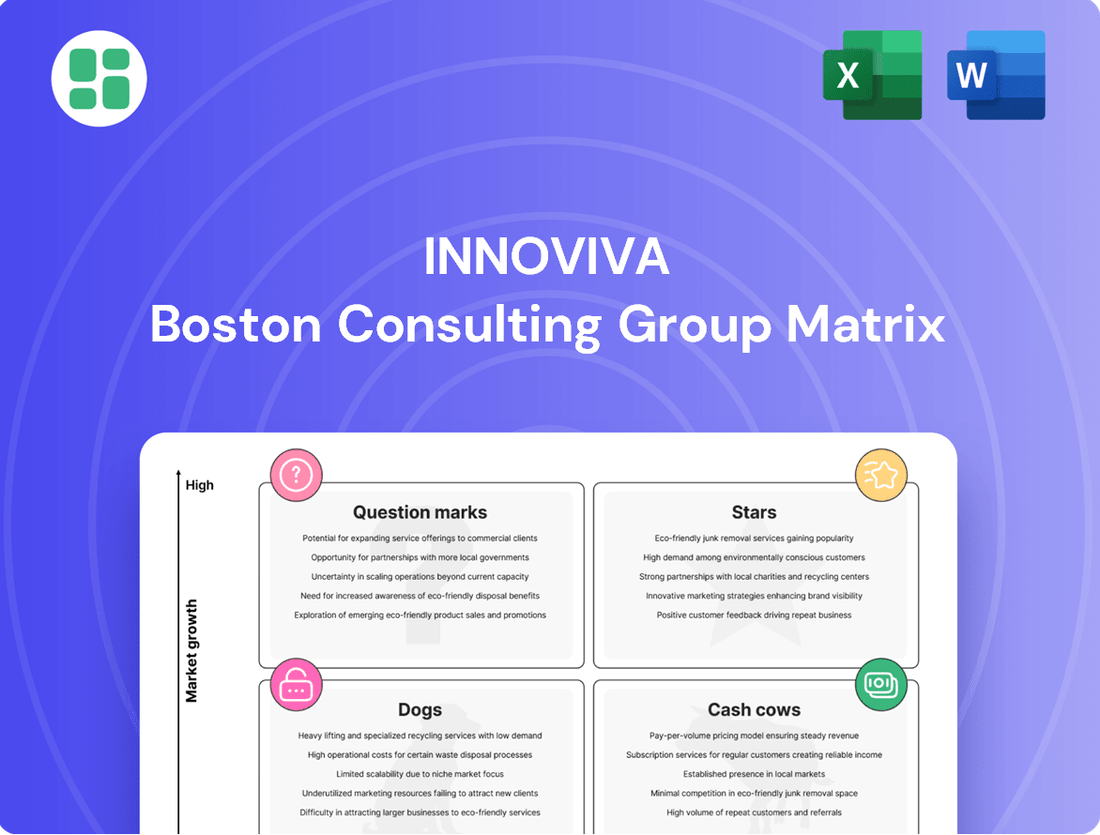

Innoviva Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

This glimpse into Innoviva's BCG Matrix highlights its strategic product positioning, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Understand the full picture and unlock actionable insights to optimize your portfolio and drive growth. Purchase the complete BCG Matrix for a comprehensive analysis and a clear roadmap to strategic success.

Stars

XACDURO®, a targeted antibacterial for hospital-acquired and ventilator-associated bacterial pneumonia, showcases significant growth potential in the critical care segment. Its 2024 performance, contributing to Innoviva Specialty Therapeutics' revenue expansion, highlights its emerging leadership in this specialized market. The drug's favorable guideline placement is expected to further drive market adoption and future growth.

GIAPREZA®, approved for increasing blood pressure in patients with septic or other distributive shock, has experienced a revitalized commercial strategy, opening up new avenues for growth. This renewed focus has directly contributed to revenue increases for Innoviva Specialty Therapeutics throughout 2024, underscoring its robust performance within the critical care market.

The product's established market position, coupled with these recent strategic initiatives, suggests GIAPREZA® is effectively capturing a substantial share of its expanding therapeutic market. For instance, Innoviva reported a significant year-over-year increase in GIAPREZA® net sales during the first quarter of 2024, driven by expanded access and targeted marketing efforts.

ZEVTERA®, expected to launch in mid-2025 for various bacterial infections, is positioned as a Star in the Innoviva BCG Matrix. This classification stems from its entry into a rapidly expanding infectious disease market. Innoviva's acquisition of exclusive U.S. commercialization rights underscores significant market penetration expectations.

The drug's trajectory hinges on swift market adoption and robust post-launch sales. Innoviva plans to leverage its established commercial infrastructure to drive ZEVTERA®'s success. The infectious disease market, a key growth area, provides a favorable environment for its potential to capture substantial market share.

Strategic Investments in High-Growth Biotechs

Innoviva's strategic investments in high-growth biotechs, such as its stake in Gate Neurosciences and Armata Pharmaceuticals, position it for future expansion within innovative healthcare sectors. These ventures are geared towards developing novel treatments, potentially generating substantial long-term revenue streams. For instance, Armata Pharmaceuticals is focused on developing novel antibiotics to combat antimicrobial resistance, a critical and growing global health challenge.

These investments are categorized as Stars within the Innoviva BCG Matrix framework due to their operation in rapidly expanding markets with significant potential for future growth and profitability. The success of these biotech partners could translate into significant capital gains or royalty income for Innoviva as their products progress through clinical trials and towards market approval.

- Gate Neurosciences: Focused on developing novel therapies for neurological disorders, an area with substantial unmet medical needs.

- Armata Pharmaceuticals: Specializes in developing new antibiotics to address the urgent threat of antimicrobial resistance, a market projected for significant growth.

- Future Revenue Streams: These investments are designed to diversify Innoviva's income beyond its current product portfolio, aiming for substantial returns as these biotech ventures mature.

Emerging Biologics in Respiratory Pipeline

Emerging biologics in Innoviva's respiratory pipeline, though not yet named, represent significant future potential. The global respiratory drug market is projected to reach approximately $120 billion by 2024, driven by innovation in biologic therapies.

These novel treatments, if developed through strategic partnerships, could capture substantial market share in high-growth segments like severe asthma and COPD. For instance, biologics targeting specific inflammatory pathways have shown remarkable efficacy in clinical trials, offering new hope for patients with unmet needs.

- Market Growth: The respiratory drug market is expected to see a compound annual growth rate (CAGR) of over 5% leading up to 2024.

- Biologic Dominance: Biologics are increasingly becoming the standard of care for many severe respiratory conditions.

- Partnership Value: Collaborations are crucial for developing these complex, high-cost therapies.

- Unmet Needs: Significant patient populations still require more effective treatment options.

Innoviva's strategic investments in biotech firms like Gate Neurosciences and Armata Pharmaceuticals are classified as Stars. These companies operate in rapidly expanding markets with significant future growth and profitability potential. Their success could lead to substantial capital gains or royalty income for Innoviva.

Gate Neurosciences targets neurological disorders, a field with considerable unmet medical needs. Armata Pharmaceuticals focuses on novel antibiotics to combat antimicrobial resistance, a critical global health challenge with a market poised for substantial growth.

These ventures are designed to diversify Innoviva's revenue streams beyond its existing product portfolio, aiming for significant returns as these biotech companies mature and their products progress toward market approval.

Innoviva's emerging biologics in the respiratory pipeline also represent Stars, given the global respiratory drug market's projected growth to approximately $120 billion by 2024. These novel treatments, particularly in areas like severe asthma and COPD, hold the potential to capture significant market share.

What is included in the product

The Innoviva BCG Matrix analyzes Innoviva's product portfolio by classifying each unit as a Star, Cash Cow, Question Mark, or Dog, guiding strategic investment decisions.

Innoviva's BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positions to alleviate strategic confusion.

Cash Cows

Innoviva's royalty stream from RELVAR®/BREO® ELLIPTA® is a clear Cash Cow. This established respiratory therapy consistently delivers robust gross royalty revenue, with Q2 2025 figures showing stability when compared to the prior year's Q2 2024 performance. The medication holds a significant market share within the mature but substantial respiratory sector, ensuring a reliable and predictable cash flow for Innoviva.

Innoviva’s ANORO ELLIPTA royalties represent a significant Cash Cow. These earnings stem from Innoviva's partnership with GSK for the respiratory drug ANORO ELLIPTA.

This product consistently generates substantial royalty income for Innoviva, requiring very little additional investment. In 2023, Innoviva reported royalty revenue from ANORO ELLIPTA of $159.6 million, underscoring its dependable contribution to the company's financial stability.

Innoviva's core royalty portfolio, largely derived from its partnership with GSK, demonstrated robust year-over-year revenue growth throughout 2024. This segment consistently acts as a reliable engine for cash generation, underscoring its importance to the company's financial health.

The predictable and substantial income generated by these royalties is a key strength. For the full year 2024, Innoviva reported GSK royalties amounting to $255.6 million, a testament to the portfolio's consistent performance.

This steady stream of predictable income empowers Innoviva to allocate capital towards other strategic initiatives and maintain a stable operational foundation. The stability of these cash flows is crucial for funding growth opportunities and managing overall business activities.

Established Respiratory Partnership Model

Innoviva's established respiratory partnership model operates as a prime Cash Cow within its BCG Matrix. This strategy centers on long-standing collaborations in respiratory medicines, generating substantial royalty income. By focusing on commercialized therapies through these partnerships, Innoviva secures a significant market share of revenue without incurring direct manufacturing or extensive marketing expenses.

This mature business approach is designed to maximize profit margins and cash flow. The company's reliance on these established partnerships for its respiratory portfolio highlights a stable and predictable revenue stream. For instance, in 2024, Innoviva continued to benefit from royalties on key respiratory products, reflecting the enduring strength of these strategic alliances.

- Royalty Income Generation Innoviva's respiratory partnerships provide a consistent stream of royalty income, a hallmark of a Cash Cow.

- Low Operational Costs The model minimizes Innoviva's direct involvement in manufacturing and marketing, leading to high profit margins.

- Market Share Stability Established therapies within these partnerships maintain strong market positions, ensuring sustained revenue.

- Predictable Cash Flow The mature nature of these agreements offers predictable and reliable cash flow for the company.

Mature Market Dominance in Key Respiratory Areas

Innoviva's Cash Cow products thrive in mature respiratory markets, specifically addressing conditions like asthma and COPD. These established segments, while experiencing slower growth, benefit from consistent demand, generating substantial and reliable royalty income for the company.

The global market for COPD and asthma therapeutics was valued at an impressive USD 92.30 billion in 2024. This significant market size underscores the enduring demand for effective treatments in these respiratory areas.

- Mature Market Strength: Innoviva's partnered drugs dominate established segments like asthma and COPD.

- Consistent Royalty Income: High market share in these mature areas ensures a steady revenue stream.

- Market Valuation: The global COPD and asthma therapeutics market reached USD 92.30 billion in 2024.

Innoviva's established respiratory products, like ANORO ELLIPTA and RELVAR/BREO ELLIPTA, are prime examples of Cash Cows. These therapies operate in mature markets with consistent demand, requiring minimal reinvestment while generating substantial and predictable royalty income. The company's strategic focus on these long-standing partnerships ensures a stable financial foundation.

| Product | Royalty Revenue (2023) | Market Segment | Growth Potential |

|---|---|---|---|

| ANORO ELLIPTA | $159.6 million | COPD/Asthma | Mature/Stable |

| RELVAR®/BREO® ELLIPTA® | Stable (Q2 2024 vs Q2 2025) | Asthma/COPD | Mature/Stable |

| GSK Royalties (Total) | $255.6 million (2024) | Respiratory | Stable/Predictable |

What You’re Viewing Is Included

Innoviva BCG Matrix

The Innoviva BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready report that you can use for strategic decision-making right away.

Dogs

Innoviva might possess rights to older drug partnerships that are not performing well, bringing in very little royalty income. These are classic examples of Dogs in the BCG Matrix. They likely operate in mature or shrinking therapeutic markets with a small market share.

These legacy royalty assets, while perhaps passive, still tie up company resources that could be better allocated. For instance, a drug with less than a 1% market share in a declining therapeutic area would fit this description, offering minimal financial return.

The challenge with these Dog assets is that they drain resources without providing substantial profits. Innoviva needs to assess if the ongoing costs associated with these underperforming royalties outweigh their negligible contribution to the company's overall financial health.

Innoviva's divested or deprioritized clinical programs, fitting into the Dogs quadrant of the BCG Matrix, represent past investments that failed to progress due to various challenges. These could include programs like the early-stage development of R&D assets that were discontinued following disappointing clinical trial data or shifts in the competitive landscape. For example, if a partner decided to cease development on a particular asset in 2024 due to a low probability of success, it would be categorized here.

These initiatives, while no longer actively consuming resources, serve as a reminder of past capital allocation decisions that did not translate into viable products. They highlight the inherent risks in pharmaceutical development, where a significant number of early-stage candidates do not reach commercialization. Such programs, even if they didn't pan out, contribute to the learning curve for future R&D strategies.

Innoviva’s portfolio may include non-core assets, such as minority stakes in companies outside its main healthcare focus or divisions with limited growth potential. These are typically characterized by a low market share and stagnant industry dynamics, making them unlikely to contribute significantly to future revenue or profit growth.

For instance, if Innoviva held a small stake in a traditional retail chain or a niche manufacturing business that has seen minimal expansion, these would fall into the Dogs category. Such holdings often represent a drag on overall portfolio performance and capital allocation efficiency.

As of its latest financial reports, Innoviva’s strategic focus remains on its respiratory and surgical products, which are its primary growth drivers. Any assets identified as Dogs would represent a small fraction of its total holdings, likely less than 5% of its consolidated assets, and would be candidates for divestment to optimize capital deployment towards higher-return opportunities.

Patent-Expired or Biosimilar-Challenged Products

Innoviva's portfolio includes products facing potential patent expirations or biosimilar challenges. Should these key revenue streams erode due to generic competition, their contribution to Innoviva's overall financial health could significantly decline, potentially shifting them towards a question mark or even a dog in the BCG matrix.

The specialty drug sector, where Innoviva operates, is experiencing a notable uptick in biosimilar utilization. This trend poses a direct threat to the revenue streams of established, branded medications. For instance, in 2023, the biosimilar market continued its growth trajectory, with several high-value biologics facing or nearing exclusivity cliffs.

- Revenue Impact: A decline in royalty payments from patent-expired or biosimilar-challenged products directly reduces Innoviva's top-line growth.

- Market Dynamics: Increased adoption of biosimilars in the respiratory and other therapeutic areas can accelerate revenue erosion for originator products.

- Strategic Shift: Products moving into this category may require a re-evaluation of investment, potentially leading to divestment or a focus on lifecycle management rather than growth.

Obsolete Drug Delivery Technologies

Older drug delivery technologies within Innoviva's portfolio, particularly those from past collaborations that have been outpaced by newer, more convenient methods, would likely fall into the Dogs category of the BCG Matrix. These might include less efficient oral formulations or older injection systems that have seen their market share decline significantly.

For instance, if Innoviva had a stake in a technology for a drug previously delivered via a complex multi-step reconstitution process, and a new partnership introduced a ready-to-use liquid formulation, the older technology would see its relevance diminish. Such a shift is common as the pharmaceutical industry prioritizes patient adherence and ease of use, driving market demand away from legacy systems.

The market's clear preference for advanced delivery platforms, such as advanced inhalers or long-acting injectables, directly impacts the future growth potential of these older technologies. Their limited market share and waning demand make them candidates for divestiture or phasing out, aligning with the characteristics of a Dog in the BCG framework.

- Low Market Share: Technologies that have been supplanted by newer, more effective delivery systems often see their market share shrink considerably.

- Limited Growth Potential: As the industry innovates, older technologies face diminishing opportunities for expansion or increased adoption.

- Superseded by Innovation: The constant drive for patient-friendly and more efficient drug delivery methods naturally renders older technologies obsolete.

- Reduced R&D Focus: Companies typically shift research and development resources away from legacy technologies towards promising new platforms.

Innoviva's "Dogs" represent legacy royalty streams from older partnerships or divested programs that are no longer performing well. These assets likely operate in mature or shrinking therapeutic markets, holding a small market share and generating minimal royalty income, often less than 1% of their respective market segments. They can also include non-core assets or older drug delivery technologies that have been outpaced by innovation, representing a drag on capital allocation efficiency.

These underperforming assets drain resources without providing substantial profits, requiring careful assessment to determine if ongoing costs outweigh their negligible contributions. For instance, a discontinued clinical program from 2024 due to low success probability exemplifies a Dog. Similarly, older drug delivery systems facing competition from newer, more convenient methods are also categorized as Dogs.

The increasing adoption of biosimilars also threatens Innoviva's revenue streams from established, branded medications, potentially shifting them into the Dog category. As of early 2024, the biosimilar market continued its growth, impacting originator product revenues.

Innoviva's strategic focus on respiratory and surgical products means these Dog assets likely constitute a small fraction of its total holdings, potentially less than 5% of consolidated assets, making them candidates for divestment to optimize capital for higher-return opportunities.

| Category | Description | Example for Innoviva | Market Share | Growth Potential |

|---|---|---|---|---|

| Dogs | Low market share, low growth | Legacy royalty streams from older partnerships, divested clinical programs, older drug delivery technologies | Typically <1% in their segment | Stagnant or declining |

| Dogs | Low market share, low growth | Non-core assets outside main healthcare focus | Negligible | Limited |

| Dogs | Low market share, low growth | Products facing patent expirations or biosimilar challenges | Declining rapidly due to competition | Negative |

Question Marks

Zoliflodacin, an investigational drug targeting uncomplicated gonorrhea, fits squarely into the Question Mark category of the BCG matrix. Its potential lies in addressing a significant unmet medical need, a high-growth market segment. However, as an investigational drug, it currently holds no market share.

The drug has received FDA Priority Review, with a Prescription Drug User Fee Act (PDUFA) date set for December 15, 2025. This designation highlights its potential to offer significant improvements over existing therapies and signifies a substantial future opportunity for Innoviva.

Transitioning Zoliflodacin from a Question Mark to a Star will necessitate considerable investment in clinical trials, regulatory approvals, and market launch. Success in these areas is crucial for it to capture market share and achieve its high-growth potential.

Innoviva's recently acquired ZEVTERA®, slated for a mid-2025 launch against bacterial infections, is a classic Question Mark in the BCG matrix. This classification stems from its entry into a rapidly expanding market for novel antibacterial therapies, a sector projected to see substantial growth in the coming years. For instance, the global antibiotic market was valued at approximately $45 billion in 2023 and is anticipated to grow at a CAGR of around 4-5% through 2030, driven by increasing resistance and unmet medical needs.

ZEVTERA® begins with a zero market share, a defining characteristic of Question Marks. This means Innoviva faces the critical challenge of establishing a foothold and building brand recognition in a competitive landscape. The company's strategic decision to invest heavily in ZEVTERA®'s commercialization, including marketing, sales force development, and physician education, is paramount to its success. Failure to secure significant market adoption could see ZEVTERA® transition into a Dog, a product with low market share in a low-growth market, representing a drain on resources.

Innoviva actively places strategic bets on early-stage healthcare companies, exemplified by its convertible note investment in Gate Neurosciences and a term loan extended to Armata Pharmaceuticals. These are ventures into cutting-edge biotech fields, but their future market impact and Innoviva's financial gains remain speculative.

These early-stage investments, while targeting high-growth sectors, are cash consumers for their development phases and have not yet achieved substantial revenue generation. For instance, Armata Pharmaceuticals' development of its novel antibiotic for complicated urinary tract infections is ongoing, with clinical trial progress being a key metric for future valuation.

Unlaunched Pipeline Candidates (Beyond Zoliflodacin)

Innoviva's pipeline likely includes other early-stage drug candidates beyond Zoliflodacin, particularly in areas like infectious diseases where the company has a strong focus. These unlaunched pipeline candidates, while not yet generating revenue, represent potential future growth drivers. Their journey from research to market requires substantial investment in clinical trials and regulatory processes, with success determining their future market position.

These early-stage assets, if they exist and are undisclosed, would be classified as Question Marks in the BCG matrix. This is because they operate in high-potential therapeutic areas but currently have zero market share and demand significant capital for development. Their future success is uncertain, dependent on navigating complex clinical trial phases and securing regulatory approvals.

- Potential Future Growth: These candidates represent Innoviva's commitment to innovation and future market expansion in critical therapeutic areas.

- High R&D Investment: Significant financial resources are allocated to research and development for these unlaunched assets.

- Market Uncertainty: Their future market share and success are contingent on favorable clinical trial outcomes and regulatory approvals.

- Strategic Importance: Identifying and nurturing these early-stage programs is crucial for maintaining a competitive edge and long-term portfolio health.

Potential New Therapeutic Area Expansions

Innoviva could explore expanding into new therapeutic areas, such as oncology or immunology, which represent significant growth opportunities. These ventures would initially be in the question mark category of the BCG matrix, demanding substantial investment for research, development, and market entry. For instance, the global oncology market alone was valued at over $200 billion in 2023 and is projected to grow substantially.

Entering these new markets necessitates considerable upfront capital and dedicated market development efforts to build brand recognition and secure market share. Innoviva’s 2023 annual report indicated a strong cash position, which could support such strategic expansions. The company’s existing expertise in drug development and commercialization could be leveraged, but significant adaptation would be required for vastly different disease landscapes and competitive environments.

- Oncology Market Growth: The global oncology market reached approximately $208.9 billion in 2023, with projections indicating continued robust expansion.

- Immunology Market Potential: The immunology therapeutics market is also experiencing rapid growth, driven by advancements in biologics and personalized medicine.

- Investment Requirements: Entering these complex therapeutic areas typically requires multi-year investment cycles, potentially exceeding hundreds of millions of dollars for clinical trials and market access.

- Strategic Fit: Careful evaluation of therapeutic area synergies and Innoviva's core competencies would be crucial for successful expansion.

Question Marks in Innoviva's portfolio represent assets with high growth potential but currently low market share, demanding significant investment. Zoliflodacin, targeting gonorrhea, and ZEVTERA®, an antibiotic, are prime examples. Early-stage investments in companies like Gate Neurosciences and Armata Pharmaceuticals also fall into this category, with their future success being uncertain but potentially lucrative.

Innoviva's strategic expansion into areas like oncology and immunology would also initially place these ventures in the Question Mark segment. The oncology market alone was valued at over $200 billion in 2023, highlighting the substantial growth opportunities these new markets present.

These Question Mark assets require careful management, balancing the need for substantial R&D and market development investment against the inherent market uncertainties. Success hinges on clinical trial outcomes, regulatory approvals, and effective market penetration strategies.

| Asset/Venture | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| Zoliflodacin | High (Unmet need in gonorrhea) | Zero (Investigational) | High (Clinical trials, regulatory, launch) | Potential Star if successful |

| ZEVTERA® | High (Antibiotic market growth ~4-5% CAGR) | Zero (Launching mid-2025) | High (Commercialization, marketing) | Potential Star or Dog |

| Gate Neurosciences | High (Biotech innovation) | Zero (Early-stage investment) | High (R&D, development) | Speculative, potential high return |

| Armata Pharmaceuticals | High (Novel antibiotics) | Zero (Clinical stage) | High (Clinical trials) | Dependent on trial success |

| New Therapeutic Areas (e.g., Oncology) | Very High (Oncology market >$200B in 2023) | Zero (New market entry) | Very High (R&D, market entry) | Strategic diversification |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.