Inventec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

Inventec operates in a dynamic market shaped by intense competition and evolving technological landscapes. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating its strategic path.

The complete report reveals the real forces shaping Inventec’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Inventec's reliance on a concentrated group of specialized suppliers for crucial components like CPUs, GPUs, and memory, including industry giants such as Intel, AMD, Nvidia, and leading memory producers, significantly shapes its bargaining power. This concentration means these suppliers often hold considerable sway, as there are few alternative sources for advanced technology. For instance, in 2024, the global CPU market saw Intel and AMD collectively holding over 95% market share, giving them substantial pricing power.

Inventec faces significant supplier bargaining power due to high switching costs for its core components. The process of changing suppliers requires substantial investment in product redesign, rigorous re-qualification of new parts, and extensive reconfiguration of manufacturing processes. For instance, in the semiconductor industry, where Inventec operates, lead times for qualifying new chip suppliers can extend for months, impacting production schedules and incurring significant engineering costs.

These complexities, including managing inventory transitions and ensuring compatibility, lock Inventec into existing supplier relationships. This dependence strengthens the leverage of these entrenched suppliers, allowing them to potentially dictate terms, influence pricing, and limit Inventec's negotiation flexibility. In 2024, the global supply chain disruptions continued to exacerbate these issues, making supplier reliability a paramount concern for companies like Inventec.

The uniqueness and differentiation of supplier offerings significantly bolster their bargaining power. For Inventec, many critical components, particularly advanced semiconductors, are characterized by proprietary technologies and extensive intellectual property. This inherent uniqueness makes it challenging for Inventec to readily identify and source equivalent alternatives, thereby concentrating power in the hands of these specialized suppliers.

Consider the impact of continuous innovation in high-demand sectors like artificial intelligence. Suppliers such as Nvidia, a key player in advanced chip manufacturing, are at the forefront of developing cutting-edge AI processors. This relentless innovation directly influences Inventec's ability to integrate the latest capabilities into its products, a factor that can significantly enhance Inventec's own market competitiveness. For instance, Nvidia's H100 AI GPU, released in 2022 and continuing its dominance into 2024, represents a technological leap that few can match, giving Nvidia substantial leverage in its dealings with manufacturers like Inventec.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while less frequent, can significantly impact Inventec's bargaining power. Large component manufacturers might explore entering the ODM/OEM space themselves, directly competing with Inventec.

This possibility grants suppliers leverage, as maintaining strong supplier relationships becomes crucial for Inventec to secure vital components and prevent its suppliers from becoming direct rivals. For instance, a major semiconductor supplier could, in theory, leverage its manufacturing expertise to offer finished electronic devices, bypassing contract manufacturers like Inventec.

Consider the global semiconductor market, valued at approximately $600 billion in 2023. A leading chip manufacturer with substantial R&D and production capabilities could potentially shift its business model to offer integrated design and manufacturing services, directly challenging established ODMs.

- Supplier Forward Integration Risk: Large component suppliers may leverage their manufacturing capabilities to enter ODM/OEM services, becoming direct competitors.

- Impact on Bargaining Power: This potential threat enhances supplier leverage, compelling Inventec to maintain favorable relationships for component access and to deter competitive entry.

- Market Example: In sectors like advanced electronics, a dominant component supplier could theoretically transition to offering complete product solutions, altering the competitive landscape.

Importance of Supplier's Input to Inventec's Product

The quality, performance, and consistent availability of components are absolutely critical for Inventec. These inputs directly dictate Inventec's capacity to produce the high-performance servers, laptops, and other devices that its major global brand customers rely on. If Inventec cannot secure these essential materials reliably, its production schedules and the overall competitiveness of its products would face significant challenges, thereby increasing supplier leverage.

Inventec's reliance on specialized electronic components, often sourced from a limited number of manufacturers, means that disruptions or price hikes from these suppliers can have a substantial ripple effect. For instance, in 2024, the global semiconductor shortage continued to impact various electronics manufacturers, leading to extended lead times and increased component costs. This situation underscores how dependent Inventec is on its suppliers' ability to maintain production and manage their own supply chains effectively.

- Component Dependency: Inventec's product success hinges on the consistent supply of high-quality semiconductors, memory modules, and other specialized electronic parts.

- Impact of Shortages: Global supply chain disruptions, like those seen in 2024 with semiconductor availability, directly affect Inventec's production capacity and delivery timelines.

- Supplier Influence: The limited number of suppliers for certain critical components grants them considerable bargaining power, potentially influencing pricing and terms.

- Quality and Performance Link: The performance and reliability of Inventec's end products are directly tied to the quality and specifications of the components it sources.

Inventec's bargaining power with its suppliers is significantly weakened by the concentrated nature of its key component sourcing. The limited number of providers for critical elements like advanced processors and memory chips means these suppliers often dictate terms. For example, in 2024, the dominance of Intel and AMD in the CPU market, holding over 95% share, grants them considerable pricing influence over manufacturers like Inventec.

High switching costs further entrench supplier power. Redesigning products, re-qualifying new components, and reconfiguring manufacturing lines represent substantial investments for Inventec. This complexity, coupled with the extended lead times for qualifying new semiconductor suppliers, which can stretch for months, locks Inventec into existing relationships and amplifies supplier leverage.

The unique and proprietary nature of many of Inventec's essential components, particularly cutting-edge semiconductors, also strengthens supplier bargaining power. When suppliers like Nvidia, a leader in AI processors, possess unique technologies, as exemplified by their H100 AI GPU which remained a benchmark into 2024, it becomes difficult for Inventec to find viable alternatives, thereby concentrating power with these specialized providers.

| Component Type | Key Suppliers (Examples) | Estimated Market Concentration (2024) | Impact on Inventec |

|---|---|---|---|

| CPUs | Intel, AMD | >95% | High supplier pricing power |

| GPUs | Nvidia, AMD | >90% (for high-end AI) | Limited sourcing options, strong supplier terms |

| Memory (DRAM/NAND) | Samsung, SK Hynix, Micron | ~90% (across top 3) | Vulnerability to price fluctuations and supply disruptions |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Inventec's position in the electronics manufacturing services industry.

Quickly identify and quantify competitive threats, allowing for proactive strategy adjustments and reduced market uncertainty.

Customers Bargaining Power

Inventec's customer base is notably concentrated, with a significant portion of its revenue coming from a few major global technology brands. These include prominent names like HP, Dell, and major cloud service providers, all of whom procure components in substantial volumes.

This concentration of powerful buyers grants them considerable bargaining leverage. They can effectively negotiate favorable terms regarding pricing, product specifications, delivery schedules, and payment conditions, directly impacting Inventec's profitability and operational flexibility.

Inventec's major customers, particularly those in the fast-moving consumer electronics sector, frequently engage in multi-sourcing. This practice is driven by a desire to mitigate supply chain risks and secure competitive pricing. For instance, a significant portion of the global smartphone market relies on multiple Original Design Manufacturers (ODMs) to ensure production continuity and leverage price negotiations.

This widespread multi-sourcing significantly amplifies the bargaining power of Inventec's customers. By having readily available alternatives, clients can easily shift production volumes to competitors if Inventec's pricing or terms become less attractive. This dynamic creates a constant pressure on Inventec to maintain competitive offerings and operational efficiency to retain its customer base.

While the initial move to contract manufacturing involves significant investment for brands, once they are committed to outsourcing, shifting between Original Design Manufacturers (ODMs) often presents fewer hurdles. This is largely due to the standardization of manufacturing processes and the relative ease with which designs and intellectual property can be transferred between different partners.

This lower barrier to switching ODMs directly translates into increased bargaining power for customers. Brands can leverage the availability of multiple capable ODMs to negotiate more favorable terms, such as lower prices, faster turnaround times, or more flexible production schedules, putting pressure on Inventec to remain competitive.

For instance, in 2024, the electronics manufacturing sector saw continued consolidation, yet a significant number of ODMs remained operational, offering a competitive landscape. This competitive environment means brands can readily compare quotes and capabilities, further empowering them to demand better terms from established players like Inventec.

Threat of Backward Integration by Customers

Large technology brands, such as Apple and Samsung, have the financial muscle and technical know-how to potentially bring design and manufacturing of certain components or even entire product lines in-house. This credible threat of backward integration allows them to negotiate more favorable terms and pricing with Original Design Manufacturers (ODMs) like Inventec.

For instance, in 2024, major smartphone manufacturers continued to invest heavily in their own R&D and manufacturing capabilities, signaling a persistent interest in controlling more of their supply chain. This can put pressure on ODMs to continually innovate and offer competitive pricing to retain business.

- Customer Leverage: Major tech clients can leverage their scale and potential for backward integration to demand lower prices and better service from ODMs.

- Technological Expertise: The technical capabilities of large customers enable them to consider bringing manufacturing processes in-house, increasing their bargaining power.

- Financial Resources: Significant financial resources allow these customers to absorb the costs associated with setting up their own production facilities.

- Market Influence: The market dominance of these customers means their decisions regarding sourcing can significantly impact an ODM's business volume.

Price Sensitivity and Standardization of Products

For many standard electronic devices that Inventec produces, there's a high level of product standardization, often driven by the very specifications provided by their customers. This standardization naturally leads to significant price sensitivity among buyers.

Customers in this market are consistently on the lookout for the most cost-effective option that still meets their quality and service expectations. This intense competition on price forces companies like Inventec to engage in aggressive pricing strategies.

- Price Sensitivity: In 2024, the global electronics manufacturing services (EMS) market, where Inventec operates, saw continued pressure on pricing due to high standardization.

- Cost Focus: Buyers frequently prioritize the lowest possible cost for comparable quality, making price a primary decision-making factor.

- Competitive Landscape: This dynamic necessitates fierce competition on price for Inventec, impacting profit margins.

Inventec's bargaining power with its customers is significantly influenced by customer concentration and the ease with which these customers can switch manufacturers. Large technology brands, often procuring components in massive volumes, possess substantial leverage to negotiate favorable terms, impacting Inventec's pricing and profit margins.

The prevalence of multi-sourcing among Inventec's key clients, driven by risk mitigation and cost optimization, further amplifies customer power. This allows buyers to readily shift business if Inventec's offerings become less competitive, necessitating continuous operational efficiency and competitive pricing from Inventec.

The threat of backward integration by major clients, who possess the financial and technical capacity to bring manufacturing in-house, also serves as a potent tool for customers to secure better deals. This dynamic puts pressure on Inventec to maintain its value proposition and cost-effectiveness.

In 2024, the electronics manufacturing services (EMS) market remained highly competitive, with a notable emphasis on cost for standardized components. This price sensitivity, coupled with the availability of alternative ODMs, means customers can exert considerable pressure on Inventec to offer the most attractive pricing and terms.

| Customer Type | Key Leverage Factors | Impact on Inventec | 2024 Market Trend |

|---|---|---|---|

| Major Tech Brands (e.g., HP, Dell) | High volume procurement, Multi-sourcing, Potential backward integration | Strong pricing power, Negotiation of terms (delivery, payment) | Continued demand for cost reduction, supply chain resilience |

| Cloud Service Providers | Large scale orders, Standardization requirements | Price sensitivity, Demand for efficient production | Increased investment in infrastructure, driving component demand |

| Consumer Electronics Companies | Fast product cycles, Price sensitivity, Ease of switching ODMs | Pressure for competitive pricing, need for rapid turnaround | Intensified competition among ODMs for market share |

What You See Is What You Get

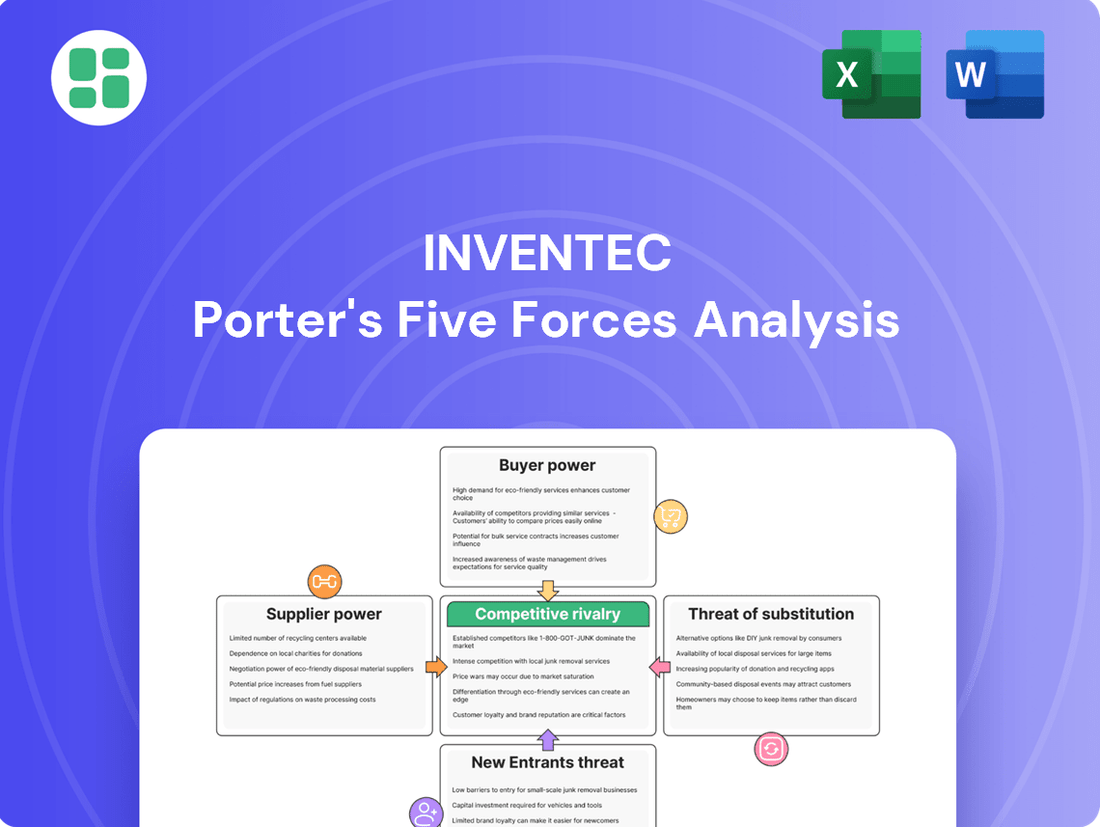

Inventec Porter's Five Forces Analysis

This preview showcases the complete Inventec Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You'll gain immediate access to this professionally formatted and ready-to-use analysis, empowering your strategic decision-making without delay.

Rivalry Among Competitors

Inventec operates in an ODM/OEM sector brimming with formidable rivals, including industry titans like Foxconn, Quanta Computer, Pegatron, Wistron, and Compal Electronics. These established global players vie intensely for the same lucrative contracts from leading technology brands, creating a highly competitive landscape where Inventec must constantly innovate and differentiate itself to secure business.

While the broader electronics manufacturing sector might see steady, albeit moderate, growth, the demand for components powering AI servers and cloud infrastructure is exploding. This surge creates a battleground where companies like Inventec are fiercely competing for dominance in these lucrative, high-growth niches.

For instance, the global AI hardware market was projected to reach $110 billion in 2024, with significant portions driven by server demand. This rapid expansion fuels intense rivalry as established players and new entrants pour resources into capturing market share, driving innovation and potentially impacting profit margins for all involved.

Inventec, as an Original Design Manufacturer (ODM), crafts products according to client blueprints, resulting in minimal inherent product differentiation from the end-user's viewpoint. This means competition primarily revolves around operational strengths like cost-effectiveness, manufacturing efficiency, consistent quality, rapid product deployment, and robust supply chain management.

In 2024, the intense competition among ODMs in sectors like consumer electronics and computing means that price is a critical differentiator, with margins often squeezed. For instance, the average gross profit margin for many electronics ODMs hovered around 10-15% in the first half of 2024, underscoring the pressure to compete on cost and operational excellence rather than unique product features.

High Fixed Costs and Exit Barriers

The ODM (Original Design Manufacturer) industry, where Inventec operates, is characterized by exceptionally high fixed costs. These include substantial investments in advanced manufacturing plants, cutting-edge research and development, and extensive global supply chain infrastructure. For instance, establishing a state-of-the-art semiconductor fabrication facility alone can run into billions of dollars.

These considerable upfront investments, coupled with highly specialized and often proprietary assets, erect significant barriers to exiting the market. Companies find themselves locked into operations, needing to continue competing fiercely to amortize their capital expenditures, even when market conditions are unfavorable.

- High Capital Intensity: ODM operations demand massive capital outlays for advanced manufacturing, R&D, and logistics.

- Significant Exit Barriers: Specialized assets and the need to recoup large investments make leaving the market difficult.

- Aggressive Competition: Companies are compelled to stay and compete intensely, even during economic downturns, to recover their sunk costs.

Aggressive Pricing and Margin Pressure

The electronics manufacturing services (EMS) sector, where Inventec operates, is characterized by intense rivalry. This stems from a crowded market with many players, coupled with powerful, large-volume customers who often have significant bargaining power. Furthermore, the services offered by many Original Design Manufacturers (ODMs) are quite similar, leading to a situation where price becomes a primary differentiator.

This dynamic inevitably creates aggressive pricing strategies and puts continuous pressure on profit margins for companies like Inventec. To survive and thrive, ODMs must relentlessly focus on operational efficiency and cost optimization. For instance, in 2024, the average gross profit margin for the EMS industry hovered around 10-15%, a testament to the ongoing margin pressure.

- High Number of Competitors: The EMS market features a substantial number of global and regional players, intensifying competition for contracts.

- Bargaining Power of Buyers: Large original equipment manufacturers (OEMs) often dictate terms and pricing due to their significant order volumes.

- Low Switching Costs for Buyers: Customers can relatively easily switch between ODMs if price or service levels are not met, further fueling price wars.

- Price as a Key Differentiator: With many services being similar, price often becomes the primary factor in customer selection, squeezing margins.

Inventec faces fierce competition from established giants like Foxconn and Pegatron in the ODM/OEM space, especially in high-growth areas like AI servers. This intense rivalry, driven by the demand for components powering AI and cloud infrastructure, forces companies to constantly innovate and focus on operational strengths like cost-effectiveness and rapid deployment to secure contracts.

The similarity in services offered by ODMs means price is a critical differentiator, leading to squeezed profit margins, with average gross profit margins in the EMS industry hovering around 10-15% in 2024. High capital intensity and significant exit barriers further compel companies to compete aggressively to recoup investments, even in challenging market conditions.

| Key Competitors | Market Share (Estimated 2024) | Key Strengths |

| Foxconn | 30-40% | Scale, Vertical Integration, Strong Customer Relationships |

| Pegatron | 15-20% | Manufacturing Expertise, Diversified Product Portfolio |

| Wistron | 10-15% | Supply Chain Management, ODM Capabilities |

| Quanta Computer | 10-15% | Notebook ODM Leadership, Cloud Infrastructure Solutions |

| Compal Electronics | 8-12% | Consumer Electronics ODM, Cost Efficiency |

SSubstitutes Threaten

The primary threat of substitution for Inventec's services comes from its global brand customers choosing to handle product design and manufacturing entirely in-house. This capability, while demanding significant investment and specialized expertise, has been demonstrated by major tech players. For instance, Apple has brought certain product lines in-house, thereby lessening its dependence on Original Design Manufacturers (ODMs) like Inventec.

Significant technological shifts, like the move towards cloud-native architectures and software-defined hardware, pose a threat by potentially reducing demand for traditional hardware. For instance, in 2024, the global cloud computing market was valued at approximately $610.3 billion, demonstrating a substantial migration away from on-premises hardware solutions.

New computing paradigms could also emerge, directly substituting Inventec's core hardware offerings. The rapid advancements in quantum computing, though still nascent, represent a long-term threat that could fundamentally alter the landscape of computing and the need for conventional server and device manufacturing.

The emergence of entirely new device categories could significantly disrupt Inventec's market. For instance, the rapid growth of the metaverse and augmented reality (AR) hardware, which requires specialized processing and display technologies, might divert consumer and enterprise spending away from traditional computing devices that Inventec currently serves. If these new categories gain substantial traction, customers might opt for dedicated AR glasses or immersive VR headsets over conventional laptops or servers for certain applications.

Modular and Open-Source Hardware Trends

The rise of modular hardware and open-source platforms presents a significant threat of substitutes for traditional electronic product manufacturers. This trend allows for greater customization and potentially lower costs as components become more standardized and accessible. For instance, the growth of the maker movement and platforms like Arduino and Raspberry Pi demonstrate how readily available, modular components can empower individuals and smaller businesses to create functional electronic devices without relying on established ODMs for every aspect. This can directly substitute for the need for fully integrated solutions offered by larger companies in certain market segments.

This shift could erode the value proposition of comprehensive Original Design Manufacturing (ODM) services, particularly in specialized or emerging markets. As open-source hardware becomes more sophisticated, it lowers the barrier to entry for creating custom solutions. Consider the increasing availability of development boards and readily available sensor modules; these can be combined to create prototypes and even finished products that might have previously required significant ODM investment. This accessibility allows for rapid iteration and cost-effective development, posing a direct substitute for more traditional, end-to-end manufacturing partnerships.

- Modularization: Components are designed to be easily swapped or upgraded, reducing reliance on proprietary integrated systems.

- Open-Source Hardware: Designs and schematics are publicly available, fostering innovation and enabling replication or modification by third parties.

- Reduced Complexity: The proprietary nature of many electronic products is being challenged, making it easier for non-traditional players to enter.

- DIY Solutions: Customers and smaller entities can assemble their own solutions, bypassing the need for full-service ODMs in niche applications.

Cost-Performance Trade-offs of Alternatives

While brands could theoretically manufacture their own products, the cost-performance trade-off often favors specialized contract manufacturers like Inventec. For instance, the significant capital investment required for advanced manufacturing equipment and skilled labor makes in-house production prohibitive for many, especially when compared to the economies of scale and established expertise Inventec provides.

The threat of substitutes intensifies for products that are highly standardized or less technologically complex. In these segments, the barriers to entry for alternative manufacturing solutions are lower, allowing more players to potentially offer comparable performance at a competitive price point.

- Cost of Capital: Establishing advanced manufacturing capabilities can require millions in upfront investment, a significant hurdle for many brands.

- Economies of Scale: Inventec's high-volume production allows for lower per-unit costs, a benefit difficult for smaller, in-house operations to match.

- Specialized Expertise: Access to specialized knowledge in areas like material science and process optimization provides a performance edge that is costly to replicate internally.

The threat of substitutes for Inventec's services primarily stems from customers bringing manufacturing in-house or adopting modular, open-source hardware solutions. Major tech companies like Apple have demonstrated the capability for in-house production, reducing reliance on ODMs. Furthermore, the growing accessibility of modular components and open-source platforms empowers smaller entities to create custom solutions, bypassing traditional ODM partnerships for certain applications.

The shift towards cloud computing and new computing paradigms like quantum computing also presents a substitution threat. For example, the global cloud computing market reached approximately $610.3 billion in 2024, indicating a significant move away from traditional hardware. Emerging technologies could fundamentally alter the demand for conventional server and device manufacturing.

| Threat Type | Description | Example/Data Point |

| In-House Manufacturing | Customers bringing production capabilities internally. | Apple's strategic shift to in-house production for certain product lines. |

| Modular/Open-Source Hardware | Use of standardized, accessible components bypassing full-service ODMs. | Growth of platforms like Arduino and Raspberry Pi enabling DIY electronics. |

| Technological Shifts | Move towards cloud computing and new paradigms reducing hardware demand. | Global cloud computing market valued at $610.3 billion in 2024. |

| New Device Categories | Emergence of new product types diverting demand. | Growth in AR/VR hardware potentially impacting traditional computing devices. |

Entrants Threaten

The ODM/OEM industry, where companies like Inventec operate, presents a formidable barrier to entry due to extremely high capital investment requirements. Establishing state-of-the-art manufacturing facilities, acquiring sophisticated machinery, and building robust R&D capabilities necessitate billions of dollars. For instance, setting up a cutting-edge semiconductor fabrication plant can easily cost upwards of $10 billion, a sum prohibitive for most newcomers.

Existing Original Design Manufacturers (ODMs) like Inventec leverage significant economies of scale, which are crucial in the competitive electronics manufacturing sector. These scale advantages translate into lower per-unit production costs, more efficient procurement of raw materials, and optimized logistics. For instance, in 2024, major ODMs often operate facilities capable of producing millions of units annually, allowing them to negotiate bulk discounts on components that smaller, new entrants simply cannot access.

New companies entering the ODM market would face a steep challenge in matching these cost efficiencies. Building the necessary production capacity and accumulating years of experience to achieve similar economies of scale requires substantial upfront investment and time. This inherent cost disadvantage, stemming from the experience curve effects and scale, acts as a formidable barrier to entry for potential competitors.

Global brands, especially in the fast-paced electronics sector, deeply value established, trust-based relationships with Original Design Manufacturers (ODMs). These partnerships are built on years of proven quality, consistent reliability, and robust intellectual property safeguards. For instance, a company like Apple, a major client for many ODMs, often renews contracts with manufacturers it has worked with for over a decade, signifying the significant barrier to entry for newcomers.

New entrants face a formidable challenge in replicating these deep-seated relationships. It requires substantial time and investment to demonstrate the same level of trustworthiness and capability that established ODMs have cultivated. Successfully displacing an incumbent supplier often means overcoming not just technical hurdles but also the inertia of existing, highly satisfactory contractual arrangements, making it difficult for new players to gain a foothold with key customers.

Proprietary Technology and Intellectual Property

Inventec and its established rivals hold significant intellectual property, including patented manufacturing processes and deep design knowledge. This proprietary information creates a substantial hurdle for newcomers, as replicating such capabilities takes considerable time and investment.

For instance, in the semiconductor industry, where Inventec operates, the cost of developing cutting-edge fabrication technology can run into billions of dollars. Companies like TSMC, a major player, invest tens of billions annually in R&D and capital expenditures, setting a high bar for any potential entrant.

- Proprietary Technology: Inventec's patents on advanced chip designs and manufacturing techniques significantly raise the barrier to entry.

- Intellectual Property Portfolio: A strong IP portfolio deters new entrants by requiring them to navigate complex licensing agreements or invest heavily in developing alternative, non-infringing technologies.

- Accumulated Expertise: Years of experience in product development and process optimization translate into a competitive advantage that is difficult for new companies to match quickly.

Government Regulations and Certifications

The threat of new entrants in the electronics manufacturing sector, specifically concerning government regulations and certifications, presents a substantial barrier. Companies like Inventec must navigate a complex web of quality, environmental, and safety standards. For instance, compliance with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directives adds significant cost and time to market entry.

New players would likely face considerable challenges in obtaining the necessary certifications, which can be both time-consuming and expensive. These can include ISO 9001 for quality management and ISO 14001 for environmental management, crucial for demonstrating operational competence and sustainability. The sheer volume and evolving nature of these regulations, particularly international trade policies impacting component sourcing and product distribution, create a steep learning curve and substantial upfront investment for any aspiring competitor.

- Regulatory Compliance Costs: Companies entering the electronics manufacturing space often incur substantial costs for compliance, which can include testing, documentation, and legal consultation. For example, in 2024, the average cost for obtaining key industry certifications could range from tens of thousands to hundreds of thousands of dollars, depending on the scope and complexity.

- Navigating International Trade: The global nature of electronics manufacturing means new entrants must understand and comply with diverse import/export regulations, tariffs, and trade agreements. These policies can change frequently, impacting supply chain stability and profitability.

- Product Safety and Environmental Standards: Adherence to stringent product safety standards (e.g., UL certification) and environmental regulations (e.g., WEEE directive for waste electrical and electronic equipment) requires significant investment in design, materials, and manufacturing processes.

The threat of new entrants for companies like Inventec is generally low due to substantial capital requirements for establishing advanced manufacturing facilities and R&D capabilities, often running into billions of dollars. Existing players benefit from significant economies of scale, which translate into lower per-unit costs and better procurement terms, making it difficult for newcomers to compete on price. Furthermore, established relationships with global brands, built on trust and proven performance, act as a significant barrier, as these brands are reluctant to switch suppliers.

Proprietary technology and a strong intellectual property portfolio further deter new entrants, requiring them to invest heavily in R&D or navigate complex licensing. Navigating stringent government regulations and obtaining necessary certifications also adds considerable cost and time. For instance, in 2024, obtaining key industry certifications could cost hundreds of thousands of dollars, a significant hurdle for new players.

| Barrier Category | Description | Illustrative Cost/Factor (2024) |

| Capital Requirements | Establishing state-of-the-art manufacturing and R&D | Semiconductor fab: $10 billion+ |

| Economies of Scale | Lower per-unit costs due to high production volume | Major ODMs producing millions of units annually |

| Brand Relationships | Long-term partnerships built on trust and reliability | Major tech brands renewing contracts with decade-long partners |

| Intellectual Property | Patented processes and design knowledge | Semiconductor R&D investment: Tens of billions annually (e.g., TSMC) |

| Regulatory Compliance | Meeting quality, environmental, and safety standards | Key certifications: $10,000s to $100,000s |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Inventec leverages data from company annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.