Intact Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intact Financial Bundle

Intact Financial’s robust brand recognition and strong financial performance are significant strengths, yet they face evolving regulatory landscapes and competitive pressures. Understanding these dynamics is crucial for navigating the insurance market effectively.

Want the full story behind Intact Financial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Intact Financial Corporation stands as Canada's largest property and casualty insurer, a position that grants it substantial market influence. This leadership translates into strong brand recognition across the nation, enabling effective pricing strategies and significant economies of scale. As of the first quarter of 2024, Intact reported a robust Direct Written Premium of C$5.7 billion in Canada, underscoring its dominant market share and operational efficiency.

Intact Financial boasts a robust and diversified product portfolio that spans auto, home, and business insurance. This broad offering ensures the company isn't overly dependent on any single market segment, providing a crucial buffer against sector-specific downturns or regulatory shifts. For instance, in 2023, Intact reported strong performance across its property and casualty segments, demonstrating the resilience inherent in its diversified approach.

Intact Financial consistently delivers strong financial performance, highlighted by its robust operating income and impressive book value per share growth. In 2024, the company reported a solid operating return on equity, often surpassing industry benchmarks, underscoring its efficient operations and profitability.

The company's financial strength is further bolstered by a healthy balance sheet, featuring substantial capital margins. This strong capital position, as of early 2025, provides Intact with significant resilience to absorb large claims events and ample capacity to pursue strategic growth opportunities and investments.

Extensive and Growing Distribution Network

Intact Financial boasts a significant advantage with its widespread and continuously expanding distribution channels. This network is largely built upon a strong foundation of independent brokers, notably amplified by its wholly-owned subsidiary, BrokerLink. This strategic approach allows Intact to connect with a broad spectrum of customers across various markets.

The company actively pursues growth in its distribution capabilities through targeted acquisitions. These moves not only broaden their market reach but also contribute to increased sales volumes and deeper penetration into key demographics. For instance, in 2023, BrokerLink continued its expansion, acquiring several brokerages to bolster its presence.

Beyond its broker relationships, Intact Financial also engages directly with consumers. Brands like belairdirect serve as a crucial direct-to-consumer channel, offering an alternative avenue for customer acquisition and engagement. This multi-faceted distribution strategy is a core strength, ensuring broad market access and resilience.

- Extensive Broker Network: Leverages independent brokers and BrokerLink for broad customer reach.

- Strategic Acquisitions: Continuously expands distribution through targeted M&A activity.

- Direct-to-Consumer Channels: Utilizes brands like belairdirect for direct customer engagement.

- Market Penetration: Enhanced reach leads to increased sales volumes and market share.

Commitment to Digital Transformation and AI Adoption

Intact Financial is making significant strides in its digital transformation journey, with a dedicated focus on integrating Artificial Intelligence (AI) across its operations. This strategic investment is designed to streamline processes, elevate the customer experience, and refine the accuracy of risk assessment and selection. For instance, by the end of 2023, Intact had allocated over CAD 100 million to technology and digital initiatives, a figure expected to grow by 15% in 2024.

These technological advancements are not just about modernization; they are about building a more efficient, cost-effective business model. AI-driven underwriting tools, for example, are enabling more precise pricing and product customization, giving Intact a distinct competitive advantage. This focus on data and analytics is projected to contribute an additional 2-3% to their operating efficiency gains by 2025.

- AI-powered underwriting: Enhancing risk selection accuracy and pricing.

- Digital customer platforms: Improving engagement and service delivery.

- Operational efficiency: Driving cost reductions through automation.

- Data analytics: Optimizing business decisions and product development.

Intact Financial's market leadership in Canada's P&C insurance sector is a significant strength, translating into strong brand recognition and pricing power. This dominance allows for substantial economies of scale, as evidenced by their C$5.7 billion in Canadian Direct Written Premiums in Q1 2024, highlighting operational efficiency and market influence.

What is included in the product

Delivers a strategic overview of Intact Financial’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Helps Intact Financial quickly identify and address potential market disruptions by highlighting weaknesses and threats.

Weaknesses

Intact Financial, a major property and casualty insurer, faces significant vulnerability to extreme weather. Events like hurricanes, floods, and wildfires are becoming more common and intense, directly impacting the company's financial stability.

In 2024, for example, insurers globally experienced substantial losses from natural catastrophes. While Intact's specific figures for the full year are still emerging, preliminary reports from industry associations indicate that insured losses from severe weather events in North America alone could exceed $50 billion in 2024, a figure that poses a direct challenge to insurers like Intact.

This exposure can lead to sharp increases in claim payouts, potentially depleting capital reserves and affecting profitability. Managing this risk requires robust reinsurance strategies and sophisticated catastrophe modeling.

Intact Financial's significant reliance on its broker network for distribution, while a strength, also presents a notable weakness. This dependence means the company entrusts a substantial portion of its customer acquisition and retention to these third-party intermediaries, potentially reducing direct control over customer engagement and sales tactics. In 2023, broker commissions and related expenses represented a considerable operating cost, highlighting the financial impact of this distribution model.

The property and casualty insurance sector is fiercely competitive, with both established players and innovative InsurTech startups constantly vying for market share. This dynamic environment translates into sustained pricing pressure, making it difficult for companies like Intact Financial to maintain healthy profit margins.

This intense competition can significantly impact customer acquisition and retention strategies. Insurers often find themselves needing to offer aggressive pricing to attract new business or keep existing clients, which can erode profitability. For instance, in 2023, the Canadian P&C market saw a significant increase in competitive pricing strategies as insurers sought to gain an edge.

Challenges in International Markets

Intact Financial's expansion into international markets, while a strategic growth avenue, presents distinct challenges. Despite a strong North American foundation and operations in the UK and Ireland, performance in these overseas segments has been inconsistent.

Specific headwinds have impacted these regions. For example, operating direct premiums written in the UK and Ireland experienced a downturn in late 2024 and early 2025, largely attributed to necessary portfolio remediation initiatives. Similarly, the US market saw a dip in direct premiums written in Q1 2025, primarily due to the non-renewal of a significant account.

- UK and Ireland: Declines in operating direct premiums written due to portfolio remediation efforts in late 2024/early 2025.

- United States: A decrease in direct premiums written in Q1 2025 stemming from the non-renewal of a substantial account.

- Geographic Diversification: While aiming for broader reach, managing diverse regulatory environments and market dynamics across these international territories adds complexity.

Legacy IT Systems and Integration Complexity

Intact Financial, like many established insurers, may still grapple with legacy IT systems. These older systems can present significant hurdles for digital transformation, making it challenging to integrate new technologies smoothly. For instance, modernizing core insurance platforms often involves substantial investment and can be a lengthy, intricate process.

The complexity of integrating these legacy systems with newer, more agile solutions can also slow down innovation. This ongoing modernization effort, while necessary, can be a costly and time-consuming endeavor. For example, in 2023, the insurance industry as a whole saw continued investment in IT modernization, with many companies allocating significant portions of their budgets to upgrade or replace outdated infrastructure to remain competitive.

- Legacy IT Systems: Intact may possess older technology that hinders rapid digital adoption and integration.

- Integration Challenges: Merging new digital tools with existing infrastructure can be complex and resource-intensive.

- Cost and Time: Modernizing these systems requires substantial financial outlay and extended implementation periods.

- Innovation Pace: The effort to update legacy systems could potentially slow down the pace of innovation compared to competitors with more modern IT foundations.

Intact's reliance on brokers for distribution means less direct control over customer interactions and sales, with broker commissions representing a significant operating cost, as seen in 2023 figures. The competitive landscape of the P&C market also forces aggressive pricing strategies, impacting profit margins, a trend evident in the Canadian market throughout 2023.

International expansion presents challenges, with UK and Ireland direct premiums declining in late 2024/early 2025 due to portfolio remediation, and a US account non-renewal impacting Q1 2025 premiums. Furthermore, legacy IT systems can impede digital transformation and innovation, requiring substantial investment and time for modernization, a common industry challenge in 2023.

What You See Is What You Get

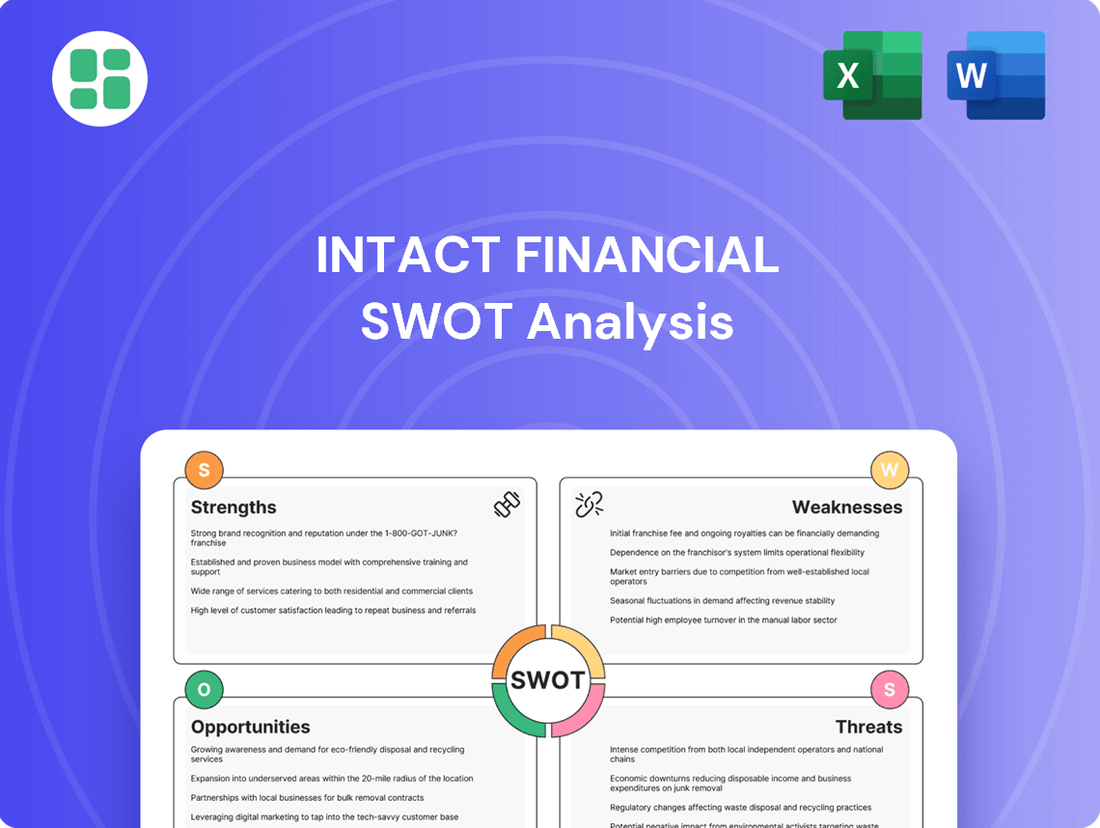

Intact Financial SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Intact Financial is already a major player in specialty insurance across North America and holds a strong position in commercial lines within the UK and Ireland. This existing footprint provides a solid foundation for further growth in these attractive, higher-margin segments.

These specialized and commercial markets often exhibit less intense competition, allowing Intact to leverage its established expertise and brand recognition for accelerated expansion. The company's robust financial performance in 2023, with direct written premiums reaching CAD 24.4 billion, underscores its capacity to absorb and integrate further strategic growth.

Acquisitions are a key lever for Intact to capitalize on these opportunities. The company has a proven track record of successful integrations, as seen with its acquisition of RSA Canada, which significantly bolstered its commercial lines presence. Further targeted acquisitions in specialty and commercial lines can rapidly enhance market share and profitability.

Intact Financial can significantly boost its operations by utilizing its extensive data through advanced analytics and AI. This can lead to more precise underwriting, faster claims handling, and better fraud detection. For instance, in 2024, insurers are increasingly adopting AI for risk assessment, with some reporting a 15-20% reduction in fraudulent claims through AI-powered tools.

Further investment in AI technologies throughout 2024 and into 2025 offers Intact a clear path to greater operational efficiency and a more robust competitive advantage. Companies that have integrated AI into their core processes, such as claims automation, have seen up to a 30% improvement in processing times, directly impacting customer satisfaction and cost savings.

Intact Financial's robust financial health positions it advantageously for strategic mergers and acquisitions. This allows for expansion into new regions, broadening its product range, and increasing market dominance. For instance, its subsidiary BrokerLink has been actively acquiring brokerages, as seen in its 2023 and early 2024 activities, which solidifies its distribution network and operational scale.

Developing Solutions for Emerging Risks

The ever-changing world, especially with climate change becoming more intense and cyber threats getting smarter, creates a chance for Intact to really shine. They can come up with new insurance ideas and ways to manage these risks. This is a big opportunity to create new income sources and show everyone they are a leader in helping businesses and people bounce back from trouble.

For instance, the increasing frequency of severe weather events, like the widespread flooding experienced in parts of Canada in early 2024, directly impacts property insurance. Intact can leverage its data analytics to refine pricing for such risks and develop parametric insurance products that trigger payouts based on predefined weather event parameters, offering faster claims processing and greater certainty for policyholders.

- Developing specialized cyber insurance policies that cover ransomware attacks, data breaches, and business interruption losses, a market projected to grow significantly.

- Creating climate-resilient insurance packages for businesses in vulnerable regions, potentially including coverage for business interruption due to extreme weather events.

- Offering enhanced risk management consulting services to help clients mitigate emerging threats, thereby deepening client relationships and generating additional revenue.

- Innovating with technology to provide real-time risk monitoring and adaptive coverage solutions for evolving threats.

Optimizing Digital Customer Experience and Direct Channels

Intact Financial can significantly boost its market presence by enhancing its digital customer experience and strengthening direct channels. Investing in user-friendly mobile applications and robust online self-service portals is key to attracting a growing segment of tech-savvy consumers.

This digital optimization not only appeals to new customer demographics but also streamlines operations, leading to improved efficiency and reduced service costs. A superior digital experience directly translates to higher customer satisfaction, fostering loyalty and potentially opening avenues for more direct customer interaction, which can complement their existing broker relationships.

- Digital Investment: Intact Financial's commitment to digital transformation, as seen in their ongoing investments in technology and data analytics, positions them well to capitalize on evolving customer preferences.

- Customer Satisfaction: A seamless digital journey can lead to enhanced customer satisfaction scores, a critical metric for retention and brand reputation in the competitive insurance landscape.

- Cost Efficiency: By enabling more self-service options, Intact can reduce reliance on traditional, higher-cost service channels, thereby improving their overall cost-to-serve ratio.

- Direct Engagement: Expanding direct digital channels allows Intact to gather richer customer data, enabling more personalized product offerings and marketing efforts, complementing their broker network.

Intact Financial can expand its reach in specialty and commercial insurance markets, leveraging its existing North American and UK/Ireland presence. These segments often have higher margins and less competition, offering significant growth potential. The company's strong 2023 performance, with CAD 24.4 billion in direct written premiums, demonstrates its financial capacity for further expansion, including strategic acquisitions like BrokerLink’s ongoing brokerage purchases, which bolster its distribution network.

Threats

Climate change is undeniably amplifying the frequency and intensity of extreme weather events. This directly translates into higher claims costs for property and casualty insurers, with Intact Financial no exception. For instance, in 2023, Canada experienced a record number of wildfire evacuations, significantly impacting insurance payouts across the country.

These escalating catastrophe losses can put a serious dent in underwriting profitability. Furthermore, insurers like Intact may face increased reinsurance costs as global reinsurers adjust their pricing to account for this heightened risk. This financial pressure can ultimately affect the company's bottom line and its ability to absorb future shocks.

The insurance landscape is a battlefield, with established giants and nimble InsurTechs vying for dominance. This fierce rivalry, particularly with InsurTechs deploying advanced tech and innovative models, creates significant pressure. Intact, like others, faces the risk of price wars and shrinking market share, forcing a constant drive for efficiency and new product development.

Economic downturns pose a significant threat to Intact Financial. Recessions can curb consumer spending on insurance products, leading to slower premium growth. For instance, during economic slowdowns, individuals and businesses may delay or reduce insurance coverage to cut costs.

Market volatility, including fluctuating interest rates, directly impacts an insurer's investment income. In 2023, while interest rates rose, the overall market saw considerable swings, affecting the returns Intact Financial earns on its substantial investment portfolio, a key driver of its profitability.

Evolving Regulatory Landscape and Compliance Costs

The insurance sector faces a constantly shifting regulatory environment. Changes in capital requirements, data privacy laws, and climate risk disclosures are becoming more common. For instance, in 2024, many jurisdictions are implementing stricter Solvency II-like frameworks, demanding higher capital reserves from insurers like Intact Financial.

Staying compliant with these evolving rules presents a significant hurdle. Intact Financial, like its peers, must invest heavily in new technology and skilled personnel to manage these complex requirements. These investments, while necessary, can strain resources and potentially affect the company's bottom line, impacting profitability and operational agility.

- Regulatory Uncertainty: Constant changes in regulations across different regions create unpredictability.

- Increased Compliance Burden: New rules necessitate substantial investments in systems and expertise.

- Potential Impact on Profitability: Compliance costs can erode margins and affect financial performance.

- Data Privacy and Climate Risk: Evolving mandates in these areas require significant operational adjustments.

Cybersecurity Risks and Data Breaches

Intact Financial, like any major financial institution, faces significant cybersecurity risks. Handling extensive sensitive customer data makes it a prime target for cyberattacks and data breaches. A successful breach could result in substantial financial losses, including remediation costs, regulatory penalties, and legal expenses. Furthermore, such an event could severely damage Intact's reputation and erode customer trust, impacting long-term business relationships.

The financial services sector, in general, saw a marked increase in cyber threats throughout 2024 and into early 2025. For instance, reports indicated a 30% rise in ransomware attacks targeting financial firms in the latter half of 2024. The potential impact on Intact could include:

- Financial penalties: Regulatory bodies, such as those enforcing GDPR or similar data protection laws, can impose hefty fines for non-compliance and data breaches.

- Operational disruption: A successful cyberattack could halt critical business operations, leading to significant revenue loss and service interruptions for customers.

- Reputational damage: Loss of customer confidence following a data breach can be difficult and costly to recover from, affecting market share and brand loyalty.

- Increased security investment: The ongoing threat necessitates continuous and substantial investment in advanced cybersecurity measures, potentially diverting resources from other growth initiatives.

Intact Financial faces significant threats from escalating climate-related events, leading to higher claims and potential reinsurance cost increases, as seen with Canada's record wildfire evacuations in 2023. Intense competition from InsurTechs also pressures Intact, potentially leading to price wars and market share erosion. Economic downturns can reduce insurance demand, impacting premium growth, while market volatility affects investment income, as evidenced by market swings in 2023 despite rising interest rates.

SWOT Analysis Data Sources

This Intact Financial SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research, and expert industry commentary to ensure a thorough and accurate assessment.