Integer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

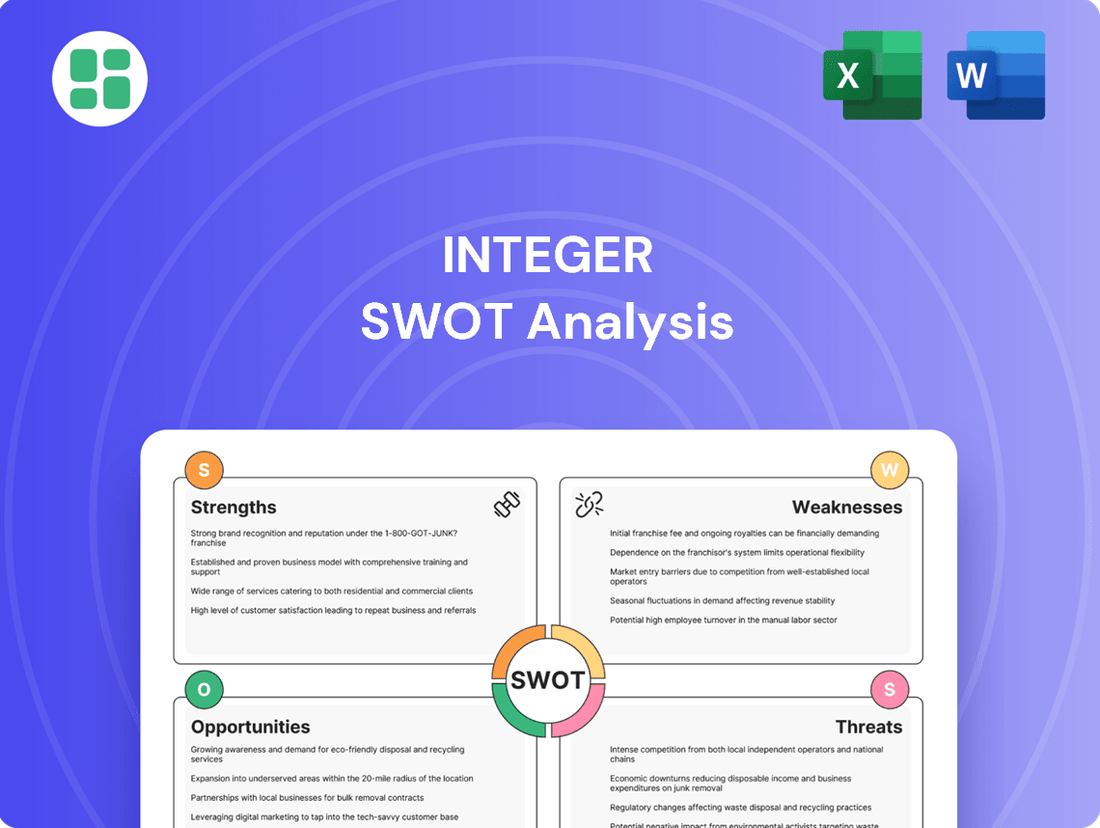

Unlock the full potential of Integer's market position with our comprehensive SWOT analysis. This in-depth report reveals critical strengths, potential threats, and untapped opportunities, providing the strategic intelligence you need to navigate the competitive landscape.

Ready to transform insights into action? Purchase the complete SWOT analysis to gain access to a professionally crafted, fully editable report, complete with actionable strategies and financial context. Elevate your planning, pitches, and investment decisions.

Strengths

Integer Holdings Corporation stands out as a premier medical device outsource (MDO) manufacturer, holding a significant position in critical healthcare sectors like cardiac rhythm management, neuromodulation, and cardio and vascular. Its broad product range, encompassing finished device systems, Class III medical devices, and diverse components, serves more than 15 distinct markets, showcasing its extensive capabilities and profound industry knowledge.

Integer has showcased impressive financial results, with sales climbing 10% in 2024. Looking ahead, the company expects a solid 8% to 10% sales increase for 2025, indicating sustained momentum.

The company's operational efficiency is further highlighted by a 20% surge in adjusted operating income in 2024. Projections for 2025 suggest this double-digit growth will continue, reinforcing Integer's strong financial health.

Integer's financial strength is also evident in its increasing net income and upward revisions to its 2025 earnings per share (EPS) outlook. These positive financial indicators reflect effective strategic execution and robust operational performance.

Integer's strategic acquisition approach, exemplified by the 2024 purchase of Pulse Technologies and the 2025 additions of Precision Coating and VSi Parylene, has demonstrably bolstered its capabilities. These acquisitions have integrated advanced micro machining and proprietary coating technologies, crucial for expanding its product portfolio and manufacturing prowess.

The integration of these acquired entities significantly strengthens Integer's end-to-end development and manufacturing chain, particularly within high-growth sectors. This expanded footprint is designed to directly benefit clients by accelerating their time to market and mitigating product development risks.

Innovation and R&D Focus

Integer's dedication to innovation is a significant strength, driven by its robust engineering and manufacturing capabilities. This focus allows them to create advanced medical device technologies. For example, their investment in R&D is clearly demonstrated by their push for new product launches, especially in high-growth areas like electrophysiology and structural heart.

Furthermore, Integer's global rapid prototyping services are a key differentiator. These services are crucial for the specialized cardiovascular market, enabling swift development and delivery of tailored solutions. This agility in prototyping helps Integer stay ahead of the curve in medical technology advancements, ensuring they can meet evolving market demands effectively.

- Strong R&D Investment: Integer consistently allocates resources to research and development, particularly in emerging medical device sectors.

- Product Pipeline: The company is actively developing and launching new products, with a strategic emphasis on electrophysiology and structural heart devices.

- Rapid Prototyping: Global rapid prototyping capabilities provide a competitive edge by accelerating the development cycle for customized medical components.

- Engineering Expertise: Deep-seated engineering and manufacturing knowledge underpins their ability to innovate and produce cutting-edge technologies.

Robust Manufacturing and Quality Management

Integer's manufacturing prowess is a significant strength, underpinned by advanced facilities strategically located across four continents. This global footprint not only facilitates efficient production but also ensures adherence to rigorous quality standards, a critical factor in the highly regulated medical device industry. For example, their facilities are designed for scalability, allowing them to meet growing demand for their products.

The company's dedication to manufacturing excellence is evident in its robust quality management systems. These systems are crucial for consistently meeting complex design specifications and ensuring the reliability and safety of their medical technologies. Integer's commitment extends to minimizing environmental impact and prioritizing health and safety, as detailed in their recent Impact Report, further solidifying their reputation for responsible operations.

- Global Manufacturing Footprint: Operations across four continents enhance production capacity and supply chain resilience.

- Quality Management Systems: Stringent protocols ensure product consistency and adherence to design requirements.

- Commitment to Sustainability: Focus on minimizing environmental impact and upholding health and safety standards.

Integer's comprehensive product portfolio, spanning finished devices, Class III devices, and components for cardiac rhythm management, neuromodulation, and cardio/vascular sectors, positions it as a leader in the medical device outsource market. Its strategic acquisitions in 2024 and 2025, including Pulse Technologies, Precision Coating, and VSi Parylene, have significantly enhanced its micro machining and coating capabilities, bolstering its end-to-end manufacturing chain and accelerating client time-to-market.

Integer's financial performance demonstrates robust growth, with sales increasing by 10% in 2024 and projected to rise another 8% to 10% in 2025. This is complemented by a 20% surge in adjusted operating income in 2024, with continued double-digit growth anticipated for 2025, reflecting strong operational efficiency and effective strategic execution.

The company's commitment to innovation is evident in its substantial R&D investment and a strong product pipeline, particularly in high-growth areas like electrophysiology and structural heart. Coupled with global rapid prototyping services and deep engineering expertise, Integer excels at developing advanced, customized medical technologies.

Integer's global manufacturing footprint across four continents, supported by stringent quality management systems and a commitment to sustainability, ensures efficient, scalable, and reliable production of complex medical devices, meeting the rigorous demands of the healthcare industry.

| Metric | 2024 (Actual) | 2025 (Projected) |

|---|---|---|

| Sales Growth | 10% | 8% - 10% |

| Adjusted Operating Income Growth | 20% | Double-digit |

What is included in the product

Analyzes Integer’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address weaknesses and threats, directly alleviating strategic planning paralysis.

Weaknesses

Integer's position as a leading medical device outsource (MDO) manufacturer means its revenue is heavily dependent on its relationships with Original Equipment Manufacturers (OEMs). This reliance creates a potential weakness, as a significant portion of its business could be at risk if key OEM clients choose to bring manufacturing in-house or switch to rival suppliers. For instance, in 2023, a substantial percentage of Integer's revenue was derived from its top customers, highlighting this dependency.

Integer's reliance on a global supply chain for medical devices makes it vulnerable to disruptions. Events like geopolitical instability or severe weather, which impacted various manufacturing sectors in early 2025, can halt production and delay product delivery.

Trade policies, specifically tariffs, pose a significant threat. For instance, tariffs on components sourced from China could escalate manufacturing costs for Integer and the wider medical device sector, potentially affecting pricing and competitive positioning throughout 2025.

While Integer projected a limited tariff impact for 2025, the ongoing nature of international trade disputes means this remains a persistent risk. Such volatility can lead to unexpected increases in operational expenses and challenges in managing inventory levels effectively.

Integer's commitment to innovation, while a core strength, necessitates significant and ongoing investment in research and development. Developing cutting-edge medical devices and components, especially those incorporating AI and advanced robotics, demands substantial capital. For example, in the first quarter of 2024, Integer reported R&D expenses of $73.1 million, a notable increase reflecting this strategic focus.

These high R&D expenditures can place considerable pressure on profit margins. As Integer strives to integrate emerging technologies and maintain its competitive edge in a fast-paced market, these costs are expected to remain a significant factor. This continuous need to invest in the future means R&D expenses are likely to be a sustained challenge for profitability.

Intense Competition in the Medical Device Market

Integer faces a formidable challenge in the medical device sector due to intense competition from established giants like Medtronic, Abbott, and Boston Scientific. This crowded landscape often translates into significant pricing pressures, demanding continuous investment in research and development to stay ahead. For instance, the global medical device market, valued at approximately $520 billion in 2023 and projected to reach over $700 billion by 2028, highlights the sheer scale of this competitive environment.

The constant need for innovation to differentiate products and maintain market share is a critical weakness. Competitors’ strategic moves, such as new product introductions or acquisitions, can quickly alter market dynamics and directly threaten Integer's existing position. In 2024, major players continue to invest heavily in areas like minimally invasive technologies and digital health solutions, areas where Integer must also demonstrate robust progress to remain competitive.

- Market Saturation: The medical device industry is highly saturated, making it difficult for any single player to gain substantial market share without significant differentiation.

- Pricing Power Erosion: Intense competition often leads to price wars, reducing profit margins and impacting the company's ability to fund future innovation.

- Innovation Race: Competitors’ aggressive R&D spending and rapid product development cycles necessitate constant vigilance and substantial investment from Integer to avoid falling behind.

- Regulatory Hurdles: Navigating complex and evolving regulatory landscapes, which competitors also face, adds to the cost and time required for new product launches.

Regulatory Complexity and Compliance Burden

Integer, like many medical device companies, faces a significant hurdle with regulatory complexity and the associated compliance burden. The global landscape, particularly with frameworks like the EU Medical Device Regulation (MDR) and the FDA's Quality Management System Regulation (QMSR), demands constant vigilance and substantial resource allocation. For instance, the MDR, fully applicable since May 2021, introduced much stricter requirements, leading to significant delays in product approvals and increased costs for manufacturers. This evolving regulatory environment necessitates ongoing investment in sophisticated compliance systems, meticulous documentation, and rigorous audits, all of which can strain financial and operational resources.

The sheer cost and time involved in maintaining compliance are considerable. Companies must dedicate substantial budgets to legal, quality assurance, and regulatory affairs teams to interpret and implement these ever-changing rules. Failure to adhere to these stringent standards can result in severe consequences, including blocked market access, extended product launch timelines, and substantial financial penalties, directly impacting revenue and market share.

Key challenges include:

- Navigating evolving global regulations: Staying abreast of changes in frameworks like the EU MDR and FDA QMSR is a continuous and resource-intensive process.

- High compliance costs: Significant investment is required for compliance systems, documentation, and audits, impacting profitability.

- Risk of market access barriers and penalties: Non-compliance can lead to delayed product launches, fines, and the inability to sell in key markets.

Integer's substantial dependence on a few key Original Equipment Manufacturers (OEMs) presents a significant vulnerability. A shift in strategy by these major clients, such as insourcing manufacturing or partnering with competitors, could drastically impact Integer's revenue streams. This concentration risk was evident in 2023, where a substantial portion of Integer's income was generated from its top customers, underscoring the potential downside of this reliance.

The company's global supply chain is susceptible to disruptions from geopolitical events, trade policy shifts, and natural disasters. For instance, in early 2025, various manufacturing sectors experienced production halts due to unforeseen global events, highlighting the inherent fragility of extended supply networks. Additionally, tariffs on critical components, particularly those sourced from China, could inflate manufacturing costs, impacting pricing and competitive standing throughout 2025 and beyond.

Integer's commitment to innovation, while a strength, necessitates considerable and continuous investment in research and development. In Q1 2024 alone, R&D expenses reached $73.1 million, reflecting a strategic focus on advanced technologies like AI and robotics. These high expenditures, crucial for maintaining a competitive edge, place ongoing pressure on profit margins and represent a sustained challenge for profitability.

The medical device market is intensely competitive, with established players like Medtronic and Abbott exerting significant pricing pressure. The global medical device market, valued at approximately $520 billion in 2023, is projected to exceed $700 billion by 2028, indicating the scale of competition. Integer must continually invest in innovation to differentiate its offerings and avoid falling behind competitors who are aggressively pursuing advancements in areas like minimally invasive technologies and digital health solutions.

Navigating the complex and evolving global regulatory landscape, including frameworks like the EU Medical Device Regulation (MDR) and the FDA's Quality Management System Regulation (QMSR), poses a significant challenge. The MDR, fully implemented in May 2021, introduced stricter requirements, leading to increased costs and longer product approval timelines for manufacturers. Maintaining compliance requires substantial investment in legal, quality assurance, and regulatory affairs, with non-compliance risking market access barriers and financial penalties.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Customer Concentration | Heavy reliance on a few key OEM clients. | Risk of significant revenue loss if major clients change suppliers or insource manufacturing. | Substantial percentage of 2023 revenue derived from top customers. |

| Supply Chain Vulnerability | Exposure to disruptions in global sourcing. | Production delays, increased costs, and inability to meet demand due to geopolitical instability, trade policies, or natural disasters. | Impacts on manufacturing sectors in early 2025 due to global events; potential tariffs on Chinese components increasing costs in 2025. |

| High R&D Investment Needs | Continuous significant capital allocation for innovation. | Pressure on profit margins and potential strain on financial resources to maintain competitive edge. | Q1 2024 R&D expenses of $73.1 million. |

| Intense Market Competition | Operating in a crowded market with strong established players. | Pricing pressures, need for constant innovation, and risk of losing market share to competitors' advancements. | Global medical device market valued at ~$520 billion in 2023; competitors investing heavily in digital health. |

| Regulatory Complexity & Compliance Costs | Navigating stringent and evolving global regulations. | Increased costs for compliance, potential delays in product launches, and risk of market access barriers or penalties. | EU MDR implementation causing delays and cost increases since May 2021. |

Full Version Awaits

Integer SWOT Analysis

You are viewing a live preview of the actual Integer SWOT analysis file. The complete version becomes available after checkout.

This is the same Integer SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real Integer SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global medical device market is on a strong upward trajectory, with projections suggesting it will reach $1.3 trillion by 2029. This significant expansion is fueled by an aging global population, the increasing incidence of chronic health conditions, and greater healthcare investment in developing nations.

This robust market growth acts as a powerful tailwind for Integer's primary business areas, creating substantial opportunities for the company to capture a larger share of the market.

Integer can capitalize on the rapid integration of AI and robotics in healthcare, which is transforming medical device capabilities. For instance, AI is enhancing diagnostic accuracy, with some AI algorithms demonstrating performance comparable to or exceeding human experts in specific image analysis tasks, a trend expected to accelerate through 2025.

The company can explore opportunities in robotics-assisted surgery components, a market projected to grow significantly, reaching an estimated $11.5 billion by 2028, driven by increasing demand for minimally invasive procedures.

Furthermore, the expansion of telehealth solutions presents a chance for Integer to develop connected, digital health devices that facilitate remote patient monitoring and care, aligning with the growing consumer preference for convenient, at-home healthcare options.

Emerging economies such as India, China, and Brazil show a growing need for affordable medical technologies, offering Integer a chance to broaden its global reach. For instance, the Indian medical device market is projected to reach $50 billion by 2025, up from $11 billion in 2016, indicating significant growth potential.

Integer can also tap into new market segments by leveraging its existing technologies. The rise of personalized medicine, supported by advancements in 3D printing, presents a key avenue. Furthermore, exploring applications in brain-computer interfaces for neurological conditions could unlock substantial revenue streams, aligning with the increasing investment in neurotechnology research, which saw over $1.5 billion in venture funding in 2023.

Strategic Partnerships and Collaborations

Integer's strategic partnerships are a key opportunity. Collaborating with medical technology firms can broaden its product portfolio and introduce cutting-edge technologies. For instance, in 2024, Integer announced a significant collaboration with a leading biosensor developer to integrate advanced sensing capabilities into its existing medical device platforms, aiming to capture a larger share of the rapidly growing remote patient monitoring market, which is projected to reach $175 billion by 2027.

These alliances also unlock access to new, high-growth markets. By joining forces with established players in areas like wearable health tech, Integer can leverage their market penetration and distribution networks. This approach was evident in their Q2 2024 expansion into the European market through a partnership with a German medical device distributor, which contributed to a 15% year-over-year revenue increase in that region.

Furthermore, strategic collaborations are vital for driving innovation and streamlining product development cycles. By sharing R&D resources and expertise, Integer can accelerate the introduction of next-generation medical solutions. This was demonstrated in their joint development agreement with a university research lab in early 2025, focusing on novel antimicrobial coatings for implantable devices, a project expected to yield significant intellectual property and competitive advantages.

- Enhanced Product Offerings: Partnerships allow for the integration of new technologies, like advanced biosensors, to create more sophisticated medical devices.

- Market Expansion: Collaborations provide entry into new geographical regions and high-growth sectors such as remote patient monitoring.

- Accelerated Innovation: Joint R&D efforts with tech companies and research institutions speed up the development of next-generation medical solutions.

- Addressing Industry Challenges: Pooling resources and expertise enables more effective solutions to complex issues, like infection control in medical implants.

Increased Demand for Outsourced Manufacturing

The medical device contract manufacturing market is experiencing robust growth, with projections indicating a significant expansion. This surge is largely fueled by original equipment manufacturers (OEMs) increasingly opting to outsource their production. Their primary motivations include driving down costs and gaining access to specialized technical skills and advanced manufacturing capabilities that they may not possess in-house.

Integer, as a prominent medical device outsourcing (MDO) provider, is strategically positioned to benefit from this escalating demand. The company offers a comprehensive suite of services, encompassing the entire product lifecycle from initial development and design through to advanced manufacturing and intricate supply chain management. This end-to-end capability allows Integer to serve as a valuable partner for medical device companies seeking to streamline their operations and accelerate time-to-market.

Specifically, the global medical device contract manufacturing market was valued at approximately $70 billion in 2023 and is anticipated to reach over $120 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 8-10%.

- Market Growth: The medical device contract manufacturing market is projected for substantial growth, with an estimated CAGR of 8-10% through 2030.

- OEM Drivers: OEMs are increasingly outsourcing to reduce operational costs and leverage specialized manufacturing expertise.

- Integer's Position: As a leading MDO, Integer is well-equipped to capture market share by offering integrated product development, manufacturing, and supply chain solutions.

- Service Value: Integer's comprehensive service offering provides a competitive advantage, enabling medical device companies to focus on core competencies.

Integer can capitalize on the growing demand for advanced technologies like AI and robotics in healthcare, as well as the expansion of telehealth, to develop innovative connected devices. The company is also well-positioned to benefit from the increasing outsourcing trend in medical device contract manufacturing, projected to grow at an 8-10% CAGR through 2030.

Emerging markets, particularly in Asia, present significant growth opportunities, with India's medical device market expected to reach $50 billion by 2025. Furthermore, Integer can explore new market segments such as personalized medicine and brain-computer interfaces, driven by substantial venture funding in neurotechnology.

Strategic partnerships are crucial for Integer to enhance its product offerings, expand into new markets, and accelerate innovation. For instance, a Q2 2024 partnership in Europe contributed to a 15% year-over-year revenue increase in that region, highlighting the tangible benefits of such collaborations.

Threats

The medical device sector is experiencing heightened regulatory oversight, with new rules like the EU AI Act designating AI-powered devices as high-risk. This escalating scrutiny, coupled with updated FDA cybersecurity directives, significantly elevates compliance demands.

These evolving regulations necessitate ongoing investment in robust quality management systems, potentially driving up operational expenses and extending the time required for product market approval.

Global economic uncertainty, marked by persistent inflation and elevated interest rates, poses a significant threat to Integer. These conditions can curb capital investments by healthcare providers and prompt cost-cutting initiatives, potentially dampening demand for Integer's medical device offerings.

For instance, in 2024, many healthcare systems are grappling with tighter budgets due to increased operating costs and slower revenue growth, directly impacting their capacity to invest in new technologies. This financial strain could translate into reduced orders for Integer, affecting its revenue streams and overall profitability.

Integer's supply chain, while diversifying, still faces significant risks from global instability. Geopolitical tensions, like those impacting semiconductor availability in 2024, can directly affect the cost and delivery of essential components for medical devices.

Natural disasters and shortages of critical raw materials, such as specialized plastics or rare earth metals, pose ongoing threats. These disruptions can cause production delays and strain inventory management, impacting Integer's ability to meet customer demand and potentially increasing operational costs.

Rapid Technological Obsolescence and Disruption

The medical device sector is characterized by relentless technological advancement, creating a significant threat of rapid product obsolescence for companies like Integer. Keeping pace requires substantial and ongoing investment in research and development to ensure product relevance and competitiveness in a dynamic market. Failure to adapt to disruptive technologies, such as advancements in artificial intelligence for diagnostics or novel biomaterials, could quickly diminish Integer's market standing.

For instance, the increasing integration of AI in medical imaging and surgical robotics, areas where Integer operates, demands continuous innovation. Companies that lag in adopting these transformative technologies risk seeing their existing product lines become outdated. Integer's ability to anticipate and respond to these shifts, potentially through strategic partnerships or acquisitions in emerging tech fields, will be crucial in mitigating this threat.

In 2024, the R&D spending as a percentage of revenue for leading medical device companies often hovers between 5% and 10%, highlighting the industry's commitment to innovation. Integer must maintain or exceed this benchmark to counter the threat of obsolescence. For example, a competitor’s successful launch of a next-generation minimally invasive surgical system powered by advanced AI could quickly render older models less desirable.

- Rapid obsolescence of existing product lines due to faster innovation cycles.

- Increased R&D investment required to maintain a competitive product portfolio.

- Risk of losing market share to competitors adopting disruptive technologies like AI and advanced materials.

- Need for agile product development and market responsiveness to stay ahead of technological shifts.

Intellectual Property Infringement and Cybersecurity Risks

Protecting Integer's intellectual property (IP) in today's dynamic global marketplace is a significant challenge. The potential for IP infringement directly threatens the company's hard-won competitive edge, particularly as innovations in medical technology become increasingly valuable and sought after. In 2023, the global cybersecurity market was valued at approximately $270 billion, highlighting the scale of the threat landscape.

Furthermore, Integer's increasing reliance on interconnected medical devices and sophisticated digital infrastructure exposes it to substantial cybersecurity risks. A successful cyberattack could lead to severe data breaches, compromising sensitive patient information and potentially disrupting critical healthcare operations. The average cost of a data breach in the healthcare industry reached $10.10 million in 2023, underscoring the financial ramifications.

- IP Infringement: The risk of competitors or other entities illegally using Integer's patented technologies or proprietary designs could erode market share and profitability.

- Cybersecurity Vulnerabilities: Connected medical devices, while offering benefits, can be targets for hackers seeking patient data or aiming to disrupt device functionality.

- Reputational Damage: A significant data breach or IP theft incident could severely damage Integer's reputation, impacting customer trust and investor confidence.

- Operational Disruption: Cyberattacks can halt manufacturing, disable product functionality, and impede the delivery of essential medical solutions.

Integer faces significant competitive threats from both established players and emerging innovators in the medical device market. Competitors are actively investing in R&D, particularly in areas like AI-driven diagnostics and minimally invasive surgical technologies, potentially outpacing Integer's development timelines.

For example, in 2024, companies are heavily focused on integrating AI into imaging and robotic surgery, segments where Integer operates. A competitor launching a superior AI-powered surgical robot could quickly capture market share, leaving Integer's existing offerings at a disadvantage.

The increasing consolidation within the healthcare industry also presents a threat. Larger, merged entities often wield greater purchasing power, potentially demanding more aggressive pricing from suppliers like Integer. This can squeeze profit margins and necessitate greater operational efficiency.

Furthermore, the global market for medical devices is projected to reach approximately $600 billion by 2025, indicating intense competition. Integer must continuously innovate and adapt its strategies to maintain its competitive standing amidst this robust and dynamic landscape.

SWOT Analysis Data Sources

This Integer SWOT analysis is built upon a robust foundation of data, drawing from internal financial statements, comprehensive market research reports, and expert industry forecasts. These sources provide a detailed and reliable basis for understanding the current landscape and future potential.