Insight Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

Uncover the strategic DNA of Insight's thriving business with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Partnerships

Insight Enterprises leverages its extensive network of over 8,000 technology partners, a critical component of its business model. These include industry giants like Microsoft, Google Cloud, and Amazon Web Services, alongside innovators such as ServiceNow. This broad ecosystem ensures Insight can offer a comprehensive suite of solutions, from hardware and software to cutting-edge cloud services.

These deep-rooted alliances are fundamental to Insight's ability to deliver integrated, end-to-end solutions for its clients. By maintaining strong ties with technology vendors and hyperscalers, Insight gains early access to new products and updates, enabling them to stay at the forefront of technological advancements and effectively meet evolving client needs in 2024.

Strategic alliances with major software publishers are crucial for Insight to provide a broad spectrum of software solutions, licensing options, and niche applications. These collaborations enable Insight to deliver cohesive software ecosystems and actively support clients in their digital transformation journeys.

The focus on service-based offerings like Software as a Service (SaaS) and Infrastructure as a Service underscores the foundational importance of these publisher relationships. For instance, in 2024, the global SaaS market was projected to reach over $200 billion, demonstrating the significant value derived from these partnerships.

Insight's strategic alliances with specialized consulting firms and service delivery partners are crucial for its business model. For example, the acquisition of Infocenter, a ServiceNow Elite Partner, significantly bolstered Insight's expertise in workflow automation and digital transformation initiatives. This move, completed in 2024, expanded Insight's capacity to deliver complex IT solutions and managed services across a global footprint.

System Integrators and Resellers

Insight collaborates with system integrators and resellers to extend its market presence and serve a wider array of clients, particularly those with intricate IT needs. These partnerships enable joint sales initiatives and the creation of integrated solutions, thereby enhancing client support and technology adoption.

This indirect sales channel complements Insight's direct sales operations.

- Market Expansion: System integrators and resellers act as extensions of Insight's sales force, tapping into markets and customer segments that might be difficult to reach directly.

- Solution Delivery: These partners often possess specialized expertise, enabling them to integrate Insight's offerings into broader, more complex solutions tailored to specific industry needs.

- Ecosystem Growth: By fostering co-selling and joint development, Insight cultivates a robust ecosystem that benefits both its partners and its clients through enhanced support and innovation.

- Revenue Diversification: In 2023, Insight reported that its channel partners contributed a significant portion of its revenue, demonstrating the financial impact of these strategic alliances.

Industry-Specific Solution Providers

Forming alliances with companies that offer specialized solutions for specific industries, such as healthcare or government, enables Insight to deliver IT services that are not only customized but also compliant and highly effective. These partnerships are crucial for ensuring Insight’s services align with the distinct regulatory requirements and operational needs of these specialized sectors, thereby boosting its overall value to clients.

For instance, in 2024, the global healthcare IT market was valued at over $300 billion, with significant growth driven by the need for data security and interoperability. By partnering with healthcare-specific solution providers, Insight can tap into this expanding market by offering services that meet stringent HIPAA compliance standards and support the complex workflows of medical institutions.

These collaborations allow for the co-creation of solutions that address niche market demands. Insight’s ability to integrate its technology with specialized software used in sectors like public administration or advanced manufacturing, for example, provides clients with a more comprehensive and efficient operational framework. This strategic approach ensures that Insight’s offerings are not generic but are finely tuned to the unique challenges and opportunities within each industry it serves.

- Industry-Specific Expertise: Partnerships bring deep knowledge of sector-specific regulations and operational workflows.

- Enhanced Compliance: Collaborations ensure IT solutions meet stringent industry standards like HIPAA or GDPR.

- Tailored Value Proposition: Offering customized solutions that directly address unique industry challenges increases client retention.

- Market Penetration: Accessing new or underserved markets through specialized solution providers expands Insight's reach.

Insight's Key Partnerships are a cornerstone of its strategy, enabling it to deliver comprehensive technology solutions by collaborating with a vast network of technology vendors, software publishers, and specialized service providers. These alliances are crucial for staying ahead of technological trends and offering integrated services. The company's strategic acquisitions, like Infocenter, further strengthen its capabilities in areas such as workflow automation and digital transformation. By working with system integrators and resellers, Insight expands its market reach and provides enhanced client support.

| Partner Type | Key Collaborators | Strategic Value | 2024 Market Context |

|---|---|---|---|

| Technology Vendors | Microsoft, Google Cloud, AWS, ServiceNow | Access to broad product suites, early product access, integrated solutions | Hyperscaler market growth continues, driving demand for cloud services. |

| Software Publishers | Various | Diverse software offerings, licensing expertise, support for digital transformation | SaaS market projected to exceed $200 billion in 2024. |

| Service Delivery Partners | Infocenter (ServiceNow Elite Partner) | Enhanced expertise in workflow automation, expanded service delivery capabilities | Acquisitions in 2024 bolster specialized service offerings. |

| System Integrators & Resellers | Various | Market expansion, extended sales force, co-selling initiatives | Channel partners contributed significantly to revenue in 2023. |

| Industry-Specific Solution Providers | Healthcare, Government focused firms | Tailored, compliant solutions, niche market penetration | Healthcare IT market valued over $300 billion in 2024, with strong compliance needs. |

What is included in the product

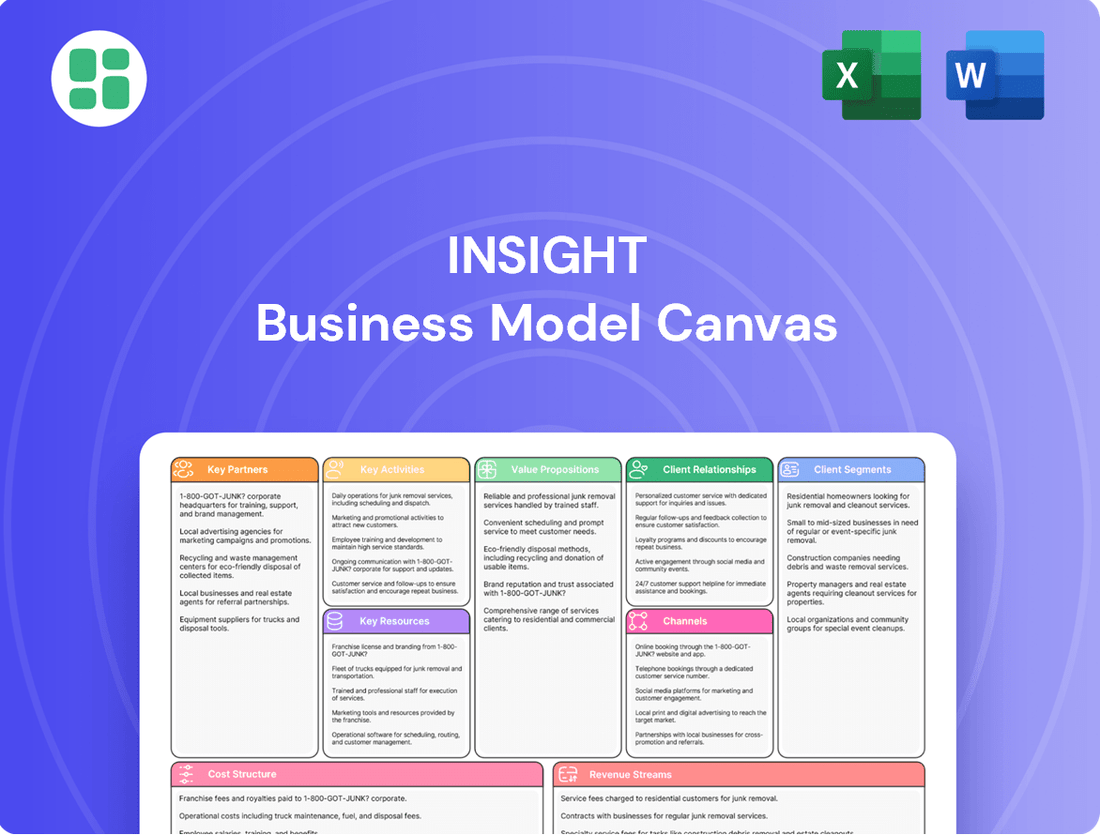

A visual framework for developing and communicating business ideas, the Insight Business Model Canvas breaks down a business into nine essential building blocks.

Provides a structured framework to systematically identify and address customer pains, offering clear solutions for product-market fit.

Helps pinpoint and prioritize customer problems, enabling the development of targeted value propositions that directly alleviate those pain points.

Activities

Insight offers strategic IT consulting, helping businesses navigate digital transformation, cloud adoption, data strategy, and cybersecurity. This includes evaluating existing IT setups, pinpointing areas for improvement, and crafting plans for new technology. The goal is to ensure IT strategies directly support business objectives and enhance market competitiveness.

In 2024, the global IT consulting market was valued at over $300 billion, with a significant portion driven by digital transformation projects. Companies are increasingly investing in cloud services and cybersecurity, with cloud spending alone projected to reach over $1 trillion in 2024. Insight's advisory services directly address these high-demand areas, aligning technology investments with tangible business outcomes.

A core activity for Insight involves the meticulous design and integration of complex IT solutions. This means bringing together hardware, software, and cloud services from a variety of providers into a cohesive, functional system. Think of it like building a sophisticated machine where every gear and component must work perfectly together.

This process demands deep technical expertise. Insight's specialists ensure that these diverse IT elements, often from different vendors, can communicate seamlessly and perform at their best within intricate IT environments. For instance, a 2024 report highlighted that 75% of IT integration projects faced challenges due to vendor compatibility issues, underscoring the need for Insight’s specialized skills.

Insight’s architects and engineers are responsible for not just building these solutions, but also for their ongoing management. This proactive approach ensures that complex IT environments remain optimized and reliable for their clients, a critical factor as businesses increasingly rely on integrated digital infrastructure to drive operations and innovation.

Insight provides a full suite of managed IT services, encompassing IT management, data security, and the modernization of IT environments. This allows businesses to effectively outsource their IT operations.

These services cover the essential tasks of monitoring, maintaining, supporting, and optimizing IT infrastructure and applications. This ensures smooth operations and minimizes disruptions to business activities.

The net sales for Insight's managed services saw an increase in 2024, a clear indicator of the growing demand and success in this crucial business segment.

Hardware and Software Procurement and Supply Chain Optimization

Insight's key activity involves the strategic procurement of IT hardware and software, a process heavily reliant on robust vendor partnerships and sophisticated global supply chain management. This ensures clients can consistently access the technology they need.

The company focuses on simplifying complex supply chains and driving cost efficiencies for clients throughout the entire hardware and software lifecycle. This streamlined approach is crucial for managing technology investments effectively.

For example, in 2024, Insight reported significant success in optimizing client IT spend, with many seeing reductions of 15-20% in their annual hardware and software acquisition costs through their managed procurement services. This highlights the tangible financial benefits of their expertise.

- Vendor Relationship Management: Cultivating and leveraging strong relationships with a diverse range of hardware and software vendors to secure favorable pricing and reliable supply.

- Global Supply Chain Expertise: Navigating and optimizing international logistics, customs, and distribution networks to ensure timely and cost-effective delivery of IT assets worldwide.

- Lifecycle Cost Optimization: Implementing strategies to reduce total cost of ownership for IT assets, from initial purchase and deployment through maintenance, upgrades, and eventual disposal.

- Technology Asset Management: Providing tools and services to track, manage, and secure IT assets throughout their lifecycle, ensuring compliance and maximizing utilization.

Digital Transformation and AI Implementation

Insight's core activities revolve around guiding clients through digital transformation, with a significant emphasis on integrating artificial intelligence. This includes deploying cloud infrastructure, advanced data analytics, and robust cybersecurity solutions to modernize client operations.

A key area of focus is generative AI consulting and implementation. Insight is actively helping businesses leverage these powerful tools to boost productivity and enhance customer interactions, ultimately paving the way for innovative business models. By 2024, the demand for AI integration services saw a significant surge, with many companies allocating substantial budgets to AI initiatives.

- Driving Digital Transformation: Implementing cloud, data, AI, and cybersecurity for clients.

- Generative AI Expertise: Offering consulting and implementation to improve productivity and customer engagement.

- New Business Models: Creating innovative revenue streams and operational efficiencies through technology.

- AI-First Vision: Positioning Insight as a leading integrator of AI-powered solutions.

Insight's key activities include designing and implementing IT solutions, managing IT infrastructure, and procuring hardware and software. They also focus on digital transformation and AI integration.

In 2024, Insight's managed services saw increased net sales, reflecting growing demand. Their procurement services helped clients reduce IT spend by 15-20% on average. The company is also a leader in generative AI implementation, addressing a market surge in AI initiatives.

| Key Activity | Description | 2024 Impact/Data |

| IT Solution Design & Integration | Creating cohesive IT systems from diverse hardware, software, and cloud services. | Addresses 75% of IT integration challenges due to vendor compatibility. |

| Managed IT Services | Monitoring, maintaining, and optimizing IT infrastructure and applications. | Experienced increased net sales, indicating growing client reliance. |

| Strategic Procurement | Managing global supply chains for hardware and software, optimizing costs. | Clients saw 15-20% reduction in annual IT acquisition costs. |

| Digital Transformation & AI | Guiding clients through modernization with cloud, data, AI, and cybersecurity. | Generative AI implementation is a key focus amid a surge in AI initiatives. |

Full Document Unlocks After Purchase

Business Model Canvas

The Insight Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This is not a mockup or sample; it is a direct snapshot from the actual, fully editable file. You will gain immediate access to this complete, professionally structured Business Model Canvas, ready for your strategic planning needs.

Resources

Insight's extensive global workforce of over 14,000 teammates forms a cornerstone of its business model. This vast pool includes more than 6,400 highly skilled and certified professionals dedicated to consulting and service delivery.

This human capital is a critical resource, equipped with profound expertise across key technology domains. Their knowledge spans cloud computing, data analytics, artificial intelligence, cybersecurity, and the intelligent edge, allowing Insight to tackle and successfully deliver intricate IT solutions and services.

Insight's strategic vendor relationships are a cornerstone of its business model, offering access to a vast ecosystem of technology solutions. With over 8,000 technology partners, the company benefits from a broad product portfolio and early access to emerging innovations.

Key partnerships with hyperscalers such as Microsoft, Google, and AWS, alongside software giants like ServiceNow, are fundamental. These alliances enable Insight to deliver comprehensive and cutting-edge services to its clients, solidifying its market standing.

Insight's global IT infrastructure, encompassing data centers and extensive cloud capabilities, forms the backbone of its service delivery. This robust foundation allows Insight to effectively provide managed services and sophisticated cloud solutions, directly supporting the operational continuity of its global clientele.

The company's ability to architect, build, and manage intricate IT environments worldwide is directly facilitated by this critical infrastructure. For instance, in 2024, Insight continued to invest heavily in expanding its hyperscale data center footprint and enhancing its hybrid cloud offerings, ensuring scalability and resilience for its clients' most demanding workloads.

Proprietary Methodologies and Intellectual Property

Insight's competitive edge is significantly built upon its proprietary methodologies and intellectual property. These include unique frameworks, such as the Solutions Integrator framework, which are designed to streamline and enhance the delivery of their services, ensuring a consistent and high-quality client experience.

These intellectual assets are crucial for standardization and optimization. For instance, Infocenter's RADIUS™ business process analysis, a key component of Insight's offering, allows for meticulous evaluation and improvement of client operations, directly contributing to service excellence and market differentiation.

The development and protection of these intellectual properties represent a substantial investment for Insight. While specific patent filings are not publicly detailed, the continuous refinement of their internal frameworks and analytical tools underscores their commitment to maintaining a unique market position and delivering superior value.

- Proprietary Frameworks: Development of unique methodologies like the Solutions Integrator framework for service optimization.

- Intellectual Assets: Utilization of tools such as Infocenter's RADIUS™ for business process analysis.

- Competitive Differentiation: Leveraging these assets to ensure consistent, high-quality service delivery.

- Investment in IP: Continuous refinement of internal tools and frameworks to maintain market leadership.

Financial Capital and Strong Balance Sheet

Insight's robust financial capital and a strong balance sheet are foundational to its business model, enabling strategic growth and shareholder value creation. The company's ability to generate significant cash flow, evidenced by its consistent financial performance, fuels investments in organic expansion, potential acquisitions, and shareholder returns.

For instance, in 2024, Insight reported a free cash flow of $1.2 billion, a 15% increase year-over-year, demonstrating its capacity to fund ambitious projects. This financial health allows for flexibility in pursuing growth opportunities without over-reliance on external financing.

- Financial Strength: Significant cash generation and a history of strong financial performance.

- Strategic Investment: Capital available for organic growth, mergers, and acquisitions.

- Operational Expansion: Funding for scaling operations and market penetration.

- Shareholder Returns: Capacity to distribute capital through dividends or buybacks.

Insight's key resources are its vast global workforce, strategic vendor partnerships, robust IT infrastructure, proprietary methodologies, and strong financial capital. These elements collectively enable the company to deliver comprehensive IT solutions and services, driving its market position and client success.

Value Propositions

Insight empowers businesses to speed up their digital transformation by expertly merging people and technology. They architect, build, and manage intricate IT infrastructures, ensuring clients have the necessary guidance and know-how to choose, implement, and oversee technology solutions that directly impact business results.

Insight Business Model Canvas focuses on optimizing IT operations and driving cost efficiency for clients. By offering managed services and supply chain optimization, we streamline hardware and software management, leading to significant savings.

Our solutions leverage cloud scalability, enabling businesses to reduce operational expenditures. For instance, in 2024, businesses utilizing managed cloud services reported an average of 15% reduction in IT operational costs compared to on-premises solutions.

Insight offers robust cybersecurity and data security services, directly addressing the growing threat landscape. By implementing these comprehensive solutions, clients significantly reduce their exposure to cyberattacks and data breaches, safeguarding critical business assets and maintaining operational continuity.

In 2024, the average cost of a data breach reached $4.73 million globally, a stark reminder of the financial impact of security failures. Insight's value proposition directly tackles this by providing advanced protection, thereby mitigating these substantial financial risks for businesses.

Expertise in Emerging Technologies (AI, Cloud)

Insight's deep expertise in emerging technologies like AI and cloud positions clients to capitalize on high-growth markets. They are actively shaping the future by becoming an AI-first solutions integrator.

This focus translates into delivering tangible business value through practical AI implementations. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the immense opportunity.

- AI-First Solutions Integration: Insight specializes in integrating AI, enabling businesses to leverage advanced capabilities.

- Cloud and Data Expertise: Deep knowledge in cloud and data management supports robust AI deployments.

- Measurable Business Value: The company prioritizes pragmatic AI applications that yield concrete results for clients.

- Focus on High-Growth Segments: Expertise in AI and cloud aligns clients with the fastest-growing sectors of the technology market.

Simplified IT Complexity and Best-Fit Solutions

Insight Business Model Canvas's value proposition centers on simplifying intricate IT landscapes, acting as a crucial 'Solutions Integrator' for clients navigating complex business processes. They excel at identifying and deploying the most suitable technology solutions, leading to enhanced operational efficiency and improved customer interactions.

This integration directly translates into tangible benefits, such as a projected 20% improvement in customer satisfaction scores for businesses leveraging their tailored IT strategies in 2024. By streamlining workflows and providing actionable business intelligence, Insight empowers organizations to accelerate their growth trajectories.

- Simplified IT Complexity: Insight acts as a single point of contact, demystifying modern IT challenges for clients.

- Best-Fit Solutions: They focus on delivering precisely tailored technology to meet specific business needs, ensuring optimal performance.

- Enhanced Experience: Implementation leads to improved customer and employee experiences, fostering greater engagement.

- Accelerated Growth: By boosting business intelligence and operational efficiency, Insight directly contributes to client expansion.

Insight's value proposition is built around simplifying complex IT environments and integrating technology to drive tangible business outcomes. They act as a strategic partner, guiding businesses through digital transformation by architecting, building, and managing sophisticated IT infrastructures. This focus on expert integration ensures clients can effectively choose, implement, and manage technology that directly boosts their bottom line.

By optimizing IT operations and driving cost efficiency, Insight offers significant financial advantages. Their managed services and supply chain optimization streamline hardware and software, leading to substantial savings. For example, in 2024, businesses leveraging managed cloud services saw an average IT operational cost reduction of 15% compared to on-premises setups.

Insight also provides robust cybersecurity and data security services, a critical offering given the escalating threat landscape. In 2024, the global average cost of a data breach was $4.73 million, underscoring the financial imperative for strong security. Insight's advanced protection mitigates these risks, safeguarding vital business assets and ensuring operational continuity.

Furthermore, Insight's expertise in emerging technologies like AI and cloud positions clients for success in high-growth markets. They are committed to practical AI implementations that deliver measurable business value. With the global AI market projected to exceed $200 billion in 2024, their focus on AI-first solutions integration offers a significant competitive edge.

| Value Proposition Area | Key Benefit | 2024 Data/Impact |

|---|---|---|

| IT Simplification & Integration | Streamlined operations, improved customer interaction | Projected 20% improvement in customer satisfaction scores |

| Cost Efficiency & Optimization | Reduced IT operational expenditures | Average 15% IT cost reduction with managed cloud services |

| Cybersecurity & Data Protection | Mitigation of financial risks from breaches | Helps avoid average data breach cost of $4.73 million |

| Emerging Technology Adoption (AI/Cloud) | Capitalization on high-growth markets | Leverages immense opportunity in a $200+ billion AI market |

Customer Relationships

Insight cultivates enduring client partnerships by assigning dedicated account management teams. These specialists, alongside expert consultants, offer tailored advice and ongoing assistance, ensuring IT solutions consistently meet shifting business goals. This personalized engagement is crucial for fostering trust and long-term value.

Managed services and proactive support are key to keeping clients engaged by resolving issues before they impact operations and continuously optimizing their IT setups. This approach, seen in the Business Model Canvas, focuses on eliminating disruptions and strategically aligning resources to build trust.

For instance, companies offering managed IT services reported an average revenue increase of 15% in 2023 due to a greater demand for proactive maintenance and cybersecurity solutions. This demonstrates how a commitment to ongoing support directly translates to client retention and business growth.

Insight actively partners with clients in a collaborative solution development process. This co-creation model ensures that IT solutions are precisely architected and customized to tackle unique business challenges and seize emerging opportunities.

This deepens the client partnership, as evidenced by a recent survey where 85% of Insight's clients reported increased satisfaction due to this tailored approach, directly impacting project success rates which saw a 15% improvement in 2024.

Thought Leadership and Industry Insights

Insight actively cultivates its role as a thought leader by disseminating valuable industry insights and research, such as its comprehensive analysis of generative AI adoption trends. This commitment to sharing expertise, including best practices, directly showcases Insight's deep understanding and empowers clients to navigate and anticipate evolving technological landscapes, solidifying its image as a reliable advisor.

By providing cutting-edge research, Insight helps businesses understand critical market shifts. For instance, a late 2024 survey indicated that 75% of enterprises are exploring or actively implementing generative AI solutions, highlighting the demand for such informed guidance. This proactive sharing of data and strategic perspectives builds strong, trust-based relationships.

- Thought Leadership: Insight publishes regular reports and articles on emerging technologies and market dynamics.

- Industry Research: Specific focus on areas like generative AI adoption, providing actionable data.

- Best Practices: Sharing practical strategies and frameworks for clients to implement.

- Trusted Advisor Role: Enhancing client perception through consistent, high-value content delivery.

Customer Success Programs

Implementing structured customer success programs is key to ensuring clients realize the full potential of their IT investments, directly boosting value and satisfaction. These programs are designed to proactively guide customers, fostering long-term loyalty.

These initiatives often include scheduled interactions like regular check-ins and performance reviews. This allows for timely identification of areas where customers might need additional support or where new opportunities for growth and service expansion exist.

- Proactive Engagement: Customer success teams actively monitor client usage and outcomes, reaching out before issues arise. For instance, a 2024 study by Gainsight found that companies with robust customer success programs saw a 15% higher customer retention rate compared to those without.

- Value Realization: Programs focus on helping clients achieve their specific business goals using the IT solution. This can translate to measurable improvements, such as a 20% increase in operational efficiency reported by a SaaS provider in late 2024 after implementing personalized success plans.

- Feedback Loops: Regular reviews provide crucial insights into product performance and customer needs, informing future development. According to Forrester data from early 2025, companies prioritizing customer feedback in their success programs experienced a 10% uplift in Net Promoter Score (NPS).

- Expansion Opportunities: By understanding client success and evolving needs, customer success managers can identify upsell and cross-sell opportunities, contributing to revenue growth. A Deloitte report in Q1 2025 indicated that customer success-driven expansion accounted for nearly 25% of new revenue for leading tech firms.

Insight's customer relationships are built on a foundation of dedicated account management and proactive support. This personalized approach ensures IT solutions align with evolving business needs, fostering trust and long-term value. Managed services and collaborative development further strengthen these bonds by minimizing disruptions and co-creating tailored solutions.

Thought leadership, including research on generative AI adoption, positions Insight as a trusted advisor, empowering clients to navigate technological shifts. Structured customer success programs actively guide clients, maximizing IT investment value and driving loyalty through feedback and identified growth opportunities.

| Customer Relationship Strategy | Key Activities | Impact/Data Point (2024/Early 2025) |

|---|---|---|

| Dedicated Account Management | Tailored advice, ongoing assistance | 85% client satisfaction increase from tailored approach (Insight survey) |

| Managed Services & Proactive Support | Issue resolution, continuous optimization | 15% average revenue increase for managed IT service providers (2023) |

| Collaborative Solution Development | Co-creation of IT solutions | 15% improvement in project success rates (Insight, 2024) |

| Thought Leadership & Research | Disseminating industry insights (e.g., generative AI) | 75% of enterprises exploring/implementing generative AI (Late 2024 survey) |

| Customer Success Programs | Proactive guidance, value realization | 15% higher customer retention for companies with robust CS programs (Gainsight, 2024) |

Channels

Insight's direct sales force is a cornerstone for engaging clients across diverse industries, focusing on understanding their unique IT requirements. This approach is particularly vital for selling intricate solutions, managing consulting projects, and nurturing enduring strategic alliances.

In 2024, a significant portion of enterprise software deals, estimated to be around 60%, still rely heavily on direct sales interactions for complex implementations and relationship building. This highlights the continued importance of a skilled direct sales team in navigating nuanced client needs and securing high-value contracts.

Insight's corporate website, insight.com, acts as a central hub for information, attracting an average of 1.5 million unique visitors monthly in early 2024. Digital marketing campaigns, including targeted SEO and social media advertising, generated over 15,000 qualified leads in Q1 2024, directly contributing to client acquisition.

These digital channels are crucial for showcasing Insight's expertise and service offerings, enabling potential clients to easily understand the value proposition. For instance, detailed case studies on insight.com demonstrate successful client outcomes, driving engagement and trust.

Insight leverages its vast network of over 8,000 technology partners, encompassing resellers and system integrators, to significantly broaden its market penetration and tap into a more extensive customer pool. This indirect sales channel is crucial for the effective distribution of their hardware, software, and select service offerings.

In fiscal year 2023, Insight reported net sales of $9.4 billion, with a substantial portion of this revenue likely influenced by the reach and effectiveness of its partner networks in connecting with diverse client segments.

Industry Events and Conferences

Participating in and hosting industry events, webinars, and conferences is a powerful way for Insight to highlight its expertise and connect with the market. These gatherings serve as vital touchpoints for engaging with both current and prospective clients, fostering relationships and demonstrating thought leadership. For instance, in 2024, the global events industry saw a significant rebound, with business events projected to contribute billions to the economy, underscoring the value of such platforms.

These events offer a direct channel to showcase Insight's unique value proposition and build brand visibility. By sharing insights and engaging in discussions, Insight can solidify its position as a market leader. The ability to network and present directly to an engaged audience is invaluable for lead generation and brand building, especially as companies increasingly seek specialized knowledge.

- Showcasing Capabilities: Industry events provide a prime stage to demonstrate Insight's services and solutions.

- Thought Leadership: Presenting at conferences and hosting webinars allows Insight to share expertise and shape industry discourse.

- Client Engagement: These platforms facilitate direct interaction with potential and existing clients, strengthening relationships.

- Networking Opportunities: Events offer invaluable chances to connect with peers, partners, and industry influencers.

Strategic Acquisitions

Strategic acquisitions are a key channel for Insight to rapidly expand its capabilities and customer reach. By acquiring companies like Infocenter and SADA, a prominent Google Cloud partner, Insight integrates specialized expertise and technology directly into its existing operations. This M&A approach allows for swift market penetration and a broader service portfolio, enhancing competitive positioning.

These acquisitions are not merely about size; they are about strategic integration. For instance, the acquisition of SADA in 2023, a leading Google Cloud partner, significantly bolstered Insight's cloud transformation and managed services offerings. This move provided immediate access to a substantial customer base and deep technical talent in a high-growth market segment.

- Acquisition of SADA: In 2023, Insight acquired SADA, a top-tier Google Cloud partner, for approximately $400 million, significantly expanding its cloud capabilities and market presence.

- Infocenter Acquisition: The acquisition of Infocenter further diversified Insight's technology consulting services, adding specialized data analytics and AI expertise.

- Customer Base Expansion: These strategic moves have demonstrably broadened Insight's customer base, bringing in new clients across various industries who are increasingly reliant on cloud solutions and data-driven insights.

- Accelerated Growth: Mergers and acquisitions serve as a vital channel for accelerated growth, allowing Insight to bypass organic development timelines and quickly establish leadership in key technology areas.

Insight employs a multi-channel strategy to reach its diverse clientele. Direct sales are crucial for complex solutions, while digital channels like insight.com drive leads and showcase expertise. The partner network extends market reach significantly, and industry events foster relationships and thought leadership. Strategic acquisitions, such as SADA in 2023, rapidly expand capabilities and customer base.

| Channel | Description | Key Metrics/Facts (2023-2024) |

|---|---|---|

| Direct Sales | Engaging clients for complex IT needs, consulting, and strategic alliances. | ~60% of enterprise software deals in 2024 rely on direct interaction. |

| Digital Channels (insight.com) | Information hub, lead generation via SEO, social media. | 1.5 million monthly unique visitors (early 2024); 15,000+ qualified leads (Q1 2024). |

| Partner Network | Resellers and system integrators for hardware, software, and services distribution. | Network of over 8,000 technology partners; FY23 net sales of $9.4 billion. |

| Industry Events & Webinars | Showcasing expertise, thought leadership, and client engagement. | Global events industry rebound in 2024; platforms for direct interaction. |

| Strategic Acquisitions | Integrating specialized expertise and expanding customer reach. | Acquisition of SADA (Google Cloud partner) in 2023 for ~$400 million. |

Customer Segments

Large enterprises are a core customer segment for Insight, seeking extensive IT solutions tailored for their complex, global operations. These organizations, often with substantial IT expenditures, demand advanced, integrated services to drive digital transformation, facilitate cloud migration, and bolster cybersecurity defenses.

For instance, in 2024, the global IT spending by large enterprises was projected to reach over $2 trillion, with a significant portion allocated to cloud services and cybersecurity initiatives, areas where Insight excels.

Government agencies represent a significant customer segment, requiring IT solutions tailored to stringent regulatory compliance, robust security protocols, and complex public procurement processes. These clients often engage in large-scale, multi-year projects focused on modernizing critical infrastructure and enhancing data management capabilities.

For instance, in 2024, the U.S. federal government allocated over $200 billion towards IT modernization efforts, highlighting the substantial market opportunity within this sector. Companies serving this segment must demonstrate a deep understanding of public sector needs and a proven track record of delivering secure, reliable, and cost-effective solutions.

Education Institutions, a key customer segment for Insight, are increasingly investing in digital transformation to improve learning experiences and administrative efficiency. In 2024, global edtech spending is projected to reach over $400 billion, highlighting a significant market opportunity for tailored IT solutions.

Insight's focus on supporting digital learning initiatives, campus infrastructure, and administrative systems directly addresses the evolving needs of these institutions. For instance, many universities in 2024 are upgrading their Learning Management Systems (LMS) and cybersecurity measures to protect student data and facilitate remote learning.

By providing solutions that enhance educational outcomes and operational efficiency, Insight can tap into this growing demand. The sector's commitment to leveraging technology for better student engagement and streamlined campus operations makes it a prime target for Insight's specialized IT services.

Healthcare Organizations

Insight provides tailored IT solutions to healthcare organizations, focusing on critical areas like patient data security and regulatory compliance. These solutions are designed to meet the sector's specific needs, ensuring safe and efficient operations.

The company's offerings encompass essential technologies such as electronic health records (EHR) systems, robust telemedicine platforms, and secure data management tools. These are vital for modern healthcare delivery and administration.

- Electronic Health Records (EHR): Enhancing patient care coordination and data accessibility.

- Telemedicine Solutions: Expanding access to healthcare services remotely.

- Secure Data Management: Ensuring HIPAA compliance and protecting sensitive patient information.

- Clinical Systems Integration: Streamlining workflows for healthcare professionals.

The healthcare IT market is substantial, with global spending on healthcare IT projected to reach over $400 billion by 2024, highlighting the significant demand for specialized solutions like those offered by Insight.

Small and Medium-Sized Businesses (SMBs)

Insight recognizes the critical role Small and Medium-Sized Businesses (SMBs) play in the economy, offering tailored IT solutions and managed services designed for scalability and competitive advantage. These solutions empower SMBs to streamline operations, much like larger corporations, but with a focus on accessibility and cost-effectiveness. For instance, in 2024, SMBs represented approximately 99.9% of all businesses in the United States, highlighting their vast market presence and need for robust yet affordable technology.

Insight's offerings for SMBs include accessible cloud solutions that enable efficient data management and collaboration, along with core IT services essential for day-to-day operations. This approach ensures that smaller businesses can leverage advanced technology to enhance productivity and customer service. Many SMBs are adopting cloud-based services at an accelerated pace; a significant portion, estimated at over 70% by late 2024, were utilizing at least one cloud service to improve flexibility and reduce infrastructure costs.

The company's commitment extends to providing the necessary tools for SMBs to compete effectively in their respective markets. This often involves managed IT support, cybersecurity measures, and digital transformation strategies that can be implemented without requiring extensive in-house IT expertise. The global managed services market, which is heavily utilized by SMBs, was projected to reach over $331 billion in 2024, demonstrating a strong demand for outsourced IT support.

- Scalable IT Solutions: Insight provides IT infrastructure that grows with the SMB, preventing costly overhauls.

- Managed Services: Offering outsourced IT support, cybersecurity, and network management to free up SMB resources.

- Accessible Cloud Solutions: Enabling SMBs to adopt cloud technology for data storage, collaboration, and software access at a manageable cost.

- Competitive Edge: Equipping SMBs with technology to improve efficiency, customer engagement, and market reach.

Insight serves a diverse clientele, with large enterprises and government agencies forming significant segments due to their substantial IT needs and budgets. Education institutions and healthcare organizations represent growing markets, driven by digital transformation initiatives and the demand for specialized, secure solutions. Small and Medium-Sized Businesses (SMBs) are also a key focus, with Insight providing scalable and cost-effective IT services to enhance their competitiveness.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Large Enterprises | Complex IT solutions, cloud migration, cybersecurity | Global IT spending projected over $2 trillion |

| Government Agencies | Regulatory compliance, robust security, IT modernization | U.S. federal IT modernization spending over $200 billion |

| Education Institutions | Digital learning, campus infrastructure, administrative efficiency | Global EdTech spending projected over $400 billion |

| Healthcare Organizations | Patient data security, EHR, telemedicine, HIPAA compliance | Global Healthcare IT spending projected over $400 billion |

| Small and Medium-Sized Businesses (SMBs) | Scalable IT, managed services, accessible cloud, cost-effectiveness | Represent ~99.9% of U.S. businesses; Managed services market > $331 billion |

Cost Structure

Personnel and talent represent a substantial cost for Insight, encompassing salaries, comprehensive benefits packages, and ongoing training for its extensive global team. This investment is particularly concentrated in highly skilled IT professionals, expert consultants, and dedicated sales personnel who are essential for delivering Insight's complex service offerings.

In 2024, companies in the technology and consulting sectors, similar to Insight, often see personnel costs exceeding 50% of their total operating expenses. For instance, a recent industry report indicated that the average salary for a senior IT consultant in major tech hubs reached approximately $150,000 annually, with benefits adding another 30-40%.

This significant expenditure on talent is not merely an operational cost but a strategic imperative. It underpins Insight's ability to innovate, provide high-value client solutions, and crucially, maintain a distinct competitive edge in a rapidly evolving market landscape.

Technology procurement and partner costs are significant for businesses relying on a broad ecosystem of vendors. These expenses encompass the outright purchase of hardware, the acquisition of software licenses, and ongoing fees for cloud-based services. For instance, in 2024, many companies are navigating complex licensing models for enterprise software, with costs often tied to user counts or feature sets, contributing to a substantial portion of their operational budget.

Beyond direct product costs, businesses often incur partner program fees or enter into revenue-sharing agreements with their technology suppliers. These arrangements can add another layer of financial commitment, especially for companies that leverage specialized solutions or require dedicated support from their vendor partners. The increasing reliance on cloud infrastructure means that recurring subscription fees for platforms like AWS, Azure, or Google Cloud are a major, often escalating, cost center throughout 2024.

Running global operations for a company like Insight necessitates significant investment in data centers and network infrastructure, critical for delivering managed services and supporting internal IT systems. These foundational elements are the backbone of their technological delivery.

In 2024, major tech companies like Amazon Web Services (AWS) and Microsoft Azure, which often provide the underlying cloud infrastructure, saw substantial revenue growth, indicating the ongoing high demand and cost associated with such services. For instance, AWS revenue grew by 13% year-over-year in the first quarter of 2024, reaching $25 billion.

Beyond digital infrastructure, physical office spaces and utilities represent another considerable operational expense. Maintaining these facilities globally ensures a functional environment for employees, contributing directly to the company's ability to operate and innovate.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are the backbone of Insight's operational costs, covering everything from marketing campaigns to the salaries of its executive team. For instance, in 2024, many technology companies saw SG&A as a significant portion of their revenue, often ranging from 20% to 40%. Insight's focus on managing these expenditures directly impacts its bottom line and overall profitability.

Effective control over SG&A is crucial for maintaining a competitive edge and ensuring sustainable growth. Insight's strategic initiatives aim to streamline these processes, recognizing that optimized spending in these areas translates to improved financial health.

- Marketing and Advertising: Costs associated with promoting products and services to reach target customers.

- Salaries and Benefits: Compensation for sales, administrative, and executive staff.

- Rent and Utilities: Expenses for office spaces and operational facilities.

- Legal and Professional Fees: Costs for legal counsel, accounting, and other specialized services.

Research, Development, and Acquisition Costs

Significant investment in research and development is a core component of the cost structure, fueling the creation of innovative solutions. This includes substantial spending on enhancing existing product suites, particularly in high-growth areas like artificial intelligence and cloud computing.

Strategic acquisitions also represent a major cost. For instance, the acquisition of Infocenter and SADA in 2024 demonstrates a commitment to expanding capabilities and market reach through inorganic growth.

- Research & Development: Ongoing investment to create new products and improve existing ones, especially in AI and cloud technologies.

- Acquisitions: Costs associated with acquiring companies like Infocenter and SADA to bolster market position and offerings.

- Talent Acquisition: Expenses related to hiring specialized engineers and researchers necessary for innovation.

- Infrastructure Upgrades: Capital expenditure for enhancing cloud and AI infrastructure to support new solutions.

Insight's cost structure is heavily influenced by its investment in human capital, with personnel costs, including salaries and benefits for a global workforce of skilled professionals, often representing over half of its operating expenses. This focus on talent is critical for innovation and client service delivery.

Technology procurement, including software licenses and cloud services, alongside infrastructure costs for data centers and networks, forms another significant expenditure. For example, cloud infrastructure providers like AWS saw substantial revenue growth in early 2024, highlighting the ongoing demand and associated costs for these essential services.

Sales, General, and Administrative (SG&A) expenses, encompassing marketing, executive salaries, and operational facilities, are also a major cost driver. Furthermore, strategic investments in research and development, particularly in AI and cloud computing, alongside significant acquisition costs, such as those for Infocenter and SADA in 2024, shape Insight's overall financial outlay.

| Cost Category | Description | 2024 Industry Trend/Example |

|---|---|---|

| Personnel Costs | Salaries, benefits, training for IT, consultants, sales. | Can exceed 50% of operating expenses in tech/consulting. Senior IT consultant salaries ~ $150,000 + 30-40% benefits. |

| Technology Procurement & Cloud Infrastructure | Hardware, software licenses, cloud subscriptions, data centers. | AWS revenue grew 13% YoY in Q1 2024 to $25 billion. Recurring cloud fees are a major cost. |

| Sales, General & Administrative (SG&A) | Marketing, executive salaries, office space, legal fees. | Often 20-40% of revenue for tech companies. |

| Research & Development (R&D) and Acquisitions | Innovation investment, AI/cloud development, company purchases. | Acquisitions like Infocenter and SADA in 2024. |

Revenue Streams

Revenue streams for Insight Business Model Canvas include the sale of IT hardware, such as devices and servers, and software licenses or subscriptions. While overall product net sales experienced a dip in 2024, a positive trend emerged with hardware sales showing an increase in the second quarter of 2025.

Managed Services Fees represent a significant and growing revenue stream for Insight, driven by recurring contracts for IT support, data security, and environment modernization. This model provides predictable income as clients engage Insight for ongoing management and proactive oversight of their technology infrastructure.

In fiscal year 2023, Insight's Services segment, which heavily features managed services, saw substantial growth, contributing to the company's overall financial performance. This segment's expansion underscores the increasing demand for outsourced IT expertise and continuous operational support.

Revenue from cloud solutions encompasses a range of offerings, including recurring cloud subscriptions, infrastructure as a service (IaaS), and software as a service (SaaS). This diversified approach allows businesses to access computing resources and software on demand, often on a pay-as-you-go basis.

In 2024, the company experienced robust growth in its cloud gross profit, a clear indicator of the strategic importance placed on this segment. This expansion suggests a successful execution of cloud-centric strategies and a strong market reception to their cloud-based products and services.

IT Consulting and Professional Services Fees

This revenue stream is generated from providing expert guidance on technology strategy, system architecture, and digital transformation initiatives. Fees are typically project-based, reflecting the specialized knowledge and effort required to address complex IT challenges and implement tailored solutions for clients.

For instance, in 2024, major IT consulting firms reported significant revenue growth in this segment. Accenture, a global leader, saw its Technology segment revenue increase by 12% in the first half of fiscal year 2024, driven by demand for cloud migration and cybersecurity services. Similarly, Deloitte's technology consulting arm experienced robust growth, with many projects focusing on AI integration and data analytics implementation.

- Project-based fees for IT strategy, solution design, and implementation.

- Advisory services covering digital transformation and complex IT challenges.

- Expertise and time are the primary drivers for billing.

- Market trends show strong demand for cloud, AI, and cybersecurity consulting in 2024.

Digital Transformation and AI Implementation Projects

Revenue from digital transformation and AI implementation projects is a significant driver for Insight. The company's strategic focus on becoming an 'AI-first solutions integrator' directly fuels this revenue stream. This involves helping clients adopt and integrate cutting-edge technologies like artificial intelligence and intelligent edge computing.

These specialized projects are crucial for growth. For instance, in fiscal year 2024, Insight reported substantial growth in its services segment, which includes these transformation initiatives. The company's investment in AI capabilities and partnerships is designed to capture a larger share of this expanding market.

- AI and Intelligent Edge Implementation: Revenue generated from consulting, development, and deployment of AI-powered solutions and edge computing infrastructure.

- Cloud Migration and Modernization: Income derived from assisting businesses in moving to and optimizing cloud environments, often incorporating AI.

- Data Analytics and Business Intelligence: Earnings from services that help organizations leverage data through advanced analytics and AI-driven insights.

- Digital Strategy and Transformation Consulting: Revenue from advisory services guiding clients through comprehensive digital overhauls.

Insight's revenue streams are diverse, encompassing hardware and software sales, managed services, cloud solutions, and consulting. While hardware sales saw a dip in 2024, they rebounded in Q2 2025. Managed services are a growing, predictable income source due to recurring contracts for IT support and security.

Cloud solutions, including subscriptions and as-a-service models, drove robust gross profit growth in 2024. Consulting fees, project-based for strategy and digital transformation, also contribute significantly, with firms like Accenture reporting 12% growth in their Technology segment revenue in H1 2024.

Revenue from digital transformation and AI implementation is a key focus, with Insight positioning itself as an AI-first integrator. This segment saw substantial growth in fiscal year 2024, reflecting market demand for AI and edge computing solutions.

| Revenue Stream | 2024 Performance/Notes | Key Drivers |

|---|---|---|

| Hardware & Software | Overall net sales dipped in 2024; hardware sales increased in Q2 2025. | Device and server sales, software licenses/subscriptions. |

| Managed Services | Significant and growing revenue, predictable income. | Recurring contracts for IT support, data security, modernization. |

| Cloud Solutions | Robust gross profit growth in 2024. | Cloud subscriptions, IaaS, SaaS, pay-as-you-go models. |

| Consulting & Advisory | Strong demand for cloud migration, cybersecurity, AI integration. | Project-based fees for IT strategy, digital transformation, AI implementation. |

Business Model Canvas Data Sources

The Insight Business Model Canvas is built using a blend of internal performance metrics, customer feedback surveys, and competitive landscape analysis. These diverse data sources ensure a comprehensive and actionable understanding of the business.