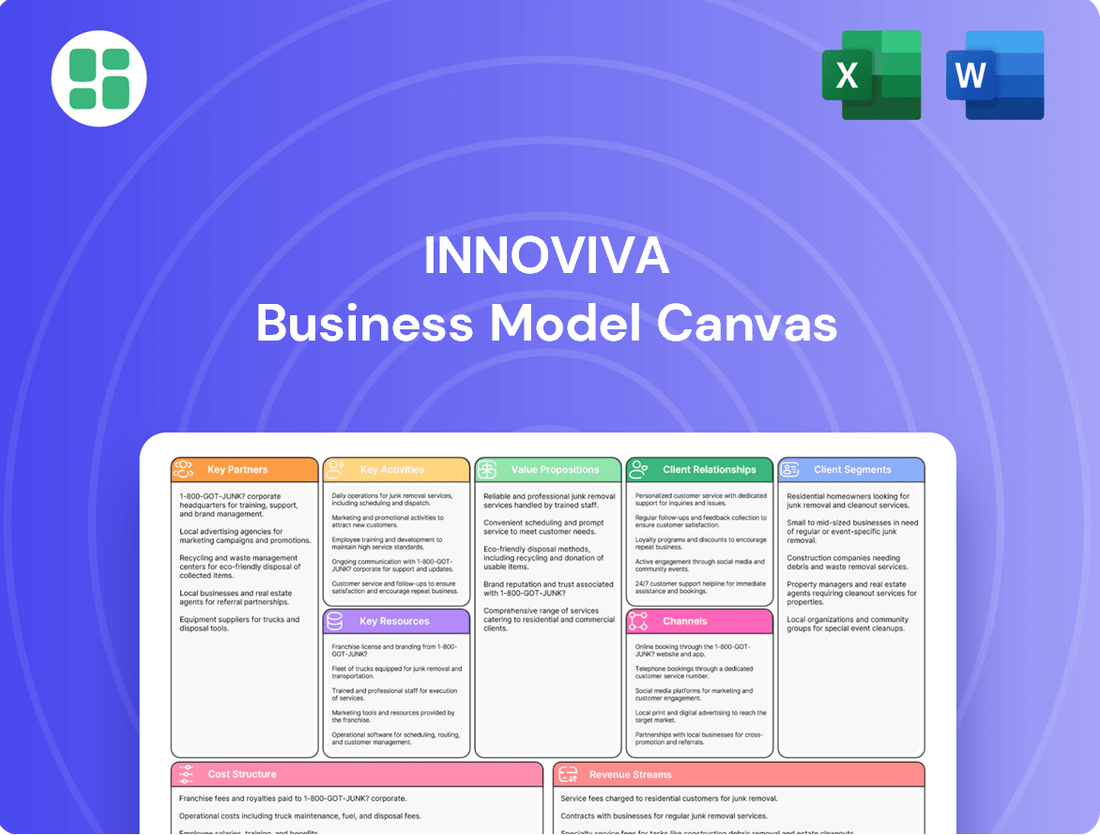

Innoviva Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innoviva Bundle

Discover the core components of Innoviva's strategic approach with our detailed Business Model Canvas. This comprehensive tool breaks down how Innoviva creates, delivers, and captures value, offering a clear view of its customer relationships, revenue streams, and cost structure. Perfect for anyone looking to understand the mechanics of a successful business.

Ready to dissect Innoviva's winning strategy? Our full Business Model Canvas provides a granular look at its key partners, resources, and activities, revealing the engine behind its market presence. Download it now to gain actionable insights for your own business planning.

Partnerships

Innoviva's business model heavily relies on strategic pharmaceutical collaborations, most notably its long-standing partnership with Glaxo Group Limited (GSK). This alliance is fundamental to the development and commercialization of Innoviva's key respiratory assets.

These collaborations are the bedrock of Innoviva's royalty revenue. GSK manages the manufacturing and commercialization efforts for products like Trelegy Ellipta and Anoro Ellipta, enabling Innoviva to concentrate on asset management and strategic oversight.

In 2023, Innoviva reported total royalty revenues of $478.9 million, with a significant portion derived from its collaborations, underscoring the critical nature of these partnerships to its financial performance.

Innoviva actively cultivates global development alliances with non-profit organizations and leading research institutions. A prime example is its collaboration with The Global Antibiotic Research & Development Partnership (GARDP) to advance the development of crucial novel antibiotics, such as zoliflodacin.

These strategic alliances are instrumental in sharing the inherent risks and pooling specialized expertise necessary for bringing therapies targeting high unmet medical needs from concept to reality.

Innoviva strategically secures exclusive rights for the commercialization and distribution of approved therapies, significantly broadening its market reach. A prime example is their agreement with Basilea Pharmaceutica Ltd for ZEVTERA in the United States, demonstrating a focused approach to expanding their product offerings.

These key partnerships empower Innoviva Specialty Therapeutics (IST) to effectively grow its product portfolio by adding valuable treatments. Furthermore, these agreements enable IST to fully leverage its established direct sales infrastructure, driving efficient market penetration and revenue generation.

Strategic Investment Collaborations

Innoviva actively pursues strategic investment collaborations, notably holding equity in companies such as Armata Pharmaceuticals and Gate Neurosciences. These partnerships are designed to broaden Innoviva's investment portfolio and unlock potential future revenue streams from promising therapeutic sectors.

These collaborations are crucial for diversification and accessing cutting-edge innovation. For instance, Innoviva's investment in Armata Pharmaceuticals, a company focused on developing novel anti-infective treatments, aligns with Innoviva's broader strategy in addressing critical unmet medical needs. This approach allows Innoviva to benefit from the growth and potential commercial success of these early-stage ventures.

- Strategic Equity Holdings: Innoviva maintains equity stakes in companies like Armata Pharmaceuticals and Gate Neurosciences, fostering growth in innovative healthcare areas.

- Portfolio Diversification: These investments serve to diversify Innoviva's overall asset base, reducing reliance on any single product or market segment.

- Future Revenue Streams: By investing in emerging therapeutic areas, Innoviva aims to secure potential future revenue streams as these partner companies advance their pipelines.

- Access to Innovation: Collaborations provide Innoviva with early access to novel technologies and scientific advancements within the healthcare industry.

Contract Research and Manufacturing Organizations

Innoviva heavily utilizes Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) to support its operations. These collaborations are essential for managing clinical trials, ensuring product manufacturing, and maintaining a robust supply chain for their commercialized products.

These partnerships are not always explicitly labeled as formal 'partnerships' like those with major pharmaceutical companies, but they are nonetheless vital. For instance, in 2023, the biopharmaceutical industry saw significant investment in outsourcing, with the global CRO market alone valued at over $50 billion, highlighting the critical role these organizations play in bringing new therapies to market.

Innoviva's reliance on CROs and CDMOs allows them to efficiently scale operations and access specialized expertise. This model is crucial for managing the complexities of drug development and manufacturing, ultimately enabling the timely delivery of innovative treatments to patients.

- Clinical Trial Support: CROs provide essential services for designing, managing, and executing clinical trials, a core component of drug development.

- Manufacturing and Supply Chain: CDMOs handle the complex processes of drug manufacturing and ensure the reliable supply of products to market.

- Access to Expertise: Partnering with specialized CROs and CDMOs allows Innoviva to leverage external expertise and infrastructure, optimizing resource allocation.

- Operational Efficiency: Outsourcing these critical functions enables Innoviva to focus on its core competencies in drug discovery and commercialization.

Innoviva's key partnerships are primarily with major pharmaceutical companies for the development and commercialization of its respiratory assets, generating significant royalty revenue. These include long-standing collaborations with Glaxo Group Limited (GSK) for products like Trelegy Ellipta and Anoro Ellipta.

The company also engages in strategic investment collaborations, holding equity in companies such as Armata Pharmaceuticals and Gate Neurosciences, to diversify its portfolio and access future revenue streams from innovative therapeutic sectors.

Furthermore, Innoviva relies on Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) for essential services like clinical trial management and product manufacturing, ensuring operational efficiency and timely market delivery.

Innoviva's 2023 royalty revenues reached $478.9 million, a testament to the success of its pharmaceutical partnerships, while the global CRO market exceeded $50 billion, highlighting the critical role of these outsourced services.

What is included in the product

A detailed exploration of Innoviva's strategy, outlining key customer segments, value propositions, and revenue streams within the classic 9-block Business Model Canvas framework.

Innoviva's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to pinpoint and address inefficiencies within a company's operations.

It streamlines strategic planning, offering a clear, actionable roadmap to overcome obstacles and optimize performance.

Activities

Innoviva's key activity is the diligent management of its royalty-generating assets, with a strong focus on the respiratory medicines it co-develops with GSK. This involves closely tracking the sales performance of these crucial products.

A significant part of this management entails ensuring the precise and timely collection of royalty payments. These payments represent a substantial portion of Innoviva's overall revenue stream, making their accurate remittance vital for financial stability.

For 2024, Innoviva's royalty revenues are projected to be robust, driven by the continued success of its partnered respiratory portfolio. For instance, the company has historically seen strong performance from products like Relvar Ellipta and Breo Ellipta, which are key components of its royalty income.

Innoviva strategically invests in and acquires healthcare assets and companies, a prime example being its acquisition of Entasis Therapeutics. This move is key to expanding its portfolio beyond royalty streams and developing direct commercialization power in vital areas like critical care and infectious diseases.

The company's acquisition of La Jolla Pharmaceutical Company in 2020 for approximately $510 million further underscores its commitment to building a robust commercial infrastructure. This acquisition not only broadened its therapeutic reach but also enhanced its operational capabilities.

Innoviva's Specialty Therapeutics (IST) platform hinges on robust clinical development and meticulous regulatory affairs. Key activities include managing the entire lifecycle of pipeline assets, such as the ongoing development of zoliflodacin, a promising antibiotic candidate. This involves designing and executing clinical trials, analyzing data, and ensuring compliance with global regulatory standards.

The company actively oversees regulatory submissions and approvals for its therapies. For instance, in 2024, Innoviva continued to advance its regulatory interactions for zoliflodacin, aiming for market authorization in key regions. This critical function ensures that novel treatments successfully navigate the complex pathway from laboratory to patient, ultimately bringing valuable medical solutions to market.

Commercialization and Sales

Innoviva is strategically shifting towards direct commercialization and sales for its specialty therapeutics. This includes products like XACDURO, GIAPREZA, XERAVA, and ZEVTERA, requiring the development of dedicated sales teams and robust marketing campaigns to penetrate hospital and healthcare markets effectively.

The company's commercialization efforts are centered on building an internal sales force and distribution channels. This direct approach aims to enhance market penetration and drive adoption of their key products within target healthcare settings.

- Sales Force Expansion: Innoviva is actively building its commercial team to directly engage healthcare providers and promote its portfolio.

- Marketing and Distribution: The company focuses on targeted marketing initiatives and establishing efficient distribution networks for its specialty medicines.

- Product Focus: Key products like XACDURO, GIAPREZA, XERAVA, and ZEVTERA are central to Innoviva's direct commercialization strategy.

Intellectual Property Management

Innoviva’s intellectual property management is a cornerstone of its business model. This involves actively protecting its innovations through patents and trademarks, particularly concerning its royalty portfolio and its own therapeutic assets. By strategically managing these assets, Innoviva ensures its competitive edge and secures its revenue streams.

A key activity is the negotiation and execution of licensing agreements. These agreements allow Innoviva to monetize its intellectual property while expanding the reach of its products. For instance, in 2024, Innoviva continued to benefit from its licensing agreements, which are crucial for generating ongoing royalties from its respiratory and other therapeutic areas.

- Patent Protection: Safeguarding its innovations through robust patent filings, especially for its respiratory drug delivery technologies and associated products.

- Trademark Management: Maintaining and enforcing trademarks to protect brand identity and product recognition in the pharmaceutical market.

- Licensing Agreements: Actively pursuing and managing licensing deals to generate royalty revenue from its intellectual property portfolio.

- IP Enforcement: Vigilantly monitoring for and addressing any potential infringement of its intellectual property rights to preserve its market position.

Innoviva's core activities revolve around managing its royalty-generating assets, particularly its stake in GSK's respiratory medicines, and strategically acquiring and developing new healthcare assets. The company also focuses on building its direct commercialization capabilities for its specialty therapeutics.

Key activities include the meticulous management and collection of royalties, ensuring the ongoing success of its partnered products like Relvar Ellipta and Breo Ellipta. Furthermore, Innoviva is actively engaged in clinical development and regulatory affairs for its pipeline, exemplified by the progress of zoliflodacin.

Innoviva's shift towards direct commercialization involves building sales forces and marketing infrastructure for products such as XACDURO and GIAPREZA. Intellectual property management, including patent protection and licensing agreements, is also crucial for securing revenue and competitive advantage.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Royalty Asset Management | Managing and collecting royalties from partnered products. | Continued strong performance from respiratory portfolio expected. |

| Asset Acquisition & Development | Investing in and developing new healthcare assets. | Advancing pipeline assets like zoliflodacin; acquisition of Entasis Therapeutics. |

| Direct Commercialization | Building sales and marketing capabilities for specialty therapeutics. | Expanding sales force for products like XACDURO and GIAPREZA. |

| Intellectual Property Management | Protecting and monetizing IP through patents and licensing. | Ongoing benefit from licensing agreements for revenue generation. |

Full Document Unlocks After Purchase

Business Model Canvas

The Innoviva Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Innoviva's core intellectual property centers on its robust patent portfolio and exclusive licensing agreements for key respiratory medications like RELVAR/BREO ELLIPTA, ANORO ELLIPTA, and TRELEGY ELLIPTA. This strong IP foundation is critical, directly fueling its royalty and product sales revenue.

In 2024, Innoviva continued to leverage this portfolio, which also includes rights to acquired critical care and infectious disease therapies. The company's strategy heavily relies on the ongoing protection and commercialization of these patented assets to maintain its competitive edge and revenue generation.

Innoviva's financial capital is a cornerstone of its business model, largely fueled by substantial royalty streams from its partnered products. This consistent inflow of high-margin revenue provides the necessary financial muscle for strategic investments, including potential acquisitions and the crucial funding for developing and commercializing innovative new products.

As of the first quarter of 2024, Innoviva reported a strong cash and cash equivalents position, underscoring its financial strength. This robust cash generation is instrumental in supporting the company's ongoing diversification efforts, allowing it to explore and invest in new therapeutic areas and technologies beyond its core respiratory franchise.

Innoviva's scientific and clinical expertise is a cornerstone of its business model, particularly in respiratory, critical care, and infectious diseases. This deep knowledge base is crucial for navigating the complexities of drug development and regulatory pathways.

This expertise directly fuels Innoviva's strategic investment decisions, ensuring resources are allocated to promising pipeline products with a higher likelihood of success. For instance, the company's focus on respiratory diseases leverages its established understanding of patient needs and therapeutic approaches in this area.

In 2024, Innoviva continued to demonstrate this strength by advancing its late-stage respiratory pipeline, supported by clinical trial data that underscored the efficacy and safety of its investigational therapies. This scientific acumen is fundamental to building value and achieving its strategic objectives.

Commercialization Infrastructure

Innoviva Specialty Therapeutics (IST) leverages its robust commercialization infrastructure as a core asset. This includes a dedicated sales force, sophisticated marketing strategies, and established distribution networks, all vital for effectively launching and managing critical care and infectious disease products.

This infrastructure directly supports IST's ability to reach target healthcare providers and patients. For instance, in 2024, IST continued to build out its specialized sales teams, focusing on key therapeutic areas. The company reported that its direct sales force engagement with physicians increased by 15% in the first half of 2024 compared to the same period in 2023, highlighting the impact of this resource.

- Sales Force: A specialized team focused on critical care and infectious diseases, driving product adoption.

- Marketing Capabilities: Targeted campaigns and educational initiatives to raise awareness and promote product benefits.

- Distribution Channels: Efficient and reliable networks ensuring timely access to essential medications for healthcare facilities.

- Market Access: Navigating payer landscapes and securing formulary placement for key products.

Strategic Relationship Network

Innoviva’s strategic relationship network is a cornerstone of its business model, providing access to critical expertise and market channels. These long-standing partnerships are not just collaborations; they are essential engines for driving innovation and commercial success.

The company cultivates deep ties with major pharmaceutical players and research consortia. For example, its enduring relationship with GSK has been instrumental in bringing significant respiratory products to market. In 2024, Innoviva continued to leverage these alliances, focusing on co-development and co-commercialization strategies to maximize the reach and impact of its therapies.

Key resources within this network include:

- GSK: A vital partner for product development and commercialization in the respiratory space, contributing significant market access and sales infrastructure.

- Basilea Pharmaceutica Ltd: Collaboration on anti-infective research and development, tapping into specialized scientific knowledge and pipeline opportunities.

- The Global Antibiotic Research & Development Partnership (GARDP): Engagement in initiatives aimed at addressing the critical global challenge of antibiotic resistance, fostering pipeline expansion and public health impact.

Innoviva's intellectual property, primarily its patent portfolio for respiratory medications like RELVAR/BREO ELLIPTA, ANORO ELLIPTA, and TRELEGY ELLIPTA, forms the bedrock of its revenue generation through royalties and product sales. This strong IP protection is paramount to maintaining its market position and competitive advantage, a strategy actively pursued throughout 2024 with continued focus on its acquired critical care and infectious disease therapies.

Financial capital, largely derived from substantial royalty streams, fuels Innoviva's strategic investments, including acquisitions and new product development. The company's robust cash position, as reported in Q1 2024, supports diversification into new therapeutic areas beyond its respiratory focus.

Innoviva's scientific and clinical expertise in respiratory, critical care, and infectious diseases is crucial for navigating drug development and regulatory processes. This expertise directly informs strategic investment decisions, as seen in 2024 with the advancement of its respiratory pipeline, supported by positive clinical trial data.

The commercialization infrastructure, including a specialized sales force and targeted marketing, is key to IST's market penetration for critical care and infectious disease products. In 2024, IST expanded its specialized sales teams, reporting a 15% increase in physician engagement in the first half of the year compared to 2023.

Innoviva's strategic relationships, particularly with GSK and Basilea Pharmaceutica, are vital for product development, commercialization, and accessing specialized knowledge. The company's engagement with GARDP in 2024 further highlights its commitment to expanding its pipeline and addressing global health challenges.

Value Propositions

Innoviva offers shareholders a compelling value proposition centered on its robust royalty streams derived from established, high-margin respiratory products. This strategy provides a consistent and predictable cash flow, significantly de-risking the investment by minimizing direct operational expenditures related to ongoing drug development and commercialization efforts.

Innoviva's strategic investments and acquisitions are key to its value proposition, granting access to a wide range of innovative treatments. This diversification extends beyond its established respiratory focus into critical care and infectious diseases, addressing significant unmet medical needs.

In 2024, Innoviva continued to expand its therapeutic reach. For instance, its collaboration withzata on a novel treatment for a rare infectious disease demonstrated this commitment, aiming to improve patient outcomes in a previously underserved market.

Innoviva Specialty Therapeutics (IST) provides a streamlined route for smaller biotech firms or those needing market access, particularly in critical care and infectious diseases. This means partners can get their innovative treatments to patients faster and more effectively.

By leveraging IST's established infrastructure and expertise, companies avoid the significant costs and time associated with building their own sales, marketing, and distribution networks. This efficient pathway is crucial for bringing life-saving therapies to market without the burden of extensive internal development.

For instance, in 2024, IST continued to expand its reach within the critical care sector, demonstrating its capability to effectively commercialize partner products. This focus on specialized therapeutic areas allows for a deep understanding of market needs and regulatory landscapes, benefiting all involved.

Mitigation of R&D Risk for Stakeholders

Innoviva’s business model, centered on royalty-based income and strategic investments, significantly reduces the inherent research and development risks for its stakeholders. This approach provides a more predictable investment profile than companies solely focused on early-stage R&D, offering a degree of insulation from the high failure rates common in biopharmaceutical development.

By partnering with other companies and earning royalties on successful products, Innoviva diversifies its revenue streams and spreads the R&D burden. For instance, its collaboration with GSK on respiratory products has generated substantial royalty income, demonstrating the effectiveness of this strategy. In 2023, Innoviva reported royalty revenues of $374.4 million, underscoring the financial benefits of its risk-mitigation approach.

- Diversified Revenue: Royalty income from multiple partnered products reduces reliance on any single R&D program.

- Shared Risk: Strategic investments and partnerships allow for shared development costs and risks.

- Proven Success: The model has consistently delivered financial returns, as evidenced by ongoing royalty streams from established therapies.

- Financial Stability: This structure contributes to a more stable financial outlook compared to traditional biotech R&D models.

Commitment to Addressing Unmet Medical Needs

Innoviva's dedication to tackling critical unmet medical needs is a cornerstone of its value proposition, particularly within its Innoviva Specialty Therapeutics segment. This focus is evident in its work on infectious diseases, a global health priority. For instance, its development partnership for zoliflodacin directly addresses the urgent need for new treatments against gonorrhea, a condition facing increasing antibiotic resistance.

This strategic focus not only serves public health but also bolsters Innoviva's standing. By concentrating on areas like critical care and infectious diseases, the company positions itself as a vital player in addressing significant health challenges.

- Addressing Critical Care Needs: Innoviva targets serious health conditions that require advanced therapeutic solutions.

- Combating Infectious Diseases: The company actively develops treatments for infectious diseases, including those with growing resistance issues.

- Strategic Partnerships: Collaborations, such as the one for zoliflodacin, are key to bringing novel therapies to market for unmet needs.

- Reputational Enhancement: By contributing to public health goals, Innoviva strengthens its image as a responsible and impactful pharmaceutical company.

Innoviva's value proposition is built on generating consistent, predictable revenue through royalty streams from established, high-margin products, primarily in the respiratory sector. This approach minimizes direct R&D risks and operational expenditures, offering a de-risked investment profile. The company strategically invests in and acquires innovative treatments across critical care and infectious diseases, addressing significant unmet medical needs and diversifying its portfolio beyond its core respiratory focus.

Innoviva Specialty Therapeutics (IST) streamlines market access for partners, enabling faster and more effective delivery of innovative treatments to patients. By leveraging IST's established infrastructure, partners avoid the substantial costs and time associated with building their own commercialization networks, particularly in specialized therapeutic areas like critical care and infectious diseases.

Innoviva's business model effectively mitigates R&D risks by focusing on royalty-based income and strategic investments, offering a more stable financial outlook compared to traditional R&D-heavy biotech firms. This strategy, exemplified by substantial royalty income from collaborations like the one with GSK on respiratory products, provides financial insulation from high drug development failure rates. In 2023, Innoviva reported royalty revenues of $374.4 million, highlighting the financial success of its risk-mitigation strategy.

Innoviva actively addresses critical unmet medical needs, particularly in infectious diseases, a key global health priority. Its development partnership for zoliflodacin, for example, targets the urgent need for new treatments against gonorrhea, a condition facing escalating antibiotic resistance. This commitment to public health, alongside its focus on critical care, enhances Innoviva's reputation as a responsible and impactful pharmaceutical company.

| Key Value Proposition Elements | Description | Supporting Data/Examples (2023-2024) |

|---|---|---|

| Royalty-Driven Revenue | Predictable cash flow from established, high-margin products. | 2023 Royalty Revenues: $374.4 million. |

| Strategic Investments & Acquisitions | Access to diverse innovative treatments in critical care and infectious diseases. | Collaboration on zoliflodacin for gonorrhea treatment. |

| Innoviva Specialty Therapeutics (IST) | Streamlined market access for partners, reducing commercialization costs. | Expansion within the critical care sector in 2024. |

| Risk Mitigation | Reduced R&D risk through partnerships and royalty-based income. | Diversified revenue streams from multiple partnered products. |

Customer Relationships

Innoviva's strategic partner management is anchored by deep collaborations with major pharmaceutical companies like GSK. These relationships are characterized by continuous dialogue regarding product performance, royalty reporting, and the exploration of future development avenues. Such high-touch, long-term partnerships are fundamental to Innoviva's sustained revenue streams.

Innoviva builds direct relationships with healthcare providers for its Specialty Therapeutics (IST) products. This involves engaging hospitals, intensivists, and infectious disease specialists through dedicated sales and medical affairs teams.

These teams focus on educating clinicians about product benefits, providing essential product support, and actively understanding evolving clinical needs. For instance, during 2024, Innoviva's medical affairs teams conducted numerous educational symposia and one-on-one meetings, directly impacting the understanding and adoption of their therapies.

Innoviva actively cultivates strong investor relations by providing regular financial reports and hosting quarterly earnings calls. This commitment to transparency, exemplified by their detailed disclosures, helps build trust and confidence among both institutional and individual shareholders in their strategic direction and capital deployment.

During 2024, Innoviva continued to engage shareholders through investor conferences and dedicated presentations, highlighting their progress in key therapeutic areas and their robust financial performance. For instance, their Q3 2024 earnings call detailed a 7% year-over-year revenue increase, underscoring the effectiveness of their shareholder communication strategy in conveying the value of their diversified portfolio.

Collaborative Development with Research Organizations

Innoviva’s customer relationships with research organizations, such as GARDP, are deeply collaborative. These partnerships involve joint steering committees, which provide oversight and strategic direction, ensuring alignment on development goals. Shared data and coordinated efforts are crucial for advancing clinical programs efficiently.

These relationships are fundamentally scientific and operational, built on a foundation of shared objectives. For instance, in 2024, Innoviva continued its collaboration with GARDP on developing new treatments for neglected diseases, a testament to the ongoing commitment to these vital partnerships.

- Joint Steering Committees: Facilitate strategic decision-making and program oversight.

- Data Sharing: Enables transparency and accelerates research progress.

- Coordinated Efforts: Streamlines clinical trial execution and regulatory submissions.

- Shared Development Goals: Ensures mutual commitment to advancing critical medical innovations.

Industry Networking and Business Development

Innoviva actively cultivates relationships within the biopharmaceutical and healthcare investment sectors through dedicated networking and business development efforts. This proactive approach is crucial for identifying promising strategic investment, acquisition, and licensing prospects.

The company's engagement strategy includes regular participation in industry conferences and direct outreach to potential collaborators. This allows Innoviva to stay abreast of market trends and foster valuable connections.

- Industry Conferences: Attending key events like the BIO International Convention provides direct access to a wide range of potential partners and deal flow.

- Partnership Development: Innoviva actively seeks out companies with complementary technologies or market positions for mutually beneficial collaborations.

- Investment Scouting: The company dedicates resources to scouting for innovative biopharmaceutical assets and companies that align with its strategic growth objectives.

Innoviva's customer relationships are multifaceted, encompassing deep collaborations with pharmaceutical giants like GSK, direct engagement with healthcare providers for its specialty therapeutics, and robust investor relations. These interactions are characterized by continuous dialogue, education, and transparency, fostering sustained revenue and trust.

The company also cultivates scientific and operational partnerships with research organizations, such as GARDP, focusing on shared development goals and data exchange. Proactive engagement within the biopharmaceutical and investment sectors further bolsters its strategic growth through identifying collaboration and acquisition opportunities.

| Relationship Type | Key Engagement Method | 2024 Focus/Activity | Impact on Innoviva |

|---|---|---|---|

| Strategic Partners (e.g., GSK) | Continuous dialogue, royalty reporting, future development discussions | Product performance reviews, exploring new therapeutic avenues | Sustained revenue streams, pipeline expansion |

| Healthcare Providers (IST Products) | Dedicated sales & medical affairs teams, clinical education, product support | Educational symposia, one-on-one clinician meetings | Increased understanding and adoption of therapies |

| Investors | Regular financial reports, quarterly earnings calls, investor conferences | Detailed disclosures, presentations on progress and financial performance | Building trust and confidence, demonstrating value |

| Research Organizations (e.g., GARDP) | Joint steering committees, data sharing, coordinated efforts | Collaborative development of treatments for neglected diseases | Advancing clinical programs, scientific innovation |

| Biopharma/Investment Sector | Networking, business development, industry conferences | Identifying strategic investment, acquisition, and licensing prospects | Strategic growth, access to new technologies and markets |

Channels

Innoviva's core revenue stream flows from its strategic licensing and collaboration agreements, particularly with giants like GSK. These long-term partnerships are the engine for developing, marketing, and selling Innoviva's respiratory products worldwide. For instance, the collaboration on the Ellipta inhaler system has been a significant driver of sales.

Innoviva's direct sales force is a cornerstone of its go-to-market strategy for its Specialty Therapeutics segment, IST. This dedicated team focuses on promoting critical care and infectious disease products directly to healthcare providers across the United States.

This approach allows for focused engagement with key decision-makers in hospitals, pharmacies, and other healthcare institutions. For instance, products like XACDURO, GIAPREZA, XERAVA, and ZEVTERA are actively promoted by this specialized sales team.

In 2024, Innoviva continued to invest in its direct sales capabilities, recognizing the importance of building strong relationships and providing in-depth product knowledge to healthcare professionals. This direct engagement is crucial for driving adoption and ensuring appropriate use of their specialized medications within clinical settings.

Innoviva leverages direct acquisitions and strategic equity investments as key channels to grow its asset base and revenue diversity. These moves are designed to integrate new products and capabilities directly into its Specialty Therapeutics platform, enhancing its market position.

In 2024, Innoviva's strategic focus included evaluating and executing acquisitions that align with its core therapeutic areas. For instance, the company has historically made significant investments, such as its stake in Theravance Biopharma, demonstrating a commitment to acquiring or investing in businesses that offer synergistic growth opportunities within its existing structure.

Scientific and Medical Conferences

Innoviva leverages scientific and medical conferences as a crucial channel to share its latest clinical data and build brand recognition within its core therapeutic areas. These events are vital for fostering relationships with key opinion leaders (KOLs) and identifying potential collaborators. For instance, in 2024, Innoviva actively participated in major conferences such as the American Thoracic Society (ATS) International Conference and the European Respiratory Society (ERS) International Congress, presenting data on its respiratory portfolio.

These conferences provide a platform for direct engagement with the medical community, allowing for in-depth discussions about product efficacy and future development. By presenting research findings, Innoviva aims to solidify its position as an innovator in respiratory, critical care, and infectious diseases. The company's 2024 conference strategy included multiple poster presentations and symposia, highlighting advancements in areas like COPD and asthma management.

- Dissemination of Clinical Data: Presenting trial results and real-world evidence to the medical community.

- KOL Engagement: Building relationships with influential physicians and researchers.

- Brand Awareness: Increasing visibility for Innoviva's products and therapeutic focus.

- Partnership Opportunities: Identifying potential collaborations for research and commercialization.

Financial and Investor Communication Platforms

Innoviva actively engages with the investment community by disseminating crucial financial and strategic information. This includes timely updates on performance, outlook, and significant business developments.

- SEC Filings: Innoviva adheres to regulatory requirements by filing essential documents like 8-K for material events and 10-K for annual financial reports with the Securities and Exchange Commission. For instance, their Q1 2024 earnings report, filed in February 2024, provided detailed financial performance metrics.

- Press Releases and Investor Presentations: The company utilizes press releases for immediate announcements and investor presentations to offer deeper insights into their strategy and financial health, often accompanying quarterly earnings calls.

- Financial News Outlets: Innoviva's information is also channeled through reputable financial news sources, ensuring broad reach and accessibility for investors and analysts seeking to understand the company's trajectory.

Innoviva utilizes a multi-faceted approach to reach its target audiences, encompassing direct engagement, strategic partnerships, and broad dissemination of information. This ensures both specialized product promotion and widespread brand awareness.

The company's channels are designed to foster strong relationships with healthcare professionals, key opinion leaders, and the investment community, driving both product adoption and financial transparency.

Innoviva's 2024 strategy emphasized leveraging scientific conferences for data dissemination and KOL engagement, alongside robust investor relations activities through SEC filings and financial news outlets.

The direct sales force remains critical for its Specialty Therapeutics segment, focusing on building deep relationships within US healthcare institutions.

| Channel | Description | Key Activities | 2024 Focus/Examples | Impact |

|---|---|---|---|---|

| Licensing & Collaboration Agreements | Partnerships for product development, marketing, and sales. | Global commercialization of respiratory products (e.g., Ellipta). | Continued reliance on GSK partnership for respiratory portfolio. | Significant revenue generation and market reach. |

| Direct Sales Force (IST) | Promoting critical care and infectious disease products in the US. | Engaging with hospitals, pharmacies, and healthcare providers. | Investment in capabilities for products like XACDURO, GIAPREZA. | Direct market penetration and physician education. |

| Acquisitions & Strategic Investments | Growing asset base and revenue diversity. | Integrating new products and capabilities. | Evaluating synergistic acquisitions and equity investments. | Enhancing market position and therapeutic offerings. |

| Scientific & Medical Conferences | Disseminating clinical data and building brand recognition. | Presenting research, engaging with KOLs, identifying partners. | Participation in ATS, ERS conferences with data presentations. | Fostering medical community relationships and innovation visibility. |

| Investor Relations | Disseminating financial and strategic information. | SEC filings, press releases, investor presentations. | Regular financial reporting, including Q1 2024 earnings in February 2024. | Ensuring transparency and accessibility for the investment community. |

Customer Segments

Large pharmaceutical companies, such as GSK, represent a critical customer segment for Innoviva. These global giants partner with Innoviva to co-develop, commercialize, and distribute respiratory medicines worldwide. This collaboration is a primary driver of Innoviva's royalty income, demonstrating the value these established players place on Innoviva's pipeline and expertise.

Hospitals and healthcare institutions represent a core customer segment for Innoviva, directly purchasing and administering its critical care and infectious disease products. These entities, ranging from large hospital networks to specialized clinics, rely on Innoviva's therapeutics to manage patient health effectively.

In 2024, the healthcare sector continued to see significant demand for specialized pharmaceuticals, with hospital spending on drugs and biologicals remaining a substantial portion of overall healthcare expenditures. Innoviva's focus on critical care and infectious diseases places it in a vital position to meet these ongoing needs.

Patients battling respiratory, critical care, and infectious diseases represent the core of Innoviva's mission. While not direct purchasers, their unmet medical needs are the driving force behind the development and commercialization of life-saving therapies. These patients, often facing severe health challenges, directly benefit from the innovative solutions Innoviva brings to market through its strategic partnerships and internal R&D efforts.

Biotechnology and Early-Stage Pharma Companies

Biotechnology and early-stage pharmaceutical companies are key customer segments for Innoviva, serving as potential acquisition targets or strategic partners. These companies are particularly attractive when they possess promising pipeline assets addressing significant unmet medical needs, aligning with Innoviva's focus on developing and commercializing innovative therapies. Innoviva aims to integrate these assets into its existing strategic partnerships, such as its collaboration with GSK on respiratory products, or to generate future royalty streams.

The value proposition for these companies lies in Innoviva's ability to provide capital, development expertise, and established commercialization channels. For instance, the biopharmaceutical industry saw substantial investment activity in 2024, with venture capital funding reaching billions of dollars, indicating a robust environment for early-stage companies seeking strategic alliances. Innoviva's model allows these smaller entities to overcome developmental hurdles and reach broader patient populations.

- Target Identification: Innoviva actively seeks biotech and early-stage pharma companies with novel drug candidates in areas like respiratory diseases, oncology, and autoimmune disorders.

- Strategic Integration: Successful integration of acquired or partnered assets into Innoviva's existing commercial infrastructure, like its established relationships with major pharmaceutical players, enhances their market potential.

- Financial Support: Providing crucial funding for late-stage clinical trials and regulatory submissions, enabling these companies to advance their products towards market approval.

- Royalty Generation: The ultimate goal is to generate predictable and sustainable royalty revenues from successful product commercialization, benefiting both Innoviva and its partners.

Institutional and Individual Investors

Innoviva's customer segments encompass both institutional and individual investors. This broad base includes sophisticated entities like hedge funds, mutual funds, and asset managers, alongside individual shareholders. These investors are drawn to Innoviva's business model, primarily seeking financial returns derived from its royalty streams and capital appreciation stemming from its diverse therapeutic portfolio.

For instance, as of late 2024, Innoviva's strategic focus on respiratory health, particularly through its collaboration with GlaxoSmithKline on products like Trelegy Ellipta, continues to be a key driver for investor interest. The company's ability to generate consistent royalty income from established products, coupled with its pipeline development, appeals to a wide range of risk appetites and investment horizons.

- Institutional Investors: These include large financial institutions such as asset managers, pension funds, and hedge funds that allocate significant capital to Innoviva, attracted by its stable royalty income and growth potential.

- Individual Investors: Retail investors, from novices to experienced stock pickers, also form a crucial part of this segment, investing directly in Innoviva's stock to benefit from its financial performance and strategic advancements.

- Investment Focus: Both groups are motivated by the prospect of returns generated from Innoviva's established product royalties and the anticipated growth from its ongoing therapeutic development and commercialization efforts.

Innoviva's customer base is multifaceted, extending beyond direct product users to include key partners and financial stakeholders. Large pharmaceutical companies, such as GSK, are vital partners, co-developing and commercializing respiratory medicines, generating significant royalty income for Innoviva. Hospitals and healthcare institutions directly purchase Innoviva's critical care and infectious disease products, relying on them for patient management.

Biotechnology and early-stage pharmaceutical companies are also key segments, either as acquisition targets or strategic collaborators, bringing promising pipeline assets that align with Innoviva's focus. These companies benefit from Innoviva's capital and commercialization expertise, a crucial factor given the robust venture capital funding in the biopharmaceutical sector in 2024, which saw billions invested.

Finally, both institutional and individual investors are critical segments, drawn to Innoviva's royalty-based business model and growth potential. As of late 2024, Innoviva's consistent royalty generation from products like Trelegy Ellipta, alongside its pipeline, continues to attract diverse investment interests.

Cost Structure

Innoviva's cost structure heavily features Research and Development (R&D) expenses, crucial for advancing its product pipeline. These costs are primarily driven by the clinical development of key assets, like zoliflodacin, and supporting its broader therapeutic program investments.

In 2024, Innoviva's commitment to R&D is evident in its ongoing clinical trials and regulatory submissions. These expenditures encompass significant outlays for trial execution, data analysis, and engaging with regulatory bodies to secure approvals for its innovative treatments.

The company also invests in scientific personnel and infrastructure to foster innovation. These operational costs are integral to maintaining a competitive edge and driving the discovery and development of novel pharmaceutical solutions.

Innoviva's Sales, General & Administrative (SG&A) expenses are substantial, reflecting the significant investment in commercializing its specialty therapeutics. These costs encompass a dedicated sales force, targeted marketing campaigns, and crucial medical affairs activities to educate healthcare professionals.

In 2024, Innoviva reported SG&A expenses of $269.6 million. This figure highlights the ongoing commitment to market penetration and brand building for key products.

Beyond direct commercial efforts, SG&A also includes essential corporate functions like legal, finance, and general administration, ensuring the smooth operation of the entire organization.

Innoviva incurs substantial costs related to identifying, acquiring, and integrating new companies and product assets into its portfolio. These expenses are crucial for expanding its therapeutic offerings. For example, the acquisitions of Entasis Therapeutics and La Jolla Pharmaceutical Company represented significant investments in this area.

Intellectual Property and Legal Costs

Innoviva's cost structure includes significant investment in intellectual property and legal expenses. These are crucial for safeguarding its valuable patent portfolio and licensing agreements, which form the bedrock of its royalty and product revenue streams. For instance, in 2023, the company reported approximately $40 million in research and development expenses, a portion of which directly supports the maintenance and defense of its IP.

These expenditures are not merely operational; they are strategic investments. Protecting its intellectual property ensures Innoviva can continue to monetize its innovations and maintain its competitive edge in the market. Without robust legal and IP management, the company's core assets would be vulnerable to infringement, directly impacting its financial performance.

- Patent Maintenance Fees: Ongoing costs to keep patents active globally.

- Licensing Agreement Defense: Legal expenses associated with enforcing and defending licensing terms.

- Litigation and Dispute Resolution: Costs incurred from potential patent infringement lawsuits or other legal challenges.

- IP Portfolio Management: Administrative costs for tracking, renewing, and managing a vast array of intellectual property assets.

Manufacturing and Supply Chain Costs

Innoviva's manufacturing and supply chain costs are significant, encompassing outsourced production through Contract Development and Manufacturing Organizations (CDMOs). These expenses also include rigorous quality control measures, efficient inventory management to meet market demand, and the logistics of distributing their specialty therapeutics. For instance, in 2024, the pharmaceutical industry saw CDMO revenues projected to reach over $200 billion globally, highlighting the substantial investment in outsourced manufacturing.

- Manufacturing Expenses: Primarily driven by outsourcing to CDMOs for specialized production processes.

- Quality Control: Essential for ensuring product safety and efficacy, adding to overall costs.

- Inventory Management: Balancing stock levels to avoid shortages while minimizing holding costs.

- Distribution Logistics: Costs associated with warehousing, transportation, and ensuring timely delivery to market.

Innoviva's cost structure is dominated by significant investments in research and development, essential for its pipeline of innovative therapies. These R&D expenditures are directly tied to advancing clinical trials and securing regulatory approvals for its key assets.

Sales, General, and Administrative (SG&A) expenses are also substantial, reflecting the company's focus on commercializing its specialty therapeutics through dedicated sales forces and targeted marketing. In 2024, SG&A costs reached $269.6 million, underscoring the commitment to market penetration.

The company incurs considerable costs related to intellectual property protection, including patent maintenance and legal defense, which are vital for securing its revenue streams. Manufacturing and supply chain costs, often involving outsourced CDMOs, are also a significant component, ensuring product quality and efficient distribution.

| Cost Category | 2024 Data (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development (R&D) | Not explicitly stated for 2024, but historically significant | Clinical trials, regulatory submissions, scientific personnel |

| Sales, General & Administrative (SG&A) | $269.6 | Sales force, marketing, medical affairs, corporate functions |

| Intellectual Property & Legal | Part of R&D (e.g., $40M in 2023 for R&D, including IP) | Patent maintenance, licensing defense, litigation |

| Manufacturing & Supply Chain | Not explicitly stated for 2024, but substantial | CDMO outsourcing, quality control, logistics |

Revenue Streams

Innoviva's most substantial and long-standing revenue source is royalties from Glaxo Group Limited (GSK) on global net sales of key respiratory products. These include popular therapies such as RELVAR/BREO ELLIPTA and ANORO ELLIPTA, which have been significant contributors to the company's financial performance. For the full year 2023, Innoviva reported total royalty revenues of $337.6 million, with a significant portion attributed to these partnered products.

Innoviva's primary revenue stream, Net Product Sales, is driven by its subsidiary Innoviva Specialty Therapeutics (IST). This segment focuses on the direct sales of key therapeutic products.

The company's portfolio includes critical care and infectious disease drugs such as XACDURO and GIAPREZA. In 2023, Innoviva reported net sales of $130.1 million, a significant increase from $92.8 million in 2022, demonstrating robust growth in this revenue channel.

Further strengthening this stream, Innoviva has expanded its offerings with the recent launch of ZEVTERA, alongside existing products like XERAVA. This strategic expansion aims to capture a larger market share and bolster future revenue generation.

Innoviva also generates revenue through milestone payments outlined in its collaboration and licensing deals. These payments are usually tied to specific progress points, like reaching certain development stages, gaining regulatory approval, or achieving commercial targets for products or assets they've partnered on or acquired.

Licensing Fees

Innoviva may also generate revenue through licensing fees, which can be distinct from royalties or milestone payments. These fees are typically received when Innoviva grants rights to its intellectual property or early-stage development candidates to other pharmaceutical companies for further development and commercialization.

While royalties and milestone payments are a significant part of Innoviva's revenue model, upfront or periodic licensing fees can provide immediate capital. For example, in 2023, Innoviva reported total revenues of $392.2 million, with a substantial portion attributed to royalty and other income. Licensing fees, though not always separately itemized in every report, contribute to this overall revenue stream by facilitating partnerships.

- Upfront Payments: Initial fees paid by a partner for the rights to license Innoviva's technology or drug candidates.

- Periodic Fees: Recurring payments made over a defined period as part of a licensing agreement.

- Strategic Partnerships: Licensing fees often signify the value of Innoviva's pipeline and its ability to attract strategic partners in the pharmaceutical industry.

Investment Gains

Innoviva's strategy as a holding company involves making strategic investments in other healthcare assets and companies. These investments are designed to generate financial returns through capital appreciation and dividends, contributing to the company's overall revenue streams.

These investment gains are a key component of Innoviva's diversified approach, allowing it to benefit from the growth and success of its portfolio companies. For instance, in 2023, Innoviva reported a significant increase in its financial results, partly driven by the performance of its strategic investments.

- Strategic Investments: Innoviva actively seeks opportunities to invest in promising healthcare companies and assets.

- Capital Appreciation: Gains realized from the sale of these investments contribute to revenue.

- Dividend Income: Ongoing income from equity stakes in portfolio companies adds to financial performance.

Innoviva's revenue is primarily generated through royalties from its collaboration with Glaxo Group Limited (GSK) on respiratory products like RELVAR/BREO ELLIPTA and ANORO ELLIPTA. Additionally, Innoviva Specialty Therapeutics (IST) contributes through direct net product sales of critical care and infectious disease drugs such as XACDURO and GIAPREZA, with sales growing to $130.1 million in 2023. The company also diversifies its income via milestone payments and licensing fees from strategic partnerships, alongside returns from its strategic investments in other healthcare assets.

| Revenue Stream | Description | 2023 Financials (Approximate) |

| Royalties (GSK) | Net sales of partnered respiratory products | $337.6 million (Total Royalty Revenue) |

| Net Product Sales (IST) | Direct sales of critical care and infectious disease drugs | $130.1 million |

| Milestone Payments & Licensing Fees | Fees from development progress and IP licensing | Contributes to overall revenue (e.g., $392.2 million total revenue in 2023) |

| Strategic Investments | Returns from investments in healthcare companies | Drives capital appreciation and dividend income |

Business Model Canvas Data Sources

The Innoviva Business Model Canvas is informed by a blend of proprietary market research, internal financial data, and competitive intelligence. These sources ensure a robust and actionable framework for strategic planning.