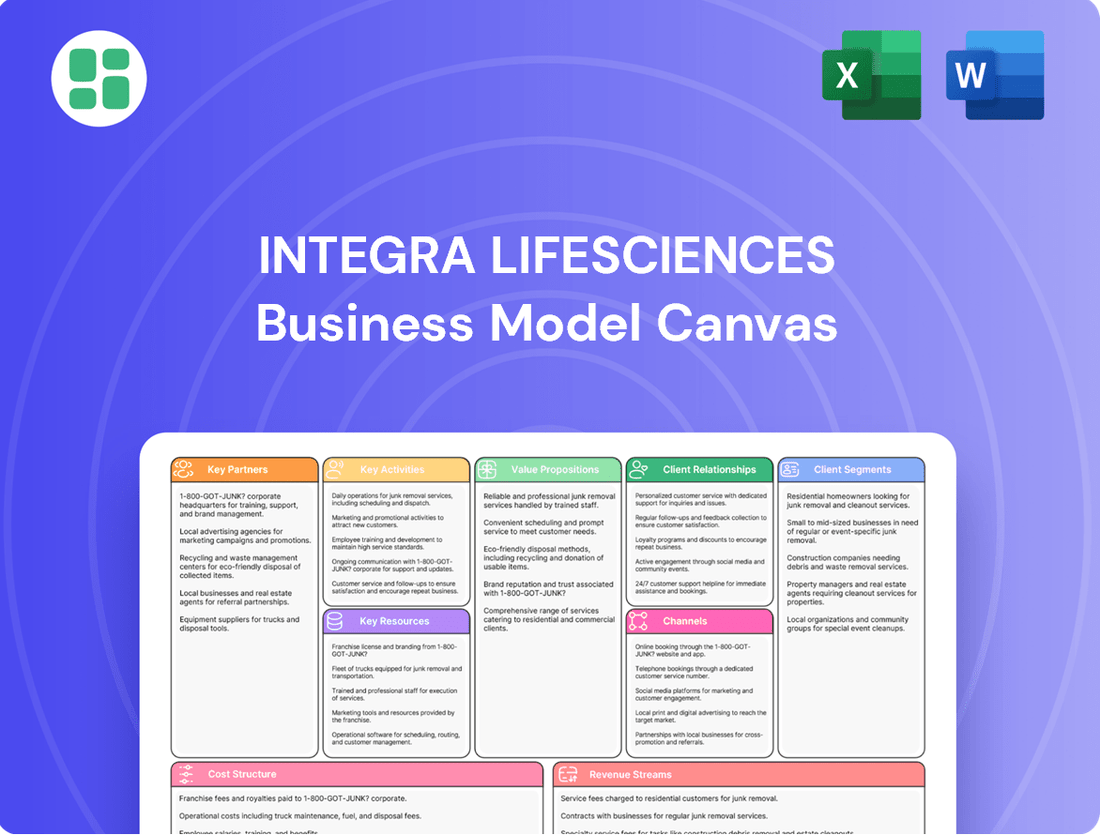

Integra LifeSciences Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

Curious about Integra LifeSciences's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the strategic blueprint behind Integra LifeSciences's market dominance. This detailed Business Model Canvas reveals how they create and deliver value, manage costs, and build lasting customer loyalty.

See how Integra LifeSciences innovates and thrives. Our full Business Model Canvas provides an in-depth look at their value proposition, key activities, and competitive advantages, perfect for strategic analysis.

Partnerships

Integra LifeSciences actively cultivates strategic alliances with hospitals, surgical centers, and integrated delivery networks. These collaborations are crucial for driving the adoption and consistent use of Integra's innovative medical devices and technologies. For instance, in 2023, Integra reported that a significant portion of its revenue was generated through these direct healthcare system partnerships, underscoring their importance to the company's market presence.

These vital partnerships often encompass comprehensive procurement agreements, specialized product training for medical professionals, and ongoing clinical support. Such multifaceted engagement fosters enduring relationships, which are indispensable for achieving deep market penetration and ensuring sustained sales growth. This approach allows Integra to effectively embed its solutions within the established operational workflows of healthcare providers.

Integra Life Sciences actively partners with universities and medical research centers. These collaborations are vital for innovation and proving the effectiveness of their products. For instance, in 2024, Integra continued to engage in research projects aimed at advancing surgical techniques and biomaterials.

These alliances are instrumental in conducting clinical trials and joint research, which are essential for developing cutting-edge surgical technologies. By working with academic institutions, Integra ensures it stays ahead in medical advancements and generates peer-reviewed data to back its product claims.

Integra Life Sciences leverages relationships with medical device distributors and Group Purchasing Organizations (GPOs) to significantly broaden its customer reach and simplify how healthcare providers acquire its products. These collaborations are crucial for managing the supply chain effectively, keeping inventory lean, and reaching smaller hospitals and clinics that might be difficult to access through direct sales alone.

GPOs play a key role in negotiating better pricing and terms, which in turn boosts Integra's market access. For instance, in 2024, GPOs continued to be a dominant force in healthcare purchasing, with many large GPOs managing billions in annual spending, allowing companies like Integra to tap into substantial purchasing power and secure wider adoption of their technologies.

Technology and Biotech Development Partners

Integra Life Sciences actively cultivates strategic alliances with specialized technology and biotechnology entities. These collaborations are crucial for co-developing advanced materials, innovative surgical techniques, and cutting-edge digital health solutions. By integrating external expertise and intellectual property, Integra significantly shortens its product development timelines and elevates the sophistication of its product portfolio.

These partnerships are instrumental in driving breakthrough innovations that provide Integra with a distinct competitive advantage. For instance, in 2024, Integra announced a collaboration with a leading AI firm to enhance its surgical robotics platform, aiming to improve precision and patient outcomes. This strategic move underscores their commitment to leveraging external technological prowess.

- Co-development of Advanced Materials: Partnering with material science specialists to create novel biomaterials for implants and regenerative medicine, enhancing biocompatibility and performance.

- Surgical Technique Innovation: Collaborating with academic institutions and specialized surgical device companies to refine and introduce new minimally invasive surgical procedures.

- Digital Health Solutions: Forming alliances with health tech companies to develop integrated digital platforms for patient monitoring, data analytics, and remote care, improving post-operative management.

- Leveraging External IP: Accessing and integrating unique technologies and patents from biotech partners to accelerate the creation of differentiated and high-value products.

Regulatory and Industry Associations Engagement

Integra Life Sciences actively engages with regulatory bodies such as the FDA, which is crucial for ensuring its products meet rigorous safety and efficacy standards. This engagement is vital for obtaining timely market approvals and maintaining compliance. For instance, in 2024, the FDA continued to emphasize robust data submission for new medical devices, a process Integra navigates through consistent dialogue and adherence to evolving guidelines.

Furthermore, participation in industry associations like AdvaMed allows Integra to contribute to shaping industry standards and advocating for policies that support innovation and market access. These collaborations are not direct revenue streams but are foundational for operational success and long-term growth. By staying abreast of industry trends and regulatory shifts, Integra can proactively adapt its strategies, thereby safeguarding its market position and reputation.

- FDA Engagement: Crucial for product approvals and compliance, ensuring adherence to 2024's stringent data requirements for medical devices.

- Industry Association Participation: Essential for setting standards and policy advocacy, fostering an environment conducive to innovation.

- Reputation Management: Strong regulatory and industry relationships bolster Integra's standing within the medical community and facilitate market entry.

Integra Life Sciences' key partnerships extend to distributors and Group Purchasing Organizations (GPOs), which are vital for expanding market reach and streamlining product acquisition for healthcare providers. These alliances are critical for efficient supply chain management and accessing smaller healthcare facilities. In 2024, GPOs continued to hold significant purchasing power, managing billions in annual spending, which provides companies like Integra enhanced market access and broader technology adoption.

| Partner Type | Role in Business Model | Impact on Integra | 2024 Relevance |

| Hospitals, Surgical Centers, IDNs | Customer adoption and consistent use of medical devices | Drives significant revenue and market presence | Key revenue generators, requiring ongoing clinical support and training |

| Universities, Medical Research Centers | Innovation, clinical validation, and product development | Ensures product efficacy and stays ahead in medical advancements | Essential for clinical trials and generating peer-reviewed data for new surgical technologies |

| Distributors, GPOs | Broadened customer reach, simplified procurement, supply chain efficiency | Increases market access, especially for smaller facilities, and leverages purchasing power | GPOs manage billions in healthcare spending, facilitating wider adoption of Integra's technologies |

| Technology & Biotechnology Entities | Co-development of advanced materials, surgical techniques, digital health | Shortens development timelines, enhances product sophistication, and provides competitive advantage | Collaborations with AI firms aim to improve surgical robotics and patient outcomes |

| Regulatory Bodies (e.g., FDA), Industry Associations (e.g., AdvaMed) | Ensuring compliance, market approvals, shaping industry standards, policy advocacy | Foundational for operational success, market access, and long-term growth | Navigating 2024's stringent data submission requirements for new medical devices is crucial |

What is included in the product

Integra LifeSciences' Business Model Canvas focuses on delivering innovative medical devices and solutions to healthcare professionals, leveraging a direct sales force and strategic partnerships to reach hospitals and surgical centers.

The model emphasizes a strong value proposition built on product differentiation, clinical efficacy, and customer support, supported by robust research and development and efficient manufacturing processes.

Integra LifeSciences' Business Model Canvas offers a high-level view of their strategy, allowing for quick identification of how they address pain points in the medical device industry through their product offerings and distribution channels.

Activities

Integra LifeSciences dedicates significant resources to research, development, and innovation, focusing on creating advanced surgical implants, instruments, and regenerative technologies. This commitment spans critical areas like neurosurgery, reconstructive surgery, and general surgery, ensuring a continuous flow of novel solutions to the market.

The company's R&D efforts encompass the entire product lifecycle, from initial preclinical and clinical studies to meticulous product design and ongoing, iterative improvements on existing offerings. This comprehensive approach is vital for staying ahead in a dynamic healthcare landscape.

In 2023, Integra LifeSciences reported R&D expenses of approximately $226.8 million, underscoring their strategic prioritization of innovation. This investment fuels their pipeline, enabling them to address unmet patient needs and maintain a strong competitive advantage in the medical technology sector.

Integra Life Sciences focuses on the precision manufacturing of its diverse medical devices and biomaterials, meticulously adhering to stringent quality control protocols and regulatory mandates. This core activity is fundamental to guaranteeing the reliability, safety, and consistent performance of their products, which is non-negotiable in the highly regulated medical technology landscape.

Maintaining exceptional quality standards is paramount for ensuring positive patient outcomes and achieving robust regulatory compliance. For instance, Integra's commitment is underscored by their ongoing investment in and execution of their Compliance Master Plan, a strategic initiative designed to uphold and enhance their adherence to global quality and regulatory requirements.

Integra LifeSciences’ global sales, marketing, and distribution activities are central to its success. These efforts involve managing a dedicated direct sales force, executing targeted marketing campaigns, and establishing strong distribution networks to serve hospitals, surgeons, and healthcare facilities across the globe. This ensures their innovative medical technologies reach the point of care efficiently.

The company actively engages in product promotion and educational initiatives to inform healthcare professionals about the benefits and proper use of its offerings. Logistical coordination is paramount to guarantee timely product availability, supporting critical medical procedures. For instance, in 2024, Integra continued to invest in its sales infrastructure, aiming to expand its reach in key international markets, which are vital for sustained revenue growth and market share expansion.

Regulatory Affairs and Compliance Management

Integra LifeSciences dedicates significant resources to navigating the intricate web of global regulatory requirements. This is crucial for bringing innovative medical devices and regenerative technologies to market and ensuring they meet stringent health authority standards worldwide. A key focus is securing and maintaining product approvals, such as the Premarket Approval (PMA) submissions for their products like DuraSorb® and SurgiMend®.

This process involves meticulous documentation, rigorous testing, and strategic engagement with regulatory bodies like the FDA. In 2023, Integra reported that regulatory affairs played a vital role in their product lifecycle management, impacting timelines for new product launches and continued market access for existing offerings. The company's commitment to compliance is underscored by ongoing efforts to adapt to evolving global regulations, ensuring patient safety and product efficacy.

- Product Approvals: Securing PMA for key products like DuraSorb® and SurgiMend®.

- Global Compliance: Adhering to diverse international health authority regulations.

- Documentation & Audits: Maintaining extensive records and preparing for regulatory inspections.

- Strategic Planning: Aligning regulatory efforts with product development and market entry strategies.

Clinical Education and Professional Training

Integra Life Sciences offers extensive training and education for surgeons and healthcare professionals, focusing on the correct application of its specialized medical devices. This commitment ensures users can maximize the benefits of Integra's innovative technologies.

These programs are crucial for improving surgical techniques and patient care. By fostering user expertise, Integra reinforces the adoption of its products, especially for intricate surgical interventions.

- Surgeon Training: Integra conducts hands-on workshops and online modules for surgeons to master the use of neurosurgical and reconstructive technologies.

- Product Application Support: The company provides ongoing education to healthcare providers on the latest applications and best practices for its portfolio, including wound care and regenerative medicine.

- Professional Development: Integra's educational initiatives aim to enhance the skills of medical professionals, contributing to better patient outcomes and solidifying its reputation as a trusted partner in healthcare. In 2023, Integra reported that over 15,000 healthcare professionals participated in its educational programs globally.

Integra Life Sciences' key activities center on innovation through robust research and development, meticulous product manufacturing adhering to strict quality standards, and effective global sales, marketing, and distribution. The company also prioritizes regulatory compliance and provides comprehensive training for healthcare professionals to ensure optimal product utilization.

Delivered as Displayed

Business Model Canvas

The Integra LifeSciences Business Model Canvas preview you are viewing is the exact, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can confidently assess the quality and comprehensiveness of the analysis before committing to your purchase.

Resources

Integra LifeSciences’ intellectual property portfolio, encompassing patents, trademarks, and proprietary technologies, is a cornerstone of its business model. This extensive collection safeguards its innovative surgical implants, instruments, and biomaterials, acting as a significant competitive advantage.

This robust intellectual property not only shields Integra from imitation but also solidifies its market leadership in niche surgical areas. For instance, in 2023, Integra reported that its patent portfolio continued to be a key driver of its revenue growth, particularly in its Codman specialty surgical segment.

The ability to protect its innovations allows Integra to differentiate its offerings and maintain premium pricing power. This strategic advantage is crucial for sustaining profitability and investing in future research and development, ensuring a continuous pipeline of advanced medical solutions.

Integra LifeSciences' advanced manufacturing facilities are the backbone of its operations, housing state-of-the-art plants and specialized equipment crucial for creating high-quality medical devices and regenerative tissues. These facilities are key to ensuring production capacity and supply chain reliability.

The company's commitment to quality is evident in its manufacturing processes, which adhere to stringent industry standards. For instance, Integra reported approximately $1.5 billion in revenue for 2023, underscoring the scale and output of its production capabilities.

Strategic investments in these facilities, such as the ongoing transition at the Braintree, Massachusetts site, are vital for maintaining a competitive edge and meeting the evolving demands of the healthcare market.

Integra LifeSciences relies heavily on its skilled scientific and clinical workforce, a critical intellectual resource. This team includes R&D scientists and engineers who spearhead product innovation, ensuring Integra stays at the forefront of medical technology. Their expertise is directly linked to the company's ability to develop and refine its diverse product portfolio.

Clinical specialists and experienced sales professionals form another vital segment of this workforce. They provide essential support to healthcare providers, demonstrating the value and proper application of Integra's products. In 2024, Integra continued to invest in training and development for these teams, recognizing that their deep understanding of both the science and the clinical application is paramount to customer adoption and satisfaction.

Global Distribution and Supply Chain Network

Integra Life Sciences operates an extensive global network of warehousing, logistics, and distribution centers. This infrastructure is crucial for ensuring their medical devices and regenerative technologies reach healthcare providers and patients across numerous countries promptly and dependably. For instance, in 2023, the company managed a complex supply chain to support its diverse product portfolio, which includes neurosurgery, spine, and extremity orthopedic products.

This intricate system is fundamental to Integra's market access, allowing them to effectively manage inventory levels and swiftly adapt to shifts in customer demand. The efficiency of this network directly impacts their ability to serve a broad international customer base, which is a core component of their business model. In 2024, ongoing investments in supply chain optimization are expected to further enhance delivery times and reduce operational costs.

- Global Reach: Facilitates timely delivery of products to over 100 countries.

- Inventory Management: Utilizes advanced systems to maintain optimal stock levels across regional distribution hubs.

- Demand Responsiveness: Agile network design allows for quick adjustments to meet fluctuating market needs.

- Customer Service: Ensures reliable access to critical medical technologies for healthcare professionals worldwide.

Financial Capital and Strategic Investments

Integra Life Sciences relies on robust financial capital as a cornerstone of its business model. This includes maintaining healthy cash reserves, leveraging established credit facilities, and ensuring consistent access to capital markets. These financial resources are critical for funding vital activities like research and development, upgrading manufacturing capabilities, and executing strategic acquisitions, such as the purchase of Acclarent. This financial flexibility directly supports Integra's ability to capitalize on growth opportunities and navigate market volatility, ensuring sustained operations and strategic advancement.

In 2024, Integra Life Sciences demonstrated its financial strength through various strategic maneuvers. For instance, the company actively managed its debt and equity to support its operational and growth initiatives. By the end of the first quarter of 2024, Integra reported approximately $300 million in cash and cash equivalents, providing a solid foundation for immediate needs and strategic investments. This liquidity is essential for their ongoing commitment to innovation and market expansion.

- Adequate Financial Capital: Integra maintains substantial cash reserves and access to credit lines to fund R&D, manufacturing, and strategic acquisitions.

- Strategic Investment Capability: Financial strength enables pursuit of growth opportunities and resilience against market fluctuations.

- Acquisition Funding: Capital resources are specifically allocated for strategic acquisitions, exemplified by past deals like Acclarent.

- Global Expansion Support: Financial backing is crucial for funding international growth initiatives and market penetration.

Integra Life Sciences' key resources extend beyond tangible assets to encompass crucial intangible elements and operational infrastructure. Its intellectual property, comprising patents and proprietary technologies, acts as a significant competitive moat, protecting its innovative surgical implants and biomaterials. The company's advanced manufacturing facilities are central to producing high-quality medical devices, with ongoing investments in sites like Braintree, Massachusetts, ensuring production capacity and adherence to stringent industry standards.

The company's skilled workforce, including R&D scientists, engineers, and clinical specialists, is fundamental to driving product innovation and providing essential customer support. Integra's extensive global distribution network ensures timely delivery of its products to healthcare providers worldwide, with ongoing efforts in 2024 focused on supply chain optimization to enhance efficiency and reduce costs. Furthermore, robust financial capital, evidenced by approximately $300 million in cash and cash equivalents at the end of Q1 2024, underpins its ability to fund research, development, and strategic acquisitions.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Intellectual Property | Patents, trademarks, proprietary technologies | Drives revenue growth, particularly in Codman specialty surgical segment (2023) |

| Manufacturing Facilities | State-of-the-art plants, specialized equipment | Supports $1.5 billion in revenue (2023); ongoing upgrades (Braintree, MA) |

| Skilled Workforce | R&D scientists, engineers, clinical specialists, sales professionals | Investment in training and development for customer adoption and satisfaction (2024) |

| Global Distribution Network | Warehousing, logistics, distribution centers | Ensures product delivery to over 100 countries; supply chain optimization in progress (2024) |

| Financial Capital | Cash reserves, credit facilities, capital markets access | Approx. $300 million in cash (Q1 2024); funds R&D, manufacturing, acquisitions (e.g., Acclarent) |

Value Propositions

Integra LifeSciences provides advanced surgical implants and instruments specifically engineered for intricate procedures in neurosurgery, reconstructive surgery, and general surgery. These innovative offerings are developed to enhance surgical precision and patient recovery.

The company's commitment to pioneering technology means they are constantly developing solutions that tackle significant challenges faced by surgeons. For instance, in 2023, Integra's neurosurgery segment saw continued growth, reflecting the demand for specialized cranial implants and dural repair products.

These cutting-edge solutions are designed not just to perform, but to deliver tangible clinical advantages, ultimately aiming for improved patient outcomes and greater surgeon confidence in complex operations.

Integra Life Sciences is fundamentally about making patients better. Their core promise is to improve how patients recover from injuries and surgeries, and to lessen the problems that can arise. This means patients can get back to their lives with fewer complications and a better overall quality of life.

This focus on tangible patient benefits is achieved through cutting-edge solutions in areas like tissue regeneration, which helps the body heal itself, and advanced tools for neurosurgery and general surgical procedures. The company prioritizes making sure their products are not only effective but also safe, directly contributing to restoring a patient's health and normal function.

Integra Life Sciences offers a comprehensive portfolio, acting as a one-stop shop for healthcare providers across numerous surgical specialties. This breadth, from dural repair to soft tissue reconstruction, simplifies procurement and ensures product compatibility, fostering efficiency in medical settings.

Their integrated solutions are built around leading brands, providing healthcare professionals with trusted and complementary products. For instance, in 2024, Integra continued to emphasize its offerings in neurosurgery and reconstructive surgery, areas where product synergy is crucial for optimal patient outcomes.

Clinical Efficacy and Safety Backed by Evidence

Integra Life Sciences prioritizes clinical efficacy and safety, ensuring its medical devices and surgical technologies are rigorously tested and validated. This commitment is demonstrated through extensive research and adherence to stringent regulatory standards, building trust with healthcare professionals and institutions.

The company's dedication to evidence-based medicine is a cornerstone of its value proposition. Surgeons and healthcare systems rely on Integra's products because they are backed by robust clinical data, assuring them of both reliability and superior patient outcomes.

- Clinical Validation: Integra's product development pipeline emphasizes thorough clinical trials and studies to confirm efficacy.

- Safety First: A paramount focus on patient safety is integrated into every stage of product design and manufacturing.

- Regulatory Compliance: Products meet or exceed global regulatory requirements, such as FDA approvals, underscoring their safety and effectiveness.

- Evidence-Based Approach: Clinical data and research findings are central to demonstrating the performance and benefits of Integra's offerings.

Dedicated Clinical Support and Training

Integra Life Sciences goes beyond just selling medical devices by offering robust clinical support and training. This commitment is crucial for ensuring that surgeons and their teams can effectively and safely use Integra's products. For example, in 2024, Integra continued to invest in educational programs designed to enhance surgical outcomes and product proficiency.

These educational initiatives are not just about product instruction; they focus on optimizing surgical techniques and best practices. This dedication to knowledge sharing builds trust and establishes Integra as a valuable partner, not just a supplier. Their focus on ongoing support directly contributes to better patient care and reinforces the overall value proposition of their offerings.

- Clinical Education Programs: Integra provides specialized training to healthcare professionals on the proper use of their neurosurgery and regenerative technologies.

- Surgeon Training: In 2024, hundreds of surgeons participated in hands-on training sessions, improving their skills with Integra's advanced instrumentation.

- Product Utilization: The company's support aims to maximize the efficacy of their products, leading to improved patient outcomes and reduced complications.

- Partnership Building: By investing in their customers' expertise, Integra fosters long-term relationships built on mutual trust and shared commitment to innovation.

Integra Life Sciences delivers advanced surgical solutions that enhance patient recovery and improve surgical precision across neurosurgery, reconstructive surgery, and general surgery. Their product portfolio simplifies procurement for healthcare providers by offering a comprehensive range of trusted, complementary products, fostering efficiency. The company's commitment to clinical efficacy and safety is paramount, backed by rigorous testing, regulatory compliance, and robust clinical data. Furthermore, Integra provides extensive clinical support and training, empowering surgeons to maximize product utilization and achieve better patient outcomes.

Customer Relationships

Integra Life Sciences cultivates robust customer relationships by deploying dedicated sales and clinical support teams. These specialized representatives directly engage with surgeons and hospital staff, offering personalized service and building strong connections.

These teams are instrumental in providing comprehensive product training, crucial technical assistance, and continuous support. This hands-on approach ensures that healthcare professionals can optimally utilize Integra's products and effectively address their specific clinical requirements.

This direct, personalized engagement is key to fostering deep trust and long-term loyalty among their customer base. For instance, in 2023, Integra reported a significant portion of its revenue stemming from repeat business, underscoring the success of these relationship-building efforts.

Integra LifeSciences focuses on building long-term, strategic partnerships with hospitals and healthcare networks. These relationships are more than just sales; they involve collaboration on developing new products and conducting clinical research. For example, in 2024, Integra continued its work with major hospital systems to refine its neurosurgical instruments, leading to enhanced surgical outcomes.

These alliances are designed for mutual growth and shared goals, particularly in improving patient care. By optimizing supply chains together, Integra ensures consistent availability of critical medical devices, a key factor for healthcare providers. This deepens institutional ties and fosters loyalty beyond simple product purchases.

Integra Life Sciences actively monitors its products after they reach the market, collecting valuable input from healthcare providers. This post-market surveillance helps them understand how their products are performing in real-world settings.

This ongoing feedback is vital for refining existing products and developing new ones. For example, in 2024, Integra reported a strong focus on integrating customer feedback into their product development pipeline, aiming to enhance user experience and address any emerging clinical needs.

By continuously listening to their customers, Integra ensures its offerings remain effective and meet the evolving demands of the healthcare industry, ultimately supporting better patient outcomes and reinforcing their commitment to product quality.

Educational Programs and Professional Development

Integra Life Sciences offers comprehensive educational programs and professional development opportunities for surgeons and medical teams. These initiatives are crucial for building strong customer relationships by ensuring users are proficient with Integra's advanced medical technologies.

By providing extensive training courses and workshops, Integra positions itself not just as a product supplier, but as a vital partner in the continuous learning and skill enhancement of healthcare professionals. This commitment goes beyond mere product transactions, fostering loyalty and trust.

For instance, in 2024, Integra continued its robust educational outreach, with thousands of healthcare professionals participating in their specialized training sessions. These programs cover a wide array of their product lines, from neurosurgery tools to regenerative technologies, directly impacting user adoption and satisfaction.

- Educational Reach: In 2024, Integra's educational programs trained over 15,000 healthcare professionals globally.

- Product Proficiency: Training focuses on advanced techniques, ensuring optimal use of Integra's innovative surgical and medical devices.

- Partnership Focus: These programs solidify Integra's role as a knowledge leader and a partner in professional growth, extending beyond sales.

- Customer Engagement: The commitment to continuous learning enhances customer retention and strengthens long-term partnerships.

Personalized Consultation and Solution Customization

Integra Life Sciences excels in offering personalized consultation for complex medical needs, particularly in surgery. For instance, in cases requiring highly specific implant configurations or unique surgical approaches, their teams collaborate directly with surgeons. This ensures that solutions are not just off-the-shelf but are meticulously tailored to individual patient anatomy and procedural requirements.

This bespoke approach is a cornerstone of their customer relationship strategy. By actively engaging with healthcare professionals to customize product designs or develop specialized configurations, Integra demonstrates a deep commitment to addressing unique challenges. This adaptability not only solves immediate customer problems but also solidifies their image as a highly responsive and flexible partner in the medical device sector.

- Tailored Solutions: Direct collaboration with surgeons for custom product configurations.

- Addressing Complexity: Focus on unique surgical requirements and patient-specific needs.

- Enhanced Partnership: Building trust through responsive and adaptable service.

- Reputation Building: Strengthening their image as a go-to provider for specialized medical challenges.

Integra Life Sciences prioritizes building lasting relationships through dedicated support and collaborative partnerships. Their approach focuses on understanding and meeting the specific needs of healthcare professionals, fostering loyalty and trust.

This commitment is evident in their continuous efforts to enhance product utilization and address evolving clinical demands. By acting as a knowledgeable partner, Integra ensures optimal outcomes for both practitioners and patients.

| Customer Relationship Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Direct Sales & Clinical Support | Dedicated teams engage directly with surgeons and hospital staff. | Continued emphasis on personalized service and technical assistance. |

| Educational Programs | Comprehensive training and professional development opportunities. | Thousands of healthcare professionals trained globally, enhancing product proficiency. |

| Collaborative Partnerships | Working with hospitals on product development and clinical research. | Refining neurosurgical instruments with major hospital systems for improved outcomes. |

| Customer Feedback Integration | Monitoring products and gathering input for improvements. | Strong focus on integrating feedback into product development pipeline. |

| Personalized Consultation | Tailoring solutions for complex medical needs and specific procedures. | Direct collaboration with surgeons for custom implant configurations. |

Channels

Integra Life Sciences relies heavily on its dedicated direct sales force to connect with key decision-makers in healthcare, including surgeons and hospital administrators. This approach is vital for showcasing complex medical devices and fostering deep clinical understanding.

This direct channel facilitates hands-on product demonstrations and detailed conversations about clinical applications, which are essential for Integra's specialized product portfolio. It enables the company to build strong relationships directly at the point of patient care.

In 2023, Integra reported total net sales of $1.57 billion, with a significant portion attributed to the effective engagement of their direct sales teams in driving adoption of their neurosurgical and reconstructive products.

Integra Life Sciences strategically utilizes authorized distributors and agents to broaden its market presence, especially in international territories and for specialized product lines. These partners are crucial for navigating diverse regulatory landscapes and tapping into established local healthcare networks.

In 2024, Integra's reliance on these third-party channels was evident as they facilitated access to new customer segments, contributing to a more robust global sales infrastructure. This approach allows Integra to efficiently deliver its innovative medical technologies while leveraging the localized expertise of its partners.

Integra Life Sciences leverages its corporate website as a primary digital hub, offering detailed product catalogs, extensive clinical resources, and vital investor relations information. This platform is key for engaging with healthcare professionals and stakeholders, providing them with the necessary data to understand Integra's offerings.

While direct online sales of complex surgical products are often constrained by regulatory hurdles and the need for specialized consultation, digital channels are indispensable for information dissemination and marketing. In 2024, the company continued to invest in its digital infrastructure to enhance customer support and streamline access to technical and educational materials, reflecting a growing reliance on online engagement for brand building and lead generation.

Medical Conferences and Trade Shows

Integra Life Sciences actively participates in major national and international medical conferences, surgical forums, and trade shows. These events are crucial for launching new products, demonstrating their capabilities, and fostering vital networking opportunities. For instance, in 2024, Integra showcased its latest advancements in regenerative medicine and surgical instrumentation at key industry gatherings like the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting and the Association of periOperative Registered Nurses (AORN) Global Surgical Conference & Expo.

These platforms enable Integra to directly engage with a concentrated audience of healthcare professionals, including surgeons, hospital administrators, and procurement specialists. This direct interaction allows for immediate feedback, builds brand awareness, and facilitates the cultivation of relationships with key opinion leaders who influence adoption rates. In 2024, attendance at these targeted events provided Integra with direct access to an estimated 50,000+ healthcare professionals across various specialties.

- Product Launches and Demonstrations: Providing hands-on experience with new medical devices and technologies.

- Key Opinion Leader Engagement: Building relationships with influential medical professionals to drive product adoption.

- Market Intelligence Gathering: Understanding competitor activities and customer needs directly from the source.

- Lead Generation: Capturing contact information from interested attendees for follow-up sales efforts.

Clinical Training and Education Centers

Integra Life Sciences leverages dedicated clinical training centers, often in partnership with healthcare institutions, as a crucial channel for its business model. These centers provide surgeons with direct, hands-on experience using Integra's innovative medical devices and surgical techniques.

This hands-on approach significantly accelerates product adoption and enhances surgeon proficiency. By fostering a deeper, practical understanding of their solutions, Integra builds clinical confidence among its user base, driving demand and reinforcing its market position.

- Direct Product Adoption: Surgeons experience Integra products firsthand, leading to quicker integration into their practice.

- Skill Development: Training centers offer a controlled environment for mastering new surgical techniques and product applications.

- Clinical Confidence: Practical, supervised experience builds trust and competence in using Integra's offerings.

- Market Penetration: These centers act as hubs for disseminating knowledge and encouraging wider use of Integra's portfolio.

Integra Life Sciences utilizes a multi-faceted channel strategy, combining direct sales for high-touch engagement with distributors for broader market reach. Digital platforms serve as crucial information hubs, while industry events and specialized training centers facilitate product adoption and key opinion leader engagement.

This integrated approach ensures that Integra can effectively demonstrate its complex medical devices, build strong relationships with healthcare professionals, and gather valuable market intelligence.

In 2024, Integra's strategic use of these channels was key to expanding its global footprint and reinforcing its position in the neurosurgical and reconstructive markets.

| Channel | Key Activities | 2024 Focus/Impact | Example Engagement |

|---|---|---|---|

| Direct Sales Force | Product demonstrations, clinical support, relationship building | Driving adoption of specialized products, direct customer feedback | Surgeon training on new neurosurgical implants |

| Distributors & Agents | Market access, navigating regulations, local network utilization | International expansion, reaching niche markets | Partnering with European distributors for reconstructive products |

| Corporate Website | Product information, clinical resources, investor relations | Brand building, lead generation, customer support | Online catalog and technical data for surgical instruments |

| Industry Events | Product launches, networking, KOL engagement, market intelligence | Showcasing innovation, direct engagement with 50,000+ professionals | Presence at AAOS and AORN conferences |

| Training Centers | Hands-on product training, skill development | Accelerating product adoption, building clinical confidence | Cadaver labs for advanced surgical techniques |

Customer Segments

Neurosurgeons represent a critical customer segment for Integra LifeSciences. They depend on Integra's advanced cranial and spinal products for procedures like dural repair and cerebrospinal fluid management. In 2023, Integra's Neurosurgery division generated $575 million in revenue, underscoring the significant market share and reliance neurosurgeons place on their offerings.

Reconstructive surgeons, encompassing plastic, orthopedic, and burn specialists, form a critical customer segment for Integra LifeSciences. These medical professionals are actively seeking innovative solutions to address complex reconstructive challenges, from intricate wound healing to the repair of damaged tissues and nerves.

Their primary need revolves around advanced biomaterials and implants that facilitate superior tissue regeneration and soft tissue repair. This includes specialized products for treating complex hernias and restoring function and aesthetics in cases of severe trauma or congenital defects.

In 2024, the global reconstructive surgery market continued its upward trajectory, driven by an aging population and increasing demand for aesthetic procedures. Integra LifeSciences’ focus on regenerative medicine positions it well to serve this segment, where outcomes are directly tied to the efficacy of the biomaterials used.

General surgeons are a core customer segment for Integra LifeSciences, relying on their extensive range of surgical instruments and devices for a multitude of procedures, from routine to complex. Their primary concerns revolve around the dependability and superior quality of instrumentation that directly impacts surgical efficiency and patient safety across diverse operating room environments. For instance, in 2023, Integra's Codman Surgical Instrument division, which serves this segment, saw continued demand for its specialized instruments, contributing to the company's overall revenue growth.

Hospitals and Healthcare Networks

Hospitals and healthcare networks represent a critical customer segment for Integra Life Sciences. These institutions are the primary purchasers of Integra's medical technologies, directly impacting their adoption across various surgical specialties.

The purchasing decisions made by these large healthcare providers are multifaceted. Key drivers include the demonstrated efficacy of Integra's products, their overall cost-effectiveness within a healthcare system, and the dependability of the supply chain. Furthermore, the availability of comprehensive support services significantly influences their choices.

- Key Decision-Makers: Hospitals and healthcare networks are the primary procurement entities for Integra's surgical products.

- Influencing Factors: Product efficacy, cost-effectiveness, supply chain reliability, and support services are paramount in their buying process.

- Market Data: In 2024, the global medical devices market was projected to reach over $600 billion, with hospitals being major consumers of these technologies.

- Strategic Importance: Securing contracts with large hospital systems is vital for Integra's revenue and market penetration.

Ambulatory Surgical Centers (ASCs)

Ambulatory Surgical Centers (ASCs) represent a burgeoning customer segment for Integra LifeSciences. These facilities are actively seeking surgical solutions that are not only efficient and cost-effective but also deliver high-quality outcomes for outpatient procedures. Integra's comprehensive product offerings, including specialized surgical instruments and advanced less invasive implants, are precisely tailored to meet the unique operational and financial requirements of ASCs.

The strategic alignment between Integra's product development and the operational demands of ASCs is a key driver of growth. ASCs prioritize streamlined workflows and cost containment, and Integra's portfolio directly addresses these needs by facilitating quicker patient turnover and reducing overall procedure costs. This focus on optimizing surgical processes resonates strongly with the ASC model.

In 2024, the ASC market continued its expansion, with industry reports indicating a steady increase in the number of procedures performed in these centers. For instance, data suggests that ASCs are increasingly handling complex procedures previously performed in hospitals, highlighting their growing capabilities and the demand for sophisticated yet cost-efficient surgical tools. Integra's commitment to innovation in areas like minimally invasive surgery positions them favorably to capture a larger share of this expanding market.

- Growing ASC Market: The outpatient surgical market continues to expand, with ASCs performing a greater volume and complexity of procedures.

- Integra's Product Fit: Integra's surgical instruments and less invasive implants are well-suited to the efficiency and cost-effectiveness demands of ASCs.

- Streamlined Procedures: The company's focus on solutions that simplify surgical workflows aligns directly with ASC operational goals.

- 2024 Market Trends: ASCs are demonstrating increased adoption of advanced technologies and a preference for vendors offering integrated solutions.

Integra LifeSciences also serves spine surgeons, who utilize their specialized implants and instruments for spinal fusion and decompression procedures. These surgeons require reliable and advanced solutions for complex spinal conditions, where patient outcomes are directly linked to implant performance and surgical technique. Integra's investment in spinal technology innovation is crucial for this segment.

The company's offerings extend to pain management specialists, who rely on Integra's devices for delivering targeted pain relief therapies. These professionals seek efficient and effective solutions to improve patient quality of life, making Integra's portfolio a valuable resource in their practice.

| Customer Segment | Key Needs | Integra's Relevant Offerings | 2023/2024 Data Point |

| Spine Surgeons | Advanced implants for fusion and decompression, reliable instrumentation. | Cranial and spinal implants, surgical instruments. | Integra's Spine division revenue was a significant contributor to overall company performance in 2023. |

| Pain Management Specialists | Targeted pain relief devices, improved patient outcomes. | Neuromodulation devices, drug delivery systems. | The global pain management market saw continued growth in 2024, with increasing demand for minimally invasive treatments. |

Cost Structure

Integra LifeSciences dedicates substantial resources to Research and Development, a critical component of its innovation engine. In 2023, the company reported R&D expenses of $275 million, reflecting significant investment in developing novel medical technologies and enhancing existing product lines. This figure represents a core cost necessary for maintaining a competitive edge in the dynamic healthcare market.

These expenditures cover a broad spectrum, from compensating highly skilled scientists and engineers to acquiring cutting-edge laboratory equipment. Furthermore, a considerable portion is allocated to the rigorous process of regulatory submissions and conducting extensive clinical trials, essential for bringing new medical solutions to market.

R&D at Integra LifeSciences is characterized by its high fixed cost nature. These investments are not directly tied to sales volume but are foundational for future growth and market differentiation. The commitment to innovation through R&D is a strategic imperative for the company's long-term success and its ability to address unmet clinical needs.

Integra LifeSciences' manufacturing and production costs are substantial, covering everything from the raw materials for surgical implants and instruments to the labor and overheads of its production facilities. These expenses are further amplified by the rigorous quality control measures and regulatory compliance demanded in the medical device industry. For instance, in 2023, the company reported cost of goods sold of $768.5 million, a significant portion of which is directly attributable to these manufacturing operations.

The company's commitment to producing high-quality biomaterials and surgical devices means investing heavily in specialized equipment and skilled personnel. Depreciation of these manufacturing assets also contributes to the overall cost structure. Any disruptions in the supply chain or unexpected production delays can lead to increased costs, impacting the company's profitability and operational efficiency.

Integra Life Sciences dedicates significant resources to its Sales, Marketing, and Distribution functions. These costs are crucial for reaching healthcare professionals and hospitals worldwide, educating them about Integra's innovative medical devices and regenerative technologies, and ensuring products are readily available. For instance, in 2023, the company reported $444.5 million in selling, general, and administrative expenses, a substantial portion of which directly supports these vital customer-facing activities.

Regulatory and Compliance Expenses

Integra Life Sciences faces substantial regulatory and compliance expenses due to the stringent nature of the medical device sector. These costs are essential for obtaining and maintaining approvals from global health authorities, ensuring product quality, and adhering to evolving regulations. For instance, in 2023, the company continued to invest in its Quality Management System and regulatory affairs functions to support its product portfolio and new product development.

These expenses encompass a range of activities critical for market access and ongoing operations. They include:

- Regulatory Submissions and Approvals: Costs associated with preparing and submitting documentation for new product clearances or approvals and maintaining existing ones.

- Quality System Maintenance: Ongoing expenses for implementing and managing robust quality management systems, including internal and external audits.

- Compliance Monitoring and Remediation: Investments in ensuring adherence to global regulations like FDA requirements and implementing corrective actions, such as those outlined in their Compliance Master Plan.

General, Administrative, and Personnel Costs

General, administrative, and personnel costs are foundational to Integra LifeSciences' operations, encompassing everything from executive leadership and IT infrastructure to essential legal services and broader corporate overhead. These expenses are primarily fixed, meaning they remain relatively stable regardless of sales volume, and are crucial for guiding the company's strategic path and ensuring smooth daily functioning.

For 2024, Integra Life Sciences reported significant investments in its personnel and administrative infrastructure. These costs are vital for maintaining regulatory compliance, supporting research and development initiatives, and managing a global workforce. Such expenditures are non-negotiable for a company of Integra's scale and scope in the life sciences sector.

- Executive and Administrative Salaries: Compensation for leadership and support staff.

- IT Infrastructure: Costs associated with technology systems and support.

- Legal and Compliance: Expenses for legal counsel and regulatory adherence.

- Corporate Overheads: General operational expenses not tied to specific product lines.

Integra Life Sciences' cost structure is significantly influenced by its substantial investments in Research and Development (R&D) and its manufacturing operations. The company reported R&D expenses of $275 million in 2023, highlighting a commitment to innovation. Concurrently, its cost of goods sold for 2023 was $768.5 million, reflecting the expenses tied to producing high-quality medical devices and biomaterials.

| Cost Category | 2023 Expense (Millions USD) | Significance |

|---|---|---|

| Research & Development | $275 | Drives innovation and new product development. |

| Cost of Goods Sold | $768.5 | Covers raw materials, labor, and overhead for manufacturing. |

| Selling, General & Administrative | $444.5 | Supports sales, marketing, distribution, and corporate functions. |

Revenue Streams

Integra LifeSciences' core revenue generation hinges on the direct sale of its sophisticated surgical implants and regenerative technologies. These are not everyday items; they are high-value, specialized products crucial for intricate surgical interventions, like dural repair solutions and advanced tissue reconstruction technologies.

In the first quarter of 2024, Integra LifeSciences reported total revenue of $389.4 million, with their Codman Specialty Surgical segment, which includes many of these implantable devices, contributing significantly. This segment alone generated $248.2 million in the same period, underscoring the substantial market demand for their advanced surgical offerings.

Integra LifeSciences generates revenue by selling a broad portfolio of medical instruments and capital equipment. This includes specialized tools for neurosurgery, reconstructive surgery, and general surgical procedures, as well as monitoring devices that aid in patient care during operations.

For instance, in the first quarter of 2024, Integra reported total revenue of $385.6 million, with a significant portion coming from their Codman specialty surgical segment, which encompasses many of these instrument and capital equipment sales. This segment saw a 2.6% increase in revenue year-over-year, highlighting continued demand for their surgical offerings.

Integra LifeSciences generates a significant portion of its revenue from the recurring sales of consumables and disposable products. These items, essential for the use of their capital equipment and implants, create a predictable income stream.

For instance, in the first quarter of 2024, Integra reported net sales of $390.1 million, with a substantial portion attributed to these recurring revenue segments, demonstrating their importance to the company's financial stability.

Licensing and Royalty Agreements

Integra Life Sciences might also earn income by licensing its unique technologies or intellectual property to other medical device manufacturers. This strategy allows them to capitalize on their research and development efforts even if they don't directly sell the final product.

Royalty agreements on products developed in collaboration with other companies represent another potential revenue stream. This approach extends the reach of Integra's innovations and provides ongoing income based on the success of partnered ventures.

- Licensing Revenue: Income generated from allowing other companies to use Integra's patented technologies or intellectual property.

- Royalty Payments: Earnings received from co-developed products, based on sales or other agreed-upon metrics.

- Leveraging R&D: Monetizing internal innovation beyond direct product sales, maximizing return on research investments.

Service and Maintenance Contracts

Integra Life Sciences offers service and maintenance contracts for its capital equipment and complex devices. These contracts provide customers with ongoing technical support, essential repairs, and scheduled preventative maintenance. This revenue stream is crucial for generating predictable, recurring income and fostering stronger, long-term relationships with clients.

For fiscal year 2023, Integra Life Sciences reported total revenue of $1.54 billion. While specific segment data for service and maintenance contracts isn't always broken out individually, such recurring revenue is a key component in supporting the company's overall financial stability and customer retention efforts. These contracts typically represent a significant portion of revenue for medical device companies with complex product lines.

- Recurring Revenue: Service and maintenance contracts provide a stable, predictable income stream, supplementing initial product sales.

- Customer Loyalty: Offering ongoing support enhances customer satisfaction and encourages continued business, reducing churn.

- Extended Product Lifespan: Preventative maintenance helps ensure equipment functions optimally for longer periods, increasing its value to the customer.

- Competitive Advantage: Robust service offerings can differentiate Integra from competitors, particularly for high-value capital equipment.

Integra Life Sciences generates revenue primarily through the sale of specialized surgical implants and regenerative technologies, alongside a broad portfolio of medical instruments and capital equipment. Recurring revenue from consumables and disposable products is also a key component, ensuring a predictable income stream.

Additionally, the company may monetize its innovations through technology licensing and royalty payments from co-developed products, further capitalizing on its research and development investments. Service and maintenance contracts for its equipment also contribute to stable, recurring income and customer retention.

| Revenue Stream | Description | Q1 2024 Data (Millions USD) |

|---|---|---|

| Surgical Implants & Regenerative Tech | High-value, specialized products for surgical procedures. | Codman Specialty Surgical Segment: $248.2 |

| Medical Instruments & Capital Equipment | Specialized tools and monitoring devices for surgery. | Codman Specialty Surgical Segment: $248.2 (part of total) |

| Consumables & Disposables | Essential items for use with capital equipment and implants. | Part of Total Net Sales: $390.1 (Q1 2024) |

| Licensing & Royalties | Monetizing patented technologies and co-developed products. | Not separately reported in Q1 2024, but a strategic stream. |

| Service & Maintenance Contracts | Ongoing support and upkeep for equipment. | Contributes to overall stability; not broken out individually in Q1 2024. |

Business Model Canvas Data Sources

The Integra LifeSciences Business Model Canvas is informed by a blend of internal financial reports, market research on medical device trends, and competitive analysis of industry players. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.