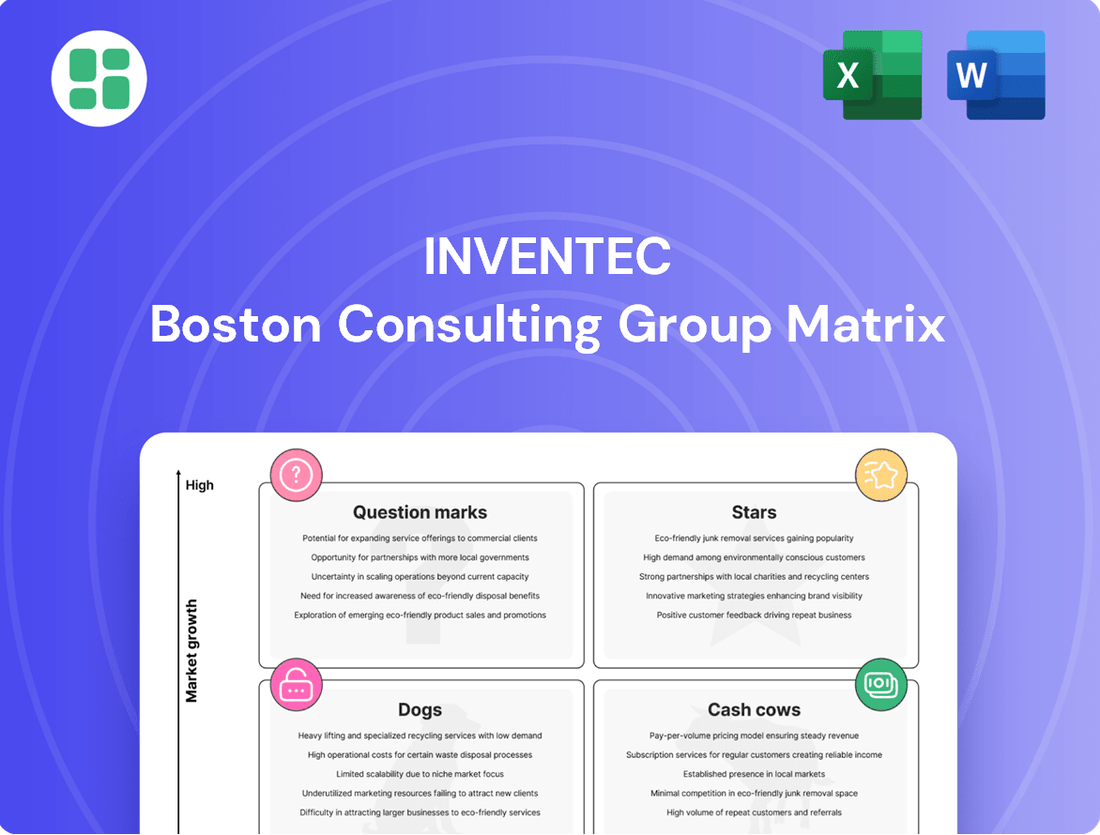

Inventec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

Discover how Inventec's product portfolio stacks up with our insightful BCG Matrix preview, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand the current landscape and identify areas for strategic focus. Purchase the full BCG Matrix for a comprehensive, data-driven analysis and actionable recommendations to optimize your investment and product strategy.

Stars

Inventec's AI server business is a clear star in its BCG matrix, showing remarkable growth. Shipments are expected to more than double in 2024 from the previous year, and this surge is projected to continue with over 60% year-on-year growth in 2025. This segment is rapidly becoming a dominant revenue driver, climbing from 5-6% in 2023 to an anticipated 30-40% by 2025.

The broader server market, especially those equipped with GPUs, is booming. In the first quarter of 2025, the market value saw an impressive 134.1% increase compared to the same period in 2024. For the entirety of 2025, the market is forecast to grow by 44.6%. Inventec, as a crucial Original Design Manufacturer (ODM), is well-positioned to capitalize on this expansion, supplying major industry players like Dell, HP, and Lenovo.

Inventec's High-Performance Computing (HPC) solutions are a significant strength, leveraging its ODM expertise in a market projected for substantial growth. These powerful computing systems are essential for demanding tasks like AI model training and complex scientific simulations, areas seeing increased investment.

The demand for HPC is accelerating, with the global HPC market size expected to reach approximately $70 billion by 2027, growing at a CAGR of over 10%. Inventec's focus on designing and manufacturing advanced server and storage hardware for these applications positions them to capture a considerable share of this expanding market.

Inventec is a vital player in the cloud computing infrastructure supply chain, delivering critical server and storage hardware to major global tech companies. The cloud services market is experiencing robust growth, fueled by widespread business adoption of cloud solutions and substantial infrastructure investments by hyperscale providers. In 2023, the global cloud computing market was valued at approximately $593 billion, with projections indicating continued expansion.

Inventec's strong industry partnerships and deep technical knowledge in this segment secure it a considerable market presence within this expanding sector. This positions the company as a significant beneficiary of the ongoing digital transformation trends. Inventec's strategic focus includes strengthening relationships with its American clientele by establishing local manufacturing capabilities.

Next-Generation Server Rack Solutions (e.g., Nvidia GB200 based)

Inventec is poised to capitalize on the burgeoning AI server market with its next-generation rack solutions, including the NVL36 and NVL72, designed around Nvidia's GB200 processors. Shipments are slated to commence in Q1 2025, placing Inventec at the vanguard of AI infrastructure development.

This strategic focus aligns Inventec with the server market's most dynamic growth segment, driven by rapid technological advancements in artificial intelligence. The company's commitment to this high-potential area underscores its ambition to secure a significant market presence in cutting-edge computing hardware.

- Market Entry: Inventec's readiness to ship Nvidia GB200-based server racks like the NVL36 and NVL72 starting Q1 2025.

- Growth Potential: Positioned in the highest growth segment of the server market due to AI advancements.

- Strategic Margins: Initial margins on AI servers may be lower, but early market share is key for long-term dominance.

- AI Demand: The market for advanced AI computing is expanding rapidly, creating substantial opportunities.

5G Smart Applications Infrastructure

The global expansion of 5G networks is fueling a significant need for advanced infrastructure, encompassing specialized servers and devices designed to power smart applications. Inventec's strategic positioning, particularly through its subsidiary Inventec Appliances (IAC), highlights its active participation in this burgeoning market segment.

With 5G adoption rapidly accelerating across diverse sectors like smart manufacturing, the Internet of Things (IoT), and improved connectivity solutions, Inventec's established Original Design Manufacturer (ODM) capabilities provide a robust platform for capturing substantial market share.

- Market Growth: The global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 40% through 2030, driven by increased 5G deployments.

- Inventec's Role: Inventec Appliances, a key player, is involved in the production of network-attached storage (NAS) and other server solutions crucial for 5G-enabled smart applications.

- Demand Drivers: Increased adoption of IoT devices, smart city initiatives, and the need for edge computing capabilities are key factors driving demand for the specialized infrastructure Inventec provides.

- Competitive Advantage: Inventec's ODM model allows for rapid adaptation to evolving technological requirements and customization for specific industry needs in the 5G ecosystem.

Inventec's AI server business is a clear star, exhibiting exceptional growth. Shipments are expected to more than double in 2024 and continue strong growth in 2025, transforming its revenue contribution significantly.

This rapid expansion is driven by the booming GPU server market, which saw substantial growth in Q1 2025 and is forecast to continue its upward trajectory. As a key ODM, Inventec is perfectly positioned to benefit from this demand, supplying major tech companies.

Inventec's expertise in High-Performance Computing (HPC) further solidifies its star status. The HPC market is experiencing accelerated demand for advanced computing systems, essential for AI and complex simulations, indicating a bright future for Inventec's offerings in this space.

| Metric | 2023 | 2024 (Est.) | 2025 (Est.) |

|---|---|---|---|

| AI Server Revenue Share | 5-6% | ~20% | 30-40% |

| GPU Server Market Growth (Q1 YoY) | 134.1% | ||

| Global HPC Market Size (by 2027) | ~$70 billion |

What is included in the product

The Inventec BCG Matrix provides a strategic overview of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear, visual representation of Inventec's portfolio, simplifying strategic decisions.

Cash Cows

Traditional Notebook PCs represent a significant Cash Cow for Inventec. In Q3 2024, this segment contributed 51-55% of the company's revenue, building on its 54% share in 2023.

Despite the mature nature of the global laptop market, modest growth of approximately 4.9% is projected for 2025, fueled by the Windows 10 end-of-life transition and commercial refresh cycles. Inventec's strong OEM/ODM position, backed by its robust manufacturing and client network, allows it to capitalize on this ongoing demand.

This established business reliably generates substantial cash flow, requiring minimal incremental investment for growth due to its mature market standing and consistent demand.

Inventec's non-AI server segment, focusing on enterprise IT solutions, remains a robust cash cow. Despite the AI server boom, this area continues to see significant shipment volumes, underpinning Inventec's position as a key assembly partner for major industry brands.

This foundational IT infrastructure business provides a stable, high-volume revenue stream. It benefits from consistent demand driven by enterprise digital transformation initiatives and regular hardware refresh cycles, ensuring reliable cash flow for Inventec.

Inventec Appliances (IAC) contributes to the Cash Cows quadrant with its mature consumer electronics, particularly established audio devices. Despite market maturity, Inventec's operational strengths, including efficient manufacturing and robust client ties, likely secure a dominant market share in these segments.

These audio products are reliable revenue generators, demanding minimal capital for growth. The strategy here centers on optimizing existing operations and distribution networks rather than pursuing aggressive market expansion. For instance, in 2024, mature audio product lines are expected to contribute a significant portion of Inventec's stable, albeit slower-growing, cash flow.

Standard Data Storage Equipment

Inventec's standard data storage equipment represents a stable Cash Cow within its portfolio. This segment caters to the persistent demand for data retention and accessibility, fundamental to enterprise and cloud infrastructure. As an OEM/ODM, Inventec leverages its position to secure a significant share in this consistent market. The predictable revenue streams from this mature business contribute substantially to the company's financial resilience.

The global data storage market, projected to reach over $200 billion by 2027, highlights the enduring need for these products. Inventec's focus on this area ensures a reliable revenue stream.

- Consistent Demand: Essential for ongoing data management needs across industries.

- OEM/ODM Advantage: Allows Inventec to capture a significant market share.

- Predictable Revenue: Contributes to stable cash flow and financial stability.

- Market Maturity: Indicates a well-established and consistent demand environment.

Thin Clients and Peripherals

Inventec's thin clients and computer peripherals represent a stable income stream, often categorized as Cash Cows in the BCG matrix. These products cater to consistent demand from sectors like corporate and education, where efficiency and cost savings are paramount. For instance, the global thin client market was projected to reach approximately $3.5 billion in 2024, showcasing its enduring relevance.

The company leverages its extensive experience in PC manufacturing to maintain a solid market position in these mature segments. This established expertise translates into efficient production and reliable sales, contributing significantly to Inventec's overall profitability. The demand for peripherals, such as keyboards and mice, also remains robust, with the global market for computer peripherals valued at over $25 billion in 2023.

- Stable Market Demand: Corporate and educational institutions consistently require these cost-effective computing solutions.

- Established Expertise: Inventec's long history in PC production ensures quality and market competitiveness.

- Reliable Revenue: The predictable nature of sales in these segments provides a steady cash flow for the company.

- Market Size: The thin client market alone is a multi-billion dollar industry, highlighting the significant revenue potential.

Inventec's traditional notebook PCs continue to be a cornerstone Cash Cow, representing 51-55% of revenue in Q3 2024. This segment benefits from a mature market with projected modest growth of 4.9% in 2025, driven by refresh cycles. Inventec's established OEM/ODM capabilities ensure it capitalizes on this consistent demand, generating substantial cash flow with minimal new investment.

| Product Segment | 2023 Revenue Share | Q3 2024 Revenue Share | Projected 2025 Growth | Cash Flow Generation |

|---|---|---|---|---|

| Traditional Notebook PCs | 54% | 51-55% | 4.9% | High, Low Investment |

| Non-AI Servers | N/A | Significant Volume | Stable Enterprise Demand | High, Stable |

| Mature Audio Devices (IAC) | N/A | Significant Portion | Market Maturity | High, Low Investment |

| Standard Data Storage | N/A | Consistent Revenue | Enduring Market Need | High, Stable |

| Thin Clients & Peripherals | N/A | Consistent Demand | N/A | High, Reliable |

What You See Is What You Get

Inventec BCG Matrix

The Inventec BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, ready-to-deploy strategic analysis. You can trust that the professional design and comprehensive data presented here are precisely what you'll be working with for your business planning. This ensures a seamless transition from preview to practical application, allowing you to leverage Inventec's strategic insights without delay.

Dogs

Inventec's legacy mobile communication devices, primarily older feature phones, likely reside in the Dogs quadrant of the BCG Matrix. While some production might continue to cater to niche markets, demand for these devices has significantly declined, with global shipments of feature phones falling by approximately 15% year-over-year in 2024, according to industry reports.

These products are characterized by a low market share within a rapidly shrinking segment of the mobile industry. The overwhelming shift towards smartphones means these devices offer minimal growth potential, making them unattractive for substantial investment or revitalization efforts.

Inventec's historical product line included basic electronic dictionaries and translation software. This segment likely represents a declining market due to the prevalence of free, sophisticated translation apps readily accessible on smartphones and online.

The market for standalone electronic dictionaries has significantly shrunk. Inventec's market share within this diminishing category is probably negligible, with these products contributing minimally to overall revenue and consuming resources that could be more effectively deployed in growth areas.

Inventec's portfolio includes IoT devices in saturated niches where competition is fierce. These products, lacking distinct features or key partnerships, often find themselves with a modest market share in segments characterized by slow growth and aggressive price wars. For example, in the smart home sensor market, which saw significant growth in the early 2020s, many generic sensors are now commoditized, leading to thin profit margins.

These less specialized IoT offerings are likely to generate low returns for Inventec. Turning around such products would necessitate substantial and potentially risky investments in R&D or marketing to differentiate them. Without a clear value proposition or a strong competitive advantage, these devices represent a challenge within the company's broader IoT strategy.

Older Generation Tablet PCs

Older generation tablet PCs from Inventec would likely be categorized as Dogs in the BCG Matrix. The tablet market, while still active, has seen significant shifts, with newer, more powerful devices dominating. For instance, in 2024, the global tablet market experienced a slight decline in unit shipments compared to previous years, indicating a maturing landscape where older models struggle to compete.

These older models might represent products with low market share in a slow-growing or declining market. Inventec's older tablet PC lines could be facing intense competition from both established players and newer entrants offering more advanced features at competitive price points. This situation often leads to products that barely cover their costs, tying up valuable capital that could be reinvested in more promising areas.

The challenge for Inventec with these older generation tablet PCs is managing inventory and potential obsolescence. Without significant differentiation or a niche market appeal, these products are unlikely to generate substantial revenue or profit.

- Low Market Share: Older tablet PCs often struggle to gain traction against newer, more feature-rich competitors.

- Slow Market Growth: The overall tablet market's maturity means fewer opportunities for older, less innovative models to capture new demand.

- Profitability Concerns: These products may only break even or incur holding costs, representing a drain on resources.

- Need for Divestment or Revitalization: Companies like Inventec often consider phasing out or significantly revamping 'Dog' products to free up capital.

Specific, Niche Automotive Electronics Yet to Scale

Within the expansive automotive electronics sector, Inventec may be developing highly specialized components, such as advanced driver-assistance systems (ADAS) for niche commercial vehicles or custom infotainment solutions for luxury electric vehicle startups. These products, while innovative, could be in their infancy, facing high initial research and development expenditures and commanding only a small slice of the overall automotive electronics market. For instance, a particular sensor array designed for autonomous agricultural machinery might represent a significant R&D investment for Inventec but currently serves a very limited customer base, thus struggling to achieve economies of scale.

These specific, niche automotive electronics products are likely positioned as Stars or Question Marks in the BCG matrix, depending on their growth trajectory and market share potential. If they are in a rapidly expanding sub-segment but have low current market share, they are Question Marks. However, if their growth is slower and market share is minimal, they might be considered Dogs. For example, a new type of in-cabin air purification system tailored for ultra-luxury sedans, while technologically advanced, might have limited sales volume in 2024 due to its high price point and the relatively small number of vehicles it's integrated into.

- Niche Market Focus: Products targeting highly specialized automotive applications, such as advanced sensor modules for autonomous drones or custom power management units for electric hypercars.

- High R&D Costs: Significant upfront investment in research, development, and testing for these specialized components, often without immediate substantial revenue generation.

- Low Market Share: Currently holding a minimal percentage of the broader automotive electronics market due to their specialized nature and limited adoption.

- Economies of Scale Challenges: Difficulty in reducing per-unit production costs because of low sales volumes and lack of widespread market penetration.

Inventec's legacy mobile communication devices, primarily older feature phones, likely reside in the Dogs quadrant of the BCG Matrix. While some production might continue to cater to niche markets, demand for these devices has significantly declined, with global shipments of feature phones falling by approximately 15% year-over-year in 2024, according to industry reports.

These products are characterized by a low market share within a rapidly shrinking segment of the mobile industry. The overwhelming shift towards smartphones means these devices offer minimal growth potential, making them unattractive for substantial investment or revitalization efforts.

Inventec's historical product line included basic electronic dictionaries and translation software. This segment likely represents a declining market due to the prevalence of free, sophisticated translation apps readily accessible on smartphones and online.

The market for standalone electronic dictionaries has significantly shrunk. Inventec's market share within this diminishing category is probably negligible, with these products contributing minimally to overall revenue and consuming resources that could be more effectively deployed in growth areas.

Inventec's portfolio includes IoT devices in saturated niches where competition is fierce. These products, lacking distinct features or key partnerships, often find themselves with a modest market share in segments characterized by slow growth and aggressive price wars. For example, in the smart home sensor market, which saw significant growth in the early 2020s, many generic sensors are now commoditized, leading to thin profit margins.

These less specialized IoT offerings are likely to generate low returns for Inventec. Turning around such products would necessitate substantial and potentially risky investments in R&D or marketing to differentiate them. Without a clear value proposition or a strong competitive advantage, these devices represent a challenge within the company's broader IoT strategy.

Older generation tablet PCs from Inventec would likely be categorized as Dogs in the BCG Matrix. The tablet market, while still active, has seen significant shifts, with newer, more powerful devices dominating. For instance, in 2024, the global tablet market experienced a slight decline in unit shipments compared to previous years, indicating a maturing landscape where older models struggle to compete.

These older models might represent products with low market share in a slow-growing or declining market. Inventec's older tablet PC lines could be facing intense competition from both established players and newer entrants offering more advanced features at competitive price points. This situation often leads to products that barely cover their costs, tying up valuable capital that could be reinvested in more promising areas.

The challenge for Inventec with these older generation tablet PCs is managing inventory and potential obsolescence. Without significant differentiation or a niche market appeal, these products are unlikely to generate substantial revenue or profit.

- Low Market Share: Older tablet PCs often struggle to gain traction against newer, more feature-rich competitors.

- Slow Market Growth: The overall tablet market's maturity means fewer opportunities for older, less innovative models to capture new demand.

- Profitability Concerns: These products may only break even or incur holding costs, representing a drain on resources.

- Need for Divestment or Revitalization: Companies like Inventec often consider phasing out or significantly revamping 'Dog' products to free up capital.

Within the expansive automotive electronics sector, Inventec may be developing highly specialized components, such as advanced driver-assistance systems (ADAS) for niche commercial vehicles or custom infotainment solutions for luxury electric vehicle startups. These products, while innovative, could be in their infancy, facing high initial research and development expenditures and commanding only a small slice of the overall automotive electronics market. For instance, a particular sensor array designed for autonomous agricultural machinery might represent a significant R&D investment for Inventec but currently serves a very limited customer base, thus struggling to achieve economies of scale.

These specific, niche automotive electronics products are likely positioned as Stars or Question Marks in the BCG matrix, depending on their growth trajectory and market share potential. If they are in a rapidly expanding sub-segment but have low current market share, they are Question Marks. However, if their growth is slower and market share is minimal, they might be considered Dogs. For example, a new type of in-cabin air purification system tailored for ultra-luxury sedans, while technologically advanced, might have limited sales volume in 2024 due to its high price point and the relatively small number of vehicles it's integrated into.

- Niche Market Focus: Products targeting highly specialized automotive applications, such as advanced sensor modules for autonomous drones or custom power management units for electric hypercars.

- High R&D Costs: Significant upfront investment in research, development, and testing for these specialized components, often without immediate substantial revenue generation.

- Low Market Share: Currently holding a minimal percentage of the broader automotive electronics market due to their specialized nature and limited adoption.

- Economies of Scale Challenges: Difficulty in reducing per-unit production costs because of low sales volumes and lack of widespread market penetration.

Question Marks

Inventec views automotive electronics as a burgeoning sector with substantial long-term revenue potential, targeting significant growth by 2027. The industry is propelled by major trends like vehicle electrification, the advancement of autonomous driving systems, and the increasing integration of connected car features.

While this market offers high growth, Inventec's position in many specific automotive electronics niches is likely nascent, reflecting its status as a newer entrant or an expanding player. Successfully capturing market share in these areas will necessitate considerable investment to achieve scale and establish a strong competitive standing.

Inventec's smart healthcare solutions, like the MyHeartScore app and Gastrointestinal AI, are positioned as potential stars in their BCG matrix. These AI-driven medical innovations, showcased at events like Computex 2025, tap into the rapidly expanding digital health market, which is projected to reach hundreds of billions globally by 2030.

While these represent high-growth areas with substantial future potential, they are likely in the question mark phase for Inventec. Significant investment in research, development, and regulatory approvals is necessary to capture market share in these nascent but promising sectors.

Inventec is actively integrating AI into its smart manufacturing processes, exemplified by its Observational Agent. This solution is designed to enhance factory floor operations through advanced monitoring and optimization.

The broader market for Industrial Internet of Things (IIoT) and AI in manufacturing is experiencing robust growth, driven by the increasing demand for efficiency and automation across industries. This trend suggests a strong potential for Inventec's AI-driven solutions.

While Inventec is utilizing these AI tools internally, their penetration as commercially available products for external manufacturers is likely still in its nascent stages. Realizing significant market share will necessitate substantial investment in product development and sales infrastructure.

The company's focus on AI for smart manufacturing aligns with a market segment projected to reach hundreds of billions of dollars globally by the late 2020s, indicating a substantial opportunity for those who can effectively capture market share.

Advanced 5G Communication Technology Applications (beyond basic products)

Inventec is actively exploring advanced 5G communication technology applications, moving beyond standard consumer products to target specialized enterprise and industrial needs. A prime example is their involvement in 5G factory network deployments, a sector projected for significant expansion.

These advanced applications, such as private 5G networks for smart manufacturing, are considered high-growth frontiers. For instance, the global private 5G market was estimated to reach $7.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 30% through 2030, reaching an estimated $45.7 billion by that year.

Inventec's current market position in these niche, high-value 5G service offerings is still developing, indicating a relatively low market share at this stage. Success in this area requires significant investment in research and development, alongside the formation of strategic partnerships to fully harness the high growth potential.

- Focus on 5G Factory Networks: Inventec is targeting specialized industrial applications like 5G-enabled smart factories.

- High-Growth Market Segment: The private 5G market, crucial for these applications, is experiencing rapid growth, with projections indicating a significant market size by 2030.

- Developing Market Position: Inventec is still establishing its presence in these high-value, specialized 5G service areas, meaning its current market share is modest.

- Strategic Investment Required: Capitalizing on the high growth potential necessitates substantial R&D investment and strategic collaborations.

Emerging IoT Segments (e.g., Smart Home, Industry IoT beyond current scale)

Inventec is strategically targeting Industry IoT and Smart Home as growth areas, aiming to broaden its Internet of Things offerings. The broader IoT market is expanding, but many individual segments are new and fiercely contested, making market share acquisition challenging.

Given the emerging nature and fragmentation of these IoT segments, Inventec's current market share is likely modest. Success hinges on developing differentiated products and achieving substantial customer adoption. For instance, the global Industrial IoT market was projected to reach $110.5 billion in 2024, with significant growth expected in areas like predictive maintenance and asset tracking.

- Industry IoT: Focus on specialized solutions for manufacturing, logistics, and energy sectors.

- Smart Home: Emphasis on interoperability and user experience for connected living devices.

- Market Dynamics: High competition from established tech giants and agile startups in both segments.

- Strategic Imperative: Significant investment is needed to gain traction and potentially transition these segments into market leaders.

Inventec's ventures into emerging technologies like AI for smart manufacturing and advanced 5G applications represent significant growth opportunities. These sectors, while promising, require substantial investment to establish market presence and achieve scale, reflecting their current position as question marks in the BCG matrix.

The company's smart healthcare solutions also fall into this category, demanding considerable R&D and market penetration efforts to realize their full potential in the rapidly evolving digital health landscape.

Inventec is navigating these nascent markets by focusing on innovation and strategic development, aiming to convert these question marks into future stars or cash cows.

The success of these initiatives will depend on their ability to secure market share in competitive, high-growth environments, a process that is inherently capital-intensive.

| Business Area | Market Opportunity | Inventec's Position | Investment Needs |

|---|---|---|---|

| AI for Smart Manufacturing | Hundreds of billions globally by late 2020s | Nascent, internal focus transitioning to external products | Substantial R&D, sales infrastructure |

| Advanced 5G Applications (e.g., Private 5G) | Projected to reach $45.7 billion by 2030 (from $7.7 billion in 2023) | Developing, low market share in niche services | Significant R&D, strategic partnerships |

| Smart Healthcare Solutions | Hundreds of billions globally by 2030 | Nascent, high investment for market capture | R&D, regulatory approvals |

BCG Matrix Data Sources

Our Inventec BCG Matrix is built on comprehensive market intelligence, integrating financial disclosures, industry growth forecasts, and competitor analysis to provide strategic direction.