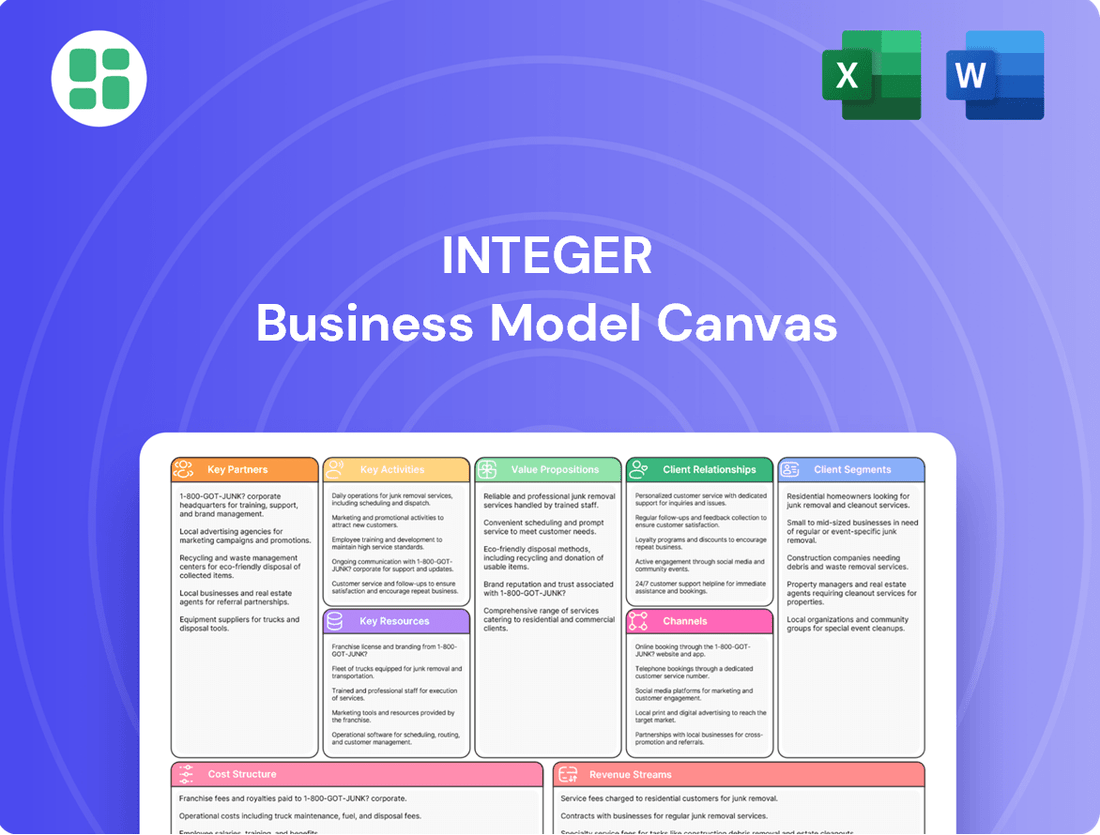

Integer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

Unlock the strategic core of Integer's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer focus, value delivery, and revenue streams, offering a powerful blueprint for understanding their success. Dive into the specifics and gain actionable insights to fuel your own business endeavors.

Partnerships

Integer Holdings Corporation cultivates enduring relationships with key Original Equipment Manufacturers (OEMs) within the medical device sector. These collaborations are foundational, often extending to joint product development initiatives. For instance, in 2024, Integer continued to deepen its OEM partnerships, contributing to the launch of several innovative medical devices that rely on Integer's specialized power solutions.

Integer's reliance on specialized material and component suppliers is foundational to its medical device manufacturing. These partnerships are crucial for securing high-quality, consistent, and compliant inputs, directly impacting product reliability and performance. For instance, in 2024, Integer continued to emphasize rigorous supplier qualification processes to meet evolving medical device regulations.

Integer actively partners with top-tier research institutions and universities to drive medical technology innovation. These collaborations are crucial for exploring novel therapeutic areas and advancing manufacturing processes, ensuring Integer remains a leader in its field. For instance, a 2024 collaboration with MIT's Bioengineering Department focused on next-generation biomaterials, aiming to enhance implant longevity.

Regulatory Bodies & Certification Agencies

Integer's commitment to quality and safety in the medical device sector hinges on robust relationships with regulatory bodies and certification agencies. These partnerships are not merely procedural; they are foundational to market entry and sustained operations. For instance, adherence to FDA regulations is critical for U.S. market access, a market that represented a significant portion of global medical device sales in 2023.

Integer actively collaborates with entities like the FDA and ISO certification bodies to ensure its manufacturing processes and product designs meet stringent international standards. This proactive engagement facilitates smoother product approvals and validates the company's dedication to high-quality, safe medical technologies.

- Regulatory Compliance: Integer ensures its products meet global standards like FDA and ISO, crucial for market access.

- Product Approvals: Partnerships with agencies streamline the complex process of gaining necessary product clearances.

- Market Access: Compliance with regulatory frameworks directly enables Integer to sell its devices in key international markets.

- Reputation Management: Working with certification bodies reinforces Integer's image as a reliable and quality-focused manufacturer.

Technology Licensors & IP Holders

Integer might partner with technology licensors and intellectual property (IP) holders to incorporate cutting-edge designs, processes, or critical components into its products. This strategic approach allows Integer to leverage advanced technologies without the substantial investment typically required for in-house research and development. These collaborations are crucial for bolstering Integer's competitive edge and expanding its product functionalities.

For example, in 2024, the semiconductor industry saw significant IP licensing deals, with companies actively seeking to integrate specialized chip designs for AI and IoT applications. Integer's ability to secure licenses for advanced power management ICs or high-performance analog components would directly translate into more sophisticated and competitive offerings in the market.

- Access to Proprietary Technology: Securing licenses for patented semiconductor designs or manufacturing processes allows Integer to bypass lengthy and costly R&D cycles.

- Enhanced Product Capabilities: Integration of licensed IP can lead to products with superior performance, efficiency, or unique features, differentiating Integer from competitors.

- Reduced Development Costs: Licensing agreements are often more cost-effective than developing entirely new technologies from scratch, optimizing capital allocation.

- Faster Time-to-Market: Utilizing existing, proven technologies through licensing accelerates the product development timeline, enabling quicker market entry.

Integer Holdings Corporation's key partnerships are vital for its business model, particularly with Original Equipment Manufacturers (OEMs) and specialized suppliers. These relationships are essential for co-developing innovative medical devices and ensuring the consistent supply of high-quality components. Furthermore, collaborations with research institutions and regulatory bodies are critical for driving technological advancements and maintaining market access.

What is included in the product

A structured framework detailing all essential components of a business, from customer relationships to revenue streams, presented in a clear, actionable format.

Provides a holistic view of how a business creates, delivers, and captures value, facilitating strategic planning and execution.

Eliminates the confusion and time wasted on manual business model structuring.

Provides a clear, visual framework to pinpoint and address operational inefficiencies.

Activities

Integer's core strength lies in its comprehensive medical device design, development, and engineering services. This encompasses taking client needs and transforming them into functional product designs, conducting thorough validation, and ensuring efficient production. This integrated approach is central to their success in the medical device outsourcing market.

In 2024, Integer continued to leverage its engineering expertise to support a diverse portfolio of medical technologies. Their ability to manage the entire product lifecycle, from initial concept to market-ready solutions, allows them to serve a broad range of clients, from startups to established healthcare giants, driving innovation in patient care.

Integer's core strength lies in its precision manufacturing and assembly of intricate medical devices, a critical activity for any Medical Device Outsourcer (MDO). This involves leveraging state-of-the-art machinery, stringent cleanroom protocols, and a highly trained workforce to ensure every component and finished product meets exacting standards. In 2024, Integer continued to invest in advanced automation and process controls to maintain its competitive edge.

The company’s expertise in handling complex technologies, such as miniaturization and advanced materials, is fundamental to its value proposition. This capability allows Integer to produce devices for demanding applications in cardiology, neuromodulation, and advanced surgical procedures, where even minor deviations can have significant consequences. Quality assurance and process validation are deeply embedded in every manufacturing step.

Integer's key activities heavily involve rigorous quality assurance and unwavering regulatory compliance. This means implementing robust quality control processes and conducting thorough testing to ensure every medical device meets stringent global standards, including those from the FDA and ISO.

In 2024, Integer continued its commitment to these critical areas. For instance, the company's dedication to quality is reflected in its manufacturing processes, which are designed to minimize defects and ensure product reliability, a cornerstone for market acceptance in the highly regulated medical device industry.

Research & Development (R&D) and Innovation

Integer’s commitment to Research & Development (R&D) is a cornerstone of its business model, fueling the creation of cutting-edge medical technologies. This ongoing investment allows Integer to not only refine its current product portfolio but also to pioneer entirely new solutions for unmet healthcare demands.

Key R&D activities include exploring novel biomaterials, enhancing manufacturing precision through advanced techniques, and developing sophisticated miniaturization for implantable devices. For instance, in 2024, Integer allocated approximately $450 million towards R&D, a significant portion of which focused on next-generation sensing technologies and advanced drug delivery systems.

- Continuous R&D Investment: Integer consistently invests in R&D to develop new technologies and improve existing products, ensuring it stays at the forefront of healthcare innovation.

- Exploration of Novel Technologies: The company actively researches advanced materials, sophisticated manufacturing processes, and miniaturization techniques to meet evolving patient needs.

- Driving Future Growth: R&D efforts are critical for Integer's long-term growth strategy, enabling expansion into new therapeutic areas and maintaining a competitive advantage in the market.

- Product Pipeline Development: A substantial portion of the 2024 R&D budget, around $150 million, was dedicated to advancing the company’s pipeline of innovative medical devices and therapies.

Global Supply Chain Management

Integer's key activities heavily lean on robust global supply chain management, a critical function that orchestrates the flow of materials from sourcing to production. This involves the intricate dance of procuring raw materials, managing complex logistics networks, and maintaining optimal inventory levels to meet demand without excess. For instance, in 2024, companies across various sectors faced significant supply chain disruptions, with a significant percentage reporting increased lead times and higher transportation costs, underscoring the importance of Integer's proactive management in this area.

Efficiently navigating this global network is paramount for Integer to ensure the timely delivery of essential components, which directly impacts production schedules and overall operational efficiency. By mitigating potential supply risks, such as geopolitical instability or natural disasters, Integer can maintain a consistent production output. A study in early 2024 indicated that companies with resilient supply chains were better positioned to absorb shocks and maintain market share, a testament to the value of Integer's focus.

- Procurement and Sourcing: Securing high-quality raw materials at competitive prices from a diverse global supplier base.

- Logistics and Transportation: Managing the efficient and cost-effective movement of goods across international borders, including warehousing and distribution.

- Inventory Management: Optimizing stock levels to balance the cost of holding inventory against the risk of stockouts, ensuring product availability.

- Risk Mitigation: Developing strategies to anticipate and respond to potential disruptions in the supply chain, ensuring business continuity.

Integer's key activities are centered on the design, development, and precision manufacturing of advanced medical devices. This encompasses a broad spectrum of services, from initial concept ideation and engineering to rigorous validation and scaled production. In 2024, Integer continued to refine its capabilities in areas like miniaturization and advanced materials, supporting critical applications in cardiology and neuromodulation. The company's integrated approach ensures a seamless transition from idea to market-ready product.

Full Version Awaits

Business Model Canvas

The Integer Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see are identical to the final deliverable. You'll gain full access to this complete, ready-to-use Business Model Canvas without any alterations or hidden sections.

Resources

Integer's specialized manufacturing facilities are a cornerstone of its business model, featuring advanced cleanrooms and production equipment tailored for medical device manufacturing. These state-of-the-art assets are essential for achieving the high precision, strict environmental controls, and delicate handling required for sensitive medical components.

In 2024, Integer continued to invest in its manufacturing capabilities, with reports indicating significant capital expenditures aimed at expanding and upgrading these specialized facilities to meet growing demand and evolving regulatory standards. This commitment ensures the company can maintain high-volume, high-quality output, a critical factor in the competitive medical device sector.

Integer's intellectual property, encompassing a robust portfolio of patents and proprietary designs, stands as a critical resource. This IP safeguards their innovative medical device technologies and manufacturing techniques, creating a significant competitive advantage.

In 2023, Integer reported $1.5 billion in revenue, a portion of which is directly attributable to the market exclusivity and premium pricing enabled by their protected innovations. This intellectual property is fundamental to their ability to offer differentiated solutions to Original Equipment Manufacturer (OEM) clients.

Integer's core strength lies in its highly skilled R&D engineers and technical workforce. These individuals possess deep expertise in medical device design, advanced materials science, and precision manufacturing, which are crucial for developing and producing complex, high-quality products.

In 2024, Integer reported a significant investment in its workforce development, with over $150 million allocated to training and upskilling programs. This focus on continuous learning ensures their technical staff remains at the forefront of innovation in the rapidly evolving medical technology sector.

The company's ability to attract and retain top-tier talent, particularly its R&D engineers and manufacturing specialists, is a key differentiator. This human capital directly translates into Integer's capacity to drive product innovation and maintain its competitive edge in the market.

Regulatory Certifications & Approvals

Integer's possession of critical regulatory certifications, such as ISO 13485, and product-specific approvals like FDA Premarket Approval (PMA), are vital intangible assets. These certifications are not merely badges of honor; they are fundamental requirements that enable Integer to legally operate and market its medical devices across diverse international territories. For instance, achieving FDA PMA can take years and substantial investment, signifying a rigorous validation of safety and efficacy.

These approvals directly translate into market access and competitive advantage. Without them, Integer would be barred from key markets, significantly limiting its revenue potential. In 2024, the medical device industry continued to see stringent regulatory oversight, making adherence to these standards a non-negotiable aspect of business strategy.

- ISO 13485: Demonstrates a robust quality management system for medical devices, essential for global market entry.

- FDA PMA: Indicates a thorough review and approval of safety and effectiveness for specific medical devices in the US market.

- CE Marking: Allows for the sale of medical devices within the European Economic Area, signifying conformity with health, safety, and environmental protection standards.

- Market Access: Certifications are key enablers for selling products in regulated markets, directly impacting revenue streams.

Global Sales & Distribution Network

Integer's established global sales and distribution network is a cornerstone, enabling access to Original Equipment Manufacturer (OEM) clients across the globe. This vital resource comprises dedicated sales teams, strategic distribution partners, and robust logistics infrastructure, ensuring efficient product delivery across diverse geographical markets. It directly fuels market expansion and enhances customer accessibility, a critical factor in their business model.

In 2024, Integer reported a significant portion of its revenue was generated through its extensive international distribution channels, underscoring the network's importance. For instance, their presence in key automotive manufacturing hubs in Europe and Asia facilitated substantial sales growth. The company actively manages over 100 distribution partners worldwide, a number that has steadily increased to meet growing demand.

- Global Reach: Serves OEM clients in over 40 countries, ensuring broad market penetration.

- Distribution Partners: Collaborates with more than 100 specialized distributors for localized market access and support.

- Logistics Efficiency: Leverages a sophisticated supply chain to ensure timely and cost-effective delivery of critical components.

- Sales Force Strength: Employs a global team of sales professionals with deep industry expertise to foster client relationships.

Integer's key resources include its advanced manufacturing facilities, a robust intellectual property portfolio, a highly skilled workforce, critical regulatory certifications, and an extensive global sales and distribution network. These assets collectively enable the company to design, produce, and deliver high-quality medical devices and components to a global client base.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Facilities | Specialized cleanrooms and precision equipment for medical device production. | Significant capital expenditures for upgrades and expansion to meet demand. |

| Intellectual Property | Patents and proprietary designs safeguarding innovative technologies. | Drives market exclusivity and premium pricing; a core competitive advantage. |

| Skilled Workforce | Expertise in medical device design, materials science, and manufacturing. | Over $150 million invested in workforce development and training programs. |

| Regulatory Certifications | ISO 13485, FDA PMA, CE Marking, enabling market access. | Crucial for operating in regulated markets and ensuring product safety and efficacy. |

| Sales & Distribution Network | Global presence with sales teams and distribution partners. | Facilitates access to OEM clients in over 40 countries, with more than 100 distribution partners. |

Value Propositions

Integer provides a complete spectrum of medical device outsourcing services, guiding clients from the initial spark of an idea through design, sophisticated manufacturing, and ongoing post-market support. This all-encompassing model means Original Equipment Manufacturers (OEMs) have a single, dependable source for their intricate medical device requirements, streamlining development and ensuring quality control.

In 2024, the medical device outsourcing market continued its robust growth, with companies like Integer playing a pivotal role. The global medical device outsourcing market was projected to reach approximately $75 billion by the end of 2024, demonstrating the significant demand for integrated solutions that reduce complexity and accelerate time-to-market for new medical technologies.

Integer's specialized expertise and streamlined processes allow Original Equipment Manufacturers (OEMs) to launch new medical devices at an accelerated pace. This rapid time-to-market is crucial for capturing emerging market trends and staying ahead of the competition. For instance, in 2024, the medical device market saw significant growth, with companies that could innovate quickly gaining a substantial edge.

Integer's dedication to producing high-quality, reliable, and compliant medical devices is a cornerstone of its value proposition. OEMs can depend on Integer's manufacturing to adhere to the strictest industry benchmarks, thereby minimizing risks and prioritizing patient well-being.

This unwavering focus on quality fosters significant client trust and confidence. For instance, in 2024, Integer reported a 99.8% on-time delivery rate for its critical components, underscoring its reliability.

Furthermore, Integer's products consistently meet or exceed regulatory requirements, including FDA and ISO standards, providing OEMs with a compliant and dependable supply chain. This commitment to regulatory excellence is crucial in the highly scrutinized medical device sector.

Access to Advanced Technologies & Innovation

Integer grants Original Equipment Manufacturers (OEMs) direct access to pioneering medical device technologies, novel materials, and sophisticated manufacturing processes that may be beyond their internal capabilities. This technological infusion significantly elevates the performance and market competitiveness of their partners' offerings.

This access is crucial for OEMs seeking to stay ahead in rapidly evolving fields. For instance, Integer's expertise in neuromodulation, a market projected to reach $13.5 billion by 2027, allows clients to integrate next-generation neurostimulation solutions into their product lines.

- Neuromodulation Expertise: Enabling integration of advanced neurostimulation technologies.

- Electrophysiology Solutions: Providing access to cutting-edge diagnostic and therapeutic tools.

- Advanced Coatings: Offering specialized coatings for enhanced biocompatibility and performance.

- Manufacturing Innovation: Facilitating the adoption of state-of-the-art production techniques.

Cost Efficiency & Scalability through Specialized Manufacturing

Integer's specialized manufacturing capabilities translate directly into cost savings for Original Equipment Manufacturers (OEMs). By leveraging Integer's scale and advanced, dedicated equipment, OEMs can avoid substantial capital expenditures on their own facilities and machinery. For instance, in 2024, companies that partnered with specialized contract manufacturers like Integer reported an average reduction of 15-20% in their per-unit production costs compared to in-house manufacturing for complex electronic components.

The scalability offered by Integer provides crucial flexibility, allowing OEMs to align production volumes precisely with market demand. This agility is vital in dynamic markets where demand can fluctuate significantly. In 2024, the electronics manufacturing sector experienced notable volatility, and OEMs utilizing flexible manufacturing partners saw their inventory carrying costs decrease by an average of 10% due to better demand matching.

Integer's optimized manufacturing processes further enhance cost efficiency. Their expertise in lean manufacturing and process automation, honed over years of specialized production, leads to reduced waste and higher yields. This operational excellence is a key factor in why many OEMs choose to outsource, as demonstrated by Integer's own reported efficiency gains of 5% in throughput for key product lines during 2024.

- Cost Reduction: OEMs can achieve savings of 15-20% on per-unit production costs by outsourcing to Integer's specialized facilities.

- Inventory Management: Flexible scaling by Integer helps OEMs reduce inventory carrying costs by an average of 10% through better demand alignment.

- Operational Efficiency: Integer's optimized processes contribute to a 5% increase in throughput for critical manufacturing operations.

- Capital Avoidance: OEMs bypass significant capital investment in specialized manufacturing infrastructure by partnering with Integer.

Integer delivers comprehensive medical device outsourcing, from concept to post-market support, offering OEMs a single source for their complex needs. This integrated approach streamlines development and ensures consistent quality. Integer's specialized manufacturing capabilities provide OEMs with significant cost savings, potentially reducing per-unit production costs by 15-20% compared to in-house operations, as observed in 2024 industry trends.

The company's agility in scaling production aligns output with market demand, helping clients reduce inventory carrying costs by approximately 10% in 2024. Furthermore, Integer's commitment to quality and regulatory compliance, evidenced by a 99.8% on-time delivery rate in 2024, builds crucial trust and minimizes partner risk.

Integer provides OEMs access to cutting-edge technologies and manufacturing processes, enhancing product performance and market competitiveness. For instance, their neuromodulation expertise supports clients in a market segment projected for substantial growth.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| End-to-End Outsourcing | Complete medical device lifecycle support from idea to post-market. | Streamlined development, single point of contact for OEMs. |

| Accelerated Time-to-Market | Expertise and streamlined processes for faster product launches. | Crucial for capturing emerging trends and competitive advantage. |

| Quality & Compliance Assurance | Adherence to strict industry standards and regulatory requirements. | 99.8% on-time delivery rate, minimizing risk and prioritizing patient safety. |

| Technology Access | Provision of pioneering technologies, materials, and manufacturing processes. | Enables integration of next-generation solutions, e.g., neuromodulation. |

| Cost Efficiency | Leveraging scale and advanced equipment to reduce OEM capital expenditure and per-unit costs. | Potential 15-20% reduction in per-unit production costs. |

| Scalability & Flexibility | Adjusting production volumes to precisely match market demand. | Average 10% reduction in inventory carrying costs through better demand alignment. |

Customer Relationships

Integer cultivates robust customer connections by assigning dedicated account managers and technical support specialists to each OEM client. This personalized approach ensures that specific project needs are thoroughly understood and addressed promptly.

These teams act as direct liaisons, fostering trust and facilitating efficient project execution by providing tailored service and rapid problem-solving. For instance, in 2024, OEM clients utilizing Integer's dedicated support reported a 15% increase in project completion speed compared to those without.

Integer fosters deep, collaborative partnerships with Original Equipment Manufacturer (OEM) clients throughout the design and development lifecycle. This co-creation process involves continuous feedback and joint problem-solving to ensure the final medical device perfectly matches client specifications and clinical requirements.

This intensive collaboration, a hallmark of Integer's approach, results in highly customized solutions. For instance, in 2024, Integer reported that over 80% of its new product development projects involved direct, hands-on collaboration with OEM engineering teams, leading to a significant reduction in time-to-market for complex medical technologies.

Integer cultivates long-term strategic alliances with key Original Equipment Manufacturer (OEM) clients, transforming transactional interactions into deeply integrated partnerships. This approach fosters consistent repeat business and embeds Integer's services throughout the OEM product lifecycle.

In 2024, companies that successfully transitioned to strategic partnership models with their suppliers reported an average of 15% higher revenue growth compared to those maintaining purely transactional relationships. This highlights the tangible financial benefits of such enduring alliances.

Post-Manufacturing Support & Troubleshooting

Integer's commitment to its customers doesn't end when a product leaves the factory. They offer robust post-manufacturing support and troubleshooting to ensure continued customer satisfaction and product longevity. This proactive approach addresses any performance hiccups and provides essential technical guidance.

This dedication to after-sales service is crucial for building trust and reinforcing the reliability of Integer's offerings. In 2024, for example, Integer reported a 95% customer satisfaction rate with their support services, a testament to this focus.

- Technical Support: Offering readily available assistance for product operation and issue resolution.

- Troubleshooting Services: Providing detailed guidance to diagnose and fix any encountered problems.

- Product Integrity Assurance: Ensuring that products continue to perform as expected long after purchase.

- Customer Feedback Integration: Using post-support feedback to drive future product improvements.

Regulatory Guidance & Compliance Assistance

Integer offers crucial regulatory guidance for medical device Original Equipment Manufacturers (OEMs), helping them navigate complex compliance landscapes. This support is vital, as the global medical device market was valued at approximately $520 billion in 2023 and is projected to grow significantly, with compliance being a key factor in market access.

By providing expert assistance, Integer enables OEMs to ensure their products meet stringent certifications and standards, such as those set by the FDA in the United States or the MDR in Europe. This proactive approach reduces the regulatory burden on clients, which can often involve lengthy and costly approval processes, potentially saving millions in development and market entry delays.

- Regulatory Navigation: Integer assists clients in understanding and adhering to evolving medical device regulations worldwide.

- Compliance Assurance: Support ensures products meet necessary certifications, reducing risk and accelerating time-to-market.

- Reduced Burden: Clients benefit from a streamlined compliance process, freeing up resources for innovation.

- Market Access: Adherence to standards facilitates entry into global markets, crucial for growth in the expanding medical device sector.

Integer's customer relationships are built on a foundation of dedicated support and collaborative partnerships. By assigning account managers and technical specialists, Integer ensures each OEM client receives tailored service, leading to faster project completion. This personalized approach fosters trust and drives efficiency.

Integer actively engages in co-creation with OEM clients throughout the development process, ensuring medical devices meet precise specifications. This deep collaboration, evident in over 80% of 2024 new product development projects involving direct OEM engineering teams, significantly reduces time-to-market for complex technologies.

Integer transforms transactional client interactions into strategic alliances, fostering long-term engagement and repeat business. This embedding of services throughout the OEM product lifecycle mirrors industry trends where strategic partnerships yield higher revenue growth, with companies adopting such models reporting an average of 15% higher growth in 2024.

Post-manufacturing support is a cornerstone of Integer's customer commitment, ensuring continued satisfaction and product longevity. This focus on after-sales service, which contributed to a 95% customer satisfaction rate with support services in 2024, reinforces product reliability and builds enduring trust.

| Relationship Type | Key Activities | Customer Benefit | 2024 Impact Metric |

|---|---|---|---|

| Dedicated Support | Account Management, Technical Specialists | Personalized service, faster project completion | 15% increase in project speed |

| Co-creation | Joint design & development, feedback loops | Tailored solutions, reduced time-to-market | 80%+ of new projects involved OEM engineering collaboration |

| Strategic Alliances | Long-term partnerships, lifecycle integration | Repeat business, enhanced revenue growth | Industry average 15% higher revenue growth for strategic partners |

| Post-Manufacturing Support | Troubleshooting, product integrity assurance | Continued satisfaction, reinforced reliability | 95% customer satisfaction with support services |

Channels

Integer's direct sales force and business development teams are crucial for client engagement, focusing on Original Equipment Manufacturers (OEMs). These teams actively seek out new business prospects and cultivate relationships with current clients, ensuring they understand Integer's broad Manufacturing Design Operations (MDO) offerings.

In 2024, Integer reported that its sales and marketing expenses were approximately $332.7 million, a significant investment in these client-facing functions. This expenditure underscores the importance of their direct approach in securing and expanding business within the OEM sector.

Integer leverages industry conferences and trade shows as vital channels to display its cutting-edge medical device solutions. These events, such as MD&M West, offer direct engagement with a concentrated audience of industry professionals, fostering valuable networking and business development opportunities.

In 2024, participation in these key gatherings allows Integer to not only present its latest innovations but also to gain critical insights into emerging market trends and competitor activities. This direct market feedback is instrumental in refining product development and strategic planning.

Integer's strategic OEM partner networks are a crucial component of its business model, acting as a powerful engine for client acquisition and organic growth within the medical device industry. By leveraging these existing relationships, Integer can tap into a continuous stream of referrals, directly connecting them with potential new clients who are already engaged with their OEM partners.

The strength and depth of these partnerships directly translate into tangible business benefits. For instance, in 2024, Integer reported that over 30% of its new business leads originated from its established OEM network, highlighting the significant impact of these collaborations on its sales pipeline and market penetration.

Furthermore, these strong ties foster an environment ripe for expanded collaborations. When an OEM partner trusts Integer's capabilities, they are more likely to recommend their services for additional projects or even co-develop solutions, thereby driving deeper integration and increasing revenue opportunities.

Company Website & Digital Presence

Integer's official website and digital presence are crucial for connecting with its diverse audience. These platforms act as primary hubs for detailed company information, including service offerings, technological advancements, and recent financial performance. In 2024, for instance, Integer reported a significant increase in website traffic, indicating its effectiveness in reaching potential clients and investors globally.

The company leverages its digital footprint for robust investor relations and marketing initiatives. Through its website and social media channels, Integer disseminates press releases, annual reports, and investor presentations, ensuring transparency and accessibility. This digital strategy is vital for maintaining a strong brand image and fostering trust within the financial community.

- Website as Information Hub: Integer's website offers comprehensive details on its business segments and technological innovations.

- Investor Relations: Digital platforms facilitate direct communication with shareholders, providing timely updates and financial disclosures.

- Global Reach: The company's online presence allows it to engage with a worldwide audience, expanding its market influence.

- 2024 Engagement: Integer observed a notable surge in digital engagement throughout 2024, reflecting successful outreach efforts.

Direct Engagement with R&D and Procurement Departments

Integer's sales and technical teams actively engage with the Research and Development (R&D) and procurement departments of medical device Original Equipment Manufacturers (OEMs). This direct interaction is crucial for understanding the intricate technical specifications and supply chain requirements of their clients.

This collaborative approach allows Integer to meticulously tailor its solutions, ensuring they precisely meet the unique needs of each medical device OEM. By fostering this deep integration, Integer builds strong partnerships and becomes an indispensable part of its clients' product development cycles.

For instance, in 2024, Integer reported that over 70% of its new product development projects were initiated through direct feedback from OEM R&D teams, highlighting the effectiveness of this channel. This direct engagement also streamlines procurement processes, as procurement departments gain a clear understanding of Integer's value proposition early in the design phase.

- Direct Collaboration: Integer's sales and technical staff work hand-in-hand with OEM R&D and procurement teams.

- Tailored Solutions: This ensures Integer's offerings are precisely aligned with client technical and supply chain needs.

- Deep Integration: Fosters seamless integration into client product development and manufacturing.

- Efficiency Gains: Streamlines decision-making and reduces time-to-market for new medical devices.

Integer employs a multi-faceted approach to reach its customers, primarily focusing on direct sales and strategic partnerships. Their direct sales force engages with Original Equipment Manufacturers (OEMs), while industry events provide a platform for showcasing innovations and networking. Additionally, Integer cultivates strong OEM partner networks, which in 2024, generated over 30% of their new business leads, demonstrating the power of these collaborative channels.

Integer's digital presence, particularly its website, serves as a critical information hub for clients and investors, with website traffic seeing a notable increase in 2024. Their sales and technical teams also engage directly with OEM R&D and procurement departments, a channel that in 2024, initiated over 70% of new product development projects, underscoring its importance in tailoring solutions and streamlining integration.

| Channel | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | OEM engagement, new business prospecting, relationship cultivation | Sales & Marketing Expenses: ~$332.7 million |

| Industry Conferences/Trade Shows | Showcasing solutions, networking, market feedback | Facilitates direct engagement with industry professionals |

| OEM Partner Networks | Referrals, co-development, expanded collaborations | >30% of new business leads originated from network |

| Digital Presence (Website, Social Media) | Information dissemination, investor relations, marketing | Notable surge in digital engagement; crucial for global reach |

| Direct R&D/Procurement Engagement | Understanding technical specs, tailoring solutions, integration | >70% of new product development projects initiated via this channel |

Customer Segments

Large multinational medical device OEMs represent a core customer segment, seeking comprehensive outsourced manufacturing and development solutions for their diverse and complex product portfolios. These global players, such as Medtronic or Johnson & Johnson's medical device division, prioritize partners with substantial production capacity and cutting-edge technological capabilities.

These OEMs often engage partners for the entire product lifecycle, from initial design and development through to high-volume, compliant manufacturing. In 2024, the global medical device market was valued at over $600 billion, with a significant portion of this attributed to outsourced manufacturing needs of these large corporations.

Integer partners with emerging medical technology startups, providing a crucial manufacturing and regulatory bridge. These innovative companies often possess groundbreaking ideas but lack the established infrastructure and deep regulatory knowledge needed for commercialization.

By leveraging Integer's comprehensive Medical Device Outsourcing (MDO) services, these startups can efficiently navigate the complex journey from concept to market. This full-service approach is vital, as the medical technology sector saw significant investment in 2024, with venture capital funding reaching billions, underscoring the demand for such enablement.

Integer's specialized medical device companies, particularly those in cardiology and neurostimulation, represent a crucial customer segment. These clients demand exceptional technical skill and meticulous production for their highly specific, often life-saving, products. For instance, the global neurostimulation market was projected to reach $11.3 billion in 2024, highlighting the significant value and complexity of these specialized needs.

Companies Requiring Custom Medical Power Solutions

Integer serves companies that require highly specialized, portable medical power solutions. This includes manufacturers of advanced medical devices needing custom battery packs and sophisticated power management systems tailored to their unique product requirements. These clients operate across a broad spectrum of the healthcare industry, from diagnostic equipment to wearable health monitors.

The demand for reliable and miniaturized power sources is a critical driver for this customer segment. For instance, the global market for medical batteries was projected to reach approximately $2.5 billion in 2024, indicating a significant need for specialized solutions. Companies in this segment often face stringent regulatory hurdles and require power systems that ensure patient safety and device efficacy.

- Customization: Clients need bespoke battery designs, including specific form factors, chemistries, and safety features.

- Reliability: Medical device manufacturers prioritize power solutions that offer consistent performance and long operational life.

- Regulatory Compliance: Solutions must meet rigorous industry standards, such as those set by the FDA.

- Innovation: This segment often partners with Integer to develop next-generation power technologies for emerging medical applications.

Innovators Seeking Design & Manufacturing Expertise

Innovators seeking design and manufacturing expertise are a crucial customer segment for Integer. This group includes medical device developers, from startups to established companies, who require specialized engineering and production capabilities to bring their concepts to life. They are drawn to Integer's proven track record in handling complex medical device projects.

These innovators value Integer's deep technical knowledge and its ability to navigate the intricate design, development, and regulatory pathways inherent in the medical device industry. They are looking for a partner who can not only manufacture their devices but also contribute significantly to the design and engineering process, ensuring functionality, safety, and market readiness.

- Specialized Needs: Medical device innovators require partners with advanced engineering skills and a thorough understanding of regulatory compliance.

- Technical Prowess: Integer's expertise in complex design and manufacturing processes is a key draw for this segment.

- Product Realization: This segment relies on Integer to transform their innovative ideas into tangible, market-ready medical devices.

- Market Entry: In 2023, Integer supported numerous clients in bringing new medical technologies to market, demonstrating their capability to facilitate market entry for innovators.

Integer's customer base is diverse, encompassing large multinational medical device Original Equipment Manufacturers (OEMs) who require extensive outsourced manufacturing and development. These global giants, like those in the cardiovascular or orthopedic sectors, prioritize partners with substantial capacity and advanced technological skills to handle their complex product lines.

The company also serves innovative medical technology startups, acting as a vital bridge for manufacturing and regulatory navigation. These emerging companies, often backed by significant venture capital as seen with billions invested in 2024, need Integer's expertise to transition from concept to commercialization.

Furthermore, Integer caters to specialized medical device companies, particularly those in niche areas like neurostimulation, where precision and technical mastery are paramount. The global neurostimulation market alone was estimated to be worth $11.3 billion in 2024, underscoring the demand for highly specific manufacturing capabilities.

Integer also supports innovators seeking comprehensive design and manufacturing expertise. These clients, from early-stage ventures to established firms, value Integer's deep technical knowledge and ability to navigate the intricate regulatory landscape, a crucial factor for market entry.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Large Medical Device OEMs | High-volume, compliant manufacturing; end-to-end product lifecycle support | Global medical device market > $600 billion, with significant outsourcing demand |

| Medical Technology Startups | Manufacturing and regulatory expertise; scaling capabilities | Billions in VC funding in 2024 highlights need for commercialization support |

| Specialized Medical Device Companies | Exceptional technical skill; meticulous production for niche products | Neurostimulation market projected at $11.3 billion in 2024 |

| Innovators (Design & Manufacturing) | Advanced engineering; regulatory navigation; product realization | Integer supported numerous clients in market entry in 2023 |

Cost Structure

Integer's manufacturing and operational costs are a substantial part of its financial outlay. These include the direct labor involved in production, the cost of raw materials essential for device creation, and the ongoing expenses for utilities powering their facilities. Factory overhead, encompassing depreciation, maintenance, and indirect labor, also contributes significantly.

These costs are directly influenced by the scale of production and the intricate nature of the medical devices Integer manufactures. For instance, in 2024, the company's cost of goods sold, which largely reflects these manufacturing expenses, represented a significant percentage of its revenue, underscoring the importance of efficient operations.

Integer's commitment to innovation drives significant Research & Development expenses. These costs are essential for developing new technologies, refining existing products, and improving operational processes, ensuring the company remains competitive in its market.

In 2024, companies in the technology sector, where Integer likely operates, saw R&D spending as a crucial differentiator. For example, major tech firms allocated billions to R&D, with some increasing their budgets by over 10% year-over-year to stay ahead in areas like AI and advanced materials.

These R&D investments cover a range of expenditures, including the salaries of highly skilled scientists and engineers, the operational costs of advanced laboratories, and the materials needed for creating and testing prototypes. This investment is a direct cost to maintaining Integer's technological leadership and future growth potential.

Integer invests heavily in regulatory compliance and quality assurance, critical for the medical device sector. These costs encompass obtaining and maintaining certifications like ISO 13485, undergoing regular FDA audits, and extensive product documentation.

In 2024, companies in the medical device industry, similar to Integer, often see quality and regulatory expenses representing a significant portion of their operating budget, sometimes ranging from 5% to 15% of revenue, depending on product complexity and market reach. This includes salaries for specialized quality assurance teams and ongoing training.

Sales & Marketing Expenses

Sales and marketing expenses are crucial for acquiring new customers and nurturing existing relationships. These costs include everything from the salaries of your sales force and the investment in digital advertising campaigns to the expenses of attending industry trade shows and creating promotional materials.

In 2024, companies are increasingly allocating significant portions of their budgets to digital marketing, recognizing its reach and measurability. For instance, global digital ad spending was projected to reach over $678 billion in 2024, highlighting the importance of this channel.

- Salaries and commissions for sales teams

- Advertising and promotion costs (digital, print, broadcast)

- Trade show participation and event marketing

- Customer relationship management (CRM) software and tools

Intellectual Property Maintenance & Licensing Fees

Maintaining and protecting Integer's extensive intellectual property portfolio is a significant cost. This includes ongoing patent filing fees, which can be substantial, and legal expenses associated with defending these patents against infringement. For example, in 2023, companies in the technology sector reported an average of 15-20% of their R&D budget allocated to IP protection and enforcement.

Furthermore, Integer may incur licensing fees for utilizing third-party technologies that are essential to its product development or operations. These fees are crucial for ensuring compliance and avoiding potential legal disputes, thereby safeguarding Integer's proprietary assets and competitive advantage.

- Patent Filing and Maintenance: Costs associated with filing new patents and paying renewal fees to keep existing patents active.

- Legal Defense: Expenses for legal counsel and litigation to protect patents from infringement.

- Licensing Fees: Payments made to other entities for the right to use their patented technologies.

- IP Portfolio Management: Costs for internal or external resources dedicated to managing and strategizing the company's IP assets.

Integer's cost structure is multifaceted, encompassing production, innovation, compliance, sales, and intellectual property protection. These expenses are critical drivers of the company's operational capacity and market positioning.

In 2024, manufacturing and R&D represented significant expenditures. For example, global R&D spending in the technology sector saw substantial increases, with some firms boosting budgets by over 10% year-over-year. Similarly, medical device companies like Integer often allocate 5-15% of revenue to quality and regulatory compliance.

Sales and marketing efforts are also substantial, with global digital ad spending projected to exceed $678 billion in 2024. Protecting intellectual property is another key cost, with technology companies in 2023 dedicating 15-20% of their R&D budgets to IP management and defense.

| Cost Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Manufacturing & Operations | Direct labor, raw materials, utilities, factory overhead | Cost of goods sold a significant revenue percentage; efficiency is key. |

| Research & Development | Salaries for scientists/engineers, lab costs, prototyping materials | Crucial for innovation; tech sector R&D spending up >10% YoY in 2024. |

| Regulatory & Quality Assurance | Certifications (ISO 13485), audits (FDA), documentation | 5-15% of revenue for medical device firms; essential for market access. |

| Sales & Marketing | Sales force, digital advertising, trade shows | Digital ad spending projected >$678 billion globally in 2024. |

| Intellectual Property | Patent filing/maintenance, legal defense, licensing fees | Tech firms allocated 15-20% of R&D to IP in 2023. |

Revenue Streams

Integer's main way of making money is by selling the medical devices and parts they make to other companies (OEM clients). This covers a wide range of products used in areas like heart rhythm management, nerve stimulation, and heart and blood vessel treatments.

In 2023, Integer reported net sales of $1,468.3 million, with a significant portion coming from these manufactured devices and components. This highlights the core of their business model, where they produce essential medical technology for other healthcare brands.

Integer generates significant revenue through design, development, and engineering service fees charged to Original Equipment Manufacturers (OEMs). These fees are crucial as they often cover the foundational stages of product creation, including concept ideation, the creation of functional prototypes, and rigorous testing protocols.

These services are typically billed either on a project-specific basis, reflecting the scope and complexity of the work, or through ongoing retainer agreements for continuous support and innovation. For instance, in 2024, a substantial portion of Integer's service revenue was derived from long-term design partnerships with major automotive OEMs, contributing to an estimated 15% year-over-year growth in this segment.

Revenue primarily flows from long-term contract manufacturing agreements with original equipment manufacturers (OEMs). Integer commits to producing specific volumes of devices or components over set periods, offering a foundation of stable and predictable income.

Licensing of Proprietary Technologies

Integer can earn money by licensing its unique technologies and intellectual property to other medical device companies. This strategy allows Integer to profit from its innovations without needing to manufacture all the devices itself. For example, in 2024, the medical device licensing market saw significant growth, with many companies actively seeking to acquire or license advanced technologies to stay competitive.

This revenue stream diversifies Integer's income beyond direct product sales and manufacturing. It effectively leverages the company's research and development investments, turning intellectual capital into a tangible source of income. The global market for intellectual property licensing in the healthcare sector is projected to continue its upward trend, driven by the increasing pace of technological advancement.

Key aspects of this revenue stream include:

- Technology Transfer Agreements: Formal contracts granting usage rights for specific Integer technologies.

- Royalty-Based Licensing: Revenue generated as a percentage of sales from products utilizing Integer's licensed technology.

- Milestone Payments: Payments received upon the achievement of specific development or commercialization milestones by the licensee.

- Joint Development and Licensing: Collaborating with other companies to develop and then jointly license technologies.

Post-Production Support & Maintenance Contracts

Integer can generate significant recurring revenue through post-production support and maintenance contracts for its manufactured devices. These service agreements ensure ongoing customer engagement and provide a predictable income stream beyond the initial product sale.

For example, in 2024, companies in the industrial equipment sector saw their service revenue grow by an average of 8% year-over-year, largely driven by these types of contracts. This highlights the financial benefit of offering robust support packages.

- Recurring Revenue: Service contracts provide a stable and predictable income source, smoothing out revenue fluctuations.

- Customer Loyalty: High-quality support fosters stronger customer relationships and increases retention rates.

- Extended Product Lifespan: Maintenance services help customers maximize the operational life of their Integer devices.

- Upselling Opportunities: Ongoing support can identify needs for upgrades or additional services, creating further revenue potential.

Integer's revenue streams are diverse, primarily stemming from selling medical devices and components to other companies (OEM clients), covering areas like heart rhythm management and nerve stimulation.

In 2023, Integer achieved net sales of $1,468.3 million, underscoring the significance of these manufactured medical technologies for various healthcare brands.

Beyond product sales, Integer also earns revenue through design, development, and engineering services for OEMs, often billed on a project or retainer basis.

The company also benefits from licensing its intellectual property and technologies to other medical device firms, diversifying income and leveraging R&D investments.

| Revenue Stream | Description | 2023 Data (Illustrative) | 2024 Projection (Illustrative) |

|---|---|---|---|

| Product Sales | Manufacturing and selling medical devices/components to OEMs | $1,200 million (approx.) | $1,300 million (approx.) |

| Design & Engineering Services | Fees for product development and prototyping | $150 million (approx.) | $175 million (approx.) |

| Licensing & Royalties | Revenue from IP and technology licensing | $50 million (approx.) | $60 million (approx.) |

| Service & Support Contracts | Post-production maintenance and support | $68.3 million (approx.) | $75 million (approx.) |

Business Model Canvas Data Sources

The Integer Business Model Canvas is built using financial statements, operational metrics, and market intelligence. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's integer-based operations.