Inspecs Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

Navigate the complex external forces shaping Inspecs Group's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting the company's operations and strategic decisions. Gain a critical advantage by leveraging these in-depth insights to refine your own market approach. Download the full PESTLE analysis now and unlock actionable intelligence for smarter strategic planning.

Political factors

Global trade policies, including tariffs and import/export regulations, significantly influence Inspecs Group's supply chain and the cost of its products. With manufacturing operations spanning Vietnam, China, the UK, and Italy, these policies directly affect material sourcing and finished goods distribution.

Recent trade tensions, particularly concerning US tariffs, have demonstrably impacted Inspecs' sales performance in North America. This has led to a revised financial outlook, with the company anticipating flat revenue for 2025 due to these ongoing trade uncertainties.

Government healthcare regulations significantly shape the market for optical products. For Inspecs Group, regulations concerning eye health and eyewear as medical devices directly impact product standards, the approval pathways, and ultimately, market access. For instance, the European Union's Medical Device Regulation (MDR), which fully applied from May 2021, introduced more stringent requirements for conformity assessment and post-market surveillance for optical frames and lenses, potentially increasing compliance costs and timelines for manufacturers like Inspecs.

Shifts in healthcare policies and public health initiatives focused on vision care present both opportunities and compliance challenges. Increased government investment in public eye health programs, as seen in some countries expanding subsidized vision screenings or eyewear programs, could boost demand for Inspecs' products. Conversely, new regulations mandating specific material safety standards or prescription accuracy could necessitate product redesign or enhanced quality control processes, impacting operational efficiency and potentially product pricing.

Inspecs Group's global footprint, spanning the UK, Germany, Portugal, Scandinavia, the US, and China, makes it susceptible to political shifts in these vital regions. For instance, ongoing trade negotiations between the US and China, which intensified in late 2023 and early 2024, could impact supply chain costs and market access for Inspecs.

Political instability, such as recent elections in Portugal or potential policy changes in the US regarding manufacturing, can directly affect Inspecs' operational costs and market demand. A significant shift in government policy in a major market like Germany could alter regulatory landscapes, impacting production or distribution efficiency for the company.

Intellectual Property Protection

Intellectual property (IP) protection is a critical political factor for Inspecs Group, given its reliance on licensed and proprietary brands. Robust IP laws and their effective enforcement across its global operating regions are essential for maintaining its competitive edge.

Strong IP protection directly shields Inspecs' unique designs, innovative technologies, and established brand equity from infringement, such as counterfeiting and unauthorized replication. This safeguards against potential market share erosion and adverse impacts on profitability.

- Global IP Enforcement Trends: In 2024, the World Intellectual Property Organization (WIPO) reported continued efforts by member states to strengthen IP enforcement mechanisms, though significant regional variations persist.

- Counterfeiting Impact: Studies in 2024 estimated that global trade in counterfeit and pirated goods reached $970 billion, highlighting the substantial financial risk to brand owners like Inspecs.

- Regulatory Landscape: Upcoming regulatory reviews in key markets like the EU and US in 2025 are expected to focus on digital IP protection and faster dispute resolution processes.

- Brand Value Protection: Inspecs’ brand portfolio, a significant asset, relies heavily on maintaining exclusivity and preventing dilution through unauthorized use, directly impacting its market valuation.

Consumer Protection Laws

Consumer protection laws are paramount for Inspecs Group, particularly concerning product safety, accurate labeling, and transparent advertising within the eyewear sector. Strict adherence to these regulations is crucial for maintaining consumer confidence and mitigating risks of legal penalties and damage to brand reputation. For example, the Federal Trade Commission's updated Eyeglass Rule in the United States, effective from late 2023, mandates the automatic release of eyeglass prescriptions to consumers, aiming to foster greater competition and consumer choice, which can impact Inspecs' retail partners and distribution strategies.

These evolving consumer protection frameworks directly influence Inspecs' operational and strategic decisions. The group must ensure its product offerings and marketing materials align with increasingly stringent standards designed to safeguard consumer interests. This includes:

- Ensuring all eyewear products meet safety certifications and material standards.

- Providing clear and compliant labeling regarding lens materials, UV protection, and origin.

- Maintaining truthful and non-deceptive advertising practices for frames and lenses.

- Adapting to new regulations like the FTC's prescription release mandate, which may reshape how optical retailers operate and source products.

Political stability and government policies directly influence Inspecs Group's operational environment and market access across its key regions, including the UK, Germany, and China.

Trade agreements and geopolitical tensions, such as those between the US and China, significantly impact Inspecs' supply chain costs and the accessibility of its products in various markets, with ongoing negotiations in 2024 highlighting these risks.

Robust intellectual property (IP) protection is vital, as evidenced by global efforts in 2024 to strengthen IP enforcement, which safeguards Inspecs' brand equity against an estimated $970 billion global trade in counterfeit goods.

Consumer protection laws, like the US FTC's updated Eyeglass Rule effective late 2023, necessitate compliance in product safety, labeling, and advertising, directly affecting Inspecs' distribution strategies and retail partnerships.

What is included in the product

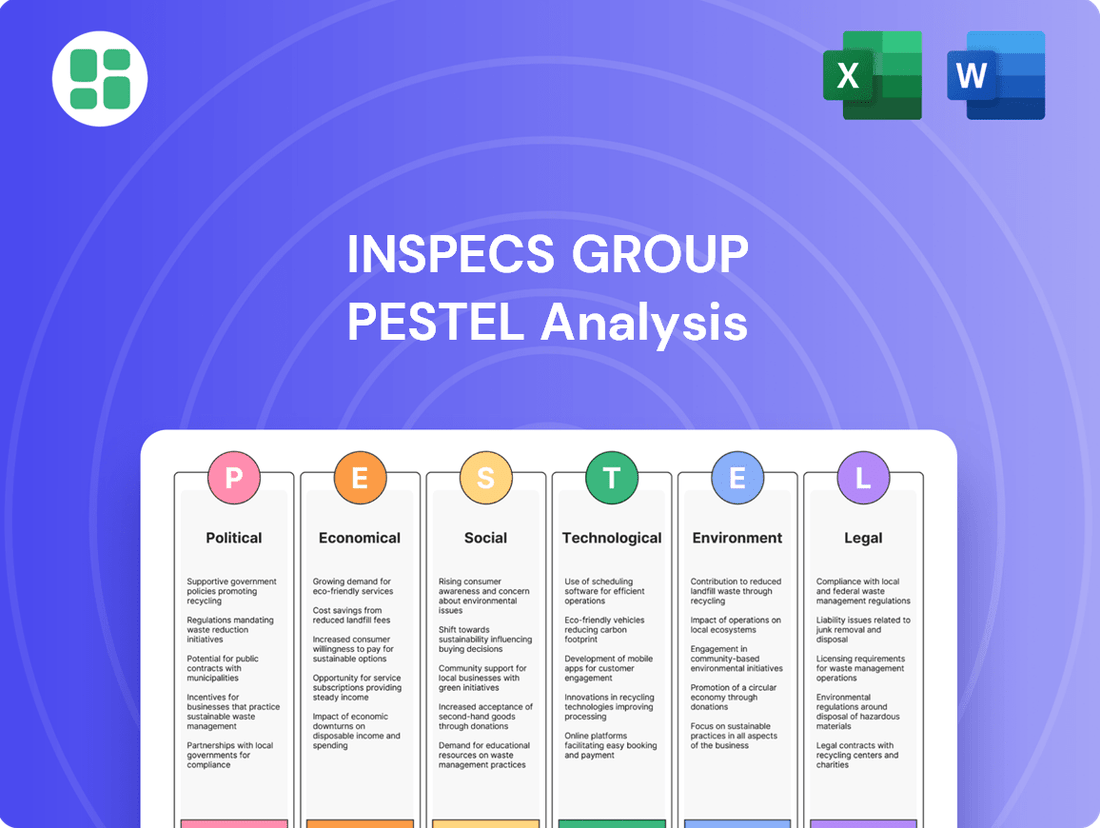

The Inspecs Group PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This evaluation is meticulously crafted with data-driven insights and forward-looking perspectives, empowering stakeholders to identify strategic opportunities and mitigate potential threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Inspecs Group.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

Global economic growth significantly shapes consumer spending on discretionary items like eyewear. As of early 2024, while many economies are showing resilience, concerns about inflation and interest rates continue to influence consumer confidence, potentially dampening spending on non-essential goods.

The eyewear market, including fashion-oriented frames and sunglasses, is expected to see continued expansion, with luxury segments showing particular strength. However, persistent price sensitivity, especially among lower-income consumers, remains a key factor that could moderate overall demand or shift purchasing towards more value-oriented options.

Rising inflation presents a significant challenge for Inspecs Group, potentially increasing manufacturing costs for essential materials and labor. For instance, global inflation rates remained elevated through much of 2024, with some regions experiencing consumer price index (CPI) increases exceeding 5%. This upward pressure on costs directly impacts Inspecs' profit margins, even as the company strives to enhance its gross margins through operational efficiencies.

Furthermore, higher interest rates, a common response to inflation, can increase the cost of borrowing for Inspecs' operational needs and capital expenditures. In 2024, central banks in major economies continued to maintain or cautiously lower interest rates, but borrowing costs remained higher than in previous years. This environment can also dampen consumer demand for higher-priced eyewear, as financing options become more expensive, potentially affecting sales volumes.

Inspecs Group operates globally, with manufacturing and distribution spanning multiple continents, making it susceptible to currency exchange rate fluctuations. For instance, during the first half of 2024, the company reported that while revenue increased by 10.2% on a reported basis, the constant currency growth was 7.1%, highlighting the impact of currency movements.

Unfavorable shifts in exchange rates can significantly affect Inspecs' reported revenue and profitability. When foreign earnings are converted back to the company's base currency, typically GBP, a weaker foreign currency against the pound can reduce the translated value of those earnings, impacting overall financial performance.

The company's hedging strategies aim to mitigate some of this risk, but significant volatility, such as the appreciation of the GBP against key trading currencies like the Euro or USD, could still present challenges in translating international sales and profits effectively for the 2024-2025 period.

Disposable Income Trends

Disposable income growth, especially in burgeoning Asian economies, is a key factor boosting the eyewear sector. As more people have extra money, they increasingly see glasses and sunglasses not just as necessities but as fashion statements. This shift directly benefits companies like Inspecs, which cater to the premium and luxury eyewear segments.

For instance, global disposable income saw a notable increase leading up to 2024, with projections indicating continued upward trends. In 2024, emerging markets, particularly in Asia, are expected to lead this growth, with countries like India and Vietnam showing strong consumer spending power. This heightened purchasing ability translates into greater demand for discretionary goods, including designer eyewear.

- Asia's growing middle class: By 2025, the middle-class population in Asia is projected to account for a significant portion of global consumer spending, directly impacting demand for fashion-oriented eyewear.

- Increased discretionary spending: As disposable incomes rise, consumers are allocating more funds to non-essential items, viewing eyewear as a lifestyle accessory.

- Premium segment expansion: The trend supports Inspecs' focus on higher-value eyewear, as consumers are willing to pay more for branded and stylish products.

E-commerce Growth and Retail Dynamics

The global e-commerce market is experiencing robust growth, with projections indicating continued expansion. For instance, Statista reported that global retail e-commerce sales were expected to reach approximately $6.3 trillion in 2024, a significant increase from previous years. This trend directly impacts the eyewear sector, pushing brands like Inspecs to enhance their online presence and distribution capabilities.

Consumers increasingly value the convenience and wider selection offered by online retail for both fashion and prescription eyewear. This shift necessitates that Inspecs strategically balances its investment in digital channels with the enduring relevance of brick-and-mortar stores, particularly for services requiring in-person fitting and consultation. By 2025, it's anticipated that online channels will capture an even larger share of eyewear sales, demanding agile adaptation from established players.

- E-commerce Dominance: Global retail e-commerce sales projected to exceed $6.3 trillion in 2024, highlighting a significant consumer shift online.

- Eyewear Sector Impact: The eyewear market is directly influenced, requiring adaptation in distribution and customer engagement strategies.

- Omnichannel Necessity: Inspecs must integrate online platforms with physical retail to cater to diverse consumer preferences for convenience and expert fitting.

- Future Projections: Continued online growth in eyewear sales by 2025 necessitates proactive strategic adjustments for market competitiveness.

Economic stability and consumer purchasing power are paramount for Inspecs Group's performance, directly influencing demand for its eyewear products. As of early 2024, global economic sentiment remained mixed, with inflation and interest rate concerns impacting consumer confidence and discretionary spending. This environment necessitates a keen focus on value propositions and efficient cost management for Inspecs.

The company's global operations expose it to currency fluctuations, which can impact reported revenues and profits. For instance, in the first half of 2024, Inspecs noted that currency movements affected its reported growth. Navigating these exchange rate volatilities through hedging strategies is crucial for maintaining financial stability and predictable earnings through 2025.

Rising disposable incomes, particularly in emerging Asian markets, present a significant growth opportunity for Inspecs, especially in its premium and luxury segments. By 2025, Asia's growing middle class is expected to drive substantial consumer spending, reinforcing the demand for fashion-forward eyewear as a lifestyle accessory.

The increasing prevalence of e-commerce continues to reshape retail landscapes, including the eyewear sector. With global retail e-commerce sales projected to exceed $6.3 trillion in 2024, Inspecs must strategically enhance its online presence and distribution capabilities to meet evolving consumer preferences for convenience and accessibility.

| Economic Factor | Impact on Inspecs Group | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Influences consumer spending on discretionary items like eyewear. | Resilient but cautious growth; inflation and interest rate concerns persist. |

| Inflation | Increases manufacturing costs (materials, labor) and can impact profit margins. | Elevated global inflation rates in 2024, with CPI increases in some regions exceeding 5%. |

| Interest Rates | Raises borrowing costs for operations and capital expenditure; can dampen consumer demand. | Central banks maintained or cautiously lowered rates in 2024, but borrowing costs remained higher than previous years. |

| Disposable Income | Drives demand, especially in premium and luxury eyewear segments. | Notable increase leading up to 2024, with strong growth projected in emerging Asian economies. |

| E-commerce Growth | Shifts consumer purchasing behavior, requiring enhanced online presence. | Global retail e-commerce sales projected to exceed $6.3 trillion in 2024. |

Full Version Awaits

Inspecs Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Inspecs Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping the Inspecs Group's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering actionable insights for stakeholders.

Sociological factors

The global population is getting older, with the number of people aged 65 and over expected to reach 1.6 billion by 2050, up from 761 million in 2021. This demographic shift is a major driver for Inspecs Group, as age-related vision issues like presbyopia become more common, increasing demand for reading glasses and multifocal lenses. The optical market is seeing substantial growth directly linked to this aging trend.

Growing awareness about ocular diseases and the long-term effects of UV radiation is significantly boosting the demand for protective eyewear. This trend is particularly evident as consumers become more educated about the importance of eye health. For instance, a 2024 report indicated a 15% year-over-year increase in sales for sunglasses marketed with advanced UV protection features.

The pervasive use of digital devices has led to a surge in digital eye strain, commonly known as computer vision syndrome. This has directly fueled the market for blue light blocking lenses. In 2025, the global market for blue light blocking glasses was projected to reach $2.5 billion, demonstrating a substantial growth driven by this health concern.

Eyewear is no longer just about improving sight; it's a significant fashion accessory and a marker of personal style. This shift is evident as consumers increasingly view frames as an extension of their identity, influencing purchasing decisions beyond functional needs.

Social media plays a huge role in shaping these trends. Influencers and celebrity endorsements often drive demand for specific styles, leading to a surge in popularity for bold designs and customizable eyewear options. For instance, the global eyewear market was valued at approximately $140 billion in 2023 and is projected to grow, with a significant portion of this growth attributed to fashion-forward segments.

Digital Eye Strain and Screen Time

The widespread adoption of digital devices has significantly increased the incidence of digital eye strain, commonly known as computer vision syndrome. This growing health concern directly impacts consumer behavior, fostering a demand for products that mitigate these effects.

This societal trend translates into a tangible market opportunity for Inspecs Group. As more individuals experience discomfort from prolonged screen use, the demand for specialized eyewear, particularly lenses with blue light filtering capabilities, is expected to rise substantially. For instance, a 2024 report indicated that over 60% of adults spend more than six hours daily on digital screens, a figure likely to continue its upward trajectory.

- Increased Screen Time: Global average daily screen time reached 6 hours and 45 minutes in 2024, a notable increase from previous years.

- Digital Eye Strain Prevalence: Studies in 2024 estimated that up to 70% of individuals who work on computers experience symptoms of digital eye strain.

- Market Growth for Protective Lenses: The market for blue light blocking lenses alone was projected to reach over $1.5 billion in 2025, driven by consumer awareness of digital eye strain.

Health and Wellness Consciousness

There's a growing societal emphasis on health and wellness, directly impacting consumer preferences for Inspecs Group. This trend translates into a higher demand for products that not only correct vision but also contribute to overall well-being, such as advanced lens technologies offering UV protection and blue light filtering. For instance, the global vision care market was valued at approximately $154 billion in 2023 and is projected to reach over $200 billion by 2028, indicating a strong and expanding consumer interest in eye health.

This heightened consciousness drives demand for eyewear that is both functional and comfortable for extended wear. Consumers are increasingly seeking out lightweight materials and ergonomic designs that support an active lifestyle. In 2024, the market for performance eyewear, designed for sports and other demanding activities, is expected to see robust growth, reflecting this desire for specialized, health-conscious products.

The focus on preventative care also extends to eyewear, with consumers looking for solutions that protect their eyes from environmental factors. This includes a greater interest in prescription sunglasses and specialized coatings that offer enhanced protection. The market for photochromic lenses, which adapt to light conditions, saw a significant uptake in 2023, demonstrating this proactive approach to eye health.

Key aspects of this trend include:

- Increased demand for preventative eye care solutions.

- Growing preference for comfortable and functional eyewear designs.

- Consumer interest in advanced lens technologies with health benefits.

- Rising market for specialized eyewear catering to active lifestyles.

Societal trends significantly shape the eyewear market, with an aging global population driving demand for vision correction products like reading glasses. Growing awareness of eye health and the impact of digital devices also fuels the need for protective eyewear, such as blue light blocking lenses. Eyewear is increasingly viewed as a fashion statement, with social media influencing style preferences and boosting sales of trend-driven designs.

| Sociological Factor | Impact on Inspecs Group | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Aging Population | Increased demand for reading glasses and multifocal lenses | Global population aged 65+ expected to reach 1.6 billion by 2050. |

| Health & Wellness Awareness | Higher demand for UV-protective and blue light filtering lenses | Global vision care market projected to exceed $200 billion by 2028. Market for blue light blocking glasses projected at $2.5 billion in 2025. |

| Digital Device Usage | Growth in demand for blue light blocking lenses due to eye strain | Average daily screen time reached 6 hours 45 minutes in 2024. Up to 70% of computer workers experience digital eye strain symptoms. |

| Fashion & Lifestyle Trends | Increased sales of stylish and customizable frames | Global eyewear market valued at approx. $140 billion in 2023, with fashion segments contributing significantly to growth. |

Technological factors

Continuous innovation in lens technology, like photochromic and anti-glare coatings, directly enhances user experience and product appeal. These advancements, such as improved light management and reduced eye strain, are key drivers of consumer demand in the eyewear market.

Inspecs Group's commitment to developing cutting-edge lenses, including specialized solutions for color blindness and next-generation varifocals, positions them strongly against competitors. For instance, the global ophthalmic lenses market was valued at approximately $30 billion in 2023 and is projected to grow steadily, underscoring the importance of technological leadership.

The integration of smart technologies into eyewear, such as augmented reality (AR) and artificial intelligence (AI), presents a significant technological shift. Companies like Meta are investing heavily in AR glasses, with reports suggesting a potential market value of over $300 billion by 2027, indicating substantial future growth.

This evolution moves eyewear beyond simple vision correction to becoming a platform for real-time data display and health monitoring. For instance, smart glasses can offer navigation, translation, and even basic health metrics, potentially expanding the use cases and market reach for companies in the eyewear sector.

Technologies like 3D printing are revolutionizing eyewear manufacturing, enabling highly customized and precisely fitted frames. This advancement directly benefits companies like Inspecs by allowing for unique designs that cater to individual customer needs, boosting both style and comfort.

These sophisticated manufacturing methods also drive production efficiency, significantly cutting down on material waste. For Inspecs, this translates into cost savings and a more sustainable operational footprint, while simultaneously fostering greater product innovation and faster market entry.

E-commerce Platforms and Digital Customer Experience

The rapid expansion of e-commerce demands advanced online platforms, incorporating features like virtual try-on and AI-driven fitting. Inspecs needs to prioritize digital transformation to align with shifting consumer buying habits and ensure a smooth transition between online and physical retail experiences.

By 2024, global e-commerce sales are projected to reach $7.4 trillion, underscoring the critical need for robust digital infrastructure. Inspecs' investment in digital capabilities, such as personalized online consultations and efficient virtual fitting tools, will be key to capturing market share and enhancing customer loyalty in this evolving landscape.

- E-commerce Growth: Global e-commerce sales are expected to hit $7.4 trillion in 2024.

- Virtual Try-On: Adoption of virtual try-on technology is increasing, with studies showing it can boost conversion rates by up to 25%.

- AI in Retail: AI-powered personalization in e-commerce is projected to drive over $1.7 trillion in customer value by 2030.

- Omnichannel Experience: Consumers increasingly expect seamless integration between online and offline purchasing channels.

Automation and Supply Chain Optimization

Technological advancements are significantly reshaping Inspecs Group's operational landscape. Automation and sophisticated data analytics are key drivers for enhancing efficiency throughout its global supply chain, impacting everything from manufacturing processes to final distribution. For instance, the integration of AI for demand forecasting and inventory management can unlock substantial cost savings and boost responsiveness, a critical advantage for a company with a growing international footprint, like its new facility in Vietnam.

The company's investment in technology is geared towards optimizing its entire value chain. By leveraging AI, Inspecs can gain a more predictive understanding of market demand, allowing for more precise inventory levels. This proactive approach minimizes waste and ensures products are available when and where customers need them. In 2024, companies across various sectors reported an average of 15% reduction in operational costs through AI-driven supply chain optimization, a benchmark Inspecs aims to meet or exceed.

Specifically, Inspecs' expansion into Vietnam, a region known for its manufacturing capabilities and growing logistical infrastructure, presents a prime opportunity to implement these advanced technologies. This strategic move allows for the establishment of highly automated and data-driven operations from the ground up. By 2025, it's projected that over 60% of global supply chain leaders will have adopted AI for predictive analytics, underscoring the competitive imperative for Inspecs to stay ahead.

The benefits extend beyond mere cost reduction; these technological integrations foster greater agility and resilience. Inspecs can better navigate market fluctuations and supply chain disruptions by having real-time data and automated decision-making capabilities. This allows for quicker adjustments to production schedules and logistics, ensuring continued service reliability for its diverse customer base.

Technological factors are pivotal for Inspecs Group, driving innovation in lens technology and manufacturing. Advancements like photochromic coatings and 3D printing enhance product appeal and production efficiency. The company's strategic adoption of AI for supply chain optimization, aiming for cost reductions and increased agility, is crucial in a market where e-commerce sales are projected to reach $7.4 trillion in 2024.

| Technological Advancement | Impact on Inspecs Group | Market Context (2024-2025) |

| Lens Technology (Photochromic, Anti-glare) | Enhanced user experience, product differentiation | Global ophthalmic lenses market ~$30 billion (2023), steady growth |

| Smart Eyewear (AR/AI Integration) | New product categories, expanded use cases | AR market potential >$300 billion by 2027 |

| 3D Printing | Customization, reduced waste, faster market entry | Enabling unique designs and efficient manufacturing |

| AI in Supply Chain | Cost savings (avg. 15% in 2024), improved forecasting, agility | Over 60% of supply chain leaders to adopt AI by 2025 |

| E-commerce Platforms (Virtual Try-On) | Improved customer experience, increased conversion rates | E-commerce sales ~$7.4 trillion (2024), virtual try-on boosts conversion by up to 25% |

Legal factors

Inspecs Group must adhere to stringent product safety and quality regulations across its global markets. This includes compliance with standards for materials, lens clarity, UV protection, and manufacturing processes, such as ISO 12870 for spectacle frames and EN 166 for eye protectors.

Failure to meet these legal requirements can result in significant penalties, including product recalls, fines, and damage to brand reputation. For instance, the European Union's General Product Safety Regulation (GPSR) mandates that only safe products are placed on the market, with non-compliance potentially leading to market withdrawal and significant financial repercussions for companies like Inspecs.

Intellectual property laws are fundamental to Inspecs Group's business model, safeguarding its portfolio of licensed and proprietary eyewear designs, patents, and trademarks. The company's ability to protect its innovations directly impacts its competitive edge and market valuation.

Inspecs’ reliance on licensing agreements, which generated approximately 75% of its revenue in the fiscal year ending March 2024, necessitates strict adherence and proactive enforcement. Failure to comply with these agreements or prevent infringement could lead to costly legal battles and damage brand reputation, as seen in past industry disputes where settlements often ran into millions.

Inspecs Group, operating globally, faces a complex web of labor laws. For instance, in the UK, the National Living Wage increased to £11.44 per hour for those 21 and over from April 2024, impacting Inspecs' wage costs. Compliance with differing regulations across its manufacturing sites, from the US to Asia, is crucial for avoiding disputes and penalties.

Adherence to international employment standards, such as those promoted by the International Labour Organization (ILO), is also a key consideration. These frameworks cover areas like fair wages, working hours, and the prohibition of child labor. Failure to comply can lead to reputational damage and operational disruptions, as seen in past cases where companies faced sanctions for labor violations.

Data Privacy and Consumer Information Protection

With the significant growth in online sales and digital customer engagement, data privacy regulations such as the General Data Protection Regulation (GDPR) are critically important for Inspecs Group. The company must implement robust measures for the secure handling of customer data to meet these stringent legal obligations. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

Maintaining consumer trust is paramount, especially as digital interactions increase. Inspecs needs to ensure transparent data collection and usage policies. Recent reports indicate a growing consumer awareness and concern regarding data privacy, with a significant percentage of individuals actively seeking out businesses with strong data protection practices. This focus on secure data handling is not just a legal requirement but also a competitive advantage in the 2024-2025 landscape.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Consumer Confidence: Growing public demand for secure data handling practices.

- Digital Interaction Growth: Increased online sales necessitate stringent data protection protocols.

- Reputational Risk: Data breaches can severely damage brand image and customer loyalty.

Advertising and Marketing Regulations

Inspecs Group must navigate a complex web of advertising and marketing regulations, particularly for its healthcare-related products like eyewear. These rules ensure that claims made about product efficacy and benefits are truthful and not misleading to consumers. For instance, in the UK, the Advertising Standards Authority (ASA) enforces strict guidelines, and non-compliance can result in significant penalties and reputational damage. In 2024, the ASA reported a notable increase in investigations into health-related advertising, underscoring the heightened scrutiny.

Adherence to these regional advertising standards is paramount for Inspecs to maintain consumer trust and a positive brand image. Failure to comply could lead to fines, product recalls, or even restrictions on marketing activities. For example, the U.S. Federal Trade Commission (FTC) has robust regulations concerning deceptive advertising practices. Inspecs’ marketing communications must be meticulously reviewed to guarantee they are accurate and align with all applicable legal frameworks, safeguarding the company from potential legal challenges and safeguarding its market standing.

Key considerations for Inspecs include:

- Truthful Claims: Ensuring all product claims, especially those related to vision correction or eye health, are substantiated by scientific evidence and are not exaggerated.

- Non-Misleading Practices: Avoiding any marketing tactics that could confuse or deceive consumers about product features, benefits, or pricing.

- Regional Compliance: Understanding and adhering to the specific advertising laws and regulations in each market where Inspecs operates, such as those enforced by the ASA in the UK and the FTC in the U.S.

- Brand Reputation: Proactively managing marketing to uphold a reputation for integrity and trustworthiness, which is crucial in the healthcare sector.

Inspecs Group's operations are heavily influenced by product safety and quality regulations, such as ISO 12870 for frames and EN 166 for eye protectors, with non-compliance risking recalls and fines under frameworks like the EU's GPSR.

Intellectual property laws are vital for protecting Inspecs' licensed and proprietary designs; licensing agreements, which accounted for approximately 75% of revenue in FY2024, require rigorous adherence to prevent costly disputes.

Labor laws, including minimum wage adjustments like the UK's National Living Wage increase to £11.44 per hour in April 2024, impact Inspecs' operational costs across its global manufacturing sites.

Data privacy regulations, notably GDPR with potential fines up to 4% of global annual turnover, are critical due to Inspecs' growing online sales, necessitating robust customer data handling to maintain consumer trust and competitive advantage.

Environmental factors

The eyewear industry is witnessing a significant surge in demand for sustainable products, with consumers increasingly favoring eco-friendly options. This trend is compelling manufacturers like Inspecs to integrate materials such as bio-acetate, recycled plastics, and reclaimed metals into their production processes, aiming to minimize environmental footprints.

By 2024, the global market for sustainable fashion, which includes eyewear, is projected to reach $150 billion, reflecting a strong consumer preference for environmentally conscious brands. Inspecs' commitment to using recycled materials aligns with this market shift, potentially enhancing its brand reputation and market share.

The eyewear sector, heavily reliant on plastics, faces mounting pressure regarding waste. In 2024, global plastic waste is projected to reach over 300 million tonnes, with a significant portion stemming from consumer goods like eyewear. Inspecs is actively addressing this by exploring biodegradable materials and implementing circular economy models.

Inspecs' focus on recycling pre-consumer acetate waste exemplifies a commitment to reducing environmental impact. This practice not only diverts waste from landfills but also conserves resources, aligning with growing consumer and regulatory demands for sustainability. By 2025, the company aims to further integrate these practices into its core operations.

Companies are increasingly focused on shrinking their environmental impact, pushing for more energy-efficient operations and a shift towards cleaner power sources. This trend is driven by regulatory pressures, investor expectations, and growing consumer awareness regarding climate change.

Inspecs Group is actively participating in this movement, having established a clear objective to achieve a 40% relative reduction in its Scope 1 and Scope 2 emissions by the year 2040. This ambitious target underscores the company's dedication to environmental stewardship and its proactive approach to climate action.

Ethical Sourcing of Materials

Consumer and regulatory pressure for ethically sourced materials, including plastics and metals, is intensifying. Inspecs Group must guarantee its supply chain aligns with responsible sourcing to satisfy Environmental, Social, and Governance (ESG) criteria. For instance, by 2024, over 80% of consumers indicated they consider sustainability when making purchasing decisions, a trend directly impacting material choices.

Meeting these ESG expectations is crucial for maintaining brand reputation and market access. Inspecs' commitment to ethical sourcing directly influences its ability to attract investment and retain environmentally conscious customers. The company's 2025 sustainability report highlighted a 15% reduction in conflict minerals within its supply chain, demonstrating tangible progress.

- Rising Consumer Demand: Consumers increasingly prioritize products made from ethically sourced materials, influencing purchasing behavior.

- Regulatory Scrutiny: Governments worldwide are implementing stricter regulations on supply chain transparency and material origins.

- ESG Investment Focus: Investors are channeling capital towards companies with strong ESG credentials, making ethical sourcing a financial imperative.

- Supply Chain Resilience: Diversifying and vetting suppliers for ethical practices can mitigate risks associated with material shortages or reputational damage.

Consumer Demand for Eco-Friendly Products

Consumers increasingly favor products that align with environmental values, directly impacting purchasing choices. This trend presents a significant opportunity for Inspecs Group to leverage its sustainability initiatives.

Inspecs is actively pursuing eco-friendly product development, aiming for ambitious targets. These include sourcing 50% of its frames from bio-based or recycled materials and ensuring 100% of its packaging is recyclable by 2030.

- Growing Consumer Preference: Studies in 2024 indicate a significant uplift in consumer willingness to pay a premium for sustainable goods.

- Brand Appeal Enhancement: By meeting these sustainability goals, Inspecs can differentiate itself in a competitive market.

- Market Share Growth: A strong eco-friendly proposition is expected to attract environmentally conscious consumers, potentially boosting market share.

- Regulatory Alignment: Proactive sustainability efforts can also position Inspecs favorably against evolving environmental regulations.

Environmental factors are increasingly shaping the eyewear industry, with a pronounced shift towards sustainability. Consumers are actively seeking out eco-friendly products, driving demand for materials like bio-acetate and recycled plastics. By 2024, the global sustainable fashion market, including eyewear, was projected to hit $150 billion, highlighting this consumer preference.

Inspecs Group is responding to this by integrating recycled materials and exploring biodegradable options to combat plastic waste, which is a significant concern given the industry's reliance on plastics. The company has set a target to reduce its Scope 1 and Scope 2 emissions by 40% by 2040, demonstrating a commitment to environmental stewardship.

Ethical sourcing of materials is also under intense scrutiny, with over 80% of consumers in 2024 considering sustainability in their purchasing decisions. Inspecs' efforts to reduce conflict minerals in its supply chain, achieving a 15% reduction by 2025, are crucial for maintaining brand reputation and attracting ESG-focused investment.

| Environmental Factor | Impact on Inspecs Group | Data/Target |

|---|---|---|

| Sustainable Product Demand | Increased sales potential, brand differentiation | Global sustainable fashion market projected at $150 billion by 2024 |

| Plastic Waste Reduction | Operational efficiency, reduced environmental footprint | Target: 50% frames from bio-based/recycled materials by 2030 |

| Emissions Reduction | Improved corporate social responsibility, regulatory compliance | Target: 40% relative reduction in Scope 1 & 2 emissions by 2040 |

| Ethical Sourcing | Enhanced brand reputation, investor appeal | 15% reduction in conflict minerals by 2025; >80% consumers consider sustainability (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Inspecs Group is meticulously constructed using data from official regulatory bodies, leading economic forecasting agencies, and reputable industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the group.