Intrepid Potash Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intrepid Potash Bundle

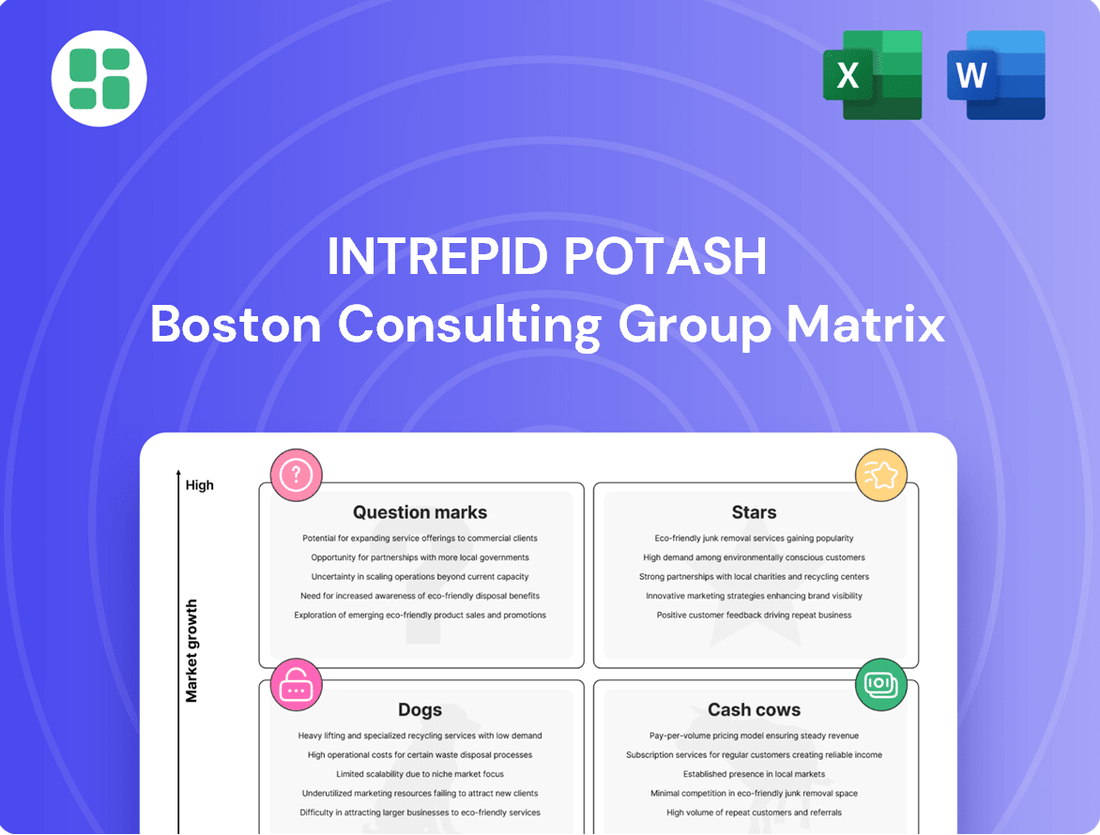

Intrepid Potash's position within the BCG Matrix offers a fascinating glimpse into its product portfolio's performance and potential. Understanding whether its key products are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making.

This preview highlights the foundational insights into Intrepid Potash's market standing, but to truly unlock actionable strategies, you need the complete picture. Dive deeper into the full BCG Matrix to gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Intrepid Potash stands as the only U.S. producer of muriate of potash, a critical nutrient for agriculture. This unique position gives them a substantial edge in the domestic market, especially due to their proximity to major farming regions, reducing transportation costs and delivery times. In 2024, the company continued to focus on enhancing its production capabilities, aiming to capitalize on the steady demand for potash.

The global potash market is on a strong upward trajectory, with projections indicating a compound annual growth rate (CAGR) between 3.5% and 4.89% from 2025 through 2034. This expansion is primarily fueled by the escalating demand for food worldwide and the continuous need to boost agricultural yields.

Intrepid Potash's strategic decision to increase its potash production in 2024, with further growth anticipated for 2025 and 2026, directly mirrors this robust market expansion. This proactive approach positions Intrepid favorably within a sector that is experiencing significant and sustained growth, reinforcing its status as a Star in the BCG Matrix.

Intrepid's Trio® specialty fertilizer, a unique blend of potassium, magnesium, and sulfate, has demonstrated exceptional market performance. In 2024, the company reported record sales volumes for Trio®, supported by robust pricing power. This success positions Trio® as a key growth driver for Intrepid Potash.

The potassium sulfate segment, where Trio® plays a significant role, is projected to be a leading growth area within the overall potash market. This favorable market outlook, coupled with Trio®'s strong sales and pricing achievements in 2024, clearly designates it as a Star in Intrepid Potash's portfolio.

Operational Efficiency Improvements

Intrepid Potash has made notable strides in enhancing its operational efficiency, directly impacting its unit economics. The company reported a reduction in its cost of goods sold per ton of potash in the fourth quarter of 2024 and continued this trend into the first quarter of 2025.

These improvements are crucial for maintaining competitiveness and profitability. By controlling production costs, Intrepid Potash strengthens its margins, which in turn fuels robust cash generation from its core products where it holds a significant market share. This focus on efficiency underpins the company's ability to sustain growth and reinforce its market leadership position.

- Reduced Production Costs: Potash cost of goods sold per ton saw a decrease in Q4 2024 and Q1 2025.

- Enhanced Margins: Operational efficiencies directly contribute to improved profit margins.

- Strong Cash Generation: Cost controls support consistent cash flow from high-market-share products.

- Sustained Growth: Efficiency gains enable the company to maintain market leadership and pursue growth.

Strategic Asset Revitalization

Intrepid Potash has strategically focused on revitalizing its potash assets over the last two years. This has resulted in a notable increase in production volumes and a reduction in emissions intensity. These investments are geared towards boosting future production capacity and improving unit economics, solidifying the long-term viability and growth of their core potash offerings.

- Asset Revitalization: Intrepid's commitment to enhancing its potash facilities is a key driver of its current performance.

- Production Growth: The company reported a significant increase in potash sales volumes in 2023, demonstrating the success of its revitalization efforts.

- Efficiency Gains: Investments have also targeted improved operational efficiency, contributing to a lower emissions intensity per ton of product.

- Strategic Positioning: These actions reinforce Intrepid's position as a Star in the BCG matrix, with strong market growth and a dominant market share in its specialized segments.

Intrepid Potash's core potash business, benefiting from strong market demand and the company's unique position as the sole U.S. producer, clearly aligns with the 'Star' quadrant of the BCG Matrix. The company's strategic focus on increasing production capacity and enhancing operational efficiencies in 2024 and into 2025 further solidifies this classification, as it capitalizes on a growing market with a dominant market share.

The Trio® specialty fertilizer is also a standout performer, demonstrating exceptional sales growth and pricing power in 2024. This product's success within the high-growth potassium sulfate market positions it as a key 'Star' within Intrepid's portfolio, contributing significantly to the company's overall strong performance.

Intrepid Potash's strategic investments in revitalizing its potash assets over the past two years have yielded tangible results, including increased production volumes and improved cost efficiencies. These efforts, evident in reduced cost of goods sold per ton in late 2024 and early 2025, underscore the company's commitment to maintaining its leadership in a growing market, reinforcing its 'Star' status.

| Product/Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Potash (Muriate of Potash) | Strong (3.5%-4.89% CAGR projected 2025-2034) | Dominant (Sole U.S. producer) | Star |

| Trio® Specialty Fertilizer | Strong (Potassium sulfate segment leading growth) | Significant (Record sales volumes in 2024) | Star |

What is included in the product

The Intrepid Potash BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear visual mapping of Intrepid Potash's business units, instantly clarifying strategic priorities.

This BCG Matrix provides a focused, actionable overview, eliminating confusion about portfolio performance.

Cash Cows

Intrepid Potash benefits from its deeply rooted presence and developed infrastructure within the U.S. fertilizer sector. This long-standing position underpins its capacity for generating steady cash flows, even as the broader potash market experiences growth.

The company's mature operational framework ensures dependable revenue streams from its established customer base. For instance, in 2023, Intrepid Potash reported total revenue of $249.5 million, demonstrating the consistent financial performance derived from its core U.S. operations. This predictable cash generation is a hallmark of a cash cow.

Intrepid Potash's core Muriate of Potash (MOP) and Trio® fertilizer segments are true cash cows, consistently producing substantial cash flow even when the market experiences ups and downs. These products are the bedrock of the company's financial stability, allowing them to generate significant earnings from established operations.

The company's financial performance, particularly in recent quarters of 2024, highlights this cash-generating power. For instance, Intrepid reported strong adjusted EBITDA figures, reaching $30 million in the first quarter of 2024, and robust cash flow from operations, demonstrating their capacity to effectively 'milk' these mature business lines for capital. This consistent financial strength from their established products underpins their position in the BCG matrix.

Intrepid Potash leverages its leadership in solar evaporation for potash production, a method that inherently yields lower operating costs and a reduced environmental footprint compared to conventional mining. This cost advantage is a cornerstone of its Cash Cow status within the BCG Matrix, allowing for substantial profit margins.

This efficiency translates directly into robust cash flow from its primary fertilizer operations. In 2024, Intrepid Potash reported strong performance in its potash segment, driven by favorable market conditions and its cost-competitive production methods, underscoring its position as a reliable cash generator for the company.

Strong Balance Sheet and Liquidity

Intrepid Potash demonstrates financial strength with a robust balance sheet and ample liquidity. This allows them to comfortably fund daily operations, service existing debt obligations, and explore growth opportunities without undue financial strain.

The company’s consistent cash flow, primarily generated from its core fertilizer sales, significantly bolsters this financial stability. This consistent generation means Intrepid Potash can maintain efficient operations without needing to heavily rely on outside funding sources.

- Financial Stability: Intrepid Potash’s strong balance sheet and liquidity position are key indicators of its financial health.

- Operational Funding: This stability enables the company to self-fund its operations and manage debt effectively.

- Strategic Pursuits: It also provides the capacity to invest in strategic initiatives and future growth.

- Reduced External Reliance: Consistent cash generation from fertilizer sales minimizes the need for external financing, enhancing financial independence.

Supportive Agricultural Demand

The agricultural sector's fundamental need for crop nutrients forms a bedrock of consistent revenue for Intrepid Potash. This demand, though experiencing some cyclicality, remains robust due to the ongoing global requirement for fertilizers to sustain food production. In 2024, the global fertilizer market was valued at approximately $250 billion, underscoring the sheer scale of this essential industry.

This steady demand translates into significant cash-generating stability for Intrepid. Their core products, potash and magnesium chloride, are vital inputs for farmers. For instance, U.S. farmers planted an estimated 87.6 million acres of corn in 2024, a crop with substantial nutrient requirements, directly benefiting potash producers like Intrepid.

- Stable Revenue Base: Agriculture's consistent need for crop nutrients provides a reliable income stream.

- Global Food Production Driver: Fertilizers are essential for meeting worldwide food demand, ensuring market relevance.

- Cash Flow Stability: The predictable nature of this demand contributes to Intrepid's strong cash generation.

- Market Size: The global fertilizer market's significant valuation highlights the importance of this sector.

Intrepid Potash's core fertilizer products, particularly muriate of potash and Trio®, function as its cash cows. These segments are characterized by mature operations and a stable market demand, allowing them to generate consistent and substantial cash flows. This reliability is crucial for funding other business areas and providing overall financial stability.

The company's established infrastructure and customer relationships in the U.S. fertilizer market further solidify the cash cow status of these segments. For example, Intrepid reported $249.5 million in total revenue for 2023, with its potash operations being a significant contributor. This consistent revenue generation from established products allows Intrepid to effectively leverage these mature assets.

Intrepid Potash's efficient solar evaporation production method contributes to lower operating costs, enhancing the profitability of its core fertilizer business. This cost advantage, coupled with steady demand from agriculture, ensures these segments remain strong cash generators. In Q1 2024, Intrepid reported $30 million in adjusted EBITDA, demonstrating the ongoing cash-generating power of its mature operations.

The company's financial performance in 2024, including strong cash flow from operations, underscores the cash cow nature of its potash and Trio® segments. These segments consistently deliver earnings that support the company's financial independence and strategic flexibility, minimizing reliance on external funding.

| Segment | Role in BCG Matrix | Key Characteristics | 2023 Revenue Contribution (Est.) | 2024 Outlook |

|---|---|---|---|---|

| Muriate of Potash (MOP) | Cash Cow | Mature market, stable demand, established infrastructure | Significant contributor to $249.5M total revenue | Continued steady cash flow |

| Trio® Fertilizer | Cash Cow | Unique product, consistent demand, cost-efficient production | Steady revenue stream | Reliable earnings generator |

Preview = Final Product

Intrepid Potash BCG Matrix

The Intrepid Potash BCG Matrix preview you're seeing is the identical, fully completed document you'll receive after your purchase. This means you'll get the exact same professionally formatted analysis, ready for immediate strategic application, without any watermarks or demo content. You can be confident that the insights and visualizations presented here are precisely what you'll unlock, enabling you to effectively assess Intrepid Potash's business units and guide future investment decisions.

Dogs

Intrepid Potash's industrial salt segment operates within a broad and competitive market where the company's specific market share isn't prominently featured. The growth trajectory for industrial salt is characterized as modest, suggesting a mature market with limited expansion potential.

While salt serves numerous industries, its role for Intrepid appears less central and potentially less profitable than its primary fertilizer offerings. This suggests that industrial salt might be considered a supporting product rather than a core strategic driver for the company.

The industrial salt market, where Intrepid Potash operates, is characterized by its highly commoditized nature. This lack of unique features makes it difficult for Intrepid to stand out from competitors or command premium pricing. For instance, the global industrial salt market was valued at approximately $45 billion in 2023, with growth projected to be modest.

Consequently, this segment likely contributes to lower profit margins for Intrepid. Without a clear competitive edge or a specialized niche, growth opportunities within this area are expected to be limited. Intrepid's industrial salt sales represented a portion of its overall revenue, but its contribution to profitability may be constrained by market dynamics.

Intrepid Potash's Oilfield Solutions segment, which provides water and brine to the oil and gas sector, saw its revenue and profit margins shrink in the second quarter of 2025. This decline, driven by lower activity in the oilfields, points to a segment that is currently underperforming.

Vulnerability to Oil & Gas Cycles

Intrepid Potash's Oilfield Solutions segment faces significant vulnerability due to the inherent cyclicality of the oil and gas industry. This dependency means its performance directly mirrors the boom and bust cycles common in energy markets.

The recent downturn in oil and gas activity serves as a stark reminder of this susceptibility. For instance, during the first quarter of 2024, many oilfield service companies reported reduced demand and pricing pressures, a trend likely impacting Intrepid's segment.

This reliance on an external, volatile market positions Oilfield Solutions as a potentially unpredictable and low-growth contributor to Intrepid's overall business. The segment's revenue streams can fluctuate wildly based on factors outside of Intrepid's direct control, such as global oil prices and drilling rig counts.

- Segment Performance Tied to Oil & Gas Activity: The Oilfield Solutions segment's revenue and profitability are directly correlated with the level of exploration and production activity in the oil and gas sector.

- Impact of Market Volatility: Declines in oil prices or reduced drilling activity can lead to lower demand for Intrepid's oilfield services and products, negatively affecting segment performance. For example, a significant drop in the Baker Hughes rig count in early 2024 signaled a slowdown in upstream activity.

- Unpredictable Growth Prospects: The cyclical nature of the oil and gas industry makes forecasting consistent growth for this segment challenging, presenting a potential drag on Intrepid's overall growth trajectory.

Non-Core Business Focus

The Oilfield Solutions segment, while offering some revenue diversification for Intrepid Potash, is a minor player compared to its core fertilizer business. In 2024, this segment generated significantly less revenue than the potash and Trio products, underscoring its non-core status.

Intrepid's strategic direction clearly prioritizes the revitalization of its potash assets and enhancing the profitability of its fertilizer operations. This focus means less capital and attention are likely to be allocated to expanding the Oilfield Solutions segment.

- Revenue Contribution: Oilfield Solutions represented a small fraction of Intrepid's total revenue in 2024, with the majority derived from potash and Trio sales.

- Strategic Priority: Management's stated objectives center on improving potash production efficiency and market share.

- Resource Allocation: Investment decisions are geared towards core fertilizer assets, indicating limited growth expectations for Oilfield Solutions in the near term.

Intrepid Potash's Oilfield Solutions segment fits the 'Dog' category in the BCG matrix due to its low market share in a mature, slow-growing industry. Its performance is heavily tied to the volatile oil and gas sector, leading to unpredictable revenue and profitability. For instance, in Q2 2025, this segment saw reduced revenue and profit margins, reflecting lower oilfield activity.

The segment's reliance on external factors like oil prices and drilling rig counts makes consistent growth unlikely, positioning it as a potential drag on overall company performance. In 2024, this segment contributed a minor portion to Intrepid's total revenue compared to its core fertilizer business.

Given Intrepid's strategic focus on revitalizing its potash assets, limited resources are expected to be allocated to expanding the Oilfield Solutions segment, further cementing its 'Dog' status.

| Segment | BCG Category | Market Growth | Relative Market Share | Key Challenges |

|---|---|---|---|---|

| Oilfield Solutions | Dog | Low (tied to oil & gas cycles) | Low | Volatility, low profitability, lack of strategic focus |

Question Marks

The magnesium chloride market is poised for substantial expansion, with projected compound annual growth rates (CAGRs) between 4.5% and 6.4% starting in 2025. This growth is fueled by its widespread use in de-icing applications, essential for maintaining infrastructure safety, as well as its critical role in water treatment processes and the construction industry. These factors highlight a significant high-growth market opportunity for companies like Intrepid Potash.

Intrepid Potash, while a producer of magnesium chloride, doesn't highlight a dominant market share or a focused strategy for this particular product. This ambiguity, especially in a sector experiencing growth, places magnesium chloride in the Question Mark category of the BCG matrix.

The company's 2024 financial reports do not provide specific segment data for magnesium chloride, making it difficult to ascertain its precise contribution to overall revenue or its market standing. Without clear data on its market share, it’s challenging to determine if this product line is a significant growth driver or a minor offering.

To elevate magnesium chloride from a Question Mark to a Star, Intrepid would need to commit substantial investment to increase its market penetration and solidify its position. This strategic focus is crucial for capitalizing on the growing demand for magnesium chloride in various industrial applications.

To truly capture the expanding magnesium chloride market, Intrepid Potash would need substantial investment in its production capabilities and marketing efforts. For instance, if the global magnesium chloride market is projected to grow by 5% annually through 2028, Intrepid's current market share might stagnate without increased capital expenditure.

Failing to invest could relegate its magnesium chloride product to the 'Dog' category within the BCG matrix, meaning it has low market share and low growth potential. This would prevent Intrepid from benefiting from the market's upward trend, potentially limiting overall company growth.

Exploratory Diversification Efforts

Intrepid Potash is exploring avenues to diversify its revenue streams, with a particular focus on leveraging byproducts. This includes the potential expansion of its magnesium chloride offerings, a move that could tap into new market segments.

These initiatives are currently in their early stages, representing exploratory or nascent efforts. While they hold significant growth potential, the market penetration and ultimate success of these ventures remain uncertain.

- Revenue Diversification: Intrepid is actively pursuing activities aimed at broadening its income sources beyond traditional potash sales.

- Byproduct Monetization: The company sees potential for growth by developing and marketing byproducts from its existing operations, such as magnesium chloride.

- Market Uncertainty: Efforts in expanding magnesium chloride offerings are considered exploratory, facing the inherent risks of unproven market acceptance and penetration.

- Growth Potential: Despite the uncertainty, these nascent diversification strategies are viewed as having high growth potential for the company.

Lithium Project Opportunities

Intrepid Potash's exploration into lithium projects positions it as a Question Mark within the BCG matrix. This nascent venture taps into the high-growth lithium market, driven by battery technology and electric vehicles (EVs). For instance, the global lithium market was valued at approximately USD 30 billion in 2023 and is projected to reach over USD 100 billion by 2030, showcasing the immense potential.

This strategic move requires significant capital investment and meticulous development to determine its future market position. The success hinges on navigating the complexities of resource extraction, processing, and securing market share in a competitive landscape. As of early 2024, many lithium projects globally are in various stages of development, with significant upfront costs and technological hurdles.

- High Growth Potential: The lithium sector is experiencing rapid expansion due to the increasing demand for EVs and renewable energy storage.

- Significant Investment Needed: Developing a lithium project requires substantial capital for exploration, extraction, and processing.

- Market Uncertainty: As a new venture for Intrepid, its future market share and profitability are yet to be established, characteristic of a Question Mark.

- Strategic Importance: Success in this area could diversify Intrepid's revenue streams and position it in a critical future industry.

Intrepid Potash's magnesium chloride offerings are currently positioned as Question Marks in the BCG matrix. This classification stems from the product's presence in a growing market, with projections indicating a CAGR of 4.5% to 6.4% from 2025, yet Intrepid's specific market share and strategic focus remain unclear. The lack of detailed segment data in their 2024 reports further complicates the assessment of its contribution and potential. Without significant investment to increase market penetration, this product risks declining into the 'Dog' category.

| BCG Category | Intrepid Potash Product | Market Growth | Intrepid's Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Magnesium Chloride | High (4.5%-6.4% CAGR from 2025) | Uncertain/Low | Requires significant investment to become a Star; risk of becoming a Dog |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.