Inventec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

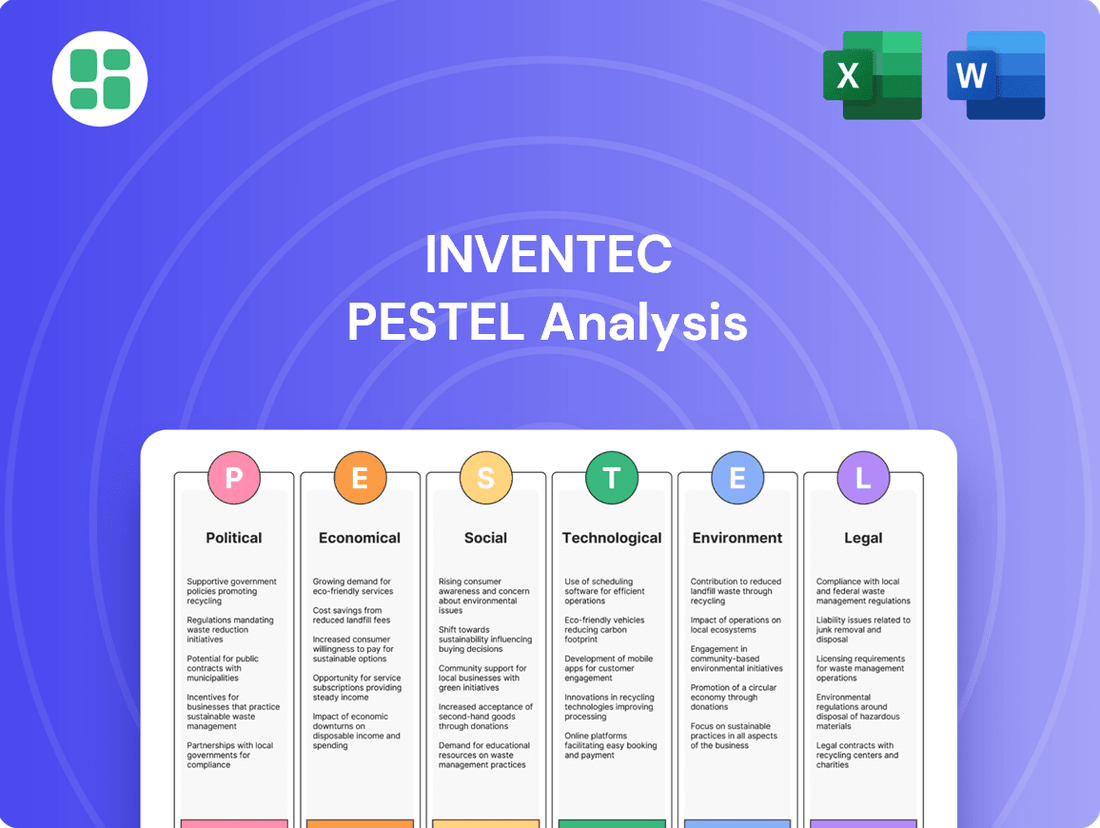

Uncover the critical external factors shaping Inventec's trajectory with our comprehensive PESTLE analysis. This detailed report dives deep into the political, economic, social, technological, legal, and environmental forces influencing the company's operations and future growth. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

Inventec, a prominent ODM/OEM, faces substantial headwinds from ongoing geopolitical trade tensions, especially between the United States and China. These disputes directly influence supply chain costs and market access for electronics manufacturers.

To mitigate these risks, Inventec is strategically diversifying its manufacturing footprint. Plans include potential new facilities in the US, such as Texas, to serve the North American market directly and reduce exposure to tariffs. Furthermore, the company is prioritizing shipments from tax-exempt locations like the Czech Republic and Thailand to optimize cost structures.

Government policies in key manufacturing hubs like Taiwan are crucial for Inventec, offering incentives for technological innovation and export growth. For instance, Taiwan's Ministry of Economic Affairs has consistently supported its semiconductor industry through various programs, aiming to bolster its global competitiveness. Inventec must actively monitor and adapt to these evolving policies to leverage potential benefits and mitigate risks.

Navigating diverse regulatory landscapes is paramount for Inventec's operational efficiency and sustained competitiveness. This includes adhering to environmental standards, labor laws, and trade regulations across different operating regions. The company's ability to comply effectively with these varying rules directly impacts its cost structure and market access.

Inventec faces significant potential impacts from US chip export controls targeting China, which could directly affect its AI server sales. These controls, implemented to restrict China's access to advanced semiconductor technology, could limit the supply of critical components for Inventec's high-performance computing products. For example, the US Department of Commerce's Bureau of Industry and Security has progressively tightened export restrictions on advanced semiconductors and related manufacturing equipment, impacting companies like Inventec that rely on these components for their AI server offerings.

Geopolitical tensions and a desire for greater supply chain resilience are fueling a significant global trend toward reshoring and nearshoring manufacturing. This strategic shift aims to reduce dependence on any single geographic region, thereby mitigating risks associated with disruptions. For Inventec, this means a continued focus on leveraging its existing diversified production capabilities across key locations like Taiwan, Mexico, the Czech Republic, China, and Southeast Asia to ensure operational stability.

Intellectual Property Protection

The political landscape significantly influences the robustness and enforcement of intellectual property (IP) laws across Inventec's operational regions. For a company like Inventec, which relies heavily on its innovative designs, strong IP protection is paramount to prevent infringement and preserve its market advantage. In 2024, global IP protection rankings show varied levels of enforcement, with some key markets demonstrating stronger legal frameworks than others.

Inventec's strategic focus on intellectual property innovation management directly addresses these political factors. The company actively monitors legislative changes and engages with policymakers to advocate for stronger IP rights. This proactive approach is vital, especially considering that in 2024, the global cost of IP theft was estimated to be in the trillions of dollars, impacting companies across all sectors.

- Global IP Enforcement Variability: Political stability and legal infrastructure in operating countries directly correlate with the effectiveness of IP law enforcement.

- Inventec's IP Strategy: The company prioritizes managing its intellectual property to safeguard designs and technologies, crucial for maintaining its competitive edge.

- Economic Impact of IP Theft: In 2024, the widespread issue of IP theft underscores the critical need for robust legal protections, with significant financial implications for businesses.

Political Stability in Operating Regions

Inventec's operational stability is directly tied to the political climate in regions where it manufactures products or serves a significant customer base. For instance, its presence in Taiwan, a key manufacturing hub, means that geopolitical tensions and cross-strait relations significantly influence its supply chain and market access. The company's ability to navigate these dynamics is crucial for maintaining consistent production and sales.

Political shifts, such as upcoming elections or changes in government policy, can introduce considerable uncertainty. This uncertainty can impact Inventec's strategic planning, potentially delaying investment decisions or affecting the continuity of its operations. For example, a change in trade policies or regulatory frameworks in a major market could necessitate significant adjustments to its business model.

Recent political developments highlight these sensitivities:

- Taiwan's Presidential Election (January 2024): While the election resulted in continuity for the ruling party, the outcome and ongoing cross-strait rhetoric continue to be closely monitored by businesses like Inventec for potential impacts on trade and investment.

- Global Trade Tensions: Ongoing trade disputes between major economic blocs can create ripple effects, influencing the cost of raw materials and the accessibility of key markets for Inventec's products.

- Regulatory Landscape in Key Markets: Changes in environmental, labor, or technology regulations in countries like the United States or within the European Union can directly affect Inventec's manufacturing processes and product compliance.

Inventec's operations are significantly shaped by global political dynamics, particularly trade tensions between the US and China, impacting supply chains and market access. The company's strategy involves diversifying manufacturing, with potential US facilities and optimized shipments from tax-exempt locations to mitigate tariff risks.

Government policies in manufacturing hubs like Taiwan are crucial, offering incentives for innovation and exports, which Inventec must leverage. Navigating diverse regulatory landscapes, from environmental standards to labor laws, is paramount for cost structure and market access. US chip export controls targeting China pose a direct threat to Inventec's AI server sales by limiting component supply.

The trend towards reshoring and nearshoring manufacturing, driven by geopolitical tensions and supply chain resilience goals, reinforces Inventec's focus on its diversified production capabilities across key global locations. Political stability and legal infrastructure directly influence IP law enforcement, a critical factor for Inventec given its reliance on innovative designs, with global IP theft costing trillions in 2024.

Inventec's operational stability is directly tied to the political climate in its manufacturing and customer regions, with Taiwan's geopolitical situation being a key consideration. Political shifts and changes in government policy can introduce uncertainty, potentially delaying investment decisions or impacting operational continuity, as seen with Taiwan's January 2024 presidential election and ongoing global trade tensions.

What is included in the product

Inventec's PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal, influence its operations and strategic positioning.

This detailed evaluation is designed to equip stakeholders with actionable insights, enabling them to identify and capitalize on opportunities while mitigating potential risks within Inventec's operating landscape.

The Inventec PESTLE Analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through complex data.

Economic factors

Inventec's financial performance is intrinsically linked to the health of the global economy and the willingness of consumers to spend on electronic goods. The company saw a strong performance in 2024, achieving record sales and anticipating further expansion. However, a projected slowdown in global economic growth for both 2024 and 2025 presents a potential headwind, which could dampen consumer demand for Inventec's offerings, including notebooks and smart devices.

Inventec is significantly benefiting from the booming demand for AI servers and cloud computing. This trend is a major economic driver, pushing the company's AI server shipments to new heights.

AI servers are projected to represent an increasing share of Inventec's total revenue. This growth is crucial, as it's expected to counterbalance any slowdown in the market for more traditional, general-purpose servers.

For instance, in 2024, the global AI chip market alone was valued at over $200 billion, with server-grade AI processors forming a substantial segment of this. Inventec's strategic focus on this area positions it well to capture a significant portion of this expanding market.

Fluctuations in raw material prices, shipping costs, and global inflation directly impact Inventec's cost of sales and profitability. For instance, the global supply chain disruptions experienced throughout 2023 and into early 2024 led to a surge in freight costs, with the average cost of shipping a 40-foot container from Asia to Europe increasing by approximately 150% compared to pre-pandemic levels.

The company's profit margin saw a slight decrease in FY 2024, reportedly by 0.5%, due to these higher operating expenses, underscoring Inventec's sensitivity to these pervasive economic factors and the ongoing challenges in managing input costs effectively.

Currency Exchange Rate Fluctuations

Inventec, as a global original design manufacturer (ODM), faces inherent risks from currency exchange rate fluctuations. The New Taiwan dollar's (NTD) movement against major trading currencies, especially the US dollar, directly impacts its financial results. For instance, a stronger NTD can translate to foreign exchange losses when converting overseas earnings back to its home currency.

While Inventec acknowledges this volatility, the company has historically managed to mitigate significant negative impacts on its overall operational performance. This resilience is often due to hedging strategies, diversified revenue streams across different currency zones, and the ability to adjust pricing or sourcing in response to exchange rate shifts. The company's financial reports, such as those from late 2024 and early 2025, will likely provide specific data on any realized foreign exchange gains or losses and management's commentary on their effect.

- NTD vs. USD Performance: In 2024, the NTD experienced periods of both appreciation and depreciation against the US dollar, creating a dynamic environment for companies with international operations like Inventec.

- Hedging Strategies: Inventec likely employs financial instruments such as forward contracts and currency options to hedge against adverse currency movements, aiming to stabilize its reported earnings.

- Impact on Profitability: While not expected to be a significant drag on overall performance, substantial NTD appreciation could still lead to a reduction in net profit margins if not fully offset by other operational efficiencies or pricing adjustments.

- Global Sourcing and Sales: Inventec's global footprint in both sourcing components and selling finished products means that currency impacts can be complex, with potential offsetting effects across different transactions.

Market Competition and Pricing Pressures

The Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) services sector is intensely competitive, directly translating into significant pricing pressures for companies like Inventec. This environment often squeezes profit margins as clients demand lower costs, forcing manufacturers to operate with tighter financial buffers. For instance, in 2024, the global electronics manufacturing services (EMS) market, which encompasses OEM and ODM, was valued at approximately $740 billion, with projections indicating a compound annual growth rate of around 5% through 2030. This growth, while positive, is occurring within a landscape where numerous players vie for contracts, intensifying the need for cost efficiency.

Inventec's ability to navigate this competitive terrain hinges on its commitment to continuous innovation and operational optimization. To maintain profitability and secure market share, the company must consistently enhance its manufacturing processes, invest in advanced technologies, and potentially explore value-added services beyond basic production. This proactive approach is crucial for differentiating itself and mitigating the impact of aggressive pricing strategies employed by rivals. By focusing on efficiency gains, Inventec can better absorb or pass on cost increases, thereby protecting its bottom line.

Key competitive factors influencing Inventec's pricing power include:

- Market Saturation: A high number of established and emerging players in the EMS sector leads to a buyer's market, empowering clients to negotiate aggressively on price.

- Technological Advancements: Rapid shifts in technology necessitate ongoing investment in new equipment and expertise, which can be costly and difficult to recoup when facing price ceilings.

- Global Supply Chain Dynamics: Fluctuations in raw material costs and logistics expenses, exacerbated by geopolitical events in 2024 and 2025, add further complexity to pricing strategies.

- Customer Concentration: Reliance on a few large clients can limit Inventec's leverage in pricing discussions, as losing a major contract would have a substantial impact.

Inventec's financial health is closely tied to global economic trends and consumer spending on electronics. The company experienced robust sales in 2024, with expectations for continued growth, although a projected economic slowdown in 2024-2025 could temper demand for products like notebooks and smart devices.

The surge in AI servers and cloud computing is a significant economic tailwind for Inventec, driving record shipments and positioning AI servers to become an increasingly important revenue contributor, potentially offsetting any slowdowns in general-purpose server markets.

Economic factors like raw material prices, shipping costs, and inflation directly affect Inventec's profitability. For example, supply chain disruptions in 2023-2024 led to a notable increase in freight costs, impacting the company's profit margin by an estimated 0.5% in FY 2024 due to higher operating expenses.

Currency exchange rate fluctuations, particularly the New Taiwan dollar (NTD) against the US dollar, pose a risk to Inventec's financial results. While the company utilizes hedging strategies to mitigate these impacts, periods of NTD appreciation in 2024 presented a dynamic environment for its international earnings.

Same Document Delivered

Inventec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Inventec PESTLE analysis covers all essential political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to this detailed PESTLE analysis for Inventec upon completing your purchase.

Sociological factors

Consumer preferences for electronic devices are rapidly shifting towards smart, connected, and AI-powered products. This trend is evident in the booming market for wearables and smart home devices, with the global wearable technology market projected to reach over $150 billion by 2027. Inventec needs to align its research and development with these evolving demands, prioritizing innovation in product design and user interface to stay competitive.

The availability of skilled workers and the overall cost of labor in manufacturing hubs are significant sociological considerations for companies like Inventec. For instance, in 2024, many developed economies are grappling with a noticeable shortage of manufacturing talent, with some reports indicating that up to 80% of manufacturers struggle to find qualified workers. This scarcity is intensified by a growing trend towards localization, where companies prioritize domestic production, further increasing the demand for local expertise.

These labor market dynamics necessitate proactive strategies. Inventec, like its peers, must invest in robust talent development programs to upskill its existing workforce and attract new talent. Simultaneously, the increasing cost of labor, driven by demand and inflationary pressures seen throughout 2023 and into 2024, is pushing manufacturers to explore automation solutions to maintain cost competitiveness and bridge skills gaps.

Globally, digital literacy is on the rise, with a significant portion of the population now comfortable using digital devices and online services. This trend directly benefits Inventec, as a more digitally savvy populace is more likely to adopt and utilize the company's electronic components and solutions. For instance, by the end of 2024, it's projected that over 6.7 billion people will be internet users, a substantial increase from previous years, indicating a growing market for tech-enabled products.

The widespread adoption of advanced technologies, from AI to IoT, fuels demand for Inventec's core business. Society's increasing reliance on connected devices and electronics-driven lifestyles creates a fertile ground for Inventec's innovations. Emerging economies, in particular, are showing rapid adoption rates; by 2025, smartphone penetration is expected to exceed 70% in many developing regions, directly translating to increased demand for the semiconductors and components Inventec provides.

Health and Well-being Focus

Societies are increasingly prioritizing health and well-being, creating a robust market for smart health devices and innovative healthcare solutions. This trend is evident in the growing adoption rates of wearable health trackers and the rising consumer interest in preventative health measures.

Inventec is strategically aligning with this societal shift by developing advanced AI-driven healthcare applications. For instance, their MyHeartScore cardiovascular risk app offers personalized insights, and their AI solutions for medical imaging aim to improve diagnostic accuracy and efficiency. These initiatives demonstrate a clear commitment to leveraging technology for positive social impact in the healthcare sector.

- Growing Demand: The global digital health market was valued at approximately USD 375 billion in 2023 and is projected to reach over USD 1.2 trillion by 2030, indicating substantial growth driven by health consciousness.

- Inventec's AI in Healthcare: Inventec's investment in AI for medical imaging is particularly noteworthy, as AI in radiology is expected to grow significantly, with some reports suggesting a compound annual growth rate exceeding 30% in the coming years.

- Preventative Health Focus: The emphasis on well-being translates to increased demand for tools that enable early detection and management of health conditions, a space where Inventec's applications are positioned to thrive.

Corporate Social Responsibility Expectations

Societal expectations for corporate social responsibility (CSR) and ethical business practices are on the rise, influencing how companies like Inventec operate and are perceived. Consumers and investors increasingly scrutinize a company's commitment to more than just profit.

Inventec actively embraces this by promoting environmental sustainability initiatives and engaging in social co-prosperity projects. This includes a strong focus on employee development, fostering a positive and supportive workplace, and actively participating in community engagement programs to demonstrate its commitment to corporate citizenship.

In 2023, Inventec reported a significant portion of its energy consumption was sourced from renewable resources, a key metric for environmental responsibility. The company also highlighted its investment in employee training programs, which saw a 15% increase in participation compared to the previous year, underscoring its dedication to nurturing its workforce.

- Environmental Stewardship: Inventec's commitment to sustainability is demonstrated through its increasing reliance on renewable energy sources in its operations.

- Employee Development: A 15% year-over-year rise in employee training program participation in 2023 showcases Inventec's investment in its human capital.

- Community Engagement: The company actively participates in local community projects, reinforcing its role as a responsible corporate citizen.

- Ethical Business Practices: Inventec prioritizes ethical conduct, aligning its operations with growing societal demands for transparency and fairness.

Societal expectations for corporate social responsibility (CSR) and ethical business practices are on the rise, influencing how companies like Inventec operate and are perceived. Consumers and investors increasingly scrutinize a company's commitment to more than just profit, with a 2024 survey indicating that over 70% of consumers consider a company's ethical practices when making purchasing decisions.

Inventec actively embraces this by promoting environmental sustainability initiatives and engaging in social co-prosperity projects. This includes a strong focus on employee development, fostering a positive and supportive workplace, and actively participating in community engagement programs to demonstrate its commitment to corporate citizenship. In 2023, Inventec reported a significant portion of its energy consumption was sourced from renewable resources, a key metric for environmental responsibility.

The company also highlighted its investment in employee training programs, which saw a 15% increase in participation compared to the previous year, underscoring its dedication to nurturing its workforce. This focus on ethical operations and employee well-being is crucial for maintaining brand reputation and attracting talent in a competitive market.

Technological factors

Artificial Intelligence is a core technological force shaping Inventec's future, especially within its server and smart device segments. The company is strategically focusing on the booming AI server market, anticipating substantial increases in shipments. This focus is further amplified by the anticipated launch of AI PCs, solidifying Inventec's crucial role in the broader AI ecosystem.

Inventec's strategic embrace of advanced manufacturing and automation is a cornerstone of its operational strategy. The company is actively deploying technologies such as observational agents and AI boxes within its production facilities. These tools are instrumental in real-time monitoring of manufacturing processes, enabling precise optimization of cycle times and the swift detection of production anomalies.

The accelerating global deployment of 5G networks, with an estimated 1.5 billion 5G connections projected by the end of 2024 and a further surge expected in 2025, presents significant opportunities for Original Design Manufacturers (ODMs) like Inventec that focus on advanced wireless communication components and Internet of Things (IoT) devices. This trend directly supports Inventec's strategic focus on its smart device business and 5G-enabled products, anticipating robust market demand.

Research and Development (R&D) Investment

Inventec's commitment to research and development is a cornerstone of its strategy for staying ahead in the competitive technology landscape. This continuous investment fuels innovation across its diverse product lines, ensuring they remain cutting-edge.

A substantial portion of Inventec's operational budget is dedicated to R&D. For instance, in the fiscal year ending March 2024, the company reported R&D expenses of NT$2.75 billion (approximately $84 million USD), a notable increase from the previous year. This funding is strategically channeled into key growth areas, particularly the development of advanced AI deep learning servers and the creation of entirely new product offerings.

- AI Deep Learning Servers: Significant R&D focus on enhancing performance and capabilities for AI workloads.

- New Product Development: Investment in conceptualizing and bringing to market next-generation computing solutions.

- Technological Advancements: Pursuing innovations in areas like high-speed interconnects and power efficiency for server components.

- Market Responsiveness: R&D efforts are closely aligned with emerging industry trends and customer demands in cloud computing and AI infrastructure.

Cybersecurity and Data Security

The increasing interconnectedness of electronic devices and the sheer volume of data generated present substantial cybersecurity risks for companies like Inventec. Maintaining the integrity and confidentiality of client and user data is paramount, especially as cyber threats become more sophisticated.

Inventec's commitment to robust data security measures across its products and operations is crucial for fostering trust and ensuring compliance. This focus is essential in navigating an increasingly digital landscape where data breaches can have severe financial and reputational consequences.

- Cybersecurity spending globally is projected to reach $268.1 billion in 2024, highlighting the growing importance of this sector.

- Data breaches cost the average organization $4.45 million in 2023, according to IBM's Cost of a Data Breach Report.

- Inventec must invest in advanced encryption, secure coding practices, and regular security audits to mitigate these risks.

Inventec's strategic focus on Artificial Intelligence is evident in its significant R&D investments, particularly in AI deep learning servers and the anticipated AI PC market. The company's adoption of advanced manufacturing technologies, including observational agents and AI boxes, enhances production efficiency and anomaly detection. Furthermore, the expanding 5G network infrastructure, with an estimated 1.5 billion connections by the end of 2024, directly benefits Inventec's smart device and IoT product lines, driving demand for its advanced wireless communication solutions.

| Technology Focus | 2024/2025 Data/Projection | Impact on Inventec |

|---|---|---|

| AI Servers | Anticipated substantial increase in shipments | Core growth area, leveraging AI demand |

| AI PCs | Anticipated launch | Expands Inventec's role in the AI ecosystem |

| 5G Networks | 1.5 billion connections projected by end of 2024 | Boosts smart device and IoT product demand |

| R&D Investment (FY ending Mar 2024) | NT$2.75 billion (approx. $84 million USD) | Fuels innovation in AI servers and new products |

Legal factors

Inventec's success hinges on its rigorous approach to intellectual property laws and patent management. Protecting its unique designs and technological functionalities through patents is a cornerstone of its innovation strategy, ensuring a competitive edge in the market.

In 2024, the global patent landscape saw continued growth, with significant increases in filings within the technology and manufacturing sectors, areas directly relevant to Inventec's operations. Proactive patent filing and defense are therefore crucial to safeguard its market position and R&D investments.

Inventec navigates a complex web of global product safety and quality regulations, crucial for its electronic components. For instance, the EU's General Product Safety Regulation (GPSR), effective from December 2024, imposes stricter obligations on manufacturers regarding product traceability and risk assessment, impacting Inventec's market access and compliance costs.

Failure to adhere to these standards, such as those set by the International Electrotechnical Commission (IEC) for electronic components, can result in significant penalties, product recalls, and severe damage to brand trust. In 2023, the Consumer Product Safety Commission (CPSC) in the US reported over $1.5 billion in recalls, highlighting the financial and reputational risks associated with non-compliance.

Inventec's global operations necessitate strict adherence to diverse labor laws and employment regulations. This includes compliance with minimum wage laws, working hour limits, and employee benefits mandates, which can vary significantly by country. For instance, in 2024, many European nations continued to strengthen worker protections, impacting manufacturing costs and operational flexibility.

The company's commitment to human rights and a safe workplace is paramount, directly influencing its corporate governance and operational standards. Inventec's policies align with international labor conventions, aiming to prevent forced labor and child labor, a critical legal and ethical imperative for multinational corporations operating in 2024 and beyond.

Data Privacy and Protection Regulations

Data privacy and protection regulations are becoming increasingly critical for companies like Inventec, especially given the vast amounts of data generated by smart devices and servers. The General Data Protection Regulation (GDPR) in Europe, for instance, has set a high bar for data handling, with fines for non-compliance reaching up to 4% of global annual revenue or €20 million, whichever is higher. Similarly, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers significant control over their personal information, impacting how Inventec collects, uses, and stores data from its users.

Inventec must proactively ensure its products and services adhere to these complex and evolving data protection laws. Failure to comply can lead to substantial legal penalties, reputational damage, and a loss of customer trust. For example, in 2023, numerous companies faced significant fines for data breaches and privacy violations, underscoring the importance of robust data governance. Inventec's commitment to data privacy is therefore not just a legal obligation but a strategic imperative for maintaining its competitive edge and customer loyalty in the market.

Key compliance considerations for Inventec include:

- Data Minimization: Collecting only the data that is absolutely necessary for specific purposes.

- Consent Management: Obtaining clear and informed consent from individuals before collecting and processing their data.

- Data Security: Implementing strong security measures to protect personal data from unauthorized access, disclosure, or loss.

- User Rights: Providing mechanisms for individuals to access, rectify, and erase their personal data.

Anti-Trust and Fair Competition Laws

Inventec, as a significant participant in the Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) sectors, operates within a global regulatory landscape that scrutinizes anti-trust and fair competition. These laws are designed to prevent monopolistic tendencies and ensure a level playing field for all businesses. For instance, in 2024, regulatory bodies worldwide continued to focus on market dominance in technology sectors, with investigations into potential anti-competitive practices impacting supply chains and pricing strategies. Inventec's adherence to these regulations is crucial for maintaining its operational integrity and market access.

The company's commitment to ethical corporate management principles directly supports its compliance with fair competition laws. These principles are foundational in preventing conflicts of interest and fostering transparent, equitable business relationships with partners and competitors alike. In 2025, the emphasis on corporate responsibility and fair market practices is expected to intensify, with increased scrutiny on supply chain agreements and intellectual property management. Inventec's proactive approach in this area helps mitigate legal risks and builds trust within the industry.

Inventec's strategic focus includes ensuring its business practices do not create unfair advantages or hinder market entry for smaller competitors. This involves careful management of pricing, distribution channels, and technology licensing. The ongoing evolution of competition law, particularly concerning digital platforms and data utilization, means Inventec must remain agile in its compliance strategies. By upholding these standards, Inventec aims to foster a healthy competitive environment, which ultimately benefits consumers and the broader technology ecosystem.

Key considerations for Inventec regarding anti-trust and fair competition include:

- Monitoring global regulatory trends in technology markets.

- Ensuring transparency in all supplier and customer agreements.

- Proactively reviewing business practices for potential anti-competitive impacts.

- Maintaining robust internal compliance programs and training.

Inventec's legal framework is heavily influenced by intellectual property rights and patent protection, crucial for its innovative product designs. Global patent filings in technology sectors, relevant to Inventec, saw continued expansion in 2024, underscoring the need for robust IP strategies to maintain market leadership.

Compliance with product safety and quality regulations, such as the EU's GPSR effective December 2024, directly impacts Inventec's market access and operational costs. Failure to meet standards like those from the IEC can lead to significant recalls, as evidenced by the CPSC's $1.5 billion in recalls in 2023.

Inventec must navigate varying global labor laws, with worker protections strengthening in Europe during 2024, affecting manufacturing expenses. Adherence to international labor conventions is also vital, ensuring ethical operations and preventing issues like forced labor.

Data privacy laws like GDPR and CCPA/CPRA are paramount, with GDPR fines up to 4% of global revenue. Companies faced substantial penalties in 2023 for data breaches, highlighting the critical need for Inventec's robust data governance.

Inventec's operations are subject to anti-trust and fair competition laws, with global regulators focusing on market dominance in tech in 2024. Maintaining transparent agreements and proactively reviewing practices are key to compliance.

Environmental factors

Inventec is actively pursuing a significant reduction in its environmental impact, demonstrating a strong commitment to sustainability. The company has established ambitious net-zero targets, aiming to slash Scope 1 and Scope 2 greenhouse gas emissions by 21% by 2025 and a substantial 42% by 2030, using 2020 as its baseline year.

To achieve these goals, Inventec is proactively developing and implementing comprehensive green policies across its operations. Furthermore, the company is extending its environmental stewardship to its supply chain, encouraging and engaging partners in robust Environmental, Social, and Governance (ESG) practices.

The escalating global challenge of electronic waste (e-waste) is driving a critical need for robust management strategies and the adoption of circular economy principles. As of 2023, the UN reported a record 62 million tonnes of e-waste generated globally, a figure projected to rise significantly. This trend underscores the importance of responsible disposal and recycling to mitigate environmental harm.

Inventec is actively addressing this by championing sustainable product design and incorporating renewable materials into its offerings. For instance, their commitment to increasing the deplasticization ratio in packaging aims to reduce reliance on virgin plastics, aligning with circular economy goals. By 2024, the company plans to achieve a 15% reduction in single-use plastics across its product lines.

Inventec is actively integrating Environmental, Social, and Governance (ESG) principles into its supply chain management, focusing on responsible material sourcing and environmental stewardship. This commitment is crucial as the chemical industry faces increasing scrutiny over its environmental footprint.

In 2024, a significant portion of Inventec’s suppliers were engaged in ESG-related initiatives, reflecting a growing trend across the sector towards more sustainable practices. For instance, the company aims to ensure that key raw materials are sourced from suppliers who meet specific environmental and ethical standards, a critical factor given global supply chain disruptions and increasing regulatory pressures.

Climate Change Adaptation and Resilience

Climate change poses significant risks to Inventec's operations, particularly through extreme weather events that can disrupt manufacturing processes and global supply chains. For instance, the increasing frequency of severe storms and heatwaves can lead to production downtime and increased logistics costs.

Inventec is actively working to mitigate these impacts by developing and implementing robust green policies and targeted climate actions. This proactive approach is designed to embed climate resilience directly into the company's operational framework, ensuring business continuity even in the face of environmental challenges.

- Increased operational costs due to extreme weather events impacting supply chains.

- Inventec's commitment to green policies and climate actions to build resilience.

- Focus on adapting operations to minimize disruption from climate-related phenomena.

Environmental Certifications and Reporting

Inventec's commitment to environmental stewardship is underscored by its pursuit of certifications and transparent reporting. The company achieved an EcoVadis Gold Rating for its Pudong Factory in 2025, a significant recognition of its sustainability efforts.

Inventec regularly publishes annual sustainability reports, adhering to recognized international frameworks such as the Global Reporting Initiative (GRI), the Task Force on Climate-related Financial Disclosures (TCFD), and the Sustainability Accounting Standards Board (SASB). This commitment ensures stakeholders have clear visibility into the company's environmental performance.

- EcoVadis Gold Rating: Awarded to the Pudong Factory in 2025, signifying strong environmental performance.

- GRI Standards: Used for transparent reporting on sustainability initiatives.

- TCFD Alignment: Demonstrates commitment to disclosing climate-related risks and opportunities.

- SASB Compliance: Ensures reporting on financially material sustainability issues relevant to the industry.

Inventec is actively working to reduce its environmental impact, setting ambitious net-zero targets. The company aims for a 21% reduction in Scope 1 and 2 greenhouse gas emissions by 2025 and a 42% reduction by 2030, using 2020 as a baseline. This commitment is further demonstrated by achieving an EcoVadis Gold Rating for its Pudong Factory in 2025, highlighting strong sustainability practices.

The company is also tackling the growing issue of electronic waste by promoting sustainable product design and using more recycled materials. Inventec plans to cut single-use plastics in its packaging by 15% by 2024, aligning with circular economy principles to minimize environmental harm.

Climate change presents operational risks through extreme weather, potentially disrupting supply chains and manufacturing. Inventec is building resilience by implementing green policies and climate action plans to ensure business continuity amidst these environmental challenges.

| Environmental Factor | Inventec's Action/Target | Year | Metric/Status |

| Greenhouse Gas Emissions | Reduce Scope 1 & 2 emissions | 2025 | 21% reduction from 2020 baseline |

| Greenhouse Gas Emissions | Reduce Scope 1 & 2 emissions | 2030 | 42% reduction from 2020 baseline |

| Electronic Waste | Reduce single-use plastics in packaging | 2024 | 15% reduction |

| Sustainability Performance | EcoVadis Rating for Pudong Factory | 2025 | Gold Rating |

PESTLE Analysis Data Sources

Our Inventec PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable financial institutions, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant.