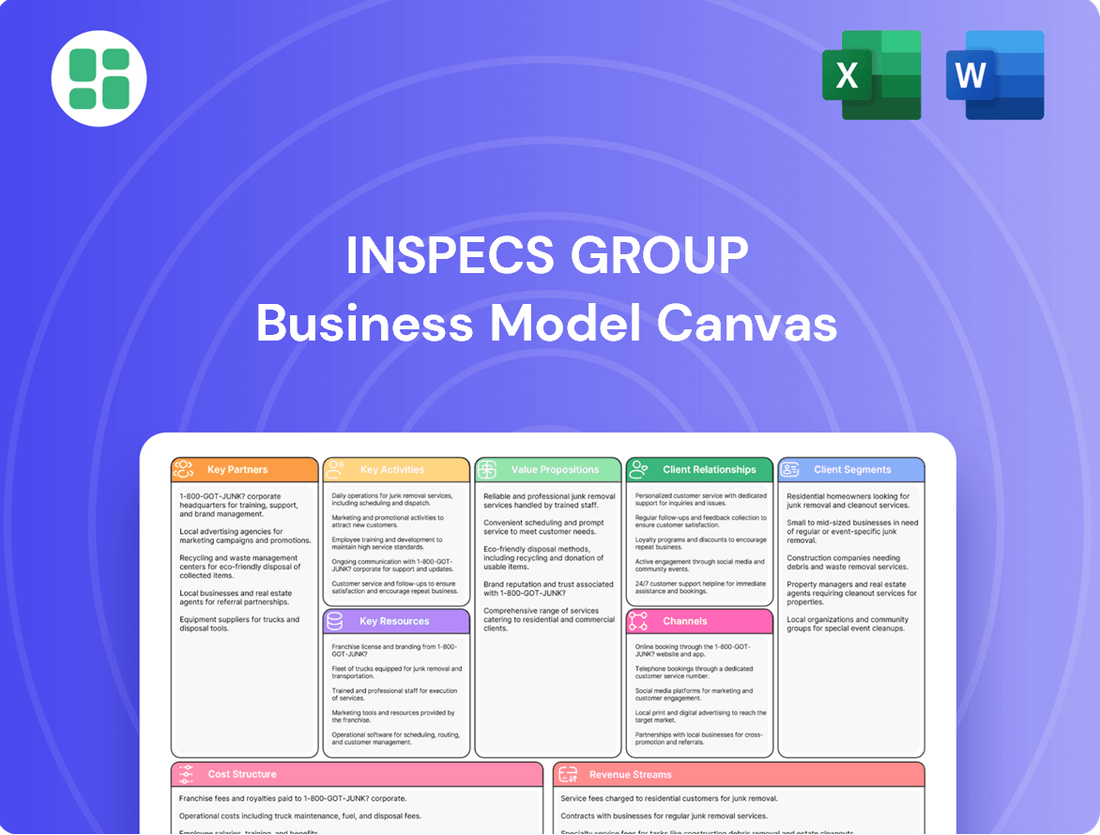

Inspecs Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

Unlock the strategic blueprint of Inspecs Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market leadership. Discover the core components that drive their growth and gain actionable insights for your own ventures.

Partnerships

Inspecs Group's key partnerships with brand licensors are fundamental to its business model, enabling the design, production, and sale of eyewear under globally recognized names. These collaborations are vital for broadening their product range and tapping into new markets by leveraging the existing equity of popular brands.

Examples of these significant brand relationships include agreements with fashion labels like Tom Tailor and lifestyle brands such as Superdry and O'Neill. These partnerships allow Inspecs to offer a diverse and appealing selection of eyewear to a wide consumer base, reinforcing brand loyalty and market penetration.

Strategic alliances with major global retailers and distributors are fundamental for Inspecs' extensive market penetration. These partnerships allow Inspecs to efficiently supply its diverse eyewear portfolio to a broad spectrum of optical and non-optical retail locations across the globe. For instance, in 2024, Inspecs secured significant new distribution agreements with prominent retailers in key markets such as the USA, Canada, and across Europe, bolstering its reach and sales channels.

Inspecs Group maintains robust relationships with a wide array of suppliers providing essential raw materials and components for eyewear production. These partnerships are critical for maintaining the high quality and consistent supply needed to meet global demand.

Strategic, long-term alliances with these key suppliers are fundamental to Inspecs' operational strategy. They enable effective management of supply chain disruptions, ensure the availability of necessary materials to support production targets, and ultimately safeguard the company's ability to deliver on customer orders across its international manufacturing footprint.

The group actively works to embed Environmental, Social, and Governance (ESG) principles within its supplier network. This focus ensures that partners align with Inspecs' commitment to sustainability and responsible business practices, a trend increasingly important for investors and consumers alike. For instance, in 2024, Inspecs reported that over 85% of its key suppliers had undergone some form of ESG assessment or engagement.

Technology and Innovation Partners

Inspecs Group actively collaborates with global technology and innovation partners to drive advancements in eyewear. These strategic alliances are crucial for developing cutting-edge products, including advanced lens technologies and smart eyewear solutions. For instance, Inspecs' integration of new materials and digital features in their 2024 collections highlights the impact of these partnerships on product evolution.

These collaborations enable Inspecs to stay ahead of technological trends in the optical sector. By working with leading tech firms, they can accelerate the development of products like digital low vision aids, enhancing accessibility and functionality for users. This focus on innovation ensures Inspecs remains competitive and responsive to market demands.

- Focus on Advanced Lens Technology: Partnerships facilitate the creation of lenses with enhanced optical performance and specialized coatings.

- Development of Smart Eyewear: Collaborations are key to integrating electronic components and connectivity features into eyewear.

- Digital Low Vision Aids: Inspecs leverages partnerships to innovate in the assistive technology space for visually impaired individuals.

- Staying at the Forefront of Innovation: These alliances ensure Inspecs can quickly adopt and implement emerging technologies in their product lines.

Acquired Entities and Subsidiaries

Inspecs Group's growth is significantly fueled by strategic acquisitions, integrating key players to bolster its operations. For instance, the acquisition of Eschenbach, which brought in brands like Tura, and Norville, along with A-Optikk AS, exemplifies this approach. These moves are designed to enhance Inspecs' vertically integrated model, broadening its global reach and brand assortment.

These integrations are crucial for Inspecs' business model, as they directly contribute to expanding its manufacturing capacity and strengthening its market presence. By bringing these entities under the Inspecs umbrella, the group unlocks significant operational synergies, aiming to optimize efficiency and leverage combined strengths across its value chain.

- Strategic Acquisitions: Integration of Eschenbach (including Tura), Norville, and A-Optikk AS.

- Vertical Integration: Acquired entities enhance manufacturing capabilities and brand portfolio.

- Global Footprint Expansion: Acquisitions broaden market presence and distribution networks.

- Synergy Maximization: Aiming for operational efficiencies and combined strengths across the group.

Inspecs Group's key partnerships extend to brand licensors, enabling them to produce and sell eyewear under well-known names, thereby expanding their market reach and product diversity. Crucially, these alliances also encompass strategic relationships with major global retailers and distributors, vital for efficiently supplying their extensive eyewear portfolio across numerous optical and non-optical outlets worldwide. In 2024, Inspecs notably strengthened its distribution network through new agreements in key markets like the USA, Canada, and Europe, significantly enhancing its market penetration.

| Partnership Type | Key Examples/Impact | 2024 Data/Significance |

|---|---|---|

| Brand Licensors | Tom Tailor, Superdry, O'Neill | Broadens product range and market access by leveraging established brand equity. |

| Retailers & Distributors | Major global optical and non-optical retailers | Facilitates extensive market penetration and efficient product supply. |

| Suppliers | Raw materials and components providers | Ensures high quality and consistent supply, managing disruptions. |

| Technology & Innovation | Global tech firms | Drives development of advanced lens tech and smart eyewear solutions. |

What is included in the product

The Inspecs Group Business Model Canvas outlines a strategy focused on providing specialized inspection and testing services across diverse industries, emphasizing global reach and technical expertise.

It details customer relationships, key resources, and revenue streams, highlighting a commitment to quality assurance and regulatory compliance as core value propositions.

The Inspecs Group Business Model Canvas serves as a powerful pain point reliever by offering a clear, one-page snapshot of their operational strategy, enabling rapid identification of inefficiencies and opportunities for streamlined service delivery.

Activities

Inspecs Group's core strength lies in its robust Eyewear Design and Research & Development activities, where they continuously innovate in optical frames, sunglasses, and lenses. Their dedicated R&D team is committed to pushing the boundaries of eyewear technology.

This focus on innovation has led to the successful launch of advanced lens technologies and specialized products. For instance, Inspecs has introduced digital low vision aids and gaming eyewear, demonstrating their commitment to creating novel solutions for diverse consumer needs.

Inspecs Group's core activity revolves around the in-house manufacturing of a wide array of high-quality eyewear. This includes crafting frames from diverse materials such as titanium, metal, acetate, and advanced injected plastics, ensuring a broad product offering.

The company boasts a robust global production footprint, with key manufacturing facilities strategically located in Vietnam, China, the UK, and Italy. A significant development in 2024 saw the completion of a substantial expansion of their Vietnam operations, bolstering their overall production capacity.

This extensive and enhanced manufacturing capability is crucial for Inspecs, enabling them to efficiently meet their global supply chain demands and support the diverse needs of their international customer base.

Inspecs Group actively manages a diverse brand portfolio, encompassing both its own creations and carefully selected licensed brands. This strategic approach allows them to cater to distinct consumer preferences and market niches.

A core activity involves deepening the market presence of their proprietary brands, aiming for greater customer adoption and loyalty. This focus on owned brands is crucial for long-term value creation.

Simultaneously, Inspecs works diligently to expand its licensed brand portfolio, fostering strong partnerships with brand owners. For instance, in 2024, they continued to leverage key licensing agreements to enhance their offering and reach new customer segments, driving mutual growth and ensuring brand vitality.

Worldwide Sales and Distribution

Inspecs Group actively manages worldwide sales and distribution to effectively serve its broad customer base, which includes global retailers, distributors, and independent opticians.

The company's expansive distribution network covers over 80 countries, reaching an impressive approximately 75,000 points of sale.

Key activities involve strategic brand launches within major retail chains and the ongoing expansion into new channels, such as travel retail markets, to broaden market penetration.

- Global Reach: Distribution in over 80 countries.

- Extensive Network: Access to approximately 75,000 points of sale.

- Strategic Expansion: Focus on new brand launches and travel retail markets.

Lens Manufacturing and Glazing Services

Inspecs Group's commitment to a comprehensive eyewear solution extends to its lens manufacturing and glazing services. This segment is vital, reinforcing their position as a one-stop-shop for optical products.

The company actively produces a diverse range of lenses, catering to various vision needs. This includes advanced options like varifocal and photochromic lenses, demonstrating a focus on technological integration and customer-centric product development.

This integrated approach allows Inspecs to control quality and delivery timelines across the entire eyewear production process. The growth in this area directly supports their strategy of providing complete, high-quality eyewear solutions to their global customer base.

- Lens Manufacturing: Inspecs produces a wide array of lens types, from standard single vision to complex progressive and specialized coatings.

- Glazing Services: The company offers precision glazing, fitting lenses into frames, ensuring a seamless and high-quality final product.

- Technological Advancement: Investment in advanced lens technologies, such as digital surfacing for personalized optics and photochromic treatments, is a key focus.

- Market Growth: The eyewear market, including the lens segment, continues to see steady growth, driven by an aging population and increased awareness of eye health. For instance, the global ophthalmic lenses market was valued at approximately USD 30 billion in 2023 and is projected to grow further.

Inspecs Group's key activities encompass the entire eyewear value chain, from initial design and research to manufacturing, brand management, and global distribution. They focus on innovation in eyewear technology and product development, evidenced by their introduction of digital low vision aids and gaming eyewear.

The company operates a significant in-house manufacturing capability across multiple global locations, including a notable expansion in Vietnam in 2024 to boost production capacity. This robust manufacturing base supports their diverse brand portfolio, which includes both proprietary and licensed brands, with continued efforts in 2024 to strengthen licensing agreements.

Furthermore, Inspecs manages extensive worldwide sales and distribution, reaching over 80 countries and approximately 75,000 points of sale, with strategic initiatives in 2024 to penetrate new channels like travel retail. Complementing these operations, their lens manufacturing and glazing services provide integrated, high-quality optical solutions, with ongoing investment in advanced lens technologies.

Full Version Awaits

Business Model Canvas

The Inspecs Group Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you get a direct, unedited look at the comprehensive business strategy that will be yours to utilize. Once your order is complete, you will gain full access to this same professionally structured and content-rich Business Model Canvas, ready for immediate application.

Resources

Inspecs Group’s intellectual property and brand portfolio is a cornerstone of its business model. The company boasts 18 proprietary brands, including well-known names like Titanflex and Humphrey's, alongside a substantial 28 licensed brands. This diverse collection of designs, patents, and trademarks is crucial for maintaining a competitive advantage and resonating with a wide range of consumers.

The strategic management and ongoing development of this extensive brand portfolio are fundamental to Inspecs Group's market standing. In 2023, the company reported that its brand portfolio contributed significantly to its revenue, with proprietary brands showing robust growth. The ability to leverage both owned and licensed intellectual property allows Inspecs to cater to different market segments and price points effectively.

Inspecs Group's global manufacturing footprint is a critical physical resource, featuring advanced facilities in Vietnam, China, the UK, and Italy. The recent 10,000 sqm expansion in Vietnam, completed in 2024, dramatically boosts their production capacity, enabling them to meet growing demand. These plants are outfitted with cutting-edge machinery, underpinning their commitment to high-quality eyewear production and a vertically integrated business model.

Inspecs Group's global team of over 1,600 employees represents a cornerstone of its business model. This extensive human capital is distributed across vital functions, ensuring comprehensive operational capabilities.

The company cultivates specialized teams dedicated to design, research and development, manufacturing, and sales. This focused expertise allows Inspecs to excel in each area, from product innovation to market penetration.

The collective expertise of its workforce is the engine driving Inspecs' innovation, operational efficiency, and customer engagement. This skilled human capital directly translates into improved company performance and competitive advantage.

Extensive Global Distribution Network

Inspecs Group's extensive global distribution network is a cornerstone of its business model, allowing it to serve a vast customer base efficiently. This network is comprised of strategically located offices and subsidiaries across key economic hubs such as the UK, Europe, the United States, and China.

This widespread presence facilitates Inspecs' ability to reach approximately 75,000 points of sale in over 80 countries worldwide. The year 2024 saw continued investment in optimizing this network to ensure responsiveness to diverse market demands and maintain competitive lead times.

The established logistics and sales infrastructure are critical enablers for Inspecs, ensuring timely product delivery and effective market penetration. This robust framework supports their goal of providing high-quality eyewear components to a global clientele.

- Global Reach: Access to over 75,000 points of sale across more than 80 countries.

- Strategic Locations: Presence in key markets including the UK, Europe, US, and China.

- Operational Efficiency: Established logistics and sales infrastructure for timely delivery.

- Market Penetration: Facilitates deep market penetration and customer service worldwide.

Financial Capital and Strategic Investments

Inspecs Group’s financial capital, bolstered by refinanced banking facilities extending to 2027, provides a solid foundation for its operational needs and ambitious strategic investments. This financial flexibility is crucial for pursuing growth avenues, including potential acquisitions.

The company’s commitment to prudent leverage management, coupled with consistent cash generation, empowers Inspecs to allocate capital towards critical areas. This includes investing in new manufacturing capabilities, expanding its diverse brand portfolio, and actively seeking out new growth opportunities across its markets.

These financial resources are the bedrock of Inspecs Group’s global expansion strategy. For instance, their 2023 results showed a strong performance with revenue reaching $438.7 million, demonstrating their capacity to fund international growth initiatives and enhance their market presence.

- Refinanced Facilities: Banking facilities extended to 2027 provide long-term financial stability.

- Investment Capacity: Prudent leverage and cash flow support investments in manufacturing and brand expansion.

- Growth Funding: Financial capital underpins the execution of their global expansion strategy.

- Revenue Performance: 2023 revenue of $438.7 million highlights financial strength supporting growth.

Inspecs Group's key resources are its robust intellectual property and brand portfolio, a global manufacturing footprint, a skilled workforce, an extensive distribution network, and strong financial capital. These elements collectively enable the company to innovate, produce efficiently, reach customers worldwide, and fund its strategic growth initiatives.

The company's brand portfolio, featuring 18 proprietary and 28 licensed brands, is a significant asset. This diversity, coupled with advanced manufacturing facilities in Vietnam, China, the UK, and Italy, allows for high-quality production and market responsiveness. In 2024, a 10,000 sqm expansion in Vietnam further boosted production capacity.

| Resource | Description | Key Data/Facts |

| Intellectual Property & Brands | Proprietary and licensed brands | 18 proprietary brands, 28 licensed brands |

| Manufacturing Facilities | Global production sites | Vietnam, China, UK, Italy; 10,000 sqm Vietnam expansion in 2024 |

| Human Capital | Global workforce | Over 1,600 employees across design, R&D, manufacturing, sales |

| Distribution Network | Global sales and logistics | ~75,000 points of sale in 80+ countries; offices in UK, Europe, US, China |

| Financial Capital | Funding for operations and growth | Banking facilities extended to 2027; 2023 revenue of $438.7 million |

Value Propositions

Inspecs Group truly offers a comprehensive suite of eyewear, covering everything from optical frames and sunglasses to specialized lenses. This broad selection includes everything from the hottest licensed brands that consumers crave to their own unique proprietary designs and flexible private label options for retailers. This diversity makes them a go-to source for businesses worldwide, simplifying their sourcing needs.

Their commitment to variety means they can serve virtually any customer. Whether someone is looking for the latest high-fashion trends or needs eyewear with specific functional requirements, Inspecs has them covered. This extensive range, encompassing everything from trendy acetate sunglasses to durable sports frames, solidifies their position as a true ‘one-stop-shop’ in the global eyewear market.

Inspecs Group stands by its commitment to delivering eyewear that excels in quality, craftsmanship, and forward-thinking innovation. This dedication is visible in every frame, from the meticulous design and robust durability to the integration of advanced functionalities that enhance user experience.

The company's value proposition is deeply rooted in its continuous pursuit of innovation. A prime example is the development of Optaro, a groundbreaking low vision aid, showcasing their ability to create state-of-the-art solutions. This drive for innovation ensures Inspecs remains at the forefront of the optical industry, meeting and anticipating market needs.

Inspecs' focus on quality and innovation is a key differentiator, enabling them to adapt to evolving consumer demands and maintain a strong competitive position. For instance, their investment in pioneering gaming eyewear reflects a strategic move to capture emerging market segments with technologically advanced products.

Inspecs Group’s vertically integrated supply chain is a core value proposition, giving them complete command from initial design through manufacturing to final distribution. This end-to-end control translates directly into enhanced production efficiency and stringent quality assurance.

This integrated approach significantly shortens the time it takes for products to reach the market. For instance, Inspecs’ acquisition of the M&N Group in 2023, which expanded their manufacturing capabilities, further solidifies this advantage, allowing for quicker adaptation to new fashion trends and client demands.

Furthermore, this model fosters remarkable flexibility, enabling Inspecs to swiftly respond to evolving customer needs and dynamic market shifts. Their ability to manage the entire process allows for customized solutions and a more agile business operation, a crucial differentiator in the competitive eyewear sector.

Global Market Access and Scalability

Inspecs Group's value proposition centers on providing extensive global market access and robust scalability to its partners. This is achieved through a vast operational and distribution network spanning over 80 countries, reaching an impressive 75,000 points of sale.

This broad geographical presence ensures that Inspecs can effectively support the widespread distribution needs of its customers, offering a reliable pathway for scaling their eyewear brands and products internationally. The company's established global footprint is a key enabler for strategic growth, particularly in markets that are currently less penetrated.

- Global Reach: Operations in over 80 countries.

- Extensive Distribution: Presence in 75,000 points of sale.

- Scalability: Facilitates widespread product distribution for partners.

- Strategic Expansion: Enables entry into under-penetrated markets.

Strong Brand Recognition and Market Relevance

Inspecs Group capitalizes on a robust portfolio of globally recognized licensed brands and distinctive proprietary brands. This dual approach ensures immediate consumer recognition and deep market relevance for their eyewear products.

Their strategic brand selection allows for targeted penetration into specific market segments. For instance, in 2024, Inspecs continued to expand its reach in the premium lifestyle segment through its partnerships with high-profile fashion houses.

The company's ability to adapt to evolving consumer preferences, such as the growing demand for sustainable materials and cutting-edge designs, further solidifies their brand appeal. This adaptability was evident in their 2024 product launches, which prominently featured recycled and bio-based materials, contributing to a strong market reception.

- Leveraging Iconic and Proprietary Brands: Inspecs Group benefits from established consumer trust and appeal through its diverse brand portfolio.

- Market Penetration Strategy: Brands are strategically chosen to effectively access and capture specific consumer demographics and market niches.

- Adaptability to Trends: The company's responsiveness to industry shifts, including sustainability and design innovation, maintains and enhances market relevance.

Inspecs Group offers a comprehensive eyewear selection, from licensed to proprietary and private label brands, simplifying sourcing for global businesses.

Their commitment to quality, craftsmanship, and innovation is evident in advanced solutions like Optaro, a low vision aid, and technologically advanced gaming eyewear, ensuring they stay ahead of market needs.

A vertically integrated supply chain, enhanced by acquisitions like M&N Group in 2023, allows for efficient production, stringent quality control, and rapid adaptation to market trends.

Inspecs Group provides extensive global market access, operating in over 80 countries with 75,000 points of sale, enabling partners to scale their brands internationally and enter new markets.

The company leverages a strong portfolio of recognized licensed and proprietary brands, strategically chosen for market penetration and adapting to trends like sustainability, as seen in their 2024 product launches featuring recycled materials.

| Value Proposition Component | Description | Key Differentiator | Supporting Data/Examples |

|---|---|---|---|

| Comprehensive Eyewear Offering | Full spectrum of optical frames, sunglasses, and lenses, including licensed, proprietary, and private label options. | One-stop-shop convenience for diverse customer needs. | Covers high-fashion trends to specialized functional requirements. |

| Commitment to Quality & Innovation | Focus on superior craftsmanship, durability, and advanced functionalities. | Leading-edge product development and enhanced user experience. | Development of Optaro low vision aid; investment in pioneering gaming eyewear. |

| Vertically Integrated Supply Chain | End-to-end control from design to distribution. | Enhanced efficiency, quality assurance, and market responsiveness. | Acquisition of M&N Group in 2023 expanded manufacturing; faster time-to-market. |

| Global Market Access & Scalability | Extensive distribution network across 80+ countries and 75,000 points of sale. | Facilitates international brand scaling and entry into new markets. | Supports widespread distribution for partners, enabling strategic expansion. |

| Strategic Brand Portfolio | Combination of globally recognized licensed brands and distinctive proprietary brands. | Immediate consumer recognition and deep market relevance. | Targeted market penetration; adaptation to trends like sustainability in 2024 product lines. |

Customer Relationships

Inspecs Group prioritizes building enduring partnerships with its largest global retailers and key accounts. This is achieved through dedicated account management, fostering a collaborative environment for strategic initiatives, new product introductions, and distribution pacts.

This approach centers on deeply understanding each client's unique requirements and delivering customized solutions that drive shared success. For instance, Inspecs' 2024 performance highlights the effectiveness of these relationships, with key accounts contributing significantly to revenue growth, demonstrating the tangible benefits of this dedicated strategy.

Inspecs Group cultivates strong B2B partnerships with distributors and independent opticians by offering extensive sales support and technical assistance. This commitment ensures partners are fully equipped to sell and service Inspecs products, fostering mutual success.

Training programs and consistent communication are cornerstones of these relationships, empowering opticians with the knowledge to excel. For instance, in 2024, Inspecs continued to invest in digital training modules, reaching over 5,000 optical professionals globally, enhancing their product expertise and sales capabilities.

Inspecs Group's dedication to enhancing operational efficiency and streamlining its supply chain translates directly into tangible benefits for its customers. This focus on internal improvements leads to better product availability and the potential for cost reductions, making Inspecs a more attractive partner. For instance, in 2024, Inspecs reported significant progress in supply chain optimization, aiming to pass these efficiencies on.

The group’s strategy of centralized procurement is a key driver of these supply chain efficiencies. By consolidating purchasing power, Inspecs can negotiate better terms and manage inventory more effectively. This integrated approach is designed to unlock further savings and elevate the quality of service delivered to their business partners throughout 2024 and beyond.

Collaborative Product Development

Inspecs Group actively participates in collaborative product development with key strategic clients, especially for private label and specialized eyewear segments. This partnership allows customers direct input on design and technical specifications, ensuring the final products precisely meet their unique market demands and consumer preferences.

This co-creation process fosters deeper relationships with customers and significantly enhances Inspecs' ability to respond swiftly to evolving market trends. For instance, in 2024, Inspecs reported that approximately 15% of its revenue was derived from custom-developed or private label products, a testament to the success of this customer relationship strategy.

- Tailored Solutions: Customers influence design and specifications for private label and specialized eyewear.

- Market Responsiveness: Co-creation allows for quicker adaptation to specific market needs.

- Strengthened Partnerships: This approach builds loyalty and deeper engagement with strategic clients.

- Revenue Contribution: In 2024, custom and private label products accounted for around 15% of Inspecs' total revenue.

Proactive Market Adaptation and Communication

Inspecs Group proactively monitors global market dynamics, adapting its business strategies to navigate challenges and capitalize on emerging opportunities. For instance, in 2024, the company continued to address the impact of evolving trade policies and fluctuating consumer preferences by diversifying its sourcing and product offerings.

This adaptive approach is communicated transparently to customers, fostering strong partnerships. By sharing insights on how they manage issues like tariffs or shifts in demand, Inspecs Group builds trust. This open dialogue ensures customers are informed about new product launches and strategic adjustments, reinforcing alignment.

- Market Monitoring: Continuously analyzes economic indicators, regulatory changes, and consumer trends.

- Strategic Adaptation: Adjusts supply chains, product development, and market focus in response to identified shifts.

- Customer Communication: Shares proactive updates on market challenges and opportunities, including new product introductions.

- Trust and Alignment: Maintains strong customer relationships through transparency about strategic decisions and market responses.

Inspecs Group fosters deep B2B relationships by offering robust sales support and technical assistance to distributors and independent opticians. This commitment ensures partners are well-equipped to sell and service Inspecs products, driving mutual success and knowledge. For example, in 2024, Inspecs enhanced its digital training platform, reaching over 5,000 optical professionals globally to boost their product expertise.

| Relationship Aspect | Description | 2024 Impact/Activity |

|---|---|---|

| B2B Partnerships | Support for distributors and opticians | Global training reach of 5,000+ professionals |

| Collaborative Development | Co-creation of private label/specialized eyewear | 15% of revenue from custom/private label products |

| Supply Chain Efficiency | Operational improvements benefiting customers | Progress in supply chain optimization reported |

| Market Adaptability | Transparent communication on market dynamics | Diversification of sourcing and product offerings |

Channels

Inspecs Group relies heavily on its extensive global network of wholesalers and distributors to serve a diverse customer base, especially independent opticians and smaller retail chains. This channel is absolutely vital for achieving broad market penetration, enabling Inspecs to operate effectively in over 80 countries worldwide.

These distribution partners are instrumental in extending Inspecs' market reach, acting as a crucial bridge to customers that might otherwise be difficult to access through direct sales efforts alone.

For instance, in 2024, Inspecs reported that its distributor network contributed significantly to its revenue, facilitating access to approximately 70% of its customer base, underscoring the channel's strategic importance.

Inspecs Group cultivates direct sales relationships with prominent global optical and non-optical retail chains. This channel is crucial for supplying both licensed and proprietary brands, frequently involving substantial product launches and pallet programs designed for large-scale distribution.

This direct engagement fosters deeper collaboration and strategic alliances with major retail partners. For instance, in 2024, Inspecs Group continued to expand its presence with key European optical retailers, securing significant orders for its new sunglass collections, contributing to a substantial portion of its overall revenue from these direct accounts.

Inspecs Group operates a robust network of company-owned subsidiaries and offices strategically positioned across the UK, Europe, North America, and Asia, including China. This extensive geographical footprint enables the company to effectively manage regional sales, distribution, and customer support, fostering localized market strategies and operational efficiency.

These regional hubs are crucial for Inspecs' business model, allowing for tailored approaches to diverse markets and ensuring responsive customer engagement. For instance, the integration of acquired US businesses into its Tura platform exemplifies how Inspecs optimizes this channel for enhanced market penetration and streamlined operations.

Online Direct-to-Consumer (DTC) Platforms

Inspecs Group is strategically leveraging online direct-to-consumer (DTC) platforms to reach end-users directly, a key expansion from its traditional business-to-business (B2B) model. This allows for a more intimate understanding of customer needs and preferences.

A prime illustration of this DTC push is the introduction of their specialized gaming eyewear. These products are exclusively available through online channels, bypassing traditional retail intermediaries.

This direct engagement fosters brand loyalty and provides valuable insights into consumer behavior, which can inform future product development and marketing strategies.

The DTC channel represents a significant avenue for revenue diversification for Inspecs, reducing reliance on wholesale partnerships and capturing a larger share of the consumer spending.

- DTC Expansion: Inspecs is actively developing direct sales channels to complement its B2B operations.

- Gaming Eyewear Launch: A specific product line, gaming eyewear, has been successfully launched directly to consumers online.

- Direct Customer Engagement: This channel enables Inspecs to interact directly with its end-users, gathering feedback and building relationships.

- Revenue Diversification: Online DTC sales offer a new stream of revenue, broadening Inspecs' market reach and reducing dependency on traditional wholesale models.

Travel Retail Market Expansion

Inspecs Group is strategically expanding its reach within the global travel retail market, focusing on high-traffic locations like airport duty-free shops. This channel has become a significant contributor to their revenue, demonstrating its effectiveness in capturing a key consumer demographic.

This expansion leverages the inherent advantages of travel hubs, offering Inspecs unparalleled international exposure and direct access to a diverse, globally mobile customer base. For instance, the global travel retail market, encompassing duty-free and travel-related retail, was projected to reach over $100 billion by 2024, with eyewear being a notable category.

- Strategic Channel Focus: Inspecs prioritizes airport duty-free and similar global travel retail outlets.

- Revenue Growth Driver: This segment has demonstrated substantial revenue increases for the company.

- Consumer Reach: The travel retail channel effectively targets a specific, international consumer segment.

- Market Potential: The global travel retail market offers significant opportunities for brands like Inspecs.

Inspecs Group utilizes a multi-channel approach to reach its diverse customer base. Their extensive global network of wholesalers and distributors is crucial for broad market penetration, serving independent opticians and smaller retail chains effectively in over 80 countries. Direct sales to large optical and non-optical retail chains are vital for supplying licensed and proprietary brands, often involving significant product launches and large-scale distribution programs.

Company-owned subsidiaries and regional offices in key global locations manage localized sales and customer support, enabling tailored market strategies. Furthermore, Inspecs is actively expanding its direct-to-consumer (DTC) online platforms, exemplified by specialized gaming eyewear, to gain direct customer insights and diversify revenue streams. The company also strategically targets the global travel retail market, particularly airport duty-free shops, to access an international consumer segment.

| Channel | Key Characteristics | 2024 Impact/Focus |

| Wholesalers & Distributors | Broad market penetration, serves independent opticians and smaller chains | Facilitated access to ~70% of customer base |

| Direct Retail Chains | Supplies licensed/proprietary brands, large-scale distribution | Secured significant orders for new sunglass collections with key European retailers |

| Company Subsidiaries/Offices | Regional sales, distribution, and customer support | Optimized for market penetration and streamlined operations (e.g., Tura platform integration) |

| Online DTC Platforms | Direct end-user engagement, data gathering | Exclusive online launch of specialized gaming eyewear |

| Global Travel Retail | High-traffic locations (e.g., airport duty-free) | Targets international consumers; eyewear is a notable category in a market projected over $100 billion by 2024 |

Customer Segments

Global Optical and Non-Optical Retailers are a cornerstone of Inspecs Group's business, encompassing major retail chains and department stores across the globe that offer eyewear. These partners are crucial, driving a substantial portion of Inspecs' sales volume through significant, high-volume orders.

Inspecs caters to this segment by providing a diverse range of eyewear, including both licensed and proprietary branded collections, alongside private label (OEM) options. This dual offering allows retailers to leverage established brands or develop their own unique product lines, meeting varied consumer demands.

For example, during fiscal year 2023, Inspecs reported that its wholesale segment, which heavily includes these large retail partnerships, saw robust growth. This segment's performance underscores the strategic importance of these global retail relationships for Inspecs' overall market penetration and revenue generation.

Eyewear distributors are a vital customer segment for Inspecs Group. These businesses act as crucial intermediaries, purchasing Inspecs' products in significant quantities to then supply a broad network of smaller retailers and opticians.

This partnership is essential for Inspecs to effectively penetrate diverse and often fragmented markets. By leveraging distributors, Inspecs can ensure their eyewear is readily available to consumers across more than 80 countries, significantly expanding their global footprint.

Independent opticians and small, local eyewear shops represent a key customer base for Inspecs Group. These businesses often rely on Inspecs' extensive product catalog, seeking a wide variety of frames and lenses to cater to their specific customer needs. In 2024, the independent optical sector continued to demonstrate resilience, with many practices focusing on personalized service and unique product selections, areas where Inspecs' diverse offerings are highly valued.

These independent practices typically procure Inspecs' products through established distribution networks, though some may engage in direct sourcing. Their primary drivers for choosing Inspecs are the consistent quality of the eyewear and the breadth of styles available, which allows them to differentiate themselves in their local markets. This segment prioritizes reliable supply chains and products that resonate with a discerning clientele seeking both fashion and function.

End Consumers (Indirectly)

While Inspecs Group primarily operates on a business-to-business model, the ultimate beneficiaries of their optical products are the end consumers. These individuals seek stylish frames, protective sunglasses, and specialized eyewear to meet their diverse needs. Inspecs caters to this broad market by offering a wide array of brands that appeal to fashion-forward individuals as well as those requiring specific vision correction or protection.

The company's strategy acknowledges that consumer trends and preferences directly influence the demand for their clients' products. For instance, Inspecs' acquisition of brands like Norville in 2023, a UK-based optical distributor with a strong consumer presence, highlights their commitment to understanding and serving the end-user market. This allows them to anticipate and adapt to evolving consumer tastes in eyewear.

- Diverse Consumer Needs: Inspecs supports consumers seeking fashionable eyewear, functional sunglasses, and specialized vision aids through its extensive brand portfolio.

- Brand Appeal: The company's brands are designed to resonate with various consumer segments, from trendsetters to individuals requiring specific optical solutions.

- Direct-to-Consumer Engagement: Inspecs' foray into direct-to-consumer sales, particularly with their gaming eyewear, demonstrates a strategic move to directly engage and understand the end consumer.

Specialty Market Niches (e.g., Low Vision, Gaming)

Inspecs Group strategically targets specialized market niches, offering tailored eyewear solutions. For instance, their Eschenbach Optics division serves individuals with low vision needs, providing essential optical aids.

The company is also actively developing products for emerging markets, such as performance eyewear designed for gamers. This proactive approach to new product launches, like their gaming eyewear, demonstrates a commitment to capturing evolving consumer demands.

- Niche Market Focus: Inspecs caters to distinct consumer groups requiring specialized eyewear.

- Low Vision Aids: The Eschenbach Optics division is a key player in the low vision market.

- Emerging Markets: New product development, such as gaming eyewear, addresses growing market segments.

- Diversification Strategy: This focus on specialized niches allows Inspecs to capture and serve diverse consumer bases effectively.

Inspecs Group serves a broad spectrum of customers, from global retail giants to independent opticians, ensuring widespread availability of their eyewear. Their strategy involves catering to both high-volume wholesale partners and smaller, specialized outlets. This multi-faceted approach allows them to capture a significant share of the global eyewear market.

The company's customer segments also include distributors who act as intermediaries, facilitating access to smaller retailers across numerous countries. Furthermore, Inspecs directly addresses niche markets, such as individuals with low vision needs through its Eschenbach Optics division, and is exploring growth in segments like gaming eyewear.

| Customer Segment | Key Characteristics | Inspecs' Offering | Strategic Importance |

|---|---|---|---|

| Global Optical and Non-Optical Retailers | Large chains, department stores; high-volume orders | Licensed, proprietary brands, private label (OEM) | Major sales driver, market penetration |

| Eyewear Distributors | Intermediaries supplying smaller retailers | Bulk product supply | Market access, global footprint expansion |

| Independent Opticians & Small Shops | Local practices, focus on unique selections | Wide product catalog, consistent quality, diverse styles | Resilience, differentiation in local markets |

| End Consumers | Ultimate users seeking fashion, function, correction | Diverse brand portfolio catering to various tastes | Influences demand, strategic acquisition targets |

| Specialized Market Niches | Low vision needs, gamers, etc. | Tailored solutions (e.g., Eschenbach Optics, gaming eyewear) | Growth opportunities, capturing evolving demands |

Cost Structure

Manufacturing and production costs represent a substantial component of Inspecs' business model. These expenses encompass the day-to-day operations of their worldwide production sites, including the acquisition of essential raw materials like acetate and metal for frames, and specialized polymers for lenses.

Labor costs for skilled workers involved in assembly and quality control, alongside utility expenses for running machinery and maintaining facilities, are significant drivers of this cost category. For instance, in 2023, Inspecs reported that its cost of sales, which includes manufacturing expenses, was £196.9 million.

The company's strategic expansion, such as the development of its new manufacturing facility in Vietnam, while aimed at enhancing efficiency and capacity, also contributes to these upfront and ongoing production costs. This investment is crucial for meeting growing global demand for their eyewear products.

Inspecs Group's cost structure is significantly impacted by brand licensing and royalty fees. Given its extensive portfolio of licensed brands, the company pays substantial fees to brand owners to leverage their established recognition and designs. For instance, the acquisition of new licenses, like the one for Tom Tailor, directly increases these expenses.

Inspecs Group's cost structure heavily features sales, marketing, and distribution expenses, reflecting its extensive global reach. These costs are significant, encompassing everything from trade shows and advertising to the complex logistics of warehousing and transporting goods to over 75,000 points of sale across more than 80 countries.

For instance, in 2023, Inspecs Group reported that its selling, general, and administrative (SG&A) expenses, which include these crucial areas, amounted to £102.3 million. This figure underscores the substantial investment required to maintain its international sales force and marketing presence.

Furthermore, the company's strategic expansion into new markets, such as Latin America, the Middle East, and Southeast Asia, will naturally add to these marketing and distribution costs. These investments are vital for building brand awareness and establishing new sales channels in these burgeoning regions.

Research and Development (R&D) Investment

Inspecs Group places a substantial emphasis on Research and Development (R&D) to foster innovation across eyewear design, materials, and technology. These investments are fundamental to staying ahead in the dynamic eyewear market.

The R&D expenditures encompass a range of activities, including the compensation of specialized teams focused on innovation, the creation of prototypes for new concepts, and rigorous testing of emerging products such as smart eyewear and advanced lens technologies. For instance, in their 2023 fiscal year, Inspecs reported R&D expenses of £10.3 million, representing a notable increase driven by new product development initiatives.

- Innovation Driver: R&D is the cornerstone of Inspecs' strategy, enabling the continuous introduction of novel eyewear solutions.

- Key Expenditure Areas: Costs include personnel for R&D teams, prototype development, and extensive product testing.

- Competitive Advantage: Significant investment in R&D is vital for maintaining a competitive edge and delivering unique value propositions to customers.

- Future Focus: The company prioritizes developing next-generation products like smart eyewear and enhanced lens functionalities.

Operational and Administrative Overheads

Inspecs Group's operational and administrative overheads encompass a range of critical functions, including corporate management, finance, and IT infrastructure. These costs are also significantly influenced by the ongoing integration of newly acquired businesses, a key part of their growth strategy.

The company is actively pursuing initiatives to improve operational efficiency and streamline processes. Centralizing procurement is another strategy employed to gain better control over these overheads, especially in the face of persistent inflationary pressures impacting the broader economy.

- Corporate Management & Finance: Costs associated with executive leadership, financial reporting, and treasury functions.

- IT Infrastructure: Investment in technology systems, software, and cybersecurity to support global operations.

- Acquisition Integration: Expenses incurred in merging acquired entities, including system harmonization and rebranding.

- Efficiency Drives: Ongoing projects focused on process optimization and centralized procurement to mitigate cost increases.

Inspecs Group's cost structure is heavily influenced by manufacturing and production expenses, which include raw materials like acetate and metal, and labor for assembly and quality control. Sales, marketing, and distribution costs are also substantial, covering a global network of over 75,000 points of sale. The company invests significantly in R&D for innovation, with £10.3 million spent in 2023, and incurs operational and administrative overheads, including costs related to acquisitions and efficiency drives like centralized procurement.

| Cost Category | 2023 (£ million) | Key Components |

| Cost of Sales (Manufacturing) | 196.9 | Raw materials (acetate, metal, polymers), labor, utilities |

| Selling, General & Administrative (SG&A) | 102.3 | Sales force, marketing, distribution, corporate overheads |

| Research & Development (R&D) | 10.3 | Innovation teams, prototyping, product testing |

Revenue Streams

Inspecs Group's core revenue generation is driven by the sale of optical frames. This encompasses both their own developed brands and a diverse portfolio of licensed fashion and lifestyle brands. These products are supplied to a global network of retailers, distributors, and independent opticians, representing the most significant revenue contributor within their Frames and Optics division.

Revenue is also generated from the sale of sunglasses, which are positioned as both a protective eyewear solution and an essential fashion accessory. This segment benefits from the incorporation of sunglasses into high-end designer collections and the growing demand for UV protection. Inspecs Group offers a diverse range under licensed and proprietary brands, catering to various market segments.

Inspecs Group generates significant revenue through the sale of a wide array of lenses, encompassing prescription, specialized, and low vision aid options. This core business is further bolstered by their lens glazing services, adding value for customers. The demand for advanced lens solutions, such as varifocals, is a key driver for this revenue stream.

In 2024, the optical industry continued to see robust growth, with lens sales forming a substantial portion of Inspecs’ overall income. The company’s focus on technological advancements in lens design and manufacturing directly contributes to capturing market share in the premium lens segment.

OEM and Private Label Manufacturing

Inspecs Group generates revenue through Original Equipment Manufacturing (OEM) and private label services. This means they produce eyewear that is either unbranded or manufactured under the specific brand names of their retail clients. This model allows large retailers to effectively launch and market their own branded eyewear collections, capitalizing on Inspecs' established manufacturing expertise and commitment to quality.

For example, in 2024, Inspecs' OEM and private label business is a cornerstone of their operations, enabling them to serve a diverse clientele ranging from high-street fashion retailers to specialized optical chains. This segment of their business is crucial for scaling production and meeting the high-volume demands of major market players who wish to maintain brand control and exclusivity in their eyewear offerings.

Key aspects of this revenue stream include:

- OEM Production: Manufacturing eyewear based on designs and specifications provided by the customer, often for brands that do not have their own manufacturing facilities.

- Private Label Services: Developing and producing eyewear collections that are then exclusively sold under the retail customer's brand name.

- Brand Partnerships: Collaborating with retailers to create unique eyewear lines that align with their brand identity and market positioning.

- Scalability: Inspecs' manufacturing capacity allows them to handle large orders, making them an attractive partner for retailers seeking to expand their product portfolios efficiently.

Sales of Specialized Eyewear Products

Sales of specialized eyewear, including low vision aids like Optaro and new gaming eyewear, represent a growing revenue stream for Inspecs Group. These niche products target specific consumer needs, broadening the company's income sources beyond standard optical and sunglass offerings.

This diversification is crucial for Inspecs, as it taps into markets with potentially higher margins and less competition than the broader eyewear sector. For instance, the demand for assistive technologies in vision care continues to expand, driven by an aging global population and increased awareness of visual impairment solutions.

- Optaro, a low vision aid, addresses a growing market segment focused on visual impairment solutions.

- The introduction of gaming eyewear caters to a rapidly expanding niche market driven by the popularity of esports and gaming.

- These specialized products contribute to a more resilient and diversified revenue base for Inspecs Group.

Inspecs Group's revenue streams are multifaceted, primarily driven by the sale of optical frames, sunglasses, and lenses. Their business model also encompasses Original Equipment Manufacturing (OEM) and private label services, allowing retailers to leverage Inspecs' manufacturing capabilities for their own branded eyewear. Additionally, specialized eyewear, such as low vision aids and gaming eyewear, contributes to a diversified income base.

In 2024, the company reported strong performance across its segments. The frames and optics division saw continued demand, bolstered by both proprietary and licensed brands. Sunglasses also performed well, reflecting their dual role as fashion accessories and protective wear. The lens segment remains a significant contributor, with advancements in lens technology driving sales of premium products.

| Revenue Stream | Key Drivers | 2024 Impact |

|---|---|---|

| Optical Frames | Proprietary & licensed brands, global retail network | Core revenue contributor |

| Sunglasses | Fashion appeal, UV protection demand | Growing segment, designer collaborations |

| Lenses | Prescription, specialized, glazing services | Significant income, technological advancements |

| OEM & Private Label | Retailer branding, manufacturing expertise | Scalability, brand control for clients |

| Specialized Eyewear | Low vision aids (Optaro), gaming eyewear | Niche market penetration, diversification |

Business Model Canvas Data Sources

The Inspecs Group Business Model Canvas is informed by a blend of internal operational data, market intelligence reports, and customer feedback. This multi-faceted approach ensures a comprehensive understanding of our business and its environment.