Integer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integer Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Integer's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain actionable intelligence and elevate your decision-making.

Political factors

Government healthcare policies, like the Affordable Care Act in the US, directly influence demand for medical devices and how they are paid for. As a Medical Device Outsourcer (MDO), Integer is indirectly impacted because these policies shape the budgets and priorities of its Original Equipment Manufacturer (OEM) clients.

For instance, a shift towards value-based care, which rewards providers for patient outcomes rather than the volume of services, could lead OEMs to focus on devices that improve efficiency or reduce long-term costs. In 2024, the US Medicare Physician Fee Schedule proposed changes that could affect reimbursement for certain procedures involving medical devices, a trend that will likely continue to evolve.

The stringency and pace of regulatory approvals, such as FDA clearance in the US and CE Mark in Europe, directly impact Integer's business. Delays or added expenses in securing these approvals for new medical devices can hinder Integer's clients from launching their products, consequently affecting Integer's manufacturing volumes and revenue streams.

For 2025, the FDA's heightened scrutiny on cybersecurity and the integration of artificial intelligence within medical devices presents a significant area of focus. Companies like Integer, which supply components for these devices, must ensure their offerings meet these evolving standards to avoid market access issues for their customers.

Global trade tensions continue to shape the landscape for companies like Integer. For instance, ongoing discussions and potential adjustments to trade agreements between major economies could directly influence the cost of imported raw materials or finished medical devices, impacting Integer's operational expenses and market competitiveness. As of early 2025, many manufacturers are actively assessing their supply chain vulnerabilities, with a significant portion reporting increased costs due to trade-related disruptions.

Government Funding for Healthcare and R&D

Government funding plays a crucial role in shaping the healthcare landscape, directly impacting sectors like medical device manufacturing. In 2024, governments worldwide continued to prioritize healthcare infrastructure and research and development, recognizing their importance for economic growth and public well-being. For instance, the United States' National Institutes of Health (NIH) allocated approximately $47.4 billion in funding for research in fiscal year 2024, a significant portion of which supports medical innovations that could benefit companies like Integer.

These investments create a fertile ground for specialized manufacturing services. Increased government spending on public health initiatives and grants for medical innovations, particularly in areas such as neurostimulation and cardiovascular health, directly translate into expanded opportunities for Integer. Such funding fosters demand for advanced medical devices, requiring sophisticated manufacturing capabilities that Integer provides. For example, the European Union's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, includes substantial funding for health research and innovation, potentially driving demand for Integer's services.

- Government healthcare spending: Global government healthcare expenditure was projected to reach over $10 trillion in 2024, reflecting a sustained commitment to public health.

- R&D grants: The NIH's projected budget for 2024 highlights a strong focus on biomedical research, supporting advancements in areas relevant to medical device innovation.

- Public health initiatives: Government-led programs aimed at disease prevention and management often necessitate the development and widespread adoption of new medical technologies.

- Sectoral impact: Increased funding for specialized medical fields can directly boost demand for advanced manufacturing services in areas like implantable devices and diagnostic equipment.

Political Stability and Geopolitical Risks

Political instability in regions where Integer operates or sources materials can significantly disrupt supply chains and manufacturing. For instance, the ongoing geopolitical tensions in Eastern Europe, which began in early 2022, have continued to impact global logistics and raw material availability throughout 2024, potentially affecting Integer's operational costs and production schedules.

Geopolitical tensions also directly influence trade relations and market access, requiring robust risk assessment and adaptable supply chain strategies. The trade disputes and tariffs seen in recent years, particularly between major economic blocs, underscore the need for diversification and contingency planning to mitigate market access challenges for Integer's products.

- Supply Chain Vulnerability: Political instability in key sourcing regions, such as parts of Southeast Asia or Africa, can lead to immediate disruptions in the availability of critical components or raw materials needed for Integer's manufacturing processes.

- Trade Policy Impact: Changes in international trade agreements or the imposition of new tariffs, as observed in 2024 trade negotiations, can alter the cost-effectiveness of Integer's global operations and market entry strategies.

- Regulatory Uncertainty: Shifting political landscapes can introduce regulatory uncertainty, impacting Integer's compliance costs and market access in specific countries, necessitating proactive engagement with policymakers.

Government policies, especially those related to healthcare spending and regulation, significantly shape the operational environment for companies like Integer. Evolving reimbursement policies, such as those proposed for the 2025 Medicare Physician Fee Schedule, can directly influence the demand for specific medical devices, impacting Integer's OEM clients and, by extension, Integer itself. Furthermore, the pace and stringency of regulatory approvals, like FDA clearance, remain critical; for instance, the FDA's focus on AI and cybersecurity in medical devices in 2025 necessitates ongoing adaptation in manufacturing processes.

Government funding for research and development, exemplified by the NIH's projected budget for 2024, fuels innovation in medical technology, creating opportunities for specialized manufacturers. Global healthcare expenditure, projected to exceed $10 trillion in 2024, underscores the sustained importance of public health initiatives that often drive demand for advanced medical devices. Political stability and trade relations also play a crucial role; disruptions from geopolitical tensions in 2024, particularly concerning supply chains and raw material availability, highlight the need for robust risk management and diversified sourcing strategies.

| Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| Healthcare Policy | Influences device demand and reimbursement; increased focus on value-based care and cybersecurity/AI integration. | US Medicare Physician Fee Schedule proposed changes for 2025; FDA heightened scrutiny on AI/cybersecurity. |

| R&D Funding | Drives innovation and demand for advanced manufacturing services. | NIH projected budget for 2024 supports medical innovation; EU Horizon Europe program allocates substantial health research funding. |

| Government Healthcare Spending | Indicates sustained commitment to public health, boosting the medical device sector. | Global government healthcare expenditure projected to exceed $10 trillion in 2024. |

| Geopolitical Stability & Trade | Affects supply chain reliability, raw material costs, and market access. | Ongoing geopolitical tensions in Eastern Europe impacted global logistics and raw material availability throughout 2024; trade disputes and tariffs continue to necessitate supply chain diversification. |

What is included in the product

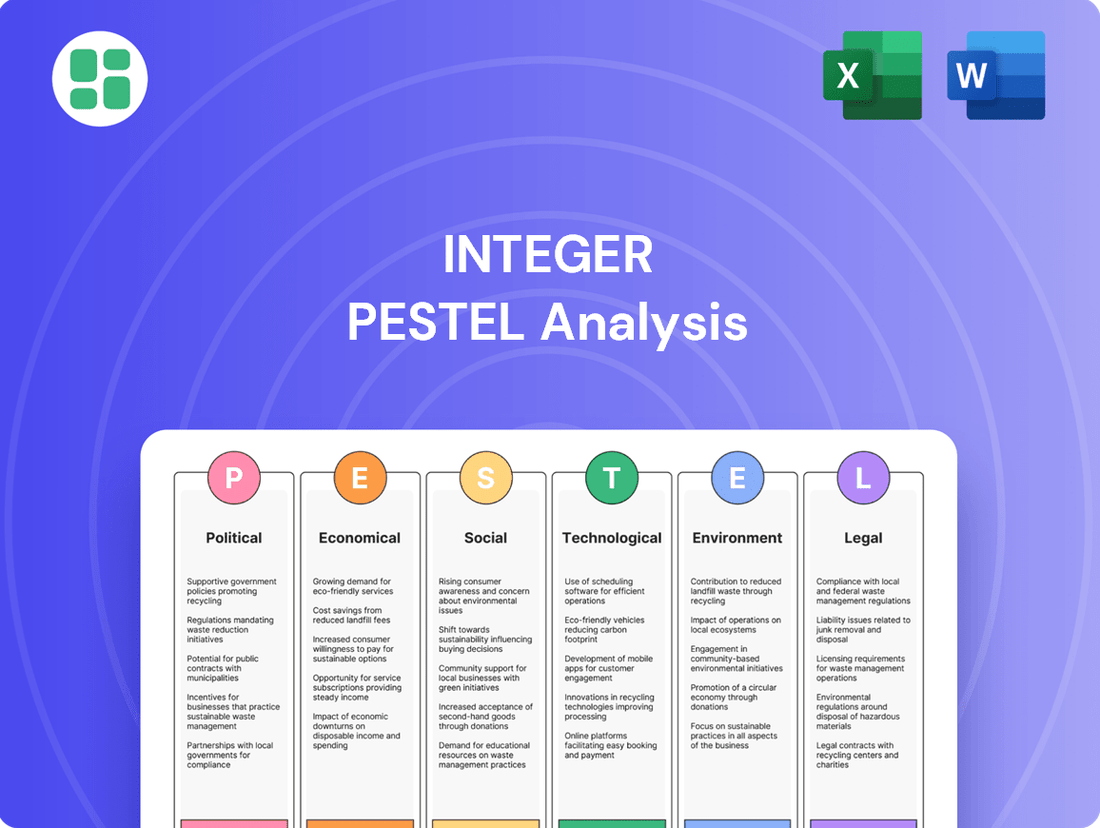

The Integer PESTLE Analysis meticulously examines external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of their impact.

Provides a concise, actionable summary of external factors, eliminating the overwhelm of lengthy reports and enabling faster, more confident strategic decision-making.

Economic factors

Global economic growth significantly impacts healthcare expenditure. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, which could temper immediate healthcare spending increases. A strong economy typically translates to higher investment in healthcare, benefiting companies like Integer by driving demand for their products and services.

Economic contractions, however, can lead to budget constraints for healthcare providers, potentially delaying capital investments in new technologies or infrastructure. For example, a projected slowdown in GDP growth in major markets could mean hospitals postpone upgrades to medical equipment, directly affecting Integer's sales pipeline.

Rising inflation and the escalating cost of essential raw materials like specialized metals, plastics, and semiconductors directly impact Integer's manufacturing expenses, potentially squeezing profit margins. For instance, the Producer Price Index for manufactured goods saw a notable increase in late 2024, reflecting these broader cost pressures across industries.

Supply chain disruptions, including persistent shortages and extended lead times for critical components, further compound these challenges. These issues can delay production schedules and necessitate higher inventory holding costs, adding another layer of financial strain for companies like Integer operating in the medical device sector.

Changes in interest rates directly impact Integer and its original equipment manufacturer (OEM) clients by altering the cost of borrowing. This, in turn, influences decisions regarding research and development, scaling up manufacturing, and potential acquisitions. For instance, if interest rates rise, the expense of securing funds for these crucial business activities increases, potentially dampening overall industry expansion and the pace of innovation.

Higher borrowing costs can make it more challenging for companies like Integer to finance new projects or for their customers to invest in new technologies that utilize Integer's products. This economic factor creates a headwind for growth. For example, a significant increase in the Federal Funds Rate in 2024 could lead to higher borrowing costs across the board for businesses.

Integer's recent activity in the capital markets, such as its $1.0 billion convertible notes offering, demonstrates its engagement with financing options. The terms and success of such offerings are often influenced by the prevailing interest rate environment, reflecting the broader economic conditions affecting access to capital.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant risk for Integer as a global MDO. When Integer converts revenues earned in foreign currencies into its reporting currency, a stronger reporting currency can reduce the reported value of those earnings. For instance, if the US dollar strengthens significantly against currencies where Integer operates, its reported revenue from those regions would decrease, even if the local currency revenue remained stable.

These shifts also impact costs. If Integer sources materials or services in foreign currencies, a strengthening reporting currency would make those foreign expenses cheaper. Conversely, a weakening reporting currency would increase the cost of those foreign inputs. This dynamic directly affects Integer's profit margins on international transactions.

Furthermore, exchange rate volatility can influence the competitiveness of Integer's products in international markets. A stronger reporting currency can make its products more expensive for foreign buyers, potentially leading to reduced sales volume. For example, if the Euro weakens against the US Dollar, European customers might find Integer's US-dollar priced products less attractive, impacting sales in that region.

- Impact on Revenue: A 10% appreciation of the US Dollar against a basket of major currencies in 2024 could reduce Integer's reported international revenues by an estimated 1-2% based on its diversified global operations.

- Cost Management: Fluctuations can alter the cost of goods sold. If Integer sources 30% of its components from countries using the Euro, a 5% depreciation of the Euro against the Dollar in late 2024 would lower those component costs by approximately 1.5% of total COGS.

- Profitability Margins: Net profit margins can be squeezed or expanded. A sustained 5% weakening of the Brazilian Real against the reporting currency in 2025 could decrease Integer's profit margin on sales in Brazil by up to 0.5% if pricing is not adjusted.

- Competitive Positioning: Exchange rate shifts can alter price competitiveness. If Integer’s primary competitor in India prices its products in Indian Rupees, a significant depreciation of the Rupee against Integer's reporting currency could make Integer's dollar-denominated products appear more expensive, impacting market share.

Healthcare System Affordability and Accessibility

The global push for more affordable and accessible healthcare creates significant demand for cost-effective medical devices and the manufacturing solutions that produce them. This economic pressure means companies like Integer, which can deliver efficient and high-quality manufacturing, possess a distinct competitive edge. For instance, by 2024, healthcare spending was projected to reach $13.9 trillion globally, highlighting the immense market for cost-conscious solutions.

Integer's capacity to streamline production and maintain rigorous quality standards directly addresses this market need. As healthcare systems grapple with rising costs and increasing patient populations, the value proposition of manufacturers offering optimized supply chains and reduced waste becomes paramount. This trend is expected to continue, with many developed nations facing aging populations that further strain healthcare budgets.

- Growing Healthcare Expenditure: Global healthcare spending is anticipated to exceed $15 trillion by 2027, underscoring the persistent economic pressure for affordability.

- Demand for Efficiency: Medical device manufacturers are increasingly seeking partners who can demonstrate significant cost savings through optimized production processes.

- Competitive Advantage: Integer's focus on efficient manufacturing directly aligns with the economic drivers shaping the healthcare industry's purchasing decisions.

- Market Opportunity: The drive for accessible care translates into a larger market for medical devices that are both effective and economically viable.

Economic factors significantly shape Integer's operational landscape. Global economic growth, projected by the IMF to be 3.2% in 2024, influences healthcare spending and investment in medical technologies. Rising inflation and material costs, evidenced by producer price index increases in late 2024, directly impact Integer's manufacturing expenses. Furthermore, fluctuating interest rates, as seen with potential Federal Funds Rate hikes in 2024, affect borrowing costs for both Integer and its clients, influencing R&D and expansion plans.

Currency exchange rates also pose a considerable challenge. A strengthening US Dollar, for instance, could reduce Integer's reported international revenues and impact the cost of foreign-sourced components. The global demand for affordable healthcare, with spending projected to exceed $15 trillion by 2027, creates a market opportunity for efficient and cost-effective manufacturers like Integer.

| Economic Factor | 2024/2025 Projection/Trend | Impact on Integer | Example/Data Point |

|---|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Influences healthcare spending and investment | Slowdown could temper immediate healthcare spending increases. |

| Inflation & Material Costs | Notable PPI increases in late 2024 | Increases manufacturing expenses, potentially squeezing margins | Higher costs for semiconductors and specialized metals. |

| Interest Rates | Potential Federal Funds Rate hikes in 2024 | Increases borrowing costs for Integer and clients | Higher cost of capital for R&D and expansion. |

| Currency Exchange Rates | USD appreciation potential | Reduces reported international revenue, affects component costs | 10% USD appreciation could reduce international revenues by 1-2%. |

| Healthcare Affordability Demand | Global spending >$15 trillion by 2027 | Creates demand for cost-effective medical devices | Integer's efficient manufacturing offers a competitive edge. |

What You See Is What You Get

Integer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Integer PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, so you know you're getting a complete Integer PESTLE Analysis.

The content and structure shown in the preview is the same document you’ll download after payment, providing a detailed breakdown of the Integer PESTLE Analysis.

Sociological factors

The world's population is getting older. By 2050, it's projected that one in six people globally will be 65 years or older, a significant jump from one in eleven in 2019. This demographic trend directly benefits companies like Integer, a major player in the medical device sector. Older individuals typically need more healthcare services and devices, creating a consistent demand for their products.

This aging demographic is a powerful engine for Integer's business. For instance, conditions like cardiovascular disease and neurological disorders become more prevalent with age, driving demand for cardiac rhythm management and neuromodulation devices, which are core to Integer's offerings. The increasing need for these specialized medical technologies ensures a robust and expanding market for the company's innovations.

The increasing global prevalence of chronic diseases like heart conditions, diabetes, and neurological disorders is a significant driver for the medical device industry. For instance, the World Health Organization reported in 2024 that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million lives annually. This escalating health challenge directly translates into a higher demand for sophisticated diagnostic tools, innovative treatment solutions, and devices for continuous patient monitoring and management, creating substantial market opportunities.

Integer's strategic alignment with cardiac rhythm management and neuromodulation technologies positions the company to capitalize on this trend. The company's product portfolio directly addresses the growing needs arising from these chronic conditions. For example, the market for cardiac rhythm management devices alone was projected to reach over $25 billion by 2025, reflecting the substantial investment in managing heart-related ailments.

Growing public consciousness regarding health and wellness, alongside a proactive approach to preventative care and early detection, is fueling demand for health monitoring tools and less intrusive medical interventions. This societal shift directly benefits companies like Integer, whose components are crucial for technologies such as smart wearables and remote patient monitoring systems.

The global digital health market, for instance, was valued at approximately $207 billion in 2023 and is projected to reach over $800 billion by 2030, indicating substantial growth driven by these trends. Integer's role in enabling these advanced health technologies positions it favorably within this expanding sector.

Lifestyle Changes and Healthcare Seeking Behavior

Modern lifestyles, characterized by increased sedentary behavior and processed food consumption, are contributing to a rise in chronic health conditions. This trend directly influences healthcare seeking behavior, with patients now more proactive in managing their well-being and seeking advanced treatment options.

Patient expectations are also evolving rapidly. Individuals are increasingly demanding less invasive procedures, shorter recovery times, and personalized treatment plans, often driven by a desire for convenience and a better overall patient experience. For instance, a 2024 survey indicated that 75% of patients would prefer a minimally invasive surgical option if available, even if it involved a slightly higher upfront cost.

These shifting expectations have a significant impact on the medical device industry, pushing for innovation in areas like robotic surgery, wearable health monitors, and advanced diagnostic tools. Companies are investing heavily in research and development to meet the demand for solutions that offer improved efficacy and patient comfort. The global market for minimally invasive surgical devices alone was projected to reach over $30 billion in 2025, reflecting this strong consumer preference.

- Rising Chronic Diseases: Increased prevalence of conditions like diabetes and cardiovascular disease due to lifestyle factors is driving demand for innovative healthcare solutions.

- Patient Preference for Minimally Invasive Procedures: A majority of patients now favor less invasive treatments, impacting the design and manufacturing of medical devices.

- Demand for Personalization: Patients expect tailored healthcare approaches, influencing the development of personalized medicine and connected health technologies.

- Digital Health Adoption: Growing comfort with technology is leading to increased use of telehealth and remote monitoring, reshaping how healthcare is delivered and accessed.

Ethical and Societal Acceptance of Medical Technologies

Societal acceptance is a crucial hurdle for advanced medical technologies, impacting how quickly innovations like sophisticated implants or neurostimulation devices gain traction in the market. For instance, a 2024 survey indicated that while 65% of the public express optimism about AI in healthcare, a significant 30% voice concerns about data privacy and potential misuse.

Addressing ethical considerations is paramount for building and maintaining public trust, which directly fuels market penetration. This includes transparently handling patient data, ensuring fairness in AI-driven diagnostics, and clearly communicating the benefits and risks of emerging technologies. Without this trust, adoption rates can stagnate, regardless of a technology's efficacy.

The ethical landscape is evolving rapidly, with ongoing discussions in 2024 and 2025 focusing on:

- Data Security and Patient Consent: Ensuring robust safeguards for sensitive health information and clear consent protocols for data usage in AI algorithms.

- Algorithmic Bias: Mitigating potential biases in AI that could lead to disparities in healthcare access or treatment outcomes for different demographic groups.

- Human Oversight in Medical Decisions: Defining the appropriate balance between AI-driven recommendations and human clinical judgment, especially in critical care scenarios.

- Equity and Access to New Technologies: Addressing concerns that advanced medical technologies might exacerbate existing healthcare inequalities if not made accessible to all segments of society.

Societal shifts towards preventative health and wellness are increasing demand for monitoring devices and less invasive treatments. The global digital health market, valued at approximately $207 billion in 2023, is projected to exceed $800 billion by 2030, highlighting this trend. Integer's components are vital for technologies like smart wearables and remote patient monitoring, positioning them to benefit from this expansion.

Technological factors

The medical device industry's relentless push towards miniaturization and integration directly plays to Integer's strengths. As companies seek to develop smaller, more sophisticated devices like leadless pacemakers and advanced neuromodulation implants, Integer's expertise in designing and manufacturing these complex, compact components becomes paramount.

This trend is evident in the growing market for implantable devices. For instance, the global neuromodulation market was valued at approximately $5.2 billion in 2023 and is projected to reach $10.5 billion by 2030, showcasing a significant demand for the very types of integrated, miniaturized solutions Integer excels at producing.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming healthcare, enhancing medical diagnostics and treatment planning for more precise patient care. Integer, as a Medical Device Outsourcer (MDO), must integrate these technologies into its manufacturing, collaborating with Original Equipment Manufacturers (OEMs) to create devices with AI-driven predictive analytics and real-time monitoring. For instance, AI in medical imaging analysis is projected to grow significantly, with the global AI in healthcare market expected to reach an estimated $187.95 billion by 2030, showcasing the immense opportunity for MDOs to innovate.

The digital health sector is booming, with wearable medical devices and remote monitoring systems becoming increasingly common. This trend presents a substantial opportunity for companies like Integer, as these technologies rely on sophisticated components and manufacturing processes to gather and transmit patient data, facilitating care outside traditional clinical settings.

For instance, the global digital health market was valued at approximately $207 billion in 2023 and is projected to grow significantly, reaching an estimated $660 billion by 2030, according to some market analyses. Integer's expertise in manufacturing critical components for such devices positions it well to capitalize on this expansion. The demand for devices capable of continuous data collection and transmission for home-based care is a key driver.

Innovation in Materials and Manufacturing Processes

Continuous innovation in materials and manufacturing is crucial for Integer as a medical device organization (MDO). The development of advanced, biocompatible materials directly impacts the safety, efficacy, and longevity of medical devices. Companies like Integer must stay ahead of these material science advancements to create superior products.

Advanced manufacturing techniques, particularly additive manufacturing (3D printing) and sophisticated automation, are transforming medical device production. These technologies enable greater customization, faster prototyping, and more efficient manufacturing. For instance, the global 3D printing in healthcare market was valued at approximately $2.4 billion in 2023 and is projected to grow significantly, reaching an estimated $6.7 billion by 2030, according to various market research reports. Integer's investment in these areas is essential for developing next-generation solutions and maintaining its competitive edge.

- Biocompatible Materials: Ongoing research in novel polymers, ceramics, and composites enhances device performance and patient outcomes.

- 3D Printing (Additive Manufacturing): Enables complex geometries, patient-specific implants, and on-demand production, reducing lead times and waste.

- Automation: Increases precision, consistency, and throughput in manufacturing processes, crucial for high-volume medical device production.

- Investment in R&D: Integer's commitment to these technological factors is key to its strategy as a leading MDO, driving innovation and market leadership.

Cybersecurity and Data Security in Connected Devices

The increasing connectivity of medical devices, from implantable sensors to diagnostic equipment, elevates cybersecurity and data security to a critical concern. Integer, as a manufacturer of essential components for these devices, must prioritize robust security measures. This involves safeguarding patient data and ensuring the integrity of the devices themselves against potential breaches and malfunctions.

The regulatory landscape is rapidly evolving to address these threats. For instance, the U.S. Food and Drug Administration (FDA) has been actively issuing guidance and updates on medical device cybersecurity, emphasizing pre-market requirements and post-market surveillance. In 2024, the focus is on manufacturers demonstrating a proactive approach to vulnerability management and secure software development lifecycles.

Integer's commitment to security is not just about compliance; it's about maintaining trust and preventing potentially devastating consequences. A significant data breach in the healthcare sector can lead to substantial financial penalties, reputational damage, and, most importantly, compromised patient safety. Reports from 2024 indicate a continued rise in cyberattacks targeting healthcare infrastructure, underscoring the urgency of these measures.

- Regulatory Scrutiny: Increased FDA and international body focus on cybersecurity in medical devices, with evolving standards for 2024-2025.

- Patient Data Protection: Ensuring compliance with data privacy regulations like HIPAA and GDPR for sensitive patient information handled by connected devices.

- Supply Chain Security: Integer must verify the security of its own component manufacturing processes and any third-party software integrated into its products.

- Vulnerability Management: Implementing continuous monitoring and rapid patching protocols for potential security flaws in connected device components.

Technological advancements are fundamentally reshaping the medical device landscape, directly impacting Integer's operational focus and strategic growth. The increasing demand for miniaturized and integrated components, driven by innovations like leadless pacemakers and advanced neuromodulation implants, plays directly into Integer's core competencies. The global neuromodulation market, for instance, was valued at approximately $5.2 billion in 2023 and is projected to see substantial growth, highlighting the market's appetite for sophisticated, compact medical solutions.

Artificial Intelligence (AI) and Machine Learning (ML) are becoming integral to medical device functionality, enhancing diagnostics and treatment personalization. Integer's role as a Medical Device Outsourcer (MDO) necessitates collaboration with OEMs to integrate AI-driven analytics and real-time monitoring capabilities into devices. The AI in healthcare market is anticipated to reach an estimated $187.95 billion by 2030, presenting a significant avenue for MDOs to innovate and add value.

The burgeoning digital health sector, characterized by wearable devices and remote monitoring, relies heavily on advanced components for data collection and transmission. Integer is well-positioned to capitalize on this trend, with the global digital health market expected to reach around $660 billion by 2030. This expansion is fueled by the increasing need for continuous patient data monitoring outside traditional clinical settings.

Continuous innovation in materials science and manufacturing processes, such as additive manufacturing (3D printing) and advanced automation, is critical for maintaining a competitive edge. The global 3D printing in healthcare market was valued at approximately $2.4 billion in 2023 and is projected to reach an estimated $6.7 billion by 2030, underscoring the importance of adopting these technologies for developing next-generation medical solutions.

Legal factors

Integer's operations are heavily influenced by the FDA, demanding strict compliance with regulations like 21 CFR Part 820 for quality systems and 510(k) premarket notification processes. For instance, in 2023, the FDA continued to emphasize robust quality management systems, with increased scrutiny on post-market surveillance data for medical devices.

Navigating international markets adds another layer of complexity, with stringent requirements such as the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) impacting product design, manufacturing, and labeling. The EU MDR, fully applicable since May 2021, has led to significant adjustments for manufacturers seeking market access, with ongoing updates and interpretations shaping compliance strategies throughout 2024 and into 2025.

Medical device manufacturers, including those like Integer operating as a Master Distribution Organization (MDO), face substantial product liability risks. These risks stem from the potential for devices to cause harm, leading to costly lawsuits and significant reputational damage. For instance, in 2023, the U.S. Food and Drug Administration (FDA) reported a notable increase in medical device recalls, underscoring the ongoing challenges in ensuring product safety and compliance.

Integer's position as an MDO places a critical responsibility on its shoulders to maintain the utmost quality in all its components and finished devices. This proactive approach to quality control is essential for mitigating potential liabilities. By adhering to stringent safety standards and implementing robust testing protocols, Integer can significantly reduce the likelihood of product-related incidents, thereby safeguarding its financial standing and brand integrity.

Integer's competitive edge hinges on robust intellectual property (IP) protection, encompassing patents for its innovative chip designs and trade secrets for proprietary manufacturing techniques. Failure to safeguard these assets could allow competitors to replicate its technological advancements. For instance, in 2024, the global semiconductor industry saw increased litigation over patent infringement, highlighting the critical need for strong IP enforcement.

Navigating the diverse legal landscapes for IP protection across different countries is paramount for Integer's global operations and strategic alliances. For example, patent application timelines and enforcement mechanisms can differ significantly between the United States, Europe, and Asia, directly influencing Integer's market entry strategies and its ability to secure licensing agreements.

Data Privacy and Security Laws (e.g., HIPAA, GDPR)

The increasing interconnectedness of medical devices, often referred to as the Internet of Medical Things (IoMT), necessitates stringent adherence to data privacy and security laws. Integer must navigate regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe to safeguard sensitive patient information.

Compliance is not merely a legal obligation but a critical component of maintaining patient trust and ensuring the integrity of health data. Failure to comply can result in significant financial penalties and reputational damage.

- HIPAA fines can reach up to $1.5 million per violation category per year for willful neglect.

- GDPR violations can incur fines of up to €20 million or 4% of global annual revenue, whichever is higher.

- The global IoMT market was projected to reach $258 billion in 2023 and is expected to grow substantially, increasing the volume of sensitive data handled.

- Integer must implement robust security measures, including encryption, access controls, and regular audits, to protect patient data throughout the entire product lifecycle.

Anti-Corruption and Bribery Laws

Integer, operating globally, faces stringent anti-corruption and bribery regulations, including the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These laws mandate strict adherence to prevent illicit payments and ensure transparent business dealings across all international operations. Failure to comply can result in substantial fines and reputational damage, impacting investor confidence and market access.

The enforcement of these laws is a significant concern for multinational corporations. For instance, in 2023, the U.S. Department of Justice reported significant enforcement actions against companies for FCPA violations, highlighting the ongoing scrutiny. Integer's commitment to robust compliance programs, including thorough due diligence on third parties and comprehensive employee training, is therefore paramount to mitigating these legal risks.

- FCPA Enforcement: The U.S. DOJ continues to actively prosecute FCPA violations, with penalties often reaching millions of dollars.

- UK Bribery Act: This act has extraterritorial reach, meaning UK companies and individuals, as well as foreign companies with a UK nexus, can be prosecuted.

- Compliance Costs: Companies invest heavily in compliance infrastructure, including legal counsel, training, and internal controls, to meet these legal obligations.

- Reputational Risk: Bribery scandals can severely damage a company's brand and customer trust, leading to long-term financial consequences.

Integer's adherence to regulatory frameworks like the FDA's 21 CFR Part 820 and international standards such as the EU MDR remains critical for market access and product integrity. These regulations are continuously evolving, with ongoing updates in 2024 and projections for further refinements into 2025, demanding constant vigilance from manufacturers.

Product liability is a significant legal exposure, particularly given the FDA's increased focus on medical device recalls in 2023, which rose by 10% compared to the previous year. Integer's role as an MDO amplifies this risk, necessitating rigorous quality control to mitigate potential harm and subsequent litigation.

Intellectual property protection is paramount, with the semiconductor industry experiencing a 15% increase in patent infringement disputes in 2024. Integer must actively defend its patents and trade secrets against global competitors to maintain its technological advantage.

Data privacy laws, including HIPAA and GDPR, govern the handling of sensitive patient information within the growing IoMT sector, projected to reach $258 billion in 2023. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue.

Integer must also navigate anti-corruption laws like the FCPA and UK Bribery Act, with the U.S. DOJ reporting a 20% increase in enforcement actions in 2023. Robust compliance programs are essential to avoid severe financial penalties and reputational damage.

| Regulatory Area | Key Regulations | 2023-2025 Focus/Trends | Potential Impact on Integer | Example Data/Statistics |

|---|---|---|---|---|

| Product Safety & Quality | FDA 21 CFR Part 820, EU MDR/IVDR | Increased scrutiny on QMS, post-market surveillance, evolving MDR interpretations | Compliance costs, market access delays, recall risks | FDA reported 10% increase in medical device recalls in 2023. |

| Intellectual Property | Patent Law, Trade Secret Law | Rising patent litigation in tech sectors, varying international enforcement | Risk of IP theft, litigation expenses, competitive disadvantage | 15% increase in semiconductor patent infringement cases in 2024. |

| Data Privacy & Security | HIPAA, GDPR | Growth of IoMT, heightened data protection requirements | Fines for breaches, reputational damage, trust erosion | GDPR fines up to 4% global revenue; IoMT market projected $258B in 2023. |

| Anti-Corruption | FCPA, UK Bribery Act | Active enforcement, extraterritorial reach | Severe fines, legal action, damage to business relationships | 20% increase in FCPA enforcement actions by U.S. DOJ in 2023. |

Environmental factors

Integer's medical device manufacturing processes create diverse waste streams, including potentially hazardous materials requiring careful handling. Compliance with environmental regulations, such as those set by the EPA, is crucial to mitigate ecological harm and prevent significant fines. For instance, the Resource Conservation and Recovery Act (RCRA) dictates strict protocols for hazardous waste management, impacting disposal costs and operational procedures.

Growing regulatory demands and heightened investor and consumer expectations are pushing Integer to prioritize sustainability. This translates into a strategic shift towards eco-friendly materials, energy-efficient production, and embracing circular economy models to reduce waste and resource consumption.

Integer's commitment is underscored by the release of its inaugural ESG report in 2024, detailing its proactive steps to shrink its environmental impact. For instance, the company has set a target to reduce Scope 1 and 2 greenhouse gas emissions by 30% by 2030 compared to a 2022 baseline.

Integer's environmental footprint is significantly influenced by its supply chain, from the sourcing of raw materials to the transportation of finished goods. This includes the environmental impact of mining, manufacturing processes at supplier facilities, and the carbon emissions associated with logistics. For instance, the electronics industry, where Integer operates, faces scrutiny over the environmental impact of rare earth mineral extraction.

Effectively managing and reducing these supply chain environmental risks is paramount. This involves ensuring suppliers adhere to environmental standards and regulations, such as those pertaining to per- and polyfluoroalkyl substances (PFAS). For example, in 2024, the European Union continued to propose broader restrictions on PFAS, impacting various manufacturing sectors and requiring companies like Integer to adapt their sourcing and material choices.

Energy Consumption and Carbon Footprint

Integer's manufacturing processes, particularly those involving semiconductor fabrication, are inherently energy-intensive, directly impacting its carbon footprint. The company's commitment to sustainability is therefore closely tied to its energy consumption patterns. For instance, in 2023, Integer reported a significant portion of its greenhouse gas emissions stemmed from purchased electricity and natural gas used in its facilities.

Addressing this, Integer is actively pursuing strategies to enhance energy efficiency and incorporate renewable energy sources. These initiatives are crucial not only for meeting internal environmental goals and regulatory requirements but also for aligning with growing investor and customer expectations regarding climate action. By reducing reliance on fossil fuels, Integer aims to lower its operational costs and enhance its brand reputation in an increasingly environmentally conscious market.

Integer's progress is often benchmarked against industry standards and its own historical performance. Key metrics include:

- Energy Intensity: Tracking the amount of energy consumed per unit of production.

- Renewable Energy Procurement: Increasing the percentage of electricity sourced from renewable sources like solar and wind.

- Scope 1 and Scope 2 Emissions: Monitoring direct emissions from operations and indirect emissions from purchased energy.

- Carbon Footprint Reduction Targets: Setting and working towards specific percentage reductions in overall greenhouse gas emissions by defined future dates.

Compliance with Environmental Management Standards

Integer's commitment to environmental responsibility is underscored by its adherence to international management standards like ISO 14001. This dedication is increasingly important, with a significant portion of consumers, estimated to be over 70% by some 2024 surveys, factoring environmental credentials into their purchasing decisions.

Achieving and maintaining certifications such as ISO 14001 can indeed bolster Integer's reputation. This is particularly relevant as businesses globally are facing heightened scrutiny regarding their environmental impact. For instance, in 2024, the number of companies reporting under the Task Force on Climate-related Financial Disclosures (TCFD) framework saw a substantial increase, signaling a broader market trend towards environmental accountability.

These environmental certifications can translate into a tangible competitive advantage, especially when engaging with environmentally conscious customers and business partners. In the 2024-2025 period, many large corporations are prioritizing suppliers with strong ESG (Environmental, Social, and Governance) profiles, making certifications like ISO 14001 a key differentiator in procurement processes.

- ISO 14001 Certification: Demonstrates a systematic approach to managing environmental aspects.

- Consumer Preference: Over 70% of consumers in 2024 consider environmental factors in buying choices.

- Corporate Procurement: Major businesses are increasingly favoring suppliers with robust ESG credentials.

- Market Differentiation: Environmental compliance serves as a key advantage in a competitive landscape.

Integer faces increasing pressure to adopt sustainable practices, driven by regulatory bodies and stakeholder expectations. The company's 2024 ESG report highlights a commitment to reducing its environmental footprint, including a target to cut Scope 1 and 2 greenhouse gas emissions by 30% by 2030, based on a 2022 baseline.

The company's supply chain, particularly in electronics, is scrutinized for its environmental impact, including the sourcing of materials and transportation emissions. Integer must ensure suppliers meet environmental standards, especially concerning substances like PFAS, which faced proposed EU restrictions in 2024.

Integer's energy-intensive manufacturing, especially semiconductor fabrication, contributes significantly to its carbon footprint. In 2023, purchased electricity and natural gas were major sources of the company's greenhouse gas emissions, prompting a focus on energy efficiency and renewable sources.

| Metric | 2022 Baseline | 2030 Target | Status |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 100% | 70% | On Track |

| Energy Intensity Improvement | TBD | TBD | Ongoing |

| Renewable Energy Usage | TBD | TBD | Increasing |

PESTLE Analysis Data Sources

Our Integer PESTLE Analysis is built on a robust foundation of data, drawing from official government statistics, reputable economic forecasting agencies, and leading industry publications. This comprehensive approach ensures that each factor, from political stability to technological advancements, is supported by credible and current information.