ING Groep PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ING Groep Bundle

Navigate the complex external forces shaping ING Groep's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, societal shifts, technological advancements, evolving environmental regulations, and legal frameworks are impacting this global financial giant. Gain the strategic foresight needed to make informed decisions and stay ahead of the curve. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governments and financial regulators globally are tightening their grip on the banking industry. This means ING, like other major banks, faces increasingly stringent rules on capital reserves, liquidity, and how they manage risks. For instance, the Basel III framework, which has been progressively implemented, continues to shape capital adequacy ratios, with ongoing discussions about potential further adjustments in 2024 and 2025. These evolving requirements directly impact ING's operational costs and strategic flexibility.

Navigating this intricate regulatory landscape is a significant challenge for a global entity like ING. Compliance with diverse national and supranational regulations, such as those from the European Central Bank for its Eurozone operations and various national authorities elsewhere, incurs substantial costs. These compliance expenditures can directly affect profitability, as seen in the ongoing investments banks are making to meet evolving data privacy and cybersecurity mandates.

Moreover, political transitions and policy shifts introduce a layer of uncertainty. Changes in government administrations can lead to alterations in the regulatory agenda, potentially impacting ING's long-term strategic planning and investment decisions. For example, discussions around digital currency regulation or changes in international tax treaties, which are active topics in 2024, could significantly alter the operating environment for financial institutions.

Global geopolitical tensions, including ongoing conflicts and trade disputes, present a significant challenge for ING's international operations. For instance, the continued impact of sanctions related to geopolitical events in Eastern Europe can disrupt cross-border transactions and affect client confidence in affected regions.

Shifting trade agreements and the rise of protectionist policies directly influence ING's ability to facilitate international commerce. The World Trade Organization (WTO) reported a slight increase in trade-restrictive measures by G20 economies in the first half of 2024, impacting global supply chains and financial flows.

ING's strategic imperative involves robust monitoring and agile adaptation to these volatile political landscapes. This includes proactive risk management to mitigate potential disruptions to its extensive European and Asian client base and ensuring business continuity amidst evolving international relations.

Political stability in ING's key markets, such as the Netherlands, Germany, and Belgium, directly shapes its operating landscape. For instance, the Netherlands, a core market for ING, maintained a stable political environment throughout 2023 and into early 2024, with a focus on economic resilience and digital transformation initiatives that benefit financial services.

Conversely, geopolitical tensions in other regions where ING operates, or has exposure through its investment banking activities, can introduce volatility. For example, ongoing global supply chain disruptions stemming from political conflicts in Eastern Europe continued to impact economic growth forecasts in 2024, potentially affecting ING's clients and their ability to service loans.

ING's continuous assessment of political risk is crucial. In 2023, the bank likely factored in the potential impact of upcoming elections in several European countries on fiscal policies and regulatory frameworks, which could influence credit risk and investment strategies across its European footprint.

Monetary and Fiscal Policy Directives

Government and central bank policies on interest rates and fiscal spending significantly influence the banking sector. For instance, the European Central Bank's (ECB) monetary policy, including its deposit facility rate, directly impacts ING's funding costs and lending income. As of early 2024, the ECB maintained a relatively high interest rate environment following a period of tightening, which generally benefits banks' net interest margins.

ING's financial performance is closely tied to these policy shifts. Changes in quantitative easing programs can affect bond yields, impacting ING's investment portfolio returns. Furthermore, government fiscal policies, such as changes in public spending or taxation, can influence overall economic activity and credit demand, thereby affecting ING's loan growth and profitability.

Key policy considerations for ING include:

- Interest Rate Environment: The ECB's benchmark rates, such as the main refinancing operations rate and the deposit facility rate, directly influence ING's net interest income. For example, a sustained period of higher rates, like those seen in 2023 and early 2024, typically widens the spread between lending and deposit rates.

- Quantitative Easing/Tightening: Central bank asset purchase programs (QE) or sales (QT) affect liquidity in the financial system and bond yields, impacting ING's treasury operations and investment returns.

- Fiscal Stimulus/Austerity: Government spending and taxation policies can boost or dampen economic growth, influencing loan demand and the credit quality of ING's borrowers.

International Cooperation and Regulatory Harmonization

The extent of international cooperation among financial regulators significantly shapes the harmonization of banking standards globally. While efforts towards common frameworks can simplify operations for multinational institutions like ING, differing national priorities often result in a patchwork of regulations. For instance, the Basel III framework, aimed at strengthening bank capital requirements, has seen varying implementation timelines and specific interpretations across countries, impacting ING's compliance strategies.

Navigating this complex environment requires ING to remain agile and proactive. The Financial Stability Board (FSB), an international body, continues to promote regulatory coherence, but the pace of change and adoption varies. ING must therefore continuously monitor and adapt to both the convergence and divergence in international regulatory trends to maintain its competitive edge and ensure compliance across its diverse operating regions.

- Regulatory Divergence: Differences in national implementation of international standards like Basel III create compliance complexities for ING.

- Harmonization Efforts: International bodies like the FSB work towards consistent banking regulations, which can reduce operational friction for global banks.

- Adaptation Strategy: ING must actively engage with and adapt to evolving international regulatory landscapes, balancing global consistency with local requirements.

Governments globally are intensifying scrutiny of the banking sector, leading to stricter capital, liquidity, and risk management rules. For instance, the ongoing implementation and potential adjustments to Basel III in 2024 and 2025 directly influence ING's capital adequacy and operational costs. Political stability in core markets like the Netherlands remains a positive factor, supporting economic resilience and digital finance initiatives.

Geopolitical tensions and trade disputes pose significant challenges, impacting cross-border transactions and client confidence, as seen with ongoing sanctions affecting regions like Eastern Europe. Shifting trade agreements and protectionism, evidenced by a slight increase in trade-restrictive measures by G20 economies in early 2024, also affect global financial flows. ING's strategy necessitates agile adaptation to these volatile political landscapes and proactive risk management.

Government and central bank policies, particularly interest rate decisions by the European Central Bank (ECB), heavily influence ING's profitability. The ECB’s higher interest rate environment in 2023 and early 2024 generally benefited banks' net interest margins. Fiscal policies, such as government spending and taxation, also play a crucial role by affecting economic activity and credit demand, thus impacting ING's loan growth and overall financial performance.

What is included in the product

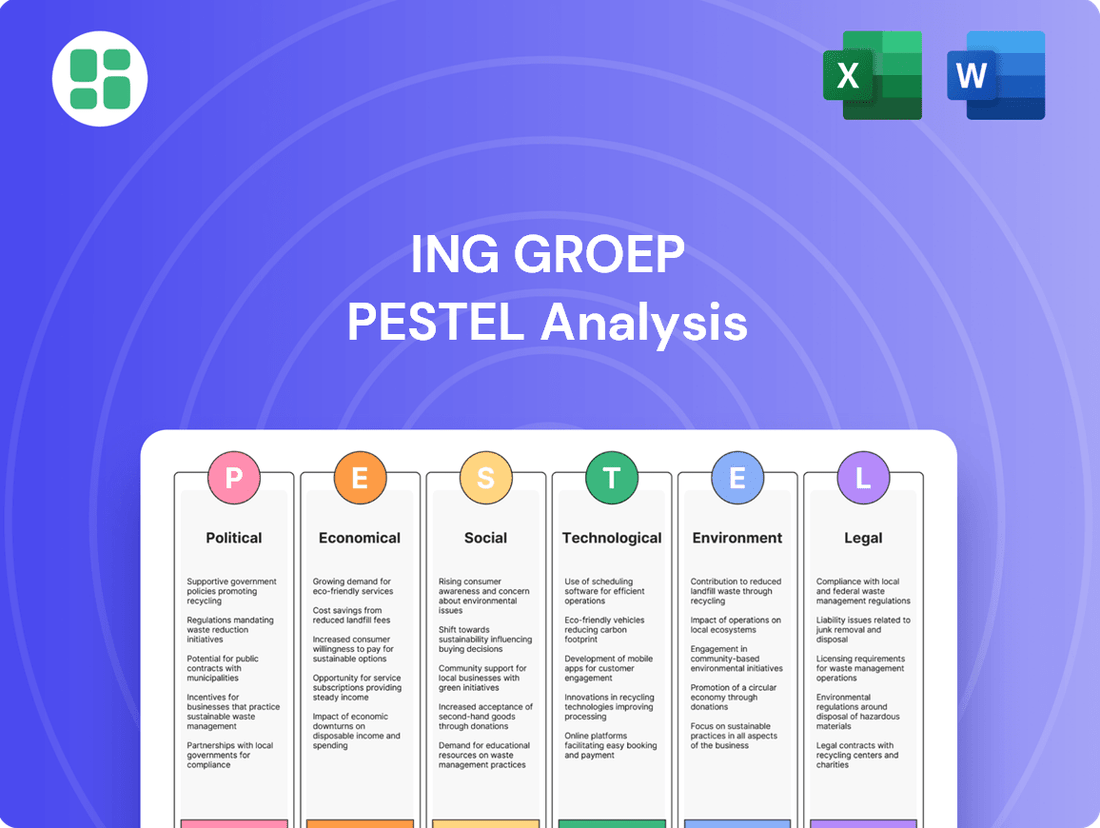

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing ING Groep, covering political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks.

It offers strategic insights by detailing how these factors present both challenges and opportunities for ING Groep's operations and future growth.

ING Groep's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliver by enabling quick referencing during meetings and presentations.

This analysis, segmented by PESTEL categories, offers a visually digestible format that simplifies complex market dynamics, relieving the pain of information overload for stakeholders.

Economic factors

The prevailing interest rate environment, shaped by central bank policies, directly influences ING's net interest income. For instance, the European Central Bank's (ECB) deposit facility rate, a key benchmark, stood at 4.00% as of mid-2024, a significant increase from previous years, impacting ING's funding costs and lending margins.

Rising interest rates, while potentially boosting net interest margins, also carry risks. Higher borrowing costs for customers could increase the likelihood of loan defaults, a critical factor for ING's risk management. The bank must adeptly manage its balance sheet to mitigate these potential negative impacts.

ING's asset and liability management strategies are crucial for navigating these monetary shifts. By adjusting its mix of loans, deposits, and other financial instruments, ING aims to optimize profitability in response to evolving interest rate landscapes and central bank actions.

Rising inflation in 2024 and projected into 2025 significantly impacts ING Groep by diminishing the real value of its capital and increasing operational expenses. For instance, persistent inflation, as seen in the Eurozone's 2.4% annual inflation rate in April 2024, directly raises the cost of goods and services ING procures, from technology to office supplies.

Central banks' primary tool against inflation, interest rate hikes, directly affects ING's cost of capital. The European Central Bank's (ECB) key interest rates, which stood at 3.75% for the main refinancing operations in mid-2024, influence how much ING pays to borrow funds, thereby impacting its lending margins and profitability.

Managing these inflationary pressures is crucial for ING's financial health. This involves strategies to mitigate the rising expense base while carefully assessing the quality of its loan portfolio, as higher interest rates can strain borrowers' ability to repay, potentially leading to increased credit risk.

The global economy is projected to grow by 2.7% in 2024, a slight slowdown from 3.0% in 2023, according to the IMF. This growth is uneven, with emerging markets generally outperforming advanced economies. However, persistent inflation and higher interest rates in many key ING markets, such as the Eurozone and the UK, pose significant recession risks, potentially dampening loan demand and increasing credit defaults.

Economic downturns directly impact ING's core business. For instance, a recession in the Netherlands, ING's largest market, could lead to higher unemployment and reduced corporate profitability, translating into increased non-performing loans for the bank. Similarly, a slowdown in major European economies would curtail investment banking activities and wealth management fees.

ING's financial health is intrinsically linked to these macroeconomic trends. The bank must vigilantly track indicators like GDP growth, inflation rates, and unemployment figures across its operating regions. For example, a sustained rise in the European Central Bank's policy rate, which has seen increases throughout 2023 and into 2024, directly affects ING's net interest income but also heightens the risk of loan defaults.

Currency Exchange Rate Fluctuations

As a global financial institution, ING Groep is significantly exposed to currency exchange rate fluctuations. These shifts can directly impact the reported value of its international assets, liabilities, and overall earnings when converted back to its primary reporting currency. For instance, a strengthening Euro against other major currencies could reduce the Euro-denominated value of ING's earnings generated in those foreign markets.

Significant volatility in exchange rates, such as those seen in 2024 with the US Dollar experiencing periods of strength against the Euro, can directly affect the profitability of ING's cross-border transactions and trade finance operations. This volatility can also impact the translation of earnings from its foreign subsidiaries, making financial planning and forecasting more complex. For example, if ING has substantial operations in a country whose currency depreciates significantly against the Euro, the reported profits from that subsidiary will be lower.

To manage these risks, ING employs robust hedging strategies. These strategies are crucial for mitigating the potential negative impacts of currency volatility on its financial performance. By using financial instruments like forward contracts and currency options, ING aims to lock in exchange rates for future transactions, thereby stabilizing its earnings and asset values.

- Impact on Earnings: Currency fluctuations directly affect the Euro-equivalent value of ING's profits earned in foreign currencies.

- Cross-Border Transactions: Volatile exchange rates can increase the cost or reduce the value of international trade finance and other cross-border activities.

- Hedging Necessity: ING's reliance on hedging strategies is critical to protect against adverse currency movements, ensuring greater financial stability.

- 2024 Context: The Euro experienced notable fluctuations against currencies like the US Dollar and British Pound throughout 2024, posing ongoing challenges for global banks.

Consumer Spending and Household Debt Levels

Consumer spending is a major driver for ING's retail banking operations. In the Eurozone, for instance, household consumption expenditure grew by an estimated 1.3% in 2023, a figure projected to reach 1.6% in 2024, according to European Commission forecasts. This sustained spending directly fuels demand for mortgages, car loans, and credit cards, key products for ING's retail segment.

Household debt levels present a dual-edged sword for ING. While moderate debt can indicate consumer confidence and willingness to engage with financial products, high leverage poses significant credit risk. For example, in late 2023, household debt in the Netherlands stood at approximately 115% of disposable income, a level that requires careful monitoring by ING, especially with interest rates potentially remaining elevated through 2024.

- Consumer spending in the Eurozone is expected to see continued growth in 2024, benefiting ING's retail banking product demand.

- High household debt, such as the over 115% of disposable income in the Netherlands, necessitates robust risk management by ING.

- ING must adapt lending strategies to manage credit risk associated with varying consumer debt levels across its markets.

Economic growth projections for 2024, such as the IMF's estimate of 2.7% global growth, indicate a moderate but potentially uneven recovery. This directly influences ING's loan demand and the overall health of its corporate and retail client portfolios. However, risks remain, with persistent inflation and higher interest rates in key markets like the Eurozone potentially leading to slower growth or even recessionary pressures, impacting credit quality.

Inflationary pressures, while showing signs of easing in some regions by mid-2024, continue to impact operational costs for ING and the real value of its earnings. For example, the Eurozone's inflation rate, which averaged around 2.4% in early 2024, necessitates careful management of expenses and a keen eye on the pricing of financial products to maintain profitability.

Interest rate policies set by central banks, such as the European Central Bank's key rates, which have been elevated through 2023 and into 2024, directly shape ING's net interest income. While higher rates can widen lending margins, they also increase borrowing costs for customers, potentially leading to higher default rates and impacting the bank's risk profile.

| Economic Factor | 2024 Projection/Data | Impact on ING | Key Considerations for ING |

|---|---|---|---|

| Global GDP Growth | IMF projects 2.7% for 2024 | Influences loan demand and credit risk | Monitor regional economic performance and recession risks |

| Eurozone Inflation | Around 2.4% annual rate (April 2024) | Increases operational costs, affects real earnings | Manage expenses, adjust product pricing |

| ECB Key Interest Rates | Elevated through 2023-2024 | Impacts net interest income and borrowing costs | Balance margin enhancement with credit risk management |

What You See Is What You Get

ING Groep PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ING Groep delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the financial institution. Gain immediate access to actionable insights for strategic planning.

Sociological factors

Societal shifts are heavily influencing how people interact with financial institutions. A significant trend is the overwhelming preference for digital-first banking. In 2024, a substantial majority of banking transactions are conducted online or via mobile apps, with this figure projected to climb further. ING, having established itself as a digital-centric bank, must remain at the forefront of this evolution.

Meeting these evolving customer preferences means ING needs to consistently enhance its digital platforms. This includes not only providing seamless user experiences but also offering personalized services that cater to individual needs. For instance, advancements in AI-driven financial advice and streamlined mobile onboarding processes are becoming crucial differentiators. Failing to innovate in these areas risks customer churn and a decline in market share, especially as competitors also invest heavily in digital capabilities.

Demographic shifts are a significant consideration for ING. Developed nations, particularly in Europe, are experiencing aging populations. For instance, in 2023, the median age in the Eurozone was around 44.5 years, a figure expected to continue rising. This trend increases demand for retirement planning, healthcare financing, and wealth management services.

Conversely, emerging markets often boast younger demographics. Africa, for example, has one of the youngest populations globally, with a median age in many countries below 20. This presents an opportunity for ING to focus on digital banking solutions, micro-financing, and products catering to young entrepreneurs and a growing middle class.

ING's strategy must adapt to these differing needs. Tailoring product portfolios and marketing campaigns to resonate with both the wealth preservation needs of older generations and the digital-first expectations of younger consumers is crucial for sustained growth and market penetration across its diverse operating regions.

Societal financial literacy levels directly influence consumer engagement with sophisticated financial products. In 2024, a significant portion of the global population still struggles with basic financial concepts, impacting their confidence in managing investments or understanding complex banking services.

Public trust in financial institutions is a fragile but crucial sociological element. Following the 2008 financial crisis and subsequent regulatory scrutiny, consumer confidence in banks has seen fluctuations, with recent surveys in late 2024 indicating a cautious but improving sentiment in some developed markets.

ING's strategy must prioritize building and retaining customer loyalty through robust financial education programs and unwavering ethical conduct. Initiatives that enhance transparency and empower consumers with financial knowledge are key to fostering long-term trust and engagement.

Workforce Diversity and Inclusion Expectations

Societal expectations for diversity, equity, and inclusion (DEI) are significantly shaping corporate landscapes, making it crucial for companies like ING to foster inclusive environments. This focus is vital not only for attracting and retaining top talent but also for bolstering brand reputation. ING's demonstrated commitment to DEI across its workforce, leadership, and customer interactions underscores its alignment with prevailing societal values.

A diverse workforce brings a multitude of perspectives, which is a powerful driver for innovation and a deeper understanding of varied customer segments. For instance, ING's 2023 annual report highlighted that 49% of its global workforce were women, with 33% in management positions, reflecting progress in gender diversity. Such initiatives are directly responsive to growing public demand for corporate accountability in social responsibility.

- Talent Attraction and Retention: Companies with strong DEI policies are more appealing to a broader talent pool, leading to better employee engagement and reduced turnover.

- Brand Reputation and Trust: Positive societal perception of DEI efforts enhances customer loyalty and investor confidence.

- Innovation and Market Understanding: Diverse teams are better equipped to understand and serve diverse customer bases, leading to more innovative products and services.

- Regulatory and Stakeholder Pressure: Increasing scrutiny from regulators and stakeholders on DEI metrics necessitates proactive engagement from organizations like ING.

Societal Attitudes Towards Sustainability and ESG

Societal attitudes are increasingly prioritizing sustainability and strong Environmental, Social, and Governance (ESG) performance. Consumers and investors alike are scrutinizing companies' ethical and environmental footprints, influencing purchasing and investment decisions. For instance, in 2024, a significant majority of global consumers indicated they would switch brands if another brand supported a good cause or was more sustainable, highlighting the direct impact of these values on market share.

This growing demand necessitates that ING Groep embed sustainability deeply within its operations and product development. By aligning its business strategy with ESG principles, ING can not only meet evolving societal expectations but also bolster its brand reputation and attract a wider customer base. Reports from 2024 show that companies with robust ESG strategies often outperform their peers in terms of long-term financial returns and resilience.

- Growing Consumer Preference: Surveys in early 2025 indicated that over 60% of millennials and Gen Z consider a company's sustainability efforts when making purchasing decisions.

- Investor Scrutiny: ESG-focused investment funds saw substantial inflows in 2024, reaching trillions of dollars globally, demonstrating a clear shift in capital allocation.

- Employee Expectations: A 2024 study revealed that a company's commitment to social and environmental responsibility is a key factor for talent attraction and retention.

- Regulatory Influence: While not a direct societal attitude, increasing regulatory focus on ESG reporting, driven by public pressure, reinforces the importance of these societal trends for businesses like ING.

Public trust in financial institutions remains a critical sociological factor, with consumer confidence showing a gradual but cautious improvement in many developed markets by late 2024, following periods of scrutiny. ING's focus on transparency and ethical conduct is paramount to solidifying this trust and fostering long-term customer loyalty.

Societal expectations for diversity, equity, and inclusion (DEI) are increasingly influencing corporate strategies. ING's commitment to DEI, as evidenced by its 2023 workforce diversity figures, aligns with prevailing societal values and enhances its appeal to both talent and customers.

Sustainability and ESG performance are now significant drivers of consumer and investor decisions, with a majority of consumers in 2024 indicating a willingness to switch brands based on ethical and environmental practices. ING's integration of ESG principles into its operations is therefore crucial for maintaining market competitiveness and brand reputation.

| Sociological Factor | 2024/2025 Data Point | Impact on ING |

|---|---|---|

| Digital Banking Preference | Over 80% of banking transactions conducted digitally (projected for 2025) | Requires continuous enhancement of digital platforms and personalized services. |

| Demographic Shifts (Europe) | Median age in Eurozone ~45 years (2023), increasing demand for retirement/wealth services. | Opportunity for tailored wealth management and retirement planning products. |

| Demographic Shifts (Emerging Markets) | Younger populations in regions like Africa present a growing base for digital banking. | Focus on accessible digital solutions and micro-financing for young entrepreneurs. |

| Financial Literacy | Significant portion of global population still struggles with basic financial concepts. | Necessitates robust financial education programs to build consumer confidence. |

| Public Trust | Cautiously improving consumer sentiment in developed markets (late 2024 surveys). | Emphasis on ethical conduct and transparency to maintain and build loyalty. |

| DEI Commitment | ING's 2023 report: 49% women in global workforce, 33% in management. | Attracts diverse talent and enhances brand reputation by aligning with societal values. |

| Sustainability Focus | >60% of millennials/Gen Z consider sustainability in purchasing (early 2025 surveys). | Drives need for embedded ESG strategies to meet consumer and investor expectations. |

Technological factors

The banking sector's digital transformation is accelerating, with mobile banking now the preferred method for many. ING's commitment to digital leadership means substantial ongoing investment in user-friendly, secure mobile apps and online services. This strategy aims to enhance customer experience and engagement through personalized offerings driven by data analytics.

Cybersecurity threats are a major concern for ING, especially as more financial dealings happen online. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a stark reminder of the potential impact on financial institutions. ING must remain vigilant against increasingly sophisticated attacks aimed at customer data and operational integrity.

Safeguarding sensitive financial information is critical for ING to maintain customer trust and adhere to stringent regulatory requirements. Failure to protect data can lead to significant financial penalties and reputational damage. For instance, the EU's GDPR fines can reach up to 4% of global annual revenue, underscoring the importance of robust data protection measures.

ING's ongoing commitment to cybersecurity involves substantial investment in advanced protective technologies, proactive threat intelligence gathering, and comprehensive employee training programs. This continuous effort is vital to counter the ever-evolving landscape of cyber risks and ensure the security of its digital infrastructure.

Artificial Intelligence and Machine Learning are revolutionizing banking, offering ING significant opportunities. These technologies can streamline operations, bolster risk assessment, and tailor customer interactions, with applications ranging from advanced fraud detection to more accurate credit scoring and predictive market analysis. By the end of 2024, ING had already invested heavily in AI capabilities, aiming to automate 80% of its customer service inquiries through AI-powered chatbots, a move expected to boost efficiency by 25%.

The strategic integration of AI and ML is crucial for ING to maintain and grow its competitive edge. By leveraging these tools for personalized financial advice and identifying emerging market trends through predictive analytics, ING can foster innovation across its diverse business segments. For instance, ING’s use of ML in its mortgage application process in 2025 led to a 15% reduction in processing times and a 10% improvement in accuracy compared to previous methods.

Fintech Competition and Collaboration

Fintech competition is forcing ING to adapt. Agile fintechs are challenging traditional banking, prompting ING to either compete head-on or partner with these innovators. For instance, in 2024, the global fintech market was valued at over $2.5 trillion, highlighting the scale of this disruption and the need for established players like ING to respond effectively.

Fintechs often specialize in specific services, compelling ING to speed up its digital enhancements to keep pace. This competitive pressure encourages ING to improve its own digital offerings and customer experiences. By 2025, it's projected that over 60% of banking customers will prefer digital channels for most interactions, underscoring the urgency for ING to bolster its digital capabilities.

ING can strategically collaborate with fintechs to integrate new technologies and services. These partnerships allow ING to expand its service ecosystem and better meet changing customer demands. For example, ING's 2024 investments in various fintech startups demonstrate a commitment to leveraging external innovation to enhance its own product suite and reach new customer segments.

- Fintech Market Growth: The global fintech market is expected to reach $3.5 trillion by 2025, indicating significant ongoing disruption for traditional banks.

- Digital Adoption: Customer preference for digital banking channels is projected to exceed 60% by 2025, pushing ING to accelerate its digital transformation efforts.

- Partnership Strategies: ING's strategic investments in fintech in 2024 signal a proactive approach to integrating innovative solutions and expanding its digital ecosystem.

- Competitive Landscape: The rise of specialized fintech services necessitates ING's continuous innovation in areas like payments, lending, and wealth management to remain competitive.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for ING, particularly in areas like cross-border payments and trade finance. These technologies promise greater security, transparency, and efficiency, potentially revolutionizing traditional banking processes. For instance, ING has been actively exploring DLT for various use cases, aiming to streamline operations and reduce costs.

The adoption of DLT could offer ING a competitive advantage as the financial services landscape continues to evolve. By piloting and integrating these technologies, ING can gain valuable insights into their practical applications and prepare for the future of digital finance. This proactive approach is crucial for maintaining market leadership.

Key areas where blockchain and DLT can impact ING include:

- Cross-border Payments: Enhancing speed and reducing fees compared to traditional correspondent banking.

- Trade Finance: Improving transparency and efficiency in letter of credit processes and supply chain finance.

- Identity Verification (KYC/AML): Creating more secure and streamlined digital identity solutions.

- Digital Assets: Facilitating the issuance and management of tokenized securities and other digital assets.

Technological advancements are reshaping banking, with ING prioritizing digital innovation. The bank's investment in AI and machine learning is transforming operations, enhancing customer service, and improving risk management. ING's strategic use of these technologies in 2024 and 2025, for instance, in streamlining mortgage processing by 15%, highlights its commitment to efficiency and accuracy.

Legal factors

Global and regional banking regulations, including the phased implementation of Basel IV, are significantly shaping ING Groep's operational landscape. These rules mandate higher capital and liquidity buffers, directly influencing how ING manages its balance sheet and risk exposure. For instance, the finalization of Basel IV, expected to be fully implemented by 2025 in many jurisdictions, will likely increase risk-weighted assets for European banks, potentially impacting ING's return on equity.

While these regulations are designed to bolster financial system stability, they present challenges to ING's profitability. Stricter capital requirements can constrain lending capacity and necessitate more capital-intensive business models, thereby increasing compliance costs. ING's ability to adapt its capital management strategies to meet these evolving benchmarks remains crucial for maintaining its competitive edge and financial resilience in the coming years.

ING Groep operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws globally, a crucial legal factor for its operations. These regulations are designed to combat financial crime and prevent illicit funds from entering the financial system. For instance, in 2023, ING reported that its compliance and control functions, which include AML/CTF efforts, incurred significant operational expenses as it continued to invest in strengthening its frameworks.

Adherence to these laws necessitates comprehensive internal controls, thorough customer due diligence (CDD) processes, and timely reporting of suspicious activities to relevant authorities. Failure to comply can lead to substantial financial penalties, with regulatory fines for AML/CTF breaches reaching billions of euros for financial institutions in recent years. ING itself has faced regulatory scrutiny and associated costs related to its AML/CTF compliance programs in the past, highlighting the financial and operational impact of these legal requirements.

The potential consequences of non-compliance extend beyond financial penalties, encompassing severe reputational damage and even criminal charges for the organization and its personnel. This makes robust AML/CTF compliance an absolutely critical legal focus for ING, impacting its strategic planning and day-to-day business practices to safeguard its integrity and market standing.

ING Groep operates under a stringent legal framework, particularly concerning data privacy. Regulations like the General Data Protection Regulation (GDPR) in Europe, and its equivalents worldwide, dictate how ING handles customer information, from collection to storage. Compliance is non-negotiable, as breaches can lead to significant financial penalties and reputational damage.

The financial sector, including ING, faces increasing scrutiny regarding data protection. In 2023, fines under GDPR alone amounted to hundreds of millions of euros across various industries, highlighting the substantial financial risk associated with non-compliance. ING must therefore continuously invest in robust data security measures, transparent consent mechanisms, and ethical data processing to maintain customer confidence and avoid legal repercussions.

Consumer Protection Laws and Fair Lending Practices

Consumer protection laws are crucial for ING, ensuring customers are treated fairly and their interests are safeguarded. These regulations cover everything from clear product disclosures to preventing predatory lending. For instance, in the EU, the Consumer Credit Directive (2008/48/EC) mandates standardized information for credit agreements, promoting transparency. ING’s adherence to these rules, including robust complaint handling procedures, is vital to avoid penalties and maintain trust.

Fair lending practices are a cornerstone of these consumer protection frameworks. ING must demonstrate non-discriminatory lending policies and ensure that credit is offered responsibly, avoiding practices that could disadvantage vulnerable groups. The ongoing scrutiny of financial institutions regarding fair access to credit, particularly in markets like the United States with regulations like the Equal Credit Opportunity Act, means ING must maintain rigorous internal controls and training programs.

- Transparency Requirements: ING must provide clear, understandable information about all financial products and services, including fees, interest rates, and terms and conditions.

- Fair Lending Enforcement: Compliance with regulations preventing discrimination in lending, ensuring equal access to credit for all eligible consumers.

- Grievance Redressal: Establishing effective mechanisms for handling customer complaints and disputes promptly and fairly.

- Data Privacy and Security: Adhering to stringent data protection laws, such as the GDPR in Europe, to safeguard customer personal and financial information.

Competition Law and Antitrust Regulations

Competition laws are crucial in the financial sector, aiming to prevent monopolies, price-fixing, and market manipulation. ING, as a significant player, must meticulously align its strategies and partnerships with these antitrust regulations to ensure a level playing field.

Regulators are actively scrutinizing mergers, acquisitions, and market behaviors to curb undue market dominance that could negatively impact consumers and smaller businesses. For instance, in 2024, the European Commission continued its robust enforcement of competition rules across various industries, including financial services, with significant fines levied for anti-competitive conduct.

- Regulatory Scrutiny: European Union competition authorities, including the European Commission, are vigilant in monitoring the financial sector for potential antitrust violations.

- Market Conduct Oversight: ING must ensure its pricing strategies, product offerings, and distribution channels do not create unfair advantages or restrict competition.

- Merger & Acquisition Impact: Any proposed mergers or acquisitions by ING undergo rigorous review to assess their potential impact on market competition and consumer choice.

- Compliance Costs: Maintaining compliance with evolving competition laws necessitates ongoing investment in legal counsel and internal control mechanisms.

ING Groep's legal obligations extend to robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance, critical for preventing financial crime. In 2023, ING highlighted significant investments in its control functions, including AML/CTF, underscoring the ongoing operational costs. Failure to adhere can result in substantial fines, with recent years seeing financial institutions penalized billions for breaches, impacting ING's operational integrity and market standing.

Data privacy laws, such as GDPR, are paramount, dictating ING's handling of customer information and carrying significant penalties for breaches. GDPR fines across industries in 2023 reached hundreds of millions of euros, emphasizing the financial risk. ING's continuous investment in data security and transparent practices is essential for maintaining customer trust and avoiding legal repercussions.

Consumer protection laws ensure fair treatment and safeguard customer interests, covering aspects like transparent product disclosures and responsible lending. ING's adherence to regulations like the EU's Consumer Credit Directive is vital for avoiding penalties and maintaining trust, particularly regarding fair lending practices and non-discriminatory policies.

Competition laws are also key, preventing monopolies and market manipulation. ING must align its strategies with antitrust regulations, as seen in the European Commission's robust enforcement in 2024, which includes significant fines for anti-competitive conduct in financial services.

Environmental factors

Climate change presents ING with significant physical risks, such as extreme weather events impacting properties and infrastructure in its loan portfolios, and transition risks stemming from evolving regulations and technological shifts in carbon-intensive sectors. For instance, the European Environment Agency reported that in 2023, climate-related disasters in Europe caused billions of euros in economic losses.

Conversely, this presents a substantial opportunity for ING in green finance, with growing demand for funding renewable energy projects, sustainable infrastructure, and the issuance of green bonds. ING's commitment to sustainable finance saw its green loan portfolio reach €24.4 billion by the end of 2023, demonstrating a clear market for these products.

To navigate these challenges and capitalize on opportunities, ING is actively integrating climate risk assessments into its lending and investment decision-making processes. The bank aims to further expand its sustainable finance offerings, aligning its business strategy with global climate goals and increasing its portfolio of green financing.

The increasing focus on Environmental, Social, and Governance (ESG) factors is a significant environmental trend impacting ING. Investors are now closely examining how ING's operations and investment portfolios affect the environment and society. This scrutiny directly influences where capital flows, with a growing preference for institutions demonstrating strong sustainability practices.

By 2024, global sustainable investment assets were projected to reach $50 trillion, highlighting the immense market shift towards ESG-aligned companies. ING's ability to attract and retain this responsible capital hinges on its transparent commitment to ESG principles. This commitment is not just about ethical operations; it's a strategic imperative for enhancing market valuation and maintaining robust investor relations.

Regulatory bodies worldwide are intensifying pressure on financial institutions like ING to provide more detailed environmental disclosures. This includes mandatory reporting on climate-related risks and, crucially, the emissions associated with their financed activities. For instance, the European Union’s Corporate Sustainability Reporting Directive (CSRD) significantly expands reporting obligations for many companies, including financial entities, starting from 2024.

To meet these demands, ING needs to build strong systems for gathering, assessing, and openly sharing data about its environmental impact and its exposure to climate-related financial risks. This is essential not only for staying compliant with regulations but also for maintaining trust with investors, customers, and other stakeholders who increasingly prioritize sustainability.

Resource Scarcity and Operational Footprint

Concerns about resource scarcity, particularly water and energy, directly influence ING Groep's operational efficiency and its long-term sustainability. Even as a service-oriented business, ING maintains an operational footprint through its offices, data centers, and employee travel, all of which consume resources.

ING's commitment to reducing energy consumption, waste generation, and overall carbon emissions is a dual strategy. It addresses environmental responsibility while also driving significant cost savings. For instance, ING's 2023 sustainability report highlighted a 12% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2019, demonstrating tangible progress. Furthermore, initiatives focused on digitalizing processes and promoting remote work contribute to a smaller physical footprint.

- Resource Efficiency: ING actively seeks to minimize its use of water and energy across its global operations.

- Operational Footprint: The company acknowledges the environmental impact of its physical infrastructure, including offices and data centers.

- Carbon Emission Reduction: Efforts are in place to lower greenhouse gas emissions, a key aspect of environmental responsibility.

- Cost Savings: Sustainability initiatives are often designed to yield economic benefits through reduced resource consumption and operational streamlining.

Biodiversity Loss and Nature-Related Financial Risks

Beyond climate change, the growing recognition of biodiversity loss and its systemic risks presents a significant environmental challenge for financial institutions like ING. The increasing awareness highlights how financing activities can impact natural ecosystems, necessitating a thorough assessment of nature-related financial risks within ING's portfolios.

ING must evaluate its dependencies on natural capital, which underpins many economic activities. For instance, sectors heavily reliant on pollination or clean water face direct financial risks if these ecosystem services degrade. This evaluation helps identify vulnerabilities and potential disruptions to business models.

Furthermore, there's a growing opportunity for ING to finance nature-positive solutions. This could involve supporting projects that restore ecosystems, promote sustainable land use, or develop innovative approaches to conservation. Such investments align with evolving investor expectations and can contribute to long-term financial resilience.

Consider these points:

- Ecosystem Services Valuation: The global economy relies heavily on ecosystem services, estimated to be worth trillions of dollars annually. For example, pollination services alone are valued at over $200 billion globally each year, directly impacting agriculture and food security.

- Nature-Related Financial Disclosure: Frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) are gaining traction, pushing companies to report on their nature-related impacts and dependencies. By 2025, a significant number of large companies are expected to adopt these disclosures.

- Investment in Nature-Based Solutions: The market for nature-based solutions is projected to grow substantially, with estimates suggesting it could reach $10 trillion by 2050. ING can play a crucial role in channeling capital towards these growth areas.

ING faces increasing pressure from regulators and stakeholders to disclose its environmental impact, particularly financed emissions. The EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates extensive environmental reporting for companies like ING, requiring robust data collection and transparent sharing of climate-related financial risks.

The bank's commitment to sustainability is evident in its growing green loan portfolio, which reached €24.4 billion by the end of 2023. This expansion reflects a strategic response to the growing market demand for green finance and ING's efforts to align its business with global climate goals.

ING is actively integrating climate risk assessments into its decision-making processes to manage physical and transition risks. By focusing on resource efficiency and carbon emission reduction, exemplified by a 12% decrease in Scope 1 and 2 emissions since 2019, ING aims to enhance operational efficiency and cost savings.

The evolving landscape of environmental factors presents both risks and opportunities for ING. The growing emphasis on ESG factors means that by 2024, global sustainable investment assets are projected to reach $50 trillion, highlighting the critical need for ING to demonstrate strong sustainability practices to attract and retain capital.

PESTLE Analysis Data Sources

ING Groep's PESTLE analysis is informed by a comprehensive blend of public and proprietary data. This includes reports from financial institutions like the IMF and World Bank, regulatory updates from European and global bodies, and market research from firms specializing in the financial services sector.