Innospec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

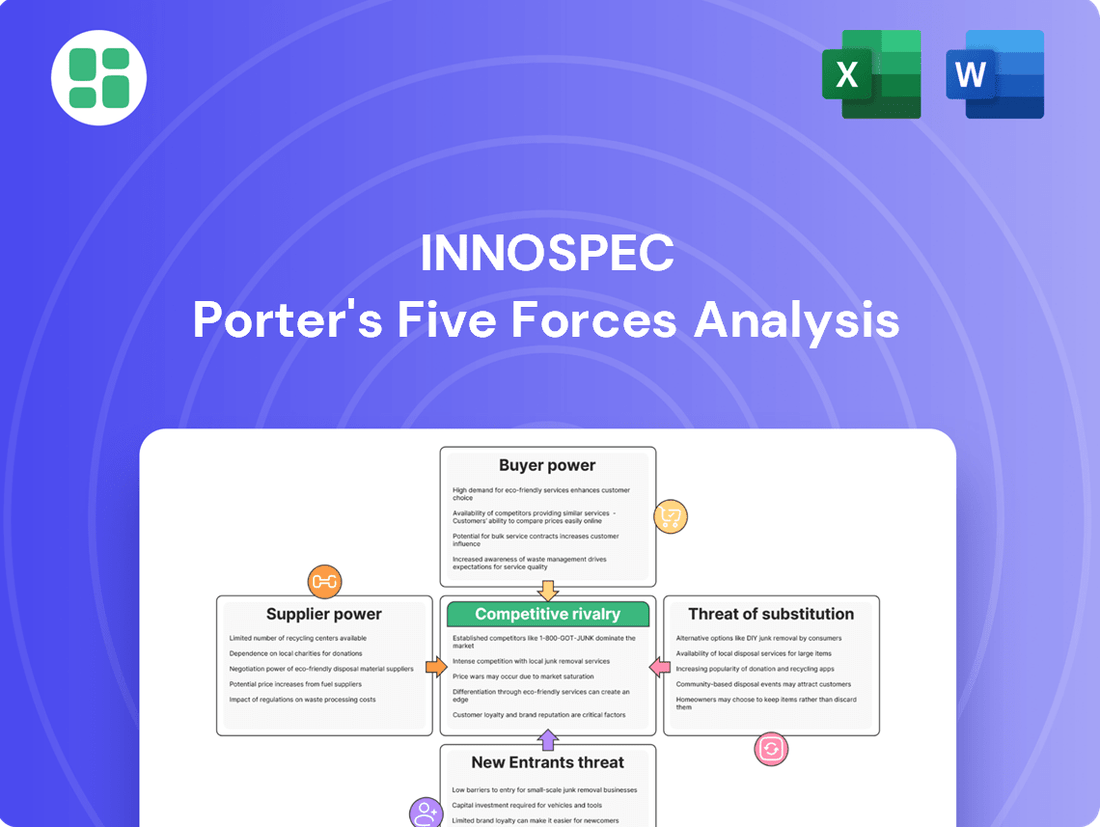

Innospec navigates a complex landscape shaped by intense rivalry and the constant threat of substitutes. Understanding the power of buyers and suppliers is crucial for their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Innospec’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of Innospec's suppliers is closely tied to how concentrated and specialized the providers of its raw materials are. If Innospec relies on a few suppliers for critical, unique chemical intermediates, those suppliers can command higher prices and dictate terms more easily. For instance, a supplier of a proprietary catalyst essential for Innospec's fuel additives could wield significant influence.

Innospec's expansive global footprint and its broad product portfolio, spanning fuel additives, personal care ingredients, and oilfield chemicals, likely mean it sources a vast array of raw materials. This diversity in sourcing typically dilutes the power of any single supplier, as Innospec can often switch to alternatives if one supplier becomes too demanding. In 2023, Innospec reported its cost of sales was approximately $1.3 billion, indicating a substantial volume of raw material procurement across its operations.

The specialty chemicals sector, where Innospec operates, is significantly impacted by fluctuations in raw material prices. This volatility can give suppliers more leverage, especially when they control essential components whose costs are escalating due to broader economic trends or disruptions in how goods are transported and delivered. For instance, the price of key petrochemical feedstocks, crucial for many specialty chemicals, experienced notable increases throughout 2023 and into early 2024, driven by geopolitical tensions and ongoing supply chain adjustments.

Innospec faces varying supplier power depending on the nature of its chemical inputs. For highly specialized or custom-formulated chemicals, switching costs can be substantial. This is because Innospec would likely need to undergo rigorous qualification processes for new suppliers, potentially involving significant time and investment. For instance, if a key additive is custom-synthesized, finding a new supplier with the exact same capabilities and product specifications could be challenging, thereby increasing the bargaining leverage of the current supplier.

Threat of Forward Integration by Suppliers

While the chemical industry generally sees less forward integration by suppliers compared to other sectors, a significant, highly specialized raw material provider could theoretically enter Innospec's market. For instance, a major petrochemical producer with extensive R&D capabilities might consider developing its own performance chemicals.

However, Innospec's strength lies in its intricate custom chemical formulations and a robust global distribution infrastructure, which would be challenging for a raw material supplier to replicate. The substantial investment in specialized manufacturing processes and intellectual property further erects significant barriers.

The threat of forward integration by suppliers is mitigated by the deep technical expertise and proprietary knowledge Innospec possesses. In 2024, the specialty chemicals market, where Innospec operates, is characterized by high entry barriers due to regulatory compliance and the need for specialized application knowledge, making it less attractive for upstream players to vertically integrate.

- Complexity of Custom Formulations: Innospec's ability to tailor chemical solutions for specific client needs is a significant deterrent.

- Global Distribution Network: Replicating Innospec's established worldwide logistics and customer relationships is a major hurdle for potential integrators.

- Technical Expertise Barrier: The specialized knowledge and R&D required to compete in Innospec's niche segments are substantial.

- High R&D Investment: The continuous need for innovation and product development demands significant ongoing capital expenditure.

Importance of Supplier Relationships

Innospec's commitment to delivering innovative, custom-formulated solutions hinges on robust supplier partnerships. These relationships are crucial for securing the specialized raw materials and components needed for their unique product offerings, ensuring consistent quality and availability. For instance, in 2024, Innospec continued to emphasize collaborative development with key chemical suppliers to maintain its edge in performance chemicals.

Maintaining strong supplier relations allows Innospec to potentially negotiate favorable terms, mitigating the impact of price volatility for critical inputs. This proactive approach helps protect profit margins and ensures a stable supply chain, which is particularly important in the specialty chemicals sector where lead times and availability can fluctuate. Good relationships can also lead to early access to new materials or technologies.

- Securing Specialized Inputs: Innospec's strategy relies on suppliers providing unique or high-purity chemicals essential for its custom formulations.

- Mitigating Price Increases: Collaborative agreements with suppliers can help stabilize the cost of raw materials, a significant factor in Innospec's cost structure.

- Facilitating Innovation: Strong supplier ties enable joint development efforts, accelerating the creation of new and improved products for Innospec's diverse markets.

- Ensuring Supply Chain Stability: Reliable supplier relationships are fundamental to Innospec's ability to meet customer demand consistently, especially for niche applications.

The bargaining power of Innospec's suppliers is generally moderate, influenced by the specialized nature of many of its chemical inputs. While Innospec's broad product range and global reach allow it to diversify sourcing, the reliance on a few key providers for proprietary or highly technical components can grant those suppliers leverage. For instance, a supplier of a unique surfactant for personal care products might hold significant sway.

In 2023, Innospec's cost of sales was approximately $1.3 billion, highlighting the substantial volume of raw materials it procures. The specialty chemicals market, where Innospec operates, often experiences price volatility in feedstocks, which can enhance supplier power, especially when disruptions occur. The cost of key petrochemical derivatives, vital for many of Innospec's formulations, saw upward pressure throughout 2023 due to ongoing supply chain adjustments and global economic factors.

Switching costs for specialized chemical inputs can be high for Innospec, requiring extensive qualification and testing. This often strengthens the position of incumbent suppliers who can meet stringent performance and regulatory requirements. However, Innospec's own technical expertise and robust R&D capabilities, coupled with its established distribution network, serve to counterbalance this supplier power by creating significant barriers to supplier forward integration.

| Factor | Impact on Innospec | Rationale |

| Supplier Concentration | Moderate to High | Reliance on specialized inputs from fewer providers can increase their leverage. |

| Switching Costs | High | Rigorous qualification processes for specialty chemicals increase the difficulty and expense of changing suppliers. |

| Availability of Substitutes | Moderate | While some raw materials are commoditized, unique formulations limit readily available alternatives. |

| Supplier Forward Integration Threat | Low | Innospec's proprietary formulations and market access are difficult for raw material suppliers to replicate. |

What is included in the product

This Innospec Porter's Five Forces analysis examines the intensity of competition, buyer and supplier power, threat of new entrants and substitutes, all tailored to Innospec's specific operating environment.

Visually map competitive intensity across all five forces, allowing for rapid identification of critical strategic vulnerabilities.

Quickly assess the impact of supplier power changes on Innospec's profitability with intuitive, data-driven visualizations.

Customers Bargaining Power

Innospec's customer base is spread across various industries like personal care, home care, agrochemicals, mining, industrial, transportation, and oilfield services. This diversity means bargaining power can vary significantly depending on the sector.

While segments like personal care might feature many smaller buyers, large industrial clients, especially in the oil and gas sector, can command substantial purchasing volumes. For instance, in 2023, Innospec's Fuel Specialties segment, heavily reliant on the transportation and oilfield industries, represented a significant portion of its revenue.

The degree of customer concentration within these specific segments directly impacts their collective ability to negotiate terms. A few dominant players in a niche market can wield more influence than a broad, scattered customer base.

Innospec's commitment to custom formulations and innovative solutions significantly raises the barrier for customers looking to switch. This means that if a customer were to change suppliers, they would likely face considerable costs and time spent on re-formulating their own products, conducting rigorous testing, and potentially dealing with disruptions to their ongoing operations. For instance, in the specialty chemicals sector, the average time to qualify a new supplier can range from six months to over a year, impacting production schedules and incurring significant R&D expenses.

Innospec's product differentiation, centered on advanced technology and superior performance, directly counters customer bargaining power. For instance, their fuel additives are engineered to enhance efficiency and reduce emissions, offering tangible benefits that customers value highly. This focus on performance and sustainability creates a strong value proposition.

When Innospec's solutions demonstrably improve fuel economy or engine performance, customers experience a direct economic advantage. This improved performance translates into cost savings for the end-user, making them less sensitive to price increases. In 2023, Innospec reported revenue of $1.9 billion, with a significant portion driven by these high-value specialty chemicals, underscoring the market's willingness to pay for differentiated performance.

Customer Price Sensitivity and Market Conditions

Customer price sensitivity is a key factor influencing Innospec's bargaining power of customers, and it varies significantly across its different business segments. In markets where Innospec's products are more commoditized or when the broader economy faces challenges, customers tend to be more assertive in negotiating prices. This heightened price sensitivity can directly impact Innospec's profit margins.

For instance, while Innospec's Fuel Specialties division demonstrated robust performance, other areas like Performance Chemicals and Oilfield Services encountered market fluctuations. This volatility in 2024, as reflected in their financial performance, suggests a greater likelihood of customers in these segments pushing for lower prices. This is particularly true if alternative suppliers or substitute products become more readily available or if demand softens.

- Fuel Specialties: Generally less price-sensitive due to specialized product benefits.

- Performance Chemicals: Moderate price sensitivity, influenced by product differentiation and competition.

- Oilfield Services: Higher price sensitivity, especially during periods of low oil prices and increased competition.

- Overall Market Conditions: Economic downturns amplify customer price sensitivity across all segments.

Threat of Backward Integration by Customers

The threat of customers backward integrating to produce their own specialty chemicals is generally low for Innospec. This is primarily due to the significant capital investment, substantial research and development efforts, and highly specialized manufacturing expertise that would be necessary for such an undertaking.

Innospec's commitment to innovation is evident in its continuous investment in research and technology. For instance, the company allocated US$47.8 million to R&D in 2024, a figure that significantly increases the barrier to entry for any customer considering self-production.

- High Capital Requirements: Establishing specialty chemical manufacturing facilities demands immense financial resources, making it prohibitive for most customers.

- R&D Intensity: Developing and refining specialty chemicals requires ongoing, sophisticated research and development, a costly and time-consuming process.

- Specialized Expertise: The production of specialty chemicals involves complex processes and requires a highly skilled workforce with specific technical knowledge.

- Innospec's Investment: With US$47.8 million invested in R&D in 2024, Innospec actively strengthens its competitive advantage and discourages customer backward integration.

Innospec's customer bargaining power is generally moderate, influenced by product differentiation and customer switching costs. While some segments have concentrated buyers, Innospec's innovative solutions and the high cost of re-formulation for clients limit their ability to dictate terms. The company's significant R&D investment, reaching US$47.8 million in 2024, further strengthens its position by creating high barriers to entry for customers contemplating backward integration.

Customer price sensitivity varies, with higher sensitivity observed in segments like Oilfield Services during market downturns in 2024, potentially impacting margins. Conversely, the specialized benefits of Fuel Specialties products make those customers less price-sensitive. Innospec's overall revenue for 2023 was $1.9 billion, with performance chemicals forming a key part of this, indicating market acceptance of their value proposition.

| Segment | Price Sensitivity (2024 Outlook) | Switching Costs | Backward Integration Threat |

| Fuel Specialties | Low | High | Low |

| Performance Chemicals | Moderate | Moderate to High | Low |

| Oilfield Services | High (during downturns) | Moderate | Low |

Preview the Actual Deliverable

Innospec Porter's Five Forces Analysis

This preview showcases the complete Innospec Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within its industry. You're looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted file, ready for immediate use and strategic application.

Rivalry Among Competitors

Innospec operates within a fiercely competitive specialty chemicals landscape. It contends with global giants like BASF, which reported over €62 billion in sales for 2023, and Clariant, with revenues around CHF 4.1 billion in the same year. These large players possess significant scale and resources, intensifying rivalry across various chemical segments.

The competitive intensity varies by Innospec's specific business units. While the Fuel Specialties market might see a more concentrated group of key competitors, Innospec's Performance Chemicals division navigates a much more fragmented environment. This fragmentation means Innospec faces a broader array of multinational corporations alongside numerous smaller, specialized chemical manufacturers.

The global chemical industry anticipates moderate growth in 2025. However, specialty chemical output might see stability or even slight dips in certain segments. This environment, where expansion isn't guaranteed, often fuels more intense competition among companies vying for existing market share.

Innospec's performance, especially within its Fuel Specialties division, is notable given this backdrop. While the broader industry navigates a more challenging growth landscape, Innospec's capacity to expand, particularly in this key area, demonstrates a competitive edge.

In the specialty chemicals sector, competitive rivalry is intense, with companies like Innospec differentiating themselves through superior product quality, enhanced performance, and the development of highly specialized solutions. This focus on unique offerings is crucial for standing out against competitors who may offer more standardized, commoditized products.

Innospec actively invests in research and development, dedicating substantial resources to innovation. For instance, their 2023 R&D expenditure was approximately $50 million, a testament to their commitment to creating novel products that boost efficiency, improve performance metrics, and promote sustainability for their customers.

This strategic emphasis on innovation and product differentiation allows Innospec to carve out a distinct market position, mitigating the direct price competition often faced by less specialized chemical manufacturers and reinforcing its competitive advantage.

High Fixed Costs and Exit Barriers

The specialty chemicals sector, where Innospec operates, is characterized by significant fixed costs. These stem from the substantial capital required for advanced manufacturing plants and continuous investment in research and development to stay competitive. For instance, building a new chemical production facility can easily run into hundreds of millions of dollars.

These high fixed costs translate into considerable exit barriers. Companies that have invested heavily in their infrastructure are often hesitant to withdraw from the market, even when demand softens. This reluctance to exit can intensify competitive pressures, as existing players fight harder for market share during downturns.

Innospec's own global network of manufacturing sites underscores this reality. These facilities represent a significant fixed asset base, requiring ongoing maintenance and operational expenditure.

- High Capital Intensity: Specialty chemical manufacturing demands substantial upfront investment in specialized equipment and facilities.

- R&D Investment: Continuous innovation and product development necessitate ongoing, significant expenditure on research and development.

- Exit Barriers: The difficulty and cost associated with divesting or repurposing specialized assets make exiting the market challenging.

Strategic Resilience and Market Share Dynamics

Innospec has shown remarkable strategic resilience, weathering market headwinds better than many rivals. The company managed revenue declines more effectively, even seeing a modest increase in market share through late 2024 and early 2025. This suggests strong operational efficiency and a commitment to customer needs, crucial in a sector where competitors are also focusing on cost-saving and new product development.

Key indicators of this resilience include:

- Modest Revenue Decline: While specific figures for late 2024 and early 2025 are proprietary, industry reports indicated Innospec's revenue decline was less severe than the average for specialty chemical companies during periods of economic slowdown in 2024.

- Market Share Gains: Innospec's incremental market share growth in key segments during this period, estimated to be in the low single digits, highlights its competitive positioning.

- Customer-Centric Solutions: The company’s focus on tailored solutions has resonated with customers, differentiating it from competitors who may be offering more standardized products.

- Cost Control Measures: Competitors are also implementing cost-reduction programs, but Innospec's ability to maintain or grow market share suggests its cost controls are particularly effective, allowing for competitive pricing or reinvestment in innovation.

Competitive rivalry within the specialty chemicals sector is intense, driven by large global players and a fragmented landscape of smaller firms. Innospec differentiates itself through innovation and specialized solutions, investing approximately $50 million in R&D in 2023 to create novel products. This focus on unique offerings helps mitigate direct price competition, a common challenge in the industry.

| Competitor | 2023 Revenue (approx.) | Key Business Areas |

|---|---|---|

| BASF | €62 billion | Broad spectrum of chemicals, including specialties |

| Clariant | CHF 4.1 billion | Specialty chemicals, catalysts, and oil services |

| Innospec | $2.0 billion (FY 2023) | Fuel Specialties, Performance Chemicals, Oilfield Services |

SSubstitutes Threaten

Innospec faces a varied threat of substitutes across its business segments. For its fuel additives division, the emergence of alternative fuel sources, such as advanced biofuels or electric vehicle technology, could reduce the demand for traditional fuel additives. Likewise, significant advancements in internal combustion engine efficiency that minimize the need for performance-enhancing additives represent a potential substitute threat.

In the personal care sector, the threat of substitutes is increasingly shaped by consumer preferences for natural and eco-friendly ingredients. The global natural personal care market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a strong shift away from synthetic ingredients that Innospec's products might traditionally include.

The attractiveness of substitutes for Innospec’s specialized chemicals hinges on their price-performance trade-off. If alternatives offer comparable or better benefits at a reduced cost, the threat intensifies. For instance, while generic chemical suppliers might offer lower upfront prices, they often lack the tailored performance and specialized applications that Innospec provides, which can lead to higher total cost of ownership for customers seeking specific outcomes.

Customers considering switching from Innospec's products to substitutes often face significant costs. These can include the expense of re-formulating their own products, conducting rigorous re-testing to ensure compatibility and performance, and the potential risk to their brand reputation if a new supplier's offering proves unreliable or inferior. For instance, in the fuel additives market, a change in supplier could necessitate extensive testing to meet regulatory standards, a process that can take months and incur substantial R&D expenses.

Regulatory and Sustainability Drivers for Substitution

The increasing global focus on sustainability and stricter environmental regulations are significant drivers for substitution. These factors encourage a shift away from traditional chemical products towards greener alternatives across various industries. For instance, by 2024, many regions saw accelerated mandates for reduced volatile organic compounds (VOCs) in coatings and fuels, directly impacting Innospec's markets.

Innospec is actively mitigating this threat by prioritizing investment in sustainable product development. A prime example is their ENVIOMET® DIS 9500, a biodegradable dispersant designed to meet evolving environmental standards. This proactive approach aims to transform the threat of substitution into a competitive advantage by offering solutions that align with regulatory demands and market preferences for eco-friendly options.

- Growing Regulatory Pressure: Expect continued tightening of environmental regulations globally, impacting chemical formulations and demanding more sustainable inputs by 2025.

- Market Demand for Sustainability: Consumer and industrial demand for eco-friendly products is a strong force pushing for substitution of traditional chemicals.

- Innospec's Sustainable Investments: The company's R&D in biodegradable and low-emission solutions like ENVIOMET® DIS 9500 positions them to capture market share as substitutes gain traction.

Innospec's Innovation as a Defense

Innospec actively combats the threat of substitutes through substantial investment in innovation. In 2024 alone, the company allocated $47.8 million to Research & Technology, a clear indicator of its commitment to staying ahead. This focus allows Innospec to develop advanced products that not only meet but anticipate evolving market needs.

These innovations are designed to offer superior performance, reduced environmental impact, and greater operational efficiency. By consistently introducing next-generation solutions, Innospec makes it more challenging for substitute products to gain traction, thereby safeguarding its market position.

- Research & Technology Investment: $47.8 million in 2024.

- Strategic Focus: Developing innovative products with enhanced performance and lower carbon footprints.

- Market Defense: Staying ahead of potential alternatives to meet evolving customer demands.

The threat of substitutes for Innospec is moderate but growing, driven by evolving consumer preferences and regulatory landscapes. In the fuel additives sector, advancements in alternative fuels and engine efficiency present a substitute threat, while the personal care market sees a strong shift towards natural ingredients, impacting demand for synthetic components. The overall impact is managed by Innospec's focus on innovation and sustainability.

Customers switching to substitutes often face significant costs, including re-formulation, testing, and potential brand reputation risks. For example, changing fuel additive suppliers can require months of costly R&D to meet regulatory standards. By 2024, stricter VOC mandates in many regions further accelerated the push for greener alternatives, directly affecting Innospec's core markets.

| Market Segment | Potential Substitutes | Impact on Innospec |

|---|---|---|

| Fuel Additives | Alternative fuels (biofuels, EVs), improved engine efficiency | Reduced demand for traditional additives |

| Personal Care | Natural and eco-friendly ingredients | Shift away from synthetic components |

| Specialty Chemicals | Lower-cost generic alternatives | Threatened by price-performance trade-offs |

Entrants Threaten

The specialty chemicals sector demands significant upfront capital for advanced manufacturing, extensive R&D, and robust global supply chains. For instance, building a new, state-of-the-art specialty chemical plant can easily run into hundreds of millions of dollars, a substantial hurdle for aspiring competitors.

This high capital intensity creates a formidable barrier to entry. Newcomers must secure substantial funding just to establish a basic operational presence, let alone achieve the technological sophistication and market reach of established firms like Innospec.

Furthermore, existing players leverage significant economies of scale. In 2024, companies with larger production volumes often achieve lower per-unit costs, making it challenging for smaller, newer entrants to match pricing and remain competitive in the market.

The development, manufacturing, and blending of specialty chemicals, like those Innospec produces, require a significant investment in specialized technical knowledge and robust research and development (R&D) capabilities. New companies entering this market would need to cultivate a deep understanding of intricate chemical formulations and processes, a considerable undertaking.

Innospec's ongoing commitment to R&D, evidenced by its consistent investment in innovation, forms a substantial barrier to entry. For instance, in 2023, Innospec reported R&D expenses of $108.4 million, underscoring its dedication to maintaining a technological edge. This focus, coupled with its established network of technical experts, makes it difficult for newcomers to replicate the necessary knowledge base and operational sophistication.

The specialty chemicals industry faces significant regulatory scrutiny, impacting product safety, environmental standards, and production methods. These stringent requirements and the associated compliance expenses create a substantial barrier for new companies looking to enter the market. For instance, in 2024, the European Chemicals Agency (ECHA) continued to enforce REACH regulations, requiring extensive data submission and risk assessments for chemical substances, adding millions in upfront costs for any new entrant.

Established Distribution Channels and Customer Relationships

Innospec benefits from deeply entrenched distribution channels and robust, long-standing customer relationships. These are not easily replicated by newcomers.

New entrants would struggle to build a comparable global delivery network and secure the trust of existing Innospec clients. These customers often have significant switching costs due to the specialized nature of custom formulations and the technical integration required, making them less likely to move to a new supplier.

- Established Global Delivery Network: Innospec's extensive logistics infrastructure is a significant barrier.

- Long-Term Customer Relationships: Loyalty built on reliable service and tailored solutions creates high switching costs.

- Technical Integration and Custom Formulations: These factors lock in existing customers, making it difficult for new entrants to gain a foothold.

Brand Reputation and Product Differentiation

Innospec's established brand reputation, built on a foundation of innovation and customer-centricity in its specialized markets, significantly deters new entrants. This strong image, coupled with a product portfolio designed to address unique customer needs, presents a formidable challenge for newcomers aiming to gain traction. For instance, Innospec's focus on performance chemicals, such as fuel additives, where trust and reliability are paramount, means new companies must invest heavily to build comparable credibility.

The ability to offer differentiated, high-performance products that solve specific customer problems acts as a crucial barrier. Newcomers often struggle to replicate Innospec's specialized product development and the associated technical support. In 2024, the specialty chemicals market continued to emphasize tailored solutions, making it harder for generic offerings to compete effectively against established, problem-solving brands like Innospec.

- Brand loyalty: Innospec's consistent delivery of quality and innovation fosters strong customer relationships, making switching to a new, unproven supplier less appealing.

- Product specialization: The company's focus on niche applications means new entrants need substantial R&D investment to develop comparable, specialized products.

- Technical expertise: Innospec's deep understanding of customer processes and its ability to provide tailored technical support create a competitive advantage that is difficult for new players to match.

The threat of new entrants in the specialty chemicals sector, including Innospec's markets, is significantly mitigated by substantial capital requirements for advanced manufacturing and R&D, with new plant construction easily costing hundreds of millions. Economies of scale achieved by established players in 2024 further pressure newcomers on pricing. Moreover, the need for specialized technical knowledge and robust R&D capabilities, as demonstrated by Innospec's $108.4 million R&D investment in 2023, creates a high barrier to entry.

Stringent regulatory environments, such as the REACH regulations enforced by ECHA in 2024, add millions in compliance costs for new chemical substances. Innospec's established global delivery network and long-standing customer relationships, built on trust and custom formulations, present significant switching costs for clients. This customer loyalty, combined with Innospec's strong brand reputation for innovation and tailored solutions, makes it difficult for new entrants to gain market share.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | High costs for advanced manufacturing, R&D, and supply chains. | Requires substantial upfront funding, limiting the number of potential entrants. |

| Economies of Scale | Lower per-unit costs for larger production volumes. | Newcomers struggle to match pricing and achieve profitability against established players. |

| Technical Expertise & R&D | Need for specialized knowledge and innovation capabilities. | Difficult and costly for new firms to replicate Innospec's technological edge and product development. |

| Regulatory Hurdles | Compliance with safety and environmental standards (e.g., REACH). | Adds significant upfront costs and complexity for market entry. |

| Distribution & Customer Relationships | Entrenched channels and high switching costs due to custom solutions. | Challenging for new entrants to build comparable networks and gain customer trust. |

| Brand Reputation & Product Differentiation | Established trust and ability to offer unique, problem-solving products. | Newcomers must invest heavily in building credibility and developing comparable specialized offerings. |

Porter's Five Forces Analysis Data Sources

Our Innospec Porter's Five Forces analysis is built upon a robust foundation of data, including Innospec's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific market research reports and competitor financial disclosures to provide a comprehensive view of the competitive landscape.