Integra LifeSciences Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

Discover how Integra LifeSciences leverages its product innovation, strategic pricing, extensive distribution, and targeted promotions to dominate the medical technology market. Understand the synergy of their 4Ps and unlock actionable insights.

Go beyond the surface—get access to an in-depth, ready-made Marketing Mix Analysis covering Integra LifeSciences' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning for Integra LifeSciences.

Product

Integra LifeSciences' surgical implants and biomaterials are central to their offering, catering to diverse medical needs from tissue repair to complex reconstructions. These advanced solutions, including those for dural, nerve, and tendon repair, underscore the company's commitment to regenerative medicine and enhancing patient recovery.

The company's product development in this segment is driven by innovation, aiming to provide surgeons with cutting-edge tools for improved patient outcomes. For instance, their regenerative technologies are designed to facilitate natural healing processes, a key differentiator in a competitive market.

In 2023, Integra LifeSciences reported total revenue of $1.57 billion, with their "Codman Specialty Surgical" segment, which includes many of these implant and biomaterial products, showing robust performance. This segment is crucial for the company's growth strategy, reflecting strong market demand for advanced surgical solutions.

Integra LifeSciences is a major player in the neurosurgery market, offering a comprehensive suite of products. Their offerings address critical needs in dural repair, CSF management, and neuro-critical care, solidifying their global leadership in this specialized field.

Key products like CereLink® intracranial pressure monitors and BactiSeal® for CSF management demonstrate Integra's dedication to advancing neurological patient care. These innovations underscore their commitment to providing sophisticated solutions for complex neurosurgical procedures.

Integra LifeSciences' Advanced Wound Care products, including DuraSorb®, MicroMatrix®, Cytal®, and Integra Skin, offer versatile, evidence-based regenerative technologies designed for complex acute and chronic wounds and burns. These solutions focus on treating, repairing, and protecting patients by facilitating the body's inherent healing mechanisms.

The company is actively bolstering its manufacturing infrastructure to ensure a more dependable supply chain for its critical wound care offerings. This strategic investment underscores their commitment to meeting market demand and supporting patient care continuity.

Surgical Instruments and Lighting

Integra LifeSciences offers a broad portfolio of surgical instruments and lighting, complementing their implant and regenerative medicine offerings. These products are vital for surgeons, ensuring accuracy and streamlining procedures across numerous medical specialties. For instance, in 2023, Integra's Codman Surgical Instrumentation segment generated $430 million in revenue, highlighting the market demand for these essential tools.

Technological innovation in surgical instruments and lighting directly impacts patient care. Advancements aim to improve visualization, reduce procedure times, and enhance surgeon ergonomics, ultimately leading to better patient outcomes. Integra's commitment to this area is evident in their continuous product development, focusing on areas like minimally invasive surgical tools.

- Product: Comprehensive range of surgical instruments and specialized lighting systems.

- Purpose: Facilitate precision, efficiency, and improved patient outcomes in surgical procedures.

- Market Relevance: Essential tools supporting a wide array of medical specialties, contributing to operational effectiveness in hospitals.

- Recent Performance: Integra's surgical instrumentation business saw consistent demand, with the company investing in R&D for next-generation surgical technologies.

Ear, Nose, and Throat (ENT) Portfolio

Integra LifeSciences' Ear, Nose, and Throat (ENT) portfolio has seen significant expansion, notably through the strategic acquisition of Acclarent, Inc. in 2024. This move bolsters Integra's offerings in the ENT space, enabling them to collaborate with medical professionals on innovative solutions. Their focus remains on developing technologies that ensure safe, rapid, and effective treatments for ENT conditions, thereby enhancing their reach within specialized surgical fields.

The integration of Acclarent's advanced technologies is designed to address unmet needs in ENT care, positioning Integra as a key player in this growing market. This strategic initiative is part of Integra's broader plan to diversify and strengthen its surgical product lines, aiming for enhanced patient outcomes and market share growth. By focusing on physician partnerships and technological advancement, Integra is cultivating a robust ENT segment.

Key aspects of the ENT portfolio's market strategy include:

- Product Innovation: Leveraging acquired technologies to introduce novel ENT treatment devices.

- Physician Collaboration: Building strong relationships with ENT specialists to drive adoption and feedback.

- Market Expansion: Increasing Integra's footprint in the specialty surgical market through targeted acquisitions.

- Treatment Efficacy: Prioritizing solutions that offer safe, fast, and effective patient outcomes.

Integra LifeSciences' product strategy centers on specialized medical devices and regenerative technologies. Their offerings span neurosurgery, advanced wound care, and surgical instruments, with a strong emphasis on innovation to improve patient outcomes. The 2024 acquisition of Acclarent further strengthens their position in the ENT market, adding advanced treatment devices.

| Product Category | Key Offerings | 2023 Revenue Contribution (Approx.) | Strategic Focus |

|---|---|---|---|

| Neurosurgery | Dural repair, CSF management, ICP monitoring | Significant portion of Codman Specialty Surgical segment | Leadership in specialized neurological care |

| Advanced Wound Care | DuraSorb, MicroMatrix, Cytal, Integra Skin | Strong performance within overall revenue | Regenerative technologies for complex wounds |

| Surgical Instruments & Lighting | Instruments for various specialties, surgical lighting | $430 million (Codman Surgical Instrumentation segment) | Precision, efficiency, and minimally invasive tools |

| ENT | Acquired Acclarent technologies (2024) | Emerging contribution post-acquisition | Expansion in specialty surgical markets |

What is included in the product

This analysis offers a comprehensive examination of Integra LifeSciences' marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Simplifies Integra LifeSciences' marketing strategy by clearly outlining how their Product, Price, Place, and Promotion efforts directly address and alleviate pain points for healthcare professionals and patients.

Provides a concise, actionable overview of Integra's 4Ps, enabling stakeholders to quickly understand how the company's marketing actively solves critical challenges in the medical field.

Place

Integra LifeSciences leverages a direct sales force to engage healthcare facilities, including hospitals and surgical centers. This strategy facilitates in-depth product education and technical support, crucial for their specialized medical devices and implants. In 2023, Integra reported approximately 1,700 sales representatives globally, a significant portion dedicated to direct engagement with healthcare providers.

Integra Life Sciences utilizes a network of specialized medical distributors to complement its direct sales efforts. These distributors are crucial for accessing smaller healthcare facilities and specific international markets where a direct presence might be less efficient. For instance, in 2024, Integra reported that its international sales, which heavily rely on distribution partners, contributed significantly to its overall revenue growth.

These distributors are chosen based on their proven track record in managing medical technology and their understanding of intricate healthcare purchasing systems. This strategic partnership allows Integra to maintain high service standards while expanding its market penetration. The company's 2025 outlook anticipates further growth in these channels, aiming to capture an increased share of the fragmented medical device market.

Integra LifeSciences is strategically growing its global commercial footprint, with its innovative products now accessible in over 120 countries. This expansive reach is a cornerstone of their market penetration strategy, aiming to bring advanced medical solutions to a diverse worldwide patient population.

A significant aspect of this global expansion involves establishing localized operational capabilities. For instance, the 'In-China-For-China' initiative, which includes local assembly in Suzhou, demonstrates Integra's commitment to tailoring their supply chain and product delivery to meet the specific needs of key regional markets, enhancing efficiency and responsiveness.

By deepening its international presence and investing in regional infrastructure, Integra LifeSciences is positioning itself to capitalize on emerging growth opportunities. This global approach is crucial for delivering sustained value to patients and healthcare providers across the globe, reflecting a forward-thinking market strategy.

Online Platforms for Information and Support

Integra Life Sciences leverages its corporate website and dedicated investor relations portals as key online platforms for information dissemination and stakeholder engagement. These digital channels are vital for providing healthcare professionals with detailed product specifications and clinical trial results, while also offering investors access to financial statements and company news. For instance, during fiscal year 2023, Integra reported net sales of $1.57 billion, with a significant portion of investor interest directed towards their online financial disclosures.

These platforms are designed to foster transparency and facilitate informed decision-making among a broad audience. They act as a central hub for accessing critical data, including regulatory updates and product innovation pipelines.

- Corporate Website: Serves as a primary resource for product information, technical data, and clinical evidence for healthcare professionals.

- Investor Relations Portal: Provides access to financial reports, SEC filings, earnings call transcripts, and corporate governance information for investors.

- Content Focus: Offers detailed product catalogs, scientific publications, and company news, supporting informed purchasing decisions and investment analysis.

- Engagement: Facilitates communication through contact forms and investor inquiry channels, enhancing transparency and accessibility.

Strategic Manufacturing and Supply Chain Investments

Integra LifeSciences is strategically investing in its manufacturing and supply chain to bolster capacity and reliability. A key initiative is the operationalization of a new facility in Braintree, Massachusetts, slated for the first half of 2026. This expansion is designed to significantly boost production for vital regenerative technology products, including PriMatrix® and SurgiMend®.

These investments are crucial for mitigating supply chain vulnerabilities and ensuring consistent product availability for customers. By enhancing its manufacturing footprint, Integra aims to strengthen its market position and support the growing demand for its innovative regenerative medicine solutions.

- Braintree, MA Facility: Operational by H1 2026.

- Product Focus: PriMatrix® and SurgiMend®.

- Strategic Goal: Enhance capacity and supply reliability.

- Risk Mitigation: Reduce supply chain risks.

Integra Life Sciences' place strategy emphasizes a multi-channel approach, combining a robust direct sales force with specialized distributors. This ensures broad market coverage, from major hospitals to smaller facilities, both domestically and internationally. The company's commitment to global reach is evident, with products available in over 120 countries, supported by localized operations like its Suzhou facility in China.

Integra's physical presence is also being strengthened through strategic investments in manufacturing. The upcoming Braintree, Massachusetts facility, expected to be operational by the first half of 2026, will enhance production capacity for key regenerative technology products, underscoring a commitment to reliable supply and market responsiveness.

| Channel | Reach | Key Products/Focus | 2023/2024/2025 Data Point |

|---|---|---|---|

| Direct Sales Force | Hospitals, Surgical Centers | Specialized medical devices, Implants | ~1,700 sales reps globally (2023) |

| Distributors | Smaller facilities, International markets | Medical technology | Significant contributor to international revenue growth (2024) |

| Global Footprint | 120+ Countries | Advanced medical solutions | Continued growth anticipated (2025 outlook) |

| Manufacturing/Supply Chain | Braintree, MA (H1 2026) | PriMatrix®, SurgiMend® | Capacity & reliability enhancement |

What You See Is What You Get

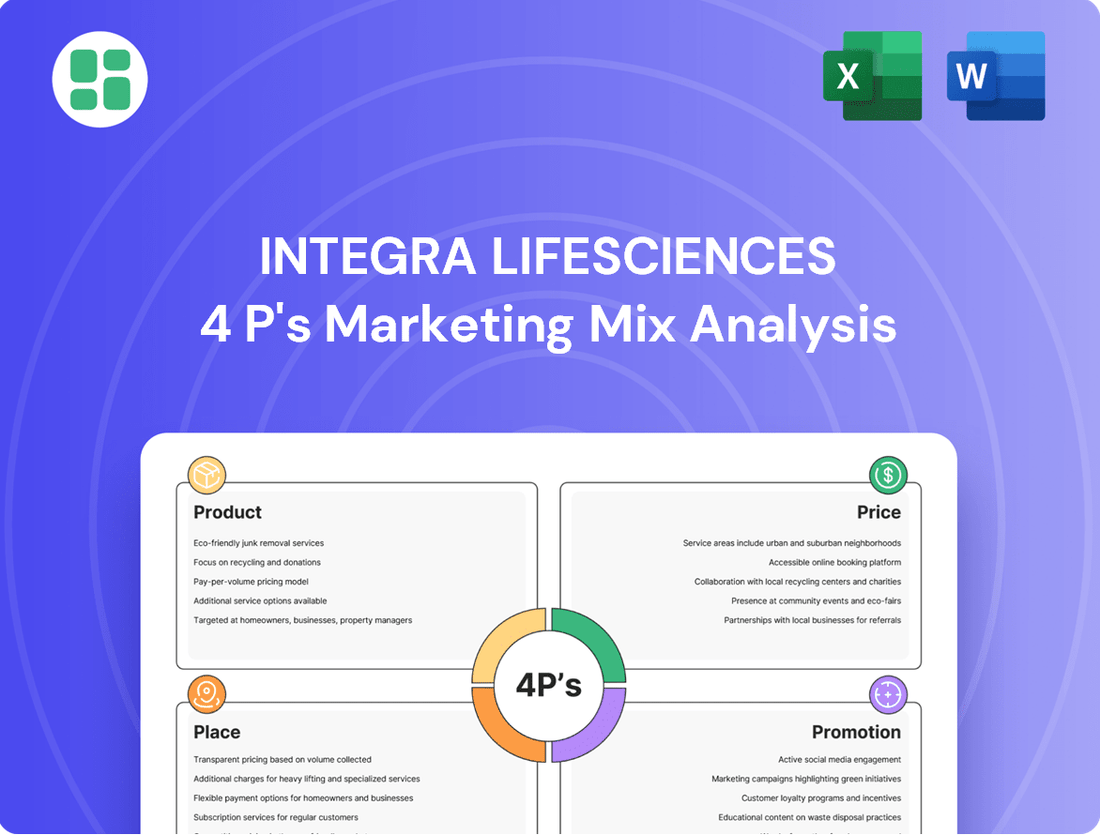

Integra LifeSciences 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises regarding Integra LifeSciences' 4P's Marketing Mix Analysis. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use. This document provides a comprehensive breakdown of Integra LifeSciences' Product, Price, Place, and Promotion strategies.

Promotion

Integra LifeSciences strongly emphasizes its commitment to clinical evidence and peer-reviewed publications to validate the effectiveness and safety of its medical devices. This scientific foundation is paramount for securing the confidence of healthcare professionals and gaining market acceptance.

The company actively showcases its progress in Premarket Approval (PMA) submissions and regulatory clearances, underscoring its dedication to rigorous scientific validation. For instance, in 2024, Integra continued to pursue regulatory pathways for new innovations, aiming to build upon its established portfolio.

Integra Life Sciences actively participates in major medical conferences and industry summits, a key element of its promotional strategy. For instance, in 2024, the company showcased its latest innovations at events like the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting, highlighting advancements in their orthopedic solutions.

These platforms are crucial for presenting new products and sharing vital clinical data directly with healthcare professionals and key opinion leaders. Integra's presence at these gatherings facilitates direct engagement, fostering relationships and gathering valuable market feedback.

Furthermore, Integra invests in educational symposia and workshops. These sessions are designed to effectively disseminate product knowledge and promote best practices among medical professionals, enhancing the adoption and effective use of their technologies.

Integra Life Sciences leverages a highly trained direct sales force to connect with surgeons and specialists, offering personalized product demonstrations and addressing unique clinical needs. This direct engagement is crucial for building trust and driving adoption of their innovative medical technologies.

In 2024, Integra's sales force actively engaged with thousands of healthcare professionals across various specialties. Their efforts are supported by strategic collaborations with Key Opinion Leaders (KOLs), who provide invaluable clinical insights and champion Integra's solutions, amplifying their reach and credibility within the medical community.

Targeted Digital Marketing and Corporate Communications

Integra Life Sciences leverages targeted digital marketing to reach its key audiences. This includes utilizing its corporate website and dedicated investor relations platforms to effectively communicate product advantages and significant company updates.

The company also prioritizes robust corporate communications. Regular press releases and detailed financial reports are distributed to keep stakeholders informed about critical business developments, new product introductions, and ongoing strategic endeavors.

- Digital Reach: Integra's corporate website and investor relations portals serve as primary digital channels for product messaging and corporate news.

- Information Dissemination: Press releases and financial reports are key tools for informing investors, healthcare professionals, and other stakeholders.

- Targeted Audience Engagement: Communications are designed to reach financially-literate decision-makers and healthcare professionals effectively.

- Transparency: Regular updates on business highlights, product launches, and strategic initiatives foster transparency and build stakeholder confidence.

Public Relations and Industry Partnerships

Integra LifeSciences actively cultivates its public relations and industry partnerships to bolster its standing in the medical technology sector. These strategic alliances are crucial for amplifying brand awareness and solidifying its reputation as a frontrunner in surgical, neurologic, and regenerative care solutions. By engaging in these activities, Integra aims to cultivate a favorable image among healthcare professionals, investors, and the general public, underscoring its commitment to innovation and patient well-being.

The company's focus on public relations and partnerships directly supports its marketing objectives by creating a narrative of leadership and reliability. This approach is vital for differentiating Integra in a competitive landscape and for building trust with key stakeholders. For instance, in 2024, Integra announced several collaborations aimed at advancing its product lines, including partnerships focused on expanding access to its neurosurgical devices and regenerative medicine technologies.

These collaborations are not merely for promotional purposes; they often pave the way for joint research and development initiatives. Such synergistic efforts can accelerate the innovation cycle, leading to the creation of next-generation medical technologies. Integra's engagement in industry events and thought leadership initiatives in 2024 further cemented its position, with executives participating in key conferences to discuss advancements in their core therapeutic areas.

- Brand Visibility: Public relations efforts in 2024 focused on highlighting Integra's contributions to patient outcomes in complex surgical procedures.

- Industry Recognition: Strategic partnerships are designed to align Integra with leading medical institutions and research bodies, enhancing its credibility.

- Collaborative Innovation: The company actively seeks partnerships that can lead to co-development of new technologies, particularly in regenerative medicine.

- Stakeholder Engagement: Integra's investor relations and public outreach in 2024 emphasized its growth strategy, supported by strong industry ties.

Integra Life Sciences' promotional strategy hinges on robust scientific validation and direct engagement with healthcare professionals. Their participation in key medical conferences, such as the 2024 AAOS Annual Meeting, alongside educational symposia and workshops, serves to disseminate product knowledge and clinical data. A highly trained direct sales force, supported by Key Opinion Leaders, actively promotes their innovative medical technologies, fostering trust and driving adoption.

The company also emphasizes targeted digital marketing and transparent corporate communications, utilizing its website and investor relations platforms for product messaging and company updates. In 2024, Integra's public relations and industry partnerships further amplified brand awareness, highlighting contributions to patient outcomes and fostering collaborative innovation, particularly in regenerative medicine.

| Promotional Activity | Key Engagement Channels | 2024 Focus/Data Points |

|---|---|---|

| Scientific Validation & Dissemination | Peer-reviewed publications, Medical conferences (e.g., AAOS 2024) | Showcased orthopedic advancements; pursued PMA for new innovations. |

| Direct Sales & KOL Engagement | Direct sales force, KOL collaborations | Engaged thousands of healthcare professionals; KOLs championed solutions. |

| Digital & Corporate Communications | Corporate website, Investor relations, Press releases | Communicated product advantages and strategic endeavors; emphasized growth strategy. |

| Public Relations & Partnerships | Industry partnerships, Media outreach | Announced collaborations for neurosurgical and regenerative medicine tech; highlighted patient outcomes. |

Price

Integra LifeSciences utilizes a value-based pricing strategy, aligning its product costs with the tangible clinical benefits and improved patient outcomes its advanced medical technologies provide. This means prices are set not just on manufacturing costs, but on the overall value delivered to patients and healthcare systems, such as enhanced quality of life and long-term cost savings. For instance, their innovative surgical implants and regenerative products are priced to reflect their demonstrated efficacy and unique features.

Integra Life Sciences' pricing strategy is deeply intertwined with understanding its competitors in the dynamic medical technology market. They meticulously track competitor pricing for comparable products, aiming to position their offerings as both valuable and cost-effective.

This competitive pricing analysis helps Integra strike a delicate balance between capturing market share and upholding the perceived value of their innovative solutions. For instance, in the neurosurgery segment, where competitors like Medtronic and Stryker are prominent, Integra must consider their pricing benchmarks when setting prices for its Dural Repair products.

The company's pricing decisions in 2024 and 2025 will likely reflect ongoing efforts to differentiate its portfolio, particularly in areas like regenerative technologies and advanced wound care, by highlighting unique selling propositions that justify its price points against established rivals.

Reimbursement policies and healthcare system purchasing behaviors are critical factors influencing Integra LifeSciences' device pricing. Navigating various reimbursement codes and hospital budget cycles, such as the Medicare Severity-Adjusted Diagnosis-Related Groups (MS-DRGs) for inpatient procedures, directly affects market access and adoption rates for their products. Securing favorable reimbursement is paramount, as demonstrated by the impact of payer decisions on device utilization within major integrated delivery networks.

Research, Development, and Regulatory Costs

Integra LifeSciences' pricing reflects significant investments in research and development (R&D) for cutting-edge medical devices. For instance, the company's commitment to innovation is evident in its ongoing pipeline development, which requires substantial capital outlay. These upfront costs are crucial for bringing novel solutions to market.

The rigorous and often lengthy regulatory approval processes, such as those mandated by the FDA in the US and the EU Medical Device Regulation, add another layer of expense. Meeting these stringent compliance standards, which ensure product safety and efficacy, directly impacts the cost structure and, consequently, the final pricing of Integra's products. This regulatory burden is a consistent factor in the medical technology industry.

These combined R&D and regulatory expenditures necessitate a pricing strategy that allows Integra to recoup its substantial investments and fund future innovation. For example, in 2023, Integra reported R&D expenses of approximately $160 million, underscoring the ongoing financial commitment required to maintain its competitive edge in the medical technology sector. This financial reality is a key driver in how their product prices are established.

Key cost drivers influencing Integra's pricing include:

- Substantial R&D investment for new product development.

- Costs associated with navigating complex global regulatory pathways.

- Ongoing compliance and post-market surveillance requirements.

- Investment in clinical trials to support product efficacy and market adoption.

Discounts, Bundling, and Contractual Terms

Integra Life Sciences employs a strategic pricing approach, utilizing volume discounts, product bundling, and long-term contracts to drive sales and build customer loyalty within the healthcare sector. These flexible pricing structures are tailored to accommodate the varied purchasing requirements of hospitals and surgical facilities, ensuring predictable revenue for Integra.

For instance, in 2023, Integra reported net sales of $1.57 billion. The company's ability to offer competitive pricing through these varied models directly impacts its market share and revenue generation. Furthermore, evolving trade policies and potential tariffs can necessitate adjustments to these pricing strategies, influencing overall profitability and competitiveness in the global market.

- Volume Discounts: Incentivize larger orders, improving per-unit cost efficiency for buyers.

- Product Bundling: Offers packages of complementary products, increasing average order value and customer convenience.

- Contractual Terms: Secure long-term commitments from healthcare providers, creating stable revenue streams.

- Tariff Impact: Pricing strategies are monitored and adjusted to mitigate the financial effects of import duties and trade regulations.

Integra Life Sciences' pricing strategy is a nuanced approach that balances value, competition, and cost. The company aims to price its innovative medical technologies based on the clinical and economic benefits they deliver, rather than solely on manufacturing costs. This value-based approach is crucial in a market where improved patient outcomes and long-term cost savings are highly valued by healthcare providers.

The company actively monitors competitor pricing in segments like neurosurgery and regenerative medicine to ensure its products are positioned competitively. This allows Integra to differentiate its offerings by highlighting unique selling propositions that justify its price points against established rivals, a strategy expected to continue through 2024 and 2025.

Reimbursement landscapes and healthcare system purchasing behaviors significantly influence Integra's pricing. Favorable reimbursement, such as through MS-DRGs, is essential for market access. The company's pricing also reflects substantial investments in R&D, with approximately $160 million spent on R&D in 2023, and the costs associated with rigorous regulatory approvals, like FDA and EU MDR compliance.

To drive sales and foster loyalty, Integra employs flexible pricing tactics such as volume discounts, product bundling, and long-term contracts. These strategies help manage the impact of trade policies and tariffs, contributing to their net sales of $1.57 billion in 2023.

| Pricing Tactic | Description | Impact on Sales/Revenue | Example Relevance |

| Value-Based Pricing | Aligns price with clinical/economic benefits. | Enhances perceived value, supports premium pricing. | Regenerative products, surgical implants. |

| Competitive Benchmarking | Considers competitor pricing for similar products. | Aids market share capture and value perception. | Neurosurgery products vs. Medtronic/Stryker. |

| Volume Discounts | Offers lower per-unit prices for larger orders. | Increases order size, improves buyer cost efficiency. | Bulk purchases by hospital networks. |

| Product Bundling | Packages complementary products together. | Increases average order value, enhances customer convenience. | Offering wound care solutions as a package. |

4P's Marketing Mix Analysis Data Sources

Our Integra Life Sciences 4P's Marketing Mix Analysis leverages a comprehensive blend of official company disclosures, including SEC filings and investor presentations, alongside detailed industry reports and competitive intelligence. This ensures our insights into their products, pricing, distribution, and promotional strategies are grounded in verifiable market activity.