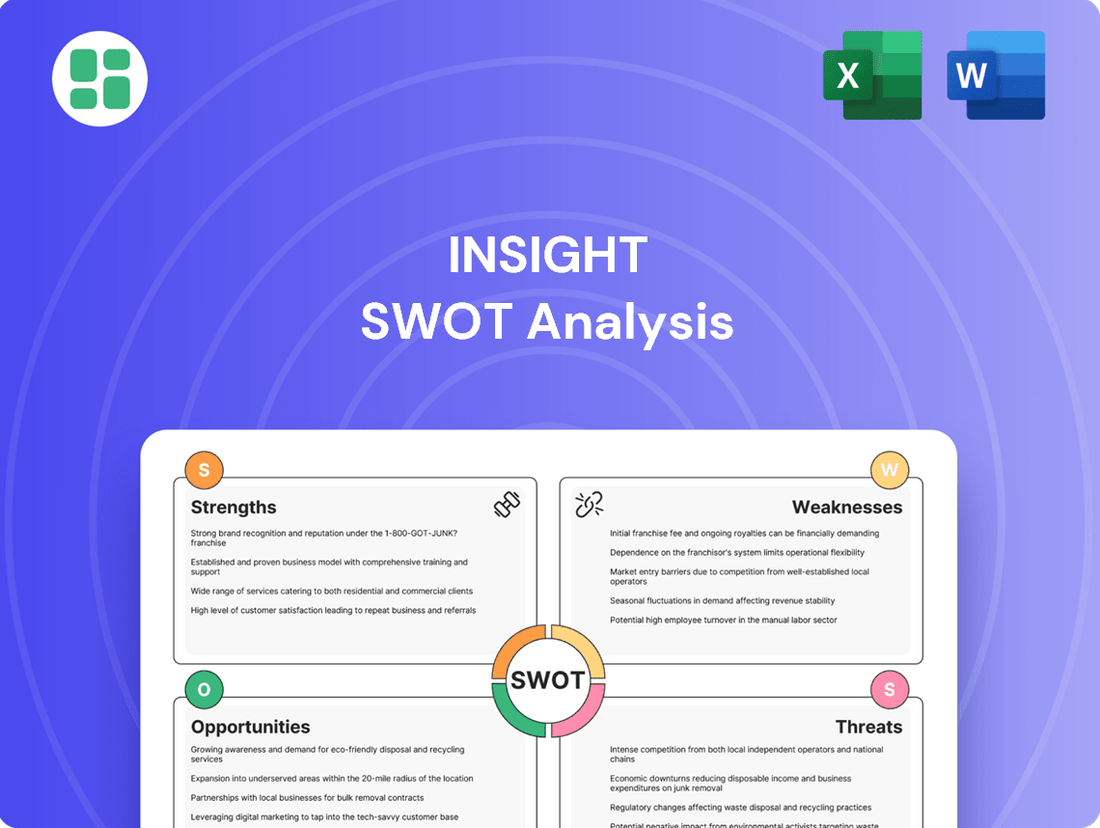

Insight SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

Curious about the hidden opportunities and potential pitfalls? Our comprehensive SWOT analysis delves deep into the company's core, revealing crucial details often missed in a brief overview. Unlock the full strategic advantage.

Strengths

Insight Enterprises' strength lies in its extensive IT solutions portfolio, encompassing hardware, software, cloud services, and managed IT. This broad offering allows them to act as a true solutions integrator, addressing a wide array of client requirements. Their strategic move towards an 'AI-first' approach further solidifies this position, enabling them to offer cutting-edge, integrated solutions.

The company's strength lies in its incredibly diverse and global client base, spanning business, government, education, and healthcare sectors worldwide. This broad reach, with operations in over 20 countries, significantly de-risks the business by preventing over-reliance on any single market or industry.

Insight's strategic pivot towards an AI-first methodology and expansion in cloud services, encompassing IaaS and SaaS, is a significant strength. These areas are projected for mid-teens growth in 2024 and 2025, positioning the company to capitalize on burgeoning market demand.

This focus on high-growth segments like artificial intelligence and cloud computing is crucial for Insight's future revenue streams and gross profit expansion. By aligning its service offerings with these critical IT trends, the company is enhancing its competitive advantage and market relevance.

Strong Partner Ecosystem and Acquisitions

Insight's strategic alliances with tech giants like Nvidia, Google, and Microsoft are a significant strength, enabling them to offer cutting-edge solutions and accelerate client digital transformations. These collaborations are crucial for delivering complex projects.

The company's acquisition strategy further amplifies its market position. For instance, the 2023 acquisition of Infocenter, a ServiceNow Elite Partner, significantly enhanced Insight's expertise in automation and managed services, areas experiencing robust demand. This move directly addresses the growing need for efficient operational solutions.

These partnerships and acquisitions translate into tangible benefits:

- Enhanced Solution Delivery: Access to advanced technologies from partners allows Insight to tackle more sophisticated client challenges.

- Expanded Service Offerings: Acquisitions like Infocenter broaden the scope of services, particularly in high-growth areas like cloud automation.

- Market Penetration: Integrating new capabilities through acquisitions opens doors to new client segments and strengthens existing relationships.

- Competitive Advantage: A well-integrated partner ecosystem and strategic acquisitions position Insight favorably against competitors.

Resilient Financial Performance and Shareholder Focus

Insight has shown remarkable financial resilience, even with economic challenges and shifts in partner programs. In the second quarter of 2025, the company achieved impressive results, including record gross and operating margins. This performance highlights strong operational execution.

The company’s dedication to shareholder value is evident through its active share repurchase program. Insight is also prioritizing the generation of robust cash flow from its operations, further underscoring its commitment to returning capital to investors.

- Record Margins: Achieved record gross and operating margins in Q2 2025, demonstrating enhanced profitability.

- Shareholder Returns: Actively engaged in a significant share buyback program, signaling confidence and a focus on increasing shareholder value.

- Cash Flow Generation: Committed to strong cash flow from operations, providing financial flexibility and supporting capital allocation strategies.

- Operational Efficiency: Maintained high levels of operational efficiency despite navigating macroeconomic headwinds and partner program adjustments.

Insight Enterprises' strengths are anchored in its comprehensive IT solutions portfolio, covering hardware, software, cloud, and managed services, positioning it as a key solutions integrator. The company's strategic focus on an AI-first approach and expansion in cloud services, especially IaaS and SaaS, which are projected for mid-teens growth in 2024-2025, ensures alignment with high-demand market trends, driving future revenue and profit growth.

The company benefits from a diversified global client base across business, government, education, and healthcare sectors, mitigating risks associated with over-reliance on any single market. Strategic partnerships with tech leaders like Nvidia, Google, and Microsoft, coupled with strategic acquisitions such as Infocenter in 2023, bolster its ability to deliver advanced solutions and expand service offerings in automation and managed services.

Insight demonstrated strong financial performance in Q2 2025, achieving record gross and operating margins despite economic challenges and partner program shifts, highlighting operational efficiency. The company actively returns capital to shareholders through a share repurchase program and prioritizes robust cash flow generation from operations, underscoring its commitment to shareholder value.

| Metric | Q2 2025 Performance | Significance |

|---|---|---|

| Gross Margin | Record High | Indicates improved profitability and pricing power. |

| Operating Margin | Record High | Demonstrates enhanced operational efficiency and cost management. |

| Share Repurchases | Active Program | Signals management confidence and commitment to increasing shareholder value. |

| Cash Flow from Operations | Robust Generation | Provides financial flexibility and supports strategic investments and capital allocation. |

What is included in the product

Analyzes Insight’s internal capabilities and external market dynamics to identify strategic advantages and potential challenges.

Simplifies complex SWOT data into actionable insights, reducing the burden of interpretation.

Weaknesses

Insight's first quarter of 2025 saw a significant 12% drop in net revenue. This decline is largely attributed to weaker product sales, especially for their on-premise software solutions.

This trend highlights a critical weakness: Insight is struggling to adapt as clients increasingly favor services over traditional product purchases. Furthermore, the company is feeling the pinch from partner consolidation and shifts in partner programs, which are disrupting sales channels.

Changes in partner programs, particularly those impacting enterprise agreements and the shift to Cloud Solution Provider (CSP) agreements, have created a notable headwind. This shift is estimated to cost the company around $70 million annually, directly affecting cloud gross profit.

The immediate consequence of these partner program adjustments has been a reduction in overall gross margins. While these changes are seen as a short-term challenge, they represent a significant factor impacting the company's profitability in the current fiscal year.

Insight's core services experienced a notable dip in gross profit during 2024, largely attributed to large enterprise clients postponing significant projects, especially within the infrastructure sector. This trend indicates a cautious approach to discretionary IT spending among major corporations.

The infrastructure segment, a key area for large enterprise engagements, saw a substantial slowdown, directly impacting Insight's service revenue growth for the year. This hesitancy suggests a broader market sentiment of delayed capital expenditures by larger businesses.

Intense Competition in the IT Services Market

The IT services sector is incredibly crowded, featuring established global giants and nimble specialized companies. This intense competition means Insight must constantly develop new solutions and stand out from rivals to protect its market position and financial health.

For instance, the global IT services market was valued at approximately $1.3 trillion in 2023 and is projected to grow, but this growth is shared among many players. Key competitors like Accenture, IBM, and TCS are investing heavily in areas such as AI and cloud, demanding significant R&D from Insight to keep pace.

- Intense rivalry from major global IT service providers.

- Emergence of niche players offering specialized solutions.

- Pressure to continuously innovate and differentiate service offerings.

- Risk of market share erosion due to strong competitor advancements.

Talent Acquisition and Retention Challenges

The IT sector, particularly in specialized fields like cybersecurity, AI, and cloud computing, is experiencing a pronounced talent deficit. This makes it difficult for companies like Insight to attract and keep qualified personnel. For instance, a 2024 report indicated that the global cybersecurity workforce gap stood at an estimated 4 million professionals, highlighting the intense competition for skilled individuals.

This scarcity directly impacts Insight's operational capacity and growth potential. The high demand for specialized IT skills drives up recruitment costs and salary expectations, potentially compressing profit margins. Furthermore, an inability to secure sufficient talent can hinder the company's ability to expand service offerings in lucrative, fast-growing market segments, thereby limiting revenue opportunities.

- Talent Scarcity: A global shortage of skilled IT professionals, especially in cybersecurity and AI, persists.

- Increased Costs: Competition for talent drives up salaries and recruitment expenses.

- Scalability Limitations: Difficulty in hiring can restrict Insight's ability to meet growing client demand in key areas.

- Service Expansion Hurdles: Lack of qualified staff may impede the development and delivery of new, in-demand services.

Insight's reliance on on-premise software sales is becoming a significant vulnerability as the market shifts towards services. This was underscored by a 12% drop in net revenue during Q1 2025, primarily due to weaker product sales.

The company is also navigating challenges stemming from partner consolidation and evolving partner programs, which have disrupted its sales channels and impacted cloud gross profit by an estimated $70 million annually. These shifts have directly led to reduced gross margins, a critical weakness affecting current profitability.

Furthermore, large enterprise clients are postponing major IT projects, particularly in infrastructure, leading to a slowdown in a key revenue segment for Insight's services. This cautious spending by major corporations highlights a vulnerability in relying heavily on large, discretionary IT investments.

The intense competition within the IT services market, valued at approximately $1.3 trillion in 2023, presents another weakness. Insight faces pressure from major players like Accenture and IBM, who are heavily investing in AI and cloud, demanding continuous innovation to prevent market share erosion.

A persistent talent deficit in specialized IT fields, such as cybersecurity and AI, poses a significant operational challenge. The global cybersecurity workforce gap alone was estimated at 4 million professionals in 2024, increasing recruitment costs and potentially limiting Insight's ability to scale and capitalize on high-demand services.

| Weakness | Impact | Supporting Data/Context |

| Over-reliance on product sales | Decreased revenue and profitability | 12% net revenue drop in Q1 2025; weaker on-premise software sales |

| Disruptions from partner program changes | Reduced cloud gross profit and overall margins | Estimated $70 million annual impact on cloud gross profit; reduced gross margins |

| Slowdown in enterprise IT spending | Impacted service revenue growth, especially in infrastructure | Large enterprise clients postponing projects; infrastructure segment slowdown |

| Intense market competition | Risk of market share erosion and pressure to innovate | Global IT services market ~$1.3 trillion (2023); competitors investing heavily in AI/cloud |

| Talent scarcity in specialized IT | Increased costs, scalability limitations, and service expansion hurdles | Global cybersecurity workforce gap ~4 million (2024); higher recruitment costs |

What You See Is What You Get

Insight SWOT Analysis

The preview you see is the actual Insight SWOT Analysis document you will receive upon purchase. You're getting a genuine look at the quality and structure of the full report. No surprises, just a complete, professional tool ready for your use.

Opportunities

The global market for digital transformation is experiencing explosive growth, with projections indicating it will approach $4 trillion by 2027. A substantial portion of this surge is driven by escalating investments in artificial intelligence (AI) technologies, reflecting a fundamental shift in how businesses operate and innovate.

Insight's strategic decision to focus on becoming an 'AI-first' solutions integrator is perfectly timed to leverage this trend. This pivot allows the company to directly address the growing client appetite for AI-powered solutions and comprehensive digital modernization initiatives.

Worldwide cloud services spending is projected to reach $679 billion in 2024, a significant increase from previous years, with multi-cloud and hybrid cloud strategies becoming the norm for many organizations. This trend directly benefits Insight, as businesses increasingly rely on external providers for IT management and cloud solutions like Infrastructure as a Service (IaaS) and Software as a Service (SaaS).

The ongoing digital transformation across industries fuels the demand for cloud and managed services, with companies seeking to optimize costs, enhance scalability, and improve operational efficiency. Insight's expertise in these areas positions it to capitalize on this sustained market expansion, particularly as more enterprises migrate their workloads to cloud environments.

The global cybersecurity market is projected to reach $300 billion by 2024, a significant increase driven by escalating cyber threats and evolving compliance mandates. Insight's specialized solutions for AI security and data protection are well-positioned to capitalize on this expansion.

By leveraging its expertise, Insight can broaden its service portfolio to address emerging security challenges, particularly those surrounding artificial intelligence, thereby securing a more substantial portion of this vital and rapidly expanding market.

Geographic Expansion and Deeper Market Penetration

Insight has a significant opportunity to bolster its market position by focusing on geographic expansion and deeper penetration within its existing territories. The company can capitalize on the accelerating global demand for digital transformation, particularly in regions experiencing robust IT spending growth. For instance, emerging markets in Southeast Asia and Eastern Europe are projected to see substantial increases in IT outsourcing budgets through 2025, presenting fertile ground for Insight's services.

Leveraging existing client relationships and a well-established partner network will be crucial for this expansion. This strategy allows Insight to tap into new business opportunities by offering its specialized digital solutions to a broader customer base within these expanding markets.

- Deepen penetration in high-growth regions: Focus on markets like India and Brazil, where digital transformation initiatives are accelerating, with IT spending expected to grow by over 10% annually through 2025.

- Explore new geographic markets: Target countries in Eastern Europe and Southeast Asia with increasing IT infrastructure investments and a growing need for digital services.

- Leverage partner ecosystems: Utilize existing partnerships with major cloud providers and technology firms to gain access to new clients and markets.

- Tailor offerings to local needs: Adapt service portfolios to meet the specific digital transformation challenges and regulatory environments of new regions.

Leveraging Low-Code/No-Code and Automation Technologies

The expanding market for low-code/no-code platforms, projected to reach $220 billion by 2025, offers a substantial growth avenue. This trend is fueled by a growing demand for intelligent enterprise automation solutions that streamline operations and enhance efficiency across various business functions.

Insight's strategic acquisition of Infocenter directly addresses this opportunity by bolstering its expertise in workflow automation and ServiceNow implementations. This integration positions Insight to capitalize on the increasing adoption of these technologies by businesses seeking to accelerate digital transformation and improve their operational agility.

- Market Growth: The global low-code development platform market is expected to grow from $21.1 billion in 2022 to $103.1 billion by 2028, at a CAGR of 30.5%.

- Automation Demand: Intelligent automation, a key component of this trend, is seeing significant investment, with the market size estimated at $220 billion by 2025.

- Synergistic Acquisition: Infocenter's capabilities in workflow automation and ServiceNow enhance Insight's service offerings, directly aligning with market demand.

- Competitive Advantage: By integrating these technologies, Insight can offer more robust and efficient solutions, differentiating itself in the competitive IT services landscape.

Insight is well-positioned to capitalize on the escalating demand for AI-driven solutions and comprehensive digital modernization. The global digital transformation market is projected to approach $4 trillion by 2027, with AI investments forming a significant part of this growth. This allows Insight to directly meet client needs for AI-powered services and digital upgrades.

The expanding cloud services market, expected to reach $679 billion in 2024, presents a substantial opportunity. As businesses increasingly adopt multi-cloud and hybrid strategies, Insight's expertise in managing these environments and offering IaaS and SaaS solutions becomes more valuable. This trend is further amplified by the ongoing digital transformation across industries, driving demand for cost-optimization and scalability through cloud adoption.

The cybersecurity market, anticipated to hit $300 billion by 2024, offers another key growth area. Insight's focus on AI security and data protection solutions aligns perfectly with the rising need for robust security measures against escalating cyber threats. By expanding its security offerings, especially in AI-related vulnerabilities, Insight can capture a larger share of this critical market.

Geographic expansion into high-growth regions like India and Brazil, where IT spending is projected to increase by over 10% annually through 2025, presents a significant opportunity. Targeting emerging markets in Eastern Europe and Southeast Asia, which are increasing IT infrastructure investments, can further broaden Insight's client base. Leveraging existing partner ecosystems and tailoring services to local needs will be crucial for success in these new territories.

The burgeoning low-code/no-code platform market, forecast to reach $220 billion by 2025, offers a substantial avenue for growth, driven by the demand for intelligent enterprise automation. Insight's acquisition of Infocenter, enhancing its workflow automation and ServiceNow capabilities, directly addresses this trend. This integration allows Insight to provide more efficient and agile solutions, giving it a competitive edge in assisting businesses with digital transformation and operational improvements.

Threats

Global economic and geopolitical uncertainties are causing businesses to hit the pause button on new IT spending, especially for big, non-essential projects. This 'uncertainty pause' directly threatens Insight's revenue streams, particularly impacting their hardware sales and large-scale enterprise service contracts. For instance, in Q1 2025, IT spending forecasts saw a downward revision by 3% globally due to these persistent concerns.

This heightened caution means Insight could see a slowdown in its growth trajectory as clients delay or scale back investments in new technologies and infrastructure upgrades. The impact is most pronounced in sectors that are highly sensitive to economic fluctuations, potentially leading to a significant drag on Insight's top-line performance throughout 2025.

The IT sector sees technologies become outdated incredibly fast. For instance, some tech skills have a half-life of just 2.5 years, meaning they lose relevance quickly. Insight needs to constantly update its offerings to stay ahead.

Disruptive technologies or new companies entering the market pose a significant threat. In 2024, the global IT spending was projected to reach $5.1 trillion, a 6.8% increase from 2023, highlighting the dynamic and competitive landscape Insight operates within.

As a provider of IT solutions and data security services, Insight faces significant cybersecurity risks. Sophisticated cyberattacks and data breaches could severely damage its reputation, leading to substantial financial losses and a critical erosion of client trust. The global cost of cybercrime is a stark warning, projected to reach an alarming US$10.5 trillion by 2025, highlighting the immense financial stakes involved.

Aggressive Competition from Hyperscalers and Specialized Firms

Insight faces intense competition from both broad-spectrum cloud providers and highly focused niche players. Hyperscalers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are increasingly offering integrated IT services, directly challenging Insight's traditional offerings and potentially driving down prices. For instance, in 2024, the global cloud computing market size was valued at approximately $700 billion, with these hyperscalers holding significant market share and expanding their service portfolios.

Furthermore, specialized firms adept at specific technologies or industries can outmaneuver Insight in high-growth areas. These niche competitors often possess deeper expertise and agility, allowing them to capture market share and exert considerable pricing pressure. This dual threat from large, resource-rich hyperscalers and nimble, specialized firms necessitates a strategic response to maintain competitive positioning.

- Hyperscaler Expansion: AWS, Azure, and Google Cloud continue to broaden their service portfolios beyond core infrastructure, encroaching on traditional IT services markets.

- Niche Specialization: Specialized firms are gaining traction in areas like AI/ML implementation and cybersecurity, where deep domain expertise is critical.

- Pricing Pressure: The competitive landscape, particularly with hyperscalers, leads to downward pressure on pricing for many IT services.

- Market Share Capture: Competitors are actively vying for market share in high-demand segments, potentially impacting Insight's growth trajectory.

Dependency on Key Partner Programs and Vendor Relationships

Insight's dependence on key partner programs, particularly from major vendors like Microsoft, presents a significant threat. Changes to these programs, such as altered rebate structures or product availability, directly impact Insight's gross profit margins and overall business model. For instance, a shift in Microsoft's cloud licensing agreements could alter the profitability of Insight's cloud solutions business.

Furthermore, a strong reliance on these vendor relationships means that unfavorable strategic decisions by partners, or increased competition directly from vendors themselves, could pose a substantial risk. This was underscored in fiscal year 2023, where Insight's Cloud Solutions Provider (CSP) revenue, heavily tied to Microsoft, continued to be a critical growth driver, highlighting the vulnerability to vendor-initiated changes.

- Vendor Program Changes: Alterations in partner program terms by key vendors can reduce profitability.

- Increased Vendor Competition: Vendors may increase direct sales efforts, bypassing partners like Insight.

- Reliance on Specific Vendors: Over-dependence on a single vendor's ecosystem creates concentrated risk.

- Evolving Partner Requirements: Vendors may impose new, costly requirements for partner status.

The rapid evolution of technology means Insight must constantly adapt its offerings to remain relevant, as skills can become obsolete quickly, with some tech skills having a half-life of just 2.5 years. Disruptive technologies and new market entrants also pose a significant threat, especially as the global IT spending was projected to reach $5.1 trillion in 2024, indicating a highly competitive environment. Furthermore, sophisticated cyberattacks, with the global cost of cybercrime projected to reach $10.5 trillion by 2025, present a substantial risk to Insight's reputation and financial stability.

Insight faces intense competition from both large cloud providers like AWS, Azure, and Google Cloud, which are expanding their service portfolios, and specialized niche players offering deep expertise in areas like AI/ML and cybersecurity. This dual competitive pressure can lead to pricing pressure and market share erosion in high-demand segments. For example, the global cloud computing market was valued at approximately $700 billion in 2024, with hyperscalers dominating a significant portion.

Insight's reliance on key vendor partnerships, particularly with Microsoft, creates a vulnerability. Changes in partner programs, licensing agreements, or increased direct competition from these vendors can directly impact Insight's profitability and business model. In fiscal year 2023, Insight's Cloud Solutions Provider revenue, heavily tied to Microsoft, was a critical growth driver, underscoring this dependence.

SWOT Analysis Data Sources

This analysis draws from a robust dataset, incorporating internal financial reports, comprehensive market research, and expert opinions to provide a well-rounded and actionable SWOT assessment.