Innospec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

Navigate the complex external forces shaping Innospec's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive edge. Download the full analysis now for a complete, expert-driven breakdown.

Political factors

Governments globally are tightening emission standards for vehicles and industrial operations, directly influencing the market for Innospec's fuel additives that boost combustion efficiency and cut pollution. For instance, the European Union's upcoming Euro 7 standards, expected to be fully implemented by 2027, will mandate further reductions in tailpipe emissions for various pollutants, creating a need for advanced additive technologies.

Innospec's ability to adapt its product portfolio to meet these evolving regulations, such as those favoring cleaner fuels and lower carbon footprints, is vital for maintaining its market position. Companies that proactively develop solutions aligning with these stricter environmental mandates, like Innospec's offerings for ultra-low sulfur diesel, can gain a significant competitive edge by helping clients achieve compliance.

Geopolitical stability in major oil-producing regions directly impacts Innospec's oilfield services segment. For instance, the ongoing geopolitical shifts in the Middle East and Eastern Europe, areas critical for global oil supply, can lead to price volatility. In 2024, continued tensions in these regions have already demonstrated their ability to influence crude oil prices, affecting exploration and production budgets, which in turn shapes demand for Innospec's specialized chemicals.

Global energy policies, including national commitments to decarbonization and the pace of renewable energy adoption, are also crucial. As of early 2025, many nations are reinforcing their climate targets, potentially slowing investment in new fossil fuel extraction projects. This trend necessitates Innospec's strategic adaptation, ensuring its oilfield chemical solutions remain relevant in a potentially contracting, yet still significant, oil and gas market.

Innospec's global operations are significantly influenced by international trade policies, including agreements, tariffs, and various trade barriers. These factors directly impact the company's supply chain, affecting the cost and availability of raw materials, as well as its ability to access international markets. For instance, the United States' imposition of tariffs on certain chemicals in recent years has presented challenges for companies like Innospec, potentially increasing input costs and affecting the competitiveness of its exported products.

Changes in trade dynamics between major economic blocs, such as the European Union and the United States, can lead to fluctuations in Innospec's profitability. For example, if new tariffs are introduced on key chemical components sourced from one region and sold into another, Innospec might face higher operational expenses or reduced demand for its finished goods. Navigating these evolving trade landscapes is crucial for maintaining efficient operations and ensuring competitive pricing across Innospec's diverse markets.

Government Incentives for Green Chemistry

Governments worldwide are actively promoting green chemistry through various financial mechanisms. For instance, the European Union's Horizon Europe program allocated €95.5 billion for research and innovation from 2021-2027, with a significant portion directed towards sustainability and climate action, including green technologies. In the United States, the Department of Energy's Office of Energy Efficiency and Renewable Energy (EERE) offers grants and funding opportunities for developing advanced manufacturing and sustainable chemical processes. These incentives can significantly reduce the R&D burden for companies like Innospec, encouraging investment in environmentally friendly product lines.

Innospec's strategic alignment with these governmental pushes for sustainability can unlock substantial market advantages. By channeling resources into the research and development of bio-based solvents, biodegradable surfactants, or low-VOC (volatile organic compound) formulations, the company can tap into a growing demand driven by regulatory pressures and consumer preference. For example, the global green chemistry market was valued at approximately $4.6 billion in 2023 and is projected to grow substantially, presenting a clear opportunity for Innospec to expand its market share.

- Governmental Support: Increased availability of grants, tax credits, and subsidies for companies developing and implementing sustainable chemical solutions.

- Market Expansion: Alignment with national and international environmental regulations and initiatives opens doors to new markets and strengthens brand reputation.

- R&D Investment: Financial incentives lower the barrier to entry for investing in the research and development of innovative, eco-friendly chemical products.

- Competitive Advantage: Proactive adoption of green chemistry principles positions Innospec favorably against competitors less focused on sustainability.

Political Stability in Key Operating Markets

The political stability of countries where Innospec operates is a cornerstone for its business continuity. For instance, Innospec has significant manufacturing and sales presence in regions like the United States and Europe, which generally exhibit high political stability. However, emerging markets, where Innospec also has operations, can present varying degrees of political risk. In 2024, geopolitical tensions in Eastern Europe continued to influence supply chains and energy costs, impacting global manufacturing operations, including those of specialty chemical companies like Innospec.

Unstable political environments can directly translate into operational disruptions, such as unexpected regulatory changes, labor unrest, or even physical damage to facilities. This instability also exacerbates supply chain challenges, making it harder to source raw materials or distribute finished products efficiently. For example, political instability in certain African nations has previously led to temporary shutdowns of mining operations, which can affect the availability of key minerals used in chemical production.

Assessing and actively mitigating political risks is therefore a necessary strategic imperative for Innospec. This involves understanding the political landscape in each key market, developing contingency plans for potential disruptions, and fostering strong relationships with local stakeholders. Innospec's 2024 financial reports likely reflect ongoing efforts to diversify its supply chains and operational bases to buffer against localized political instability, ensuring the protection of its investments and the uninterrupted flow of its business.

- United States: Generally stable political environment, a key market for Innospec's Fuel Specialties division.

- Europe: Stable political landscape across major operating countries, though regional economic policies can shift.

- Emerging Markets: Variable political stability, requiring diligent risk assessment and management for Innospec's global operations.

- Geopolitical Impact: In 2024, ongoing global political events continued to influence raw material costs and logistics for specialty chemical manufacturers.

Governments globally are increasingly prioritizing environmental regulations, directly impacting Innospec's fuel additives and chemicals. Stricter emission standards, like the anticipated Euro 7 regulations in Europe, necessitate advanced additive technologies for cleaner fuels, a market Innospec is positioned to serve. The company's ability to align its product development with these evolving environmental mandates, including those promoting lower carbon footprints, is crucial for maintaining its competitive edge and ensuring client compliance.

Geopolitical shifts in oil-producing regions significantly influence Innospec's oilfield services segment by affecting crude oil prices and exploration budgets. For example, continued tensions in the Middle East and Eastern Europe in 2024 have demonstrated their capacity to impact global energy markets, thereby shaping demand for specialized chemicals. Furthermore, global energy policies focused on decarbonization and renewable energy adoption, reinforced by national climate targets in early 2025, may temper investments in new fossil fuel extraction, requiring Innospec to adapt its oilfield chemical solutions for a potentially transforming market.

International trade policies, including tariffs and trade agreements, directly affect Innospec's supply chain and market access. For instance, past tariffs on chemicals have increased input costs and impacted export competitiveness. Fluctuations in trade dynamics between major economic blocs can lead to higher operational expenses or reduced demand for finished goods, making navigation of these evolving landscapes critical for Innospec's profitability and pricing strategies.

Governmental incentives for green chemistry, such as EU's Horizon Europe program and US Department of Energy grants, are fostering innovation in sustainable chemical processes. These financial mechanisms can significantly reduce R&D costs for companies like Innospec, encouraging investment in eco-friendly product lines. The growing global green chemistry market, valued at approximately $4.6 billion in 2023, presents a substantial opportunity for Innospec to expand its market share by developing bio-based solvents and biodegradable surfactants.

Political stability in Innospec's operating regions is vital for business continuity, with the US and Europe generally offering stable environments. However, emerging markets present variable political risks, and geopolitical events in 2024, such as those in Eastern Europe, continued to influence raw material costs and logistics for specialty chemical manufacturers. Unstable political environments can lead to operational disruptions, supply chain challenges, and necessitate diligent risk assessment and management strategies for Innospec's global operations.

| Political Factor | Impact on Innospec | Example/Data Point |

| Environmental Regulations | Drives demand for cleaner fuel additives and eco-friendly chemicals. | EU's Euro 7 standards (expected full implementation by 2027) mandate further emission reductions. |

| Geopolitical Stability in Oil Regions | Influences oil prices and exploration budgets, affecting oilfield services demand. | Tensions in the Middle East and Eastern Europe in 2024 impacted crude oil prices. |

| Global Energy Policies | Shapes investment in fossil fuels, requiring adaptation of oilfield chemical solutions. | National climate targets in early 2025 may slow new fossil fuel extraction projects. |

| International Trade Policies | Affects supply chain costs, raw material availability, and market access. | Tariffs on chemicals can increase input costs and impact export competitiveness. |

| Governmental Support for Green Chemistry | Reduces R&D costs and encourages investment in sustainable products. | Global green chemistry market valued at ~$4.6 billion in 2023, with significant growth projected. |

| Political Stability of Operating Regions | Ensures business continuity; instability can cause operational disruptions. | Geopolitical events in 2024 influenced raw material costs and logistics for specialty chemicals. |

What is included in the product

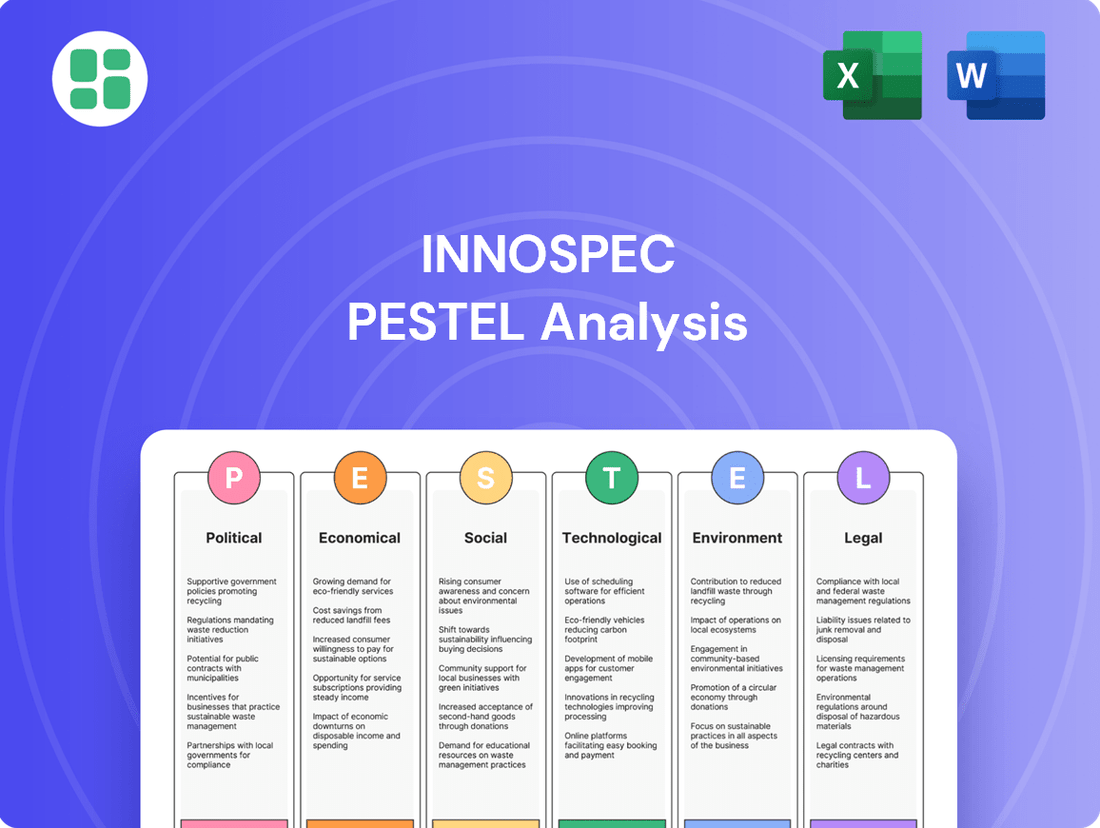

This Innospec PESTLE analysis examines the critical external factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Innospec PESTLE analysis offers a clear, summarized version of complex external factors, making it easy to reference during strategic discussions and ensuring everyone is aligned on key market influences.

Economic factors

Global economic growth significantly impacts Innospec's performance. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023's 3.1%, indicating a mixed demand environment for Innospec's products.

Industrial production is a key indicator for Innospec, especially in its fuel additives and oilfield chemicals segments. In the US, industrial production saw a 0.1% increase in April 2024, suggesting a modest uptick in manufacturing activity that could translate to higher demand for Innospec's offerings.

A strong global economy generally boosts demand for transportation fuels, energy exploration, and consumer products, all areas where Innospec operates. However, any economic contraction or slowdown in industrial output, such as the 0.9% decline in Eurozone industrial production in March 2024, poses a direct risk to Innospec's sales volumes and profitability.

Crude oil price volatility directly impacts Innospec's oilfield services segment, influencing exploration and production (E&P) spending. For instance, West Texas Intermediate (WTI) crude oil prices averaged around $77.50 per barrel in Q1 2024, a level that generally supports E&P activity, thereby boosting demand for Innospec's specialized chemicals. However, significant price drops, such as those seen in late 2023 where WTI briefly dipped below $70, can lead to reduced drilling and completion projects, impacting Innospec's revenue streams.

While lower oil prices can dampen demand for oilfield chemicals, they also influence fuel costs, which indirectly affects Innospec's fuel additives business. If crude oil prices decrease, gasoline and diesel prices tend to follow, potentially stimulating consumer demand for fuel. This could lead to increased volumes for Innospec's fuel additives, offsetting some of the challenges in the oilfield services sector.

Managing this price exposure is crucial for Innospec's oilfield services segment. The company's ability to adapt its product offerings and pricing strategies to fluctuating oil markets, such as offering cost-effective solutions during downturns, is key to maintaining profitability and market share. For example, Innospec's focus on performance chemicals that improve efficiency can be a strong selling point even when oil prices are lower.

Disposable income and consumer spending are critical drivers for Innospec's personal care ingredients segment. In 2024, global disposable income is projected to see moderate growth, with advanced economies generally experiencing slower increases compared to emerging markets. This trend directly impacts consumer willingness to purchase premium personal care items, which often utilize Innospec's specialized ingredients.

When consumers have more discretionary funds, they tend to opt for higher-quality, innovation-driven personal care products, boosting demand for Innospec's offerings. For instance, a rise in disposable income often correlates with increased spending on skincare, haircare, and cosmetics that feature advanced formulations. Conversely, economic slowdowns, such as those potentially experienced in late 2024 or early 2025 due to inflation concerns, can lead consumers to prioritize essential goods, potentially impacting sales volumes and necessitating adjustments in pricing and product development strategies for Innospec.

Inflation, Interest Rates, and Exchange Rates

Inflationary pressures in 2024 and early 2025 continue to impact operational costs for companies like Innospec. For instance, the global Harmonised Index of Consumer Prices (HICP) averaged 2.9% in the Eurozone in April 2024, a slight decrease from previous months but still elevated, suggesting persistent cost increases for raw materials, energy, and labor. This directly affects Innospec's gross margins as they navigate higher input expenses across their specialty chemicals segments.

Rising interest rates pose a significant challenge. The US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, signaling a cautious approach to monetary policy. This environment increases borrowing costs for Innospec and its industrial customers, potentially slowing down investment in new projects and dampening demand for the company's products.

Fluctuations in currency exchange rates are a constant factor for a global entity like Innospec. The US dollar's strength relative to other major currencies in late 2023 and early 2024 means that revenues earned in foreign currencies translate into fewer dollars. For example, a stronger USD can negatively impact Innospec's reported earnings from its European or Asian operations, even if local currency performance remains robust.

- Inflation: Persistent global inflation continues to drive up Innospec's costs for key inputs like chemicals, energy, and wages, pressuring profit margins.

- Interest Rates: Elevated interest rates, exemplified by the Fed's steady stance in 2024, increase Innospec's financing expenses and can reduce customer investment capacity.

- Exchange Rates: A strong US dollar, observed through much of 2023-2024, can negatively impact Innospec's reported financial results by devaluing foreign earnings.

Industry-Specific Market Growth and Competition

The economic health of Innospec's key sectors significantly influences its performance. For instance, the global specialty chemicals market was projected to reach approximately $750 billion by 2024, with growth driven by demand in various end-use industries. Intense competition within these segments, including fuel additives and oilfield chemicals, necessitates ongoing investment in research and development and operational efficiency to secure market share and profitability.

Innospec navigates a competitive environment where staying ahead requires constant innovation. The fuel additives market, for example, faces pressure from evolving emissions regulations and the transition to alternative fuels, demanding adaptive product development. Similarly, the oilfield chemicals sector is sensitive to fluctuations in oil prices and exploration activity, impacting demand and pricing.

Understanding specific market forecasts and competitor strategies is paramount for Innospec's sustained growth. For example, projections for the personal care ingredients market indicate continued expansion, driven by consumer demand for natural and sustainable products. Companies that can effectively respond to these trends through product differentiation and cost management are better positioned for success.

- Global specialty chemicals market projected to exceed $750 billion by 2024.

- Intense competition in fuel additives and oilfield chemicals demands innovation.

- Personal care ingredients market shows strong growth, influenced by consumer trends.

- Market forecasts and competitor analysis are vital for Innospec's strategic planning.

Global economic growth, projected at 3.2% for 2024 by the IMF, influences demand across Innospec's sectors. Industrial production, up 0.1% in the US in April 2024, signals modest manufacturing activity. However, a 0.9% industrial production decline in the Eurozone in March 2024 highlights regional economic risks.

Crude oil prices, averaging around $77.50/barrel for WTI in Q1 2024, support oilfield services, though dips below $70 in late 2023 show volatility. Lower fuel costs from these price drops could boost Innospec's fuel additives segment by stimulating consumer demand.

Disposable income growth supports Innospec's personal care ingredients, though advanced economies see slower increases in 2024. Persistent inflation, with Eurozone HICP at 2.9% in April 2024, raises Innospec's operational costs. Elevated US interest rates (5.25%-5.50% range through mid-2024) increase borrowing costs.

| Economic Factor | 2024 Projection/Data | Impact on Innospec |

|---|---|---|

| Global GDP Growth | 3.2% (IMF Projection) | Influences overall demand for fuel additives, oilfield chemicals, and personal care ingredients. |

| US Industrial Production | +0.1% (April 2024) | Modest positive indicator for manufacturing demand for Innospec's products. |

| Eurozone Industrial Production | -0.9% (March 2024) | Highlights regional economic slowdown risks affecting sales. |

| WTI Crude Oil Price | ~$77.50/barrel (Q1 2024 average) | Supports oilfield services spending; price volatility impacts revenue. |

| Eurozone HICP (Inflation) | 2.9% (April 2024) | Increases operational costs and pressures profit margins. |

| US Federal Funds Rate | 5.25%-5.50% (Through mid-2024) | Raises borrowing costs and may reduce customer investment. |

Same Document Delivered

Innospec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive Innospec PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors affecting Innospec.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE framework for Innospec's strategic planning.

Sociological factors

Consumers worldwide are increasingly prioritizing sustainable, eco-friendly, and 'clean label' products, especially within the personal care market. This shift directly impacts Innospec's performance chemicals segment, making its capacity to innovate and market ingredients like bio-based or biodegradable alternatives a key performance driver.

Public sentiment towards the chemical sector significantly shapes regulatory oversight, product adoption, and investor confidence. Negative perceptions of environmental or health risks can lead to stricter regulations and reduced market demand, impacting companies like Innospec.

Innospec's emphasis on corporate social responsibility, safety protocols, and transparent reporting, as detailed in its 2023 Sustainability Report, is crucial for fostering a positive brand image and maintaining stakeholder trust. For instance, the report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline.

Actively communicating Innospec's commitment to safe operational practices and its contributions to sustainability, such as developing lower-emission fuel additives, is vital for counteracting potentially damaging public narratives and solidifying its reputation.

Shifting workforce demographics, particularly a growing demand for specialized chemical engineers and manufacturing technicians, present a significant challenge for Innospec. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth in chemical engineers between 2022 and 2032, indicating a competitive talent landscape.

Securing and keeping these skilled professionals is crucial for Innospec's ability to innovate and maintain its manufacturing prowess. Companies like Innospec are increasingly focusing on robust employee training programs and fostering diverse, inclusive environments to attract and retain top talent, which is essential for long-term operational success.

Shifting Lifestyle and Beauty Trends

Consumer lifestyles are increasingly prioritizing wellness and self-care, driving demand for ingredients perceived as natural and beneficial. This shift is evident in the booming 'skinification' of haircare, where consumers seek sophisticated, science-backed formulations for their hair, mirroring their approach to skincare. Innospec must remain attuned to these evolving preferences to ensure its ingredient portfolio aligns with the desire for efficacy and perceived health benefits.

The demand for personalized beauty solutions is also a significant sociological factor. Consumers are moving away from one-size-fits-all products, seeking ingredients that can be tailored to individual needs, whether for specific hair types, concerns, or ethical considerations. For instance, the global personalized beauty market was valued at approximately $27.9 billion in 2023 and is projected to grow significantly, highlighting the importance of Innospec’s ability to offer adaptable and customizable ingredient solutions.

- Skinification of Haircare: Consumers are increasingly looking for haircare products with sophisticated, active ingredients similar to those found in skincare.

- Demand for Personalization: A growing segment of consumers seeks customized beauty products, influencing the need for versatile and adaptable ingredients.

- Wellness and Self-Care Focus: Lifestyles are shifting towards prioritizing personal well-being, impacting ingredient choices towards those perceived as natural and beneficial.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are rapidly evolving, pushing companies like Innospec to demonstrate robust ethical sourcing, community engagement, and a commitment to human rights. This directly influences Innospec's brand reputation and its relationships with various stakeholders, from customers to investors. For instance, Innospec's 2023 Sustainability Report highlighted their investment of over $1 million in community development projects globally, aiming to foster positive local impact.

Innospec's active participation in social partnerships and community programs is crucial for building trust and aligning with the values of increasingly conscious investors and customers. This proactive approach helps mitigate reputational risks and can even unlock new market opportunities. Surveys from 2024 indicate that over 60% of consumers consider a company's CSR performance when making purchasing decisions, underscoring the financial imperative of these initiatives.

- Ethical Sourcing: Innospec is increasingly scrutinized for the ethical origins of its raw materials, with a growing demand for transparency in its supply chains.

- Community Engagement: Investments in local communities, such as job training programs or environmental clean-ups, are becoming a key metric for evaluating corporate citizenship.

- Human Rights: Ensuring fair labor practices and upholding human rights throughout its operations and supply chain is paramount for maintaining a positive brand image.

- Stakeholder Relations: Strong CSR performance directly enhances Innospec's relationships with investors, customers, employees, and regulatory bodies, fostering long-term loyalty and support.

Consumers' increasing focus on wellness and self-care is driving demand for ingredients perceived as natural and beneficial, impacting Innospec's personal care segment. For instance, the global wellness market reached an estimated $5.6 trillion in 2023, with a significant portion attributed to beauty and personal care products emphasizing natural ingredients.

The demand for personalized beauty solutions is also a significant sociological factor, influencing the need for versatile and adaptable ingredients. The personalized beauty market was valued at approximately $27.9 billion in 2023 and is projected to grow, highlighting Innospec’s need to offer customizable solutions.

Societal expectations for corporate social responsibility are rapidly evolving, pushing companies like Innospec to demonstrate robust ethical sourcing and community engagement. Surveys from 2024 indicate that over 60% of consumers consider a company's CSR performance when making purchasing decisions, underscoring the financial imperative of these initiatives.

| Sociological Factor | Impact on Innospec | Supporting Data/Trend |

|---|---|---|

| Wellness & Self-Care Trend | Increased demand for natural, beneficial ingredients in personal care. | Global wellness market reached $5.6 trillion in 2023. |

| Demand for Personalization | Need for versatile, customizable ingredient solutions. | Personalized beauty market valued at $27.9 billion in 2023. |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and stakeholder trust through ethical practices. | 60%+ of consumers consider CSR in purchasing decisions (2024 data). |

Technological factors

Innospec's commitment to continuous innovation in chemical synthesis and formulation is a key technological driver. This allows them to consistently introduce new products with enhanced performance and efficiency across their business segments. For instance, advancements enable the creation of fuel additives that boost engine performance while simultaneously lowering emissions, a critical factor in today's environmentally conscious market.

The company's investment in research and development (R&D) is paramount to staying ahead. In 2023, Innospec reported R&D expenses of $55.1 million, a significant allocation aimed at developing next-generation fuel additives and high-performance personal care ingredients. This focus on innovation directly addresses evolving customer demands for more sustainable and effective chemical solutions.

The global energy landscape is rapidly evolving, with a pronounced shift towards alternative fuels and renewable energy sources. This transition, driven by environmental concerns and technological advancements, presents a dual-edged sword for Innospec. For instance, the International Energy Agency (IEA) reported in 2024 that global renewable electricity capacity is projected to grow by over 60% between 2023 and 2028, reaching more than 7,700 gigawatts. This growth directly impacts the demand for traditional fossil fuel additives.

However, this shift also unlocks new avenues for chemical innovation. The increasing adoption of electric vehicles and the development of hydrogen fuel cell technology, for example, necessitate specialized chemical solutions for battery production, fuel cell membranes, and hydrogen storage. Innospec's strategic focus on research and development for biofuel compatibility and exploring non-fuel applications, such as those in personal care or home care markets, is vital to adapt and capitalize on these emerging trends.

Technological advancements in sustainable and bio-based chemistry are critical for Innospec's environmental commitments and catering to consumer desires for eco-friendly products. This includes innovating processes that minimize waste and energy usage, alongside creating offerings from renewable feedstocks.

In 2024, the global bio-based chemicals market was valued at approximately $100 billion, with projections indicating significant growth driven by sustainability initiatives. Such innovation directly bolsters Innospec's sustainability image and unlocks access to burgeoning green markets.

Automation and Digitalization in Manufacturing

The manufacturing sector's ongoing embrace of automation and digitalization promises substantial gains for Innospec. By integrating technologies like AI-powered process optimization and smart factory solutions, the company can expect a notable uplift in operational efficiency and a reduction in production costs. For instance, in 2024, the global manufacturing automation market was valued at approximately $60 billion and is projected to grow significantly, indicating a strong industry trend towards these advancements.

These technological shifts directly translate into improved product consistency and quality, crucial for Innospec's specialty chemicals. Advanced analytics, particularly in supply chain management, can further streamline operations, minimize waste, and enhance responsiveness to market demands. Companies that effectively leverage these digital tools, such as predictive maintenance, often see a reduction in downtime, with some reporting up to a 30% decrease in unexpected equipment failures.

- Enhanced Efficiency: Automation can streamline production lines, reducing cycle times and labor dependency.

- Cost Reduction: Optimized processes and reduced waste contribute to lower manufacturing expenses.

- Quality Improvement: Consistent application of digital controls leads to more uniform product output.

- Competitive Edge: Early adoption of Industry 4.0 technologies can position Innospec ahead of less digitized competitors.

Research and Development Investment

Innospec's commitment to research and development is a cornerstone of its strategy, with significant investments fueling innovation in specialty chemicals. For the fiscal year 2023, the company reported R&D expenses of $48.5 million, a slight increase from $46.2 million in 2022, underscoring its dedication to staying competitive.

This consistent funding is crucial for developing new products, enhancing existing ones, and exploring novel applications for their chemical technologies across various sectors. A robust R&D pipeline allows Innospec to anticipate and respond to evolving market needs and regulatory landscapes, ensuring sustained growth and market leadership.

- R&D Investment Growth: Innospec's R&D spending increased from $46.2 million in 2022 to $48.5 million in 2023.

- Focus Areas: Investments target new product development, process optimization, and market expansion for specialty chemicals.

- Strategic Importance: A strong R&D pipeline is vital for maintaining a competitive edge and adapting to future market demands.

- Innovation Pipeline: The company prioritizes exploring new market applications and advancing its technological capabilities.

Innospec's technological strategy centers on continuous innovation, evident in its R&D investments. In 2023, R&D expenditure reached $48.5 million, up from $46.2 million in 2022, demonstrating a commitment to developing advanced fuel additives and personal care ingredients. This focus is crucial for creating products that meet evolving environmental standards and consumer demands for performance and sustainability.

The company is also leveraging automation and digitalization in manufacturing, a trend mirrored globally. The manufacturing automation market was valued around $60 billion in 2024, with significant projected growth. By adopting these technologies, Innospec aims to enhance operational efficiency, reduce costs, and improve product consistency, thereby securing a competitive advantage.

Furthermore, Innospec is adapting to the energy transition by exploring chemical solutions for alternative fuels and renewable energy sources. The global bio-based chemicals market, valued at approximately $100 billion in 2024, represents a key area for innovation. This strategic pivot allows Innospec to capitalize on emerging green markets and develop offerings from renewable feedstocks.

| Technology Area | 2023 R&D Spend | Key Trend | Market Relevance |

|---|---|---|---|

| Chemical Synthesis & Formulation | $48.5 million | Enhanced Performance Additives | Lower Emissions, Improved Engine Efficiency |

| Automation & Digitalization | N/A (Operational Investment) | Smart Factory Adoption | Increased Efficiency, Reduced Costs |

| Sustainable & Bio-based Chemistry | N/A (Integrated R&D) | Growth in Green Chemicals | Access to $100B Bio-based Market |

Legal factors

Innospec operates under a stringent global framework of environmental protection laws and chemical regulations. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and the US's TSCA (Toxic Substances Control Act) dictate how chemical substances are manufactured, utilized, and disposed of. Failure to comply can result in significant penalties, jeopardizing operating licenses and product access in key markets.

The company must maintain vigilant adherence to these evolving regulations, which include increasing scrutiny on substances like per- and polyfluoroalkyl substances (PFAS). As of early 2024, several jurisdictions are implementing or proposing further restrictions on PFAS, necessitating ongoing investment in compliance and potential product reformulation for Innospec to ensure continued marketability and avoid disruptions.

Innospec must navigate a complex web of product liability laws and safety standards across its diverse markets, particularly for personal care ingredients and fuel additives where consumer and environmental exposure is high. Failure to meet these rigorous requirements, such as those set by the European Chemicals Agency (ECHA) for REACH compliance, can lead to significant fines and reputational damage.

Maintaining robust product safety through comprehensive testing, accurate labeling, and adherence to global standards like ISO certifications is paramount. For instance, in 2024, regulatory bodies worldwide continue to scrutinize chemical safety, with ongoing updates to substance restrictions impacting formulation choices and requiring diligent compliance management to avoid costly recalls or lawsuits.

Protecting Innospec's intellectual property, particularly its innovative chemical formulations and manufacturing processes, is paramount to sustaining its market edge. The company relies on robust legal frameworks for patent registration, ensuring its unique technologies are legally safeguarded. In 2023, Innospec continued to invest in R&D, with a significant portion of its budget allocated to developing and protecting new intellectual property.

Labor Laws and Employment Regulations

Innospec must navigate a complex web of labor laws and employment regulations across its global operations, impacting everything from worker safety to wage structures and working conditions. Compliance is not just a legal necessity but a cornerstone of maintaining a positive employee environment and a strong corporate reputation. Failure to adhere to these diverse mandates can lead to costly legal battles and damage to Innospec's standing as a responsible employer. For instance, in 2024, companies globally faced increased scrutiny on fair wage practices, with several jurisdictions implementing or considering significant minimum wage hikes.

Adherence to these regulations is critical for several reasons:

- Legal Compliance: Avoiding penalties and litigation stemming from violations of worker safety, wage, and non-discrimination laws.

- Employee Morale: Fostering a positive and fair work environment, which is crucial for talent retention and productivity.

- Reputational Management: Upholding the image of a responsible and ethical employer in the international market.

- Operational Stability: Ensuring uninterrupted business operations by mitigating risks associated with labor disputes and regulatory interventions.

Anti-Trust and Competition Laws

Innospec operates within highly competitive sectors and must diligently comply with anti-trust and competition laws. These regulations are crucial for preventing monopolistic behaviors and ensuring a level playing field, safeguarding against unfair competitive advantages.

Adherence to these legal frameworks is particularly vital during mergers, acquisitions, or the formation of strategic alliances. Such actions require careful scrutiny to maintain fair market practices and avoid potential legal repercussions from regulatory authorities.

For instance, the European Commission actively monitors market concentration. In 2023, the Commission reviewed over 300 mergers, with a significant portion flagged for in-depth investigation due to potential competition concerns. This highlights the rigorous oversight Innospec and its peers face.

- Regulatory Scrutiny: Competition authorities globally, including the US Federal Trade Commission (FTC) and the UK's Competition and Markets Authority (CMA), scrutinize market share and business practices.

- Merger Control: Transactions exceeding certain thresholds require pre-notification and approval, ensuring they do not substantially lessen competition.

- Anti-Competitive Agreements: Laws prohibit cartels, price-fixing, and market-sharing arrangements that distort competition.

- Abuse of Dominance: Companies with significant market power are restricted from exploiting their position to the detriment of consumers or competitors.

Innospec's operations are heavily influenced by international chemical regulations like REACH and TSCA, with ongoing scrutiny on substances such as PFAS as of early 2024, demanding continuous compliance investment and potential reformulation to maintain market access.

Product liability and safety standards are critical, particularly for consumer-facing products, where adherence to global norms and accurate labeling are vital to prevent costly recalls and lawsuits, especially with evolving safety regulations in 2024.

Intellectual property protection remains a key legal focus, with Innospec investing in patent registration to safeguard its chemical formulations and manufacturing processes, a strategy reinforced by its 2023 R&D investments.

Labor laws and employment regulations globally impact Innospec's workforce management, with a 2024 trend towards increased scrutiny on fair wage practices and working conditions, necessitating robust compliance to uphold its reputation as an employer.

Environmental factors

Innospec faces significant operational costs due to stringent regulations on chemical waste disposal and pollution control, impacting its manufacturing processes. For instance, the European Union’s Industrial Emissions Directive (IED) mandates strict limits on pollutants from industrial activities, requiring substantial investment in advanced abatement technologies for facilities like Innospec's.

To maintain compliance and its public image, the company must continually invest in sustainable waste management and pollution control systems, which directly affect its bottom line and competitive positioning. Failure to adhere to these environmental standards could jeopardize operational permits and lead to reputational damage, as seen with past environmental fines levied against chemical manufacturers globally.

The intensifying global commitment to carbon footprint reduction and climate change mitigation presents a significant environmental factor for Innospec. This translates into mounting pressure on the company to decrease greenhouse gas (GHG) emissions stemming from both its operational activities and the lifecycle of its products.

Innospec is actively addressing this by focusing on reducing its Scope 1 and Scope 2 GHG emissions. Simultaneously, the development of fuel additives designed to help customers lower their CO2e emissions is a key strategy. These efforts are vital for Innospec to align with international climate objectives and meet the growing expectations of investors, regulators, and the public.

Increasing global concerns about resource scarcity directly affect Innospec's reliance on chemical inputs. For instance, the International Energy Agency (IEA) has highlighted growing demand for critical minerals essential in various chemical processes, projecting a significant increase in demand for lithium and cobalt by 2030, which could impact raw material costs and availability for Innospec.

The company's strategy must therefore focus on identifying and securing reliable, sustainably sourced raw materials. This includes exploring renewable or recycled alternatives to traditional chemical inputs, a move that aligns with increasing investor pressure for Environmental, Social, and Governance (ESG) performance. Innospec's 2024 sustainability report indicated a target to increase the proportion of sustainably sourced materials in its key product lines by 15% by 2027.

This proactive approach to sustainable sourcing not only enhances supply chain resilience against potential disruptions but also positions Innospec to meet evolving environmental regulations and customer expectations. Companies that demonstrate robust sustainable sourcing practices are increasingly favored, contributing to a stronger brand reputation and potentially better access to capital.

Impact of Climate Change on Operations and Supply Chains

Innospec's operations and supply chains face significant disruption risks from the physical impacts of climate change. Extreme weather events, like floods or droughts, can directly affect manufacturing facilities and transportation networks, potentially halting production or delaying deliveries. For instance, the increasing frequency of severe storms in regions where Innospec operates could lead to unexpected downtime and increased maintenance costs.

Water scarcity, another consequence of climate change, poses a critical threat, particularly for chemical manufacturing processes that often rely heavily on water. Ensuring access to reliable water sources is paramount for maintaining operational continuity.

To build resilience, Innospec must proactively assess and mitigate these climate-related risks. This involves developing adaptive strategies such as:

- Diversifying sourcing locations for raw materials to reduce reliance on climate-vulnerable regions.

- Strengthening infrastructure at manufacturing sites to withstand extreme weather events.

- Investing in water-efficient technologies and exploring alternative water sources.

- Developing robust business continuity plans that account for climate-induced disruptions.

Demand for Biodegradable and Environmentally Benign Solutions

Consumers and regulators increasingly favor chemicals that break down easily and pose little risk to the environment. This trend presents a significant opportunity for Innospec to lead with innovative, eco-friendly products.

Innospec's commitment to developing biodegradable and non-toxic ingredients, especially for its personal care and fuel additive segments, directly addresses this growing market demand. For instance, the company's personal care division has seen success with formulations that meet stringent environmental standards, reflecting a strategic alignment with consumer preferences. The global market for green chemicals is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 8% in the coming years, reaching hundreds of billions of dollars by 2030.

- Growing Consumer Preference: Surveys in 2024 indicate that over 70% of consumers actively seek out products with clear environmental benefits.

- Regulatory Push: Stricter regulations on chemical usage and disposal, particularly in Europe and North America, are driving demand for sustainable alternatives.

- Market Growth: The biodegradable ingredients market, a key area for Innospec, is expected to exceed $50 billion globally by 2027.

Innospec faces increasing pressure to reduce its environmental footprint, driven by stringent regulations like the EU's Industrial Emissions Directive and global climate change initiatives. The company is actively investing in sustainable practices, focusing on reducing greenhouse gas emissions and developing eco-friendly products. For example, Innospec aims to increase sustainably sourced materials by 15% by 2027, demonstrating a commitment to environmental stewardship.

Resource scarcity, particularly for critical minerals, impacts raw material costs and availability, necessitating a focus on reliable and sustainable sourcing. Climate change also poses physical risks, such as extreme weather events and water scarcity, requiring Innospec to build resilience through diversified sourcing and infrastructure upgrades.

Consumer demand for biodegradable and non-toxic chemicals is growing, presenting an opportunity for Innospec's personal care and fuel additive segments. The global green chemicals market is projected for substantial growth, with biodegradable ingredients alone expected to exceed $50 billion by 2027.

Innospec's environmental performance is increasingly scrutinized by investors and regulators, making adherence to environmental standards crucial for maintaining operational permits and brand reputation.

| Environmental Factor | Impact on Innospec | Innospec's Response/Strategy | Relevant Data/Projections |

|---|---|---|---|

| Regulatory Compliance | Increased operational costs for waste disposal and pollution control. | Investment in advanced abatement technologies; adherence to directives like IED. | EU's Industrial Emissions Directive (IED) mandates strict pollutant limits. |

| Climate Change Mitigation | Pressure to reduce greenhouse gas (GHG) emissions. | Focus on Scope 1 & 2 GHG reduction; development of CO2e-reducing fuel additives. | Global commitment to carbon footprint reduction. |

| Resource Scarcity | Potential impact on raw material costs and availability. | Focus on identifying and securing reliably, sustainably sourced raw materials; exploring renewable/recycled alternatives. | Target to increase sustainably sourced materials by 15% by 2027. |

| Physical Climate Risks | Disruptions from extreme weather and water scarcity. | Diversifying sourcing locations, strengthening infrastructure, investing in water-efficient technologies. | Increasing frequency of severe storms and water scarcity globally. |

| Consumer & Regulatory Preference for Eco-Friendly Products | Demand for biodegradable and non-toxic chemicals. | Development of biodegradable and non-toxic ingredients for personal care and fuel additives. | Global green chemicals market projected to grow over 8% CAGR; biodegradable ingredients market to exceed $50 billion by 2027. |

PESTLE Analysis Data Sources

Our Innospec PESTLE analysis is constructed using data from official government publications, leading financial news outlets, and reputable industry-specific research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Innospec.