Inspecs Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

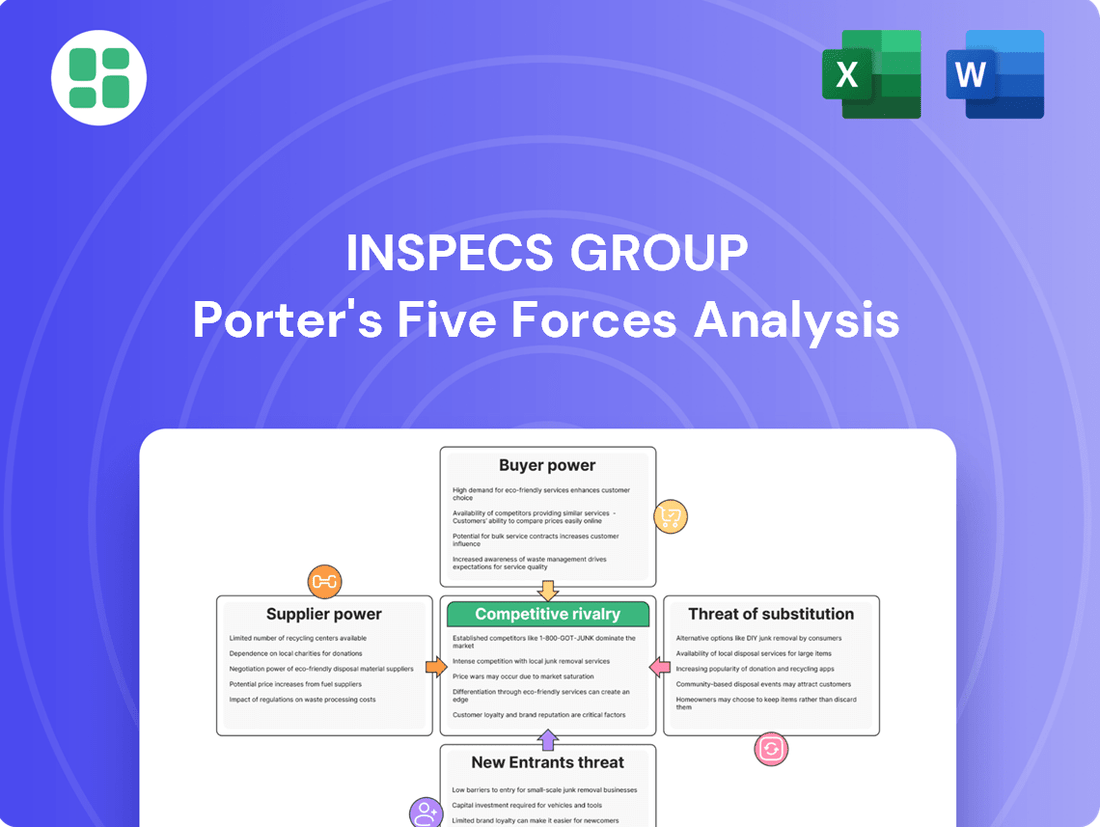

Inspecs Group faces a dynamic competitive landscape shaped by several key forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for navigating this market. Discover how these forces, along with the threat of substitutes and existing rivalry, impact Inspecs Group's strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of Inspecs Group’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Inspecs Group's vertically integrated operations, encompassing in-house design, development, and manufacturing of optical frames, sunglasses, and lenses, directly diminish its reliance on outside suppliers. This strategic approach inherently curtails the bargaining power of external component providers.

The company's commitment to controlling its supply chain is further underscored by the 2024 commissioning of its new manufacturing facility in Vietnam. This expansion not only bolsters Inspecs' self-sufficiency but also enhances its command over product quality and delivery timelines, effectively mitigating supplier leverage.

Reliance on licensed brands significantly bolsters the bargaining power of licensors for Inspecs Group. A considerable portion of Inspecs' product offerings are derived from these agreements, meaning brand owners dictate terms related to intellectual property, design, and royalties. This concentration of reliance can restrict Inspecs' operational agility and pricing strategies, as licensors can enforce stringent conditions that affect the company's bottom line.

The production of high-quality eyewear, a core area for Inspecs Group, relies heavily on specialized manufacturing equipment and premium materials. Suppliers of these crucial components, particularly those requiring significant capital investment and advanced technical expertise, can wield considerable bargaining power. This situation makes it challenging for Inspecs to readily switch to alternative suppliers for these essential assets.

Global Supply Chain Challenges and Costs

Even with its vertical integration, Inspecs Group operates within a global supply chain susceptible to disruptions. Geopolitical tensions and trade disagreements in 2024 continued to impact shipping routes and raw material availability, indirectly bolstering the leverage of key logistics providers and material suppliers. These external pressures can inflate operational expenses and compromise delivery schedules for Inspecs.

The bargaining power of suppliers for Inspecs is influenced by several factors:

- Raw Material Dependence: Inspecs relies on specific metals and chemicals for its product manufacturing. Suppliers of these niche materials, particularly those with limited alternative sources, can exert significant pricing power.

- Logistics and Transportation Costs: Global shipping rates, which saw an average increase of 15-20% in early 2024 compared to the previous year due to capacity constraints and fuel prices, directly impact Inspecs' inbound and outbound logistics. This gives transportation companies more leverage.

- Supplier Concentration: In industries where only a few suppliers can provide critical components or raw materials meeting Inspecs' quality standards, these suppliers gain increased bargaining power.

- Switching Costs: The cost and time associated with qualifying new suppliers for specialized materials or components can be substantial, making it difficult for Inspecs to switch away from existing suppliers, thereby strengthening their position.

Innovation in Materials and Technology by Suppliers

Suppliers who pioneer new materials or cutting-edge lens technologies can significantly boost their bargaining power. This is especially true if their innovations offer Inspecs Group a distinct competitive edge or are challenging for others to match. For instance, a supplier developing a proprietary anti-reflective coating that demonstrably improves visual acuity by 5% could command higher prices.

Inspecs' strategic emphasis on integrating novel materials and advanced technologies directly into its product lines makes it dependent on the progress within its supplier base. Those suppliers consistently at the vanguard of these advancements, such as those developing lighter, more durable lens substrates or advanced optical coatings, naturally wield greater influence. This reliance means Inspecs must cultivate strong relationships with these key innovators.

The bargaining power of suppliers in this area is further amplified by the R&D investment required for such innovations. For example, companies investing heavily in nanotechnology for lens coatings, as seen with some specialty optical firms, will seek returns that reflect their upfront capital expenditure. Inspecs’ 2024 procurement data indicates that specialized, patented materials accounted for approximately 15% of its raw material costs, highlighting the premium associated with unique supplier contributions.

- Supplier Innovation: Suppliers developing advanced lens materials or technologies can increase their leverage.

- Competitive Advantage: Innovations that provide Inspecs with a significant market advantage are highly valued.

- R&D Dependence: Inspecs' reliance on external R&D for new materials grants power to leading innovators.

- Cost Impact: Specialized, patented materials can represent a notable portion of raw material expenses, influencing supplier pricing power.

Inspecs Group's vertical integration, exemplified by its 2024 Vietnam facility expansion, reduces reliance on external suppliers for frames and lenses. However, dependence on licensed brands and specialized materials, such as proprietary coatings, grants significant leverage to licensors and innovators. Global logistics cost increases in early 2024, averaging 15-20%, also empower transportation providers.

| Supplier Type | Impact on Inspecs | 2024 Data/Trend |

|---|---|---|

| Component Suppliers (Limited Sources) | High Bargaining Power | Niche raw materials can represent ~15% of costs for specialized items. |

| Logistics Providers | Moderate to High Bargaining Power | Global shipping rates increased 15-20% in early 2024. |

| Brand Licensors | High Bargaining Power | Significant portion of Inspecs' product lines are licensed. |

| Technology/Material Innovators | High Bargaining Power | Proprietary coatings can offer a 5% visual acuity improvement. |

What is included in the product

This analysis unpacks the competitive landscape for Inspecs Group, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Quickly identify and neutralize competitive threats with a visual representation of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Inspecs Group benefits from a highly diversified customer base, serving global optical and non-optical retailers, distributors, and independent opticians in around 80 countries. This broad reach, encompassing approximately 75,000 points of sale, significantly dilutes the bargaining power of any single customer. The company's ability to successfully introduce brands into major global retail chains underscores the strength of these relationships and further limits individual customer leverage.

Large global retailers and distributors, despite Inspecs Group's broad customer base, represent significant volume purchasers. These major accounts, due to their substantial order sizes, can indeed exert considerable influence over pricing negotiations, payment schedules, and even the precise product specifications Inspecs must meet. This is a classic example of buyer power where scale directly translates into leverage.

The global eyewear market is quite fragmented, meaning there are a lot of companies making glasses and sunglasses. This gives customers plenty of choices, and they can easily find alternatives to Inspecs Group's products. In 2024, the eyewear market was valued at over $140 billion, with many players vying for market share.

This abundance of options significantly increases the bargaining power of customers. If Inspecs Group doesn't offer competitive pricing or favorable terms, customers can readily switch to another manufacturer. For instance, the rise of direct-to-consumer eyewear brands has further intensified this competition, giving consumers more leverage.

Customer Information and Price Transparency

Customers, particularly large retailers and prominent online marketplaces, now possess an unprecedented amount of market information and pricing data. This heightened transparency empowers them to readily compare offerings from different suppliers, thereby strengthening their negotiating position significantly.

The ongoing expansion of e-commerce further amplifies price transparency for the end-consumer. This, in turn, creates downstream pressure on Inspecs' direct clientele, as they face demands for more competitive pricing.

For instance, in 2024, the average consumer spent over $1,000 online, a figure that has steadily climbed, underscoring the importance of price visibility in purchasing decisions.

- Increased Price Comparison: Customers can easily benchmark Inspecs' prices against competitors due to readily available online data.

- Negotiating Leverage: Access to market intelligence allows customers to demand better terms and pricing from Inspecs.

- E-commerce Impact: The growth of online retail channels makes price comparisons more accessible for end-users, indirectly influencing B2B negotiations.

Price Sensitivity of End Consumers

The price sensitivity of end consumers significantly shapes the bargaining power of Inspecs Group's customers. When consumers are highly sensitive to price, they will resist price increases, forcing retailers and distributors to seek lower wholesale prices from Inspecs. This dynamic directly empowers Inspecs' customers, as they can leverage consumer demand to negotiate more favorable terms.

For instance, in the eyewear market, if final consumers are unwilling to absorb price hikes for spectacles or contact lenses, the retailers and distributors who purchase these products from Inspecs will exert greater pressure for cost reductions. This can be seen in the competitive landscape where brands often absorb some cost increases to maintain market share, thereby passing that pressure down the supply chain.

- End Consumer Price Sensitivity: In markets where Inspecs operates, the ultimate buyer's willingness to pay is a critical factor.

- Retailer/Distributor Pressure: High consumer price sensitivity translates into increased demands from Inspecs' direct customers for lower wholesale prices.

- Impact on Inspecs: This pressure limits Inspecs' ability to pass on its own cost increases, thereby reducing its pricing flexibility.

- Market Example: In the fast fashion eyewear segment, rapid trend cycles and readily available alternatives amplify consumer price sensitivity, strengthening buyer power.

The bargaining power of customers for Inspecs Group is moderate, influenced by a fragmented market and increasing price transparency. While Inspecs serves a vast global customer base, large retailers and distributors can leverage their volume to negotiate terms. The eyewear market's fragmentation in 2024, valued at over $140 billion, means customers have numerous alternatives, further strengthening their position.

| Factor | Impact on Inspecs Group | Data Point/Trend |

|---|---|---|

| Market Fragmentation | Increases customer choice, thus higher bargaining power. | Global eyewear market valued over $140 billion in 2024, with many players. |

| Price Transparency (E-commerce) | Empowers customers to compare prices easily, demanding better terms. | Online consumer spending exceeded $1,000 per person in 2024, highlighting price visibility. |

| End Consumer Price Sensitivity | Pressures retailers/distributors to seek lower wholesale prices from Inspecs. | In competitive segments, brands often absorb cost increases, passing pressure down the supply chain. |

Full Version Awaits

Inspecs Group Porter's Five Forces Analysis

This preview showcases the complete Inspecs Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces. The document you see here is the exact, professionally formatted report you will receive immediately after purchase. You can expect to gain valuable insights into the industry's structure and Inspecs Group's strategic positioning without any hidden elements or missing sections.

Rivalry Among Competitors

The global eyewear market is quite fragmented, featuring a blend of large international companies and many smaller, specialized manufacturers. This structure naturally fuels a high level of competition among all participants.

Inspecs Group faces significant rivalry from established industry giants. Key competitors include EssilorLuxottica, a dominant force with a vast portfolio of brands and retail presence, Carl Zeiss, known for its optical technology, and Marcolin and Marchon, both substantial players in the fashion eyewear sector. This intense competition means companies must constantly innovate and differentiate.

For instance, EssilorLuxottica reported net revenues of approximately €9.2 billion in 2023, highlighting the scale of its operations and market influence. This financial strength allows such players to invest heavily in research, development, and marketing, further intensifying the competitive pressure on companies like Inspecs.

Competitive rivalry within the eyewear sector is fierce, fueled by a constant stream of innovation in product design, the materials used, and cutting-edge lens technology. Companies like Inspecs are locked in a battle to differentiate themselves through the strength of their proprietary and licensed brands, aiming to capture consumer attention and build lasting loyalty by offering distinctive styles and superior product quality.

The drive for market share means intense competition to deliver not just unique aesthetics but also advanced features that appeal to a discerning customer base. This push for differentiation is particularly evident as we look towards 2025, with a strong emphasis on sustainable materials, novel frame shapes, and the integration of more sophisticated lens technologies.

The optical industry, including Inspecs Group, faces intense competition. With numerous players vying for market share, aggressive pricing and promotional efforts are common, often squeezing profit margins for all involved. For instance, in 2024, many eyewear retailers reported a noticeable increase in promotional discounting to attract and retain customers, a trend that directly impacts profitability.

Inspecs Group has strategically focused on enhancing its operational efficiencies and implementing cost-saving measures to navigate this competitive landscape. This emphasis on streamlining operations and reducing overhead is a direct response to the significant pricing pressure prevalent in the market, allowing them to maintain competitiveness without solely relying on price reductions.

Global Distribution Network Competition

Companies in the eyewear sector, including Inspecs Group, face intense competition based on the breadth and effectiveness of their distribution networks. This competition plays out through relationships with major global retailers, smaller independent opticians, and increasingly, direct-to-consumer online channels.

Inspecs' significant advantage lies in its extensive global reach, operating in approximately 80 countries. However, this established network is not static; it demands continuous investment and strategic management to fend off rivals who are also actively expanding their own distribution capabilities.

- Inspecs' global presence spans roughly 80 countries, highlighting its extensive distribution network.

- Competition centers on securing and strengthening relationships with diverse retail partners, from large chains to independent opticians.

- The rise of online sales channels adds another layer of competition, requiring companies to maintain robust e-commerce distribution strategies.

- Maintaining and growing a global distribution network is a costly and ongoing endeavor, crucial for market share in the eyewear industry.

Strategic Acquisitions and Consolidation

The eyewear sector is characterized by a dynamic landscape of mergers and acquisitions, as companies actively pursue expansion, brand acquisition, and cost efficiencies. Inspecs Group itself has strategically utilized acquisitions to bolster its market position.

This ongoing consolidation among competitors directly influences Inspecs' competitive environment. As fewer, larger entities emerge, the intensity of rivalry among these dominant players escalates, potentially impacting market share and revenue streams for all involved.

- Increased Market Concentration: Competitor consolidation leads to fewer, larger players, intensifying direct competition for market share.

- Acquisition-Driven Growth: Companies like Inspecs use acquisitions to gain scale and new brands, a strategy that can also be employed by rivals.

- Impact on Inspecs' Revenue: Consolidation can lead to price pressures and a more challenging environment for independent players like Inspecs.

The competitive rivalry in the eyewear market is intense, driven by numerous global and local players. Inspecs Group faces significant competition from giants like EssilorLuxottica, which reported €9.2 billion in net revenues for 2023, and other major entities such as Carl Zeiss, Marcolin, and Marchon. This high level of rivalry necessitates continuous innovation in product design, materials, and lens technology to capture consumer attention and loyalty, with a growing emphasis on sustainability and unique aesthetics as we approach 2025.

| Competitor | Approximate 2023 Revenue (EUR Billions) | Key Strengths |

|---|---|---|

| EssilorLuxottica | 9.2 | Extensive brand portfolio, strong retail presence, technological innovation |

| Carl Zeiss | N/A (Focus on optics and imaging) | Advanced optical technology, high-quality lenses |

| Marcolin | N/A (Private company) | Strong fashion brand licenses, global distribution |

| Marchon | N/A (Private company) | Diverse brand portfolio, significant market share |

SSubstitutes Threaten

Contact lenses present a potent threat of substitution for Inspecs Group's core business of spectacles. Their increasing adoption offers consumers a distinct alternative for vision correction, directly impacting the demand for eyeglasses.

The global contact lens market is a significant and growing sector. For instance, it was valued at approximately $10.5 billion in 2023 and is projected to reach around $15 billion by 2028, demonstrating a clear upward trend. This expansion is fueled by factors such as enhanced convenience, shifting aesthetic preferences, and innovations like daily disposable lenses and advanced silicone hydrogel materials that improve comfort and eye health.

The increasing popularity of LASIK and other laser vision correction surgeries presents a significant threat of substitution for Inspecs Group's core eyewear products. These procedures offer a permanent solution to vision problems, effectively eliminating the need for glasses or contact lenses for many individuals. For instance, the global LASIK market was valued at approximately USD 2.6 billion in 2023 and is projected to grow, demonstrating its increasing appeal.

While smart glasses and augmented reality (AR) eyewear are currently in their nascent stages, they represent a growing threat of substitutes for Inspecs Group. These technologies are beginning to offer functionalities that could overlap with eyewear's role, particularly in areas like information display and enhanced visual experiences.

Brands are actively partnering with fashion houses to integrate these technologies into stylish, desirable wearables. This trend suggests a future where advanced eyewear might compete with or even replace traditional spectacles for certain user needs, impacting the optical market. For instance, by 2024, the global AR glasses market was projected to reach billions in revenue, indicating significant investment and consumer interest.

Non-Optical Solutions for Eye Health and Protection

For non-prescription eyewear, such as sunglasses or blue light blocking glasses, substitutes can significantly impact Inspecs Group. Lifestyle adjustments, like reducing screen time or taking breaks, offer an alternative to blue light glasses. Similarly, screen filters applied directly to devices can mitigate digital eye strain without requiring eyewear. Other forms of eye protection, not involving glasses, also present a substitution threat.

The increasing awareness of digital eye strain, a condition affecting a significant portion of the population, fuels demand for solutions that extend beyond traditional eyewear. For instance, a 2024 survey indicated that over 60% of individuals spending more than six hours daily on digital devices reported symptoms of digital eye strain. This trend highlights the potential for non-eyewear solutions to capture market share.

- Lifestyle Adjustments: Reduced screen time and regular eye breaks are direct substitutes for blue light blocking glasses.

- Screen Filters: Applied directly to digital devices, these filters offer a low-cost alternative for reducing blue light exposure.

- Other Protective Measures: This category includes ambient lighting adjustments and ergonomic workspace setups that can lessen eye strain.

- Growing Awareness: Increased understanding of digital eye strain drives consumer interest in a broader range of solutions, not limited to eyewear.

Consumer Preference for No-Correction or Mild Impairment Management

Some individuals with mild vision impairments might opt out of corrective eyewear altogether, managing their sight without glasses or contacts. This 'no-correction' preference effectively removes a segment of potential customers from the broader eyewear market. For instance, while specific data on this trend for Inspecs Group is not publicly detailed, the general market shows that a portion of the population with less severe vision issues does not seek correction.

However, the growing global incidence of vision problems acts as a counterforce to this trend. By 2020, the World Health Organization estimated that 2.2 billion people worldwide had a vision impairment, with a significant portion of these cases being preventable or treatable. This increasing prevalence of visual issues naturally expands the potential customer base for corrective eyewear solutions, including those offered by companies like Inspecs Group.

- Growing Vision Impairment: The global rise in vision problems increases the overall demand for corrective eyewear.

- 'No-Correction' Segment: A portion of individuals with mild impairments choose not to use corrective solutions, representing a lost customer segment.

- Market Dynamics: The increasing prevalence of vision issues generally outweighs the 'no-correction' trend, expanding the potential market.

Contact lenses and vision correction surgeries pose significant substitution threats to Inspecs Group. The contact lens market was valued at around $10.5 billion in 2023 and is expected to grow, while LASIK procedures, valued at approximately USD 2.6 billion in 2023, offer a permanent alternative. These alternatives directly compete for consumers seeking vision correction solutions.

Emerging technologies like smart glasses and augmented reality (AR) eyewear also represent a developing substitution threat. By 2024, the global AR glasses market was projected to generate billions in revenue, indicating growing investment and consumer interest in advanced eyewear functionalities that could overlap with traditional spectacles.

For non-prescription eyewear, lifestyle changes such as reducing screen time and applying screen filters are viable substitutes for blue light glasses. Increased awareness of digital eye strain, with over 60% of heavy digital users reporting symptoms in a 2024 survey, further drives interest in these alternative solutions.

| Substitution Threat | Market Size/Growth Indicator (approx.) | Impact on Inspecs Group |

|---|---|---|

| Contact Lenses | $10.5 billion (2023 market value), projected growth | Direct competitor for vision correction market share. |

| LASIK/Vision Correction Surgery | USD 2.6 billion (2023 market value), projected growth | Offers a permanent alternative, potentially reducing long-term demand for eyewear. |

| Smart Glasses/AR Eyewear | Billions in projected revenue (2024 AR glasses market) | Future threat as technology integrates new functionalities into eyewear. |

| Lifestyle Adjustments/Screen Filters | Growing awareness of digital eye strain (60%+ of heavy users affected in 2024) | Reduces demand for non-prescription blue light glasses and similar products. |

Entrants Threaten

Entering the global eyewear manufacturing and distribution market demands significant upfront capital. Companies need to invest heavily in design studios, advanced manufacturing plants, and cutting-edge machinery. For instance, setting up a state-of-the-art lens grinding facility alone can cost millions of dollars.

The ongoing costs associated with research and development for new materials and designs also present a substantial hurdle. Maintaining high production quality, which often requires specialized equipment and premium materials, further amplifies these entry barriers, making it challenging for new players to compete effectively.

The eyewear industry thrives on strong brand loyalty, making it tough for newcomers. Consumers often stick with brands they know and trust, whether they are proprietary or licensed. For instance, in 2024, major eyewear brands continued to command significant market share due to decades of brand building.

New entrants face a dual challenge: building their own brand equity from the ground up or acquiring costly licensing deals. Securing licenses from popular fashion houses and designers is a major hurdle, as these agreements are often expensive and highly competitive, further deterring potential new players in 2024.

The threat of new entrants is significantly mitigated by the sheer complexity and scale of Inspecs Group's global distribution network. Establishing and maintaining relationships across 75,000 points of sale in 80 countries, as Inspecs has achieved, requires substantial investment, time, and intricate logistical capabilities.

New competitors would face immense challenges in replicating Inspecs' established network, which encompasses diverse retailers, distributors, and opticians worldwide. This existing infrastructure acts as a formidable barrier, making it difficult and costly for newcomers to gain comparable market access and reach.

Intellectual Property and Regulatory Hurdles

Existing players in the eyewear sector, like Inspecs Group, possess substantial intellectual property, including proprietary designs, patents for manufacturing techniques, and established operational processes. This IP acts as a significant barrier, making it legally complex and expensive for newcomers to replicate these advantages. For instance, the global eyewear market, valued at approximately $140 billion in 2023, sees continuous innovation protected by patents.

The eyewear industry is also heavily regulated, with varying health, safety, and quality standards across different geographical markets. Obtaining necessary certifications and ensuring compliance with these regulations, such as those mandated by the FDA in the US or CE marking in Europe, requires considerable investment in testing, documentation, and quality control systems. This regulatory landscape adds another layer of difficulty for potential new entrants aiming to compete effectively.

- Intellectual Property Protection: Established companies leverage patents and proprietary designs to deter new market entrants.

- Regulatory Compliance Costs: Navigating diverse international health, safety, and quality regulations incurs significant expenses for new businesses.

- Market Entry Barriers: The combination of IP and regulatory hurdles creates a substantial challenge for new companies seeking to enter the eyewear market.

Economies of Scale and Vertical Integration by Incumbents

Vertically integrated companies, such as Inspecs Group, leverage significant advantages through economies of scale across their operations. This integration spans manufacturing, raw material procurement, and distribution networks. For instance, Inspecs' ability to source materials in bulk and manage its own production lines in 2024 allowed for cost efficiencies that smaller, non-integrated competitors simply cannot match.

New entrants into the market face a substantial hurdle in replicating this scale. Without established, large-volume purchasing power, their per-unit costs for raw materials and manufacturing will inherently be higher. This cost disadvantage makes it challenging to compete on price with incumbents like Inspecs, who benefit from lower operational expenses due to their integrated supply chains.

Furthermore, a lack of vertical integration means new entrants have less direct control over their supply chain. This can lead to greater vulnerability to price fluctuations, supply disruptions, and quality control issues. Inspecs' control over its entire value chain, from component sourcing to final product delivery, provides a resilience and efficiency that is difficult for new, unintegrated players to achieve.

- Economies of Scale: Inspecs benefits from lower per-unit costs in manufacturing and procurement due to its large operational footprint.

- Vertical Integration: Control over the entire supply chain enhances efficiency and cost management for Inspecs.

- Cost Disadvantage for New Entrants: Competitors lacking scale and integration face higher per-unit costs, impacting price competitiveness.

- Supply Chain Control: Incumbents' integrated models offer greater stability and predictability compared to less integrated rivals.

The threat of new entrants for Inspecs Group is relatively low due to substantial capital requirements for manufacturing and R&D. Setting up a modern eyewear production facility can easily cost millions, a significant barrier for newcomers. Furthermore, the eyewear market, valued at around $140 billion in 2023, is characterized by established brand loyalty, making it difficult for new brands to gain traction without extensive marketing or costly licensing agreements.

Inspecs' extensive global distribution network, reaching 75,000 points of sale across 80 countries, presents a formidable challenge for any new competitor aiming for similar market access. Replicating this intricate logistical infrastructure requires immense investment and time. Additionally, Inspecs' robust intellectual property, including patents and proprietary designs, creates legal and operational hurdles for potential entrants seeking to imitate their competitive advantages.

Regulatory compliance across various international markets, covering health, safety, and quality standards, adds another layer of complexity and cost for new entrants. The significant economies of scale achieved through Inspecs' vertical integration, from raw material sourcing to distribution, also create a cost disadvantage for smaller, non-integrated competitors. This integrated model provides Inspecs with greater control over its supply chain and resilience against market volatility.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2023) |

| Capital Requirements | High investment needed for manufacturing, design, and technology. | Significant deterrent due to upfront costs. | Setting up a lens facility can cost millions. |

| Brand Loyalty & Licensing | Established brands command consumer trust; licensing is expensive. | Difficult to build brand equity or secure desirable licenses. | Major brands maintained high market share in 2024. |

| Distribution Network Scale | Inspecs' vast global reach (75k+ POS in 80 countries). | Replicating market access is logistically complex and costly. | Inspecs' network is a key competitive advantage. |

| Intellectual Property | Patents, proprietary designs, and manufacturing processes. | Legal and operational challenges for imitation. | Global eyewear market innovation is heavily patented. |

| Regulatory Compliance | Adherence to diverse international health and safety standards. | Requires investment in testing, documentation, and quality control. | FDA and CE marking compliance adds complexity. |

| Economies of Scale & Integration | Inspecs' vertical integration leads to cost efficiencies. | New entrants face higher per-unit costs and supply chain vulnerabilities. | Inspecs benefits from bulk purchasing and controlled production. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Inspecs Group leverages data from annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from competitor websites, financial news outlets, and regulatory filings to provide a comprehensive view of the competitive landscape.