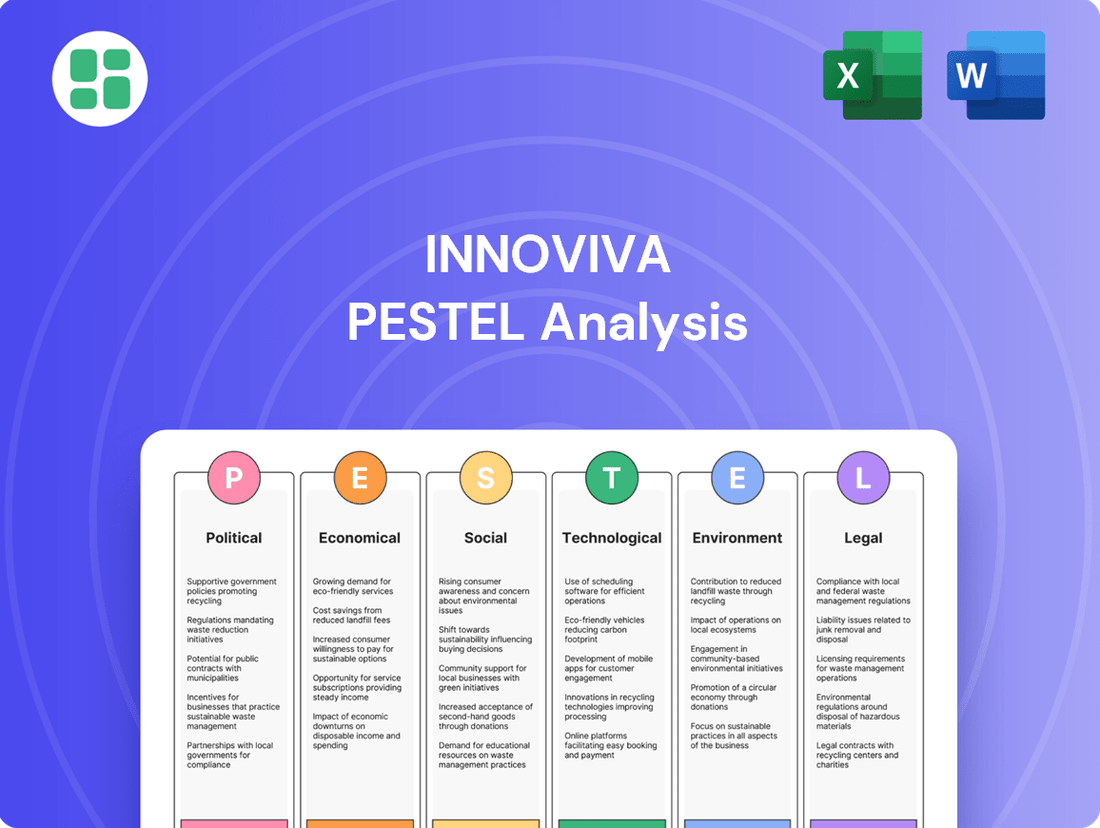

Innoviva PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Innoviva's trajectory. Our meticulously researched PESTLE analysis provides the essential context to understand the external forces driving change in the healthcare sector. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full analysis now and gain a strategic advantage.

Political factors

The Inflation Reduction Act (IRA) in the U.S. is a significant political factor impacting biopharmaceutical companies like Innoviva. This legislation allows Medicare to negotiate prices for certain high-cost, single-source drugs, which can directly affect revenue streams for companies with patented medications. For instance, the IRA's first round of drug price negotiations, announced in late 2023, targeted ten Part D drugs, with potential savings for Medicare estimated to be around $4.5 billion annually by 2030.

Broader healthcare policy shifts in 2024 and 2025 are increasingly focused on making healthcare more affordable and accessible. Initiatives targeting reforms to prior authorization processes and efforts to lower out-of-pocket expenses for patients are directly shaping the market for pharmaceutical products like those Innoviva offers.

These governmental actions significantly influence reimbursement landscapes. For instance, changes in how respiratory medicines are covered and how patients can afford them directly impact demand and necessitate adjustments in pricing strategies for companies operating in this space.

Government stances and legislative actions on intellectual property (IP) rights are paramount for biopharmaceutical firms like Innoviva, which depend on royalties from patented drugs. For instance, the US Chamber of Commerce's Global Innovation Policy Center reported in its 2023 IP Index that while many countries are strengthening IP protections, ongoing debates around patent exclusivity and potential compulsory licensing, especially for AI-driven drug discovery, create uncertainty. This directly affects Innoviva's ability to safeguard its innovations and future earnings.

International Trade and Geopolitical Relations

Global trade policies and geopolitical tensions significantly impact Innoviva's biopharmaceutical supply chain, affecting everything from raw material sourcing to finished product distribution. These external forces can create volatility and uncertainty, necessitating robust risk management strategies.

Legislation like the BIOSECURE Act, enacted in 2024, underscores the increasing influence of national security concerns on international collaborations within the biotechnology sector. This type of legislation can directly alter partnership opportunities and market access for companies like Innoviva.

The ongoing shifts in international trade relations, including potential tariffs and trade disputes, could influence the cost of imported materials and the competitiveness of Innoviva's products in various global markets. For instance, disruptions in established trade routes or increased import duties could add substantial costs.

- Impact on Supply Chain: Geopolitical instability and trade disputes can disrupt the flow of critical raw materials, potentially leading to production delays and increased costs for Innoviva.

- Regulatory Landscape: New legislation, such as the BIOSECURE Act, can restrict collaborations and market access, forcing companies to re-evaluate their international partnerships and market strategies.

- Market Access and Pricing: Changes in trade policies can affect import/export duties and currency exchange rates, influencing the pricing of Innoviva's products in different regions and overall profitability.

- Research and Development: International tensions may hinder cross-border scientific collaboration, potentially slowing down innovation and the development of new biopharmaceutical solutions.

Government Funding and Research Initiatives

Government funding plays a crucial role in shaping the landscape for companies like Innoviva. In 2024, the U.S. National Institutes of Health (NIH), a primary source of biomedical research funding, allocated approximately $47.4 billion for research, with a significant portion directed towards areas relevant to respiratory health. This level of investment can accelerate the discovery of new therapeutic targets and advanced treatment modalities.

While Innoviva's revenue primarily stems from product sales, government-backed research initiatives can indirectly fuel its growth. For instance, increased public funding for understanding complex respiratory diseases like COPD or asthma could lead to breakthroughs that create new market opportunities or attractive partnership prospects for Innoviva. These initiatives foster a more robust ecosystem for innovation.

The direction of this funding is also critical. In 2025, we anticipate continued emphasis on precision medicine and novel drug delivery systems within respiratory research, areas where Innoviva has strategic interests. Such focused government support can de-risk early-stage research, making it more appealing for private sector investment and collaboration.

- NIH Budget: The NIH's substantial budget in 2024 underscores a commitment to advancing biomedical science, including respiratory health research.

- Stimulating Innovation: Government funding acts as a catalyst, potentially uncovering new therapeutic avenues and technologies that benefit the entire healthcare sector.

- Market Influence: Publicly funded research can define future market trends and create fertile ground for strategic alliances and product development.

- De-risking Early Research: Government investment helps bridge the gap between fundamental scientific discovery and commercial viability, encouraging private sector engagement.

Governmental actions on drug pricing, such as the Inflation Reduction Act allowing Medicare negotiation, directly impact Innoviva's revenue potential from patented drugs. Healthcare policy shifts in 2024-2025 aim to lower patient costs and streamline processes, influencing market access and reimbursement for Innoviva's products.

Legislative actions concerning intellectual property rights remain critical for Innoviva's royalty income, with ongoing debates impacting patent exclusivity and the security of innovations.

National security concerns are increasingly shaping biotechnology, as seen with the BIOSECURE Act, potentially altering international collaborations and market access for companies like Innoviva.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Innoviva, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Innoviva's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for Innoviva's strategic discussions.

Economic factors

Global healthcare expenditure is projected to continue its upward trajectory, with estimates suggesting it could reach $10 trillion by 2024, up from around $9 trillion in recent years. This surge is fueled by an aging global population, with individuals over 65 expected to represent a significant portion of the population in developed nations, and the increasing prevalence of chronic conditions like diabetes and heart disease.

The introduction of innovative, yet often expensive, treatments and medical technologies further contributes to this rise. For Innoviva, this expanding market presents a clear opportunity for its portfolio of respiratory and other specialty medicines. However, it also intensifies scrutiny from governments and insurance providers aiming to curb rising costs, potentially impacting Innoviva's pricing strategies and reimbursement rates for its products.

The biotechnology sector's investment climate is showing signs of recovery, with venture capital funding and initial public offering (IPO) activity experiencing a rebound. This renewed interest is crucial for companies like Innoviva, as it directly impacts their ability to secure capital for vital research and development initiatives. For instance, biotech IPOs raised approximately $4.3 billion in the first half of 2024, a notable increase from the same period in 2023.

Mergers and acquisitions (M&A) trends also play a significant role, with large pharmaceutical companies actively seeking innovative assets to bolster their pipelines. This demand can create lucrative partnership opportunities for smaller biotechs. In 2023, biotech M&A deal volume reached over $100 billion, signaling a strong appetite for strategic acquisitions within the industry.

Inflation directly impacts Innoviva's operational costs, from raw materials for drug manufacturing to the expenses associated with clinical trials. For instance, the US CPI rose by 3.3% year-over-year in May 2024, indicating persistent inflationary pressures that could elevate these expenditures.

Rising interest rates, such as the Federal Reserve's benchmark rate holding steady in the 5.25%-5.50% range through mid-2024, increase the cost of borrowing for Innoviva. This makes financing new research and development projects or potential acquisitions more expensive, potentially delaying the launch of new therapies.

The interplay of inflation and interest rates can also affect consumer and healthcare provider spending on pharmaceuticals. Higher inflation might reduce disposable income, impacting demand for certain treatments, while elevated interest rates can make it harder for healthcare systems to fund new drug procurements.

Global Economic Stability

Global economic stability is a critical factor influencing Innoviva's performance. A robust global economy generally translates to increased consumer spending and higher healthcare budgets across nations, directly boosting demand for pharmaceutical products. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 2023, indicating a generally supportive economic environment.

Conversely, economic downturns can significantly curtail healthcare spending. This reduction impacts sales volumes and profitability, particularly for Innoviva's partnered products where government or employer-sponsored healthcare plans are prevalent. In 2023, many developed economies experienced inflationary pressures and slower growth, which could have led to tighter healthcare reimbursements and budget constraints.

- Global GDP Growth: The IMF's forecast of 3.2% global growth for 2024 suggests a moderately favorable economic climate for pharmaceutical demand.

- Inflationary Impact: Persistent inflation in major markets can erode consumer purchasing power and strain national healthcare budgets, potentially affecting Innoviva's revenue streams.

- Healthcare Spending Trends: Variations in government healthcare expenditure, influenced by economic conditions, directly impact the market access and sales potential of Innoviva's portfolio.

- Emerging Market Volatility: Economic instability in emerging markets, which often have less resilient healthcare systems, poses a greater risk to sales volumes of partnered products.

Patent Expiration and Market Dynamics

The pharmaceutical industry is keenly aware of the 'patent cliff,' a phenomenon where patent expirations for blockbuster drugs lead to substantial revenue declines for major players. This pressure is a significant driver for mergers, acquisitions, and strategic partnerships as these companies actively seek to bolster their portfolios with new, innovative assets. For instance, in 2024, several major pharmaceutical companies faced or anticipated significant revenue drops due to patent expiries on key medications, prompting increased M&A activity in the biotech and specialty pharma sectors.

This market dynamic presents a fertile ground for companies like Innoviva, particularly those with strong research and development pipelines, especially in areas like respiratory medicine where Innoviva has historically focused. The impending patent expirations create opportunities for such companies to negotiate favorable licensing deals and royalty agreements, or even to become attractive acquisition targets for larger firms looking to fill their revenue gaps.

- Patent Expirations Drive M&A: In 2024, the pharmaceutical M&A landscape was heavily influenced by patent cliff concerns, with deal values often reflecting the potential for acquiring revenue streams from soon-to-expire patents or innovative pipeline assets.

- Licensing Opportunities: Companies with differentiated drug candidates, such as those in the respiratory space, can leverage patent expirations of competitors to secure lucrative licensing agreements, generating upfront payments and ongoing royalties.

- Acquisition Targets: Innovative biotechs with strong intellectual property and promising clinical trial data are increasingly becoming targets for acquisition by large pharmaceutical companies seeking to mitigate the impact of their own patent expiries.

- Revenue Diversification: The need to replace revenue lost to patent expirations encourages pharmaceutical giants to acquire companies with diverse therapeutic areas, reducing reliance on single blockbuster drugs.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports increased healthcare spending, benefiting Innoviva. However, persistent inflation, seen in the US CPI's 3.3% year-over-year rise in May 2024, increases operational costs and can strain healthcare budgets, potentially impacting product pricing and reimbursement. Rising interest rates, with the Fed's rate holding between 5.25%-5.50% through mid-2024, also elevate borrowing costs for R&D and acquisitions.

| Economic Factor | 2024 Projection/Data | Impact on Innoviva | Key Considerations |

|---|---|---|---|

| Global GDP Growth | 3.2% (IMF forecast) | Generally positive for healthcare demand | Supports market expansion |

| US CPI (Inflation) | 3.3% YoY (May 2024) | Increases operational costs, potential pricing pressure | Raw material and clinical trial expenses |

| Federal Funds Rate | 5.25%-5.50% (through mid-2024) | Higher borrowing costs for R&D and M&A | Financing new initiatives |

Preview the Actual Deliverable

Innoviva PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Innoviva PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

The world's population is getting older, and this demographic shift is significant for companies like Innoviva. As people age, the likelihood of developing chronic health conditions, such as respiratory illnesses, increases. This means more people will need ongoing medical treatment and healthcare services. In 2023, the United Nations reported that the number of people aged 65 and over globally reached 771 million, a substantial increase from previous years.

This growing elderly population directly translates into a larger market for biopharmaceutical companies. Innoviva, with its focus on respiratory diseases, is well-positioned to capitalize on this trend. The demand for treatments for age-related illnesses and solutions for long-term care is expected to rise, creating opportunities for companies that can provide effective and accessible healthcare products.

The persistent global health challenge posed by respiratory diseases, exacerbated by factors such as rising air pollution levels and the increasing frequency of infectious outbreaks, underscores a continuous and significant demand for innovative pharmaceutical solutions. For instance, the World Health Organization reported in 2023 that lower respiratory infections remained the deadliest communicable disease globally, highlighting the critical need for advanced treatments.

Public health initiatives and heightened awareness surrounding conditions like asthma, COPD, and cystic fibrosis directly translate into increased patient engagement and a stronger impetus for research and development in the respiratory medicine sector. This societal focus, coupled with the sheer prevalence of these illnesses, directly fuels market opportunities for companies like Innoviva.

The increasing voice of patient advocacy groups is a significant sociological force, pushing for greater access to affordable medicines and better healthcare results. This trend directly impacts pharmaceutical companies like Innoviva, influencing their strategies around drug pricing and patient assistance programs.

For instance, in 2024, patient advocacy organizations actively lobbied for lower prescription drug costs, contributing to ongoing policy debates and legislative proposals aimed at increasing price transparency and affordability. These societal pressures are compelling biopharma firms to enhance their corporate social responsibility efforts, focusing on patient support and equitable access to treatments.

Evolving Health Consciousness and Lifestyles

Public awareness around health and wellness is surging, directly influencing how people approach disease, including respiratory conditions. This heightened consciousness means individuals are more proactive about prevention and seeking tailored medical solutions, which in turn steers research and development efforts in the pharmaceutical sector.

Lifestyle shifts are also playing a significant role. For instance, a growing preference for active living and healthier diets, while beneficial overall, can alter the landscape of chronic disease management. This evolving health landscape presents opportunities for companies like Innoviva to focus on innovative treatments and support systems for respiratory health.

- Increased demand for preventive health solutions: Globally, the wellness market is projected to reach $7 trillion by 2025, indicating a strong consumer drive towards proactive health management.

- Focus on personalized medicine: Advancements in genomics and data analytics are enabling more tailored treatment plans, a trend expected to grow significantly in the coming years.

- Impact on chronic disease management: As people live longer and adopt healthier lifestyles, the focus shifts from acute treatment to long-term management of conditions like asthma and COPD.

Healthcare Workforce Shortages

The healthcare industry, including biopharmaceutical companies like Innoviva, faces significant sociological challenges due to workforce shortages. These shortages aren't just about doctors and nurses; they extend to crucial roles in research, clinical trial management, and the specialized manufacturing of complex drugs. For instance, a 2024 report indicated a projected deficit of over 124,000 physicians in the US by 2034, a trend that also impacts the availability of researchers and specialized clinical staff vital for drug development.

These gaps directly hinder the pace of innovation and the ability to deliver patient care effectively. The intricate process of bringing a new drug to market relies heavily on a skilled workforce, from bench scientists to regulatory affairs specialists. When these professionals are scarce, drug development timelines can lengthen, and the capacity for conducting large-scale clinical trials, a cornerstone of pharmaceutical progress, can be severely constrained.

Addressing these shortages requires forward-thinking strategies. Innoviva and its peers must invest in robust talent development programs and explore technological solutions. This could involve:

- Expanding partnerships with academic institutions to cultivate future researchers and clinicians.

- Implementing advanced automation and AI in manufacturing and data analysis to offset personnel gaps.

- Developing specialized training programs for existing staff to upskill them in critical areas like bioprocessing and digital health.

- Exploring global talent pools and remote work models for certain research and administrative functions.

Sociological factors significantly shape Innoviva's operating environment, particularly through demographic shifts and evolving health consciousness. The global population is aging, with the UN reporting 771 million people aged 65 and over in 2023. This trend directly increases the demand for treatments for age-related conditions, a key area for Innoviva's respiratory focus.

Public awareness of respiratory diseases like asthma and COPD is rising, driven by advocacy groups and health initiatives. This heightened awareness encourages proactive health management and greater patient engagement in seeking effective treatments, benefiting companies like Innoviva. Furthermore, the burgeoning wellness market, projected to reach $7 trillion by 2025, underscores a consumer drive toward preventative health, influencing R&D priorities.

Workforce shortages in healthcare, including research and specialized manufacturing, present a critical challenge. A projected deficit of over 124,000 physicians in the US by 2034, as indicated by a 2024 report, highlights this issue. These gaps can slow innovation and patient care delivery, prompting companies like Innoviva to invest in talent development and technological solutions.

Technological factors

The pharmaceutical industry is witnessing a seismic shift driven by artificial intelligence (AI) and machine learning (ML) in drug discovery. These technologies are dramatically accelerating the identification of potential drug targets and the optimization of drug candidates. For instance, by mid-2024, companies are reporting that AI can reduce the time for initial compound screening by up to 70%, a significant leap forward.

This technological acceleration translates directly into cost savings and faster market entry for new therapies. By 2025, it's projected that AI could shave billions off the total cost of drug development, which currently averages over $2 billion per drug. This efficiency boost creates a more dynamic R&D environment, allowing for quicker responses to unmet medical needs.

Innovations in drug delivery systems are significantly reshaping the respiratory medicine landscape. For instance, advanced inhalers, such as those incorporating smart technology to track usage and adherence, are becoming more prevalent. Nebulizers are also evolving, offering more portable and efficient ways to deliver medication directly to the lungs.

These technological advancements directly impact therapeutic efficacy and patient compliance. By ensuring more precise and consistent medication delivery, these systems can lead to better disease management outcomes. For Innoviva, this translates to opportunities for enhanced product offerings and a stronger competitive edge in the respiratory market.

The market for respiratory drug delivery devices is projected for substantial growth. Analysts anticipate the global respiratory drug delivery market to reach approximately $75 billion by 2027, with a compound annual growth rate of around 6.5% in the coming years, driven by these very innovations.

The healthcare landscape is rapidly evolving with the integration of digital health, encompassing telemedicine, remote patient monitoring, and digital therapeutics. This shift is fundamentally altering how healthcare is delivered and how patients engage with their well-being. For biopharmaceutical companies like Innoviva, this presents significant opportunities to enhance patient support programs, gather valuable real-world evidence, and explore innovative business models focused on medication adherence and chronic disease management.

Biotechnology Innovations

Breakthroughs in biotechnology, like CRISPR-Cas9 gene editing and advanced cell therapies, are revolutionizing treatment options. These advancements are paving the way for highly targeted and effective medicines, promising significant improvements in patient outcomes. For instance, the global gene editing market was valued at an estimated $5.1 billion in 2023 and is projected to grow substantially, reflecting the increasing investment in this area.

Innoviva, as a company focused on respiratory care, can leverage these biotechnological innovations to develop next-generation therapies. Personalized medicine, tailored to an individual's genetic makeup, offers a pathway to more effective treatments with fewer side effects. The personalized medicine market is expected to reach over $100 billion by 2027, highlighting its immense potential.

However, these powerful innovations also present challenges. The development costs for novel biotechnologies are substantial, often running into hundreds of millions of dollars. Furthermore, navigating complex regulatory pathways and addressing ethical considerations surrounding gene editing and cell therapies are critical hurdles that companies like Innoviva must manage effectively.

- CRISPR-Cas9: Enabling precise DNA modifications for potential cures of genetic diseases.

- Cell Therapies: Utilizing living cells to treat diseases, with CAR T-cell therapy being a prominent example in oncology.

- Personalized Medicine: Tailoring treatments based on individual genetic profiles, improving efficacy and reducing adverse reactions.

- Market Growth: The global biotechnology market is projected to reach over $1.5 trillion by 2030, indicating robust innovation and investment.

Automation and Data Analytics

Innoviva benefits significantly from the increasing automation in laboratories and manufacturing. This tech trend boosts efficiency and ensures higher reproducibility in its biopharmaceutical operations. For instance, in 2024, many biopharma companies reported a 15-20% reduction in manual errors due to automated lab processes.

Advanced data analytics is another key technological factor. Innoviva can leverage this to manage the massive datasets generated from research and clinical trials. By 2025, the biopharmaceutical industry is expected to see a 30% increase in the use of AI for drug discovery and development, directly impacting companies like Innoviva by speeding up R&D cycles.

- Enhanced Efficiency: Automation streamlines complex laboratory and manufacturing tasks, reducing cycle times and operational costs.

- Improved Reproducibility: Standardized automated processes minimize human variability, leading to more consistent and reliable results.

- Data-Driven Decisions: Advanced analytics allow for deeper insights into research, clinical, and manufacturing data, optimizing quality control and process improvements.

- Accelerated R&D: The integration of AI and machine learning in data analysis is speeding up drug discovery and development timelines.

Technological advancements, particularly in AI and machine learning, are revolutionizing drug discovery, potentially cutting screening times by up to 70% by mid-2024 and reducing development costs by billions by 2025. Innovations in drug delivery systems, such as smart inhalers and advanced nebulizers, are enhancing therapeutic efficacy and patient adherence, contributing to a projected global respiratory drug delivery market of $75 billion by 2027. Furthermore, breakthroughs in biotechnology, including gene editing and cell therapies, are creating new treatment avenues, with the gene editing market already valued at $5.1 billion in 2023, offering significant opportunities for companies like Innoviva to develop next-generation respiratory treatments.

| Technology Area | Impact on Pharma/Innoviva | Key Statistics/Projections |

|---|---|---|

| AI/Machine Learning in Drug Discovery | Accelerated R&D, reduced discovery time and cost | Up to 70% reduction in initial compound screening time (mid-2024); Billions saved in drug development costs (by 2025) |

| Advanced Drug Delivery Systems | Improved therapeutic efficacy, patient adherence, market growth | Global respiratory drug delivery market projected at $75 billion by 2027; 6.5% CAGR |

| Biotechnology (Gene Editing, Cell Therapies) | Novel treatment options, personalized medicine, potential cures | Global gene editing market valued at $5.1 billion (2023); Personalized medicine market to exceed $100 billion by 2027 |

Legal factors

Legislation like the Inflation Reduction Act (IRA) of 2022 is a significant legal factor, mandating Medicare drug price negotiations for a select group of high-cost drugs. This directly affects pharmaceutical companies by potentially capping revenue streams for these negotiated products. For instance, the IRA initially identified 10 Part D drugs for negotiation in 2026, with Part B drugs to follow.

Ongoing legal challenges to these IRA provisions introduce considerable uncertainty for the pharmaceutical sector. These lawsuits, filed by industry groups, question the constitutionality of the negotiation process. Such legal battles can influence a company's willingness to invest in research and development for drugs that may fall under future negotiation mandates, impacting long-term strategic planning and innovation pipelines.

Innoviva, like other biopharmaceutical firms, navigates a complex legal environment concerning intellectual property. Patent infringement lawsuits, challenges to patent validity, and emerging disputes over data ownership, particularly with AI-generated inventions, are ongoing concerns. Robust IP protection is critical for maintaining market exclusivity and securing future revenue streams.

In 2024, the U.S. Patent and Trademark Office (USPTO) continued to see a high volume of patent applications and litigation. While specific Innoviva litigation details may not be publicly disclosed, the broader industry faced significant legal costs. For instance, the pharmaceutical sector’s litigation expenses related to IP disputes can run into millions of dollars annually, impacting R&D investment and market strategies.

Innoviva's product launches are heavily influenced by regulatory bodies like the FDA and EMA. For instance, the FDA's review times for new drug applications (NDAs) can vary significantly, with the Prescription Drug User Fee Act (PDUFA) target action dates providing a benchmark, though delays are common. The evolving landscape, particularly for innovative treatments or those incorporating AI in clinical trials, necessitates flexible adaptation of submission strategies to meet these stringent, and often changing, approval pathways.

Antitrust and Merger Control

Antitrust regulators are increasingly scrutinizing pharmaceutical mergers and acquisitions, which can significantly influence Innoviva's strategic partnerships and consolidation efforts. This heightened legal oversight is designed to foster market competition and prevent monopolistic practices, potentially shaping the company's future growth avenues through mergers and acquisitions.

For instance, in 2023, the US Federal Trade Commission (FTC) continued its aggressive stance on healthcare consolidation, reviewing a substantial number of proposed deals. The FTC's focus on pharmaceutical mergers aims to ensure that such transactions do not unduly restrict patient access or inflate drug prices.

- Increased regulatory scrutiny on M&A: Antitrust bodies globally are intensifying their review of pharmaceutical industry consolidation.

- Focus on market competition: Regulators aim to prevent monopolies and ensure fair competition, impacting deal approvals.

- Potential impact on growth strategies: Innoviva's ability to pursue growth through M&A may be influenced by these legal frameworks.

- Example of regulatory action: The FTC's ongoing reviews in 2023 highlight the active enforcement environment for healthcare mergers.

Data Privacy and Cybersecurity Regulations

Innoviva, like all biopharmaceutical companies, navigates a complex landscape of data privacy and cybersecurity regulations. Strict laws such as HIPAA in the United States and GDPR in Europe govern how patient data is collected, stored, and utilized, especially with the increasing reliance on digital health technologies. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust cybersecurity measures is not just a legal necessity but also critical for preserving patient trust and safeguarding proprietary information.

The escalating threat of cyberattacks on healthcare data makes adherence to these regulations paramount. In 2024, the healthcare sector continued to be a prime target for ransomware attacks, with data breaches impacting millions of individuals. Innoviva must invest significantly in cybersecurity infrastructure and protocols to protect sensitive patient information and intellectual property. This includes implementing advanced encryption, regular security audits, and comprehensive employee training to mitigate risks and avoid costly breaches and reputational damage.

- HIPAA fines can reach $1.5 million per violation category annually.

- GDPR violations can incur penalties of up to €20 million or 4% of global annual turnover.

- The healthcare industry experienced a significant increase in data breaches in 2023-2024, underscoring the critical need for robust cybersecurity.

- Compliance is essential to avoid legal penalties and maintain public trust in handling sensitive patient data.

Innoviva operates within a stringent legal framework, encompassing drug pricing regulations like the Inflation Reduction Act (IRA) of 2022, which mandates Medicare drug price negotiations. This directly impacts potential revenue for negotiated products, with initial negotiations targeting 10 Part D drugs for 2026. Legal challenges to these IRA provisions by industry groups introduce significant uncertainty, potentially influencing R&D investment decisions for future therapies.

Intellectual property law remains a critical legal factor, with patent infringement lawsuits and challenges to patent validity posing ongoing risks. The USPTO's high volume of applications and litigation in 2024 underscores the competitive IP landscape, where robust protection is vital for market exclusivity. Innoviva's strategic planning must account for these legal intricacies to safeguard its innovations and revenue streams.

Regulatory approval processes, managed by bodies like the FDA and EMA, are paramount for product launches. PDUFA target action dates provide benchmarks for review times, though delays are not uncommon, especially for novel treatments. Furthermore, antitrust regulators are increasingly scrutinizing pharmaceutical M&A, as exemplified by the FTC's active reviews in 2023, impacting Innoviva's growth through consolidation.

Data privacy and cybersecurity regulations, such as HIPAA and GDPR, are critical due to the increasing use of digital health technologies. Non-compliance carries substantial financial penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million. The healthcare sector's continued vulnerability to cyberattacks in 2023-2024 necessitates significant investment in cybersecurity to protect patient data and maintain trust.

| Legal Factor | Impact on Innoviva | Key Data/Regulation |

| Drug Pricing Regulation (IRA) | Potential revenue caps on negotiated drugs | Negotiations for 10 Part D drugs starting 2026 |

| Intellectual Property Law | Risk of patent disputes, need for strong protection | High volume of IP litigation in the pharmaceutical sector |

| Regulatory Approvals (FDA/EMA) | Influence on product launch timelines | PDUFA target action dates; evolving pathways for novel treatments |

| Antitrust Scrutiny (M&A) | Impact on growth through mergers and acquisitions | FTC's active review of healthcare consolidation in 2023 |

| Data Privacy & Cybersecurity | Risk of fines for non-compliance, need for robust security | GDPR fines up to 4% of global revenue; healthcare sector data breaches in 2023-2024 |

Environmental factors

Innoviva, like other pharmaceutical firms, faces mounting pressure from investors, regulators, and the public to demonstrate strong Environmental, Social, and Governance (ESG) performance. This push for transparency is compelling companies to adopt more sustainable operational practices, impacting everything from supply chains to waste management.

By integrating ESG principles into their core strategies, companies like Innoviva aim to bolster their reputation and meet the evolving expectations of stakeholders. For instance, in 2024, a significant majority of institutional investors indicated that ESG factors are material to their investment decisions, with many actively engaging with companies on these issues.

Climate change directly impacts health by worsening air quality and increasing allergens, leading to a rise in respiratory diseases. This trend is projected to continue, with studies indicating a significant increase in asthma exacerbations linked to higher temperatures and pollen counts by 2030.

These health challenges create a clear market demand for advanced respiratory treatments. Innoviva's research and development efforts are increasingly focused on addressing these climate-related health issues, aiming to capture a larger share of this growing market.

Innoviva, like many in the pharmaceutical sector, faces increasing pressure to adopt sustainable manufacturing practices. This involves a significant focus on energy efficiency, aiming to lower operational costs and environmental impact. For instance, the industry is exploring advanced manufacturing techniques that reduce water consumption and minimize waste generation, with many companies setting ambitious targets for the coming years.

Investment in green chemistry and renewable energy sources is becoming a strategic imperative. Innoviva's peers are actively deploying solar and wind power for their facilities, and circular economy models are being integrated to reuse materials and reduce reliance on virgin resources. These shifts are driven by both regulatory demands and a growing consumer and investor preference for environmentally responsible companies.

Supply Chain Environmental Footprint

Innoviva recognizes that its environmental footprint isn't limited to its direct operations but encompasses its entire supply chain. This includes the sourcing of raw materials, the packaging of products, and the logistics involved in distribution. The company is actively working to mitigate these impacts.

Efforts are underway to reduce carbon emissions and waste throughout the value chain. This involves a focus on adopting eco-friendly packaging solutions and optimizing distribution networks to minimize transportation-related environmental effects. Innoviva is also prioritizing partnerships with suppliers who demonstrate a strong commitment to environmental responsibility.

Key initiatives include:

- Eco-friendly Packaging: Exploring and implementing sustainable materials for product packaging to reduce plastic waste and improve recyclability.

- Logistics Optimization: Streamlining transportation routes and methods to lower fuel consumption and associated emissions, aiming for more efficient delivery networks.

- Supplier Partnerships: Engaging with suppliers who adhere to stringent environmental standards, ensuring responsible sourcing of raw materials and components.

- Waste Reduction Programs: Implementing comprehensive waste management strategies across the supply chain to minimize landfill contributions and promote circular economy principles.

Regulatory Focus on Environmental Impact of Products

Regulatory bodies, including the World Health Organization (WHO), are intensifying their focus on the environmental impact of medical products. They are advocating for innovative regulatory approaches that encourage sustainable manufacturing processes and minimize the ecological footprint of products across their entire lifecycle. This scrutiny extends to critical areas like the discharge of active pharmaceutical ingredients (APIs) and the broader environmental consequences of product use and disposal.

Innoviva must navigate a landscape where environmental stewardship is becoming a non-negotiable aspect of product development and market access. For instance, the European Medicines Agency (EMA) has been actively promoting the assessment of environmental risks associated with pharmaceuticals, with new guidelines expected to further shape industry practices. Companies are increasingly being held accountable for the environmental performance of their supply chains and product end-of-life management.

- Increased Scrutiny on API Discharge: Regulators are demanding stricter controls on the release of APIs into water systems, impacting manufacturing site permits and waste treatment protocols.

- Lifecycle Environmental Assessments: Expect a greater emphasis on comprehensive lifecycle assessments for medical devices and pharmaceuticals, covering raw material sourcing, manufacturing, distribution, use, and disposal.

- Sustainable Packaging Mandates: Governments are implementing regulations that favor reduced plastic use and increased recyclability in product packaging, a key area for Innoviva’s product delivery.

- Carbon Footprint Reporting: Companies may face requirements for detailed reporting on their carbon emissions, influencing energy sourcing and operational efficiency strategies.

Innoviva, like many in the pharmaceutical sector, faces increasing pressure to adopt sustainable manufacturing practices, focusing on energy efficiency to lower costs and environmental impact.

Investment in green chemistry and renewable energy is becoming a strategic imperative, with peers deploying solar and wind power, and integrating circular economy models.

The company must navigate a landscape where environmental stewardship is increasingly scrutinized, with regulators demanding stricter controls on API discharge and greater emphasis on lifecycle assessments.

Innoviva's environmental footprint extends across its supply chain, prompting efforts to reduce carbon emissions and waste through eco-friendly packaging and optimized logistics.

| Environmental Factor | Impact on Innoviva | Key Initiatives/Considerations |

|---|---|---|

| Climate Change & Health | Increased demand for respiratory treatments due to worsening air quality. | Focus R&D on climate-related health issues. |

| Sustainable Manufacturing | Need for energy efficiency, reduced water consumption, and waste minimization. | Explore advanced manufacturing, green chemistry, renewable energy. |

| Supply Chain Responsibility | Mitigating environmental impact from raw material sourcing to distribution. | Eco-friendly packaging, logistics optimization, supplier partnerships. |

| Regulatory Landscape | Intensifying focus on environmental impact of medical products and lifecycle management. | Adherence to EMA guidelines on environmental risk assessment, stricter API discharge controls. |

PESTLE Analysis Data Sources

Innoviva's PESTLE analysis is informed by a robust blend of data, including reports from leading financial institutions like the World Bank and IMF, alongside current government publications and regulatory updates. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.