intense competition.

Offers a clear, actionable framework to identify and leverage Inventec's strengths, mitigating weaknesses and capitalizing on opportunities for improved strategic execution.

Weaknesses

Inventec, despite the booming demand for AI servers, operates with thin profit margins, often hovering around 5% in this segment. This is largely because the most significant profits in the AI server ecosystem are captured by key component suppliers, like Nvidia, who control the high-value intellectual property and specialized chips. As an ODM, Inventec's role as a system assembler means they are more exposed to pricing pressures and less able to capture the premium pricing associated with core AI technology.

Inventec's global footprint makes it particularly vulnerable to geopolitical shifts and trade disputes. For instance, escalating tariffs between the United States and China, which intensified in late 2023 and early 2024, directly impact the cost of components and finished goods, potentially squeezing profit margins.

Such trade tensions can force costly supply chain realignments. Inventec's reported investments in expanding its US manufacturing capabilities in 2024, while strategic for resilience, represent significant capital outlays driven partly by these external pressures, adding to operational expenses and business uncertainty.

Inventec's revenue stream shows a notable concentration, with notebooks accounting for approximately 51-55% and servers representing 41-45% of its income. This reliance on a few key product areas makes the company susceptible to shifts in demand within these specific markets.

Such a concentrated revenue model means Inventec's performance is closely tied to the success and market reception of its notebook and server offerings. Any downturn in these segments, perhaps due to increased competition or changing consumer preferences, could disproportionately impact the company's overall financial health.

Furthermore, the dependence on a limited number of major clients for a significant portion of sales in these key categories introduces another layer of risk. The purchasing decisions of these few large clients hold considerable sway over Inventec's revenue stability.

Limited Direct Brand Recognition

Inventec's position as an Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) means it largely works behind the scenes for prominent global brands. This inherently limits its direct brand recognition with consumers. For instance, while Inventec is a key player in producing devices for major tech companies, the average consumer likely wouldn't recognize the Inventec name on their purchased electronics.

This lack of direct consumer visibility impacts its market leverage. Without a strong brand identity among end-users, Inventec has less ability to influence purchasing decisions or justify premium pricing. Its success is therefore closely tied to the marketing prowess and market success of its clients, rather than its own brand equity.

In 2023, the ODM/OEM market continued to be dominated by established players, with revenue growth often driven by the volume of orders from major brands. Inventec's reliance on these relationships means its revenue streams are directly influenced by the demand for its clients' products. For example, a slowdown in the personal computer market, a key sector for Inventec, directly affects its order volumes.

- Limited Consumer Awareness: Inventec's business model as an ODM/OEM prevents widespread consumer recognition, unlike brands that directly market to the public.

- Dependence on Client Success: The company's revenue and growth are heavily reliant on the market performance and brand strength of its partner companies.

- Pricing Constraints: Without direct brand appeal, Inventec faces challenges in commanding premium pricing compared to companies with strong consumer-facing brands.

Exposure to Supply Chain Disruptions

Inventec's reliance on a globalized supply chain exposes it to significant vulnerabilities. The electronics manufacturing sector, a key area for Inventec, has been grappling with persistent raw material shortages and a scarcity of essential components. For instance, the semiconductor industry, crucial for many electronic devices, experienced widespread shortages throughout 2022 and 2023, impacting production volumes across various sectors.

These challenges are often amplified by geopolitical tensions and unforeseen global events. Such disruptions can lead to considerable delays in production timelines, driving up manufacturing costs and potentially hindering Inventec's ability to meet customer delivery commitments. The ongoing war in Ukraine, for example, has continued to affect the availability and pricing of certain raw materials and energy, indirectly impacting manufacturers like Inventec.

- Raw Material Scarcity: Persistent shortages of key materials like rare earth elements and specialized chemicals.

- Component Availability: Continued difficulties in securing critical electronic components, such as advanced microprocessors and memory chips.

- Skilled Labor Gaps: A deficit in skilled labor within the manufacturing and logistics sectors, affecting operational efficiency.

- Geopolitical Impacts: Ongoing global uncertainties that can disrupt trade routes and increase the cost of doing business.

Inventec's position as an Original Design Manufacturer (ODM) means it lacks direct consumer brand recognition, limiting its market leverage and ability to command premium pricing. Its success is therefore intrinsically linked to the marketing efforts and brand strength of its clients, making it vulnerable to their market performance. This reliance on partner companies means Inventec's revenue is directly tied to the demand for its clients' products, with any downturn in key sectors like personal computers disproportionately affecting its order volumes.

What You See Is What You Get

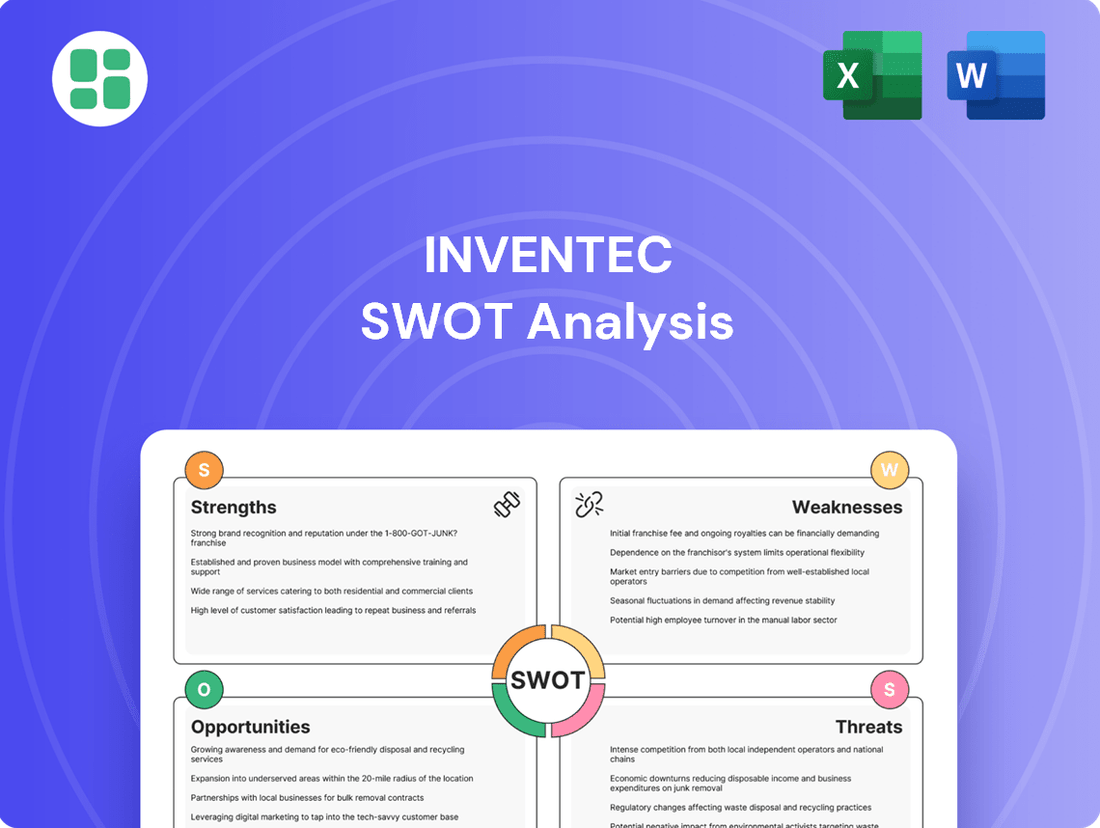

Inventec SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Inventec's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, meticulously detailing each aspect of Inventec's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights to your specific needs.

Opportunities

The burgeoning AI server market offers a substantial growth avenue for Inventec. Market forecasts indicate AI server shipments are poised to more than double, significantly increasing their contribution to overall revenue in the near future.

Inventec is well-positioned to leverage this surge, particularly with the anticipated launch of new server configurations featuring advanced processors like Nvidia's GB200. This strategic product development directly taps into the escalating demand for high-performance computing essential for AI workloads.

The global Internet of Things (IoT) market is on a significant growth trajectory, with projections indicating over 29 billion connected devices by 2030, a substantial leap from previous years. This expansion fuels a robust demand for specialized components and manufacturing capabilities, directly benefiting Inventec's core competencies.

Inventec's expertise in designing and producing a wide array of IoT devices positions it to capitalize on this burgeoning market. The increasing integration of IoT solutions across sectors like smart homes, industrial automation, and healthcare presents a fertile ground for revenue expansion and strategic product line diversification.

Inventec's strategic push into automotive electronics and 5G technology presents a significant growth avenue. The anticipated surge in AI PCs from 2025-2026, with market forecasts suggesting substantial year-over-year increases in shipments, offers a prime opportunity to leverage their expertise in advanced computing solutions.

These emerging technology sectors, including the burgeoning AI PC market, are poised for rapid expansion, offering Inventec a chance to diversify its revenue streams and tap into high-margin segments. This vertical expansion allows Inventec to apply its established design and manufacturing prowess to innovative product categories, potentially capturing significant market share.

Reshoring and Nearshoring Manufacturing Trends

The global trend of reshoring and nearshoring manufacturing presents a significant opportunity for Inventec. This shift, fueled by concerns over geopolitical instability and supply chain disruptions, encourages companies to bring production closer to home. For instance, the US manufacturing sector saw a rebound, with industrial production increasing by 0.4% in April 2024 compared to the previous month, indicating a growing domestic capacity.

Inventec can capitalize on this by expanding its manufacturing footprint in strategic locations, such as its announced investment in Texas. This move aligns with customer desires for geographically diversified production bases, potentially leading to reduced lead times and lower transportation expenses. The reshoring movement is not just a trend; it's a strategic recalibration of global supply chains, with many companies actively seeking domestic partners.

Key benefits for Inventec include:

- Enhanced supply chain resilience: By diversifying manufacturing locations, Inventec can mitigate risks associated with international disruptions.

- Reduced logistics costs and lead times: Proximity to key markets can significantly cut down shipping expenses and delivery schedules.

- Meeting evolving customer demands: Many clients are now prioritizing suppliers with localized or nearshored manufacturing capabilities to ensure continuity.

- Potential for government incentives: As countries encourage domestic manufacturing, Inventec may benefit from tax credits or subsidies for expanding its US operations.

Digital Transformation and Industry 4.0 Adoption

Inventec can capitalize on the accelerating digital transformation in manufacturing, driven by Industry 4.0. This shift offers a significant opportunity to boost operational efficiency and competitiveness.

By integrating advanced technologies like the Internet of Things (IoT), big data analytics, and artificial intelligence (AI) into its production lines, Inventec can achieve substantial improvements. These include optimizing manufacturing workflows, enhancing quality control through real-time monitoring, and driving further automation for increased productivity. For instance, the global Industry 4.0 market was valued at approximately $80 billion in 2023 and is projected to grow, indicating a strong market demand for such solutions.

- Enhanced Operational Efficiency: Implementing IoT sensors can provide real-time data on machine performance, enabling predictive maintenance and reducing downtime.

- Improved Quality Control: AI-powered visual inspection systems can identify defects with greater accuracy and speed than manual methods.

- Cost Reduction: Automation and optimized resource allocation through data analytics can lead to significant cost savings in production.

- Increased Productivity: Streamlined processes and reduced manual intervention contribute to higher output volumes.

Inventec is strategically positioned to benefit from the rapid expansion of the AI server market, with projections indicating a significant increase in demand for high-performance computing solutions. The company's focus on new server configurations, particularly those incorporating advanced processors, directly addresses this growing need.

The burgeoning IoT market presents a substantial growth opportunity, as billions of connected devices are expected by 2030, driving demand for specialized components. Inventec's established expertise in IoT device manufacturing allows it to capitalize on this trend across various sectors.

Inventec's expansion into automotive electronics and 5G technologies, coupled with the anticipated surge in AI PCs from 2025-2026, offers diversification into high-margin segments. This strategic move leverages their advanced computing capabilities.

The global reshoring and nearshoring trend offers Inventec a chance to strengthen its supply chain resilience and reduce logistics costs by expanding its manufacturing presence in key regions like Texas. This aligns with growing customer preferences for localized production.

Threats

Inventec faces significant challenges due to the highly competitive nature of the Original Design Manufacturer (ODM) and Electronics Manufacturing Services (EMS) sectors. This market is crowded with both large global competitors and smaller, agile local players, all competing fiercely for manufacturing contracts.

This intense rivalry, with major players like Quanta Computer, Wistron, and Compal Electronics actively participating, directly impacts Inventec's ability to maintain healthy profit margins. The constant pressure to offer competitive pricing erodes profitability, making it crucial for Inventec to differentiate itself through innovation and efficiency.

Global trade friction and geopolitical tensions, especially concerning semiconductor and electronics supply chains, present a substantial threat. For instance, the ongoing US-China trade dispute, which saw tariffs imposed on numerous goods in 2023, directly impacts component sourcing and finished product markets for companies like Inventec.

Shifting tariff structures and export restrictions can significantly disrupt Inventec's manufacturing processes, leading to increased costs for raw materials and shipping. This instability might necessitate expensive adjustments to their global production footprint to mitigate risks and maintain competitive pricing, a challenge many electronics manufacturers faced throughout 2024.

Despite significant investments in diversification and nearshoring, the global electronics supply chain, a critical area for Inventec, continues to grapple with persistent vulnerabilities. These include ongoing shortages of key raw materials, such as rare earth elements vital for advanced components, and a scarcity of specialized semiconductors, exacerbated by geopolitical tensions and increased demand. For instance, the global semiconductor shortage, which began in late 2020, continued to impact production volumes across the tech industry well into 2024, with some analysts predicting lingering effects until late 2025.

These vulnerabilities directly translate into tangible threats for Inventec. Production delays become more frequent, as the company may struggle to secure necessary components on time. Procurement costs are also on the rise, as competition for limited resources drives up prices for raw materials and specialized parts. This inflationary pressure on input costs can erode profit margins. Furthermore, the inability to meet client demands due to these supply chain disruptions can damage Inventec's reputation and lead to lost business opportunities, directly impacting its financial performance and market position.

Rapid Technological Obsolescence

The consumer electronics and computing sectors are characterized by incredibly fast technological evolution, meaning products can become outdated almost as soon as they are released. Inventec faces the constant challenge of keeping its offerings relevant in this dynamic environment.

To counter this, Inventec needs to make substantial, ongoing investments in research and development (R&D) and consistently upgrade its manufacturing facilities. For instance, in 2024, the company's R&D spending was reported to be a significant portion of its revenue, reflecting this commitment to innovation.

Failure to adapt swiftly to emerging technologies poses a serious threat. If Inventec cannot keep pace with industry advancements, it risks losing its competitive edge and seeing its market share erode as newer, more advanced products from rivals gain traction.

- Rapid obsolescence in consumer electronics and computing.

- Necessity for continuous, heavy R&D investment.

- Requirement for ongoing manufacturing capability upgrades.

- Risk of losing competitiveness and market share if adaptation is slow.

Economic Downturns and Weak Consumer Demand

Broader macroeconomic challenges, including persistent inflation and rising interest rates, are creating a more cautious consumer environment. This can significantly dampen demand for discretionary electronic products, impacting Inventec's key markets for laptops and smartphones.

A sustained economic downturn, characterized by reduced disposable income and heightened uncertainty, could lead to a noticeable decrease in orders from Inventec's brand clients. This directly translates to potential revenue headwinds and pressure on the company's profitability throughout 2024 and into 2025.

- Inflationary Pressures: Global inflation remained elevated through much of 2023 and is projected to continue impacting consumer purchasing power in 2024, potentially reducing spending on premium electronics.

- Interest Rate Hikes: Central banks' aggressive interest rate hikes in 2023 and early 2024 increase the cost of borrowing for consumers and businesses, further discouraging large purchases of electronics.

- Consumer Confidence: Declining consumer confidence indices in major markets, such as the US and Europe, signal a reluctance to spend, directly affecting demand for Inventec's manufactured goods.

Inventec operates in a highly competitive ODM/EMS market, facing pressure from global and local rivals. This intense competition, exemplified by players like Quanta and Wistron, forces aggressive pricing, impacting profit margins. Geopolitical tensions and trade disputes, such as those affecting semiconductor supply chains throughout 2023-2024, also pose significant threats by disrupting sourcing and increasing costs.

Supply chain vulnerabilities, including shortages of critical raw materials and semiconductors, continued to plague the industry into 2024. This leads to production delays, higher procurement costs, and potential loss of business due to an inability to meet demand. Furthermore, the rapid pace of technological change in consumer electronics necessitates continuous, substantial R&D investment and manufacturing upgrades to avoid obsolescence and maintain market share.

Macroeconomic headwinds, such as persistent inflation and rising interest rates through 2023 and into 2024, are dampening consumer demand for discretionary electronics. This economic caution reduces disposable income and discourages spending, directly impacting Inventec's order volumes and profitability. A sustained economic downturn could further exacerbate these revenue challenges.

| Threat Category | Specific Examples/Data (2023-2025) | Impact on Inventec |

| Market Competition | High concentration of competitors (e.g., Quanta, Wistron); Price wars impacting margins. | Eroded profit margins, need for differentiation. |

| Geopolitical & Trade Risks | US-China trade tensions, tariffs impacting component sourcing (2023 data); Export restrictions. | Disrupted manufacturing, increased costs, need for supply chain adjustments. |

| Supply Chain Vulnerabilities | Semiconductor shortages (persisting into 2024); Rare earth element scarcity; Production delays. | Increased procurement costs, production bottlenecks, reputational damage. |

| Technological Obsolescence | Rapid product lifecycles in consumer electronics; Need for continuous R&D investment (Inventec's 2024 R&D spend significant). | Risk of losing competitive edge, market share erosion if adaptation is slow. |

| Macroeconomic Factors | Elevated inflation (2023-2024); Rising interest rates (2023-2024); Declining consumer confidence in key markets. | Reduced consumer spending on electronics, lower order volumes, revenue headwinds. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Inventec's official financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded perspective.