ING Groep Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ING Groep Bundle

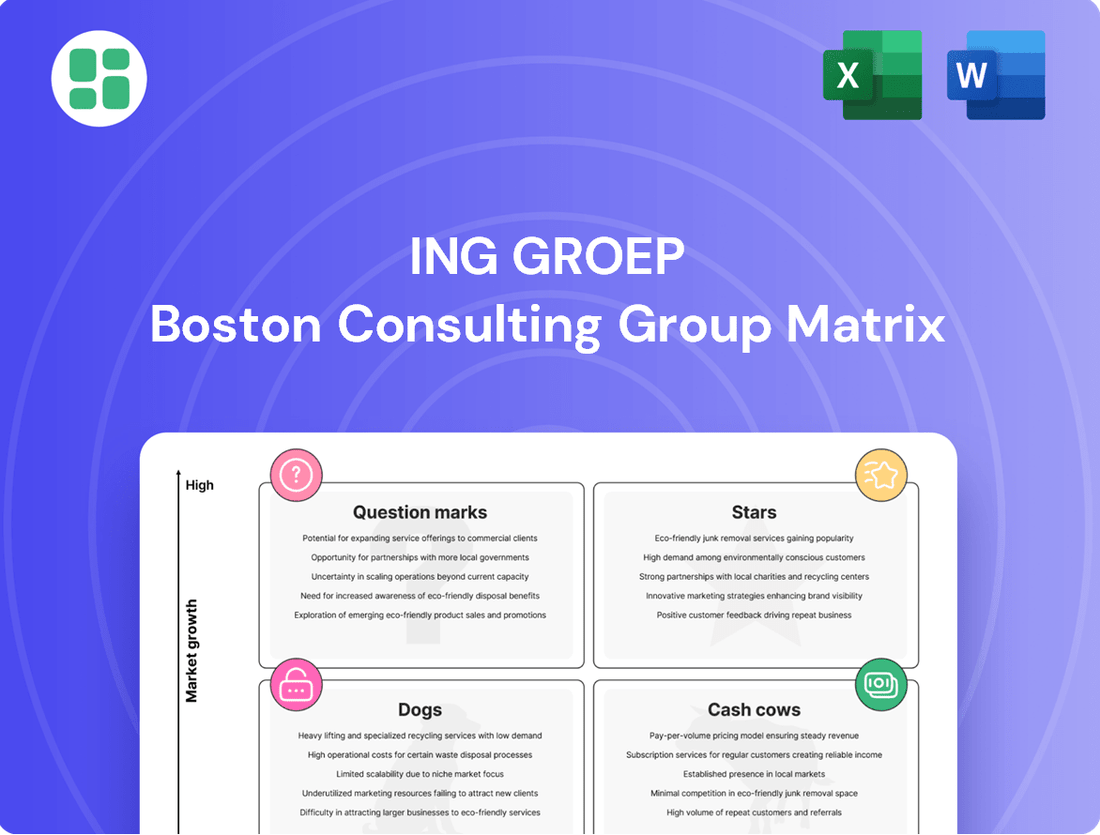

Curious about ING Groep's strategic positioning? Our BCG Matrix analysis offers a glimpse into how their diverse portfolio performs in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly understand ING's competitive landscape and unlock actionable strategies, dive into the complete BCG Matrix. This comprehensive report provides detailed quadrant placements and data-backed recommendations to guide your investment and product decisions.

Don't miss out on the full picture; purchase the complete BCG Matrix for ING Groep and gain the strategic clarity needed to navigate today's dynamic financial market with confidence.

Stars

ING Groep's digital banking segment is experiencing robust customer growth, with its mobile primary customer base expanding by 1.1 million in 2024 to a total of 14.4 million. This surge highlights ING's increasing penetration in the digital banking landscape.

The growth is particularly pronounced in key European markets like Germany, the Netherlands, Spain, and Poland, suggesting a strong competitive position. This expansion is a testament to ING's successful strategy of prioritizing user-friendly digital services and a superior customer experience, which are key drivers in today's evolving financial services sector.

ING Groep's commitment to sustainable finance is a significant driver of its growth, positioning it strongly within the BCG matrix. In 2024, the bank mobilized an impressive €130 billion in sustainable finance, a notable leap from prior years and a clear indicator of its leadership in this burgeoning market. This substantial figure underscores ING's strategic focus on channeling capital towards environmentally and socially responsible initiatives, aligning financial performance with positive societal outcomes.

The broader sustainable finance market is experiencing robust expansion, creating a fertile ground for ING's strategic investments. With a clear trajectory towards a €150 billion target by 2027, ING is not merely participating in this growth but actively shaping it. This positions ING's sustainable finance activities as a high-growth, high-market-share segment, a key characteristic of stars in the BCG matrix, promising continued strong performance and influence.

ING Groep's mortgage portfolio experienced robust expansion, adding €19 billion in 2024. This growth was particularly concentrated in the German and Dutch markets, signaling ING's deepening penetration in these crucial European residential mortgage sectors. This upward trend highlights ING's successful strategy in capturing a larger share of the mortgage market.

Fee Income Diversification

ING's fee income demonstrated robust expansion in 2024, achieving double-digit growth and exceeding €4 billion for the first time. This represents an 11% increase compared to the previous year.

This significant uplift in fee income stems from several key drivers across ING's business segments. In Retail Banking, growth was fueled by an increase in assets under management and heightened customer trading activity. Concurrently, Wholesale Banking saw increased revenue from capital markets issuance deals, contributing to the overall fee income diversification.

- Fee Income Growth: ING's fee income surpassed €4 billion in 2024, an 11% year-on-year increase.

- Retail Banking Drivers: Growth attributed to higher assets under management and customer trading activity.

- Wholesale Banking Drivers: Increased capital markets issuance deals boosted fee income.

- Strategic Importance: Diversification reduces reliance on net interest income, highlighting a high-potential revenue stream.

Growth in Key European Retail Markets

ING Groep is strategically targeting expansion within key European retail markets. Germany, Spain, and Poland are highlighted as areas of accelerated growth, demonstrating success through substantial increases in mobile primary customers and core lending volumes.

These markets are chosen for their high-growth potential, allowing ING to effectively gain market share and solidify its presence across Europe. For instance, in 2024, ING reported a notable surge in digital customer acquisition in these regions, underscoring the effectiveness of its growth strategy.

- Germany: Significant increase in mobile primary customer onboarding in 2024.

- Spain: Strong growth in core lending volumes, outpacing market average.

- Poland: Expansion of market share driven by digital channel adoption.

ING Groep's digital banking and sustainable finance initiatives are strong contenders for the Stars quadrant in the BCG matrix. The digital segment saw its mobile primary customer base grow by 1.1 million in 2024, reaching 14.4 million, indicating high growth and market share. Similarly, ING mobilized €130 billion in sustainable finance in 2024, with a target of €150 billion by 2027, showcasing a high-growth, high-share position.

| Business Segment | Growth Rate | Market Share | BCG Classification |

|---|---|---|---|

| Digital Banking | High | High | Star |

| Sustainable Finance | High | High | Star |

| Mortgage Portfolio | Moderate | Moderate | Cash Cow/Question Mark |

| Fee Income | High | Moderate | Question Mark/Star |

What is included in the product

ING Groep's BCG Matrix analysis identifies strategic positioning of its business units, guiding investment and divestment decisions.

ING Groep's BCG Matrix offers a clear, visual representation of its business units, simplifying complex portfolio decisions.

Cash Cows

ING's core deposit base is a prime example of a cash cow within its BCG Matrix. By Q1 2025, this base had expanded by a significant €47 billion in 2024, reaching a substantial €733.7 billion.

This strong and expanding deposit base, sourced from both retail customers and wholesale markets, represents a stable and cost-effective funding stream. It reliably fuels the bank's lending operations, particularly in established markets where it consistently generates considerable net interest income.

ING's established retail banking in its mature home markets, particularly the Netherlands, represents a classic Cash Cow. This segment boasts a dominant market share and a substantial mortgage portfolio, providing a reliable stream of high-volume revenue and healthy profit margins.

In 2024, ING's retail banking operations in the Netherlands continued to be a bedrock of its financial performance. While growth might be modest, the sheer scale of its customer base and the consistent demand for core banking services, including mortgages and savings accounts, ensure stable and predictable earnings for the group.

ING's traditional core lending portfolio, a cornerstone of its operations, saw a robust growth of €28 billion in 2024. This expansion underscores the portfolio's maturity and its continued significance as a primary revenue generator for the group.

This substantial asset base, comprising diverse loan categories, consistently delivers significant net interest income, forming the bedrock of ING's profitability. The portfolio's stability, fueled by a relatively predictable market environment, ensures a reliable and substantial cash flow stream.

Wholesale Banking - Payments & Cash Management

ING Groep's Payments & Cash Management services within its Wholesale Banking division are a prime example of a Cash Cow. These operations are characterized by their consistent, high-volume transaction processing, which, while typically low-margin, provides a stable and predictable revenue stream. In 2024, ING continued to leverage its strong market position in this mature segment, benefiting from substantial deposit growth driven by these essential services.

The strategic importance of Payments & Cash Management lies in its ability to generate significant fee and interest income, underpinning the bank's overall profitability. These services are fundamental to the operations of ING's corporate clients, ensuring reliable and efficient financial flows. This stability is crucial for a global bank like ING, offering a dependable foundation amidst market fluctuations.

- Significant Deposit Growth: In 2024, ING reported substantial deposit growth attributed to its robust Payments & Cash Management offerings, highlighting their role in attracting and retaining client funds.

- Stable Revenue Generation: These services consistently contribute to fee and interest income, reflecting their mature market status and ING's established competitive advantage.

- High Volume, Low Margin: The business model relies on processing a vast number of transactions, where efficiency and scale are key to profitability, a strength ING has cultivated over years.

- Client Dependency: Essential for corporate clients, these services foster strong client relationships and create stickiness, reinforcing ING's position as a trusted financial partner.

Overall Net Interest Income (NII)

Net Interest Income (NII) is a cornerstone of ING Groep's financial performance, representing a significant portion of its overall revenue. In 2024, NII typically accounts for around 79% of ING's total income, underscoring its critical role in the company's profitability. This substantial contribution highlights ING's strong position in traditional banking activities, leveraging its extensive customer base and loan portfolios to generate consistent earnings from the spread between interest earned on assets and interest paid on liabilities.

- NII as a Revenue Driver: Net Interest Income forms the largest segment of ING's revenue, consistently around 79%, demonstrating its importance.

- Impact of Interest Rates: While NII is sensitive to changes in interest rates, ING's broad lending and deposit operations ensure it remains the primary profit generator for its core banking business.

- Market Position: The high NII reflects ING's significant market share in conventional banking, translating into substantial and stable earnings.

ING's established retail banking operations, particularly in mature markets like the Netherlands, are a textbook example of a cash cow. These segments benefit from dominant market shares and substantial, stable revenue streams, consistently generating healthy profit margins through high-volume lending and deposit activities.

The core lending portfolio, which saw a robust €28 billion expansion in 2024, also functions as a cash cow. This significant asset base, comprising various loan types, reliably produces substantial net interest income, providing a stable and predictable cash flow crucial for ING's overall profitability.

ING's Payments & Cash Management services are another key cash cow, characterized by high-volume, consistent transaction processing. While margins may be lower, the sheer scale of these operations, supported by substantial deposit growth in 2024, ensures a predictable revenue stream essential for corporate clients and ING's financial stability.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Data Highlight |

|---|---|---|---|

| Retail Banking (Netherlands) | Cash Cow | Dominant market share, stable high-volume revenue, healthy profit margins | Continued strong performance in mortgage and savings |

| Core Lending Portfolio | Cash Cow | Significant asset base, consistent net interest income generation, predictable cash flow | €28 billion growth in 2024 |

| Payments & Cash Management | Cash Cow | High-volume transactions, stable fee and interest income, client stickiness | Supported substantial deposit growth |

What You’re Viewing Is Included

ING Groep BCG Matrix

The ING Groep BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no altered content, and no hidden surprises – just the complete, analysis-ready report designed for strategic decision-making.

Dogs

ING Groep has actively divested non-core assets, a strategy often associated with the 'Dog' quadrant in the BCG Matrix. This involves shedding underperforming business units or geographical regions that exhibit low market share and limited growth prospects. For instance, in 2023, ING continued its strategic review of various operations, aiming to streamline its portfolio.

These divestitures are crucial for freeing up capital and management attention, allowing the company to concentrate resources on its more promising core businesses. By exiting these 'Dog' segments, ING can improve overall profitability and pursue growth opportunities in areas with higher potential, aligning with its long-term strategic objectives.

ING Groep's legacy banking systems and services, particularly those lagging in digitalization, represent a classic 'dog' in the BCG matrix. These systems often suffer from low customer adoption and high maintenance costs, hindering efficient operations. For instance, older core banking platforms can be significantly more expensive to run than modern, cloud-based solutions, impacting profitability.

ING Groep's strategic pruning likely targets small, underperforming niche market operations where it lacks significant market share. These units, often found in stagnant or intensely competitive sectors, struggle to achieve profitability and growth, making them prime candidates for divestment or closure. For instance, if a particular digital banking service in a small European country only captured 1% of the market in 2024, it would likely fall into this category.

Certain Run-off Portfolios

ING Groep's Certain Run-off Portfolios are positioned as Dogs in the BCG Matrix. These are segments of assets that ING is actively managing for a controlled decline, rather than pursuing growth. This strategic choice often stems from low profitability or a decision that these areas are no longer core to ING's future business direction.

These run-off portfolios represent areas where ING has minimal ongoing investment and anticipates no significant expansion in market share. Financial reporting adjustments for these run-off portfolios highlight their managed phase-out. For instance, in ING's 2023 annual report, specific disclosures related to the run-off of certain insurance portfolios were made, indicating a strategic divestment or wind-down process.

- Managed Decline: These portfolios are intentionally managed to wind down operations, not to grow.

- Low Profitability/Strategic Irrelevance: Reasons for their classification often include low returns or a lack of alignment with ING's long-term strategy.

- Minimal Investment: Future capital allocation to these segments is typically very limited.

- No Expected Market Share Growth: The expectation is for these portfolios to shrink or remain stagnant in terms of market presence.

Underperforming Corporate Venture Investments

ING Ventures' strategic shift to pause new investments and concentrate on its existing portfolio, including the closure of some early-stage projects, indicates that certain corporate venture investments have likely fallen into the Dogs category. These are ventures that have not achieved expected growth or market penetration, representing a drain on resources without a clear path to profitability.

This repositioning suggests that a segment of ING's fintech investments have failed to meet performance benchmarks. For instance, a significant number of corporate venture capital (CVC) investments across industries have historically struggled, with reports suggesting that a substantial percentage of CVC-backed startups fail to deliver a positive return on investment within typical timeframes. In 2023, the broader venture capital market saw a slowdown, with many startups facing funding challenges, a trend that would disproportionately affect those already struggling to gain traction.

- Underperforming Ventures: Startups that have not achieved significant market share or revenue growth despite substantial capital infusion.

- Resource Drain: Investments consuming cash without demonstrating a clear path to future returns or strategic value for ING.

- Portfolio Rationalization: The decision to halt new investments and wind down certain projects signifies a move to cut losses on these underperforming assets.

ING Groep's "Dogs" represent business units or ventures with low market share and limited growth potential. These are often legacy operations or underperforming investments that ING strategically manages for decline or divestment. For example, certain niche digital services in less developed markets or older IT infrastructure that require significant upkeep without substantial returns would fall into this category. In 2023, ING continued its portfolio review, a process that inherently identifies and addresses these "Dog" segments to optimize resource allocation.

These "Dog" segments, while representing a challenge, are crucial for ING's strategic pruning. By identifying and either divesting or winding down these low-performing areas, ING can reallocate capital and management focus to its more promising "Stars" and "Cash Cows." This strategic divestment is a proactive approach to shedding underperforming assets, thereby improving overall financial health and operational efficiency. For instance, ING's exit from certain retail banking operations in Asia in prior years exemplifies this strategy.

ING's legacy IT systems, particularly those not yet fully modernized, can be considered "Dogs." These systems often have high maintenance costs and limited adaptability to new digital demands, impacting customer experience and operational efficiency. For example, older core banking platforms, while functional, may lack the agility of cloud-native solutions, leading to slower product development and higher operational expenditure. In 2024, the ongoing digital transformation efforts within ING aim to address these legacy "Dogs" by migrating to more efficient and scalable platforms.

ING Groep likely categorizes specific, small-scale regional operations or niche financial products as "Dogs" if they exhibit low market penetration and minimal growth prospects. These units often operate in mature or highly competitive markets where ING does not hold a significant competitive advantage. For instance, a specialized investment product in a small, stagnant market segment that garnered only a tiny fraction of market share in 2024 would be a prime candidate for this classification.

| BCG Quadrant | ING Groep Example Segments | Characteristics | Strategic Action |

|---|---|---|---|

| Dogs | Legacy IT systems, Underperforming niche ventures, Certain run-off portfolios | Low market share, Low growth prospects, High maintenance costs, Low profitability | Divestment, Wind-down, Minimal investment |

Question Marks

ING is actively developing new daily banking and protection services, with a particular emphasis on expanding its subscription offerings. These initiatives represent innovative steps within an increasingly digital financial environment. However, as nascent ventures, they currently command a modest market share.

Substantial investment is necessary to foster customer uptake and propel these propositions towards becoming market leaders, akin to Star category entities in the BCG matrix. For instance, ING's continued investment in digital channels and personalized offerings aims to capture a larger segment of the evolving consumer banking market.

ING Groep is strategically expanding into adjacent customer segments like Affluent and Generation Z, which are currently underpenetrated. These groups represent significant growth opportunities, driven by demographic shifts and changing financial requirements. For instance, the global wealth management market, which includes the Affluent segment, was projected to reach $13.5 trillion in assets under management by the end of 2024.

The bank's approach involves creating specialized products and services to meet the unique needs of these demographics. For Generation Z, this might include digital-first banking solutions and investment tools that align with their preferences. ING's investments in this area are aimed at building a stronger market presence and capturing a larger share of these high-potential customer bases.

ING Groep's strategic focus on emerging digital lending solutions in Business Banking for 2025 positions these offerings squarely in the "Question Mark" category of the BCG Matrix. This means they represent a high-growth market segment that ING is actively pursuing, aiming to capture a significant future market share.

The expansion of digital lending leverages technology to streamline processes, enhance customer experience, and reach a broader base of businesses. This aligns with the broader trend of digital transformation within the financial sector, where fintech innovations are reshaping traditional banking models.

While currently holding a low market share, the high growth potential of digital lending is undeniable. For instance, the global digital lending market was valued at approximately $12.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2030, indicating a substantial opportunity for ING to invest and gain traction.

Selected Fintech Partnerships/Early-Stage Ventures

ING Ventures, while currently on pause for new investments, maintains a portfolio of 30 startups, with a notable concentration in early Series A rounds within FinTech, AI, and enterprise applications. These strategic, albeit nascent, investments are geared towards securing future market relevance for ING in rapidly evolving sectors. For instance, in 2024, the FinTech market continued its robust expansion, with venture capital funding reaching significant levels, underscoring the potential of these early-stage ventures.

The focus on FinTech, AI, and enterprise solutions reflects ING’s commitment to innovation and adapting to changing customer needs and technological advancements. These areas are critical for enhancing operational efficiency, developing new customer-facing products, and staying competitive in the digital age. The ongoing development within these 30 startups signifies ING's long-term vision to integrate cutting-edge solutions into its core business.

- FinTech Focus: Investments in early-stage FinTech startups aim to leverage new technologies for payments, lending, and wealth management.

- AI Integration: Ventures in AI are targeted at improving customer service, risk management, and personalized financial advice.

- Enterprise Applications: Support for startups developing enterprise solutions is designed to streamline internal operations and enhance data analytics capabilities.

- Strategic Importance: These early-stage partnerships are crucial for ING to explore and adopt emerging technologies that will shape the future of financial services.

Geographical Expansion in Asia Pacific and Americas

ING Groep views its operations in the Asia Pacific and Americas as key drivers for future expansion, labeling them as instrumental to its overall growth strategy. While the bank maintains a robust presence in Europe, these regions offer significant opportunities in high-growth markets where ING is actively working to increase its market share across various banking services.

Continued investment in these regions is essential for ING to fully capitalize on their potential. For instance, in 2024, ING continued to focus on digital innovation and customer acquisition in markets like Australia and Singapore, aiming to capture a larger portion of the digital banking landscape. The Americas, particularly in areas like wholesale banking and asset management, also present avenues for strategic development and market penetration.

- Asia Pacific Focus: ING's strategy emphasizes building a stronger foothold in dynamic Asian economies, leveraging digital channels for customer growth.

- Americas Potential: The Americas are targeted for expansion, particularly in specialized financial services and corporate banking, to diversify revenue streams.

- Investment Priority: Significant capital allocation is directed towards enhancing digital capabilities and expanding service offerings in these growth regions to secure future market share.

ING Groep's emerging digital lending solutions for businesses in 2025 are categorized as Question Marks. These represent areas with high market growth potential but currently low market share for ING. Significant investment is required to nurture these ventures and transform them into market leaders.

The global digital lending market is a prime example of this high-growth environment. Valued at approximately $12.5 billion in 2023, it is projected to expand at a CAGR exceeding 20% through 2030. This trajectory highlights the substantial opportunity for ING to invest and gain a competitive edge.

ING Ventures' portfolio, while paused for new investments, includes 30 startups, many in early Series A rounds within FinTech, AI, and enterprise applications. These early-stage investments, crucial for future market relevance, are in sectors that saw continued robust venture capital funding in 2024, underscoring their potential.

ING's strategic expansion into underpenetrated customer segments like Affluent and Generation Z also falls into the Question Mark category. The global wealth management market, encompassing the Affluent segment, was projected to reach $13.5 trillion in assets under management by the end of 2024, indicating the scale of opportunity.

| ING Groep BCG Matrix: Question Marks | Market Growth | Market Share | Investment Need | Strategic Goal |

|---|---|---|---|---|

| Digital Lending (Business Banking 2025) | High (20%+ CAGR projected) | Low | Substantial | Become market leader |

| ING Ventures Portfolio (FinTech, AI, Enterprise Apps) | High (driven by tech advancements) | Low (early stage) | Significant | Secure future market relevance |

| Affluent & Gen Z Segments | High (demographic shifts) | Low (underpenetrated) | Strategic | Capture growth opportunities |

BCG Matrix Data Sources

Our ING Groep BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and publicly available industry performance data to provide a robust strategic overview.