Intrepid Potash Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intrepid Potash Bundle

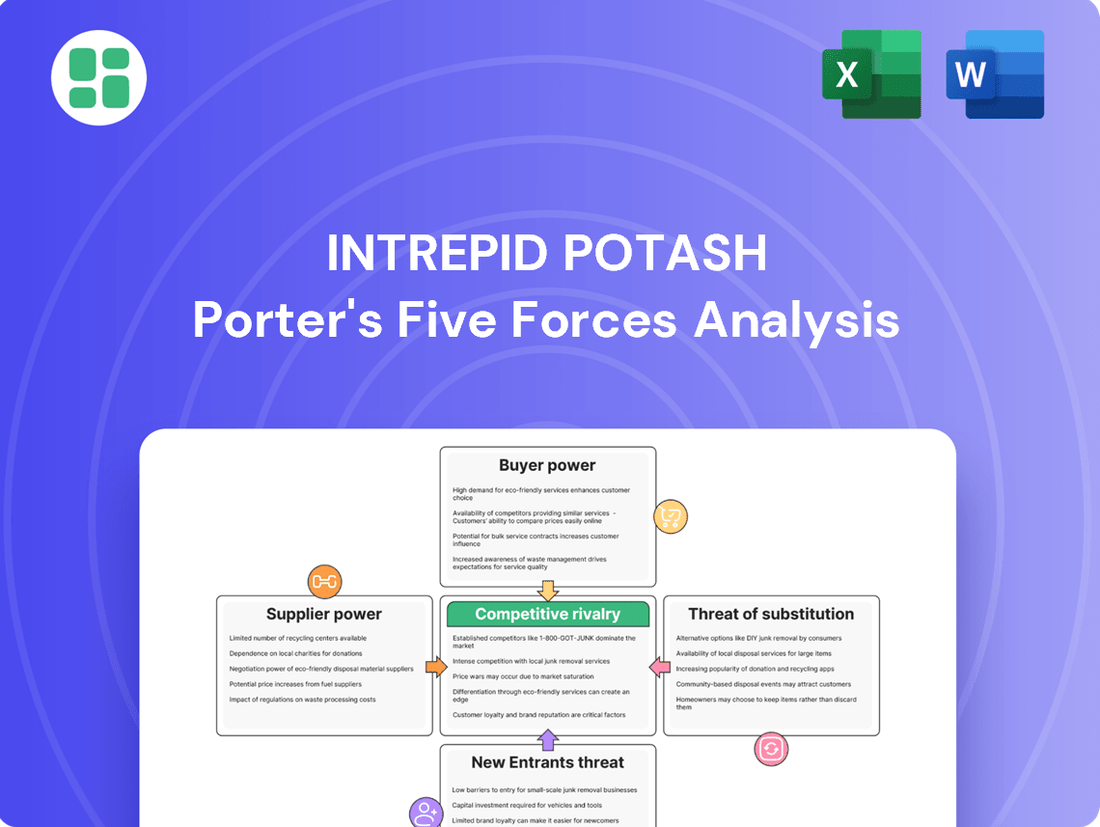

Intrepid Potash faces a dynamic competitive landscape shaped by significant buyer power and the threat of substitutes in the fertilizer market. Understanding these forces is crucial for any stakeholder aiming to navigate this industry effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Intrepid Potash’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Intrepid Potash's direct control over its primary raw material, potash ore, extracted from its own U.S. facilities, significantly diminishes the bargaining power of external raw material suppliers. This vertical integration means the company isn't reliant on third-party miners for its core input.

However, this advantage is tempered by the substantial fixed costs inherent in mining operations. Intrepid Potash must invest heavily in machinery, infrastructure, and ongoing maintenance, which represents a significant capital outlay. For instance, in 2023, the company reported capital expenditures of $38.6 million, reflecting these ongoing investments.

Suppliers of specialized mining equipment, maintenance services, and essential energy like electricity and fuel hold a degree of influence over Intrepid Potash. This is largely because the mining industry is inherently capital-intensive, requiring significant investment in specialized machinery and ongoing operational inputs. The global mining equipment market was projected to reach approximately $230 billion in 2024, highlighting consistent demand for such specialized assets.

Energy costs represent a substantial portion of Intrepid's operational expenditures. In 2024, electricity prices for industrial users in the United States saw an average increase, making companies like Intrepid Potash susceptible to volatility in energy markets and the bargaining power of energy providers.

The availability of skilled labor for mining operations, particularly in the specific geographic regions where Intrepid Potash operates within the US, can significantly influence supplier power. Specialized skills are often needed for efficient potash extraction and processing.

These specialized skill requirements can grant labor a degree of bargaining power, potentially affecting wage costs and overall operational efficiency for companies like Intrepid Potash. In 2024, the US mining sector experienced varying labor availability depending on the region and specific skill sets required.

Labor availability and associated costs are therefore critical considerations for ensuring the continuous operation and profitability of potash mines. Fluctuations in the labor market, including wage pressures, directly impact the cost structure for producers.

Limited Alternative Input Sources

While Intrepid Potash primarily mines its own potash, the specialized chemicals and components needed for its beneficiation processes can come from a limited number of suppliers. This scarcity can give these specific suppliers a degree of bargaining power, particularly if the costs associated with switching suppliers or the risks of supply chain interruptions are substantial. For instance, unique processing agents required for Intrepid's distinct product lines, such as Trio and brine, might only be available from a select few manufacturers.

- Limited Supplier Options: The specialized nature of certain chemicals and components essential for potash beneficiation means fewer suppliers are available.

- Supplier Leverage: This limited availability grants suppliers more influence, especially when switching costs or supply chain vulnerabilities are high.

- Product-Specific Needs: Intrepid's unique product portfolio, including Trio and brine, necessitates specific processing agents, further concentrating supplier options.

- Potential Cost Impact: Dependence on a few specialized suppliers can lead to higher input costs for Intrepid Potash if these suppliers choose to exercise their bargaining power.

Geographic Concentration of Operations

Intrepid Potash's operations are exclusively located within the United States. This US-centric approach offers a degree of protection from the volatility of global supply chains and international political tensions. However, it also concentrates Intrepid's reliance on the domestic regulatory landscape and infrastructure for securing essential raw materials and services.

This geographic concentration can narrow the pool of available suppliers for critical inputs, potentially amplifying the bargaining power of those regional suppliers. For instance, if a specific mining equipment supplier or a transportation service has a limited presence in Intrepid's operating regions, they may be able to command higher prices or dictate more favorable terms.

- US Operations: Intrepid Potash's sole operational base is in the United States, mitigating exposure to global geopolitical supply chain disruptions.

- Supplier Dependency: The company's US focus creates a reliance on local regulatory frameworks and infrastructure for sourcing essential inputs.

- Regional Supplier Power: Limited supplier diversity within its operating regions can enhance the bargaining leverage of domestic suppliers for services and materials.

While Intrepid Potash mines its own potash, suppliers of specialized mining equipment, maintenance, and energy hold significant sway. The capital-intensive nature of mining means these suppliers are crucial, and their pricing power is amplified by the high costs associated with acquiring and maintaining specialized machinery. For instance, the global mining equipment market was valued at approximately $230 billion in 2024, underscoring the importance of these suppliers.

Energy costs, particularly electricity and fuel, represent a substantial operational expense for Intrepid Potash. In 2024, industrial electricity prices in the U.S. saw an average increase, directly impacting Intrepid's cost structure and giving energy providers greater leverage. Furthermore, the availability of skilled labor in specific U.S. mining regions can influence wage negotiations, as specialized skills are vital for efficient potash extraction and processing.

The bargaining power of suppliers is also influenced by the limited availability of certain specialized chemicals and components used in Intrepid's beneficiation processes. For unique product lines like Trio and brine, dependence on a few manufacturers can grant these suppliers considerable leverage, especially if switching costs or supply chain risks are high. This concentration of suppliers for niche inputs can lead to increased input costs for Intrepid Potash.

| Factor | Impact on Intrepid Potash | Supporting Data (2024 Estimates/Trends) |

| Specialized Mining Equipment Suppliers | High Bargaining Power due to specialized nature and capital intensity of mining. | Global mining equipment market projected at ~$230 billion. |

| Energy Providers (Electricity, Fuel) | Moderate to High Bargaining Power due to essential operational input and price volatility. | U.S. industrial electricity prices showed an upward trend. |

| Skilled Labor | Moderate Bargaining Power, particularly in specific U.S. mining regions, impacting wage costs. | Labor availability varied by region and skill set in the U.S. mining sector. |

| Specialized Chemical/Component Suppliers | Moderate to High Bargaining Power due to limited options for unique beneficiation inputs. | Dependence on few manufacturers for specific product lines (e.g., Trio, brine). |

What is included in the product

This analysis delves into the competitive landscape for Intrepid Potash, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the potash industry.

Intrepid Potash's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, perfect for quick strategic decision-making and identifying key pain points in the potash market.

Customers Bargaining Power

Intrepid Potash's diverse customer base, spanning agriculture, industrial applications, and animal feed, significantly dilutes the bargaining power of individual customers. This broad market reach ensures that no single customer or customer segment holds a dominant position, preventing any one entity from dictating terms or demanding unfavorable pricing. For example, in 2023, Intrepid Potash's sales were spread across these various sectors, with no single sector representing an overwhelming majority of revenue, thereby limiting the leverage of any particular buyer.

Farmers and agricultural distributors, while needing potash for optimal crop yields, often demonstrate significant price sensitivity. This is particularly true when agricultural commodity prices experience volatility, directly impacting their own profitability and ability to invest in inputs like fertilizers. For instance, in 2024, the average price of corn, a key crop, saw fluctuations that directly correlated with farmers' purchasing power for essential nutrients.

The affordability of fertilizers remains a critical factor influencing how much farmers choose to apply to their fields. When fertilizer costs rise disproportionately to crop prices, farmers may reduce application rates, thereby exerting downward pressure on potash prices. This dynamic highlights the bargaining power of customers in the agricultural sector, as their purchasing decisions are heavily tied to economic realities on the farm.

For Intrepid Potash, the bargaining power of customers is significantly influenced by the critical nature of its products. In the agricultural sector, for instance, the consistent quality, reliability, and punctual delivery of potash are paramount. Farmers depend on these inputs for crop health and yield, making them less inclined to switch suppliers solely on minor price fluctuations if Intrepid Potash demonstrates strong product dependability.

Availability of Substitutes Impacts Customer Leverage

The availability of substitutes significantly amplifies customer bargaining power for companies like Intrepid Potash. When customers have numerous alternative products to choose from, whether for fertilizer applications or de-icing purposes, they can readily switch if pricing or terms become unfavorable. This ease of substitution directly translates into greater leverage for customers during price negotiations.

For instance, in the agricultural sector, while potash is a vital nutrient, farmers can explore other fertilizer options or adjust their nutrient management strategies if potash prices become prohibitive. Similarly, in the de-icing market, alternatives like calcium chloride or magnesium chloride exist, providing consumers with choices. This competitive landscape means Intrepid Potash must remain competitive on price and value to retain its customer base.

In 2024, the global fertilizer market, a key segment for Intrepid Potash, continued to see price volatility influenced by supply chain dynamics and demand from major agricultural regions. For example, while potash prices experienced fluctuations, the availability of nitrogen and phosphate fertilizers, alongside organic alternatives, provided farmers with a degree of choice. This constant presence of alternatives underscores the inherent bargaining power customers wield.

- Increased Customer Leverage: The presence of multiple substitute products grants customers the ability to switch easily, thereby increasing their bargaining power.

- Price Sensitivity: Customers can leverage the availability of alternatives to negotiate lower prices or demand better terms from Intrepid Potash.

- Market Dynamics: The agricultural and de-icing sectors, where Intrepid Potash operates, feature a range of competing products, from other mineral fertilizers to chemical and organic alternatives.

- Competitive Pressure: Intrepid Potash faces continuous pressure to maintain competitive pricing and product quality to counteract the bargaining power of its customers, who have readily available substitutes.

Geographic Proximity and Logistics

Intrepid Potash's US-based production facilities offer a significant logistical advantage to domestic customers. This proximity can translate into lower transportation costs and more reliable, quicker delivery times compared to sourcing potash from overseas. For instance, in 2024, domestic fertilizer markets often prioritize suppliers who can ensure timely delivery to meet seasonal planting demands, making Intrepid's location a key selling point.

However, the bargaining power of large-scale agricultural operations or industrial users with sophisticated logistics capabilities remains. These entities may still leverage their scale and established supply chains to negotiate competitive pricing, even if it means sourcing from international suppliers with potentially longer lead times. This dynamic means that while geographic proximity offers a tangible benefit, it doesn't entirely negate the influence of price-sensitive, high-volume buyers.

- Logistical Advantage: Intrepid's US locations reduce shipping costs and delivery times for domestic buyers.

- Market Preference: Proximity fosters a preference, especially for customers prioritizing timely deliveries in 2024.

- Customer Bargaining Power: Large buyers with strong logistics can still negotiate based on price, even with international options.

Intrepid Potash faces moderate bargaining power from its customers due to the essential nature of potash and the presence of alternatives. While farmers need potash for crop yields, they can adjust application rates or use substitute fertilizers if prices become too high, as seen with fluctuating corn prices impacting farmer purchasing power in 2024.

The de-icing market also presents alternatives like calcium chloride, allowing buyers to switch if Intrepid's pricing is not competitive. This means Intrepid must balance its logistical advantages with market realities to maintain its customer base.

| Customer Segment | Key Bargaining Factors | Impact on Intrepid Potash |

|---|---|---|

| Agriculture | Price sensitivity, availability of substitutes (other fertilizers), crop prices | Moderate pressure on pricing, potential for reduced application rates |

| Industrial/De-icing | Availability of substitutes (calcium chloride, magnesium chloride), price competition | Need for competitive pricing and value proposition |

Full Version Awaits

Intrepid Potash Porter's Five Forces Analysis

This preview displays the complete Intrepid Potash Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. You are viewing the exact document you will receive immediately after purchase, ensuring there are no surprises or placeholder content. This professionally formatted analysis is ready for your immediate use, providing actionable insights into the industry's dynamics.

Rivalry Among Competitors

The US potash market is quite concentrated, with Intrepid Potash standing as a significant domestic producer. It competes directly with giants like Nutrien and Mosaic, who also hold substantial market presence in the United States. This limited number of major domestic players often fuels a fierce rivalry, especially concerning pricing strategies and efforts to capture a larger share of the US market.

Intrepid Potash's core products, including potash, salt, and magnesium chloride, are fundamentally commodity items. This lack of distinctiveness makes it difficult to stand out based on product features, which in turn fuels intense price competition. Customers frequently prioritize cost and immediate availability, placing significant pressure on Intrepid's profit margins.

The potash mining sector, including companies like Intrepid Potash, operates with substantial fixed costs related to plant and equipment. This necessitates high production volumes to spread these costs and achieve profitability. In 2023, Intrepid Potash reported total operating costs of $243.3 million. This high cost structure inherently pressures companies to maintain high capacity utilization.

When demand softens or the industry experiences oversupply, this pressure to utilize capacity can intensify competitive rivalry. Companies may resort to more aggressive pricing to move inventory, even if it erodes margins. For instance, a slowdown in agricultural demand, a key driver for potash, can quickly lead to a price war among producers seeking to maintain sales volumes.

Global Market Dynamics Influence Domestic Prices

While Intrepid Potash primarily serves the U.S. market, it's not immune to global influences. International supply and demand for potash and fertilizers significantly shape domestic pricing. For instance, major global producers increasing their output can put downward pressure on prices within the U.S., intensifying competition.

Geopolitical events also play a crucial role. Disruptions in key exporting regions or changes in trade policies can alter global supply chains, leading to price volatility that affects U.S. producers like Intrepid. This interconnectedness means even a U.S.-focused company must monitor worldwide market shifts.

- Global Production Impact: Increased production from international competitors, such as those in Canada and Russia, can lead to lower global prices, which then filter into the U.S. market.

- Geopolitical Factors: Trade disputes or political instability in major potash-producing nations can disrupt supply, causing price spikes that benefit domestic producers temporarily.

- Fertilizer Demand: Overall global agricultural output and demand for fertilizers directly influence potash prices, impacting Intrepid's operating environment.

Diversification into Other Products

Intrepid Potash's move into salt, magnesium chloride, and brine production serves as a strategic buffer against intense rivalry in the potash market. By diversifying, Intrepid spreads its revenue across different product lines, lessening its sole reliance on potash prices and demand. This diversification allows the company to tap into various market dynamics, potentially offsetting downturns in one sector with stability or growth in another.

However, this diversification doesn't eliminate competitive pressures; it merely shifts them. Each new market Intrepid enters—salt, magnesium chloride, and brine—possesses its own unique set of competitors and market characteristics. For instance, the salt market is highly competitive with numerous global and regional players, while the magnesium chloride market might see different competitive dynamics depending on the end-use application, such as de-icing or industrial uses.

- Diversification Strategy: Intrepid Potash's expansion into salt, magnesium chloride, and brine aims to reduce reliance on the volatile potash market.

- Market Dynamics: Each of these new product markets presents its own competitive landscape, requiring tailored strategies for market penetration and retention.

- Competitive Landscape Examples: The salt market is broadly competitive, while magnesium chloride markets can vary based on specific end-use applications.

- Mitigation of Rivalry: While spreading revenue streams, diversification necessitates navigating distinct competitive rivalries in each product segment.

The competitive rivalry within the U.S. potash market is intense, driven by a concentrated industry structure and the commodity nature of its primary product. Intrepid Potash faces direct competition from major players like Nutrien and Mosaic, who also have a significant presence domestically. This limited number of large competitors often leads to aggressive pricing strategies as each seeks to gain market share.

High fixed costs associated with production, exemplified by Intrepid's 2023 operating costs of $243.3 million, compel companies to maintain high capacity utilization. This pressure can exacerbate rivalry, especially during periods of softened demand or oversupply, potentially triggering price wars to move inventory.

Intrepid's diversification into salt and magnesium chloride offers a strategic advantage by reducing its sole dependence on potash. However, these new markets also present their own competitive challenges, requiring Intrepid to navigate distinct rivalries in each segment.

| Competitor | Primary Products | U.S. Market Presence |

|---|---|---|

| Nutrien | Potash, Nitrogen, Phosphate, Crop Protection | Significant Producer and Distributor |

| Mosaic | Potash, Phosphate | Significant Producer and Distributor |

| Intrepid Potash | Potash, Salt, Magnesium Chloride | Domestic Producer |

SSubstitutes Threaten

While nitrogen and phosphorus fertilizers aren't direct replacements for potassium in crop nutrition, their pricing and the overall cost of nutrient application can sway farmers' choices regarding potash. For instance, if the cost of applying a full nutrient package increases significantly due to potash prices, farmers might re-evaluate their overall fertilization strategy, potentially impacting potash demand.

Emerging alternatives like bio-potash and natural minerals such as glauconite are showing promise, but their large-scale commercial viability and widespread adoption are still in early stages. As of early 2024, the market for these bio-based or naturally occurring potassium sources remains relatively niche compared to traditional mined potash, with adoption rates heavily dependent on cost-effectiveness and proven efficacy in diverse agricultural settings.

The growing interest in organic farming and sustainable agriculture presents a potential threat to Intrepid Potash. As consumers increasingly seek organic produce, there's a corresponding rise in demand for natural or organically sourced fertilizers, which could serve as substitutes for conventional potash. This shift, while still developing, encourages alternatives to synthetic nutrient production.

For industrial and de-icing purposes, Intrepid Potash faces competition from substitutes like calcium chloride, urea, and sand. These alternatives offer different performance characteristics and environmental profiles, directly impacting the threat of substitution for Intrepid's non-potash offerings in these markets.

Technological Advancements in Agriculture

Technological advancements in agriculture, particularly in precision farming and nutrient management, present a growing threat of substitutes for traditional fertilizer use, including potash. These innovations allow farmers to apply nutrients more precisely, matching crop needs at specific growth stages and locations. This optimization can reduce the overall volume of fertilizer required per acre, thereby dampening demand for products like potash. For instance, the adoption of sensor technology and variable rate application systems, which were gaining traction significantly in 2024, enables farmers to apply fertilizers only where and when they are most needed, leading to increased efficiency and potentially lower overall consumption. This rise in efficiency effectively acts as a substitute by diminishing the necessity for larger quantities of conventional fertilizers.

The impact of these technologies is not about replacing potash with an entirely different product, but rather about making the existing use of potash more efficient. This efficiency gain can slow down demand growth for potash producers. As of 2024, the global precision agriculture market was projected to reach over $10 billion, indicating a substantial and growing investment in these technologies. This trend suggests that the threat of substitution through enhanced efficiency will likely intensify.

- Precision agriculture technologies enable more targeted fertilizer application, reducing overall potash needs.

- Nutrient management advancements optimize existing fertilizer use, acting as an indirect substitute.

- The global precision agriculture market's growth in 2024 signals increasing adoption of efficiency-boosting technologies.

- Optimized nutrient use can dampen demand growth for potash producers by reducing per-acre requirements.

Cost-Effectiveness and Performance of Substitutes

The threat of substitutes for potash is significantly influenced by the cost-effectiveness and performance of alternative nutrient sources. If other fertilizers can provide comparable crop yields at a lower price or with a reduced environmental footprint, farmers may shift away from potash. This can directly impact Intrepid Potash's market share and its ability to command premium pricing.

For instance, while potash is crucial for plant health, other sources of potassium exist. These include potassium chloride (the most common form), potassium sulfate, and even organic sources like wood ash, though their widespread application can be limited by cost, availability, or nutrient balance. In 2024, the global average price for Muriate of Potash (MOP), the primary potash product, remained a key consideration for agricultural buyers. Fluctuations in MOP prices, driven by supply and demand dynamics, directly affect the attractiveness of these substitutes.

- Cost-Effectiveness: The price per unit of potassium delivered to the soil is a primary determinant. Lower-priced substitutes, even if slightly less efficient, can attract price-sensitive farmers.

- Performance Parity: Substitutes must offer comparable benefits in terms of crop yield, quality, and plant resilience to be considered viable alternatives.

- Environmental Considerations: Growing concerns about soil health and environmental impact might favor substitutes perceived as more sustainable, even if initially more expensive.

- Availability and Logistics: The ease of sourcing and applying alternative potassium sources plays a role in their adoption rate.

While direct chemical substitutes for potassium in plant nutrition are limited, the threat of substitutes for Intrepid Potash arises from alternative approaches to crop management and nutrient delivery. Advancements in precision agriculture, which allow for more efficient application of existing fertilizers, effectively reduce the overall volume of potash needed per acre. Furthermore, shifts towards organic farming encourage the use of naturally sourced fertilizers, which can displace conventional potash use in certain market segments.

The competitive landscape for Intrepid Potash's non-potash products, such as those used for de-icing, includes readily available substitutes like calcium chloride and urea. These alternatives offer varying performance characteristics and cost structures, directly impacting the substitutability in industrial applications. For example, as of early 2024, the cost and environmental impact of de-icing agents were key factors influencing market choices.

Emerging bio-potash and natural mineral sources are also developing as potential substitutes, though their large-scale commercial viability and widespread adoption were still in nascent stages in early 2024. The market penetration of these alternatives is heavily contingent on their cost-effectiveness and proven efficacy compared to traditional potash.

The overall threat of substitutes is underscored by the constant evaluation of cost-effectiveness and performance by farmers. If alternative potassium sources or improved nutrient management strategies offer comparable or superior results at a lower cost or with a reduced environmental impact, Intrepid Potash faces a tangible risk of demand erosion. For instance, the price of Muriate of Potash (MOP) in 2024 remained a critical factor for agricultural buyers when considering alternative nutrient inputs.

Entrants Threaten

The potash and mineral mining sector demands enormous upfront capital for exploration, mine development, and processing infrastructure. For instance, developing a new potash mine can easily cost billions of dollars, making it a formidable hurdle for aspiring companies. This substantial financial commitment significantly deters most potential new entrants from entering the market.

New potash mining ventures in the United States confront a labyrinth of intricate and time-consuming regulatory approval processes. These typically involve comprehensive environmental impact assessments and the acquisition of numerous permits, creating significant barriers to entry.

While the current administration has expressed an intention to expedite permitting for crucial minerals such as potash, the substantial obstacles inherent in these procedures persist. For example, securing all necessary federal and state approvals can take many years, often exceeding a decade.

These extensive regulatory complexities, coupled with the considerable time investment required to navigate them, act as a powerful deterrent for potential new entrants into the domestic potash market.

The threat of new entrants in the potash market, specifically concerning limited access to reserves, is a significant barrier. Economically viable potash deposits are scarce, particularly in the United States where Intrepid Potash is a key player. Established companies already control most of the high-quality mining sites, making it exceedingly difficult for newcomers to secure the necessary land and resources to begin operations.

Established Distribution Channels and Customer Relationships

Established players like Intrepid Potash benefit from deeply entrenched distribution channels, making it challenging for newcomers to gain market access. Building these networks, which connect producers to agricultural distributors, industrial clients, and animal feed manufacturers, requires substantial investment and time. For instance, in 2024, Intrepid Potash's established logistics and customer base provided a significant competitive advantage, as new entrants would need to replicate this infrastructure and foster trust over many years.

The threat of new entrants is therefore moderated by the high cost and time required to establish comparable distribution and customer relationships. Newcomers face the hurdle of not only producing potash but also efficiently getting it to market and building the necessary trust with buyers. This barrier is particularly significant in an industry where reliable supply and established partnerships are crucial for success.

- High Capital Investment: New entrants need substantial capital for building logistics and distribution infrastructure.

- Long Sales Cycles: Establishing relationships with large agricultural and industrial customers takes considerable time.

- Brand Loyalty and Trust: Existing players have built trust, making it difficult for new brands to penetrate the market.

- Regulatory Hurdles: Navigating complex regulations for distribution can also be a barrier for new companies.

Technological Expertise and Operational Know-How

The threat of new entrants into the potash market, specifically concerning technological expertise and operational know-how, is significantly mitigated by the inherent complexities of the industry. Potash extraction and processing are not simple operations; they demand a deep understanding of geological surveys, mining techniques, and sophisticated chemical processing. For instance, Intrepid Potash, a key player, utilizes both conventional underground mining and solution mining, each requiring distinct and specialized knowledge bases.

Developing this level of expertise is a substantial hurdle for any potential new competitor. It involves not only acquiring the technical skills but also the practical, on-the-ground operational experience that comes from years of managing complex mining and processing facilities. This learning curve can be both time-consuming and incredibly expensive, creating a substantial barrier to entry.

Consider the capital investment alone. Beyond the initial plant and equipment, the cost of training and retaining a skilled workforce capable of navigating the intricacies of potash production is immense.

- Specialized Knowledge: Potash mining requires expertise in geology, engineering, and chemical processing.

- Operational Experience: Years of hands-on experience are crucial for efficient and safe production.

- High Capital Investment: Acquiring technology and training personnel demands significant financial resources.

- Regulatory Compliance: Navigating environmental and safety regulations adds another layer of complexity for new entrants.

The threat of new entrants in the potash sector remains relatively low due to substantial capital requirements and regulatory complexities. New mine development costs can run into billions, and securing permits, even with expedited intentions, can take over a decade. These factors, combined with established players controlling prime reserves, create significant barriers for newcomers in 2024.

Porter's Five Forces Analysis Data Sources

Our Intrepid Potash Porter's Five Forces analysis is built upon a foundation of reliable data, including SEC filings, annual reports, and industry-specific market research from firms like IBISWorld. This ensures a comprehensive understanding of the competitive landscape.