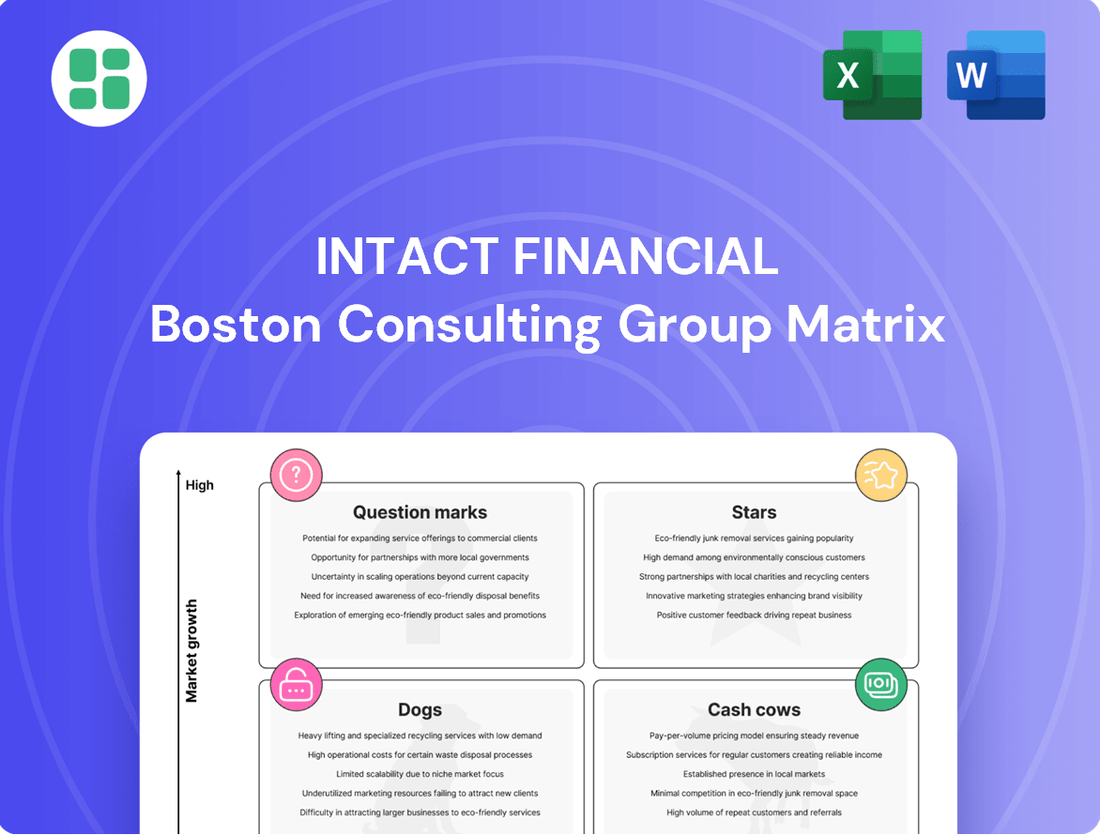

Intact Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intact Financial Bundle

Curious about Intact Financial's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dynamics and make informed investment decisions, you need the full picture.

Purchase the complete Intact Financial BCG Matrix report to unlock detailed quadrant analysis, actionable strategic recommendations, and a clear roadmap for optimizing their product portfolio. Don't miss out on the insights that will drive your own business forward.

Stars

Intact Financial Corporation holds a commanding position in Canadian personal auto insurance, demonstrating robust premium growth and unit momentum. This sector is a cornerstone of Intact's business, consistently generating a substantial portion of its direct premiums written, underscoring its significant market share. In 2024, the company continued to navigate a market characterized by ongoing rate adjustments and overall growth, reinforcing its leadership.

Intact's Canadian personal property insurance, a key component of its business, shows remarkable strength despite significant catastrophe losses. In 2024, this segment continued to grow, largely due to necessary rate adjustments in a challenging market, highlighting Intact's substantial market presence and ability to influence pricing.

This resilient performance in personal property, coupled with the personal auto segment, underpins a significant portion of Intact's overall Canadian premium generation. The company's strategic approach allows it to navigate adverse events while maintaining a solid financial footing in this crucial market.

BrokerLink, a wholly-owned subsidiary of Intact Financial, is a significant player in Canada's insurance distribution landscape. Its aggressive acquisition strategy and robust organic growth are propelling its expansion, positioning it as a star in Intact's BCG Matrix for the distribution segment.

The company's focus on increasing its direct premiums written through strategic mergers and acquisitions highlights its ambition and market penetration. This approach has led to a substantial market share and a clear upward trajectory in growth, underscoring its star classification.

BrokerLink has set an ambitious target to achieve $5 billion in operating direct premiums written by the close of 2025. This financial goal further solidifies its status as a star, indicating high growth and a strong competitive position within its market.

Global Specialty Lines Growth

Intact Financial is making significant strides in global specialty insurance, leveraging its expanding international expertise. This segment is poised for robust growth, fueled by targeted strategic initiatives and key acquisitions.

The company's focus on specialty lines positions it in a high-growth area. While precise market share data for each niche specialty line isn't readily available, Intact's reported growth trajectory suggests a strong and expanding presence.

- Global Specialty Lines Growth: Intact is actively growing its international specialty insurance operations.

- Strategic Expansion: The company's growth in this segment is driven by strategic initiatives and acquisitions.

- Future Potential: Intact's focus indicates a high-growth, potentially high-market-share area for the future.

Data & AI Driven Underwriting

Intact Financial's strategic focus on Data & AI Driven Underwriting is a cornerstone of its growth, positioning it firmly within the Stars quadrant of the BCG Matrix. The company has made substantial investments in technology, notably deploying over 500 AI models. These advanced capabilities are directly translating into significant annual benefits, estimated to be in the hundreds of millions of dollars, by improving pricing accuracy and risk selection across its diverse insurance portfolios.

This sophisticated approach to data analytics and artificial intelligence provides Intact with a distinct competitive edge. It fuels operational efficiency and bolsters profitability, allowing the company to excel in its high-growth segments. By leveraging technology for superior underwriting, Intact is solidifying its leadership in the insurance industry, demonstrating a clear path to sustained market outperformance.

- 500+ AI Models Deployed: Intact's extensive use of AI enhances underwriting precision.

- Significant Annual Benefits: These AI investments deliver substantial financial returns, improving profitability.

- Enhanced Pricing & Risk Selection: Advanced data analytics lead to more accurate pricing and better risk management.

- Competitive Advantage: Technology leadership drives efficiency and positions Intact for high-growth outcomes in the insurance sector.

BrokerLink, a key player in insurance distribution, is a star due to its aggressive acquisition strategy and strong organic growth. The company aims for $5 billion in operating direct premiums written by the end of 2025, showcasing its high growth and market position.

Intact's Data & AI Driven Underwriting is a significant star, with over 500 AI models deployed. This technology yields hundreds of millions in annual benefits through improved pricing and risk selection, driving competitive advantage and high growth.

Global Specialty Lines represent another star for Intact, driven by strategic initiatives and acquisitions in high-growth areas. While specific market share data is evolving, Intact's growth trajectory indicates a strong and expanding international presence.

| Business Unit | BCG Category | Key Growth Drivers | 2024 Performance Indicators |

| BrokerLink | Star | Acquisitions, Organic Growth | Targeting $5B in operating DPW by end of 2025 |

| Data & AI Driven Underwriting | Star | AI Model Deployment, Enhanced Pricing | 500+ AI models, Hundreds of millions in annual benefits |

| Global Specialty Lines | Star | Strategic Initiatives, Acquisitions | Strong reported growth trajectory |

What is included in the product

This BCG Matrix overview for Intact Financial highlights strategic recommendations for investing in Stars and Question Marks, while managing Cash Cows and divesting Dogs.

The Intact Financial BCG Matrix provides a clear, one-page overview, alleviating the pain of deciphering complex business unit performance.

Cash Cows

Intact's Canadian P&C operations are a classic cash cow. As the country's largest P&C insurer, this segment benefits from a dominant market share in a mature industry. It reliably produces significant cash flow, which is crucial for funding Intact's growth initiatives and shareholder returns.

Despite facing headwinds like catastrophe losses, the underlying strength of this business unit remains evident. For instance, in the first quarter of 2024, Intact reported a combined ratio of 89.8% for its Canadian P&C operations, demonstrating profitable underwriting even with significant weather events. This consistent profitability solidifies its position as a cash cow, providing stability and resources for the broader organization.

Intact's commercial lines in Canada are a solid performer, even with some rivalry for the biggest clients. This segment consistently sees mid-single-digit rate increases, showing strong underlying financial health.

This business area holds a powerful market position, significantly boosting Intact's overall profitability. It generates dependable cash flow, requiring less investment in promotions because of its well-established reputation.

For instance, in the first quarter of 2024, Intact reported that its Canadian P&C insurance business, which heavily features commercial lines, achieved an impressive combined ratio of 87.7%, indicating strong underwriting profitability.

Intact Financial's established UK & Ireland Commercial Lines, bolstered by strategic acquisitions and an exit from personal lines, are now performing as significant cash cows. This segment consistently demonstrates robust combined ratios, a key indicator of profitability in the insurance industry.

In 2024, this mature market position is reflected in the segment's positive contribution to Intact's overall direct premiums written, underscoring its stability and reliable cash flow generation. The focus on commercial lines has solidified its role as a dependable income stream.

Investment Income Portfolio

Intact's investment income portfolio is a classic cash cow within its BCG Matrix. This segment reliably churns out substantial profits with low investment required, acting as a stable financial engine for the company.

The portfolio's strength lies in its consistent generation of net operating investment income. For 2025, this income is projected to be around $1.6 billion, underscoring its role as a significant contributor to Intact's financial health.

- Projected 2025 Net Operating Investment Income: Approximately $1.6 billion.

- Role in Portfolio: Acts as a reliable cash cow, providing liquidity.

- Profitability Contribution: Significantly bolsters overall profitability.

- Operational Cost: Requires minimal direct operational expenditure.

Direct-to-Consumer Brand (belairdirect)

The belairdirect brand serves as Intact Financial's direct-to-consumer (DTC) insurance channel, capturing a distinct segment of the market. While its growth trajectory may be less aggressive than the broker network, belairdirect is a mature business that reliably produces significant cash flow, underscoring its Cash Cow status.

This established channel benefits from strong brand recognition and efficient operations, translating into stable premium generation. For instance, in 2023, Intact reported that its direct channel, which includes belairdirect, continued to be a significant contributor to overall results, demonstrating its ongoing value.

- Established Distribution Channel: belairdirect provides direct access to consumers, bypassing traditional intermediaries.

- Stable Cash Flow Generation: The brand consistently delivers reliable premiums and profits for Intact.

- Market Segmentation: It caters to a specific customer base seeking direct insurance solutions.

- Operational Efficiency: Streamlined processes contribute to its profitability and cash-generating ability.

Intact's Canadian P&C operations, particularly its commercial lines, are a prime example of a cash cow. This segment benefits from a strong market position and consistent, mid-single-digit rate increases, solidifying its dependable cash flow generation. Its profitability is highlighted by a combined ratio of 87.7% in Q1 2024, showcasing strong underwriting even amidst market fluctuations.

The UK & Ireland Commercial Lines also function as a cash cow, benefiting from strategic acquisitions and a focused approach on commercial business. This mature market consistently contributes positively to Intact's direct premiums written, reinforcing its role as a stable income stream with robust combined ratios.

Intact's investment income portfolio is another key cash cow, reliably generating substantial profits with minimal incremental investment. This segment is projected to contribute around $1.6 billion in net operating investment income for 2025, underscoring its significance as a stable financial engine for the company.

The belairdirect brand, Intact's direct-to-consumer channel, also operates as a cash cow. Despite less aggressive growth than its broker network, belairdirect's strong brand recognition and operational efficiency ensure stable premium generation and consistent cash flow, as evidenced by its significant contribution to Intact's overall results in 2023.

| Segment | BCG Category | Key Financial Indicator | 2024/2025 Data Point | Significance |

|---|---|---|---|---|

| Canadian P&C (Commercial) | Cash Cow | Combined Ratio | 87.7% (Q1 2024) | Strong underwriting profitability |

| UK & Ireland Commercial | Cash Cow | Direct Premiums Written | Positive Contribution (2024) | Stable income stream |

| Investment Income | Cash Cow | Net Operating Investment Income | ~$1.6 billion (Projected 2025) | Significant financial engine |

| belairdirect (DTC) | Cash Cow | Overall Results Contribution | Significant Contributor (2023) | Reliable premium generation |

Preview = Final Product

Intact Financial BCG Matrix

The Intact Financial BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, only the complete, analysis-ready strategic tool ready for your immediate use. You can confidently assess Intact Financial's product portfolio and market positions, knowing the purchased version offers the same depth and professional presentation. This preview serves as a direct representation of the valuable insights and actionable data contained within the final report.

Dogs

Intact Financial Corporation strategically exited its UK personal lines operations in 2023. This move signals a business segment characterized by low growth potential and likely limited profitability or market share within the United Kingdom. The divestiture aligns with the BCG Matrix's 'Dog' quadrant, as Intact sought to enhance its overall financial performance by divesting this underperforming or non-strategic asset.

Certain niche specialty lines in the U.S. market, like public Directors & Officers (D&O) liability and cyber insurance, have experienced significant weakness. This underperformance has prompted corrective underwriting actions, including a reduction in the overall book of business for these segments.

These areas represent challenges within Intact Financial's specialty insurance portfolio, likely characterized by low market share or persistent profitability issues. For instance, in 2024, the public D&O market continued to grapple with elevated claims frequency and severity, impacting profitability for many carriers.

The strategic response involves careful management, which could include repricing, stricter underwriting guidelines, or, if performance doesn't improve, a potential divestment of these underperforming segments.

Legacy systems and inefficient processes at Intact Financial, while not direct products, can act as significant drains on resources. These entrenched operational hurdles can consume substantial capital and employee time without yielding proportional growth or competitive edge. For instance, if a core underwriting system from the early 2010s still requires extensive manual intervention, it diverts resources that could be channeled into developing new digital customer experiences or enhancing AI-driven risk assessment models.

Intact's commitment to digital transformation, including significant investments in AI and cloud-based infrastructure, directly targets these inefficiencies. By mid-2024, the company reported that its digital initiatives were streamlining operations, with a goal to reduce operational expenses by a targeted percentage through automation. However, any remaining pockets of resistance to modernization, such as outdated claims processing software or manual data entry points, represent potential candidates for this 'Dogs' category within the BCG matrix, as they tie up capital and hinder agility.

Segments with Intense Competition and Low Differentiation

In the Canadian insurance landscape, personal auto insurance often presents a scenario of intense competition with limited product differentiation. Intact Financial, like its peers, navigates a market where pricing is a significant driver for consumers, potentially leading to margin pressures.

This segment can be characterized by:

- High Market Saturation: Numerous insurers vie for a similar customer base, making it challenging to capture significant market share growth without aggressive pricing strategies.

- Commoditized Offerings: Basic auto insurance policies are largely similar across providers, forcing differentiation through service or niche products, which may not always translate to substantial competitive advantage.

- Regulatory Influence: Provincial regulations in Canada can impact pricing and product flexibility, further constraining differentiation opportunities and intensifying price competition.

Highly Catastrophe-Exposed, Unmitigated Portfolios

Highly catastrophe-exposed, unmitigated portfolios within Intact Financial could be categorized as question marks in a BCG Matrix. These are segments where, despite Intact's robust catastrophe risk management, consistently high losses exceeding projections indicate a need for closer scrutiny. For instance, if a specific line of business or geographic region experiences a disproportionate share of payouts following major weather events, even with mitigation strategies in place, it signals potential underperformance.

Such portfolios would likely consume significant capital resources without generating commensurate returns. This cash drain necessitates continuous corrective actions, such as repricing, adjusting coverage limits, or even exiting certain markets if mitigation efforts prove insufficient. For example, in 2024, while specific portfolio data for Intact is proprietary, the general insurance industry faced increased claims from severe weather events, impacting profitability in exposed areas.

- High Catastrophe Exposure: Portfolios with a concentration of risk in areas prone to natural disasters like hurricanes, floods, or wildfires.

- Consistent Loss Deviations: Segments where incurred losses regularly surpass expected loss ratios, even after accounting for risk mitigation measures.

- Cash Consumption Without Returns: These portfolios act as cash drains, requiring ongoing investment for claims and operational costs without delivering adequate profitability.

- Need for Strategic Re-evaluation: Continuous monitoring and potential restructuring, repricing, or divestment are crucial for these underperforming segments.

Dogs in Intact Financial's portfolio represent business segments with low market share and low growth potential. These are typically areas where the company has struggled to gain traction or where market dynamics limit expansion. For example, Intact's divestiture of its UK personal lines operations in 2023 aligns with this classification, as it was a segment with limited profitability. Similarly, certain niche specialty lines in the U.S. that have experienced persistent weakness, like public D&O liability, can be considered dogs if corrective actions don't yield improvement.

Question Marks

Intact Financial is actively investing in digital and AI-driven products, positioning these as potential future stars within its business portfolio. The acquisition of Jiffy, a home maintenance app, and the exploration of Generative AI highlight this commitment. These ventures, while operating in high-growth sectors, currently represent a small fraction of Intact's overall market share and direct premium generation.

These emerging digital and AI products are characterized by their high growth potential but also by their nascent stage and uncertain immediate returns. Think of them as investments in the future, where the payoff is not yet guaranteed but the opportunity for significant disruption and market leadership is substantial. For example, while specific revenue figures for Jiffy's contribution to Intact are not publicly detailed, the broader digital home services market is projected for significant expansion, with some estimates suggesting a compound annual growth rate exceeding 10% in the coming years.

Intact Financial's new geographic expansion initiatives, particularly in North America's insurance 'sandbox' and potential new international markets, align with a 'Question Mark' in the BCG Matrix. While Intact holds a dominant position in Canada, these ventures represent high-growth opportunities where its current market share is relatively low, necessitating substantial investment to gain traction and market penetration.

Intact Financial is actively broadening its cyber insurance capabilities in response to the escalating global threat landscape. This burgeoning market exhibits robust demand, though Intact's current penetration within this dynamic sector may be modest when juxtaposed with its established property and casualty operations.

The cyber insurance segment is characterized by substantial growth prospects, positioning it as a 'Question Mark' within Intact's business portfolio. For context, the global cyber insurance market was projected to reach $20.8 billion in 2024, with a compound annual growth rate (CAGR) of approximately 15.7% expected through 2030, according to various market analyses.

Climate Resiliency Solutions & Partnerships

Intact Financial is actively investing in climate resiliency solutions, recognizing the increasing societal demand for adaptation and mitigation strategies. These programs, like the Municipal Climate Resiliency Grants, tap into a high-growth area that addresses critical environmental challenges.

While these investments bolster Intact's brand and contribute to long-term risk reduction, their direct impact on immediate financial market share or profitability within the core insurance business is likely limited. This positions them as strategic initiatives with potential for future returns rather than immediate cash cows.

- Investment Focus: Climate adaptation and resiliency programs, including grants for municipalities.

- Societal Need: Addresses a rapidly growing demand for solutions to climate change impacts.

- Brand & Risk: Enhances brand reputation and contributes to long-term risk mitigation efforts.

- Market Position: Likely a strategic investment with low immediate market share or profitability in the core business.

High-Net-Worth Client Offerings (Intact Prestige)

Intact Prestige specifically targets high-net-worth individuals, offering bespoke insurance solutions designed for their unique needs. This segment is experiencing increased demand for specialized coverage, presenting a valuable growth opportunity for Intact.

While the potential for high premium values within this niche is significant, Intact's market share in this particular high-end segment may still be in its formative stages. This suggests a need for strategic investment to solidify and expand its position.

- Targeted Growth: Intact Prestige focuses on a lucrative but specialized market segment.

- Premium Potential: High-net-worth clients typically generate higher premium values.

- Market Share Development: Intact is actively building its presence in this exclusive sector.

- Strategic Investment: Further investment is likely needed to capture a larger share of this high-value market.

Intact Financial's digital and AI ventures, along with its expansion into new geographic markets, represent classic Question Marks. These areas offer substantial growth potential but require significant investment to establish market share, with uncertain immediate returns.

The cyber insurance market and specialized offerings like Intact Prestige also fit the Question Mark profile. They are high-growth segments with considerable premium potential, yet Intact's current penetration suggests a need for continued strategic investment to capture greater market share.

These initiatives, while not yet major revenue drivers, position Intact for future leadership in evolving insurance landscapes. The company's commitment to these areas underscores a forward-looking strategy focused on long-term value creation.

The global cyber insurance market, projected to reach $20.8 billion in 2024, exemplifies this. Intact's expansion here is a strategic move into a rapidly growing, albeit competitive, sector.

| Business Area | BCG Category | Growth Potential | Market Share | Investment Needs |

|---|---|---|---|---|

| Digital & AI Products | Question Mark | High | Low/Nascent | High |

| New Geographic Expansion | Question Mark | High | Low | High |

| Cyber Insurance | Question Mark | Very High (Global CAGR ~15.7% through 2030) | Modest/Growing | High |

| Intact Prestige (High-Net-Worth) | Question Mark | High | Developing | Moderate to High |

| Climate Resiliency Solutions | Question Mark | High (Societal Demand) | Low (Direct Financial Impact) | Moderate (Strategic) |

BCG Matrix Data Sources

Our Intact Financial BCG Matrix is built on a foundation of robust data, integrating company financial statements, market share analysis, and industry growth projections to provide strategic clarity.