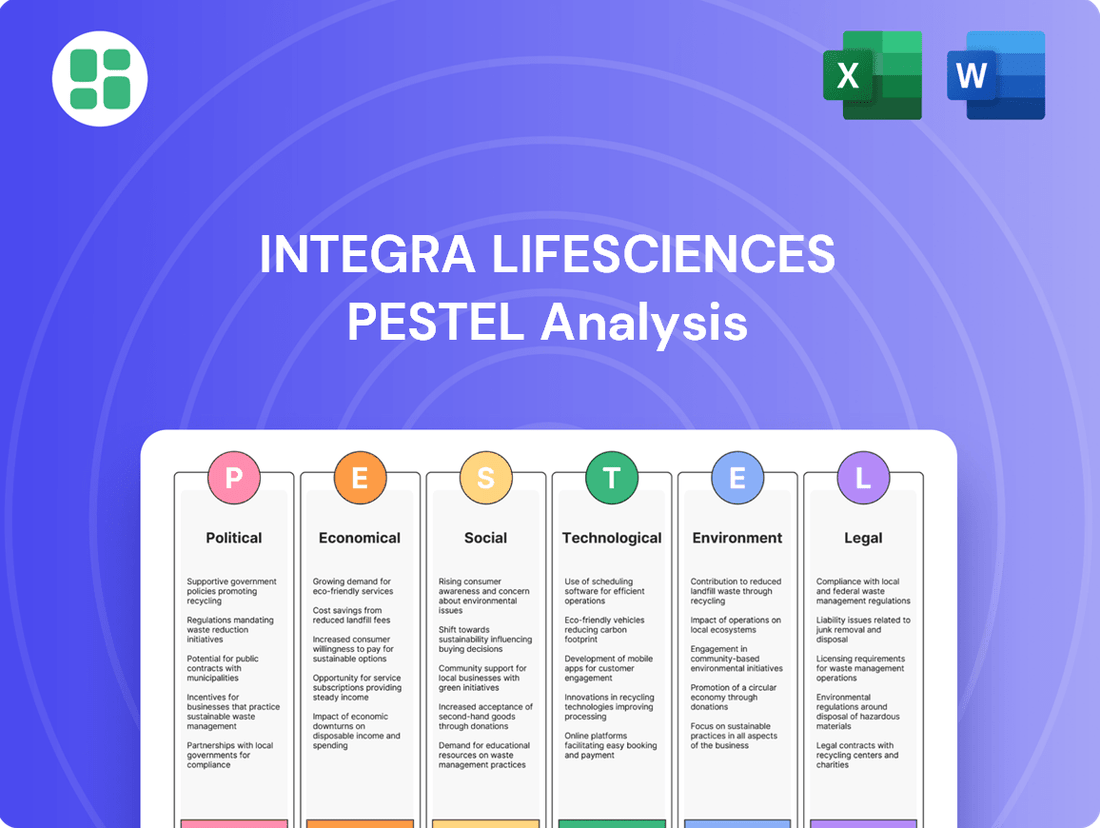

Integra LifeSciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

Navigate the complex external landscape impacting Integra LifeSciences with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the medtech industry and Integra's strategic positioning. Gain a crucial competitive advantage by leveraging these in-depth insights. Download the full PESTLE analysis now for actionable intelligence to inform your decisions.

Political factors

Government healthcare spending policies are a significant driver for Integra LifeSciences. For instance, in 2023, the US government allocated approximately $1.5 trillion to Medicare and Medicaid, directly impacting the purchasing power of healthcare providers for medical devices and implants. These decisions on budget allocations for hospitals and national health services can directly influence Integra's sales volumes and pricing strategies, especially in markets heavily reliant on public healthcare funding.

Integra LifeSciences faces significant hurdles with evolving regulatory approval processes, like the FDA in the U.S. and the EU MDR in Europe. These stringent requirements directly impact how quickly new products can reach the market and how much it costs to develop them. For instance, the average time for FDA approval of new medical devices can stretch for years, adding substantial R&D expenses.

Fluctuations in international trade policies, including tariffs and protectionist measures, directly impact Integra LifeSciences' global supply chain and distribution. For instance, the imposition of tariffs on medical devices or raw materials can increase operational costs. In 2024, ongoing trade disputes, particularly between the US and China, continued to create uncertainty, potentially affecting the cost of imported components essential for Integra's manufacturing processes.

Political Stability in Key Markets

Integra LifeSciences' global operations are significantly influenced by political stability in its key markets. For instance, in 2024, the company's presence in regions experiencing heightened geopolitical tensions, such as parts of Eastern Europe or the Middle East, could pose operational challenges and affect supply chain reliability. Sudden policy changes regarding healthcare regulations or trade agreements in major markets like the United States or European Union countries also present potential risks that require proactive monitoring and adaptation.

The company's financial performance can be directly impacted by these political dynamics. For example, currency fluctuations driven by political instability in emerging markets where Integra operates could affect reported earnings. In 2023, the company reported revenue from international markets, highlighting the sensitivity of its financial results to political and economic conditions abroad. Robust risk management frameworks are therefore essential to navigate these uncertainties.

- Geopolitical Risk: Ongoing conflicts or political instability in regions where Integra sources materials or sells products can disrupt operations.

- Regulatory Shifts: Changes in healthcare policies, such as pricing controls or approval processes, in major markets like the US or EU can impact market access and profitability.

- Trade Relations: Evolving trade agreements and tariffs between countries where Integra has manufacturing or sales operations can affect cost structures and market competitiveness.

- Political Uncertainty: Upcoming elections or significant political transitions in key operating countries can lead to policy unpredictability, impacting long-term investment decisions.

Healthcare Reform Initiatives

Ongoing healthcare reform initiatives, particularly those emphasizing value-based care and preventative health, are significantly influencing the market for medical technologies. These shifts can alter demand for specific devices and solutions. For instance, the move towards bundled payments for procedures means providers are more keenly focused on the total cost and outcomes associated with implants and surgical tools, directly impacting companies like Integra LifeSciences.

Integra LifeSciences needs to proactively adapt its product development and commercial strategies to align with these evolving reforms. Demonstrating clear clinical efficacy and economic value is paramount for gaining traction with healthcare providers and payers. In 2024, a substantial portion of US healthcare payments are already tied to value-based arrangements, a trend expected to accelerate, underscoring the urgency for such alignment.

- Value-Based Care Focus: Reforms pushing for value-based care encourage the adoption of technologies that improve patient outcomes while controlling costs.

- Bundled Payment Models: These models incentivize providers to select cost-effective solutions with proven long-term benefits, potentially favoring integrated product offerings.

- Preventative Health Emphasis: A greater focus on preventative measures could shift demand towards solutions that aid in early detection or management of conditions, impacting Integra's portfolio diversification.

- Demonstrating ROI: Companies must clearly articulate the return on investment for their products to succeed in this reform-driven environment.

Government healthcare spending directly impacts Integra LifeSciences. For example, in 2023, US Medicare and Medicaid spending reached approximately $1.5 trillion, influencing hospital purchasing power for medical devices. These budget allocations significantly affect Integra's sales volumes and pricing, particularly in publicly funded healthcare systems.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Integra LifeSciences, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic advantages.

A PESTLE analysis for Integra LifeSciences offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of navigating complex market dynamics.

Economic factors

The global economic outlook significantly impacts healthcare demand, affecting Integra LifeSciences. A slowdown or recession typically translates to reduced discretionary healthcare spending, impacting procedures and patient affordability of out-of-pocket costs.

For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, signaling potential headwinds. This slowdown can pressure hospital budgets and influence purchasing decisions for medical devices and instruments, directly affecting Integra's sales volumes and revenue growth.

Global healthcare expenditure is projected to reach $11.9 trillion by 2028, a significant increase that bodes well for companies like Integra LifeSciences. This growth, driven by aging populations and advancements in medical technology, suggests a robust market for their surgical instruments and regenerative medicine products. However, specific national trends matter; for instance, the US, a key market, saw its healthcare spending grow by 4.1% in 2022 to $4.5 trillion, or $13,493 per capita.

The allocation of these funds is crucial. If a larger portion is directed towards areas like orthopedics or neurosurgery, where Integra has a strong presence, it directly benefits their revenue streams. Conversely, if payers implement aggressive cost-containment strategies, especially in response to economic slowdowns, Integra might face increased pressure to demonstrate the cost-effectiveness and value of its offerings, potentially impacting pricing and sales volumes.

Rising inflation in 2024 and projected into 2025 directly impacts Integra LifeSciences by increasing the cost of essential raw materials and manufacturing processes. For instance, global inflation rates hovered around 5.9% in 2024, a figure that directly translates to higher input costs for medical device components and pharmaceutical ingredients.

Supply chain disruptions, exacerbated by geopolitical tensions and lingering pandemic effects, continue to inflate freight and logistics expenses. Integra LifeSciences, like many in the healthcare sector, faced an average increase of 15-20% in shipping costs throughout 2024, potentially squeezing profit margins if these elevated costs cannot be fully absorbed by consumers.

Insurance Reimbursement Policies

Insurance reimbursement policies significantly shape the adoption of Integra LifeSciences' medical devices and surgical products. Favorable reimbursement codes and adequate payment rates are crucial for healthcare providers to integrate these technologies into their practices. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) finalized payment rates that impact various medical device categories, directly affecting the profitability and accessibility of products like Integra's neurosurgery or wound care solutions.

The willingness of hospitals and surgeons to adopt new or premium-priced technologies from Integra is directly tied to how well these are reimbursed by payers. If reimbursement rates are low or if specific procedures using Integra's devices are not adequately coded, it creates a barrier to market entry and growth. This was evident in discussions around device-specific payment adjustments in 2024, where clarity on reimbursement pathways was a key concern for manufacturers.

- Reimbursement Impact: Insurance policies dictate the financial viability of using advanced medical devices and surgical instruments.

- Market Access: Adequate reimbursement codes and payment levels are essential for Integra LifeSciences to gain traction in the healthcare market.

- 2024/2025 Trends: Evolving CMS payment rules and private payer policies continue to influence the economic landscape for medical technology adoption.

- Innovation Adoption: Higher reimbursement rates often correlate with a greater willingness by providers to adopt innovative, potentially higher-cost, solutions.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Integra LifeSciences, given its substantial international operations. A strengthening U.S. dollar, for instance, can negatively impact the reported value of its overseas earnings when translated back into dollars. For example, in the first quarter of 2024, the company noted that foreign currency headwinds impacted its net sales by approximately $10 million.

Conversely, a weaker dollar can enhance the competitiveness of Integra's U.S.-manufactured products in global markets, potentially boosting sales volume. Effective management of these currency exposures through hedging strategies or other financial instruments is crucial for stabilizing revenue streams and ensuring predictable profitability across its diverse geographic segments.

- Global Exposure: Integra LifeSciences operates in numerous countries, making it susceptible to the volatility of foreign exchange markets.

- USD Strength Impact: A stronger U.S. dollar reduces the dollar-equivalent value of international revenue, as seen in Q1 2024 where it caused a $10 million sales reduction.

- USD Weakness Advantage: A weaker dollar can improve the price competitiveness of U.S.-made medical devices and instruments abroad.

- Risk Management Necessity: Proactive currency risk management is vital for maintaining financial stability and achieving consistent performance across Integra's global business units.

The economic environment significantly shapes demand for Integra LifeSciences' products. Global economic growth projections, like the IMF's 3.2% forecast for 2024, indicate potential slowdowns that could affect healthcare spending. Higher inflation, around 5.9% globally in 2024, increases Integra's operational costs for materials and manufacturing.

Currency fluctuations also play a key role; for example, a strong U.S. dollar negatively impacted Integra's net sales by approximately $10 million in Q1 2024. Insurance reimbursement policies, such as those finalized by CMS in 2024, are critical for market access and adoption of Integra's innovative medical technologies.

| Economic Factor | 2024/2025 Data/Impact | Integra LifeSciences Relevance |

|---|---|---|

| Global GDP Growth | Projected 3.2% in 2024 (IMF) | Impacts overall healthcare demand and hospital budgets. |

| Global Inflation Rate | Around 5.9% in 2024 | Increases raw material, manufacturing, and logistics costs. |

| US Healthcare Spending Growth | 4.1% in 2022 | Indicates market size and potential for growth in key markets. |

| Foreign Exchange Impact (USD Strength) | -$10 million net sales impact in Q1 2024 | Reduces reported international revenue when the dollar strengthens. |

| CMS Payment Rates | Finalized in 2024, impacting device categories | Crucial for product adoption and financial viability of procedures. |

Full Version Awaits

Integra LifeSciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Integra LifeSciences delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and potential opportunities and threats relevant to Integra LifeSciences.

Sociological factors

The world's population is getting older, with a notable increase in individuals over 65, especially in developed countries. By 2024, it's projected that over 1.1 billion people will be aged 65 and older globally. This demographic trend directly fuels a greater need for medical solutions addressing age-related ailments, including treatments for conditions like Alzheimer's, hip replacements, and cosmetic procedures.

This demographic shift is a significant tailwind for Integra LifeSciences, as their specialized products are well-positioned to meet the growing demand for these types of medical interventions. The expanding market for neurodegenerative disease treatments and orthopedic solutions, in particular, represents a substantial growth avenue for the company's offerings.

The increasing global burden of chronic diseases, such as diabetes and cardiovascular conditions, directly fuels demand for surgical solutions. For instance, the World Health Organization reported in 2023 that non-communicable diseases, primarily chronic ones, accounted for 74% of all deaths globally, many of which require surgical intervention. This ongoing health challenge translates into a consistent need for Integra LifeSciences' advanced surgical instruments and implants, especially within general and reconstructive surgery sectors.

Patients are increasingly informed about their health, driving demand for sophisticated medical interventions. This heightened awareness, amplified by online resources and patient advocacy, means people expect treatments that are not only effective but also minimally invasive and quicker to recover from.

For companies like Integra LifeSciences, this translates into a constant need to develop and refine advanced technologies. For instance, the global medical devices market was projected to reach $687.5 billion in 2024, indicating a strong appetite for innovation in this sector, directly impacting Integra's product development pipeline and market strategy.

Lifestyle Changes Impacting Health

Societal shifts towards more sedentary lifestyles and less healthy eating habits are fueling an increase in conditions such as obesity and its related health issues. These trends are projected to drive greater demand for medical interventions, including surgical procedures.

Integra LifeSciences is well-positioned to capitalize on these evolving health landscapes. Their product offerings, particularly in reconstructive surgery and wound care, directly address the growing need for treatments stemming from these lifestyle-induced health challenges.

- Rising Obesity Rates: In 2023, global obesity rates continued to climb, with estimates suggesting over 1 billion people worldwide are now obese, a significant increase from previous years.

- Demand for Surgical Solutions: This rise in obesity and related comorbidities is expected to boost the market for bariatric and reconstructive surgeries, areas where Integra LifeSciences has a strong presence.

- Healthcare Expenditure: Increased prevalence of chronic diseases linked to lifestyle factors will likely lead to higher healthcare spending, benefiting companies providing essential medical devices and solutions.

Healthcare Accessibility and Equity

Societal emphasis on healthcare accessibility and equity directly impacts how medical technology firms like Integra LifeSciences approach product development, pricing, and distribution. Growing public demand pushes for innovations that are not only advanced but also affordable and reachable by a wider patient base. This can translate into increased scrutiny on cost-effectiveness and the implementation of global outreach initiatives.

For instance, the push for equitable access to advanced wound care, a key area for Integra, is heightened by global health disparities. In 2024, the World Health Organization reported that an estimated 100 million people worldwide fall into poverty due to out-of-pocket health expenses, underscoring the critical need for accessible solutions.

- Global Health Spending Trends: Healthcare spending is projected to reach $11.3 trillion by 2025, according to Deloitte, yet accessibility remains a significant challenge in many regions.

- Patient Affordability: A 2024 survey indicated that over 60% of patients in low- and middle-income countries face financial barriers to accessing essential medical devices.

- Corporate Social Responsibility: Companies are increasingly evaluated on their commitment to social impact, with a growing expectation for them to contribute to improving healthcare equity through their product portfolios and pricing strategies.

Societal trends are increasingly favoring less invasive procedures and faster patient recovery times, directly impacting the demand for advanced medical technologies. This shift is particularly relevant for Integra LifeSciences, given their focus on specialized surgical products.

The growing global emphasis on health and wellness, coupled with increased patient awareness, is driving demand for high-quality, effective medical solutions. This heightened patient engagement means individuals are more proactive in seeking out treatments that offer improved outcomes and quality of life.

The increasing prevalence of chronic diseases, often linked to lifestyle factors, is a significant driver for surgical interventions. For example, by 2025, non-communicable diseases are expected to account for a substantial majority of global mortality, necessitating a greater reliance on surgical and reconstructive solutions.

Societal expectations for healthcare accessibility and affordability are also shaping the market. Companies like Integra LifeSciences face pressure to ensure their innovative products are available to a broader patient population, influencing pricing and distribution strategies.

| Societal Factor | Impact on Integra LifeSciences | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for age-related medical solutions (orthopedics, neurosurgery). | Global population aged 65+ to exceed 1.1 billion by 2024. |

| Chronic Disease Prevalence | Higher demand for surgical instruments and implants. | Non-communicable diseases caused 74% of global deaths in 2023. |

| Patient Empowerment & Awareness | Need for advanced, minimally invasive technologies. | Global medical devices market projected at $687.5 billion in 2024. |

| Lifestyle Trends (Obesity) | Growth opportunities in reconstructive surgery and wound care. | Over 1 billion people globally are obese as of 2023. |

| Healthcare Accessibility Demands | Focus on cost-effectiveness and wider distribution. | 60% of patients in low/middle-income countries face financial barriers to medical devices (2024). |

Technological factors

The surgical landscape is constantly evolving, with a significant push towards minimally invasive procedures, robotic-assisted surgeries, and sophisticated image-guided navigation systems. These advancements directly impact the demand for specialized surgical instruments and implants. For instance, the global market for surgical robots was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, underscoring the need for compatible technologies.

Integra LifeSciences must proactively invest in research and development to align its product offerings with these emerging surgical paradigms. This ensures their instruments and implants not only support but also integrate seamlessly with new techniques, maintaining market relevance. Failing to adapt could lead to a diminished product portfolio in the face of technological shifts.

Breakthroughs in biomaterials science and tissue engineering are a significant technological driver for Integra LifeSciences. The company's focus on tissue regeneration and reconstructive surgery is directly influenced by advancements in this field.

The development of novel biocompatible materials, scaffolds, and regenerative therapies presents a clear opportunity for Integra. These innovations can lead to more effective and durable implants, ultimately improving patient outcomes and reducing complications.

For instance, the market for regenerative medicine, which heavily relies on biomaterials, was valued at approximately USD 13.4 billion in 2023 and is projected to grow substantially in the coming years, indicating strong demand for Integra's product pipeline.

The growing integration of AI and data analytics in medical devices is a significant technological driver. For instance, by 2024, the AI in healthcare market was projected to reach $150 billion globally, indicating a massive investment and adoption trend. This allows for more precise surgical planning and personalized patient treatments, directly impacting the development of advanced medical instruments and predictive analytics tools.

Integra LifeSciences can capitalize on this trend by developing "smart" instruments that offer real-time feedback during procedures, potentially improving surgical outcomes. Furthermore, predictive analytics can optimize surgical workflows, reducing procedure times and enhancing efficiency, a key competitive advantage in the medical technology sector.

Development of Personalized Medicine

The growing trend in personalized medicine, where treatments are specifically designed for an individual's genetic makeup and health profile, directly fuels the demand for highly customizable implants and patient-specific surgical solutions. This shift necessitates that companies like Integra LifeSciences invest in and explore advanced manufacturing techniques, such as 3D printing, to create bespoke medical devices. For instance, the global 3D printing in healthcare market was valued at approximately USD 2.4 billion in 2023 and is projected to reach USD 6.9 billion by 2028, showcasing a significant compound annual growth rate (CAGR) of around 23.5% during the forecast period (2023-2028).

Integra LifeSciences must therefore develop robust platforms that can support the creation and delivery of these bespoke medical devices. This includes investing in digital technologies for patient data management and device design, as well as building flexible manufacturing capabilities. The company's ability to adapt to these technological advancements will be crucial for maintaining a competitive edge in a market increasingly focused on individualized patient care.

- Personalized medicine drives demand for custom implants.

- 3D printing is a key enabling technology for bespoke devices.

- The 3D printing in healthcare market is experiencing rapid growth, projected to reach USD 6.9 billion by 2028.

- Integra needs to invest in digital platforms and flexible manufacturing.

Cybersecurity for Connected Medical Devices

The increasing connectivity of medical devices, such as those manufactured by Integra LifeSciences, presents significant cybersecurity challenges. As these devices integrate with hospital networks, protecting patient data and ensuring uninterrupted device operation becomes paramount. This trend is driven by the desire for remote monitoring and data analytics, but it also opens avenues for cyber threats.

Integra LifeSciences must prioritize robust cybersecurity protocols to safeguard its connected medical devices. Healthcare providers are increasingly scrutinizing device security, and regulatory bodies are tightening compliance requirements. For instance, the U.S. Food and Drug Administration (FDA) has issued guidance emphasizing pre-market cybersecurity risk assessments for medical devices, a trend expected to continue and intensify through 2025.

Key considerations for Integra LifeSciences include:

- Secure by Design: Embedding cybersecurity features from the initial product development phase.

- Ongoing Threat Monitoring: Implementing systems for continuous detection and response to emerging cyber threats.

- Regulatory Compliance: Adhering to evolving cybersecurity standards and regulations from agencies like the FDA and international bodies.

- Data Encryption: Ensuring that patient data transmitted or stored by devices is encrypted to prevent unauthorized access.

Technological advancements are reshaping the surgical field, with a growing emphasis on minimally invasive techniques and robotic assistance. The global surgical robotics market, valued at approximately $6.5 billion in 2023, highlights the demand for compatible technologies, requiring Integra LifeSciences to align its offerings with these evolving surgical paradigms to maintain market relevance.

Breakthroughs in biomaterials and tissue engineering are crucial for Integra's focus on regenerative medicine and reconstructive surgery. The regenerative medicine market, estimated at USD 13.4 billion in 2023, shows significant potential for innovative, biocompatible materials that enhance implant efficacy and patient outcomes.

The integration of AI and data analytics in healthcare is accelerating, with the AI in healthcare market projected to exceed $150 billion globally by 2024. This trend enables more precise surgical planning and personalized treatments, encouraging companies like Integra to develop "smart" instruments offering real-time feedback and predictive analytics for workflow optimization.

Personalized medicine is driving demand for custom implants, with 3D printing in healthcare valued at USD 2.4 billion in 2023 and expected to reach USD 6.9 billion by 2028, growing at a CAGR of 23.5%. This necessitates investment in digital platforms and flexible manufacturing for bespoke medical devices.

| Technological Trend | Market Value (2023/2024) | Projected Growth/Value | Impact on Integra LifeSciences |

| Surgical Robotics | $6.5 billion (Surgical Robots) | Substantial growth | Need for compatible instruments |

| Regenerative Medicine | USD 13.4 billion | Significant growth | Opportunity for novel biomaterials |

| AI in Healthcare | >$150 billion (Projected AI in Healthcare) | Rapid expansion | Development of smart instruments, predictive analytics |

| 3D Printing in Healthcare | USD 2.4 billion | USD 6.9 billion by 2028 (CAGR 23.5%) | Demand for custom implants, investment in digital platforms |

Legal factors

Integra LifeSciences navigates a complex web of global medical device regulations, including the EU MDR and FDA mandates. These frameworks are not static; they are constantly evolving, demanding substantial resources for compliance. For instance, the EU MDR, fully applicable since May 2021, introduced more rigorous requirements for clinical evidence and post-market surveillance, impacting product lifecycle management and market entry strategies.

Integra LifeSciences operates within a stringent legal framework governing product liability and patient safety, essential for medical device manufacturers. Adherence to rigorous quality control and manufacturing standards is paramount to mitigate risks associated with product defects and potential patient harm. Failure in these areas can trigger expensive litigation, severely damage brand reputation, and necessitate product recalls, all of which can destabilize financial performance.

Integra Life Sciences heavily relies on its intellectual property, including patents, trademarks, and trade secrets, to protect its innovative medical devices and technologies. This legal framework is essential for maintaining its competitive advantage in a rapidly evolving market.

The company's ability to enforce these intellectual property rights is critical for recouping its significant investments in research and development. For instance, in 2023, Integra reported R&D expenses of $217.7 million, underscoring the importance of patent protection to ensure a return on these expenditures.

Legal challenges and patent expirations pose potential risks. As patents expire, generic or biosimilar competition can emerge, impacting market share and pricing. Integra actively monitors and defends its patent portfolio to mitigate these threats.

Data Privacy Regulations (e.g., GDPR, HIPAA)

Integra LifeSciences faces significant legal challenges with data privacy regulations. With the increasing use of digital health tools, the company must ensure strict adherence to laws like GDPR in Europe and HIPAA in the US. Failure to protect patient data can lead to substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining patient trust is paramount, especially when handling sensitive health information and clinical trial data.

These regulations impact how Integra LifeSciences collects, stores, and processes patient information. Compliance is not just about avoiding fines but also about building and maintaining a reputation for security and reliability in the healthcare sector. For example, HIPAA violations can result in penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses, depending on the level of negligence.

- GDPR fines: Up to 4% of global annual revenue or €20 million.

- HIPAA penalties: $100 to $50,000 per violation, up to $1.5 million annually for repeat offenses.

- Impact on data handling: Strict protocols for patient data, clinical trial information, and PII.

Anti-kickback Statutes and Compliance

Integra LifeSciences operates under stringent anti-kickback statutes and anti-corruption regulations globally. These laws govern interactions with healthcare professionals and institutions, aiming to prevent illegal inducements for product adoption. For instance, the U.S. Anti-Kickback Statute (AKS) and the False Claims Act (FCA) are critical compliance areas, carrying significant penalties for violations. In 2023, the Department of Justice reported billions in settlements related to healthcare fraud and abuse, underscoring the high stakes for companies like Integra.

Maintaining robust compliance programs is essential for Integra to safeguard its legal standing and corporate reputation. These programs are designed to ensure all business practices are ethical and transparent, mitigating risks associated with improper payments or benefits. Failure to comply can result in substantial fines, debarment from federal healthcare programs, and damage to brand trust, impacting future revenue streams and market access.

- U.S. Anti-Kickback Statute (AKS): Prohibits offering, paying, soliciting, or receiving remuneration to induce referrals of items or services reimbursable under federal healthcare programs.

- False Claims Act (FCA): Allows the government to recover triple damages plus penalties for fraudulent claims submitted to federal programs.

- DOJ Healthcare Fraud Settlements: In 2023, the DOJ secured over $2.6 billion in settlements and judgments in healthcare fraud cases, highlighting enforcement activity.

- Compliance Program Importance: Essential for preventing illegal inducements, maintaining legal standing, and protecting corporate reputation in the healthcare sector.

Integra Life Sciences must navigate evolving medical device regulations, such as the EU MDR and FDA mandates, which require significant investment in compliance and impact product lifecycles. The company's operations are also governed by strict product liability laws, emphasizing the need for rigorous quality control to prevent costly litigation and reputational damage.

Protecting its intellectual property through patents and trademarks is crucial for Integra's competitive edge, especially given its substantial R&D investments, which were $217.7 million in 2023. The company actively defends its patent portfolio against potential generic competition upon expiration.

Data privacy laws like GDPR and HIPAA are critical, with potential fines for non-compliance reaching up to 4% of global annual revenue for GDPR and up to $1.5 million annually for HIPAA repeat offenses, impacting how patient data is handled.

Furthermore, Integra must adhere to anti-kickback and anti-corruption statutes globally, as exemplified by the U.S. Anti-Kickback Statute and False Claims Act, which carry severe penalties. The Department of Justice's 2023 healthcare fraud settlements, totaling over $2.6 billion, highlight the importance of robust compliance programs for maintaining legal standing and corporate reputation.

Environmental factors

Integra LifeSciences faces increasing pressure to adopt sustainable manufacturing, with global environmental concerns rising. This means focusing on reducing waste and lowering their carbon footprint across operations. For instance, the medical device industry, which Integra operates within, is seeing a push for circular economy principles, aiming to divert a significant portion of manufacturing waste from landfills.

Implementing greener practices, such as improving energy efficiency in production facilities and carefully selecting responsibly sourced materials, is becoming crucial. These efforts not only bolster brand image but also ensure compliance with evolving environmental regulations. In 2024, many companies in the healthcare sector are reporting increased investments in renewable energy for their manufacturing sites, with some aiming for 50% or more of their energy to come from sustainable sources by 2025.

As a medical device manufacturer, Integra LifeSciences' operations inherently involve significant energy consumption, directly impacting its carbon footprint. The company's manufacturing processes, supply chain logistics, and facility management all contribute to its environmental impact.

There's a growing imperative from stakeholders, including investors, consumers, and governments, to curb greenhouse gas emissions. For instance, the healthcare sector globally is under scrutiny for its environmental impact, with many companies setting ambitious net-zero targets by 2050. This trend puts pressure on companies like Integra to demonstrate tangible progress in emission reduction.

Integra can mitigate its environmental impact and enhance long-term sustainability by strategically investing in renewable energy sources for its facilities and optimizing operational efficiency. This could involve adopting more energy-efficient manufacturing technologies and exploring on-site solar power generation. Such initiatives not only address regulatory and investor demands but also can lead to cost savings over time.

Integra LifeSciences' environmental footprint is significantly shaped by its extended supply chain. This includes the sourcing of raw materials, often involving resource-intensive extraction processes, and the extensive transportation networks required to move goods globally. The disposal of product components at the end of their lifecycle also presents environmental challenges that must be managed.

To address this, Integra LifeSciences actively engages with its suppliers, encouraging the adoption of sustainable manufacturing processes and responsible resource management. For instance, in 2023, the company reported efforts to reduce waste in its packaging, aiming for a 15% reduction in single-use plastics by 2025.

Furthermore, evaluating and optimizing the environmental impact of logistics is a key focus. This involves exploring more fuel-efficient transportation methods and consolidating shipments to minimize carbon emissions associated with the movement of medical devices and related products.

Compliance with Environmental Regulations

Integra LifeSciences navigates a complex web of environmental regulations, covering everything from emissions and waste management to chemical handling and water consumption across its global operations. Failure to adhere to these rules can result in substantial financial penalties, legal entanglements, and a tarnished brand image, underscoring the critical need for strong environmental oversight.

For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that environmental penalties collected from businesses reached over $100 million, highlighting the financial risks associated with non-compliance. Integra's commitment to sustainability is therefore not just ethical but also a crucial element of risk management.

- Global Regulatory Landscape: Adherence to diverse environmental standards in North America, Europe, and Asia is paramount.

- Risk Mitigation: Robust environmental management systems are key to avoiding fines and legal challenges.

- Reputational Impact: Strong environmental performance enhances brand trust and stakeholder confidence.

- Operational Efficiency: Compliance often drives more efficient resource utilization, reducing waste and costs.

Resource Scarcity and Material Sourcing

Integra LifeSciences faces environmental risks related to the availability and sustainable sourcing of raw materials critical for its medical devices. Some of these materials, essential for advanced medical technology, are rare or susceptible to supply chain disruptions, impacting production continuity. For instance, the global supply of specialized polymers and rare earth elements, often used in implantable devices and surgical instruments, can be volatile due to geopolitical factors and mining limitations.

To mitigate these risks, Integra LifeSciences must prioritize material circularity and explore innovative alternative materials. The company's commitment to environmental responsibility extends to ensuring ethical and sustainable sourcing practices. This proactive approach is crucial for securing long-term production capabilities and maintaining a competitive edge in the medical technology sector, especially as global demand for advanced healthcare solutions continues to rise.

- Supply Chain Vulnerabilities: Reliance on specific, often non-renewable, raw materials creates inherent business and environmental risks.

- Material Circularity Focus: Implementing strategies for recycling and reusing materials can reduce reliance on virgin resources.

- Alternative Material Exploration: Investing in research and development for bio-based or more readily available synthetic materials is key.

- Ethical Sourcing Mandate: Ensuring that all sourced materials adhere to strict environmental and social governance standards is paramount for brand reputation and operational resilience.

Integra LifeSciences operates within an increasingly stringent environmental regulatory framework, impacting its manufacturing and product lifecycle. The company must navigate diverse global standards, from emissions control to waste management, with non-compliance risking significant financial penalties and reputational damage. For example, in 2023, environmental penalties collected by the U.S. EPA exceeded $100 million, underscoring the financial implications of regulatory adherence.

The company faces pressure to reduce its carbon footprint, with the healthcare sector aiming for ambitious net-zero targets by 2050, a trend that pushes companies like Integra to demonstrate tangible emission reduction progress. Many healthcare companies are increasing investments in renewable energy, with some targeting over 50% sustainable energy sources by 2025.

Integra's environmental performance is also tied to its supply chain, from raw material sourcing to product disposal. Efforts to reduce waste, such as a 15% reduction in single-use plastics by 2025, are underway. Furthermore, optimizing logistics for fuel efficiency and shipment consolidation is a key focus to minimize emissions.

The company must also address supply chain vulnerabilities related to critical raw materials, exploring material circularity and alternative, sustainably sourced materials to ensure long-term production and competitive advantage.

| Environmental Factor | Impact on Integra LifeSciences | Key Initiatives/Data (2024/2025 Focus) |

|---|---|---|

| Climate Change & Emissions | Pressure to reduce carbon footprint, operational energy consumption. | Healthcare sector aiming for net-zero by 2050; increased investment in renewables (targeting >50% by 2025). |

| Waste Management & Circularity | Need to minimize manufacturing waste, reduce single-use plastics. | Aiming for 15% reduction in single-use plastics by 2025. |

| Regulatory Compliance | Navigating diverse global environmental standards, risk of penalties. | U.S. EPA collected over $100 million in environmental penalties in 2023. |

| Sustainable Sourcing | Reliance on critical raw materials, supply chain volatility. | Focus on material circularity and exploring alternative, bio-based materials. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Integra LifeSciences is built on a robust foundation of data from leading market research firms, government regulatory bodies, and reputable financial news outlets. This ensures comprehensive insights into political, economic, social, technological, legal, and environmental factors impacting the company.