Integra LifeSciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

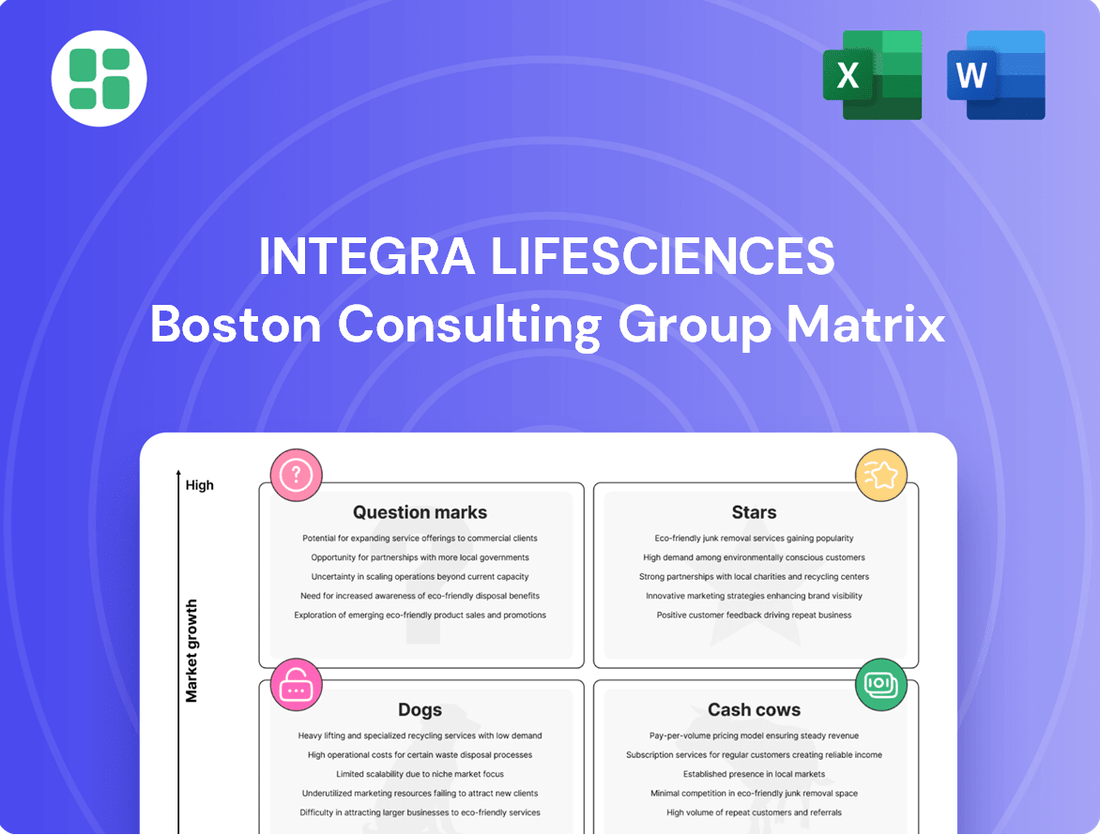

Integra LifeSciences' BCG Matrix offers a strategic snapshot of their product portfolio, categorizing innovations as Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is crucial for informed decision-making and resource allocation.

This glimpse into Integra LifeSciences' product performance is just the beginning. Unlock the full potential of their BCG Matrix by purchasing the complete report for detailed quadrant analysis, actionable insights, and a clear path to optimizing their market strategy.

Stars

The acquisition of Acclarent in April 2024 marked a pivotal moment for Integra LifeSciences, injecting approximately $1 billion into its total addressable market within the ENT surgical interventions sector. This strategic integration is poised to deliver immediate scale and contribute to accretive growth for the company.

Acclarent's reputation as an innovator and a leader in the ENT market positions this acquired portfolio as a high-growth, high-market share segment for Integra. This strategic addition significantly bolsters Integra's competitive standing and future revenue potential in a key medical specialty.

CereLink® ICP Monitors, a key offering in Integra LifeSciences' neuro monitoring portfolio, are experiencing robust expansion with high single-digit organic growth. This impressive performance is driven by the product's distinct clinical benefits, particularly its precision and enhanced infection prevention capabilities.

These advantages are enabling CereLink® ICP Monitors to capture an increasing share of the market. The growing demand within the neuro-critical care sector, where these monitors are essential, further solidifies their position.

Integra LifeSciences reported that their neurosurgery segment, which includes ICP monitoring, saw a 4.6% increase in revenue for the first quarter of 2024, reaching $128.1 million. This growth trajectory for CereLink® ICP Monitors strongly suggests their classification as a Star product within the BCG matrix, reflecting their high market share and high growth potential.

Integra Life Sciences' BactiSeal® and Certas® Plus, key offerings in cerebrospinal fluid (CSF) management, have demonstrated robust performance, achieving low double-digit organic growth. This consistent expansion solidifies Integra's standing in the lucrative neurosurgery market.

These products are classified as Stars within the BCG Matrix due to their significant market share and high growth rate. In 2023, Integra reported that its neurosurgery segment, which includes these CSF management solutions, saw substantial revenue contributions, underscoring their importance to the company's overall success.

DuraSorb®

DuraSorb® is a key player within Integra Life Sciences' Wound Reconstruction portfolio, demonstrating consistent low double-digit growth. This performance places it firmly in the Star category of the BCG matrix.

The advanced wound care market, where DuraSorb® operates, has seen significant expansion. Integra Life Sciences reported that its Wound Reconstruction segment, which includes DuraSorb®, experienced strong organic growth in 2024, driven by positive market reception and increasing demand for innovative solutions.

- DuraSorb® contributes to Integra's Wound Reconstruction segment, which saw robust organic growth in 2024.

- The product exhibits low double-digit growth, a strong indicator for its Star status.

- Its success is tied to the favorable market reception within the expanding advanced wound care sector.

- This positions DuraSorb® as a high-growth, high-market-share product for Integra Life Sciences.

Craniomaxillofacial Implants

Integra LifeSciences is a significant force in the craniomaxillofacial (CMF) implants market, offering a broad array of solutions for neurosurgery and cranial reconstruction. This segment is experiencing robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of 7.13% from 2025 through 2034.

Given Integra's extensive product offerings and the substantial growth anticipated in the CMF implants sector, this business unit is classified as a Star in the BCG Matrix. The market's upward trajectory, driven by advancements in medical technology and increasing demand for reconstructive procedures, supports this classification.

- Market Growth: The CMF implants market is expected to grow at a CAGR of 7.13% between 2025 and 2034.

- Integra's Position: Integra LifeSciences holds a strong portfolio in this expanding market.

- Star Classification: The combination of high market growth and Integra's significant presence positions CMF implants as a Star.

Integra Life Sciences' CereLink® ICP Monitors are a prime example of a Star product, exhibiting high single-digit organic growth driven by superior clinical benefits like precision and infection prevention. This strong performance, contributing to a 4.6% revenue increase in the neurosurgery segment in Q1 2024, firmly places them in the high-growth, high-market-share category.

BactiSeal® and Certas® Plus CSF management solutions are also Stars, achieving low double-digit organic growth and solidifying Integra's neurosurgery market position. DuraSorb®, in the Wound Reconstruction portfolio, similarly demonstrates low double-digit growth, benefiting from the expanding advanced wound care market and positive reception.

The craniomaxillofacial (CMF) implants segment, with its projected 7.13% CAGR from 2025-2034, is another Star for Integra Life Sciences. Integra's extensive offerings in this growing market, fueled by technological advancements and demand for reconstructive procedures, solidify its Star status.

| Product/Segment | Growth Rate | BCG Classification | Supporting Factor |

| CereLink® ICP Monitors | High single-digit organic growth | Star | Clinical benefits, Q1 2024 neurosurgery revenue up 4.6% |

| BactiSeal® & Certas® Plus (CSF Management) | Low double-digit organic growth | Star | Strong neurosurgery segment contribution |

| DuraSorb® | Low double-digit growth | Star | Expanding advanced wound care market, positive reception |

| CMF Implants | Projected 7.13% CAGR (2025-2034) | Star | Strong Integra portfolio in a high-growth market |

What is included in the product

The Integra LifeSciences BCG Matrix identifies product portfolio strengths and weaknesses to guide investment decisions.

Clear visualization of Integra LifeSciences' portfolio for strategic decision-making.

Streamlined analysis of Integra LifeSciences' business units to identify growth opportunities.

Cash Cows

The Mayfield Cranial Stabilization Systems are a cornerstone of Integra LifeSciences' portfolio, fitting squarely into the Cash Cow quadrant of the BCG Matrix. These systems are foundational in neurosurgery, enjoying widespread recognition and consistent utilization for cranial access, a testament to their reliability and efficacy.

Despite operating in a mature market for such established neurosurgical instruments, Mayfield's robust brand equity and deep market penetration translate into a predictable and substantial cash flow for Integra. In 2024, the neurosurgery market, where these systems are dominant, demonstrated steady growth, with reports indicating a compound annual growth rate (CAGR) of approximately 5% for neurosurgical devices, underscoring the sustained demand for reliable stabilization solutions.

These systems function as dependable revenue generators, requiring minimal aggressive promotional investment due to their entrenched market position and established clinical value. This allows Integra to leverage the substantial cash flow generated by Mayfield to fund investments in other areas of its business, such as high-growth potential Stars or Question Marks.

Integra Life Sciences' CUSA Disposables, a key component of their advanced energy portfolio, are exhibiting low single-digit organic growth. This performance suggests a mature product line with a substantial existing customer base, consistently contributing to revenue streams.

The CUSA brand's strong market presence allows Integra to leverage these disposables as cash cows. This means the company can effectively generate reliable cash flow from these products without needing significant new investments to drive further expansion.

DuraGen® and DuraSeal® represent Integra LifeSciences' established dural repair solutions, fitting squarely into the Cash Cow quadrant of the BCG Matrix. These products have a history of consistent performance, even amidst broader market segment challenges, highlighting their crucial role in Integra's dural access and repair portfolio.

As high-quality, long-standing brands, DuraGen® and DuraSeal® benefit from strong market recognition and a steady, predictable demand. Their presence in a mature market allows them to leverage an established competitive advantage, translating into high profit margins and a reliable source of cash generation for the company.

Integra® Skin (Mature Applications)

Integra® Skin (Mature Applications) sits firmly in the Cash Cows quadrant of the BCG Matrix for Integra LifeSciences. This product boasts a significant market share within the wound reconstruction sector, a segment that, while mature, continues to exhibit steady demand. In the fourth quarter of 2024, Integra® Skin demonstrated mid-single-digit growth, underscoring its consistent performance.

Despite experiencing some temporary production disruptions, Integra LifeSciences is making concerted efforts to resolve these issues and stabilize the supply chain. The company anticipates a return to historical production levels, which will further solidify Integra® Skin's position as a reliable revenue generator.

Key financial and performance indicators for Integra® Skin include:

- Market Position: High market share in a mature wound reconstruction segment.

- Growth Rate: Mid-single-digit growth observed in Q4 2024.

- Production Status: Temporary delays being addressed with a focus on supply chain stabilization.

- Cash Generation: Consistently generates significant cash flow, indicative of a strong Cash Cow.

MicroMatrix® and Cytal® (Regenerative Matrices)

MicroMatrix® and Cytal® are key regenerative matrix products in Integra LifeSciences' Tissue Technologies segment. These offerings are consistently achieving low double-digit growth, demonstrating their sustained market appeal.

These products hold leading positions within their specific niches in wound reconstruction. This strong market share in a stable, mature segment signifies their established presence and customer trust.

The robust cash flow generated by MicroMatrix® and Cytal® is a significant advantage. Their mature market status means they require relatively low investment for promotion and expansion.

- Market Position: Leaders in wound reconstruction niches.

- Growth: Consistent low double-digit growth.

- Financial Contribution: Strong, stable cash flow generators.

- Investment Needs: Low ongoing investment for promotion.

Integra Life Sciences' CUSA Disposables, part of their advanced energy offerings, are experiencing low single-digit organic growth, indicating a mature product line with a loyal customer base. This stability allows them to function as reliable revenue generators for the company.

The strong market presence of the CUSA brand means these disposables effectively generate consistent cash flow without requiring substantial new investment for further expansion. This positions them as valuable cash cows within Integra's portfolio.

DuraGen® and DuraSeal®, Integra Life Sciences' established dural repair solutions, are also firmly positioned as cash cows. Their consistent performance and strong market recognition in a mature segment translate into high profit margins and predictable cash generation.

Integra® Skin (Mature Applications) holds a significant market share in the wound reconstruction sector, a mature but steady market. In Q4 2024, it showed mid-single-digit growth, reinforcing its role as a reliable revenue generator despite temporary production issues being addressed.

| Product Line | BCG Quadrant | 2024 Growth Indicator | Market Characteristic | Cash Flow Contribution |

|---|---|---|---|---|

| CUSA Disposables | Cash Cow | Low single-digit organic growth | Mature product line, strong customer base | Reliable revenue generator |

| DuraGen® & DuraSeal® | Cash Cow | Steady demand, high profit margins | Established brands, mature market | Predictable cash generation |

| Integra® Skin (Mature Applications) | Cash Cow | Mid-single-digit growth (Q4 2024) | Mature wound reconstruction segment, high market share | Significant cash flow |

Delivered as Shown

Integra LifeSciences BCG Matrix

The Integra LifeSciences BCG Matrix preview you are viewing is the exact, unedited document you will receive upon purchase. This comprehensive analysis is fully formatted and ready for immediate implementation in your strategic planning. You can confidently expect the same high-quality, data-driven insights that will empower your decision-making processes. Rest assured, there are no watermarks or demo content; just the complete, professional report you need.

Dogs

Integra's private label products are currently positioned as Dogs in the BCG matrix. In the fourth quarter of 2024, these products saw a sharp 16% organic decline in sales, largely attributed to ongoing component supply delays. This significant contraction suggests a shrinking market share and a weak competitive standing.

Integra LifeSciences' recalled Dural Access and Repair Patties and Strips are positioned as Dogs in the BCG Matrix. These specific products, crucial for dural access and repair, faced a recall, significantly impacting their sales trajectory.

The recall has led to a sharp decline in revenue for these patties and strips, likely placing them in a low market share and negative growth quadrant. This means they are currently generating minimal to no revenue for the company.

Despite their poor performance, these products still require ongoing resources for recall management, remediation efforts, and potential regulatory compliance. This drains company resources without a commensurate return, solidifying their Dog status.

Older, less differentiated general surgical instruments from Integra LifeSciences likely fall into the Dogs category of the BCG Matrix. These products, often found in mature and highly competitive markets, struggle to capture significant market share due to a lack of unique features or technological advancements.

While Integra’s overall portfolio is robust, these specific instrument lines may represent a low-growth segment where differentiation is minimal. Without a clear competitive advantage, they are unlikely to drive substantial revenue or profit, potentially acting as cash traps that consume resources without generating commensurate returns.

Products Permanently Impacted by Unresolved Compliance Holds

Integra Life Sciences' BCG Matrix would likely place products with unresolved compliance holds in the question mark category, or potentially even the dog category if the issues are severe and prolonged. These products, unable to be shipped or sold due to quality system failures, represent a drain on resources. For example, if a significant portion of their product portfolio, say 15% of their total revenue in 2024, was affected by these holds, it would severely impact their market share and growth potential.

Products stuck in this limbo tie up valuable capital that could be invested elsewhere. They also consume resources for ongoing compliance efforts without generating any revenue. This situation is particularly damaging for Integra, as it directly impacts their ability to serve customers and maintain market presence. The financial burden of holding inventory that cannot be sold, coupled with the costs of remediation, significantly hinders the company's overall performance.

- Products with unresolved compliance holds are categorized as question marks or dogs in the BCG Matrix.

- These products tie up capital and cannot generate revenue.

- Ongoing compliance efforts drain resources without market return.

- A significant percentage of affected products can severely impact market share and growth.

Legacy Products with Declining Demand

Integra Life Sciences may have legacy products that are seeing reduced demand. These are items that were once popular but have been surpassed by newer innovations or changing market needs. While specific product names aren't publicly highlighted as Dogs in recent financial disclosures, any product line that doesn't align with current growth strategies and experiences a shrinking market share would fall into this category.

These products typically require ongoing investment for maintenance or distribution without generating significant returns. For instance, if Integra maintains an older generation of a medical device that has been largely replaced by its own more advanced offerings or those of competitors, it would likely be classified as a Dog.

The company's focus in recent years has been on expanding its portfolio in areas like regenerative technologies and advanced surgical instruments. This strategic shift means that older, less competitive product lines are less likely to receive substantial investment, further solidifying their position as potential Dogs in the BCG Matrix.

While Integra Life Sciences' 2024 financial reports do not explicitly label specific products as Dogs, the general principle applies. Any product that represents a declining market share and low growth potential, requiring resources without contributing meaningfully to the company's overall growth trajectory, would fit this classification.

Integra's private label products and recalled Dural Access and Repair Patties and Strips are classified as Dogs in the BCG Matrix. These items are experiencing significant sales declines, with private label products seeing a 16% organic drop in Q4 2024 due to supply chain issues. The recall of the Dural products has also severely impacted their revenue generation, placing them in a low market share, negative growth quadrant.

These Dog products consume company resources for management and remediation without generating substantial returns. Legacy surgical instruments that lack differentiation in a competitive market also fit this category, tying up capital and requiring ongoing investment for maintenance rather than driving growth. Integra's strategic focus on newer technologies further sidelines these underperforming product lines.

| Product Category | BCG Classification | Key Challenges | Observed Performance (2024) |

| Private Label Products | Dog | Component supply delays | 16% organic sales decline (Q4 2024) |

| Dural Access and Repair Patties and Strips | Dog | Product recall, regulatory compliance | Significant revenue decline |

| Legacy General Surgical Instruments | Dog | Low differentiation, mature market, high competition | Low market share, minimal revenue contribution |

Question Marks

SurgiMend® and PriMatrix® represent Integra LifeSciences' potential stars in the BCG matrix, boasting strong long-term growth prospects, including an anticipated pre-market approval for SurgiMend PRS in breast reconstruction. However, their current market performance is hampered by manufacturing challenges stemming from the Boston facility, leading to production disruptions.

These regenerative products are currently in a cash-consuming phase due to investments in a new Braintree facility, slated for operation in early 2026, and necessary remediation efforts. This transition period, coupled with supply constraints, is temporarily limiting their ability to capture full market potential, placing them in a position that requires significant investment to realize their future growth.

Newer Acclarent products like AERA® and TruDi navigated disposables are positioned as Question Marks within Integra LifeSciences' BCG Matrix. While the overall Acclarent acquisition is considered a Star due to its strong market position, these specific innovations are still developing.

These products operate in a high-growth Ear, Nose, and Throat (ENT) market, which is a positive indicator. However, they currently possess a relatively low market share within Integra's broader product offerings, necessitating substantial investment in marketing and sales efforts to build momentum.

The strategy for AERA® and TruDi involves significant resource allocation to increase their market penetration. The goal is to convert these Question Marks into Stars by capturing greater market share, thereby solidifying their position in this expanding sector.

Integra Life Sciences' commitment to R&D fuels innovation in treatment pathways. Emerging technologies in fields like regenerative medicine and advanced wound care are prime examples of this investment.

Newly launched or near-launch products from this R&D, utilizing cutting-edge tech, typically begin with a modest market share. For instance, a novel bio-engineered skin substitute might enter a competitive market with only a few percentage points of market penetration initially.

These innovative products demand significant capital for market development, clinical trials, and physician education. This high upfront investment, coupled with the inherent uncertainty of market adoption for groundbreaking technologies, places them squarely in the Question Mark quadrant of the BCG matrix, signifying their potential for high growth but also their current low market share.

Strategic International Expansion Initiatives

Integra Life Sciences' strategic international expansion into markets like Brazil, India, and China, where it holds a low initial market share but anticipates high growth, positions these ventures as Stars within the BCG framework. These initiatives require substantial capital infusion to build brand recognition and robust distribution networks in these emerging economies.

- Brazil, India, and China are key targets for Integra's global commercial growth.

- These markets represent nascent opportunities with high growth potential but low current market share for Integra.

- Significant investment is necessary to establish a strong market presence and distribution infrastructure.

- In 2024, Integra continued to emphasize its commitment to these regions, with reported sales growth in emerging markets contributing to its overall revenue expansion strategy.

Advanced Regenerative Technologies in Early Commercialization

Integra LifeSciences' advanced regenerative technologies, currently in early commercialization, represent potential stars within its BCG matrix. These innovative products, focusing on biologics and tissue regeneration, are targeting new, high-growth medical indications. For instance, their offerings in areas like advanced wound care and bone grafting are seeing initial market traction.

These technologies require significant investment in market education and sales efforts to drive adoption and capture market share. While still in their nascent commercial phases, their high growth potential positions them as key future revenue drivers for Integra. The company is actively investing in clinical data and physician training to accelerate this adoption process.

- Focus on Regenerative Medicine: Integra's commitment to regenerative technology and biologics is a core strategic pillar.

- Early Commercialization Stage: Products are beyond R&D, entering markets for new indications, indicating early-stage growth.

- High Growth Potential: These technologies are positioned in rapidly expanding segments of the healthcare market.

- Market Education Required: Significant effort is needed to inform healthcare providers and patients about the benefits and applications.

Newer Acclarent products like AERA® and TruDi are classified as Question Marks in Integra LifeSciences' BCG Matrix. These innovations are part of the Acclarent acquisition, which itself is viewed as a Star due to its strong market position, but these specific product lines are still in their developmental stages. They operate within the high-growth Ear, Nose, and Throat (ENT) market, yet currently hold a modest market share, necessitating substantial investment to gain traction.

The strategic approach for AERA® and TruDi involves significant resource allocation aimed at increasing their market penetration. The objective is to transform these Question Marks into Stars by capturing a larger share of the expanding ENT sector.

Integra LifeSciences is channeling considerable investment into these products to foster market adoption and expand their reach. This investment is crucial for their transition from Question Marks to potentially dominant Stars.

BCG Matrix Data Sources

Our Integra LifeSciences BCG Matrix is informed by comprehensive market research, including financial disclosures, industry growth trends, and competitor analysis to provide strategic insights.