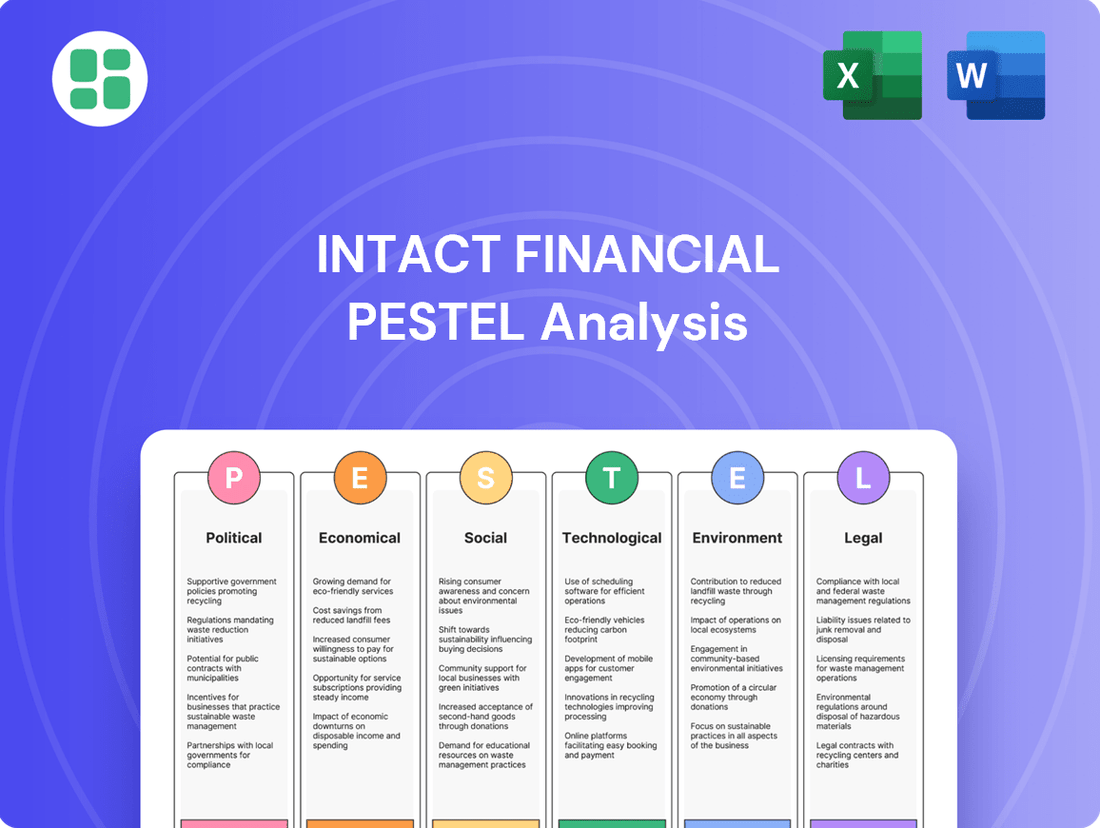

Intact Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intact Financial Bundle

Navigate the complex external forces shaping Intact Financial's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends present both challenges and opportunities for the insurance giant. Gain a strategic advantage by leveraging these expert-level insights to inform your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policy and regulatory stability are crucial for Intact Financial. For instance, changes in provincial auto insurance regulations, a significant market for Intact, can directly impact profitability and operational strategies. In 2023, Canadian insurers faced evolving regulatory landscapes, with ongoing discussions around capital requirements and consumer protection measures, highlighting the need for adaptability.

The Office of the Superintendent of Financial Institutions (OSFI) in Canada imposes rigorous capital requirements and solvency standards on insurers, directly impacting Intact Financial. For instance, OSFI's 2024 guidelines continue to emphasize robust capital buffers, a key factor for Intact's financial resilience.

Changes in these regulations, often influenced by political considerations or broader economic stability goals, can significantly affect Intact's ability to deploy capital for growth or acquisitions. Adherence to these evolving frameworks is critical for maintaining Intact's operating licenses and the confidence of its stakeholders.

Intact Financial's operations are heavily influenced by the trade relationship between Canada and the United States. In 2024, the continued stability of agreements like the Canada-United States-Mexico Agreement (CUSMA) is vital for maintaining smooth cross-border insurance operations, impacting capital flow and underwriting capacity.

Any geopolitical tensions or shifts in trade policy between these two nations could introduce volatility. For instance, changes to regulations affecting financial services or data transfer could directly impact Intact's ability to manage its North American specialty insurance portfolio efficiently, potentially affecting its 2025 revenue streams.

Government Fiscal and Spending Policies

Government fiscal policies, such as taxation and public spending, play a crucial role in shaping the economic environment for insurers like Intact Financial. Changes in these policies can indirectly impact the insurance market by influencing overall economic activity and the disposable income consumers have available for insurance products. For example, government investments in infrastructure projects can lead to an increased demand for construction-related insurance, while tax reforms might affect the profitability of businesses or the affordability of insurance for individuals.

The Canadian federal budget for 2024, for instance, introduced measures that could influence consumer spending and business investment, thereby indirectly affecting the demand for various insurance lines. Specifically, adjustments to tax credits or deductions can alter household budgets, impacting their capacity to purchase insurance. Furthermore, government spending priorities, such as those directed towards climate resilience initiatives, could create new opportunities for specialized insurance products or increase the need for coverage on newly developed assets.

- Fiscal Policy Impact: Government fiscal decisions, including tax rates and public expenditure, directly influence economic conditions relevant to Intact Financial.

- Infrastructure Spending: Increased government spending on infrastructure projects, such as those announced in the 2024 Canadian federal budget, can stimulate economic activity and create new insurable assets.

- Taxation Effects: Tax reforms can alter corporate profitability and individual disposable income, impacting the demand and affordability of insurance products.

- Economic Backdrop: These fiscal policies collectively establish the broader economic context within which Intact Financial operates and assesses risk.

Political Risk and Public Opinion

Political stability and public sentiment toward large corporations significantly impact regulatory scrutiny for insurers like Intact Financial. For instance, in Canada, public opinion polls from early 2024 indicated a growing concern over rising insurance premiums, which could translate into increased political pressure for regulatory intervention or consumer protection measures.

Public pressure, particularly on environmental, social, and governance (ESG) issues, directly influences mandates for insurers. A 2024 report by the Canadian Institute for Climate Choices highlighted the increasing demand for climate risk disclosure and action from financial institutions, suggesting potential new regulations for insurers regarding climate-related product development and risk management.

Intact Financial's proactive engagement with policymakers and focus on maintaining a strong public image are crucial for navigating these political landscapes. By demonstrating commitment to sustainability and consumer fairness, the company can mitigate potential negative impacts from shifting public opinion and regulatory changes, as evidenced by their ongoing ESG reporting and community investment initiatives.

- Public Concern: Surveys in early 2024 showed a notable increase in Canadian public concern regarding insurance affordability.

- ESG Mandates: Growing demand for climate risk disclosure is expected to shape future insurer regulations.

- Stakeholder Engagement: Proactive engagement with government and the public is key to mitigating political risk.

Government policy and regulatory stability are paramount for Intact Financial. For instance, shifts in provincial auto insurance regulations, a core market for Intact, can directly affect profitability and operational strategies. In 2023, Canadian insurers navigated evolving regulatory landscapes, with ongoing discussions around capital requirements and consumer protection measures, underscoring the need for adaptability.

The Office of the Superintendent of Financial Institutions (OSFI) in Canada mandates stringent capital and solvency standards for insurers, impacting Intact Financial. OSFI's 2024 guidelines continue to emphasize robust capital buffers, a critical element for Intact's financial resilience. These regulatory frameworks, often politically influenced, shape Intact's capital deployment for growth and acquisitions, and adherence is vital for maintaining operating licenses and stakeholder confidence.

Political factors significantly influence Intact Financial's operating environment, from regulatory stability to public sentiment. For example, public concern over rising insurance premiums, noted in early 2024 surveys, can lead to increased political pressure for regulatory intervention. Furthermore, growing demands for climate risk disclosure, as highlighted by a 2024 Canadian Institute for Climate Choices report, may shape future regulations for insurers regarding climate-related product development and risk management.

What is included in the product

This PESTLE analysis delves into the external forces impacting Intact Financial, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic opportunities and potential challenges.

Provides a concise version of Intact Financial's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Interest rate fluctuations are a major concern for Intact Financial. As a large insurer, Intact manages substantial investment portfolios, primarily in fixed-income assets. When interest rates rise, the income generated from these investments generally increases, which is beneficial for profitability. Conversely, a decline in interest rates can put pressure on investment returns, potentially impacting margins and the company's capacity to offer competitive insurance pricing.

Inflationary pressures significantly impact Intact Financial's property and casualty (P&C) insurance operations. Rising inflation directly inflates the cost of claims, encompassing everything from vehicle repair parts and labor to building materials and reconstruction expenses. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) for motor vehicle repair and maintenance services saw a notable increase, directly impacting auto insurance claims costs for Intact.

This escalation in claim expenses can erode underwriting profitability if premiums are not adjusted swiftly and accurately to reflect these higher costs. Intact Financial, like other insurers, must closely monitor inflation trends and adjust its pricing models to ensure that premiums adequately cover the anticipated rise in claim payouts. Failing to do so can lead to underwriting losses, as seen in periods of rapid cost escalation where premium adjustments lag behind the actual increase in repair and replacement costs.

Effectively managing inflation risk is therefore a cornerstone of Intact's strategy for maintaining underwriting profitability and ensuring the accuracy of its pricing. This involves sophisticated data analysis to forecast inflation's impact on various claim types and implementing dynamic pricing strategies to stay ahead of rising costs. The company's ability to navigate these inflationary headwinds is crucial for its financial health and its capacity to deliver consistent returns to shareholders.

The overall health of the Canadian and North American economies significantly impacts Intact Financial's demand for insurance products. During economic expansion, businesses grow and individuals accumulate more assets, boosting the need for commercial, auto, and home insurance. For instance, Canada's GDP growth was projected to be 1.7% in 2024 and 1.9% in 2025, indicating a generally favorable environment for insurance sales.

Conversely, economic downturns can lead to reduced insurable values and decreased consumer spending on insurance. A potential slowdown in North American growth, with the US economy forecasted to grow by 2.2% in 2024 and 1.9% in 2025, presents a mixed outlook. If these growth rates falter, Intact could see a dampening effect on premium volumes.

Unemployment Rates and Disposable Income

Unemployment rates directly affect Intact Financial's ability to maintain premium volumes, especially for optional insurance products. When joblessness rises, consumers often cut back on non-essential spending, which can include certain types of insurance. For instance, a surge in unemployment could lead to policy lapses, directly impacting Intact's revenue streams.

Conversely, a robust job market, characterized by low unemployment, typically translates to increased disposable income for households and businesses. This financial stability allows consumers and companies to afford and even expand their insurance coverage. In Canada, for example, the unemployment rate hovered around 5.8% in early 2024, a figure that generally supports consumer spending power and thus, the insurance market.

- Impact on Premium Volume: Higher unemployment can lead to policy cancellations or reduced coverage, directly affecting Intact Financial's premium income.

- Disposable Income Correlation: Low unemployment generally means higher disposable income, enabling consumers to afford and increase insurance coverage.

- Market Stability: Stable employment environments foster a more predictable and potentially growing customer base for personal and commercial insurance lines.

- Economic Indicator: Unemployment rates serve as a key economic indicator, signaling the overall health of the consumer base that Intact Financial serves.

Currency Exchange Rate Volatility

Currency exchange rate volatility poses a significant factor for Intact Financial. As Intact Financial operates extensively in the United States, fluctuations between the Canadian and U.S. dollars directly influence its reported earnings. When U.S. financial results are converted into Canadian dollars for reporting purposes, a stronger Canadian dollar can diminish the reported value of those U.S. earnings. Conversely, a weaker Canadian dollar can inflate them, thereby impacting Intact Financial's overall financial performance and reported profitability.

For instance, if the Canadian dollar strengthens against the U.S. dollar, Intact Financial's U.S.-based revenues and profits translate into fewer Canadian dollars. This can lead to a reduction in reported net income and potentially impact key financial ratios. The opposite occurs when the Canadian dollar weakens, making U.S. earnings appear larger in Canadian dollar terms.

- Impact on Reported Earnings: A stronger CAD/USD rate decreases the Canadian dollar value of U.S. earnings, while a weaker rate increases it.

- Financial Performance: Exchange rate movements directly affect Intact Financial's reported profitability and financial metrics.

- Strategic Hedging: Companies like Intact Financial often employ hedging strategies to mitigate the impact of currency fluctuations.

Economic stability and growth directly influence Intact Financial's business. Positive GDP growth, such as Canada's projected 1.7% in 2024 and 1.9% in 2025, generally fuels demand for insurance as businesses expand and individuals acquire more assets. Conversely, economic slowdowns can reduce insurable values and consumer spending on insurance, impacting premium volumes.

Inflation significantly impacts claims costs for Intact Financial, particularly in its property and casualty segments. Rising costs for repairs, materials, and labor directly inflate the payout amounts for claims. For example, increased costs in auto repair services, as noted by the U.S. Bureau of Labor Statistics in early 2024, necessitate careful premium adjustments to maintain underwriting profitability.

Interest rate changes affect Intact Financial's investment income. Higher rates can boost returns on its fixed-income portfolios, while lower rates can pressure profitability and pricing competitiveness. This makes managing investment strategies crucial for offsetting underwriting performance and ensuring stable financial results.

Unemployment rates are a key indicator of consumer financial health and its impact on insurance demand. Low unemployment, like Canada's rate around 5.8% in early 2024, supports disposable income and insurance purchasing. Conversely, rising unemployment can lead to policy lapses and reduced coverage, directly affecting Intact's revenue.

What You See Is What You Get

Intact Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Intact Financial covers all key political, economic, social, technological, legal, and environmental factors impacting the company. Dive into this detailed report to gain strategic insights.

Sociological factors

Canada's population is aging, with the proportion of those aged 65 and over projected to reach 23% by 2030, up from around 19% in 2023. This demographic shift directly impacts Intact Financial by increasing demand for health, critical illness, and long-term care insurance products. Simultaneously, urbanization continues, with over 80% of Canadians now living in urban areas, concentrating risks like property damage from fires and motor vehicle accidents, requiring tailored coverage solutions.

Modern consumers, especially those in the 2024-2025 period, are increasingly demanding seamless digital experiences, highly personalized services, and crystal-clear communication from their insurance providers. This expectation is driven by their interactions with other digitally advanced industries.

Intact Financial needs to prioritize investments in intuitive online portals and robust mobile applications. For instance, in 2024, a significant portion of new policy inquiries and claims processing for leading insurers were initiated digitally, reflecting this trend. Responsive customer service channels are also critical for retaining customer loyalty in a fiercely competitive insurance landscape.

This evolving consumer behavior directly reshapes how insurance products are distributed and serviced. Insurers are shifting from traditional in-person interactions to a hybrid model, leveraging digital tools for onboarding, policy management, and claims, while reserving human touchpoints for complex needs or high-value customers.

The shift towards remote work and the expansion of the gig economy are fundamentally altering how people live and earn, directly impacting insurance needs. For instance, a significant portion of the workforce continues to embrace hybrid or fully remote arrangements, creating demand for coverage tailored to home-based businesses or altered commuting patterns. Intact Financial needs to adapt by offering flexible products like usage-based auto insurance or specialized policies for freelance professionals to address these evolving risk landscapes.

Social Inflation and Litigation Trends

Social inflation, a phenomenon where rising litigation costs and larger jury awards increase insurance claims, is a significant concern for property and casualty insurers like Intact Financial. This trend, fueled by factors such as increased plaintiff-friendly verdicts and a broader understanding of liability, directly impacts the profitability of liability insurance lines. For instance, in the United States, the average jury award in large commercial liability cases saw a notable increase in recent years, putting pressure on insurers to adjust their pricing and reserving strategies accordingly.

Key drivers contributing to social inflation include:

- Increased frequency and severity of lawsuits: More claims are being filed, and the amounts awarded are often higher than in previous periods.

- Broader interpretations of liability: Courts and juries are sometimes holding parties responsible for a wider range of damages and outcomes.

- Public perception and jury sentiment: Societal attitudes can influence jury decisions, sometimes leading to more generous awards, particularly in cases involving perceived corporate wrongdoing or significant harm.

- The "reptile theory" in litigation: This legal strategy focuses on appealing to a jury's sense of safety and outrage, often leading to higher damages.

Public Perception and Trust in Insurance

Public trust is a cornerstone for insurers like Intact Financial. Perceptions of fairness in pricing, efficiency in claims processing, and a strong commitment to corporate social responsibility significantly shape this trust. In 2024, a significant portion of consumers expressed concerns about the transparency of insurance policies and the speed of claim resolutions, highlighting the importance of Intact's efforts in these areas.

Intact Financial's proactive approach to building and maintaining public trust is crucial. This involves clear communication, ethical operations, and a demonstrated commitment to customer satisfaction, particularly during challenging times like natural disasters. For instance, following severe weather events in early 2025, Intact’s rapid claims response was noted in industry reports, positively impacting customer sentiment.

- Consumer trust in the insurance sector is often tested by claims handling efficiency and perceived fairness.

- Intact Financial’s reputation for transparency and ethical practices directly influences customer acquisition and retention.

- In 2024, consumer surveys indicated a growing demand for insurers to demonstrate strong corporate responsibility.

- A swift and empathetic claims process, as observed in Intact’s 2025 responses to extreme weather, significantly bolsters public confidence.

Societal attitudes and consumer expectations are rapidly evolving, directly shaping the insurance landscape. The increasing demand for digital-first interactions and personalized services, evident in 2024-2025, means insurers must prioritize user-friendly platforms. Furthermore, the growing awareness of social inflation, driven by factors like increased litigation and broader liability interpretations, necessitates careful risk management and pricing strategies for companies like Intact Financial.

Technological factors

Intact Financial is leveraging advanced data analytics and AI to revolutionize its operations. These technologies are enhancing underwriting accuracy, allowing for more precise risk assessment and personalized pricing strategies. For instance, by analyzing millions of data points, Intact can better predict claim likelihood, leading to more competitive and profitable premiums.

The integration of AI is also streamlining claims processing and bolstering fraud detection. AI algorithms can rapidly sift through claims data, identifying suspicious patterns and anomalies far more effectively than traditional methods. This not only reduces financial losses due to fraud but also speeds up payouts for legitimate claims, improving customer satisfaction.

In 2024, the insurance industry saw significant investment in AI and analytics, with companies like Intact aiming to gain a competitive edge through data-driven insights. This focus is expected to continue through 2025, as insurers strive for greater operational efficiency and improved customer experiences.

Intact Financial is heavily invested in digital transformation, with a significant focus on InsurTech. This strategy aims to improve customer interactions and operational efficiency. For instance, in 2023, Intact reported that digital channels accounted for a growing percentage of new business acquisition, reflecting a shift in consumer preference.

The company's adoption of InsurTech solutions, such as AI-powered claims processing and advanced data analytics, is key to its competitive edge. By streamlining processes, Intact can reduce costs and speed up service delivery. Their mobile app, launched in 2022, saw a 30% increase in active users by the end of 2023, demonstrating strong customer engagement with digital offerings.

Telematics in auto insurance and IoT in home insurance are transforming how Intact Financial operates. By collecting real-time data on driver habits and property conditions, Intact can offer usage-based insurance and proactive risk management. This data-driven approach allows for more personalized coverage and preventative services, aiming to reduce claims frequency.

Cybersecurity Threats and Data Protection

As Intact Financial deepens its digital operations and handles vast amounts of customer data, cybersecurity threats pose a substantial risk. Effective defenses are crucial for protecting sensitive information, preserving customer confidence, and adhering to data privacy laws, all of which are vital for Intact's reputation and financial health.

The increasing sophistication of cyberattacks, including ransomware and data breaches, demands continuous investment in advanced security protocols. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved.

- Data Breach Costs: The average cost of a data breach in the financial sector reached $5.90 million in 2023, a significant figure that underscores the financial impact of security failures.

- Regulatory Fines: Non-compliance with data protection regulations like GDPR or CCPA can result in substantial penalties, potentially impacting Intact's profitability.

- Customer Trust: A major cyber incident could erode customer trust, leading to customer attrition and a negative impact on market share.

- Operational Disruption: Cyberattacks can disrupt critical business operations, leading to service downtime and lost revenue.

Automation and Blockchain Technology

Automation is a game-changer for Intact Financial, streamlining repetitive tasks like policy administration and claims processing. This efficiency boost translates directly into cost reductions and faster service for customers.

Blockchain technology offers exciting possibilities for the insurance sector, promising enhanced security and transparency. Intact could leverage this for more robust claims verification and smoother reinsurance transactions. While still developing, blockchain's impact on insurance is poised to grow significantly in the coming years.

- Operational Efficiency: Automation in areas like claims processing can reduce processing times by up to 50% in some insurance applications, leading to substantial cost savings for Intact.

- Cost Reduction: By automating manual workflows, Intact can lower expenses related to labor and error correction, potentially saving millions annually.

- Blockchain Potential: While specific adoption rates for blockchain in insurance are still emerging, pilot programs in 2024 and 2025 are exploring its use for fraud detection and faster claims settlement.

Technological advancements are central to Intact Financial's strategy, with AI and data analytics driving improved underwriting and claims processing. By 2025, the company aims to further leverage these tools for enhanced risk assessment and fraud detection, building on significant 2024 investments in InsurTech. This focus on digital transformation, including mobile engagement which saw a 30% user increase by end of 2023, is key to operational efficiency and customer experience.

Legal factors

Intact Financial navigates a multifaceted regulatory landscape, encompassing federal and provincial laws in Canada and state-specific rules in the United States. These regulations dictate crucial aspects of operations, including licensing, financial stability, market behavior, product approvals, and safeguarding consumers, necessitating ongoing adherence and adjustments to evolving legal requirements.

For instance, in 2023, Canadian insurers faced scrutiny over pricing practices, leading to potential regulatory reviews aimed at enhancing consumer fairness. Similarly, in the US, state insurance departments actively monitor solvency ratios, with many states maintaining capital requirements exceeding federal recommendations to bolster insurer financial strength.

Data privacy and cybersecurity laws are paramount for Intact Financial. Regulations like Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) and numerous U.S. state-level privacy laws, such as the California Consumer Privacy Act (CCPA), impose strict requirements on how Intact handles customer data. Failure to comply can result in substantial penalties; for instance, PIPEDA violations can lead to fines of up to $100,000 for an organization. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial and reputational risks Intact must actively mitigate.

Consumer protection legislation, such as the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada, directly shapes how Intact Financial handles customer data and communicates policy terms. These laws, designed to prevent deceptive practices, mandate transparency in advertising and claims, influencing Intact's marketing strategies and the clarity of its policy documents. Failure to comply can lead to significant fines; for instance, the Office of the Superintendent of Financial Institutions (OSFI) can impose penalties for non-adherence to consumer fairness principles.

Tort Law and Litigation Environment

Changes in tort law, such as evolving liability standards and caps on damages, directly influence claims costs and frequency for insurers like Intact Financial, especially in auto and general liability. For instance, shifts in product liability statutes can alter the potential payout for defective product claims.

Intact Financial must closely track the legal environment, including the framework for class-action lawsuits, which can dramatically increase the scale and cost of litigation. This ongoing vigilance is crucial for accurate product pricing and effective reserve management.

- Litigation Trends: In 2024, the Canadian legal landscape continues to see a steady volume of tort claims, with a particular focus on personal injury and property damage arising from both auto accidents and general business operations.

- Regulatory Scrutiny: Insurers face increasing regulatory oversight concerning claims handling practices, impacting litigation defense costs and the potential for fines.

- Class Action Impact: The prevalence of class-action lawsuits in Canada, particularly in areas like product liability and consumer protection, presents a significant risk factor for insurers, potentially leading to large, aggregated payouts.

Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) Compliance

Intact Financial, operating within the financial services sector, must adhere to rigorous Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations. These laws are designed to curb illicit financial flows and are a critical component of legal compliance for any financial institution. Failure to comply can result in substantial fines and damage to the company's reputation.

To meet these obligations, Intact Financial implements comprehensive internal controls. This includes robust reporting systems for suspicious transactions and ongoing employee training programs. For instance, in 2023, global AML fines reached record highs, underscoring the importance of proactive compliance measures.

- Regulatory Scrutiny: Intact Financial faces ongoing oversight from regulatory bodies like FINTRAC in Canada and similar agencies internationally.

- Compliance Costs: Significant investment is required for technology and personnel dedicated to AML/ATF compliance, impacting operational expenses.

- Reputational Risk: Non-compliance can lead to severe penalties and a loss of public trust, directly affecting market share and customer loyalty.

- Data Security: Protecting customer data used in AML/ATF monitoring is paramount, with strict data privacy laws governing its handling.

Intact Financial's operations are heavily shaped by consumer protection laws, demanding transparency in product disclosures and claims handling. For example, the Canadian Insurance Services Regulatory Organization (CISO) provides guidelines that insurers must follow to ensure fair treatment of customers, impacting how policies are explained and claims are processed.

The company must also navigate evolving data privacy regulations, such as Canada's proposed Consumer Privacy Protection Act (CPPA), which aims to strengthen individual control over personal information. In the US, state-specific privacy laws continue to proliferate, requiring robust data security measures and clear consent protocols for data usage.

Changes in tort law and liability standards directly affect Intact's claims costs, particularly in areas like auto and general liability insurance. For instance, shifts in negligence standards or damage caps can significantly alter the financial exposure from claims, influencing pricing and reserving strategies.

Intact Financial is subject to Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations, necessitating stringent internal controls and reporting. Non-compliance carries substantial financial penalties and reputational damage, as evidenced by global AML fines that reached record highs in 2023.

Environmental factors

The increasing frequency and severity of extreme weather events, like the record-breaking wildfires in Canada during 2023 which resulted in billions in insured losses, directly impact Intact Financial's property and casualty insurance operations. This trend necessitates advanced risk modeling and a dynamic approach to underwriting to manage escalating claims costs.

Intact Financial must continuously adapt its underwriting practices and pricing strategies to account for heightened exposure to climate-related risks. For instance, the company's 2024 first-quarter results showed a significant increase in catastrophe claims, underscoring the financial impact of these environmental shifts.

Investor and stakeholder focus on Environmental, Social, and Governance (ESG) performance is intensifying, compelling Intact Financial to showcase robust sustainability efforts. This heightened scrutiny means demonstrating a clear understanding of its environmental footprint and climate-related risks is crucial for attracting investment and maintaining a positive corporate image.

For instance, by the end of 2024, a significant majority of institutional investors globally were expected to integrate ESG factors into their investment decisions, a trend that continued to grow through early 2025. Intact Financial's ability to transparently report on its progress in areas like carbon emissions reduction and sustainable underwriting practices directly impacts its valuation and access to capital.

The global pivot to a low-carbon economy presents Intact Financial with a dual-edged sword of risks and opportunities. A significant risk lies in the potential for 'stranded assets' within their investment portfolios, particularly those tied to fossil fuel industries, which could see diminished value as the world decarbonizes. Furthermore, businesses Intact insures that are undergoing this transition may face new liabilities related to their shift away from carbon-intensive operations.

Conversely, this transition unlocks substantial opportunities for Intact. The burgeoning green technology sector and the expansion of renewable energy projects require specialized insurance coverage. For instance, the renewable energy sector is projected to attract trillions in investment globally through 2030, creating a growing market for insurers like Intact to underwrite these innovative and essential ventures.

Pollution and Environmental Liability

Intact Financial's specialty insurance divisions are directly impacted by pollution and environmental liability. These policies cover claims arising from contamination and environmental damage, meaning shifts in environmental regulations or heightened public concern can directly translate to increased claims. For instance, as of early 2024, the increasing frequency of extreme weather events, often linked to climate change, is elevating the risk profile for environmental liability, potentially leading to higher premiums and more stringent underwriting for businesses in vulnerable sectors.

The evolving regulatory landscape presents both challenges and opportunities for Intact Financial. Stricter environmental standards, such as those being implemented or considered in 2024 and 2025 regarding carbon emissions and waste management, can increase the potential for liability claims. Conversely, these changes also drive demand for specialized environmental insurance products designed to protect businesses against these new risks.

- Increased regulatory scrutiny: Governments worldwide are enhancing environmental protection laws, impacting industries and thus insurance liabilities.

- Climate change impact: Growing awareness and scientific data on climate change are leading to more claims related to historical pollution and future environmental risks.

- Litigation trends: Public and governmental focus on environmental accountability is driving more litigation, potentially increasing claims payouts for insurers like Intact.

Resource Scarcity and Supply Chain Impacts

Resource scarcity and climate-driven disruptions are increasingly impacting global supply chains, directly affecting Intact Financial's operations. For instance, extreme weather events in 2024 have led to shortages of key building materials, driving up repair costs for insured properties. This scarcity can prolong claims settlement times and increase the overall cost of claims for Intact Financial.

The availability and cost of essential materials for repairs, such as lumber and specialized components, are particularly vulnerable. For example, a 2024 report indicated a 15% increase in the cost of construction materials in North America due to supply chain bottlenecks exacerbated by climate events. This trend directly translates to higher claims payouts for Intact Financial.

These environmental factors create a ripple effect on Intact Financial's claims management:

- Increased Claims Costs: Higher material prices and limited availability directly inflate the cost of repairing damaged properties.

- Extended Settlement Times: Delays in sourcing necessary materials can significantly prolong the time it takes to fully settle claims.

- Operational Strain: Intact Financial must navigate these complexities to ensure timely and fair compensation to policyholders, potentially straining resources.

- Need for Supply Chain Resilience: The company faces pressure to develop more resilient supply chain strategies to mitigate these environmental risks.

Environmental factors, particularly the escalating impact of climate change, present significant challenges for Intact Financial. The growing frequency of extreme weather events, such as the severe flooding experienced in parts of Canada in early 2024, directly translates into higher claims payouts for property and casualty insurance. This necessitates continuous adaptation of underwriting and pricing models to reflect these evolving risks.

The global push towards sustainability and decarbonization also shapes the investment landscape for Intact. While risks associated with 'stranded assets' in fossil fuel industries are present, the growth in green technologies and renewable energy projects offers substantial new markets for specialized insurance products. For instance, the renewable energy sector is expected to see continued robust investment through 2025, creating a significant opportunity for insurers to underwrite these emerging ventures.

Furthermore, stricter environmental regulations being implemented or considered globally are increasing potential liability claims for businesses. Intact Financial, through its specialty insurance divisions, is positioned to offer coverage for these environmental liabilities, but must also navigate the increased complexity and potential for litigation arising from heightened environmental accountability.

Supply chain disruptions, often exacerbated by climate-related events, are also impacting Intact's claims management. The scarcity and increased cost of building materials, which saw a notable rise in 2024, directly inflate repair costs and can extend claim settlement times, placing operational strain on the company.

| Environmental Factor | Impact on Intact Financial | Data/Trend (2024-2025) |

|---|---|---|

| Extreme Weather Events | Increased property and casualty claims, higher repair costs | Record insured losses from wildfires and floods in 2023-2024; ~15% increase in construction material costs due to climate-driven supply chain issues in North America (2024) |

| Climate Change & Decarbonization | Risk of stranded assets, opportunity in green energy insurance | Growing investor focus on ESG; trillions projected for renewable energy investment through 2030 |

| Environmental Regulations | Increased environmental liability claims, demand for specialized insurance | Stricter emissions and waste management standards being implemented globally; heightened focus on environmental accountability driving litigation |

| Resource Scarcity & Supply Chains | Extended claim settlement times, higher claims costs | Shortages of key building materials impacting repair timelines and expenses; operational strain on claims management |

PESTLE Analysis Data Sources

Our PESTLE analysis for Intact Financial is built on a robust foundation of data from reputable sources including financial news outlets, regulatory filings, industry-specific reports, and economic indicators. We meticulously gather information on political stability, economic trends, technological advancements, environmental regulations, and social shifts impacting the insurance sector.