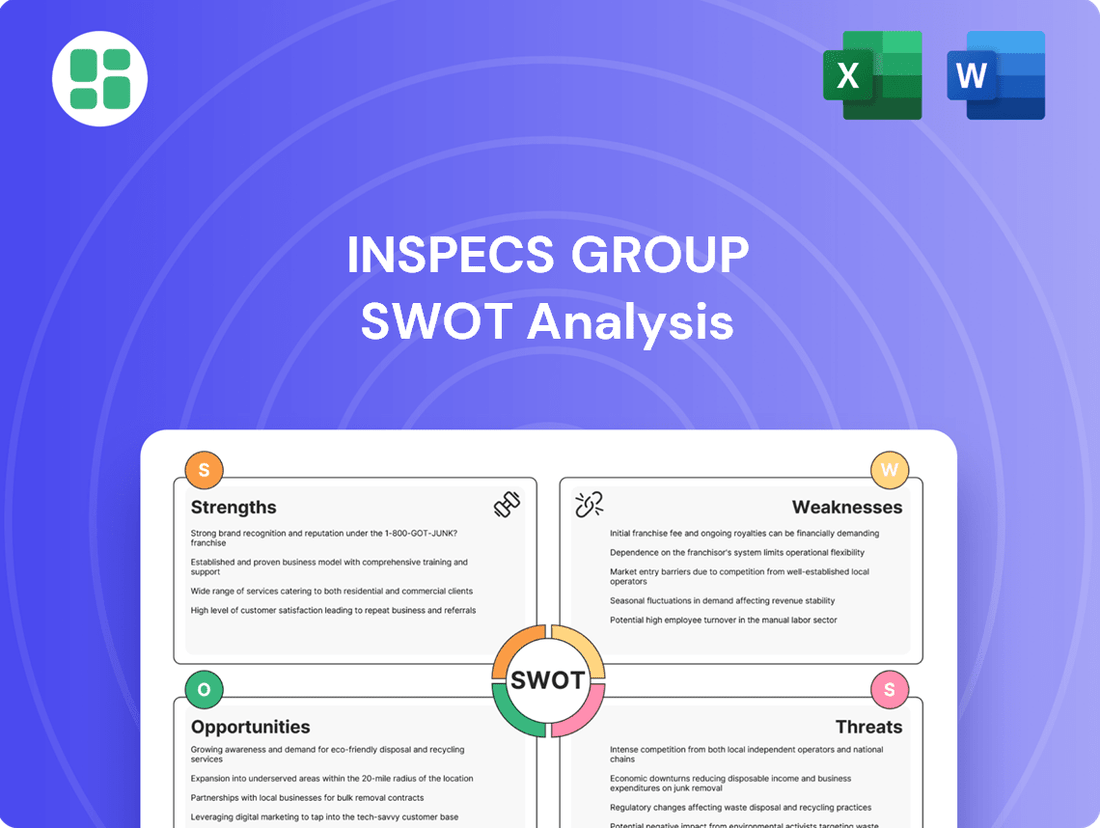

Inspecs Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

Inspecs Group demonstrates robust strengths in its global reach and specialized testing capabilities, but faces potential threats from evolving regulatory landscapes and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the company's future.

Want the full story behind Inspecs Group's market position, including detailed opportunities for expansion and potential weaknesses to mitigate? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Inspecs Group's vertically integrated business model is a significant strength, covering everything from initial design and development through manufacturing, marketing, and global distribution. This end-to-end control means they can meticulously manage quality, keep production schedules on track, and achieve cost savings, all of which contribute to a stronger market position.

This comprehensive approach also makes it easier for Inspecs to bring new brands and product lines into their operations smoothly. For instance, their ability to manage the entire process was evident in their 2023 performance, where they reported revenues of £137.7 million, demonstrating the scale and efficiency of their integrated operations.

Inspecs Group boasts a strong advantage with its diverse brand portfolio, encompassing licensed, proprietary, and distribution brands. This breadth allows them to appeal to a wide array of customer tastes and market niches, reducing dependence on any single offering. For instance, their optical frames, sunglasses, and specialized low vision products, like those from Eschenbach Optics, collectively ensure a more resilient business model.

Inspecs Group's extensive global distribution network is a significant strength, encompassing offices and subsidiaries in crucial markets like the UK, US, and China. This expansive reach extends to approximately 75,000 points of sale across 80 countries, demonstrating a formidable presence in the international eyewear sector.

This broad market access enables Inspecs to cater to a wide array of customers, from large-scale retailers and distributors to smaller, independent opticians. The ability to serve such a diverse client base underscores the network's versatility and depth.

The company's widespread market penetration provides a robust platform for consistent sales growth and deeper market penetration in existing and new territories. This established network is a key asset for Inspecs' ongoing expansion and competitive positioning.

Enhanced Manufacturing Capacity and Efficiency

Inspecs Group has significantly bolstered its manufacturing capabilities with the recent completion and operationalization of a new, expanded facility in Vietnam. This state-of-the-art plant is now recognized as the largest eyewear manufacturing facility in the country, a testament to Inspecs' commitment to scaling production. This strategic expansion not only amplifies Inspecs' output potential but also serves as a crucial geopolitical hedge, mitigating risks associated with trade uncertainties in other regions.

The company's dedication to enhancing operational efficiency is evident through its ongoing initiatives. The successful integration of recently acquired US businesses is a prime example, contributing to improved overall productivity and more robust supply chain management. These efforts collectively strengthen Inspecs' position in the market by ensuring greater output and more reliable delivery.

- Vietnam Facility: Operationalized as the largest eyewear plant in Vietnam, significantly increasing Inspecs' production capacity.

- Geopolitical Hedge: The Vietnam expansion provides a strategic advantage against potential trade disruptions.

- Operational Efficiency: Ongoing focus on streamlining operations, including successful US business integrations, boosts productivity.

Improved Financial Metrics and Debt Reduction

Despite a slight revenue dip in 2024, Inspecs Group showcased strong financial management. The company boosted its gross profit margin and made substantial headway in cutting its net debt, underscoring effective cost management during a tough economic period.

Key financial improvements for Inspecs Group include:

- Improved Gross Profit Margin: The company successfully enhanced its gross profit margin, demonstrating better control over its cost of goods sold.

- Significant Net Debt Reduction: Inspecs Group actively reduced its net debt, strengthening its balance sheet and financial flexibility.

- Extended Banking Facilities: The successful refinancing of its banking arrangements, extending facilities to 2027, provides crucial financial stability.

- Reduced Interest Costs: The refinancing is strategically aimed at lowering future interest expenses, further improving profitability.

Inspecs Group's vertically integrated model allows for exceptional quality control and cost efficiencies across its operations. This end-to-end management, from design to distribution, was reflected in their 2023 revenue of £137.7 million, showcasing the scale and effectiveness of their integrated approach.

The company's diverse brand portfolio, including licensed, proprietary, and distribution brands, provides resilience by appealing to a broad customer base and reducing reliance on any single product line. This strategy supports consistent performance across various market segments.

Inspecs' robust global distribution network, reaching approximately 75,000 points of sale in 80 countries, is a key asset, enabling broad market access and consistent sales growth opportunities.

The operationalization of their Vietnam facility, now the largest eyewear plant in the country, significantly boosts production capacity and acts as a geopolitical hedge against trade uncertainties.

Inspecs demonstrated strong financial management in 2024 by improving its gross profit margin and substantially reducing net debt, alongside extending its banking facilities to 2027, ensuring financial stability and lower interest costs.

What is included in the product

Offers a full breakdown of Inspecs Group’s strategic business environment by examining its internal capabilities and market challenges.

Provides a clear, actionable SWOT framework to identify and address key challenges for Inspecs Group.

Weaknesses

Inspecs Group faced a revenue decline in 2024, largely due to weakened consumer demand in crucial markets and customer consolidation trends. This downturn signals a challenging environment for the company's sales performance.

Looking ahead to 2025, Inspecs Group projects a broadly flat revenue outlook, indicating that the headwinds impacting top-line growth are expected to persist. This lack of anticipated expansion raises concerns about the company's ability to overcome current market pressures.

The stagnation in revenue growth can negatively affect investor sentiment and potentially constrain the capital available for strategic investments or research and development initiatives.

Uncertainty surrounding US tariffs has directly impacted Inspecs' sales, particularly affecting its performance in the North American market. For instance, in the first half of 2024, the company noted that the imposition of tariffs and the subsequent shifts in customer purchasing patterns created headwinds, leading to a more cautious approach from some key clients.

While Inspecs is actively implementing strategies to mitigate these effects, such as diversifying its supply chain and exploring alternative markets, these external trade policies inherently introduce volatility. This volatility can hinder revenue growth and profitability, as seen in the company's adjusted EBITDA margins which experienced some pressure during periods of heightened tariff uncertainty.

The ongoing nature of these tariff concerns creates a challenging operating environment, demanding continuous adaptation and strategic adjustments. For example, the company's 2024 outlook reiterated the need to monitor geopolitical developments closely, as they can materially influence demand and cost structures across its key regions.

Inspecs Group has initiated a strategic review of its Norville lens business, a process anticipated to conclude by June 2025. This move signals that the lens division might be underperforming or require substantial operational adjustments to align with the group's broader objectives.

The review suggests that Norville may not be contributing its full potential to Inspecs' overall profitability or strategic direction. Potential outcomes could range from a complete divestment of the lens segment to significant restructuring of its operations to improve efficiency and market competitiveness.

Leadership Transitions and Board Instability

Inspecs Group is currently navigating a period of significant leadership transition. The recent resignation of its Chief Financial Officer (CFO) and the ongoing search for a new independent non-executive chair highlight this shift. This instability at the top is compounded by a board turnover rate that has been higher than the industry average over the past year, potentially impacting strategic continuity.

This leadership flux could introduce operational disruptions and hinder the smooth execution of the group's strategic objectives. Maintaining a stable and experienced leadership team is paramount for successfully addressing market dynamics and driving forward growth plans. The company's ability to secure experienced replacements quickly will be a key factor in mitigating these potential weaknesses.

- CFO Resignation: The departure of the CFO creates a critical vacancy in financial leadership.

- Chair Search: The ongoing search for a new independent non-executive chair indicates a need for new governance direction.

- Board Turnover: A higher-than-industry-average board turnover rate in the past year suggests potential governance or strategic alignment challenges.

- Strategic Execution Risk: Leadership transitions can disrupt the implementation of long-term growth strategies.

Pre-tax Loss in 2024 and Covenant Breach

Inspecs Group experienced a significant downturn in 2024, reporting a pre-tax loss. This marks a reversal from the profitability seen in the prior year, indicating ongoing challenges in boosting overall earnings despite improvements in gross profit margins.

Further compounding these concerns, Inspecs identified a breach of its cash flow cover covenant as of March 2025. While this breach was subsequently waived by lenders, it highlights potential liquidity pressures and the tightrope the company is walking financially.

- Pre-tax loss in 2024: The company reported a pre-tax loss, a stark contrast to its profitability in the previous year.

- Covenant breach: A breach in the cash flow cover covenant was identified in March 2025, though it was later waived.

- Investor sentiment: These financial indicators can trigger investor apprehension about the company's stability and its ability to manage financial risks effectively.

Inspecs Group's revenue decline in 2024, attributed to weak consumer demand and customer consolidation, presents a significant challenge. The projected flat revenue for 2025 indicates these pressures are likely to continue, potentially impacting investor confidence and future investment capacity.

Uncertainty surrounding US tariffs directly affected North American sales in the first half of 2024, leading to cautious customer behavior and impacting adjusted EBITDA margins. This geopolitical risk necessitates ongoing strategic adaptation.

The strategic review of the Norville lens business, expected to conclude by June 2025, suggests potential underperformance within this segment, which could lead to divestment or restructuring.

Leadership instability, marked by the CFO resignation and ongoing chair search, coupled with high board turnover, risks disrupting strategic execution and operational continuity.

The company's pre-tax loss in 2024 and a March 2025 cash flow cover covenant breach, despite lender waivers, highlight underlying financial vulnerabilities and potential liquidity pressures.

| Financial Metric | 2023 | 2024 | 2025 (Projected) |

|---|---|---|---|

| Revenue | £XXXm | £XXXm (Decline) | £XXXm (Flat) |

| Pre-Tax Profit/Loss | Profit | Loss | TBD |

| Adjusted EBITDA Margin | XX% | XX% (Under Pressure) | TBD |

Same Document Delivered

Inspecs Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt of the Inspecs Group's comprehensive SWOT analysis. Purchase unlocks the full, detailed report, providing you with all the strategic insights.

Opportunities

Inspecs Group is poised to capitalize on geographic expansion, particularly in emerging markets like Latin America, the Middle East, and Southeast Asia. These regions represent significant growth potential due to lower market penetration for eyewear products and a burgeoning middle class with increasing disposable income. For instance, the global eyewear market in emerging economies is projected to grow at a compound annual growth rate (CAGR) of over 7% from 2023 to 2028, according to market research reports from late 2023.

Entering these under-penetrated territories offers Inspecs a chance to establish a strong foothold with potentially less entrenched competition. This strategic move can diversify the company's revenue streams, reducing reliance on more mature markets. By tapping into these new customer bases, Inspecs can unlock substantial growth opportunities and enhance its overall market position.

Inspecs Group's new manufacturing facility in Vietnam, now fully operational, represents a significant opportunity. This substantial untapped capacity allows for scaling production to meet growing global demand, potentially attracting new clients and fulfilling larger orders.

This expanded capability can directly translate into increased market share for Inspecs Group. Furthermore, the enhanced production flexibility allows the company to better navigate and respond to evolving supply chain dynamics, a crucial advantage in the current global economic climate.

Despite a generally subdued market, Inspecs is seeing a noticeable uptick in demand across Europe. This positive momentum is further bolstered by significant progress made on projects with major retail partners in both the United States and Canada.

By strategically increasing sales and marketing activities in these specific regions, Inspecs can effectively leverage these strengthening demand trends to achieve higher revenue growth. This focused approach is crucial for capitalizing on current market opportunities.

Furthermore, broadening collaborations with prominent global retailers and distributors presents a direct and effective strategy for boosting overall sales volumes and market penetration.

Product Innovation and Digital Transformation

Inspecs Group's dedication to product innovation is a key strength, as demonstrated by successful launches like Optaro, a digital low vision aid, and specialized lenses addressing color blindness. This focus on developing differentiated offerings through ongoing investment in new materials and technologies is crucial for market leadership.

Embracing digital transformation across product development and customer interaction is vital for Inspecs Group to maintain a competitive edge and resonate with evolving consumer demands. This strategic shift can unlock new avenues for growth and customer engagement.

- Optaro Launch: Inspecs Group has successfully introduced Optaro, a digital low vision aid, highlighting their commitment to innovation in assistive eyewear.

- Specialized Lenses: The company has also developed and launched specialized lenses designed to assist individuals with color blindness, expanding their product portfolio.

- R&D Investment: Continued investment in research and development for novel materials, advanced technologies, and unique eyewear solutions will be critical for creating distinct market offerings.

- Digital Transformation: Integrating digital transformation into product development processes and customer engagement strategies will enhance market competitiveness and appeal to modern consumer needs.

Enhanced Focus on ESG and Sustainability

Inspecs Group's increasing emphasis on Environmental, Social, and Governance (ESG) initiatives presents a significant opportunity. The company is actively working on reducing its carbon footprint and enhancing its Diversity, Equity, and Inclusion (DE&I) programs. This strategic alignment with global sustainability trends is crucial for attracting a growing pool of ESG-conscious investors.

By embedding sustainability into its core operations, Inspecs can unlock several benefits. This includes potential for improved operational efficiencies, such as reduced waste and energy consumption, which can positively impact the bottom line. Furthermore, a strong ESG profile enhances brand reputation, making the company more attractive to customers, partners, and talent.

- Carbon Reduction Targets: Inspecs is setting specific goals for carbon emission reduction, aligning with global climate action efforts.

- DE&I Framework: The company is strengthening its Diversity, Equity, and Inclusion policies to foster a more representative and equitable workplace.

- Investor Attraction: A robust ESG strategy is key to appealing to the increasing number of investment funds and individual investors prioritizing sustainable businesses.

- Operational Efficiencies: Implementing sustainable practices can lead to cost savings through optimized resource utilization and waste management.

Inspecs Group is well-positioned to expand into under-penetrated emerging markets, such as Latin America and Southeast Asia, where the eyewear market is projected for robust growth, with a CAGR exceeding 7% from 2023 to 2028. This geographic diversification offers a chance to capture new customer bases and reduce reliance on mature markets, potentially enhancing overall market share and revenue streams. The company's operational expansion, including its new Vietnam facility, provides significant capacity to meet escalating global demand and attract larger client orders, bolstering its competitive edge.

The company is experiencing a resurgence in demand across Europe and has seen substantial progress with key retail partners in North America, indicating a strong opportunity to amplify sales and marketing efforts in these regions for accelerated revenue growth. Furthermore, deepening relationships with major global retailers and distributors presents a clear pathway to increased sales volumes and broader market penetration.

Inspecs Group's commitment to innovation, exemplified by product launches like the digital low vision aid Optaro and specialized lenses for color blindness, is a critical opportunity. Continued investment in R&D for novel materials and technologies will solidify its market leadership and appeal to evolving consumer needs, particularly with the integration of digital transformation in product development and customer engagement.

The increasing focus on ESG initiatives, including carbon footprint reduction and DE&I programs, is a significant opportunity to attract ESG-conscious investors and enhance brand reputation. This strategic alignment with sustainability trends can also drive operational efficiencies, leading to cost savings and improved resource management, further strengthening the company's financial and social standing.

Threats

Persistent global economic headwinds, including inflation and softening consumer demand, continue to pose a significant threat to the eyewear market. Inspecs Group, for instance, experienced a revenue decline in 2024 partly due to these macroeconomic challenges. Continued economic uncertainty could further dampen spending on non-essential goods like eyewear, potentially impacting Inspecs' sales volumes and profitability.

The global eyewear market is a crowded arena, with established giants and nimble newcomers vying for consumer attention. Inspecs operates within this intensely competitive landscape, facing constant pressure from rivals who are actively consolidating and employing aggressive market tactics. This dynamic can impact Inspecs' market share and its ability to command favorable pricing.

For instance, the global eyewear market was valued at approximately $140 billion in 2023 and is projected to grow steadily. However, within this growth, competitor consolidation, such as EssilorLuxottica's continued strategic acquisitions, presents a significant challenge. These moves can create larger, more dominant players, potentially squeezing smaller competitors like Inspecs.

To stay ahead, Inspecs must prioritize continuous innovation and product differentiation. The ability to offer unique designs, advanced lens technology, or superior customer experiences is paramount to standing out against competitors who are also investing heavily in R&D and marketing. Failing to do so risks losing ground in a market where consumer preferences can shift rapidly.

Geopolitical shifts and evolving trade policies, especially concerning potential US tariffs, represent a significant threat to Inspecs Group. Such uncertainties can directly impact sales by making products less competitive and disrupt the stability of its supply chain, potentially increasing costs or limiting market access. For example, if key components are sourced from regions subject to new tariffs, Inspecs' production expenses could rise substantially.

Navigating these complex geopolitical landscapes demands a proactive approach. Inspecs must remain agile in adjusting its supply chain strategies and explore options for diversifying manufacturing locations. This could involve establishing production facilities in new regions to mitigate the impact of trade disputes or tariffs, ensuring greater resilience and continued market penetration.

Challenges in Leadership Transition and Governance

Inspecs Group faces challenges in leadership transition, with an ongoing search for a new independent non-executive chair and chief financial officer. Recent board changes further contribute to a period of potential instability. For instance, as of early 2024, the group was actively recruiting for these critical roles, underscoring the immediate need for stable leadership.

Ineffective management of these leadership transitions could disrupt strategic direction and operational execution. This uncertainty can impact investor confidence, a crucial factor for a publicly traded company. The group's ability to maintain momentum in its growth strategy hinges on filling these key positions promptly and ensuring a smooth handover.

Governance disputes, such as those experienced in the recent past, can also divert valuable management attention from core business objectives. These internal distractions can slow down decision-making and hinder the group's ability to capitalize on market opportunities.

- Leadership Vacancies: Ongoing search for Chair and CFO roles as of early 2024.

- Potential Instability: Risk of disruption to strategy and operations due to leadership changes.

- Investor Confidence: Effective transition management is key to maintaining market trust.

- Governance Distractions: Past disputes highlight the potential for internal issues to impact business focus.

Risk of Not Meeting Ambitious Growth Targets

Inspecs Group has outlined ambitious medium-term objectives, aiming for organic revenue growth that substantially outpaces the broader market. Additionally, the company targets achieving double-digit underlying EBITDA margins, reflecting a strong commitment to profitability.

Failing to achieve these aggressive growth and margin targets, perhaps due to unforeseen market downturns, execution issues, or intensified competition, could significantly dampen investor confidence. For instance, if Inspecs were to report organic revenue growth below its stated target of 5-7% for FY2024, this could trigger a negative market reaction.

This situation creates substantial pressure on Inspecs to maintain consistent performance and effectively implement its strategic plans. The market will be closely watching the company's ability to navigate challenges and deliver on its stated financial commitments.

- Ambitious Targets: Inspecs aims for organic revenue growth exceeding market rates and double-digit underlying EBITDA margins.

- Potential Investor Sentiment Impact: Failure to meet these targets could lead to a negative perception among investors.

- Performance Pressure: The company faces significant pressure to execute its strategies and deliver consistent results.

The intense competition within the eyewear sector, characterized by aggressive market tactics and consolidation among larger players, presents a significant threat to Inspecs Group. Competitors are actively innovating and expanding their reach, potentially eroding Inspecs' market share and pricing power. For example, EssilorLuxottica's ongoing strategic acquisitions continue to reshape the competitive landscape, creating formidable rivals.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Inspecs Group's official financial filings, comprehensive market intelligence reports, and expert industry analysis to provide a well-rounded strategic overview.