Intrepid Potash PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intrepid Potash Bundle

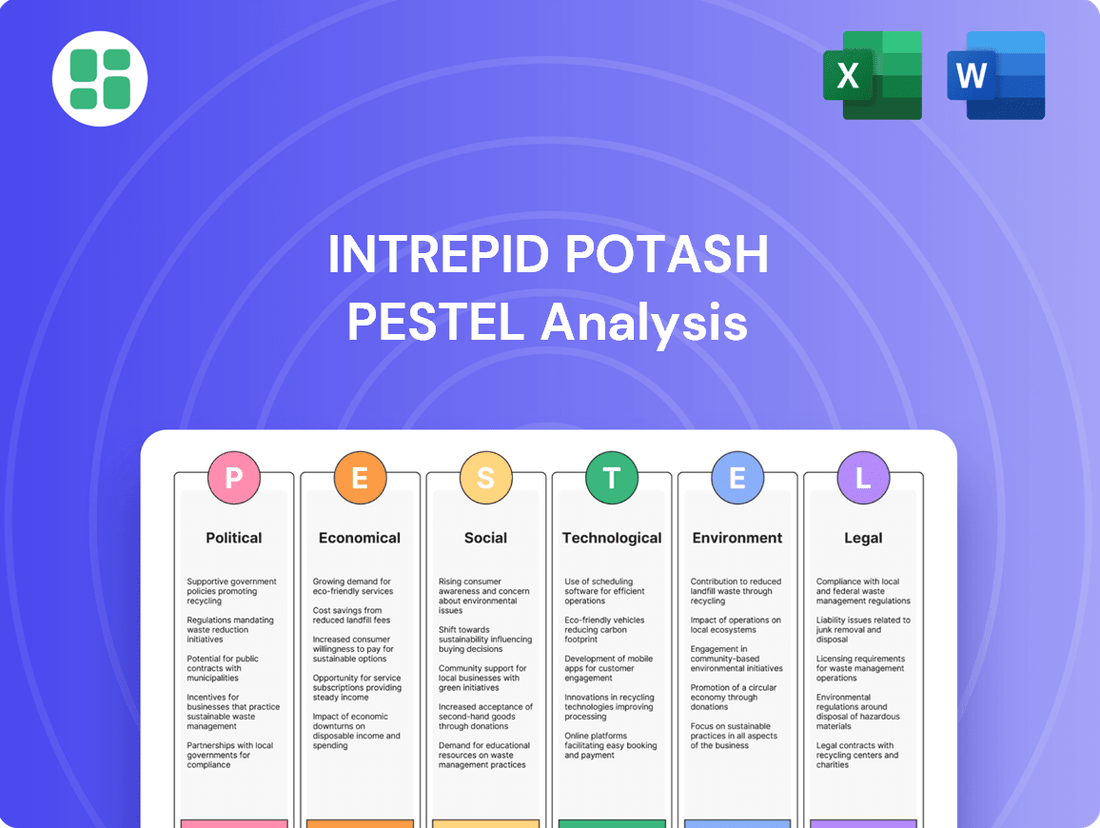

Uncover the intricate web of political, economic, social, technological, environmental, and legal factors impacting Intrepid Potash. Our comprehensive PESTLE analysis offers a deep dive into these external forces, providing you with the critical intelligence needed to anticipate market shifts and refine your strategic approach. Don't get left behind; download the full version now for actionable insights.

Political factors

U.S. agricultural policy, particularly government support and subsidies, plays a crucial role in shaping the demand for fertilizers like potash. The USDA's Emergency Commodity Assistance Program (ECAP) is allocating up to $10 billion for the 2024 crop year to aid producers facing higher input costs and lower commodity prices.

This substantial financial backing is designed to bolster farm incomes and reinforce food security. By stabilizing the agricultural sector, these programs indirectly sustain the demand for essential crop inputs, including potash, which is vital for maximizing yields.

Trade policies, especially tariffs, play a crucial role in the fertilizer market by influencing both the price and accessibility of essential agricultural inputs. The recent implementation of US tariffs on Canadian fertilizer imports, effective March 2025, has directly escalated the cost of bringing potash into the country. This development adds pressure to global efforts aimed at improving crop yields.

These trade tensions are a significant contributor to market instability, potentially driving up operational expenses for farmers across the United States. Even though Intrepid Potash operates solely within the US, these external trade dynamics can still create ripple effects, impacting overall fertilizer pricing and availability for the domestic agricultural sector.

Government initiatives to bolster domestic fertilizer production capacity are crucial for reducing reliance on imports and stabilizing supply chains. The USDA announced over $116 million in December 2024 and an additional $120 million in October 2024 to expand fertilizer production facilities across several states.

These efforts aim to increase domestic supply, foster market competition, and potentially lower costs for US farmers, directly impacting companies like Intrepid Potash by creating a more robust and competitive domestic market.

Mining Permitting and Regulations

Legislation like the Mining Regulatory Clarity Act of 2024, passed by the U.S. House, aims to simplify federal authorizations for mineral projects. This act could allow mining companies to conduct necessary support operations on federal lands, even without valuable mineral deposits, rectifying previous land-use restrictions. Such regulatory adjustments can significantly reduce project timelines and operational uncertainties for domestic mining entities like Intrepid Potash.

The impact of these regulatory changes is substantial. For instance, by clarifying land use for activities such as waste disposal, the act directly addresses a common bottleneck in mining operations. This increased clarity can lead to more predictable project development cycles and potentially lower the cost of compliance for companies operating within the United States.

- Legislation: The Mining Regulatory Clarity Act of 2024, passed by the U.S. House, seeks to streamline federal authorizations for mineral projects.

- Land Use Clarification: The act permits support operations on federal lands without valuable mineral deposits, resolving prior restrictions.

- Operational Impact: This regulatory clarity is expected to reduce project delays and operational uncertainties for domestic miners.

- Potential Cost Savings: Simplified regulations can lead to more predictable project timelines and potentially lower compliance costs for companies.

Geopolitical Stability

Ongoing geopolitical tensions, particularly the protracted Russia-Ukraine war and conflicts in the Middle East, continue to significantly impact the global fertilizer market. These events disrupt critical supply chains for essential nutrients like potash, leading to increased maritime freight costs and overall market volatility. For instance, the conflict in Eastern Europe has been a major driver of elevated natural gas prices, a key input for fertilizer production, impacting cost structures worldwide.

While Intrepid Potash primarily operates within the United States, it is not immune to these global disruptions. Fluctuations in international potash prices, driven by geopolitical events and supply chain issues, directly influence domestic pricing and competitive dynamics. The global market's instability can lead to higher input costs for Intrepid or create opportunities if international competitors face more severe supply constraints. For example, the International Fertilizer Association (IFA) reported in late 2023 that global fertilizer prices, while easing from their 2022 peaks, remain sensitive to supply-side shocks stemming from these geopolitical flashpoints.

- Supply Chain Disruptions: Conflicts directly impede the movement of fertilizers and their raw materials, increasing lead times and transportation expenses.

- Price Volatility: Geopolitical instability fuels uncertainty, causing sharp swings in commodity prices, including those for potash and natural gas.

- Input Cost Inflation: Tensions can drive up the cost of energy and other essential inputs required for fertilizer production, affecting profitability.

- Market Access: Sanctions or trade restrictions related to geopolitical events can limit access to certain markets for both suppliers and buyers.

Government agricultural support programs, such as the USDA's Emergency Commodity Assistance Program (ECAP) with its $10 billion allocation for the 2024 crop year, aim to stabilize farm incomes. This indirectly supports demand for fertilizers like potash by ensuring the financial health of the agricultural sector.

Trade policies, including the March 2025 US tariffs on Canadian fertilizer imports, directly increase the cost of potash for American farmers, contributing to market instability and higher operational expenses. These external dynamics can still impact domestic fertilizer pricing and availability for companies like Intrepid Potash.

Initiatives to boost domestic fertilizer production, like the over $236 million in USDA funding announced in late 2024 for new facilities, aim to strengthen supply chains and foster competition. This could lead to more predictable pricing and a more robust domestic market for U.S. potash producers.

Regulatory changes, such as the Mining Regulatory Clarity Act of 2024, are designed to streamline federal authorizations for mineral projects. This could reduce project timelines and operational uncertainties for domestic mining companies by clarifying land-use regulations for support activities.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Intrepid Potash, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive overview of how these forces create both challenges and strategic advantages for the company within its operating landscape.

This Intrepid Potash PESTLE analysis offers a concise, actionable summary, relieving the pain point of sifting through extensive data by providing clear insights for strategic decision-making.

Economic factors

The global potash market is on a strong growth trajectory, expected to expand from an estimated $63.00 billion in 2024 to $66.11 billion in 2025. This upward trend is largely fueled by a growing world population and the subsequent need for increased food production, which directly translates to higher demand for fertilizers like potash to boost agricultural yields.

By 2034, the market is projected to reach an impressive $101.57 billion, underscoring the sustained importance of potash in global agriculture. Intrepid Potash, a significant player in this sector, is well-positioned to capitalize on this expanding market, benefiting from the fundamental driver of enhanced agricultural productivity required to feed a growing planet.

Fertilizer prices are anticipated to stay unpredictable through late 2025 and into 2026. This instability is largely driven by ongoing geopolitical issues, the fluctuating cost of energy, particularly natural gas crucial for nitrogen fertilizer production, and continued disruptions in global supply chains.

Despite a slight dip in potash prices from an average of $462 per ton in 2024 to an estimated $443 per ton in 2025, the fertilizer market's susceptibility to swift price swings remains a significant factor. This volatility directly affects Intrepid Potash's financial performance, impacting both its income and overall profitability.

The prices of key agricultural commodities like corn, palm oil, and soybeans significantly impact farmer profitability and, by extension, their fertilizer expenditures. As of March 2025, robust prices for these commodities, with corn seeing a 25% increase and palm oil an 18% rise since August 2024, are bolstering demand for fertilizers.

These favorable crop prices incentivize farmers to maximize their yields, which directly translates into increased demand for essential nutrients like potash. This trend supports companies like Intrepid Potash by creating a more robust market for their products.

Operational Costs and Efficiency

Intrepid Potash is actively working to enhance its operational efficiencies to better manage costs. A key indicator of this effort is their Q4 2024 Potash Cost of Goods Sold (COGS) per ton, which saw a significant improvement of 24% compared to the same period in the previous year.

The company's strategic focus on revitalizing its potash assets is designed to boost unit economics and overall financial performance. This involves increasing production levels while keeping variable emissions at minimal increases.

- Q4 2024 Potash COGS per ton improvement: 24% year-over-year.

- Strategic Goal: Revitalize potash assets to improve unit economics and financial performance.

- Production Impact: Higher production with minimal variable emission increases.

- Expected Facility Performance: Increased production at Wendover is projected to support unit economics in 2025-2026.

Farmer Affordability and Income

Farmer affordability is a critical factor influencing fertilizer demand, and confidence levels are showing regional variations. For instance, while some areas might see cautious spending, others are more optimistic about their purchasing power.

Government support plays a significant role in bolstering farmer incomes. The $10 billion allocated for economic assistance for the 2024 crop year is a prime example, directly enabling farmers to continue purchasing essential inputs like fertilizers, even when facing rising operational costs and market volatility.

This financial backing acts as a crucial buffer, helping to offset the impact of higher input prices on farmers' bottom lines. Consequently, it encourages more consistent fertilizer application, supporting agricultural productivity.

- $10 billion in government economic assistance for the 2024 crop year.

- Government aid directly supports farmer incomes, influencing fertilizer purchase decisions.

- Mitigates the impact of increased input costs on farmer affordability.

The global potash market is expanding, projected to grow from $63 billion in 2024 to $66.11 billion in 2025, driven by the need for increased food production. Despite a slight projected dip in average potash prices to $443 per ton in 2025 from $462 in 2024, fertilizer prices remain volatile due to geopolitical factors and energy costs.

Favorable commodity prices for corn and palm oil, up 25% and 18% respectively since August 2024 as of March 2025, are boosting farmer profitability and fertilizer demand. Government support, such as the $10 billion allocated for the 2024 crop year, further underpins farmer affordability for essential inputs like potash.

| Economic Factor | 2024 Projection/Data | 2025 Projection/Data | Impact on Intrepid Potash |

|---|---|---|---|

| Global Potash Market Size | $63.00 billion | $66.11 billion | Increased demand and revenue potential |

| Average Potash Price (per ton) | $462 | $443 | Potential pressure on per-unit revenue |

| Corn Price Change (Aug 2024 - Mar 2025) | N/A | +25% | Increased farmer purchasing power for fertilizers |

| Palm Oil Price Change (Aug 2024 - Mar 2025) | N/A | +18% | Increased farmer purchasing power for fertilizers |

| Government Economic Assistance (2024 Crop Year) | N/A | $10 billion | Supports farmer affordability and consistent fertilizer demand |

Preview Before You Purchase

Intrepid Potash PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Intrepid Potash delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

The world's population is projected to reach 9.7 billion by 2050, a significant increase that directly fuels a greater need for food production. This demographic shift is a powerful, long-term driver for the agricultural sector, and by extension, for companies like Intrepid Potash that supply essential crop nutrients.

Potash, a key ingredient in fertilizers, is critical for boosting crop yields and ensuring global food security. As more people require sustenance, the demand for efficient and productive farming practices intensifies, making potash an indispensable component of modern agriculture.

Societal demand for sustainable agriculture is rapidly increasing, with a growing focus on regenerative practices and circular economy principles. By 2025, expect a surge in farming methods prioritizing soil health, biodiversity, and climate resilience, such as crop rotation and organic fertilizer use. This shift directly impacts fertilizer companies like Intrepid Potash, encouraging the development and marketing of responsibly sourced and produced products.

Consumer awareness and preference for sustainably produced food and agricultural products are on the rise globally. This societal shift is creating significant pressure on the entire agricultural supply chain, from farming practices to the production of essential inputs like fertilizers, to adopt more environmentally conscious methods.

Intrepid Potash's reliance on solar evaporation for its potash production is a key differentiator. This method is inherently less energy-intensive and produces fewer greenhouse gas emissions compared to conventional methods, positioning Intrepid Potash favorably in the eyes of increasingly eco-conscious consumers and agricultural businesses. For instance, the company's Moab facility in Utah utilizes this natural process.

Community Engagement and Social License to Operate

The mining sector, including Intrepid Potash, faces growing demands to obtain a social license to operate. This means fostering strong relationships and gaining approval from local populations and Indigenous groups, especially regarding how water is managed and the environmental footprint of operations. For instance, in 2024, community consultations regarding water usage for mining projects in arid regions like New Mexico, where Intrepid operates, have become more rigorous, with local stakeholders increasingly vocal about conservation efforts.

Maintaining operational continuity and preventing disputes hinges on responsible water stewardship and open communication with these communities. Intrepid's proactive approach to sustainable practices, such as investing in water recycling technologies, directly supports these positive community relations. Their 2024 sustainability report highlighted a 15% reduction in freshwater withdrawal per ton of product compared to 2022, a figure closely watched by community leaders.

- Community Alignment: Securing buy-in from local and Indigenous communities is paramount for mining operations, influencing project timelines and public perception.

- Water Stewardship: Responsible water management is a critical factor in community engagement, directly impacting environmental concerns and resource availability.

- Operational Continuity: Transparent engagement and demonstrable commitment to sustainability are key to avoiding conflicts and ensuring uninterrupted operations.

- Intrepid's Commitment: Intrepid Potash's focus on sustainable practices is central to building and maintaining trust with the communities where it operates.

Workforce Safety and Wellness

Societal expectations and regulatory bodies are placing a heightened emphasis on the health and well-being of the mining workforce. This trend is directly impacting companies like Intrepid Potash, pushing for more robust safety measures and comprehensive wellness initiatives.

New Mine Safety and Health Administration (MSHA) regulations set to take effect in 2025 underscore this shift. These regulations include more stringent standards for respirable dust, which is a significant concern in potash mining, alongside enhanced requirements for emergency response planning and the crucial integration of mental health and wellness programs for miners.

Prioritizing worker safety and health isn't just about compliance; it's fundamental to maintaining a productive and stable workforce. Companies that invest in these areas also bolster their corporate social responsibility profile, which is increasingly important to investors and the public.

- Respirable Dust Standards: MSHA's 2025 regulations aim to reduce miner exposure to silica dust, a key component of respirable dust, by lowering permissible exposure limits.

- Emergency Preparedness: Enhanced protocols will require more frequent drills, better communication systems, and updated equipment for rapid response to underground incidents.

- Mental Health Support: The inclusion of mental health and wellness programs acknowledges the psychological toll of mining work and aims to provide resources for miners and their families.

- Productivity Impact: A safer and healthier workforce is generally a more engaged and productive one, reducing absenteeism and turnover, which can significantly impact operational efficiency.

Growing global awareness regarding environmental sustainability is shaping consumer preferences and influencing corporate practices. This societal emphasis on eco-friendly products and processes directly impacts industries like agriculture, driving demand for responsibly sourced inputs. Intrepid Potash's use of solar evaporation, a less energy-intensive method, aligns with these evolving societal values, positioning it favorably in the market.

Community engagement and responsible resource management are increasingly critical for the social license to operate in the mining sector. Intrepid Potash's proactive approach to water stewardship, including investments in water recycling technologies, demonstrates a commitment to local communities. Their reported 15% reduction in freshwater withdrawal per ton of product from 2022 to 2024 highlights this focus, a metric closely monitored by stakeholders.

Workplace safety and employee well-being are paramount, with new regulations like the MSHA's 2025 standards for respirable dust and enhanced emergency preparedness protocols directly affecting mining operations. Investing in these areas not only ensures compliance but also fosters a more productive workforce and strengthens corporate social responsibility, a key consideration for investors and the public alike.

Technological factors

Technological advancements are significantly boosting efficiency and safety in mining, with Intrepid Potash likely benefiting from these trends. Innovations like real-time monitoring systems and AI-powered solutions are optimizing operations, including crucial areas like water management. These tools enable continuous assessment of operational parameters, predictive maintenance, and automated adjustments for better resource utilization.

Precision agriculture, leveraging GPS, sensors, and AI, is revolutionizing nutrient application in farming. This allows for highly targeted fertilizer use, minimizing waste and maximizing crop yields. For instance, in 2024, the global precision agriculture market was valued at approximately $10.5 billion, with projections indicating continued strong growth.

The adoption of variable rate technology (VRT) enables farmers to apply fertilizers precisely where and when needed, optimizing input efficiency. This shift directly fuels demand for advanced, high-efficiency liquid fertilizers and specialized nutrient formulations, moving away from traditional, less targeted methods.

Technological advancements are transforming water management in the mining sector, directly impacting companies like Intrepid Potash. Closed-loop water systems are increasingly common, capable of recycling upwards of 90% of water used in operations. This is a significant shift from traditional practices, especially vital given the increasing scarcity of freshwater resources in many mining regions.

The adoption of sophisticated filtration and purification technologies allows for the effective reuse of water, thereby reducing the need for new freshwater intake. Coupled with real-time monitoring systems that track water quality and usage, these innovations are critical for environmental stewardship and ensuring long-term operational viability, particularly in arid areas where Intrepid Potash operates.

Development of High-Efficiency Fertilizers

The agricultural sector is increasingly favoring high-efficiency liquid fertilizers, which offer precise nutrient delivery and a reduced environmental footprint compared to conventional solid forms. This trend is driven by a desire for more sustainable farming practices and improved crop yields. For instance, the global liquid fertilizer market was valued at approximately USD 20 billion in 2023 and is projected to grow steadily, reflecting this shift.

New formulations and application technologies are emerging that integrate seamlessly with precision agriculture. These advancements allow farmers to optimize nutrient application based on real-time crop needs, minimizing waste and runoff. Companies that can innovate in this space, offering data-driven and environmentally conscious fertilizer solutions, stand to gain significant market share.

- Growing Demand: The market for specialty fertilizers, including liquid and slow-release formulations, is expanding due to their efficiency and environmental benefits.

- Precision Agriculture Integration: New fertilizer technologies are being developed to work with GPS-guided applicators and soil sensors, enabling highly targeted nutrient management.

- Environmental Focus: Reduced nutrient loss and lower greenhouse gas emissions are key selling points for these advanced fertilizer products, aligning with global sustainability goals.

- Market Growth: Projections indicate continued robust growth in the high-efficiency fertilizer segment through 2030, driven by technological innovation and farmer adoption.

Data Analytics and AI in Agriculture

Data analytics and AI are transforming agriculture, making them essential for modern farm management. AI-driven predictive analytics are now key for optimizing planting schedules, anticipating resource needs, spotting potential problems early, and customizing strategies for specific local environments.

This shift towards data-informed farming directly impacts fertilizer demand and application. By improving yields, boosting operational efficiency, cutting expenses, and enhancing resilience to climate shifts, these technologies encourage more precise and effective use of agricultural inputs like potash.

- Yield Improvement: AI can analyze vast datasets to recommend optimal nutrient application, potentially increasing crop yields by 5-10% in many scenarios by 2025.

- Efficiency Gains: Precision agriculture, powered by data analytics, can reduce fertilizer waste by up to 15-20% through targeted application.

- Cost Reduction: Optimized resource use and reduced waste contribute to lower overall farming costs, a significant factor for farmers in the 2024-2025 season.

Technological advancements are driving efficiency and sustainability in potash mining and agriculture. Innovations in automation and data analytics are optimizing resource use, from water management in mining to precision application in farming.

The global precision agriculture market reached approximately $10.5 billion in 2024, highlighting the adoption of technologies like GPS and AI for targeted nutrient delivery. This trend directly influences demand for efficient fertilizers, with the liquid fertilizer market valued at about USD 20 billion in 2023.

AI-powered analytics can improve crop yields by 5-10% and reduce fertilizer waste by 15-20% through optimized application, making these technologies crucial for cost savings and increased output in the 2024-2025 agricultural season.

| Technology Area | Impact | 2024/2025 Data Point |

| Precision Agriculture | Optimized nutrient application, reduced waste | Market valued at $10.5 billion in 2024 |

| Liquid Fertilizers | Increased efficiency, reduced environmental footprint | Market valued at USD 20 billion in 2023 |

| AI & Data Analytics | Yield improvement, cost reduction | Potential 5-10% yield increase, 15-20% waste reduction |

Legal factors

New Mine Safety and Health Administration (MSHA) regulations are set to significantly impact mining operations starting in 2025. These updates focus on elevating miner safety through stricter permissible exposure limits for respirable dust, which is crucial for preventing respiratory diseases like black lung. Intrepid Potash, like all mining companies, must adapt to these enhanced safety requirements.

The evolving MSHA standards also mandate improved emergency response plans and the integration of advanced technologies, such as real-time tracking systems to monitor miner locations. Furthermore, the inclusion of mental health and wellness programs underscores a broader commitment to the overall well-being of the mining workforce. For Intrepid Potash, proactive compliance is essential to avoid potential penalties and ensure operational continuity.

Mining operations, including those of Intrepid Potash, are heavily regulated by environmental protection laws like the National Environmental Policy Act (NEPA) and the Clean Water Act. These statutes mandate environmental impact assessments for significant federal actions and govern water quality, discharges, and waste disposal. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce strict water quality standards, with penalties for non-compliance impacting companies' bottom lines.

Legislation governing land use and permitting is a critical legal consideration for Intrepid Potash. The Mining Regulatory Clarity Act of 2024, for instance, seeks to reduce uncertainty regarding the use of federal lands for essential mining support activities, a move that could simplify the permitting landscape for domestic producers.

Trade and Tariff Regulations

Trade regulations, especially tariffs on imported goods, significantly influence the fertilizer sector. The U.S. imposed a 25% tariff on Canadian fertilizer imports, including potash, effective March 2025. This policy introduces trade friction, potentially raising input costs for American farmers.

These trade policies can reshape the competitive landscape for domestic producers like Intrepid Potash. By making imported potash more expensive, the tariffs could shift demand towards domestically sourced supplies.

- Tariff Impact: A 25% tariff on Canadian potash imports, effective March 2025, directly increases costs for U.S. buyers.

- Competitive Shift: Intrepid Potash, as a U.S.-based producer, may see an advantage as imported alternatives become pricier.

- Market Dynamics: Such regulations can alter supply chains and pricing strategies within the North American fertilizer market.

Product Safety and Labeling Standards

Regulations concerning the safety, quality, and labeling of agricultural inputs, including potash, are crucial for maintaining consumer confidence and ensuring market access. These standards dictate that products must meet precise nutrient content specifications and be safe for application in agricultural, industrial, and animal feed applications. For instance, the U.S. Environmental Protection Agency (EPA) regulates fertilizer products to ensure they are not harmful to human health or the environment.

Intrepid Potash's product portfolio, which includes Muriate of Potash (MOP), Sulfate of Potash (SOP), and various specialty fertilizers, must adhere to these rigorous standards. Compliance is not merely a legal obligation but a fundamental aspect of Intrepid Potash's operational integrity, directly impacting its ability to serve diverse markets. In 2024, the global fertilizer market is projected to reach approximately $250 billion, underscoring the significant economic implications of meeting these regulatory benchmarks.

- Nutrient Content Verification: Ensuring potash products consistently meet specified potassium (K) levels, vital for crop yields.

- Safety Data Sheets (SDS): Providing comprehensive information on chemical properties, hazards, and safe handling procedures for all products.

- Labeling Accuracy: Guaranteeing clear and accurate labeling of product composition, application rates, and potential environmental impacts.

- Regulatory Compliance Audits: Regularly undergoing audits by bodies like the Association of American Plant Food Control Officials (AAPFCO) to confirm adherence to standards.

New Mine Safety and Health Administration (MSHA) regulations, effective in 2025, will impose stricter exposure limits for respirable dust and mandate enhanced emergency response protocols, impacting Intrepid Potash's operational costs and safety procedures. Additionally, the Mining Regulatory Clarity Act of 2024 aims to streamline permitting for mining support activities on federal lands, potentially easing some of Intrepid Potash's land-use challenges.

Trade regulations, particularly the 25% tariff on Canadian potash imports starting March 2025, are poised to alter market dynamics, potentially benefiting domestic producers like Intrepid Potash by increasing the cost of foreign competition. Furthermore, stringent environmental laws, including the Clean Water Act, continue to necessitate rigorous compliance for water quality and waste disposal, with the EPA actively enforcing these standards.

| Legal Factor | Impact on Intrepid Potash | 2024/2025 Data/Projection |

|---|---|---|

| MSHA Regulations | Increased safety compliance costs, potential operational adjustments. | New regulations effective 2025; focus on dust exposure and emergency plans. |

| Mining Regulatory Clarity Act | Potential simplification of federal land permitting. | Legislation enacted in 2024. |

| Trade Tariffs (Potash) | Potential competitive advantage for domestic production. | 25% tariff on Canadian potash imports effective March 2025. |

| Environmental Laws (e.g., Clean Water Act) | Ongoing need for strict adherence to water quality and waste disposal. | Continued EPA enforcement in 2024; penalties for non-compliance. |

Environmental factors

Water management is a significant environmental hurdle for mining, particularly in dry climates. Intrepid Potash, a key player in solar evaporation for potash, highlights its commitment to sustainable water practices.

The mining sector is increasingly adopting sophisticated water recycling, closed-loop systems, and continuous monitoring to lessen reliance on freshwater and reduce ecological footprints. For instance, advancements in water treatment technologies are enabling higher rates of water reuse within mining operations, aiming to conserve this vital resource.

Intrepid Potash is actively working to lower its environmental footprint. The company has set a target to reduce the intensity of its Scope 1 and 2 emissions by 5% by the end of 2026, using 2023 as its baseline. This is largely accomplished by increasing potash production, which in turn makes the emissions per ton of fertilizer produced more efficient.

Furthermore, Intrepid Potash is exploring the feasibility of integrating renewable energy sources into its operations. The company is also mindful of how climate change itself can affect its business, with factors like water scarcity and more frequent extreme weather events potentially impacting agricultural practices and the availability of essential resources.

Mining activities, particularly at Intrepid Potash, produce byproducts like brine and tailings that necessitate stringent environmental controls to avert contamination. The industry is placing a growing emphasis on robust tailings management to minimize ecological footprints.

Intrepid Potash's solar evaporation method offers a unique approach to brine management, facilitating natural evaporation and concentrating solid residues. This process is crucial for handling the large volumes of brine generated, with the company's 2023 annual report detailing significant brine processing volumes, though specific tailings quantities are not itemized separately.

Land Use and Biodiversity Conservation

Mining operations, including those by Intrepid Potash, inherently alter land use patterns, potentially impacting local ecosystems and the biodiversity they support. The company's solar evaporation process, utilized at its Moab, Utah facility, is generally viewed as less disruptive than conventional underground mining methods, requiring significant surface area but avoiding extensive underground excavation.

There's a notable global shift towards regenerative agriculture, emphasizing practices that enhance soil health and biodiversity, thereby lessening the pressure for extensive land conversion for food production. This trend could indirectly influence land availability and regulations relevant to mining activities.

Intrepid Potash operates under various environmental permits and regulations designed to mitigate the impact of its operations. For instance, in 2023, the company reported adhering to its environmental compliance obligations across its facilities, including those related to land management and water usage. The company's focus on solar evaporation, a method that relies on natural processes, aligns with a strategy to minimize certain environmental footprints compared to more energy-intensive extraction techniques.

- Land Use Impact: Intrepid Potash's solar evaporation ponds cover significant acreage, a key consideration in land use planning and environmental impact assessments.

- Biodiversity Concerns: Potential impacts on local flora and fauna are managed through environmental mitigation plans, as required by regulatory bodies.

- Regenerative Agriculture Influence: The growing adoption of regenerative farming practices may lead to increased scrutiny on land use by all industries, including mining.

- Operational Method: Solar evaporation is a less land-intensive method than some conventional mining techniques, though it requires substantial surface area.

Sustainable Production Methods

Intrepid Potash's commitment to sustainable production methods is a key differentiator, particularly its reliance on solar solution mining. This approach harnesses the sun's energy for evaporation, making it a significantly more environmentally friendly and energy-efficient process than conventional mining. By minimizing fossil fuel consumption, Intrepid Potash actively reduces its carbon footprint.

This method not only conserves energy but also aligns with growing global demand for responsibly sourced agricultural inputs. In 2024, the agricultural sector continued to emphasize sustainability, with a growing number of large-scale farming operations seeking suppliers with demonstrable environmental credentials. Intrepid Potash’s solar solution mining directly addresses this market need.

- Solar Solution Mining: Intrepid Potash utilizes this method, which relies on solar evaporation for potash extraction.

- Environmental Benefits: Significantly lower fossil fuel usage and a reduced carbon footprint compared to traditional mining.

- Energy Efficiency: The process is inherently energy-efficient due to its reliance on natural solar energy.

- Market Demand: Growing demand in 2024 from agricultural clients for sustainably produced potash.

Environmental regulations are a critical aspect for Intrepid Potash, influencing its operational strategies and compliance efforts. The company's 2023 environmental compliance report indicated adherence to all applicable regulations, including those concerning air and water quality, and waste management. These regulations often mandate specific emission controls and water usage monitoring, impacting operational costs and efficiency.

Intrepid Potash is actively working to lower its environmental footprint. The company has set a target to reduce the intensity of its Scope 1 and 2 emissions by 5% by the end of 2026, using 2023 as its baseline. This is largely accomplished by increasing potash production, which in turn makes the emissions per ton of fertilizer produced more efficient.

The mining sector is increasingly adopting sophisticated water recycling, closed-loop systems, and continuous monitoring to lessen reliance on freshwater and reduce ecological footprints. For instance, advancements in water treatment technologies are enabling higher rates of water reuse within mining operations, aiming to conserve this vital resource. Intrepid Potash's 2023 operations involved extensive brine management, a key component of its environmental stewardship.

Climate change presents a growing environmental factor, with potential impacts on water availability and extreme weather events. Intrepid Potash is exploring the feasibility of integrating renewable energy sources into its operations to mitigate its carbon footprint. The company’s 2024 sustainability initiatives are focused on enhancing energy efficiency and reducing greenhouse gas emissions.

| Environmental Factor | Intrepid Potash's Approach/Data | Relevance |

| Water Management | Utilizes solar evaporation, requires significant water for brine processing. 2023 brine volumes processed were substantial. | Crucial for operations in arid regions, focus on recycling and conservation. |

| Emissions Reduction | Target: 5% reduction in Scope 1 & 2 emissions intensity by end of 2026 (vs. 2023 baseline). | Addresses climate change concerns and regulatory pressures. |

| Land Use | Solar evaporation ponds require large surface areas. Moab facility utilizes this method. | Impacts local ecosystems; solar evaporation is less disruptive than underground mining. |

| Renewable Energy | Exploring integration of renewable energy sources. | Strategy to reduce fossil fuel dependency and carbon footprint. |

PESTLE Analysis Data Sources

Our Intrepid Potash PESTLE Analysis is grounded in comprehensive data from government regulatory bodies, industry associations, and financial market reports. We utilize economic indicators, environmental impact assessments, and technological innovation trends to ensure a thorough understanding of the external landscape.