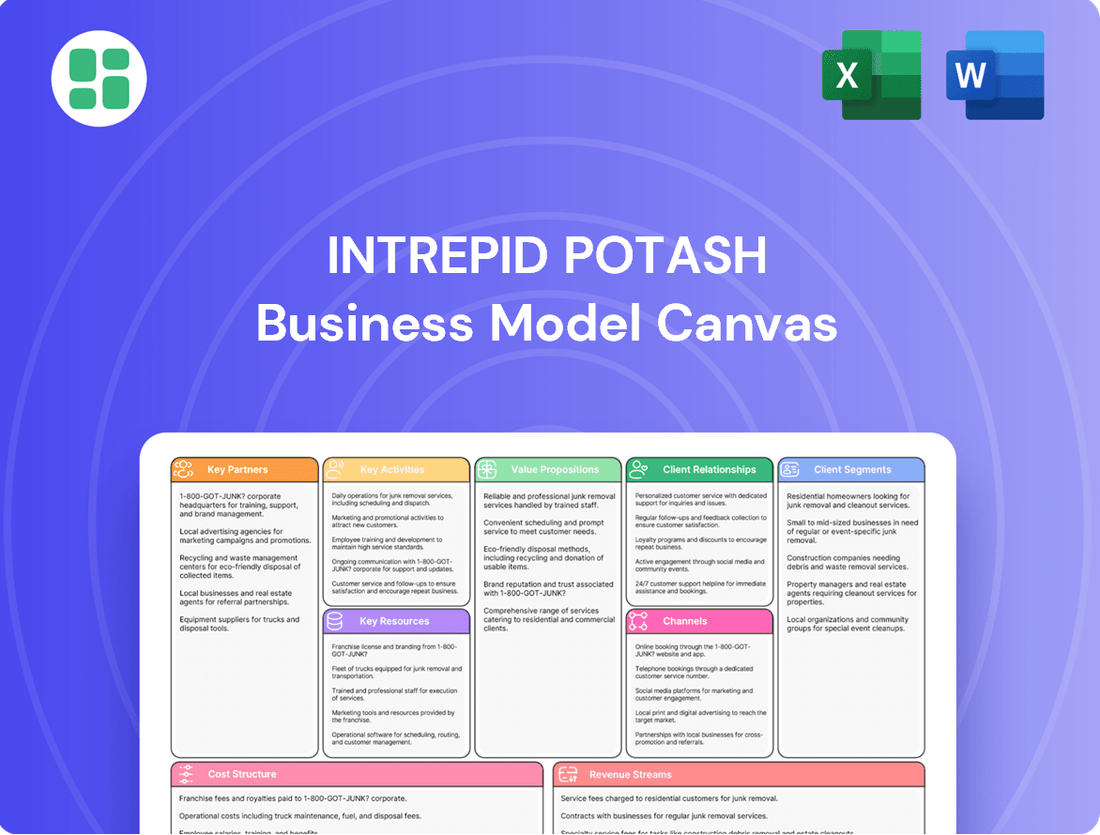

Intrepid Potash Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intrepid Potash Bundle

Curious about Intrepid Potash's strategic foundation? This Business Model Canvas breaks down their core operations, from key resources to revenue streams, offering a clear view of their competitive advantage. Discover the intricate workings of a leading potash producer.

Unlock the full strategic blueprint behind Intrepid Potash's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Intrepid Potash's success hinges on its logistics partnerships, ensuring timely delivery of essential products like potash and salt. In 2024, the company continued to leverage relationships with major Class I railroads, which are critical for moving bulk commodities across vast distances. These rail networks are fundamental to Intrepid's ability to serve its diverse customer base across the United States.

The company also works closely with a network of trucking firms to provide last-mile delivery and serve regional markets. This multimodal approach, combining rail and truck, allows Intrepid to optimize transportation costs and maintain supply chain flexibility. Reliable transportation is a key differentiator, especially in the competitive agricultural and industrial sectors.

Intrepid Potash relies on key partnerships with equipment and technology suppliers to maintain and upgrade its mining and production infrastructure. These relationships are crucial for acquiring specialized machinery for solar evaporation and solution mining, as well as advanced mineral processing equipment.

In 2024, Intrepid Potash continued to invest in optimizing its production processes. For instance, the company's focus on enhancing operational efficiency through technology is reflected in its ongoing efforts to improve its solar evaporation ponds, a core component of its environmentally conscious production strategy.

Intrepid Potash actively partners with research institutions and technology firms to foster innovation. These collaborations are crucial for developing advanced fertilizer application techniques and optimizing mineral extraction processes.

For instance, in 2024, Intrepid Potash continued its work with universities on projects aimed at improving nutrient uptake efficiency in crops, a key area for sustainable agriculture. Such partnerships are instrumental in exploring novel uses for their potassium and magnesium products, thereby enhancing their market value and environmental footprint.

Agricultural Distributors and Retailers

Intrepid Potash relies on agricultural distributors and retailers to connect with a wider array of farmers, especially smaller operations. These partnerships are crucial for expanding market access and providing localized sales and inventory support.

These intermediaries act as vital conduits, enabling Intrepid to penetrate diverse farming communities throughout the U.S. By leveraging their established networks, Intrepid can effectively manage inventory and deliver its products efficiently to end-users.

- Market Reach: Distributors and retailers extend Intrepid's geographical and customer base, reaching farmers who might not directly engage with the company.

- Localized Support: These partners offer on-the-ground sales, agronomic advice, and customer service tailored to specific regional farming needs.

- Inventory Management: They hold inventory closer to the point of sale, ensuring timely availability of essential fertilizers for farmers.

- Sales Volume: In 2023, Intrepid Potash reported significant sales volumes, with a substantial portion likely facilitated through these channel partners.

Industrial and Specialty Product Buyers

Intrepid Potash cultivates crucial partnerships with major industrial and specialty product buyers, focusing on sectors such as oil and gas, de-icing, and chemical manufacturing. These relationships are foundational, often solidified through long-term contracts that guarantee a steady demand for Intrepid's salt, magnesium chloride, and brine products. For instance, in 2024, Intrepid's sales to industrial customers represented a substantial portion of its revenue, underscoring the importance of these steady supply agreements.

These collaborations are vital for ensuring consistent quality and reliable delivery, meeting the stringent requirements of these demanding industries. Such partnerships not only stabilize Intrepid's revenue streams but also provide a predictable base for operational planning and investment. The company's strategic focus on these buyer relationships highlights their role in driving diversified and resilient income.

- Long-term Contracts: Securing multi-year agreements with large industrial clients for consistent product offtake.

- Sector Diversification: Supplying key materials to critical industries like oil and gas, municipal de-icing, and chemical production.

- Revenue Stability: These partnerships contribute significantly to predictable revenue, reducing market volatility.

- Quality Assurance: Maintaining high product standards to meet the rigorous demands of industrial applications.

Intrepid Potash's key partnerships extend to financial institutions and investors, crucial for securing capital for operations and expansion. These relationships provide the necessary funding for plant upgrades and exploration activities. In 2024, the company continued to focus on maintaining strong ties with its lenders and shareholders to ensure financial stability and growth opportunities.

The company also engages with government agencies and regulatory bodies to ensure compliance and explore potential opportunities related to resource management and environmental stewardship. These interactions are vital for navigating the complex regulatory landscape of the mining industry.

What is included in the product

This Business Model Canvas outlines Intrepid Potash's strategy for producing and selling potash and langbeinite, focusing on its established mining operations and distribution channels to agricultural and industrial customers.

It details key resources like mineral reserves and production facilities, alongside revenue streams derived from product sales and cost structures associated with mining and processing.

Intrepid Potash's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, simplifying complex strategies for better understanding and decision-making.

Activities

Intrepid Potash's primary activities revolve around extracting and processing potash and its unique Trio® fertilizer. This involves operating extensive solar evaporation ponds and engaging in underground mining to extract these valuable minerals. The company is dedicated to optimizing its production processes and ensuring the consistent high quality of its output.

In 2024, Intrepid Potash reported selling approximately 621,000 tons of potash and 158,000 tons of Trio®. This highlights their significant operational capacity and market presence in these essential agricultural inputs.

Intrepid Potash's core operations involve transforming extracted minerals into marketable goods. This includes processing potash for agriculture, industrial salt, and magnesium chloride, a key component in de-icing solutions. For instance, in 2023, Intrepid Potash reported sales of 566,000 tons of potash and 164,000 tons of Trio® fertilizer.

Ensuring the purity and consistency of these products is paramount. Intrepid utilizes various industrial techniques to meet stringent quality standards demanded by diverse customer bases. This focus on product specification is crucial for maintaining market competitiveness and customer satisfaction.

Intrepid Potash actively pursues sales and marketing across agriculture, industrial, and animal feed markets to boost demand. This involves direct sales engagement and nurturing customer relationships, highlighting the advantages of their U.S.-made, eco-friendly products. Their market positioning directly impacts commercial success.

Logistics and Supply Chain Management

Intrepid Potash's logistics and supply chain management are critical to its operations, ensuring products reach customers efficiently. This involves meticulous oversight of the entire process, from mining and processing to final delivery. The company leverages its domestic production base to streamline these activities.

Key activities include managing inventory levels across its facilities and coordinating the transportation of its potash and langbeinite products. Intrepid utilizes a mix of rail and truck transport to serve its diverse customer base, with a focus on timely and cost-effective delivery. For instance, in 2023, the company continued to optimize its transportation networks to mitigate rising freight costs.

- Inventory Management: Maintaining optimal stock levels at production sites and distribution points to meet demand without incurring excessive holding costs.

- Transportation Coordination: Arranging and managing rail and truck shipments to ensure reliable and punctual delivery to agricultural and industrial customers across North America.

- Cost Optimization: Continuously seeking ways to reduce transportation expenses and improve overall supply chain efficiency, a key factor given the commodity nature of its products.

- Customer Service: Ensuring product availability and on-time delivery to foster strong customer relationships and maintain market share.

Environmental Stewardship and Compliance

A core activity for Intrepid Potash is diligently complying with and often surpassing environmental regulations. This focus is particularly strong on responsible water usage, controlling air emissions, and undertaking thorough land reclamation efforts after mining operations. In 2024, Intrepid Potash continued to invest in technologies and processes to achieve these environmental goals, reflecting a commitment to sustainable resource extraction.

Intrepid Potash highlights its dedication to sustainable mining through practices like solar evaporation. This method utilizes natural sunlight to concentrate potash solutions, significantly reducing the need for energy-intensive processing and thereby minimizing the company's environmental footprint. This approach is a key component of their operational strategy for environmental stewardship.

Ongoing monitoring and reporting on Environmental, Social, and Governance (ESG) initiatives are critical activities. Intrepid Potash regularly tracks and communicates its performance in these areas, ensuring transparency and accountability to stakeholders. For instance, their 2024 sustainability reports detailed progress in reducing water consumption and enhancing land restoration efforts at their mining sites.

- Adherence to and exceeding environmental regulations for water, emissions, and land reclamation.

- Implementation of sustainable mining practices, such as solar evaporation, to reduce environmental impact.

- Regular monitoring and transparent reporting of ESG performance metrics.

Intrepid Potash's key activities center on the extraction and processing of potash and its unique Trio® fertilizer, utilizing both solar evaporation and underground mining. The company focuses on optimizing production for high-quality output, evident in their 2024 sales of approximately 621,000 tons of potash and 158,000 tons of Trio®. This operational scale underscores their significant role in supplying essential agricultural and industrial minerals.

Intrepid Potash also manages its supply chain and logistics, coordinating transportation via rail and truck to ensure timely delivery. They actively engage in sales and marketing to diverse sectors, emphasizing the benefits of their domestically produced, eco-friendly products, while also prioritizing environmental compliance and sustainable practices like solar evaporation.

| Activity | Description | 2024 Data/Focus |

|---|---|---|

| Extraction & Processing | Mining and solar evaporation of potash and langbeinite (Trio®). | Sales of ~621,000 tons potash, ~158,000 tons Trio®. |

| Sales & Marketing | Direct sales and relationship management across agriculture, industrial, and animal feed markets. | Highlighting U.S.-made, eco-friendly product advantages. |

| Logistics & Supply Chain | Managing inventory and coordinating rail/truck transport for efficient delivery. | Optimizing networks to mitigate rising freight costs. |

| Environmental Stewardship | Ensuring regulatory compliance, responsible water use, emissions control, and land reclamation. | Investing in technologies for environmental goals; reporting ESG progress. |

Delivered as Displayed

Business Model Canvas

The Intrepid Potash Business Model Canvas you are previewing is the complete, final document you will receive upon purchase. This is not a sample or mockup; it's an exact representation of the detailed analysis that will be delivered to you, ready for immediate use and strategic planning.

Resources

Intrepid Potash's core asset is its substantial mineral reserves, including potash, Trio®, salt, and brine, coupled with the vital mining rights across the United States. These reserves are the bedrock of their operations, underpinning their ability to produce essential minerals.

The company boasts long-life reserves situated in key locations like New Mexico and Utah. This strategic positioning is fundamental to maintaining consistent production levels and securing a reliable supply chain for the future.

Having direct access to these domestic mineral resources grants Intrepid Potash a significant competitive edge. It allows for greater control over their supply chain and cost structure compared to competitors reliant on imports.

As of the first quarter of 2024, Intrepid Potash reported total potash reserves of approximately 11.4 million tons, and Trio® reserves of roughly 3.7 million tons, highlighting the scale of their resource base.

Intrepid Potash's production facilities are the backbone of its operations. These include three solar solution potash facilities located in Carlsbad, New Mexico, and two in Utah: Moab and Wendover. These sites are equipped with extensive evaporation ponds and processing plants, essential for extracting and refining potash.

Complementing the solar solution operations is Intrepid's conventional underground mine for Trio®, a specialty fertilizer. This diverse infrastructure, including specialized equipment, underpins the company's capacity to produce and deliver its product range to market.

In 2023, Intrepid Potash reported that its Carlsbad facility had a significant portion of its total potash production capacity. The company's infrastructure is designed for efficient extraction and processing, crucial for maintaining competitive operational costs.

Intrepid Potash's proprietary solar evaporation technology is a cornerstone of its operations, offering a distinct cost advantage and a more sustainable production method than traditional underground mining. This specialized process allows for efficient extraction of potash from brine, contributing significantly to its competitive edge in the market.

This advanced processing capability, including its solar evaporation ponds, represents a critical intellectual resource for Intrepid Potash. It underpins the company's ability to produce potash in a manner that is both economically viable and environmentally responsible, a key differentiator in today's market.

In 2024, Intrepid Potash continued to emphasize its solar solution. For instance, the company's production costs are often benchmarked against competitors, and its solar evaporation method generally allows for lower operating expenses per ton of potash produced, especially in favorable weather conditions.

Skilled Workforce and Technical Expertise

Intrepid Potash relies heavily on its skilled workforce, encompassing engineers, geologists, mining specialists, and operational staff. This human capital is fundamental to their success in mineral extraction and processing.

The technical expertise of their employees is critical for safe and efficient operations, driving innovation in extraction techniques, and ensuring consistent product quality. For instance, in 2024, Intrepid Potash continued its focus on operational efficiency, leveraging the deep knowledge of its mining teams to optimize production from its various sites.

- Expertise in Mineral Extraction: Geologists and mining engineers possess the specialized knowledge required for effective extraction of potash and langbeinite.

- Processing and Quality Control: Skilled technicians ensure that the extracted minerals are processed to meet stringent quality standards for agricultural and industrial markets.

- Environmental Management: Expertise in environmental science and engineering is crucial for adhering to regulations and implementing sustainable mining practices.

- Employee Safety and Training: Intrepid Potash prioritizes employee safety, investing in continuous training programs to maintain a high level of operational competence and safety awareness throughout its workforce.

Strong Balance Sheet and Liquidity

Intrepid Potash's strong balance sheet and liquidity are foundational. The company notably operated with no long-term debt as of the first quarter of 2024, a significant advantage. This financial resilience translates directly into operational flexibility and strategic maneuverability.

This robust financial position, evidenced by substantial liquidity, allows Intrepid Potash to navigate market volatility effectively. It also empowers the company to pursue strategic investments, such as asset revitalization, without the encumbrance of significant debt obligations. For instance, their ability to fund capital expenditures from operating cash flow in 2023 highlights this financial strength.

- No Long-Term Debt: As of Q1 2024, Intrepid Potash maintained a debt-free balance sheet, enhancing financial flexibility.

- Substantial Liquidity: The company possesses significant liquid assets, enabling it to manage operational needs and market fluctuations.

- Strategic Investment Capacity: This financial strength supports investments in asset improvements and growth initiatives, crucial for long-term viability.

- Operational Stability: A clean balance sheet ensures consistent operations, even during periods of market uncertainty.

Intrepid Potash's key resources are its vast mineral reserves, including potash and Trio®, along with its strategic mining rights across the U.S. These reserves, concentrated in New Mexico and Utah, are the foundation of its production capabilities.

The company's infrastructure, featuring solar evaporation ponds and a Trio® underground mine, is crucial for efficient mineral extraction and processing. This operational setup, including its proprietary solar technology, provides a significant cost advantage.

A highly skilled workforce, comprising geologists, engineers, and operational staff, drives Intrepid Potash's success. Their expertise is vital for safe, efficient extraction, processing, and environmental management.

Intrepid Potash benefits from a strong financial position, notably operating with no long-term debt as of Q1 2024. This financial flexibility allows for strategic investments and resilience against market volatility.

| Resource Category | Specific Asset/Capability | Key Feature/Benefit |

|---|---|---|

| Mineral Reserves | Potash Reserves (Q1 2024) | Approx. 11.4 million tons |

| Mineral Reserves | Trio® Reserves (Q1 2024) | Approx. 3.7 million tons |

| Production Facilities | Solar Solution Potash Facilities | Located in Carlsbad, NM, and Moab/Wendover, UT |

| Production Facilities | Trio® Underground Mine | Specialty fertilizer production |

| Intellectual Property | Proprietary Solar Evaporation Technology | Cost advantage and sustainable production |

| Human Capital | Skilled Workforce | Expertise in extraction, processing, and safety |

| Financial Strength | No Long-Term Debt (Q1 2024) | Enhanced financial flexibility and operational stability |

Value Propositions

Intrepid Potash stands as the sole U.S. producer of muriate of potash, a vital nutrient for agriculture. This unique position ensures a reliable, U.S.-based supply for farmers, bolstering domestic food security and offering a stable alternative to potentially volatile international markets. For instance, in 2023, the U.S. imported a significant portion of its potash, highlighting the strategic importance of domestic production.

Intrepid Potash delivers premium mineral products, including potassium chloride and their unique Trio® blend, which provides potassium, magnesium, and sulfate. These are crucial for robust crop growth and serve as vital inputs for numerous industrial processes. In 2024, the agricultural sector's demand for specialized fertilizers remained strong, underscoring the value of Intrepid's nutrient-rich offerings.

Intrepid Potash stands out by leading in solar evaporation for potash production, a method that drastically cuts down on fossil fuel use and greenhouse gas emissions. This approach aligns with growing environmental consciousness, making it attractive to eco-minded customers and investors.

In 2024, Intrepid Potash's commitment to sustainable practices is more critical than ever, as global demand for environmentally sound agricultural inputs rises. Their solar evaporation process, a cornerstone of their operations, directly addresses the industry's carbon footprint challenges.

Logistical Advantages and Timely Delivery

Intrepid Potash's production facilities are strategically positioned across the central and western United States, a key factor in its logistical strength. This geographic advantage translates directly into more efficient transportation networks and reduced transit times for its customer base.

This proximity allows Intrepid to offer reliable, on-time delivery, a critical factor for industries that depend on consistent supply chains. For instance, in 2023, Intrepid Potash reported that its Western U.S. operations, including its Moab, Utah facility, were crucial for serving agricultural and industrial customers in that region, minimizing lead times.

- Strategic Location: Production sites in the central and western U.S. offer close proximity to key markets.

- Efficient Logistics: Enables streamlined transportation and reduced freight costs for customers.

- Reliable Delivery: Ensures timely supply, supporting customer operational continuity.

- Cost Savings: Lower freight expenses contribute to overall customer value proposition.

Tailored Solutions and Customer Support

Intrepid Potash focuses on delivering customized mineral solutions, recognizing that different agricultural and industrial applications require specific product formulations. This dedication to tailored offerings ensures that customers receive precisely what they need to optimize their processes and achieve desired outcomes.

Beyond product customization, Intrepid Potash provides robust customer support, including technical assistance to guide clients on the most effective ways to apply their minerals. This commitment to helping customers maximize value fosters strong, lasting relationships and reinforces Intrepid's position as a trusted partner.

- Tailored Product Formulations: Intrepid Potash adapts its potash and Trio® products to meet unique customer specifications for nutrient content and physical properties.

- Responsive Technical Support: The company offers expert advice on application methods, soil health, and product integration to enhance customer success.

- Customer Relationship Focus: Intrepid prioritizes building partnerships through personalized service, aiming to maximize the value derived from its mineral products.

Intrepid Potash's value proposition centers on its unique position as the sole U.S. producer of muriate of potash, ensuring domestic supply and food security. They offer premium mineral products, including their distinctive Trio® blend, catering to agricultural and industrial needs with a strong emphasis on tailored solutions and responsive technical support.

Their commitment to sustainable production through solar evaporation appeals to environmentally conscious markets, aligning with the growing demand for eco-friendly agricultural inputs seen in 2024. Strategically located facilities in the central and western U.S. facilitate efficient logistics and reliable delivery, providing cost savings and operational continuity for their clientele.

| Value Proposition | Description | Supporting Data/Facts |

|---|---|---|

| Sole U.S. Muriate of Potash Producer | Ensures a reliable, domestic supply of a vital agricultural nutrient. | In 2023, the U.S. continued to rely on imports for a significant portion of its potash needs, highlighting the strategic importance of domestic production. |

| Premium Mineral Products (incl. Trio®) | Provides essential potassium, magnesium, and sulfate for crop growth and industrial uses. | Demand for specialized fertilizers remained robust in the agricultural sector throughout 2024. |

| Sustainable Solar Evaporation | Reduces fossil fuel use and greenhouse gas emissions in production. | This method aligns with increasing global demand for environmentally sound agricultural inputs. |

| Strategic U.S. Locations | Enables efficient logistics, reduced transit times, and cost savings for customers. | Intrepid's Western U.S. operations, including Moab, Utah, were critical in 2023 for serving regional customers with minimized lead times. |

Customer Relationships

Intrepid Potash cultivates robust customer connections by directly engaging with major agricultural producers, industrial users, and animal feed manufacturers. This is achieved through specialized sales forces and dedicated account managers who ensure tailored service and a thorough grasp of client requirements.

This direct approach facilitates the negotiation of favorable, long-term supply contracts, a strategy that proved beneficial in 2024 as fertilizer demand remained steady. For instance, Intrepid reported that its direct sales efforts contributed significantly to securing consistent off-take for its potash and Trio products.

By building these direct relationships, Intrepid fosters strong customer loyalty and encourages recurring business. This strategy allows them to better anticipate market shifts and adapt their offerings, a key advantage in the competitive fertilizer market.

Intrepid Potash offers crucial technical support and agronomic expertise to its agricultural clients. This means helping farmers understand how to best use their fertilizers for maximum benefit.

By providing this guidance, Intrepid Potash goes beyond simply selling products; they actively contribute to improving crop yields and quality for their customers. This commitment to farmer success is a key element in building strong, lasting relationships.

Intrepid Potash secures its market position through long-term supply contracts with major industrial and agricultural clients. These agreements, often spanning multiple years, provide a bedrock of predictable revenue and demand, crucial for operational planning. For instance, in 2023, a significant portion of Intrepid's potash sales were under such multi-year arrangements, offering a buffer against market volatility.

Customer Service and Order Fulfillment

Intrepid Potash places a high priority on delivering exceptional customer service and ensuring dependable order fulfillment across all its customer segments. This commitment is fundamental to building and maintaining strong relationships.

Streamlined processes are key. This involves efficient order processing, from initial placement to final delivery, coupled with proactive and clear communication throughout the entire transaction. For instance, in 2023, Intrepid Potash focused on optimizing its logistics network to reduce delivery times.

Effective complaint resolution is also a cornerstone of their customer relationship strategy. Addressing issues promptly and satisfactorily not only resolves immediate concerns but also strengthens customer loyalty and reinforces the company's image as a reliable supplier.

- Customer Service Excellence: Ensuring responsive communication and efficient handling of inquiries and issues for all customer types.

- Reliable Order Fulfillment: Guaranteeing timely and accurate delivery of potash products, crucial for agricultural and industrial clients.

- Complaint Resolution: Implementing robust systems for addressing customer feedback and resolving problems effectively to maintain satisfaction.

- Reputation Reinforcement: Consistent delivery of prompt and accurate service enhances Intrepid Potash's reputation for dependability in the market.

Industry Engagement and Collaboration

Intrepid Potash actively participates in industry associations, trade shows, and conferences. This engagement is crucial for connecting with a wider customer base and gaining insights into agricultural and industrial market trends.

These events are vital for building strong relationships and understanding evolving customer needs. For instance, in 2024, Intrepid Potash's presence at key agricultural expos allowed them to showcase their specialty fertilizer products directly to farmers and distributors.

- Industry Association Membership: Maintaining active memberships in organizations like The Fertilizer Institute (TFI) provides a platform for dialogue and collaboration.

- Trade Show Participation: Exhibiting at major agricultural and mining trade shows in 2024, such as the Commodity Classic, facilitated direct customer interaction and feedback.

- Conference Engagement: Presenting at industry conferences helps establish Intrepid Potash as a thought leader and identify emerging market demands.

- Relationship Building: These interactions are designed to foster long-term partnerships and ensure Intrepid Potash remains aligned with customer expectations and market dynamics.

Intrepid Potash focuses on building lasting customer relationships through direct engagement, offering tailored solutions and technical expertise. This approach, exemplified by their 2024 participation in agricultural expos, ensures they meet the evolving needs of farmers and industrial users.

Their strategy of securing long-term supply contracts, a practice evident in 2023 with a substantial portion of potash sales under multi-year agreements, provides revenue stability and strengthens partnerships.

Exceptional customer service, reliable order fulfillment, and effective complaint resolution are central to their relationship management, reinforcing their reputation as a dependable supplier in the market.

Intrepid Potash's commitment to customer success is further demonstrated through its active involvement in industry events, allowing for direct interaction and feedback, crucial for staying aligned with market demands.

| Customer Segment | Relationship Strategy | Key Engagement Activities | 2024 Focus Area |

|---|---|---|---|

| Agricultural Producers | Direct Sales, Technical Support, Agronomic Expertise | Industry Expos, Long-term Contracts | Showcasing Specialty Fertilizers |

| Industrial Users | Direct Sales, Account Management, Reliable Fulfillment | Long-term Contracts, Efficient Logistics | Optimizing Delivery Processes |

| Animal Feed Manufacturers | Direct Sales, Tailored Service | Direct Engagement, Understanding Needs | Consistent Off-take Support |

Channels

Intrepid Potash utilizes a dedicated direct sales force to cultivate relationships with key clients in agriculture, industry, and animal feed. This internal team is crucial for securing large-volume contracts and tailoring offerings to specific customer needs.

In 2024, Intrepid Potash's direct sales efforts are focused on enhancing engagement with their primary customer base, which includes major agricultural cooperatives and industrial chemical manufacturers. This approach allows for more personalized service and a deeper understanding of market demands.

Intrepid Potash leverages a robust agricultural distribution network, partnering with numerous distributors and retailers to reach a broad customer base. This strategy is crucial for accessing smaller farms and businesses that might otherwise be difficult to serve directly. In 2024, their distribution channels were key in delivering essential nutrients to the agricultural sector.

These partnerships extend Intrepid's market reach significantly, ensuring their potash and Trio products are readily available across various regions. Distributors provide essential local inventory management and offer tailored regional support, which is vital for customer satisfaction and product accessibility. This network acts as an extension of Intrepid's own sales and logistics capabilities.

Intrepid Potash's industrial supply chains for products like salt and magnesium chloride connect directly with procurement teams in manufacturing, chemical, and de-icing sectors. This integration often occurs through direct sales channels or partnerships with specialized industrial distributors, ensuring efficient product flow.

In 2024, the industrial minerals market, including salt and magnesium chloride, continued to see steady demand. For instance, de-icing salt usage is heavily influenced by winter weather patterns, with significant volumes purchased by municipalities and private contractors. Intrepid's ability to reliably supply these essential commodities positions it within these critical, albeit weather-dependent, supply chains.

Company Website and Online Presence

Intrepid Potash's official website is a vital channel, acting as the central hub for investor relations, detailed corporate information, and comprehensive product specifications. It’s where stakeholders can find the latest news, financial reports, and insights into their operational and sustainability initiatives.

While not a direct e-commerce platform for all its offerings, the website is instrumental in providing essential information to potential and existing customers, guiding them to the right contacts and resources. For instance, in 2024, the company continued to update its site with details on its fertilizer products, including potash and langbeinite, crucial for agricultural productivity.

- Investor Relations Hub: Provides access to SEC filings, press releases, and annual reports, reinforcing transparency.

- Product Information: Details on Intrepid's diverse fertilizer products and their applications are readily available.

- Corporate News & Sustainability: Updates on company performance, environmental practices, and community engagement are shared.

- Stakeholder Engagement: Serves as a key point of contact for customers, suppliers, and the broader financial community.

Trade Shows and Industry Events

Intrepid Potash actively participates in crucial trade shows and industry events. These gatherings are vital for showcasing their potash and langbeinite products to a wide audience. For instance, in 2024, the company likely engaged with attendees at events like the National Association of Fertilizer Dealers (NAFD) annual convention, a key venue for agricultural sector engagement.

These events are more than just displays; they are strategic opportunities for Intrepid Potash to generate leads and cultivate new business relationships. By being present at major agricultural, industrial, and mining conferences, they can directly connect with potential customers and partners, understanding their evolving needs firsthand.

Furthermore, attending these industry events allows Intrepid Potash to maintain a pulse on market trends and innovations. This knowledge is critical for adapting their product offerings and business strategies. In 2023, for example, discussions around sustainable agriculture and nutrient management were prominent at many agricultural expos, influencing how companies like Intrepid position their products.

- Showcasing Products: Direct interaction at events allows for demonstrations and detailed product information, highlighting Intrepid's offerings in potash and langbeinite.

- Lead Generation: Trade shows provide a concentrated environment for identifying and engaging with prospective clients across agriculture and industry.

- Market Intelligence: Conferences offer insights into emerging trends, competitive landscapes, and customer demands, informing strategic decisions.

- Networking: Building relationships with potential partners, distributors, and key stakeholders is a primary benefit of event participation.

Intrepid Potash utilizes a direct sales force and a broad agricultural distribution network to reach its diverse customer base. Their industrial supply chains are integrated through direct sales or specialized distributors, ensuring efficient product flow for commodities like salt and magnesium chloride. The company's website serves as a key information hub, while participation in trade shows and industry events facilitates lead generation and market intelligence gathering.

In 2024, Intrepid Potash continued to emphasize direct engagement with major agricultural and industrial clients, aiming to secure large contracts and tailor product offerings. Their distribution partnerships were vital for widespread product availability, especially for essential agricultural nutrients. The industrial segment saw steady demand, with de-icing salt purchases influenced by weather patterns, highlighting Intrepid's role in critical supply chains.

Trade shows in 2024, such as those focused on sustainable agriculture, provided Intrepid Potash with opportunities to showcase its potash and langbeinite products, gather market insights, and build relationships. These events are crucial for understanding evolving customer needs and adapting business strategies in response to market trends.

Intrepid Potash's channels are designed for broad market penetration and targeted client engagement, covering agriculture, industry, and investor relations. Their 2024 strategy involved strengthening direct sales, leveraging distribution networks, and utilizing digital platforms and industry events for market presence and intelligence.

Customer Segments

Agricultural producers, primarily large-scale farmers and agricultural cooperatives, represent Intrepid Potash's core customer base. These entities rely on potash and Trio® as critical fertilizers to boost crop yields and enhance quality, directly impacting their profitability and sustainability.

Their purchasing decisions are closely tied to nutrient management strategies, soil health initiatives, and the overall economic outlook for agriculture. For instance, in 2024, the U.S. Department of Agriculture projected that net farm income would decline, potentially influencing fertilizer purchasing patterns and the demand for products like those offered by Intrepid Potash.

Industrial sector companies represent a broad customer base for Intrepid Potash, encompassing manufacturers that rely on salt for chemical production, such as chlorine and caustic soda. For instance, in 2023, the demand for these chemicals remained robust, driven by sectors like plastics and water treatment, directly impacting salt consumption.

Road maintenance departments are also key clients, particularly during winter months, utilizing salt and magnesium chloride for effective de-icing. In 2024, many regions experienced significant snowfall, leading to increased demand for these products to ensure public safety and maintain transportation networks.

Furthermore, various other industries leverage Intrepid Potash's offerings, including those using brine for drilling fluids in the oil and gas sector or for dust control on unpaved roads. These diverse applications highlight the critical role of consistent supply, adherence to precise product specifications, and competitive pricing for these industrial customers.

Animal feed manufacturers represent a key customer segment for Intrepid Potash, as they utilize potash and Trio® as essential nutrient supplements in livestock and pet food formulations. These companies are focused on producing high-quality feed that supports animal health and optimal growth.

The demand for feed-grade minerals is driven by stringent safety and nutritional standards. In 2024, the global animal feed market was valued at approximately $500 billion, with mineral supplements forming a significant portion of this value, highlighting the importance of reliable suppliers like Intrepid Potash.

Oil and Gas Industry

Intrepid Potash's oilfield solutions segment directly serves the oil and gas industry, with a significant focus on the Permian Basin. These clients require dependable and accessible water, brine, and associated services crucial for their drilling and completion operations.

Customers in this sector prioritize suppliers who can consistently deliver the necessary fluids to maintain operational momentum. For instance, in 2024, the Permian Basin continued to be a major hub for oil and gas activity, underscoring the demand for such services.

- Water and Brine Supply: Providing essential fluids for hydraulic fracturing and other well completion techniques.

- Logistical Support: Ensuring timely delivery and management of water resources to remote drilling sites.

- Environmental Compliance: Offering solutions that meet stringent regulatory requirements for water handling and disposal.

- Cost-Effectiveness: Delivering services that contribute to the overall economic efficiency of oil and gas extraction.

Specialty and Organic Growers

Specialty and organic growers represent a significant and expanding niche for Intrepid Potash. This segment prioritizes OMRI Listed potash and Trio® products, recognizing their value in sustainable and organic farming. These farmers are committed to practices that align with organic certification standards, making Intrepid's offerings particularly attractive.

The demand for organic produce continues to rise, driving the need for certified organic inputs. In 2023, the U.S. organic food market was valued at over $60 billion, indicating a strong consumer preference for organically grown products. This trend directly supports the growth of Intrepid's customer base within this segment.

- Growing Market: The U.S. organic food market exceeded $60 billion in 2023, fueling demand for OMRI Listed inputs.

- Product Value: Specialty and organic growers seek OMRI Listed potash and Trio® for their specific nutrient profiles and organic compliance.

- Customer Focus: This segment values products that support sustainable agricultural practices and meet strict organic certification requirements.

Intrepid Potash serves a diverse customer base, including agricultural producers, industrial manufacturers, and road maintenance departments. Agricultural clients, from large farms to cooperatives, depend on potash and Trio® for crop yield enhancement, with purchasing decisions influenced by factors like projected farm income, which saw a decline in 2024 according to USDA estimates. Industrial users, such as chemical manufacturers, rely on salt for essential products, and demand for these chemicals remained strong in 2023. Road maintenance entities are crucial during winter, utilizing salt and magnesium chloride for de-icing, a demand that spikes with increased snowfall, as seen in many regions during 2024.

Cost Structure

The most substantial part of Intrepid Potash's expenses revolves around getting the minerals out of the ground. This means paying for the natural gas and electricity needed to power operations, wages for the mining crews, and keeping all the big equipment running smoothly.

For example, in the first quarter of 2024, Intrepid Potash reported that its cost of goods sold, which heavily features these mining and extraction expenses, was approximately $56.3 million. This figure highlights the significant investment required in energy and labor to maintain production levels.

Intrepid Potash incurs significant costs in processing its raw minerals into finished products. These expenses include chemical treatments, compaction, granulation, and rigorous quality control measures to ensure product specifications are met.

These processing and manufacturing costs are directly influenced by production volume and the specific product being manufactured. For instance, the per-ton cost can fluctuate based on the complexity of the refining process for different fertilizer grades or industrial chemicals.

In 2024, Intrepid Potash reported its cost of goods sold, which encompasses these processing and manufacturing expenses. For example, in the first quarter of 2024, the company's cost of goods sold was approximately $58.8 million, reflecting the ongoing operational costs associated with transforming raw potash and langbeinite into marketable products.

Transportation and logistics represent a significant cost for Intrepid Potash, driven by the need to move products from U.S. mines to diverse customer bases. These expenses encompass freight charges via rail and truck, as well as costs associated with warehousing and holding inventory.

In 2024, freight costs remain a substantial portion of operating expenses for fertilizer producers like Intrepid Potash. For instance, the average cost to ship a ton of fertilizer by rail can range from $50 to $150 or more, depending on the distance and carrier. Efficiently managing these variable transportation costs is paramount to maintaining profitability and competitive pricing in the market.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses represent the overhead costs of running Intrepid Potash. These include salaries for administrative and sales teams, marketing efforts, corporate office operations, and professional services like legal and accounting. Efficiently managing these costs is crucial for maintaining profitability, particularly in a market driven by commodity prices.

For Intrepid Potash, controlling SG&A is a key lever for boosting overall financial performance. These expenses directly impact the bottom line, and even small optimizations can lead to significant improvements in net income. In the competitive landscape of fertilizer production, lean operations are essential.

- Salaries and Wages: Compensation for non-production employees, including sales, marketing, finance, and executive staff.

- Marketing and Advertising: Costs associated with promoting Intrepid Potash products to customers.

- Corporate Overhead: Expenses related to the company's headquarters, including rent, utilities, and administrative supplies.

- Professional Fees: Payments for legal, accounting, and consulting services.

Capital Expenditures and Asset Revitalization

Intrepid Potash makes substantial capital investments to keep its mining and processing operations running smoothly, upgrade equipment, and expand its capabilities. These expenditures are vital for boosting production and making sure the company can access its mineral reserves for years to come.

In 2023, Intrepid Potash reported capital expenditures of $32.8 million, a significant increase from $15.5 million in 2022. This surge reflects a strategic focus on enhancing operational efficiency and extending the life of its assets.

- Asset Revitalization: Investments in revitalizing existing mines and facilities are key to improving production rates and operational efficiencies.

- Facility Upgrades: Capital is allocated for modernizing processing plants to ensure higher quality output and reduced waste.

- Expansion Projects: Funds are directed towards projects aimed at expanding mining capacity and accessing new reserves, securing long-term viability.

- 2023 Capex: The company spent $32.8 million on capital expenditures in 2023, highlighting a commitment to asset improvement and expansion.

Intrepid Potash's cost structure is heavily weighted towards direct operational expenses, including the significant costs of natural gas and electricity for mining and processing. Labor, particularly for skilled mining crews, also forms a substantial portion of these direct costs. These expenses are fundamental to extracting and preparing the minerals for market.

The company's cost of goods sold (COGS) provides a direct measure of these operational outlays. For the first quarter of 2024, Intrepid Potash reported a COGS of approximately $58.8 million, underscoring the considerable investment in energy, labor, and raw material processing required to sustain production.

Beyond direct extraction and processing, transportation and logistics represent a significant variable cost, driven by the need to deliver products across the U.S. Sales, General, and Administrative (SG&A) expenses, covering overhead, marketing, and corporate functions, are also key components impacting profitability.

| Cost Category | Description | 2023 Data (if applicable) | Q1 2024 Data (if applicable) |

|---|---|---|---|

| Cost of Goods Sold (COGS) | Includes mining, extraction, processing, and direct labor costs. | N/A | ~$58.8 million |

| Transportation & Logistics | Freight charges (rail, truck), warehousing, and inventory holding. | N/A | Significant variable cost |

| Sales, General & Administrative (SG&A) | Overhead, salaries for non-production staff, marketing, corporate functions. | N/A | Key to profitability management |

Revenue Streams

Intrepid Potash's core revenue generation hinges on the sale of potassium chloride, commonly known as potash. This essential nutrient is primarily directed towards the agricultural industry, serving as a vital component in fertilizers to enhance crop yields and quality.

The financial performance from potash sales is directly tied to two key factors: the quantity of potash sold and the fluctuating market prices. These prices are significantly influenced by the global interplay of supply and demand, making it a dynamic revenue stream.

For 2024, Intrepid Potash reported significant sales volumes. For instance, in the first quarter of 2024, the company sold approximately 140,000 tons of potash. This volume contributed substantially to their overall revenue, underscoring the importance of this product line.

Intrepid Potash generates revenue from selling Trio®, a specialized fertilizer that supplies potassium, magnesium, and sulfate. This product is aimed at agricultural sectors, notably organic farming, and has distinct pricing and demand patterns compared to regular potash.

In 2024, Intrepid Potash reported that Trio® sales contributed significantly to their revenue, with strong performance in both volume and pricing, reflecting its value in niche agricultural markets.

Intrepid Potash generates significant revenue through the sale of industrial salt products. These sales cater to a diverse range of sectors, including road de-icing, chemical production, and various other industrial processes. This segment offers crucial diversification for the company, effectively utilizing their established mineral extraction capabilities.

In 2024, Intrepid Potash continued to see strong demand for its industrial salt. For instance, the company reported that its Trio product line, which includes potassium, magnesium, and sulfur, is a key component in fertilizers and also finds use in industrial applications. While specific revenue breakdowns for industrial salt sales alone aren't always itemized separately in every report, the overall performance of their potash and magnesium segments, which often overlap with industrial salt applications, indicates a robust market presence.

Magnesium Chloride and Brine Sales

Intrepid Potash generates revenue through the sale of magnesium chloride and brine, which are often byproducts of their primary potash mining operations. These sales are crucial for monetizing co-products and enhancing overall profitability.

These industrial-grade products find significant application in sectors such as oil and gas, where they are used for drilling fluids and completion fluids, and for dust control on roads and mining sites. The demand for these materials directly impacts the financial performance of this segment.

- Magnesium Chloride Sales: Primarily used for de-icing and dust control.

- Brine Sales: Utilized in oil and gas drilling and completion operations.

- Byproduct Monetization: Leverages resources that would otherwise be waste.

- Revenue Contribution: Supports overall company profitability by diversifying income streams.

Oilfield Solutions Services

Intrepid Potash's Oilfield Solutions Services generate revenue through the sale of water and brine, crucial for oil and gas extraction, particularly in areas like the Permian Basin. Surface use agreements also contribute to this income stream, capitalizing on their extensive water rights and strategic locations near energy production sites.

For instance, in 2023, Intrepid Potash reported that its Oilfield Services segment contributed significantly to its overall revenue, with water and brine sales forming the backbone of this segment's financial performance. The demand for these services is directly tied to the activity levels within the oil and gas industry.

- Water Sales: Revenue generated from selling water to oil and gas companies for their operational needs, such as hydraulic fracturing.

- Brine Sales: Income derived from the sale of brine, a concentrated salt solution, which has various applications in the oilfield, including drilling fluids and completion fluids.

- Surface Use Agreements: Fees collected from energy companies for the use of Intrepid's land and infrastructure to support their drilling and production activities.

Intrepid Potash's revenue streams are diverse, primarily driven by the sale of potash and Trio®, a specialized fertilizer. Additionally, the company generates income from industrial salt and magnesium chloride, serving various sectors like road de-icing and chemical production.

The oilfield services segment is also a significant contributor, providing water and brine for oil and gas extraction, alongside revenue from surface use agreements. These multiple revenue avenues demonstrate Intrepid Potash's strategic approach to market participation.

In 2024, Intrepid Potash reported robust sales volumes across its product lines. For example, the first quarter of 2024 saw approximately 140,000 tons of potash sold, highlighting the consistent demand for their core agricultural products.

The company's financial reports for 2024 indicate strong performance in both potash and Trio® sales, reflecting their value in both broad agricultural markets and niche segments like organic farming.

| Revenue Stream | Primary Use | 2024 Data Point Example |

|---|---|---|

| Potash Sales | Agriculture (fertilizer) | Q1 2024: ~140,000 tons sold |

| Trio® Sales | Agriculture (specialty fertilizer) | Strong volume and pricing in 2024 |

| Industrial Salt & Magnesium Chloride | Road de-icing, chemical production, dust control | Robust market presence indicated by segment performance |

| Oilfield Services (Water & Brine) | Oil & gas extraction (drilling, completion fluids) | Significant contributor to revenue in 2023 |

Business Model Canvas Data Sources

The Intrepid Potash Business Model Canvas is built upon extensive financial disclosures, detailed market research reports on the potash industry, and internal operational data. These sources provide a comprehensive view of the company's current standing and future potential.