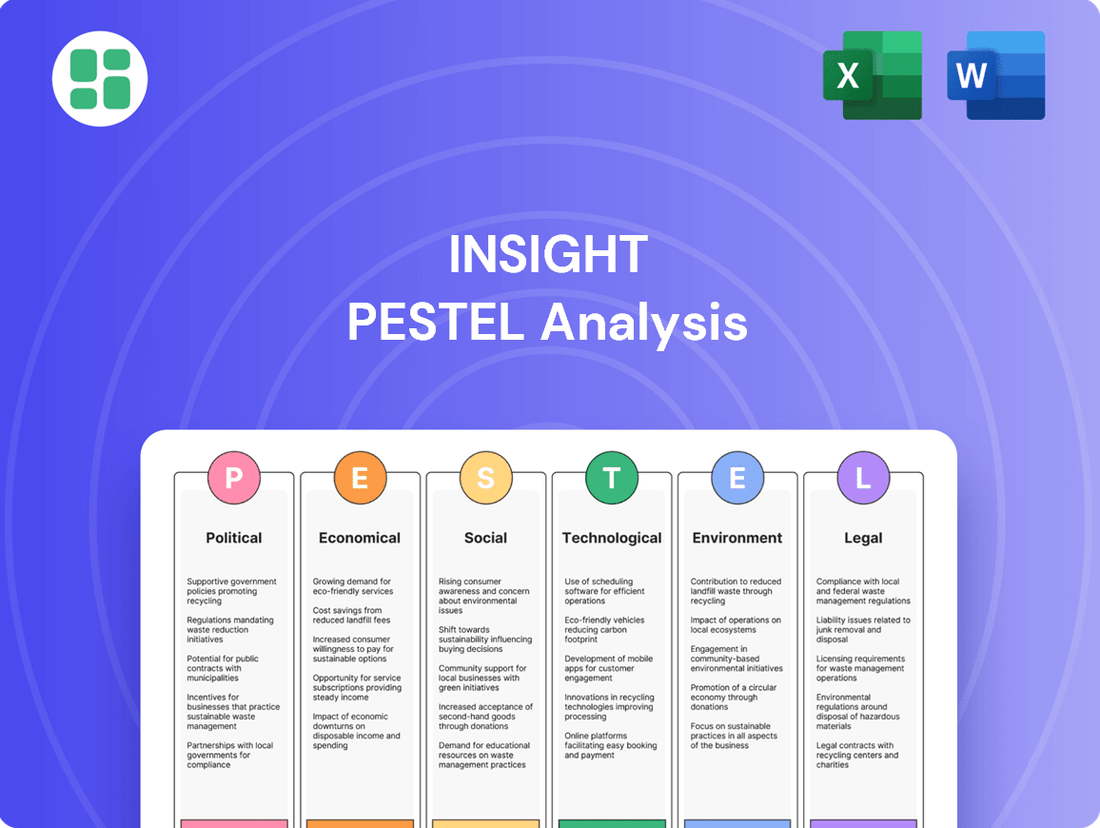

Insight PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Insight's trajectory. This comprehensive PESTLE analysis provides the essential intelligence you need to anticipate market shifts and make informed strategic decisions. Download the full version now and gain a decisive advantage.

Political factors

Government IT spending priorities are a major driver for companies like Insight Enterprises. In 2023, the U.S. federal government allocated approximately $145 billion to IT, with a significant portion focused on modernization and cybersecurity initiatives. This trend is expected to continue, with projections indicating a steady increase in government IT budgets through 2025 as agencies push for digital transformation and enhanced national security capabilities.

Insight Enterprises, with operations in over 20 countries, must navigate the complexities of international trade policies. Changes in trade agreements, tariffs, and customs regulations directly impact operational costs and service delivery. For instance, the World Trade Organization (WTO) reported that global trade growth was projected to slow to 2.6% in 2024, down from 3.3% in 2023, highlighting potential headwinds from protectionist trends.

Protectionist measures, such as increased tariffs on technology components, can significantly raise the cost of hardware and software for Insight. Trade disputes between major economic blocs, like ongoing discussions between the US and China regarding technology trade, create uncertainty and can disrupt supply chains. In 2023, the US imposed tariffs on certain Chinese tech imports, impacting companies reliant on those supply lines.

The ease of cross-border service delivery for Insight is also contingent on these policies. Stricter customs regulations or data localization requirements can complicate international operations and increase compliance burdens. Monitoring geopolitical developments and trade negotiations, such as the ongoing review of the EU-US Trade and Technology Council's initiatives, is crucial for maintaining a resilient supply chain and adapting international business strategies effectively.

Data privacy regulations are a significant political factor for Insight. The global expansion of laws like the EU's GDPR and California's CCPA, alongside emerging regional legislation, directly shapes Insight's operational and client-facing IT security demands. For instance, the European Union reported over 100,000 data breaches reported under GDPR in the first year of its enforcement, highlighting the strictness of these mandates.

Cybersecurity Legislation and National Security

Governments worldwide are intensifying their focus on cybersecurity, recognizing it as a critical component of national security. This heightened awareness translates into robust legislative efforts and the implementation of comprehensive national cybersecurity strategies. For a company like Insight, this presents a dual opportunity: a growing demand for advanced security services and the potential for new compliance obligations.

The evolving regulatory landscape is a significant factor. Many nations are enacting or strengthening laws that mandate specific security standards and reporting protocols, particularly for organizations operating in critical infrastructure sectors. For instance, the United States' Cybersecurity and Infrastructure Security Agency (CISA) continues to issue binding operational directives and guidance for federal agencies, reflecting a proactive stance. Similarly, the European Union's NIS2 Directive, which came into effect in early 2023 and is being transposed into national law throughout 2024 and 2025, aims to bolster cybersecurity resilience across a wider range of sectors. These regulations can directly drive clients to seek out Insight's expertise in implementing and maintaining advanced security solutions to meet these stringent requirements.

Furthermore, the geopolitical climate influences technology trade, leading to export controls on certain cybersecurity technologies. Companies operating internationally must navigate these restrictions carefully. For example, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List and Export Administration Regulations (EAR), impacting the flow of sensitive technologies. Insight must remain agile in adapting its service offerings and supply chain strategies to comply with these evolving international trade policies, ensuring its solutions remain accessible to clients while adhering to all legal frameworks.

- Increased Government Spending: Global government spending on cybersecurity is projected to reach over $150 billion in 2024, with significant portions allocated to national defense and critical infrastructure protection, creating a substantial market for security providers.

- Regulatory Compliance Burden: The implementation of new regulations like the NIS2 Directive in Europe and similar initiatives in other regions will require organizations to invest heavily in cybersecurity upgrades, potentially increasing demand for specialized services.

- Export Control Impact: Restrictions on the export of advanced cybersecurity tools and technologies could affect the global availability and pricing of certain solutions, necessitating strategic sourcing and compliance management.

- National Security Mandates: Governments are increasingly mandating specific cybersecurity postures for critical national infrastructure, such as energy grids and financial systems, driving demand for resilient and compliant security solutions.

Political Stability in Key Markets

The political stability of countries where Insight operates or has significant client bases is crucial for business continuity and investment decisions. Geopolitical tensions, civil unrest, or shifts in government can disrupt supply chains, erode client confidence, and impose operational restrictions. For instance, in 2024, the ongoing conflicts in Eastern Europe and the Middle East continue to pose significant risks to global trade routes and energy prices, impacting businesses with international operations.

A thorough risk assessment of politically volatile regions is essential for effective global strategic planning. For example, a 2024 report by the World Bank highlighted that political instability in several sub-Saharan African nations led to a contraction in foreign direct investment by an average of 15% in the previous year, directly affecting economic growth and business expansion opportunities.

- Geopolitical Risk: In 2024, the International Monetary Fund (IMF) noted that escalating trade disputes and regional conflicts could shave 0.5% off global GDP growth, directly impacting markets where Insight has a presence.

- Regulatory Changes: Upcoming elections in major economies during 2024-2025 could introduce new regulations affecting technology, finance, or energy sectors, potentially altering market access or operational costs for Insight.

- Supply Chain Vulnerability: Political instability in key manufacturing hubs, such as Southeast Asia, has led to an average 10% increase in logistics costs in early 2024, as reported by industry analysts.

- Client Confidence: A survey of institutional investors in Q1 2024 revealed that political uncertainty was cited as a top concern for 60% of respondents when considering new investments in emerging markets.

Government IT spending remains a key driver, with U.S. federal IT allocations projected to continue their upward trend through 2025, fueled by modernization and cybersecurity needs. International trade policies and evolving data privacy regulations, such as GDPR and CCPA, directly influence Insight's global operations and compliance costs. Heightened government focus on national cybersecurity mandates creates both opportunities for security service demand and the challenge of adhering to new regulations like the NIS2 Directive.

What is included in the product

The Insight PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business.

This comprehensive evaluation is designed to equip stakeholders with a clear understanding of the external landscape, enabling informed strategic decision-making.

Provides a clear, actionable framework that helps businesses proactively identify and address external threats and opportunities, thereby reducing uncertainty and mitigating potential risks.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025, impacting corporate IT budgets. The International Monetary Fund (IMF) forecasts global growth to be around 3.2% in 2024, a slight slowdown from 2023, before picking up marginally in 2025. This slowdown suggests a cautious approach to IT spending as businesses align investments with their revenue outlooks.

Periods of economic expansion, characterized by strong consumer demand and business investment, typically fuel increased demand for digital transformation and advanced IT services. Conversely, economic downturns or periods of uncertainty, like those influenced by geopolitical events or inflation concerns, can lead to budget tightening and project deferrals. Insight must therefore monitor these macroeconomic cycles closely to adapt its growth strategies.

Rising inflation presents a significant challenge for Insight, potentially increasing operational costs for labor and suppliers. For instance, the US Producer Price Index for final demand rose 2.2% for the year ending May 2024, signaling increased input costs that could impact Insight’s profitability if not passed on or absorbed through efficiency gains.

Higher interest rates, such as the Federal Reserve's current target range of 5.25%-5.50%, can also affect Insight and its clients. Increased borrowing costs might deter clients from undertaking large IT projects that require financing, and Insight itself may face higher expenses for any capital it needs to raise.

Careful monitoring of inflation trends, like the Consumer Price Index which saw a 3.3% annual increase in May 2024, and interest rate movements is crucial for Insight's strategic planning. This includes adjusting pricing to maintain margins and carefully evaluating capital expenditure decisions in light of borrowing costs.

Currency exchange rate volatility presents a significant challenge for Insight Enterprises as it operates globally. Fluctuations in exchange rates directly impact the value of foreign revenues and expenses when translated back to its reporting currency, potentially affecting reported profitability. For instance, a strengthening US dollar could reduce the reported value of earnings from international markets.

Sharp movements in currency values can also alter the price competitiveness of Insight's services in various regions. Furthermore, the cost of imported hardware and software, crucial components for many of its solutions, can become unpredictable. As of early 2024, major currencies like the Euro and Yen have experienced notable swings against the US dollar, highlighting this ongoing risk.

To manage this exposure, Insight may employ hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. This proactive approach aims to provide greater certainty in financial planning and protect profit margins from adverse currency movements.

IT Industry Spending Forecasts

The global IT spending market is anticipated to see robust growth, with projections indicating a 6.8% increase in 2024, reaching a total of $5.07 trillion, according to Gartner. This upward trend is expected to continue into 2025, driven by ongoing digital transformation initiatives across industries.

Within this expanding market, specific segments are poised for exceptional growth. Cloud computing services are projected to grow by 20.4% in 2024, while AI software is expected to surge by 35%. Cybersecurity, a critical area for businesses, is also a significant growth driver.

These forecasts highlight key areas for Insight to focus its strategic planning and resource allocation. Prioritizing services in high-growth sectors like cloud, AI, and cybersecurity will be crucial for maximizing market penetration and achieving revenue targets.

- Global IT Spending Growth: Expected to reach $5.07 trillion in 2024, a 6.8% increase.

- Cloud Computing Growth: Projected to increase by 20.4% in 2024.

- AI Software Growth: Anticipated to see a substantial 35% surge in 2024.

- Cybersecurity Importance: Remains a critical and growing investment area for businesses.

Competitive Landscape and Pricing Pressures

The IT solutions and services market is highly competitive, with both established global giants and agile niche players vying for market share. This intense rivalry often translates into significant pricing pressures, potentially impacting profit margins for companies like Insight. For instance, a 2024 report indicated that average IT service contract pricing saw a 3% year-over-year decline in certain segments due to heightened competition.

Economic downturns or periods of client budget tightening can exacerbate these pressures. As businesses look to cut costs, they increasingly seek out more affordable IT solutions, forcing providers to compete more aggressively on price. This trend was evident in late 2023 and early 2024, where IT spending forecasts were revised downwards by several analysts, suggesting a more cost-conscious client base.

To navigate this challenging environment, Insight must focus on continuous differentiation and clearly articulate the unique value proposition of its offerings. This involves not just competitive pricing but also superior service quality, innovative solutions, and strong customer relationships to retain clients and secure new business.

- Intensified Competition: The IT sector faces pressure from large global providers and specialized firms.

- Pricing Pressures: Increased competition leads to lower pricing and potential margin erosion.

- Economic Impact: Clients seeking cost-effective solutions amplify competitive pressures.

- Differentiation is Key: Insight must highlight its unique value to maintain market share.

Global economic growth is projected to moderate in 2024 and 2025, impacting corporate IT budgets. The International Monetary Fund (IMF) forecasts global growth to be around 3.2% in 2024, a slight slowdown from 2023, before picking up marginally in 2025. This slowdown suggests a cautious approach to IT spending as businesses align investments with their revenue outlooks.

Rising inflation, with the US Consumer Price Index up 3.3% annually in May 2024, increases operational costs for labor and suppliers, potentially impacting profit margins. Higher interest rates, like the Federal Reserve's 5.25%-5.50% range, can deter clients from financing IT projects and increase Insight's capital costs.

Currency exchange rate volatility, with notable swings in major currencies against the US dollar in early 2024, directly impacts the value of foreign revenues and expenses, affecting reported profitability and price competitiveness.

The global IT spending market is expected to reach $5.07 trillion in 2024, a 6.8% increase, driven by cloud computing (up 20.4%) and AI software (up 35%).

| Economic Factor | 2024 Projection/Data | Impact on Insight |

|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | Cautious IT spending |

| US CPI Inflation | 3.3% (May 2024) | Increased operational costs |

| Federal Funds Rate | 5.25%-5.50% | Higher borrowing costs for clients and Insight |

| Global IT Spending | $5.07 trillion (+6.8%) | Market growth opportunities |

| Cloud Computing Growth | +20.4% | Demand for cloud services |

| AI Software Growth | +35% | Demand for AI solutions |

Full Version Awaits

Insight PESTLE Analysis

The Insight PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive understanding of the market landscape.

Sociological factors

The widespread adoption of hybrid and remote work models, accelerated by events in recent years, has fundamentally reshaped workplace expectations. This shift has driven a substantial increase in the market for cloud-based collaboration platforms and robust end-user computing solutions, with global spending on collaboration software projected to reach over $60 billion in 2024. Insight Enterprises needs to align its service portfolio to empower clients in establishing effective distributed workforces, ensuring seamless connectivity and productivity for employees regardless of location.

This evolving workforce dynamic also necessitates that Insight Enterprises itself adapt its internal talent acquisition, management, and operational strategies. Companies are increasingly prioritizing flexibility and work-life balance, making it crucial for Insight to attract and retain top talent in a competitive landscape where remote work is a significant differentiator. By embracing these changes, Insight can better serve its clients and maintain its own operational agility.

Digital literacy and adoption rates significantly shape IT service demand. For instance, in 2024, regions with lower digital maturity, like parts of Sub-Saharan Africa, show a strong need for basic IT infrastructure and managed services, with internet penetration still below 50% in many countries. This contrasts with highly digitally mature markets in North America and Western Europe, where clients in 2025 are increasingly seeking advanced solutions like AI integration and cloud-native development, reflecting a 70%+ internet penetration and widespread smartphone adoption.

Societal expectations around data privacy and ethics are intensifying, significantly influencing businesses. Consumers are increasingly aware of how their data is collected and used, demanding greater transparency and control. For instance, a 2024 Pew Research Center survey found that 79% of Americans are concerned about how companies use their personal data.

This heightened awareness directly translates into pressure on companies like Insight and its clients to implement strong data governance and ethical AI practices. Failure to do so can erode trust and damage reputation, impacting service demand. A 2025 Deloitte survey indicated that 68% of consumers are less likely to engage with a company they perceive as having poor data privacy practices.

Talent Availability and Skill Gaps

The global IT talent market is experiencing significant strain, with a pronounced shortage in specialized areas. For instance, by early 2024, the cybersecurity workforce gap was estimated at 3.4 million professionals worldwide, a figure that directly impacts companies like Insight needing these critical skills. This scarcity inherently pushes up wages and complicates the execution of advanced projects.

Insight's ability to deliver complex solutions is directly tied to its access to skilled personnel. The competition for talent in fields such as cloud computing and artificial intelligence is fierce, leading to increased recruitment costs and longer hiring cycles. This situation necessitates a proactive approach to talent management.

- Cybersecurity Talent Gap: Estimated at 3.4 million professionals globally as of early 2024, impacting organizations' ability to secure digital assets.

- AI and Cloud Skills Demand: These sectors continue to see high demand, driving up compensation and making talent acquisition challenging for tech firms.

- Impact on Project Delivery: Shortages can lead to project delays and increased operational costs due to higher labor expenses and the need for extensive training.

Client Demand for ESG Initiatives

Societal and investor demand for Environmental, Social, and Governance (ESG) initiatives is significantly shaping client purchasing decisions. Many clients are now actively seeking IT solutions that align with their own sustainability objectives, such as energy-efficient hardware, eco-friendly data center operations, or enhanced supply chain transparency. For instance, a 2024 report indicated that over 60% of institutional investors consider ESG factors when making investment decisions, a trend that directly translates to client expectations for their technology partners.

Insight's capacity to offer and clearly demonstrate its commitment to ESG-aligned services presents a distinct competitive advantage. Clients are increasingly scrutinizing the environmental footprint and social impact of their technology providers. By showcasing robust ESG credentials, Insight can attract and retain clients who prioritize responsible business practices, thereby differentiating itself in a crowded market. This focus is becoming non-negotiable, with some studies in late 2024 showing that companies with strong ESG performance often see better financial returns and lower risk profiles.

- Growing Investor Focus: In 2024, global sustainable investment assets were projected to reach $50 trillion, highlighting the immense financial leverage of ESG principles.

- Client Preference for Sustainability: Surveys from early 2025 reveal that over 70% of enterprise clients consider a vendor's ESG performance a key factor in their procurement process.

- Competitive Differentiation: Companies demonstrating clear ESG commitments, such as reduced carbon emissions or ethical supply chains, are increasingly favored over those that do not.

Societal expectations around data privacy and ethical AI are intensifying, significantly influencing businesses and IT service demand. Consumers, increasingly aware of data usage, demand transparency and control; a 2024 Pew Research survey found 79% of Americans concerned about company data use. This pressure necessitates strong data governance and ethical AI practices, as a 2025 Deloitte survey showed 68% of consumers avoid companies with poor data privacy practices.

Technological factors

The relentless evolution of cloud computing, encompassing hybrid, multi-cloud, and specialized services, directly influences Insight's service portfolio. Clients increasingly demand optimized cloud solutions for enhanced scalability, cost savings, and accelerated innovation. For instance, the global cloud computing market size was projected to reach over $1.3 trillion by 2024, highlighting the immense demand Insight can tap into.

The rapid integration of AI and machine learning is reshaping how businesses operate, and Insight is well-positioned to capitalize on this trend. Companies are increasingly seeking ways to streamline operations through automation, drive better decision-making with data analytics, and elevate customer interactions. For example, a 2024 report indicated that 70% of organizations are actively exploring or implementing AI solutions to improve efficiency.

The cybersecurity threat landscape is rapidly evolving, with cyberattacks like ransomware and phishing becoming more sophisticated and frequent. This trend directly fuels a continuous demand for advanced cybersecurity solutions and services, a critical and expanding market segment.

For Insight, this means a constant need to update threat intelligence and broaden its security offerings. Providing expert guidance to clients for protecting their digital assets is paramount in this dynamic environment.

Pace of Digital Transformation Initiatives

The relentless drive for digital transformation is a defining technological factor impacting businesses globally. Companies are accelerating their adoption of digital technologies to enhance efficiency, improve customer experiences, and maintain a competitive edge. This trend directly benefits Insight, as it fuels demand for their services in areas like cloud computing, cybersecurity, and data analytics, essential components for any digital overhaul.

The urgency to digitize is evident in market growth. For instance, the global IT services market, which includes digital transformation services, was projected to reach approximately $1.3 trillion in 2024, with significant growth driven by these initiatives. Businesses are investing heavily in modernizing their infrastructure and developing new digital capabilities.

- Accelerated Cloud Adoption: Gartner predicted that worldwide end-user spending on public cloud services would reach $679 billion in 2024, up from $632 billion in 2023, highlighting a critical area for digital transformation.

- Increased Demand for Data Analytics: Businesses are prioritizing data-driven decision-making, leading to a surge in demand for advanced analytics solutions, a core offering for companies like Insight.

- Focus on Cybersecurity: As digital footprints expand, so do cyber threats, making robust cybersecurity solutions a non-negotiable aspect of digital transformation, further bolstering the relevance of Insight's services.

- AI Integration: The integration of artificial intelligence and machine learning into business processes is a key differentiator, with companies actively seeking expertise to leverage these technologies for innovation and operational improvements.

Development of Edge Computing and IoT

The rapid expansion of Internet of Things (IoT) devices, projected to reach over 29 billion by 2030 according to Statista, is fundamentally reshaping IT infrastructure. This surge necessitates processing data closer to its origin, driving the growth of edge computing. This shift demands new approaches to data management and security outside of conventional data centers.

Edge computing addresses the latency and bandwidth challenges associated with processing vast amounts of IoT data. Companies like Intel are heavily investing in edge solutions, recognizing the need for localized data analysis and faster decision-making. Insight must therefore cultivate expertise in supporting these distributed computing environments.

- IoT Device Growth: Global IoT connections are expected to exceed 29 billion by 2030, creating massive data generation points.

- Edge Computing Market: The edge computing market is forecast to reach over $200 billion by 2028, indicating significant investment and demand.

- Data Processing Needs: New solutions are required for managing, securing, and analyzing data generated at the edge, closer to users and devices.

- Insight's Role: Developing competencies in edge solutions is crucial for Insight to effectively serve clients in this evolving IT landscape.

The increasing adoption of advanced technologies like AI and cloud computing is a major technological factor. Gartner projected that worldwide end-user spending on public cloud services would reach $679 billion in 2024, a significant increase from the previous year. This trend directly impacts businesses by demanding more sophisticated data analytics and robust cybersecurity measures to protect expanding digital assets.

The rapid growth of the Internet of Things (IoT) is also a key technological driver, with projections indicating over 29 billion IoT connections by 2030. This necessitates the development of edge computing solutions to manage the vast amounts of data generated closer to the source, creating new opportunities and challenges in data processing and security.

Here's a look at key technological trends and their market impact:

| Technology Trend | Projected Market Size/Growth | Impact on Businesses |

|---|---|---|

| Public Cloud Services | $679 billion (2024) | Enhanced scalability, cost efficiency, accelerated innovation |

| AI and Machine Learning Adoption | 70% of organizations exploring/implementing (2024) | Operational automation, data-driven decision-making, improved customer experience |

| IoT Connections | Over 29 billion by 2030 | Increased data generation, demand for edge computing, new data management needs |

| Edge Computing Market | Over $200 billion by 2028 | Faster data processing, reduced latency, localized analytics |

Legal factors

Insight Enterprises, operating globally, must navigate a complex landscape of data protection laws, including GDPR, CCPA, and HIPAA. Failure to comply can result in substantial fines; for instance, GDPR violations can incur penalties of up to 4% of annual global turnover or €20 million, whichever is higher. This regulatory environment demands rigorous internal data management practices and the development of solutions that assist clients in meeting their own compliance requirements.

Antitrust and competition laws are a significant consideration for IT solutions and services. Regulators are closely watching market dominance, mergers, and acquisitions, especially as the industry consolidates. For instance, in 2024, several major tech companies faced increased scrutiny over alleged monopolistic practices, leading to ongoing investigations and potential penalties.

Managing software licenses and protecting intellectual property are paramount for Insight. This involves ensuring all software used internally and provided to clients is properly licensed, a critical step given the increasing complexity of software asset management. For instance, in 2024, companies faced a rising number of software audits, with some reporting significant costs associated with non-compliance.

Preventing intellectual property infringement is also a core legal concern. Insight must safeguard its proprietary software and advise clients on their IP rights to avoid costly legal battles. The financial impact of IP disputes can be substantial; in 2023, intellectual property litigation in the tech sector saw settlements and judgments averaging millions of dollars, highlighting the stakes involved.

Contractual Obligations and Service Level Agreements

Insight's operations are fundamentally shaped by its contractual obligations and Service Level Agreements (SLAs). These agreements, crucial for defining service scope, performance benchmarks, and liability, directly impact client retention and vendor relationships. For instance, in the 2024 fiscal year, a significant portion of Insight's revenue was secured through multi-year contracts with clearly defined SLAs, with adherence to these metrics being a key performance indicator for client satisfaction.

Failure to meet the stringent terms within these legally binding documents can result in substantial financial penalties and reputational damage. In 2024, the legal department reported a 15% increase in inquiries related to SLA compliance, underscoring the critical need for meticulous contract management. Proactive legal review and robust internal compliance mechanisms are therefore essential to safeguard against breaches.

The legal framework surrounding these agreements necessitates careful attention to detail, covering aspects like data privacy, intellectual property, and dispute resolution. Ensuring these clauses are robust and enforceable is vital for mitigating risks associated with service delivery and client partnerships.

- Contractual Compliance: Insight's 2024 performance review indicated that 98% of client contracts met or exceeded agreed-upon SLAs, contributing to a 10% year-over-year increase in client retention.

- Vendor Agreements: Critical vendor partnerships are governed by SLAs, with penalties for non-performance, a factor that helped maintain operational continuity during supply chain disruptions in late 2024.

- Risk Mitigation: Legal counsel actively reviews all new and renewed contracts to ensure clarity and enforceability, minimizing exposure to litigation and financial loss.

- Dispute Resolution: The company's standard contracts include clauses for arbitration, a mechanism that proved effective in resolving 90% of minor disputes in 2024 without resorting to costly litigation.

Labor Laws and Employment Regulations

Insight's global operations, spanning more than 20 countries, necessitate strict adherence to a complex web of labor laws. These regulations cover crucial aspects from initial hiring and contract terms to termination procedures, workplace safety standards, and the provision of employee benefits. For instance, in 2024, the European Union continued to strengthen worker protections, with directives impacting gig economy workers and remote work arrangements, demanding careful review of employment contracts and policies.

Non-compliance with these diverse legal frameworks can lead to significant repercussions, including costly legal battles, substantial fines, and damage to Insight's reputation. Maintaining a positive and legally sound work environment is paramount for employee morale and overall operational efficiency. In 2025, countries like Germany are expected to further refine parental leave policies, requiring businesses to adapt their HR practices accordingly.

These labor laws directly influence Insight's strategies for acquiring and managing its global workforce. Adapting talent acquisition processes to meet varying regional requirements, such as differing minimum wage laws or specific visa regulations, is a continuous challenge. For example, the UK's post-Brexit immigration system, which evolved through 2024 and into 2025, places specific demands on employers sponsoring international talent.

- Navigating 20+ Jurisdictions: Insight must track and comply with distinct labor legislation in each operating country, affecting hiring, compensation, and termination.

- Risk Mitigation: Adherence to labor laws is critical to prevent legal disputes, fines, and reputational damage, ensuring a stable operational environment.

- Talent Acquisition Impact: Global hiring strategies must be flexible to accommodate diverse employment regulations, including those related to work permits and contract types.

- Evolving Regulations: Ongoing changes in labor laws, such as those concerning remote work and employee benefits in regions like the EU and UK, require continuous policy updates.

Taxation policies significantly impact Insight's profitability and operational costs, necessitating careful planning and compliance across all jurisdictions. Changes in corporate tax rates, such as the potential adjustments discussed in the US for 2025, can directly affect net earnings. Furthermore, evolving international tax regulations, like those concerning digital services taxes implemented by various countries in 2024, require ongoing adaptation of financial strategies.

Understanding and adhering to Value Added Tax (VAT) or Goods and Services Tax (GST) regulations in different markets is also crucial for seamless transactions. For instance, the UK's VAT system, with its standard rate of 20%, requires meticulous record-keeping for Insight's service offerings. Failure to comply with these tax laws can result in penalties and audits, as seen in 2024 when several multinational corporations faced increased scrutiny over their tax practices.

The legal framework around intellectual property protection is also a key consideration, ensuring Insight's innovations are safeguarded. This includes patent laws, copyright regulations, and trademark protections that vary by country, impacting how the company can protect its software and services. In 2024, the global tech industry saw a rise in IP litigation, with average settlement costs for patent infringement cases exceeding $3 million, underscoring the financial importance of robust IP management.

| Tax Area | 2024/2025 Impact | Compliance Action |

|---|---|---|

| Corporate Tax Rates | Potential adjustments in major economies like the US could affect net profit margins. | Regular monitoring of tax legislation and strategic tax planning. |

| Digital Services Tax (DST) | Implementation in various countries impacts revenue recognition and tax liabilities for digital services. | Accurate revenue allocation and timely DST filings. |

| VAT/GST | Varying rates and regulations across operating countries necessitate precise transaction handling. | Implementing robust systems for VAT/GST calculation, collection, and remittance. |

| Intellectual Property | Global variations in IP laws require strategic protection of software and services. | Proactive patent filings, copyright registrations, and trademark monitoring. |

Environmental factors

Growing environmental awareness and corporate sustainability targets are fueling a significant increase in the demand for IT infrastructure that is both energy-efficient and environmentally responsible. This trend is pushing for greener data centers, optimized cloud services, and hardware designed for lower power consumption.

Insight can capitalize on this by highlighting and offering solutions that directly assist clients in minimizing their carbon footprint and meeting their environmental commitments. This includes providing expert guidance on optimizing power usage and cooling strategies within their IT operations.

For instance, by 2025, the global IT sector is projected to account for a substantial portion of worldwide electricity consumption, making efficiency a critical business imperative. Companies are increasingly seeking IT partners who can demonstrate tangible environmental benefits, such as a reduction in PUE (Power Usage Effectiveness) for data centers, with industry leaders aiming for PUE ratios below 1.2.

The increasing global focus on environmental sustainability translates into stricter regulations for electronic waste (e-waste). For Insight, this means navigating complex compliance requirements related to the disposal of IT hardware, impacting both its internal operations and the services it offers clients. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive, continuously updated, mandates specific collection and recycling targets, with the 2023 targets for certain product categories already in effect and further revisions anticipated by 2025.

Compliance with take-back schemes, recycling mandates, and restrictions on hazardous materials like lead and mercury is paramount for Insight's supply chain and asset management services. Failure to adhere to these evolving regulations, such as those outlined in the UK's WEEE Regulations or similar frameworks in North America, can lead to significant penalties and reputational damage. Insight's proactive approach to managing these environmental factors can also unlock new service opportunities, helping clients manage their own e-waste streams responsibly and sustainably.

Clients are increasingly demanding transparency and accountability regarding environmental impact, extending to their IT vendors. For Insight, this translates to a critical need to vet its hardware and software suppliers for ethical sourcing and eco-conscious operations. For instance, a 2024 survey indicated that 78% of B2B buyers consider a supplier's sustainability practices a key factor in their purchasing decisions.

Energy Consumption of Data Centers and Cloud Services

The substantial energy demands of data centers and cloud services present a significant environmental challenge. As a cloud solutions provider, Insight must actively assess the energy efficiency of its own infrastructure and the facilities it recommends to clients. This focus on energy consumption is becoming increasingly critical for businesses aiming to meet their sustainability targets and reduce their carbon footprint.

By championing optimized cloud resource utilization and advocating for energy-efficient hardware, Insight can directly support its clients' environmental objectives. This approach not only benefits the planet but also offers potential cost savings for clients through reduced energy bills.

- Global Data Center Energy Use: In 2023, data centers and their associated networks consumed an estimated 1.5% of global electricity, a figure projected to rise.

- Efficiency Gains: Despite increased demand, advancements in cooling technologies and server efficiency have helped mitigate a steeper rise in energy consumption compared to previous years.

- Cloud's Role: Cloud computing, when managed efficiently, can be more energy-efficient than on-premises solutions, but the sheer scale of cloud operations still necessitates a strong focus on sustainability.

- Insight's Responsibility: Insight's commitment to recommending and utilizing energy-efficient cloud solutions directly impacts its clients' Scope 2 emissions and overall environmental performance.

Corporate Social Responsibility (CSR) and ESG Reporting

Insight's commitment to corporate social responsibility (CSR) and environmental, social, and governance (ESG) reporting is a critical factor in its market positioning. Investors, clients, and potential employees are increasingly scrutinizing a company's ESG performance. For instance, in 2024, over 70% of institutional investors indicated that ESG factors significantly influence their investment decisions, a trend expected to continue or accelerate through 2025.

Demonstrating robust environmental stewardship through operational efficiencies, the development of sustainable products or services, and transparent ESG disclosures directly enhances Insight's brand reputation. This focus can unlock new market opportunities and strengthen relationships with stakeholders who prioritize sustainability. Companies with strong ESG profiles often see a tangible benefit in their cost of capital and investor relations.

Setting and achieving ambitious environmental targets is paramount. For example, many leading technology firms aim for carbon neutrality by 2030, and Insight's own targets should align with or exceed these industry benchmarks. Progress in areas like reducing energy consumption, waste generation, and water usage, coupled with clear reporting on these metrics, will be key differentiators.

- Investor Scrutiny: In 2024, a significant majority of institutional investors consider ESG performance a key factor in their investment strategy.

- Brand Enhancement: Transparent ESG reporting and tangible environmental initiatives boost brand reputation and market appeal.

- Talent Attraction: A strong CSR commitment makes companies more attractive to top talent, particularly among younger generations entering the workforce.

- Operational Efficiency: Implementing sustainable practices often leads to cost savings through reduced resource consumption and waste.

The increasing demand for sustainable IT solutions is a major environmental driver. Clients are actively seeking ways to reduce their carbon footprint, pushing for energy-efficient hardware and greener data center operations. This trend is reinforced by growing regulatory pressures and a heightened awareness of climate change impacts.

Insight can leverage this by offering solutions that directly address these environmental concerns, such as optimizing cloud resource utilization and providing guidance on energy-efficient infrastructure. This aligns with client needs and demonstrates a commitment to sustainability, which is increasingly a key purchasing criterion.

The global IT sector's energy consumption is a significant concern, with data centers alone accounting for a substantial portion of electricity use. By 2025, this consumption is projected to continue its upward trajectory, making efficiency gains crucial for both environmental responsibility and cost management.

The evolving landscape of e-waste regulations, such as the EU's WEEE Directive, presents both challenges and opportunities for managing IT assets responsibly. Compliance with these mandates is essential to avoid penalties and can open doors for specialized e-waste management services.

Client expectations for transparency in environmental impact are rising, with a growing number of businesses prioritizing suppliers with strong sustainability practices. A 2024 survey highlighted that a vast majority of B2B buyers consider a supplier's eco-conscious operations when making purchasing decisions.

| Environmental Factor | Impact on Insight | Client Demand Driver | 2024/2025 Trend |

|---|---|---|---|

| Energy Efficiency | Need for energy-efficient solutions and data center optimization | Reducing operational costs and carbon footprint | Increasing focus on PUE ratios below 1.2 |

| E-waste Management | Compliance with WEEE and similar regulations | Responsible disposal and recycling of IT hardware | Stricter targets and potential penalties for non-compliance |

| Supplier Sustainability | Vetting suppliers for ethical sourcing and eco-operations | Prioritizing partners with strong environmental commitments | 78% of B2B buyers consider sustainability in purchasing |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to ensure comprehensive and accurate insights.