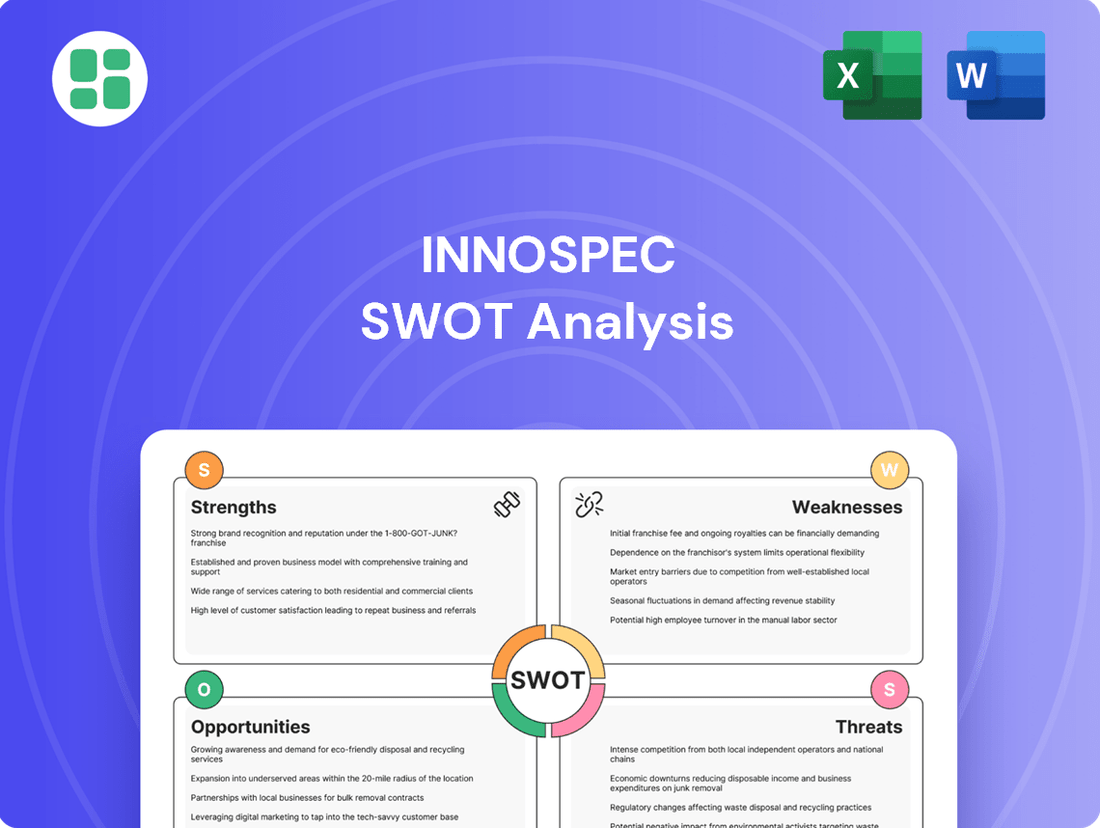

Innospec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

Innospec's strengths lie in its specialized chemical formulations and strong customer relationships, but its reliance on specific end markets presents a key vulnerability. Understanding these dynamics is crucial for anyone looking to invest or strategize within the specialty chemicals sector.

Want the full story behind Innospec's competitive advantages, potential threats, and untapped opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Innospec Inc. boasts a robust and specialized product range, covering fuel additives, oilfield chemicals, and personal care ingredients. This diverse offering creates stability by spreading risk across multiple industrial and consumer sectors.

The company's dedication to innovation is evident in its significant R&D investments, with US$47.8 million allocated in 2024. This focus resulted in a 22% surge in patent applications and the creation of advanced chemical solutions designed for superior performance and efficiency.

This ongoing commitment to developing cutting-edge chemistries allows Innospec to effectively address and anticipate the growing customer demand for highly specialized and tailored products.

Innospec's dedication to sustainability is a significant strength, as highlighted in its 2024 Sustainability Report released in July 2025. The company has made substantial progress, achieving a 23% reduction in Scope 1 & 2 greenhouse gas emissions compared to a 2014 baseline.

Furthermore, Innospec's fuel additives played a crucial role in its customers' environmental efforts, enabling the avoidance of 20.8 million metric tons of CO2e emissions in 2024. This achievement surpasses the company's own operational emission reductions, demonstrating a powerful multiplier effect.

The company's proactive approach to sustainability is further underscored by its completion of product carbon footprint assessments for over 90 products. This commitment resonates with growing global demand for environmentally responsible solutions, bolstering Innospec's corporate image and market appeal.

Innospec demonstrates robust financial health, boasting a debt-free balance sheet and a substantial net cash position exceeding $266 million as of June 30, 2025. This strong liquidity equips the company with considerable flexibility to pursue strategic opportunities, including mergers, acquisitions, and organic growth investments. Furthermore, this financial strength supports consistent shareholder returns through dividends and share repurchases, underpinned by consistent operating cash flow generation.

Global Reach and Customer-Centric Approach

Innospec's global footprint is a significant strength, with manufacturing sites and technical expertise spread across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. This extensive reach allows them to effectively serve a wide array of diverse markets. For instance, in 2023, the company reported that its Performance Chemicals segment, which benefits greatly from this global network, saw a substantial contribution to its overall revenue.

The company's customer-centric approach is equally vital. By focusing on custom formulations and providing highly responsive customer support, Innospec delivers solutions precisely tailored to client needs. This strategy is key to enhancing performance, efficiency, and sustainability for their customers. This dedication to client needs was evident in the positive feedback received across multiple regions in their 2024 customer satisfaction surveys.

- Global Manufacturing Presence: Operates in Americas, Europe, Middle East, Africa, and Asia-Pacific.

- Customer-Centric Model: Emphasizes custom formulations and responsive support.

- Tailored Solutions: Focuses on enhancing client performance, efficiency, and sustainability.

- Market Adaptability: Global presence aids in meeting diverse regional demands and building relationships.

Resilient Fuel Specialties Segment Performance

Innospec's Fuel Specialties segment stands out for its robust financial performance, a key strength for the company. This segment saw its operating income climb by a significant 16% in the second quarter of 2025.

Looking back at 2024, the segment delivered impressive growth across the board, with increases in sales, profits, operating income, and margins. This consistent financial strength is driven by strategic advantages like a more favorable sales mix and effective pricing strategies, making it a reliable source of high-margin cash flow that helps stabilize the company's overall financial health, even when other business areas face market fluctuations.

- Resilient Fuel Specialties Segment Performance: The Fuel Specialties segment consistently demonstrates strong financial performance, with operating income increasing by 16% in Q2 2025.

- 2024 Growth Metrics: The segment reported increases in full-year sales, profits, operating income, and margins for 2024.

- Profitability Drivers: This segment benefits from a stronger sales mix and disciplined pricing, proving to be a stable and high-margin cash generator.

- Stabilizing Influence: The resilience of the Fuel Specialties segment is vital for overall company stability amidst varying market conditions.

Innospec's diversified product portfolio, encompassing fuel additives, oilfield chemicals, and personal care ingredients, provides significant stability by mitigating risk across various industries. The company's commitment to research and development, with US$47.8 million invested in 2024, fuels innovation, leading to a 22% increase in patent applications and the creation of advanced chemical solutions. This focus on cutting-edge chemistries allows Innospec to meet evolving customer demands for specialized products.

Sustainability is a core strength, evidenced by a 23% reduction in Scope 1 & 2 greenhouse gas emissions (2014 baseline) by July 2025. Innospec's fuel additives enabled customers to avoid 20.8 million metric tons of CO2e emissions in 2024, a substantial environmental impact. With over 90 products undergoing carbon footprint assessments, the company aligns with global demand for eco-friendly solutions.

Financially, Innospec is exceptionally strong, maintaining a debt-free balance sheet and over $266 million in net cash as of June 30, 2025. This liquidity supports strategic growth and shareholder returns, bolstered by consistent operating cash flow. The Fuel Specialties segment, in particular, showed resilience with a 16% operating income increase in Q2 2025, driven by a favorable sales mix and effective pricing.

Innospec's global manufacturing and technical presence across continents ensures effective service to diverse markets, enhancing its Performance Chemicals segment. Coupled with a customer-centric approach focused on custom formulations and responsive support, Innospec delivers tailored solutions that boost client performance, efficiency, and sustainability, as confirmed by positive 2024 customer satisfaction surveys.

| Strength Area | Key Metric/Fact | Impact |

| Product Diversification | Fuel Additives, Oilfield Chemicals, Personal Care Ingredients | Risk mitigation, market stability |

| Innovation & R&D | US$47.8M invested in 2024; 22% surge in patent applications | Development of advanced, high-performance solutions |

| Sustainability Leadership | 23% GHG emission reduction (2014 baseline); 20.8M MT CO2e avoided by customers in 2024 | Enhanced corporate image, market appeal, regulatory compliance |

| Financial Strength | Debt-free balance sheet; >$266M net cash (June 30, 2025) | Strategic flexibility, shareholder returns, operational stability |

| Global Reach | Operations in Americas, Europe, MEA, Asia-Pacific | Access to diverse markets, localized customer support |

| Customer Focus | Custom formulations, responsive support, positive 2024 survey feedback | Increased client loyalty, enhanced customer performance |

| Fuel Specialties Performance | 16% operating income growth (Q2 2025); strong 2024 growth metrics | Consistent high-margin cash flow, overall financial stability |

What is included in the product

Delivers a strategic overview of Innospec’s internal and external business factors, highlighting its strengths and weaknesses alongside market opportunities and threats.

Identifies key market opportunities and competitive threats for proactive strategy adjustments.

Weaknesses

Innospec's financial performance shows some unevenness. For instance, the company saw a 12% drop in total revenues during the first quarter of 2025 compared to the previous year. While the second quarter of 2025 brought a slight 1% uptick, this mixed performance highlights segment-specific challenges.

The Fuel Specialties division demonstrated resilience, but other areas struggled. Performance Chemicals faced headwinds, and the Oilfield Services segment experienced notable declines. This kind of volatility, especially concentrated in particular business units, can make it harder to reliably predict the company's overall financial trajectory and future growth prospects.

Innospec's profitability, particularly in its Performance Chemicals segment, faces headwinds from volatile raw material and energy prices. This exposure directly impacts gross margins, as evidenced by the Q2 2025 results for Performance Chemicals, which saw a contraction due to these elevated input costs. Effectively navigating these fluctuating costs remains a significant operational challenge that can dampen overall financial performance.

The Oilfield Services segment grapples with significant challenges, notably a slowdown in production chemical demand in Latin America. This downturn stems from political instability and operational hurdles within the region, impacting Innospec's performance. For instance, in the first half of 2024, this segment experienced a decline in revenue, contributing to lower overall operating income.

This regional dependency creates a vulnerability, as adverse conditions in Latin America can disproportionately affect the segment's financial results. Consequently, Innospec has been compelled to implement cost-saving measures and realign its operational strategies to mitigate these impacts and improve segment margins.

Impact of One-Time Financial Charges

Innospec's financial performance can be vulnerable to one-time charges, as demonstrated by the significant impact of a non-cash settlement charge. For the full year 2024, the company recorded a $155.6 million charge related to its UK pension scheme buyout. This event contributed to a net loss in the fourth quarter of 2024.

While this was a singular event, such substantial charges can skew financial reporting and temporarily depress profitability. This can influence how investors perceive the company's ongoing operational strength and create volatility in its stock performance. It underscores the importance of scrutinizing the nature of reported earnings, distinguishing between recurring operational results and one-off financial adjustments.

- Significant Pension Charge: Innospec incurred a $155.6 million non-cash settlement charge in 2024 for its UK pension scheme buyout.

- Q4 2024 Net Loss: This charge directly led to a net loss for the company in the fourth quarter of 2024.

- Impact on Investor Perception: Large, one-time charges can distort profitability and negatively affect how investors view the company's underlying financial health.

- Legacy Obligations: The event highlights the potential for historical financial commitments to affect current financial results.

Regulatory and Environmental Compliance Burden

Innospec faces significant challenges due to the extensive regulatory and environmental compliance demands inherent in the specialty chemicals sector. These requirements necessitate substantial ongoing investment in operational adjustments and management oversight. For instance, the company recorded a $2.3 million provision for legacy environmental matters in the second quarter of 2025, highlighting the financial impact of these obligations.

Furthermore, Innospec must continually allocate resources towards plant closure provisions and adapt to evolving environmental directives, such as the EU Corporate Sustainability Reporting Directive (EU CSRD). This persistent need to adhere to a complex and changing regulatory framework represents a recurring operational and financial burden.

Innospec's reliance on specific geographic markets, particularly Latin America for its Oilfield Services segment, creates a notable vulnerability. The political instability and operational challenges in this region directly impacted segment revenue in the first half of 2024, contributing to lower overall operating income. This regional dependency means adverse conditions can disproportionately affect the company's financial results.

The company's profitability is susceptible to fluctuations in raw material and energy prices, which directly impact gross margins. This was evident in the Q2 2025 Performance Chemicals segment results, where elevated input costs led to margin contraction. Effectively managing these volatile input costs remains a critical operational challenge for Innospec.

Innospec experienced a significant $155.6 million non-cash settlement charge in 2024 related to its UK pension scheme buyout, which resulted in a net loss for Q4 2024. Such substantial, one-time charges can skew financial reporting and temporarily depress profitability, potentially influencing investor perception of the company's underlying operational strength.

The specialty chemicals sector's extensive regulatory and environmental compliance demands necessitate substantial ongoing investment. In Q2 2025, Innospec recorded a $2.3 million provision for legacy environmental matters, underscoring the financial impact of these evolving obligations and the need to adapt to directives like the EU CSRD.

| Weakness | Impact | Example Data |

| Geographic Concentration (Oilfield Services) | Revenue vulnerability due to regional instability | First half 2024 revenue decline in Oilfield Services due to Latin America |

| Input Cost Volatility | Margin compression in Performance Chemicals | Q2 2025 margin contraction due to elevated raw material/energy prices |

| One-Time Charges | Temporary profitability reduction and investor perception impact | $155.6 million pension charge in 2024 leading to Q4 net loss |

| Regulatory & Environmental Compliance | Ongoing investment and financial burden | $2.3 million provision for legacy environmental matters in Q2 2025 |

Preview Before You Purchase

Innospec SWOT Analysis

The preview you see is the same document the customer will receive after purchasing—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Innospec SWOT analysis.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global push for sustainability is a major tailwind for Innospec. As industries worldwide prioritize environmental responsibility, there's a surging demand for green chemistry solutions. Innospec's established expertise in developing products that cut emissions, boost fuel efficiency, and offer biodegradable alternatives places it in a strong position to capitalize on this trend.

For instance, the market for sustainable fuels and additives is projected to see significant growth. Reports from 2024 indicate that the global green chemistry market is expanding rapidly, with a compound annual growth rate expected to be around 9-10% through 2030. This growth is driven by stricter environmental regulations and increasing consumer preference for eco-friendly products.

Innospec's commitment to innovation in this space, particularly in areas like fuel additives that improve combustion and reduce particulate matter, directly aligns with these market demands. This allows the company to not only expand its existing product portfolio but also to pioneer new solutions that cater to a cleaner future, potentially capturing a larger share of industries actively seeking to lower their carbon footprint.

Innospec has a significant opportunity to grow its global footprint by entering and expanding within emerging markets. Strategic acquisitions, like the purchase of QGP Química Geral in Brazil, are already proving effective in boosting its Performance Chemicals and Fuel Specialties segments. This move into a key South American market demonstrates a clear intent to capture growth in developing economies.

Furthermore, Innospec is actively pursuing expansion in Canada and aiming to sustain its strong performance in the Middle East for its Oilfield Services division. These targeted geographic expansions are crucial for diversifying revenue sources and mitigating risks associated with over-reliance on more saturated, mature markets, potentially leading to more robust and stable financial performance in the coming years.

Innospec's robust financial position, evidenced by its strong balance sheet and substantial net cash reserves, creates a significant opportunity for strategic acquisitions. These moves could bolster its technological capabilities, expand its global footprint, or diversify its product offerings, thereby enhancing its overall market competitiveness.

Furthermore, Innospec can leverage its financial strength to forge key partnerships. Collaborations, like those already established with organizations such as the International Justice Mission (IJM) and UNESCO, can open new avenues for market penetration and operational diversification. These alliances not only broaden its reach but also solidify its competitive standing, potentially accelerating growth and fostering innovation.

Development and Commercialization of New Technologies and Applications

Innospec's continuous investment in research and development fuels innovation, leading to the introduction of new products and the expansion of applications for existing ones. This commitment is crucial for staying ahead in competitive markets.

Specifically, the company is focused on developing novel mild surfactants and advanced formulations for both personal care and industrial sectors. Simultaneously, Innospec is pushing forward with its Fuel Specialties technologies, aiming to enhance fuel economy and significantly reduce pollution. These strategic R&D efforts are designed to unlock new market segments and solidify Innospec's reputation as a leader in cutting-edge solutions.

- New Product Development: Focus on mild surfactants and advanced formulations for personal care and industrial applications.

- Fuel Technology Advancement: Innovation in Fuel Specialties to improve fuel efficiency and environmental impact.

- Market Expansion: Leveraging technological breakthroughs to enter new market segments.

- Competitive Edge: Reinforcing market position through the provision of advanced and differentiated solutions.

Anticipated Recovery and Growth in Oilfield Services

Innospec anticipates a sequential recovery in its Oilfield Services segment throughout 2025, signaling a positive shift after recent industry headwinds. This anticipated improvement is underpinned by several key drivers expected to boost performance.

The company expects growth to be fueled by increased U.S. completions and production activities, a strong performance in its Drag Reducing Agents (DRA) business, and sustained momentum in the Middle Eastern markets. These specific areas represent significant opportunities for Innospec to regain market share and enhance profitability.

- U.S. Completions and Production: Expected to see an uptick in 2025, driving demand for Innospec's services.

- Drag Reducing Agents (DRA): The DRA business is poised for continued strong performance, contributing to segment growth.

- Middle East Momentum: Innospec anticipates continued positive trends and opportunities within the Middle Eastern oilfield services sector.

By strategically capitalizing on these growth avenues and diligently implementing cost control measures, Innospec is positioned to restore profitability within its Oilfield Services segment, thereby contributing positively to the company's overall financial health and performance in 2025.

Innospec has a clear opportunity to expand its product offerings by focusing on sustainable solutions and advanced chemical technologies. The growing demand for green chemistry, driven by global environmental initiatives, presents a significant avenue for growth. The company's ongoing investment in research and development, particularly in areas like mild surfactants and fuel efficiency additives, is expected to yield new products and unlock access to novel market segments, reinforcing its competitive position.

The company's financial strength provides a solid foundation for strategic growth. Substantial net cash reserves enable Innospec to pursue value-enhancing acquisitions and forge strategic partnerships. These financial capabilities can be leveraged to acquire new technologies, broaden its international presence, and diversify its product portfolio, ultimately strengthening its market competitiveness and driving long-term value creation.

The anticipated recovery in the Oilfield Services segment during 2025 offers a significant rebound opportunity. Growth is expected to be driven by increased activity in U.S. completions and production, alongside the robust performance of its Drag Reducing Agents (DRA) business and sustained momentum in the Middle East. These factors are poised to enhance profitability and market share for this division.

| Opportunity Area | Key Drivers | Expected Impact |

|---|---|---|

| Sustainable Solutions & Green Chemistry | Global environmental initiatives, increasing demand for eco-friendly products | Market share expansion, new product development |

| Strategic Acquisitions & Partnerships | Strong balance sheet, substantial net cash reserves | Technological enhancement, global footprint expansion, product diversification |

| Oilfield Services Recovery (2025) | Increased U.S. completions/production, strong DRA performance, Middle East growth | Profitability restoration, market share gains |

Threats

Innospec faces significant risks from market volatility and economic downturns, directly impacting industrial activity and customer spending. For instance, in Q1 2025, tariff announcements led to a noticeable moderation in the Performance Chemicals segment, underscoring the company's sensitivity to macroeconomic shifts.

Fluctuations in global economic conditions can severely affect demand for Innospec's specialty chemicals across diverse end-markets, consequently influencing sales volumes and pricing power. This susceptibility means that broader economic slowdowns or geopolitical uncertainties can translate into direct revenue challenges.

Innospec's profitability is inherently tied to the unpredictable nature of raw material and energy prices. For instance, the company noted in its Q2 2025 earnings call that rising input costs directly impacted the gross margins within its Performance Chemicals segment, demonstrating a clear sensitivity to these market fluctuations.

When these essential inputs become more expensive, it puts pressure on Innospec's ability to maintain its profit margins. Successfully navigating this threat hinges on the company's capacity to either pass these increased costs onto customers through price adjustments or find ways to become more efficient in its operations and procurement processes.

Innospec faces a significant challenge from intense competition across its specialty chemicals segments. The market is populated by a multitude of global and regional competitors, creating constant pressure on pricing, the need for ongoing product innovation, and the imperative to deliver superior customer service. For instance, the fuel additives market, a key area for Innospec, sees competition from major players like Lubrizol and Afton Chemical, who also invest heavily in R&D to capture market share.

Stringent and Evolving Environmental Regulations

The specialty chemicals sector faces a growing challenge from increasingly strict environmental regulations globally. These evolving standards, covering areas like emissions, waste handling, and product safety, can lead to substantial operational expenses and potential legal risks for companies like Innospec. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which became mandatory for many large companies in 2024, requires extensive environmental and social disclosures, adding to compliance burdens and reporting costs.

Failure to keep pace with these changes, such as new restrictions on PFAS chemicals or stricter air quality standards, can result in significant financial penalties, disruptions to manufacturing processes, or damage to a company's public image. The chemical industry, in general, saw increased regulatory scrutiny in 2024, with a particular focus on sustainability and circular economy principles, impacting raw material sourcing and product lifecycle management.

- Increased compliance costs: Adapting to new environmental standards often requires investment in new technologies and processes, directly impacting operational budgets.

- Potential for fines and liabilities: Non-compliance with regulations like the CSRD or specific chemical bans can lead to substantial financial penalties and legal challenges.

- Risk of operational disruption: Changes in regulations regarding emissions or waste disposal could necessitate temporary or permanent alterations to manufacturing operations.

- Reputational damage: Environmental missteps can severely harm a company's brand image, affecting customer loyalty and investor confidence.

Geopolitical Risks and Regional Instability

Geopolitical issues and regional instability, particularly in areas like Latin America, have negatively impacted Innospec's Oilfield Services segment. For instance, the company noted in its 2023 annual report that disruptions in certain regions contributed to reduced activity and delayed recovery in its Oilfield Services business.

These external factors, often beyond the company's direct control, introduce significant uncertainty. This uncertainty can affect operations, disrupt supply chains, and introduce volatility into financial performance in the affected regions. The potential for sudden shifts in political landscapes or regional conflicts poses a consistent threat to predictable revenue streams and operational stability.

- Reduced Demand: Geopolitical tensions can lead to decreased oil and gas exploration and production activity, directly impacting demand for Innospec's services.

- Supply Chain Disruptions: Instability in key regions can hinder the reliable sourcing of raw materials and the timely delivery of finished products, affecting production schedules and costs.

- Operational Interruptions: Regional conflicts or political unrest can force temporary shutdowns or limit access to operational sites, leading to lost revenue and increased security costs.

Innospec faces significant threats from intense competition, particularly in its fuel additives and performance chemicals segments. Competitors like Lubrizol and Afton Chemical actively invest in R&D, creating pricing pressure and the need for continuous innovation. The company also contends with increasingly stringent environmental regulations globally, exemplified by the EU's CSRD, which mandates extensive sustainability reporting and can lead to higher compliance costs and potential fines for non-adherence. Furthermore, geopolitical instability, especially in regions impacting its Oilfield Services, can disrupt operations, supply chains, and reduce demand, as seen with moderated activity in Latin America during 2024.

SWOT Analysis Data Sources

This Innospec SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.