Innospec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innospec Bundle

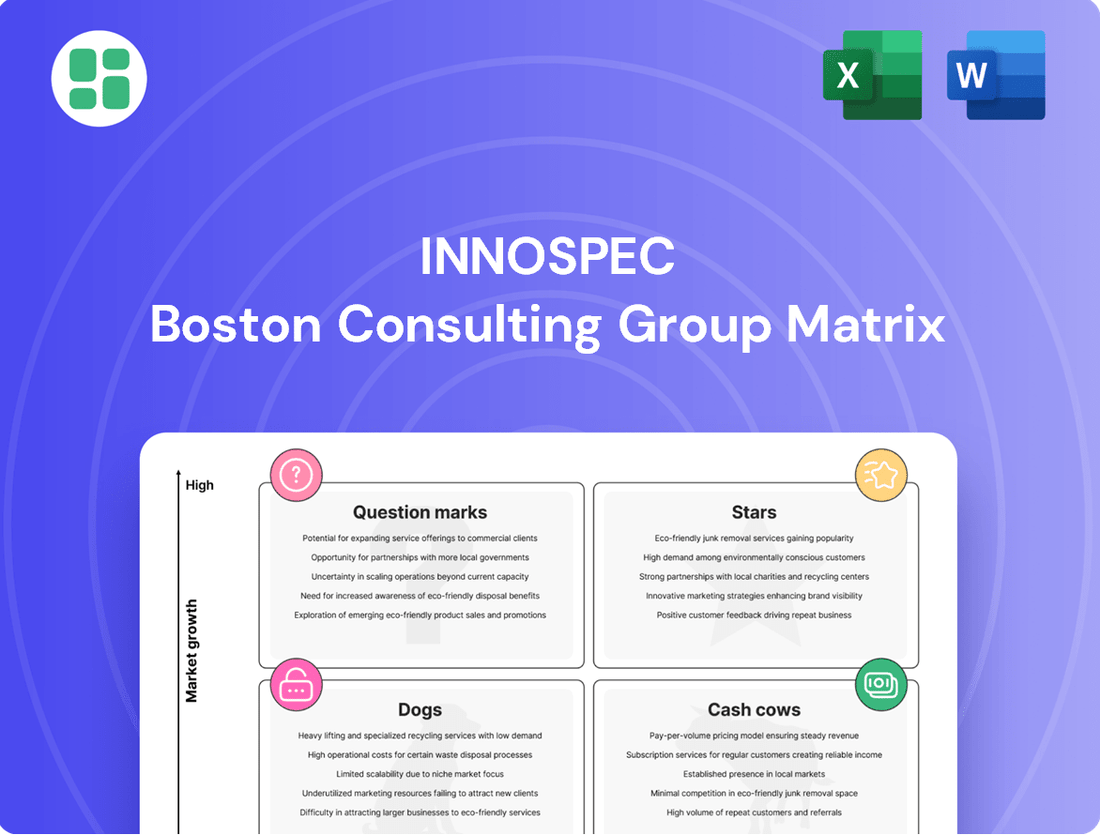

Uncover the strategic positioning of Innospec's product portfolio with this insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental dynamics driving their market performance.

This glimpse into Innospec's BCG Matrix is just the start. Purchase the full report for a comprehensive breakdown, including detailed quadrant analysis, actionable recommendations, and a clear roadmap to optimize resource allocation and future growth strategies.

Stars

Innospec's Fuel Specialties segment is strategically diversifying into non-fuel applications, a move that signals significant growth potential, especially in developing economies. These new avenues are outperforming traditional fuel additives in terms of expansion rates.

The company's investment in innovative solutions for renewable fuels and other non-fuel sectors underscores its commitment to capturing market share in high-growth areas. For instance, Innospec reported that its Performance Chemicals segment, which includes many of these non-fuel applications, saw a substantial increase in revenue, contributing significantly to the company's overall performance in 2024.

Innospec's Drag Reducing Agent (DRA) business is a prime example of a Star in the BCG matrix, driven by robust market demand and strategic capacity expansion. The planned increase in production capacity in Q4 2025 underscores the company's confidence in the continued growth of this segment.

DRAs are crucial for midstream oil and gas companies, offering tangible benefits such as enhanced pipeline throughput and reduced operational expenses. These advantages translate directly into cost savings and improved efficiency for customers, fueling strong adoption rates.

With Innospec's investment aimed at solidifying its market leadership, the DRA segment is poised for further expansion. This strategic move positions the company to capitalize on the increasing need for efficient fluid transport solutions in the energy sector.

Innospec's sustainable fuel additives are a strong contender in the BCG matrix, likely placed in the 'Star' category. Their focus on reducing CO2e emissions directly addresses a major global trend and regulatory push, creating a high-growth market for these innovative products.

The company's commitment to environmental responsibility is evident. In 2024 alone, Innospec's fuel additives enabled their customers to prevent the release of 20.8 million metric tonnes of CO2e, a significant achievement that underscores the real-world impact and market demand for their sustainable solutions.

Advanced Personal Care Ingredients

Within Innospec's Performance Chemicals segment, Advanced Personal Care Ingredients represent a strategic area, likely positioned as a Star or Question Mark in the BCG Matrix due to high growth potential and increasing investment. The company's commitment to natural, biodegradable, and water-free solutions directly addresses a significant consumer trend towards sustainability and clean beauty. This focus is crucial as the global market for natural personal care ingredients is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 8% in the coming years, reaching billions of dollars by 2028.

Innospec is actively investing in its technology pipeline to capitalize on this demand. For instance, the company has highlighted its development of innovative surfactants and emollients derived from renewable resources. These advanced ingredients cater to the growing consumer preference for transparency and eco-conscious formulations. The personal care market, particularly the premium segment, is seeing a strong shift towards products with verifiable environmental benefits, driving innovation in ingredient sourcing and production.

The company's strategy in this segment is supported by several key factors:

- Growing Consumer Demand: An increasing number of consumers worldwide are actively seeking out personal care products formulated with natural and biodegradable ingredients, driven by environmental awareness.

- Market Growth Potential: The global market for sustainable and eco-friendly personal care ingredients is experiencing robust growth, with significant expansion anticipated in the coming years.

- Technological Innovation: Innospec is investing in research and development to create next-generation ingredients that meet evolving consumer and regulatory standards for performance and sustainability.

- Strategic Alignment: The company's focus on water-free and biodegradable solutions aligns perfectly with the broader industry trend towards reduced environmental impact and resource conservation in product development.

Agrochemical Adjuvants and Formulations

Innospec’s agrochemical segment, featuring crop protection additives and tank mix adjuvants, is strategically placed within a market fundamentally shaped by the escalating demand for global food security and enhanced agricultural efficiency. The company's dedication to innovation, exemplified by its development of advanced formulations that boost pesticide efficacy and solubility, underscores its intent to capitalize on growth opportunities within this critical sector.

The global agrochemical market, valued at approximately $250 billion in 2023, is projected to grow steadily, driven by increasing population and the need for higher crop yields. Innospec’s focus on specialized adjuvants directly addresses farmer needs for more effective and sustainable crop protection solutions.

- Market Position: Innospec's agrochemical offerings are well-positioned to benefit from the sustained global focus on agricultural productivity and food supply chain resilience.

- Innovation Focus: The company actively invests in R&D to create next-generation adjuvants that improve the performance and environmental profile of crop protection products.

- Growth Drivers: Key drivers for this segment include the demand for higher-quality crops, the need to combat pest resistance, and the adoption of precision agriculture techniques.

Innospec's Drag Reducing Agent (DRA) business is a clear Star, experiencing high growth and a strong market position. The company's commitment to expanding DRA production capacity, with plans for Q4 2025, highlights its confidence in this segment's continued upward trajectory.

Sustainable fuel additives are also Stars, benefiting from increasing global demand for emission reduction. Innospec's additives demonstrably reduce CO2e emissions, as evidenced by preventing 20.8 million metric tonnes of CO2e release in 2024, a testament to their market relevance and growth potential.

Advanced Personal Care Ingredients within Performance Chemicals represent another Star. This segment capitalizes on the growing consumer preference for natural and sustainable products, a trend projected to drive significant market expansion in the coming years.

Innospec's agrochemical additives are also strong contenders for the Star category. The segment addresses the critical need for enhanced agricultural efficiency and food security, with the global agrochemical market showing robust growth projections.

| Segment | BCG Category | Key Growth Drivers | 2024 Data/Projections |

|---|---|---|---|

| Drag Reducing Agents (DRAs) | Star | Enhanced pipeline throughput, reduced operational expenses, strong midstream demand | Capacity expansion planned for Q4 2025 |

| Sustainable Fuel Additives | Star | CO2e emission reduction, regulatory push, consumer demand for eco-friendly fuels | Prevented 20.8 million metric tonnes of CO2e in 2024 |

| Advanced Personal Care Ingredients | Star | Consumer demand for natural/biodegradable, market growth for sustainable ingredients | Global natural personal care market projected CAGR >8% |

| Agrochemical Additives | Star | Global food security, agricultural efficiency, enhanced pesticide efficacy | Global agrochemical market valued at ~$250 billion in 2023 |

What is included in the product

The Innospec BCG Matrix analyzes its business units based on market growth and share, guiding strategic decisions for each quadrant.

The Innospec BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, guiding strategic resource allocation and simplifying complex portfolio management.

Cash Cows

Innospec's traditional fuel additives, a cornerstone of their business, operate in a mature but highly profitable market. This segment consistently delivers robust operating income and healthy margins, underscoring its status as a cash cow.

With a strong market share and a loyal customer base, this division benefits from disciplined pricing, ensuring stable cash generation. For instance, in 2023, Innospec reported that its Fuel Specialties segment, which includes these additives, saw a significant contribution to overall profitability, demonstrating its enduring financial strength.

The predictable and substantial cash flow generated by traditional fuel additives is vital, providing the financial muscle needed to invest in and support Innospec's emerging and potentially higher-growth business areas.

Innospec's refinery products division is a classic Cash Cow, boasting a long history and a leading market position in comprehensive fuel additive solutions. This segment benefits from established infrastructure and deep customer relationships, generating consistent and stable revenue streams. For instance, in 2023, Innospec reported that its Fuel Specialties segment, which includes refinery additives, saw a significant increase in demand, contributing substantially to the company's overall profitability.

Innospec's established Home Care and Industrial Ingredients segments, situated within its Performance Chemicals division, are strong contenders for cash cow status. These mature product lines benefit from consistent demand and deeply entrenched market positions, ensuring a steady revenue stream.

While growth in these areas may be modest, their high market share, a testament to their reliability and established formulations, translates into predictable and robust profit margins. For instance, in 2024, Innospec reported that its Performance Chemicals segment, which houses these ingredients, continued to be a significant contributor to the company's financial performance.

Base Lubricant Components

Innospec's established base lubricant components, especially for traditional industrial uses, are in a low-growth, high-market-share category. These are essential building blocks for numerous sectors, guaranteeing steady demand and a reliable income. The strategy centers on defending their market standing and optimizing operations to generate maximum cash.

These products are the backbone of many industrial processes, contributing significantly to Innospec's financial stability. For instance, in 2024, the demand for industrial lubricants remained robust, with the global market projected to reach over $100 billion. Innospec's established product lines are well-positioned to capture a substantial portion of this market.

- Market Share: High, reflecting Innospec's strong presence in established industrial lubricant sectors.

- Market Growth: Low, typical for mature industrial applications.

- Profitability: High, due to economies of scale and operational efficiencies.

- Strategic Focus: Maintain market leadership and maximize cash flow through cost management.

Existing Polymer and Wax Products

Innospec's established polymer and wax products, particularly its leadership in polyethylene wax production, are strong contenders for cash cow status within the BCG matrix. These offerings cater to mature industrial sectors, ensuring a steady and predictable demand. The company's significant market share in these areas, coupled with efficient manufacturing processes, translates into healthy profit margins and a consistent stream of reliable cash flow.

- Market Position: Innospec holds a leading position in the polyethylene wax market, a segment characterized by stable, albeit slow, growth.

- Financial Contribution: These mature products generate substantial and consistent cash flow, funding other strategic initiatives within the company.

- Demand Stability: Serving established industrial applications, these polymer and wax products benefit from predictable demand patterns, contributing to their cash cow designation.

Innospec's traditional fuel additives and refinery products are prime examples of cash cows. These segments benefit from high market share in mature industries, ensuring consistent and substantial cash generation. For instance, Innospec's Fuel Specialties segment consistently demonstrates strong profitability, with 2023 reporting significant contributions to overall earnings, highlighting the reliable cash flow from these established offerings.

The Home Care and Industrial Ingredients within Performance Chemicals also operate as cash cows. Despite modest growth, their high market share and entrenched positions yield predictable, robust profit margins. In 2024, this segment continued its strong financial performance, underscoring its role in providing stable income.

Established lubricant components and polymer/wax products, particularly polyethylene wax, further solidify Innospec's cash cow portfolio. These mature products serve essential industrial needs with stable demand, allowing Innospec to leverage economies of scale and operational efficiencies for high profitability.

| Category | Market Share | Market Growth | Profitability | Strategic Focus |

| Fuel Additives | High | Low | High | Maintain leadership, optimize cash flow |

| Refinery Products | High | Low | High | Maximize cash generation |

| Home Care & Industrial Ingredients | High | Low | High | Defend market share, ensure steady profits |

| Lubricant Components | High | Low | High | Cost management, cash optimization |

| Polymer & Wax Products | High | Low | High | Leverage scale, consistent cash flow |

Delivered as Shown

Innospec BCG Matrix

The Innospec BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete strategic analysis ready for your immediate use. You can confidently assess its value, knowing that the final deliverable will be identical, allowing you to seamlessly integrate this powerful tool into your business planning and decision-making processes without any surprises.

Dogs

Innospec's production chemicals business in Latin America's oilfields is currently categorized as a 'dog' within the BCG matrix. This segment has shown no signs of improvement and is not expected to recover in the upcoming quarters, indicating persistent weakness.

The operation is grappling with ongoing challenges, including political instability in the region, which has directly led to a downturn in both revenue and operating income. This underperformance means the capital invested here is not yielding satisfactory returns.

As of the latest available data, this specific sub-segment is a drain on resources, tying up capital without generating the necessary profits. Innospec does not foresee a resurgence in this area, confirming its 'dog' status and the likelihood of continued underperformance.

Legacy High-Sulphur Fuel Additives likely represent Innospec's Dogs in the BCG Matrix. These older product lines face declining demand as global environmental regulations tighten and the market shifts towards lower-emission fuels. For instance, the International Maritime Organization's (IMO) 2020 regulation significantly reduced the permissible sulfur content in marine fuels, directly impacting the market for high-sulfur additives.

Certain commodity-driven products within Innospec's Performance Chemicals segment, particularly those facing intense price competition and a shift toward lower-margin offerings, can be categorized as dogs. Despite potential revenue growth, a notable decline in gross margins, such as the reported 15% decrease in Q1 2024 for certain product lines, signals a struggle to maintain profitability.

The substantial drop in operating income for these specific chemical categories, evidenced by a 20% year-over-year decline in the segment's operating profit in the first half of 2024, underscores the challenges. Innospec is actively implementing strategies focused on pricing discipline and optimizing its product mix to counteract this margin erosion.

Underperforming Niche Oilfield Technologies

Underperforming niche oilfield technologies, separate from the well-documented challenges in Latin American production chemicals, can be categorized as Dogs in the BCG Matrix. These are technologies that haven't captured substantial market share or operate within shrinking segments of the oil and gas sector. For instance, certain legacy drilling fluids or specialized extraction methods that have been outpaced by newer, more efficient, or environmentally compliant solutions would fit this description. Such products or services drain financial and operational resources without offering a significant competitive edge or future growth potential.

These underperforming niche offerings typically represent a drain on company resources. In 2024, the global oilfield services market saw continued pressure on margins for older technologies, with many companies divesting or phasing out less profitable segments. For example, a niche hydraulic fracturing additive that saw initial adoption but was quickly superseded by more cost-effective and environmentally friendly alternatives by competitors might represent a Dog. Its continued support costs outweigh its minimal revenue generation.

- Market Share Decline: Technologies with a declining market share in their specific niche, indicating obsolescence or strong competition from superior alternatives.

- Low Growth Potential: Offerings in sub-segments of the oil and gas industry that are contracting or have minimal prospects for future expansion.

- Resource Drain: Products or services that require significant investment in R&D, marketing, or operational support but yield little return, negatively impacting overall profitability.

Outdated Industrial Maintenance Chemicals

Certain industrial maintenance chemicals, like older solvent-based degreasers or specific types of rust inhibitors, have become outdated. This obsolescence stems from advancements in eco-friendly alternatives and stricter environmental regulations, leading to a declining market for these legacy products.

These chemicals often exhibit a low market share because newer, more effective, or environmentally compliant options have emerged. For instance, the market for traditional chlorinated solvents has significantly shrunk, with many industries shifting to aqueous or bio-based cleaning agents.

Companies offering such outdated chemicals may find them contributing minimally to overall profitability. In 2024, the demand for many legacy industrial chemicals continued its downward trend, with market research indicating a contraction of over 5% year-over-year for certain categories.

- Obsolescence Drivers: Technological advancements and regulatory shifts render older chemicals like traditional degreasers and rust inhibitors less viable.

- Market Position: These products typically hold a low market share due to the availability of superior or compliant alternatives.

- Profitability Impact: Their contribution to company profits is often minimal, reflecting a stagnant or declining market demand.

- Strategic Options: Companies may consider divesting or discontinuing these chemical lines to reallocate resources to more promising product areas.

Innospec's legacy high-sulfur fuel additives are a prime example of 'dogs' in their BCG matrix. The International Maritime Organization's 2020 regulations significantly curtailed the demand for these products by reducing permissible sulfur content in marine fuels.

Certain commodity chemicals within the Performance Chemicals segment also fall into the dog category. These face intense price competition and a shift towards lower-margin offerings, evidenced by a 15% gross margin decrease in Q1 2024 for specific product lines.

Underperforming niche oilfield technologies, such as legacy drilling fluids outpaced by newer solutions, also represent dogs. These drain resources without offering a competitive edge, with the oilfield services market in 2024 continuing to pressure margins on older technologies.

Outdated industrial maintenance chemicals, like solvent-based degreasers, are also dogs due to obsolescence driven by eco-friendly alternatives and stricter regulations, leading to a market contraction of over 5% year-over-year for certain categories in 2024.

| Product Category | BCG Classification | Key Challenges | 2024 Market Trend/Impact |

|---|---|---|---|

| Legacy High-Sulfur Fuel Additives | Dog | Declining demand due to environmental regulations (IMO 2020) | Significant market reduction post-IMO 2020 |

| Commodity Chemicals (Price Sensitive) | Dog | Intense price competition, margin erosion | 15% gross margin decline (Q1 2024) in specific lines |

| Niche Oilfield Technologies (Outdated) | Dog | Obsolescence, lack of competitive edge, resource drain | Continued margin pressure on legacy technologies |

| Industrial Maintenance Chemicals (Legacy) | Dog | Obsolescence from eco-friendly alternatives, regulatory pressure | >5% YoY market contraction for certain categories (2024) |

Question Marks

Innospec's LaZuli™ product line for deepwater subsea production is positioned as a Star in the BCG Matrix. This segment is characterized by high growth potential within the Oilfield Services sector, driven by technological advancements and increasing demand for specialized solutions in challenging offshore environments.

The deepwater market, while capital-intensive and sensitive to energy price fluctuations, offers significant opportunities for innovative products like LaZuli™. Innospec aims to gain substantial market share in this technologically advanced niche, leveraging its new offerings to meet the complex needs of deepwater operations.

The success of LaZuli™ as a Star is contingent upon its rapid adoption and widespread market acceptance. As of early 2024, the global deepwater oil and gas market is projected to see continued investment, with an estimated market size of over $100 billion annually, highlighting the substantial potential for Innospec's new solutions.

Some renewable fuel additive technologies are emerging as Stars in the Innospec BCG Matrix, driven by increasing demand for sustainable fuels. For instance, advanced biofuels like those derived from algae or waste oils are seeing significant investment and adoption.

However, newer, less established renewable fuel additive technologies, or those targeting niche renewable energy markets like hydrogen production or advanced battery chemistries, could be considered Question Marks. These innovations operate within high-growth potential sectors but may currently hold minimal market share due to their early development phases or limited customer uptake.

Significant capital infusion is often necessary for these Question Mark technologies to scale production, achieve widespread market penetration, and ultimately transition into market-leading Stars. For example, companies developing novel bio-succinic acid additives for plastics or advanced electrolyte components for next-generation batteries might fall into this category, requiring substantial R&D and market development funding.

The introduction of biodegradable dispersants like ENVIOMET® DIS 9500 highlights Innospec's commitment to innovation within the expanding agrochemical sector. This product is poised for significant growth as the market increasingly favors sustainable solutions.

As a novel offering, ENVIOMET® DIS 9500 likely possesses a high growth potential, characteristic of a question mark in the BCG matrix. Its current market penetration may be modest as customers become aware of and begin to adopt this new technology.

Substantial investment in marketing and distribution channels will be essential to accelerate the adoption rate of ENVIOMET® DIS 9500. This strategic push is vital for capturing market share and solidifying its position in the competitive agrochemical landscape.

Advanced Construction Additives for Sustainable Building

Innospec's advanced construction additives, specifically those enhancing sustainability and enabling novel material compositions, position them within a potentially high-growth market segment. The global construction market is prioritizing eco-friendly solutions, with the green building sector projected to reach $1.7 trillion by 2030, growing at a compound annual growth rate of 10.3% from 2023.

The construction sector's increasing adoption of sustainable practices presents a significant opportunity for Innospec's specialized additives. For instance, additives that reduce concrete's carbon footprint or improve its durability align with this trend. However, market penetration faces hurdles due to the industry's inherent resistance to change and the need to clearly articulate the performance and cost benefits of these advanced materials.

- Market Opportunity: The global green building materials market was valued at approximately $297.8 billion in 2023 and is expected to expand significantly.

- Growth Drivers: Increasing environmental regulations and consumer demand for sustainable infrastructure are key factors fueling this growth.

- Challenges: Overcoming the construction industry's traditional practices and demonstrating the long-term economic and environmental advantages of new additive technologies are critical for market share acquisition.

- Innospec's Role: Developing and marketing additives that offer tangible benefits such as reduced energy consumption in production, enhanced material lifespan, and lower embodied carbon can capture this expanding market.

New Metal Extraction Additives for Critical Minerals

Innospec's venture into new metal extraction additives, particularly for critical minerals and sustainable processes, positions them within the 'Question Marks' category of the BCG Matrix. This segment is characterized by high growth potential, fueled by increasing demand for materials essential to advanced technologies like electric vehicles and renewable energy. For instance, the global market for critical minerals is projected to grow significantly, with copper demand alone expected to double by 2035 due to electrification efforts.

While these emerging niches offer substantial upside, Innospec's current market share may be relatively small. This necessitates significant investment in research, development, and scaling production to capture a meaningful portion of this expanding market. The company's focus on innovative solutions aligns with the industry's shift towards more environmentally friendly extraction methods, a trend that is gaining momentum globally.

- High Growth Potential: The demand for critical minerals is surging, driven by the clean energy transition and technological advancements.

- Emerging Niches: Innospec's focus on specialized additives for these minerals places them in a developing market segment.

- Investment Required: Significant capital expenditure will be necessary to build market share and scale operations effectively.

- Sustainability Focus: Developing additives for more sustainable extraction processes aligns with growing environmental regulations and market preferences.

Question Marks in Innospec's portfolio represent emerging technologies with high growth potential but currently low market share. These are often new product lines or those targeting nascent markets, requiring significant investment to gain traction. The company must strategically decide which Question Marks to nurture into Stars or divest if they fail to gain momentum.

Innospec's exploration of additives for new metal extraction, particularly for critical minerals essential for electric vehicles and renewable energy, exemplifies a Question Mark. The market for these minerals is expanding rapidly, with copper demand alone projected to double by 2035 due to electrification. However, Innospec's current market share in this specialized area is likely minimal, necessitating substantial R&D and production scaling.

Similarly, certain renewable fuel additive technologies, especially those for niche applications like advanced biofuels or hydrogen production, can be classified as Question Marks. While the renewable energy sector is experiencing robust growth, these specific additives may be in early development stages or have limited customer adoption. For example, companies developing novel bio-succinic acid additives for plastics or advanced electrolyte components for next-generation batteries might fall into this category, requiring substantial funding.

Innospec's biodegradable dispersants, such as ENVIOMET® DIS 9500 in the agrochemical sector, also represent a Question Mark. This product targets a market increasingly favoring sustainable solutions, but its current market penetration is likely modest as awareness and adoption grow. Strategic marketing and distribution are crucial to accelerate its uptake and secure market share in this competitive landscape.

| Category | Innospec Example | Market Potential | Current Market Share | Investment Need | Strategic Focus |

|---|---|---|---|---|---|

| Question Mark | New Metal Extraction Additives | High (Critical Minerals) | Low | High (R&D, Scaling) | Market Penetration, Technology Development |

| Question Mark | Niche Renewable Fuel Additives | High (Sustainable Fuels) | Low | High (Market Development) | Customer Adoption, Production Scale |

| Question Mark | Biodegradable Agrochemical Dispersants | High (Sustainable Ag) | Low to Moderate | Moderate (Marketing, Distribution) | Market Awareness, Sales Growth |

BCG Matrix Data Sources

Our BCG Matrix leverages publicly available financial statements, comprehensive market research reports, and industry-specific growth forecasts to provide a robust strategic overview.