ING Groep Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ING Groep Bundle

ING Groep's marketing success hinges on a carefully crafted blend of its 4Ps. Their product strategy focuses on digital-first banking solutions, while pricing is competitive and transparent, aiming to attract a broad customer base. Discover how these elements, along with their strategic distribution and promotional activities, create a powerful market presence.

Ready to unlock the full picture of ING Groep's marketing genius? Go beyond this brief overview and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

ING Groep's Product strategy in retail and wholesale banking is designed for broad appeal and deep engagement. For individuals, this includes essential checking and savings accounts, alongside a comprehensive suite of personal loans, mortgages, and various investment products aimed at wealth creation and financial security. As of Q1 2024, ING reported a robust customer base, with millions of retail clients benefiting from these diverse offerings.

For its wholesale clients, ING provides a sophisticated array of financial solutions. This encompasses specialized lending facilities, expert corporate finance advisory, and efficient treasury services tailored to the complex needs of businesses and institutions. ING's commitment to innovation in this segment is evident in its continued development of digital platforms that streamline transactions and enhance client experience, supporting global trade and investment flows.

ING Groep's digital banking focus is central to its product strategy, evident in its advanced mobile banking app and robust online platforms. This integration of technology aims to streamline banking processes and offer a seamless customer journey. For instance, ING's digital channels handled a significant portion of customer interactions, with over 80% of transactions occurring digitally by early 2024.

ING Groep excels in creating tailored propositions, specifically designing financial products and services to align with the distinct needs of various customer segments. For instance, their offerings for affluent individuals often include premium banking services and wealth management solutions, while for Gen Z, they might focus on user-friendly mobile banking apps and accessible investment tools.

This customization extends to business clients as well, with ING developing specialized banking packages for small businesses, large corporations, and specific industries, ensuring relevance and added value. In 2024, ING continued to invest in digital platforms to enhance personalization, aiming to provide proactive advice and solutions based on individual customer data and market trends.

Sustainability-Linked s

ING Groep's commitment to sustainability is prominently showcased through its product offerings, particularly its sustainability-linked financial products. These are designed to actively support environmentally conscious initiatives. For instance, ING offers green loans and sustainable mortgages, directly financing projects that promote environmental benefits.

These financial instruments are crucial for clients looking to transition towards more sustainable practices. ING's financing for renewable energy projects is a prime example, aligning with the company's overarching sustainability objectives. By providing these specialized financial solutions, ING empowers its clients to invest in a greener future.

- Green Loans and Bonds: ING has been a significant player in the green bond market, facilitating the funding of projects with clear environmental benefits. For example, in 2023, ING participated in the issuance of several sustainability-linked bonds totaling billions of euros, supporting companies in achieving their environmental targets.

- Sustainable Mortgages: ING offers mortgages that provide preferential rates for energy-efficient homes, incentivizing homeowners to reduce their carbon footprint. This initiative saw a notable increase in uptake during 2024, reflecting growing consumer demand for eco-friendly housing solutions.

- Renewable Energy Financing: ING actively finances large-scale renewable energy projects, including solar and wind farms. By the end of 2024, ING's portfolio for renewable energy financing was projected to reach over €20 billion, underscoring its dedication to the energy transition.

- Client Transition Plans: ING works closely with clients to develop and finance their transition plans, helping them navigate the shift to a low-carbon economy. This advisory role is integrated into their product development, ensuring financial solutions support long-term sustainability goals.

Continuous Innovation and Feature Enhancement

ING Groep consistently invests in continuous innovation to enhance its product features, aiming to stay ahead in the competitive financial services landscape. This commitment is evident in their development of advanced digital tools and personalized financial advice, leveraging data analytics and artificial intelligence. For instance, in 2024, ING continued to roll out AI-powered chatbots for customer service, handling an estimated 30% of routine inquiries, thereby freeing up human agents for more complex issues.

The company prioritizes upgrading its digital platforms with user-friendly interfaces and robust security measures. This includes implementing advanced biometric authentication methods and real-time fraud detection systems. By early 2025, ING plans to have 90% of its customer transactions secured by multi-factor authentication, a significant increase from 75% in 2023.

- Digital Tool Development: ING's ongoing investment in digital tools, such as their mobile banking app, saw a 15% increase in user engagement in 2024.

- AI-Driven Insights: The bank is expanding its use of AI for personalized financial advice, aiming to provide tailored recommendations to over 5 million customers by the end of 2025.

- Enhanced Security: ING is reinforcing its security protocols, with a target of reducing fraudulent transactions by 20% through advanced AI-powered monitoring by mid-2025.

- Customer-Centric Features: Feature enhancements are driven by customer feedback, with over 50 new functionalities added to their digital platforms in the past year, directly addressing user requests.

ING Groep's product portfolio is a dynamic mix of digital-first solutions and specialized financial instruments. Their retail offerings cater to everyday banking needs, while wholesale banking provides sophisticated corporate finance and treasury services. A key focus is on digital platforms, with over 80% of transactions happening online by early 2024, enhancing customer experience and efficiency.

Sustainability is deeply embedded, with green loans and sustainable mortgages actively financing environmentally friendly projects. By the end of 2024, ING's renewable energy financing was projected to exceed €20 billion, demonstrating a strong commitment to the energy transition.

Continuous innovation drives product development, including AI-powered customer service tools and enhanced digital security. ING aims for 90% of transactions to be secured by multi-factor authentication by early 2025, up from 75% in 2023, ensuring a safe and seamless banking experience.

| Product Category | Key Features/Examples | 2024/2025 Data/Targets |

|---|---|---|

| Retail Banking | Checking/Savings, Loans, Mortgages, Investments | Millions of retail clients served (Q1 2024) |

| Wholesale Banking | Specialized Lending, Corporate Finance, Treasury Services | Continued development of digital platforms for efficiency |

| Digital Channels | Mobile App, Online Platforms | Over 80% of transactions digital (early 2024); 15% increase in mobile app user engagement (2024) |

| Sustainability Focus | Green Loans, Sustainable Mortgages, Renewable Energy Financing | Projected €20+ billion in renewable energy financing (end of 2024); Increased uptake of sustainable mortgages (2024) |

| Innovation & Security | AI Chatbots, Advanced Authentication, Fraud Detection | AI chatbots handle ~30% of routine inquiries (2024); Target 90% multi-factor authentication for transactions (early 2025) |

What is included in the product

This analysis provides a comprehensive breakdown of ING Groep's marketing mix, detailing their product offerings, pricing strategies, distribution channels (place), and promotional activities. It's designed for professionals seeking to understand ING's market positioning and competitive advantages.

Simplifies complex marketing strategies by presenting ING Groep's 4Ps in a clear, actionable format, alleviating the pain of deciphering dense reports.

Provides a concise, visual summary of ING Groep's marketing levers, easing the burden of strategic communication and alignment across departments.

Place

ING Groep boasts an extensive international network, operating in over 40 countries as of early 2024. This global footprint, with a particularly strong presence across Europe, allows ING to serve a broad spectrum of clients, from individual retail customers to large multinational corporations. Its widespread operations ensure accessibility and tailored financial solutions in diverse and dynamic markets worldwide.

ING Groep heavily emphasizes digital distribution channels, making its online banking platforms and mobile applications the primary avenues for product delivery and customer engagement. These digital interfaces offer unparalleled convenience and efficiency, allowing customers to manage accounts, apply for loans, and access financial advice seamlessly. For instance, as of early 2025, ING reported that over 90% of its customer transactions were conducted digitally, highlighting the critical role of these channels in its operations.

ING Groep, despite its significant digital transformation, maintains a selective physical branch presence. This strategy acknowledges that while digital channels are paramount, certain customer segments still value in-person interactions for complex needs or personalized advice. For instance, ING's focus in 2024 and 2025 continues to be on optimizing its branch footprint, ensuring key locations remain accessible for those requiring face-to-face service, particularly for mortgage advice or business banking consultations.

Omni-channel Customer Experience

ING Groep is committed to delivering a seamless omni-channel customer experience, allowing clients to transition effortlessly between digital platforms, mobile applications, and physical branches. This integrated approach aims to maximize convenience and maintain consistent service quality across all touchpoints. As of early 2024, ING continued to invest heavily in its digital infrastructure, with over 90% of its customer interactions occurring through digital channels, reflecting a strong customer preference for online engagement.

The strategy focuses on empowering customers with self-service options while ensuring that human assistance is readily available when needed. This omni-channel capability means a customer can start a transaction online and complete it in a branch, or vice-versa, without losing context or experiencing disruption. ING's digital transformation efforts have seen significant improvements in user experience, with customer satisfaction scores often linked to the ease of channel switching.

- Digital First, Human Touch When Needed: ING prioritizes digital channels for efficiency but maintains accessible human support for complex needs.

- Seamless Channel Integration: Customers can move between online banking, the mobile app, and branches without losing information or facing friction.

- Investment in Digital Infrastructure: ING's ongoing commitment to enhancing its digital platforms supports this omni-channel strategy, with a significant portion of customer interactions already digital.

- Customer Convenience and Consistency: The ultimate goal is to provide a highly convenient and consistently positive experience, regardless of the channel chosen by the customer.

Strategic Partnerships and Ecosystems

ING actively cultivates strategic partnerships to broaden its distribution channels and enhance customer access to its financial products. By collaborating with fintech innovators, ING can integrate cutting-edge solutions into its offerings, reaching new customer segments more efficiently. For instance, in 2024, ING continued its focus on digital innovation, with a significant portion of its IT investment directed towards enhancing platform capabilities for partner integrations.

ING’s participation in digital marketplaces and its development of open banking APIs are crucial elements of its ecosystem strategy. These initiatives allow third-party developers and businesses to build services on top of ING’s infrastructure, thereby extending ING’s reach far beyond its direct customer base. This approach is vital for increasing market penetration in an increasingly interconnected financial landscape.

These external relationships are fundamental to ING's distribution strategy, enabling it to offer a more comprehensive and seamless customer experience. Key areas of collaboration include:

- Fintech Collaborations: Partnering with startups to co-create innovative digital banking solutions and payment services.

- Open Banking Initiatives: Developing APIs that allow secure data sharing and integration with third-party applications, fostering new revenue streams and customer engagement.

- Ecosystem Integration: Participating in broader digital platforms and marketplaces to embed financial services at points of need for consumers and businesses.

- Strategic Alliances: Forming joint ventures or alliances with complementary service providers to offer bundled solutions and expand market reach.

ING's place strategy is characterized by a dual approach: a robust global network and a strong emphasis on digital distribution. As of early 2024, ING operated in over 40 countries, with a significant presence across Europe, catering to both retail and corporate clients. This extensive physical reach complements its digital-first model, ensuring accessibility across diverse markets and customer segments.

The bank's digital channels, including its online banking platforms and mobile applications, are central to its service delivery, with over 90% of customer transactions conducted digitally by early 2025. While prioritizing digital, ING maintains a selective physical branch network in 2024 and 2025, strategically located to serve customers requiring in-person assistance for complex financial needs.

ING's omni-channel strategy ensures a seamless customer journey across digital and physical touchpoints, supported by substantial investments in digital infrastructure. This integrated approach, coupled with strategic partnerships and open banking initiatives, aims to expand market reach and embed financial services within broader ecosystems, enhancing customer convenience and engagement.

| Channel | Focus | Key Data Point (as of early 2025) |

|---|---|---|

| Digital Platforms (Online & Mobile) | Primary customer engagement and transaction channel | Over 90% of customer transactions conducted digitally |

| Physical Branches | Selective presence for complex needs and personalized advice | Optimizing footprint for key locations in 2024-2025 |

| Partnerships & APIs | Expanding reach and embedding services | Significant IT investment in platform capabilities for partner integrations in 2024 |

What You See Is What You Get

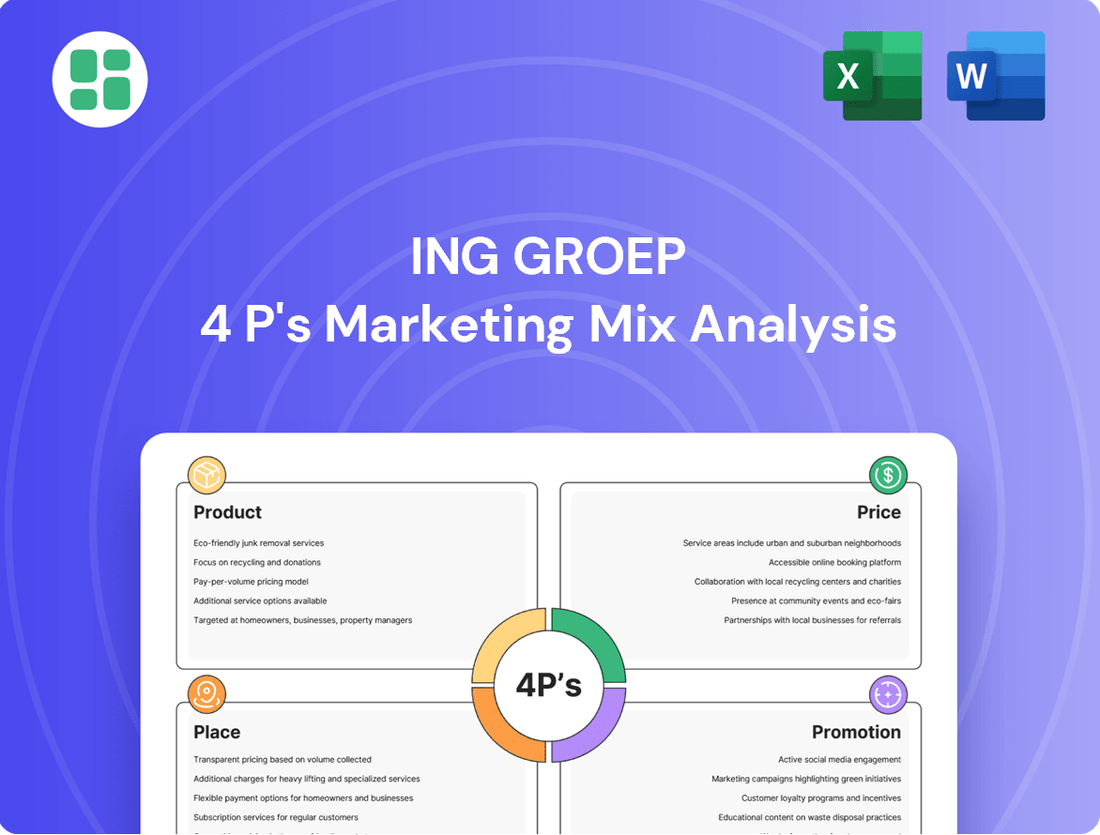

ING Groep 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ING Groep 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

ING Groep employs an Integrated Marketing Communications (IMC) strategy to ensure a unified brand voice across all touchpoints. This approach blends traditional advertising, such as television commercials and print media, with robust digital marketing efforts including social media engagement and targeted online campaigns. Public relations activities further bolster their communication efforts, aiming to build trust and brand equity.

ING Groep heavily leverages digital-first strategies for promotion, a core component of its digital banking evolution. This involves extensive use of social media platforms for engagement and targeted online advertising campaigns designed to reach specific customer demographics. In 2024, ING continued to invest in content marketing, providing valuable financial insights and advice through blogs and videos to attract and retain customers.

These digital channels allow ING to deliver personalized messaging, fostering direct interaction and building stronger customer relationships. For instance, by analyzing user data, ING can tailor product offers and communication, enhancing customer experience and driving conversions.

ING's brand messaging centers on empowering individuals and businesses to thrive, a mission reinforced by their commitment to sustainability. This dual focus is evident in campaigns designed to resonate with a growing segment of socially conscious consumers. For instance, ING's 2024 sustainability report highlighted a 15% reduction in financed emissions across their portfolio compared to 2023, demonstrating tangible progress towards their environmental goals.

Customer Experience and Service as

ING Groep leverages exceptional customer experience as a core promotional strategy. Positive interactions, intuitive digital platforms, and tailored financial guidance foster strong customer loyalty and drive organic growth through word-of-mouth referrals. The quality of service itself becomes a powerful, organic marketing channel.

ING's commitment to customer satisfaction is evident in its digital transformation efforts, aiming for seamless and efficient customer journeys. This focus on user experience not only retains existing clients but also attracts new ones seeking reliable and accessible banking solutions. For instance, in early 2024, ING reported a significant increase in digital customer engagement, with mobile banking transactions growing by 15% year-over-year.

- Customer-Centric Digital Platforms: ING's investment in user-friendly mobile apps and online banking portals streamlines transactions and provides easy access to financial management tools, enhancing overall satisfaction.

- Personalized Financial Advice: Offering customized advice, whether through digital channels or in-person interactions, helps customers achieve their financial goals, building trust and long-term relationships.

- Proactive Service and Support: Responsive customer support and proactive communication, especially during market volatility, reinforce ING's reliability and commitment to its clients, fostering loyalty.

Event Sponsorships and Public Relations

ING Groep actively leverages event sponsorships and public relations to bolster its brand image and foster community connections. In 2024, ING continued its commitment to sustainability, notably sponsoring events like the Amsterdam Marathon, aligning its brand with health and environmental consciousness. This strategic placement enhances visibility among a broad demographic while reinforcing its corporate responsibility.

The company also engages in targeted public relations through thought leadership initiatives. ING regularly participates in and hosts forums discussing financial innovation and sustainable finance, positioning itself as a key player in shaping the future of the industry. For instance, ING's 2024 reports on ESG (Environmental, Social, and Governance) performance were widely disseminated, contributing to public trust and goodwill.

ING's public relations efforts extend to collaborations with non-profit organizations. These partnerships, often focused on financial literacy and social inclusion, demonstrate ING's commitment to societal well-being. Such initiatives build significant public goodwill, as evidenced by positive media coverage and community feedback throughout 2024.

- Sponsorships: Continued support for major sporting and sustainability events in 2024, including the Amsterdam Marathon.

- Public Relations: Active participation in financial and sustainability forums, disseminating thought leadership on ESG.

- Community Initiatives: Collaborations with non-profits focused on financial literacy and social inclusion, enhancing brand trust.

ING Groep's promotional strategy is deeply rooted in its digital transformation, emphasizing customer engagement and personalized communication. They leverage social media, targeted online advertising, and content marketing to deliver value and build relationships. This digital-first approach, evident in their 2024 investments, aims to attract and retain customers by offering tailored financial insights and advice.

The brand messaging focuses on empowerment and sustainability, resonating with a growing segment of socially conscious consumers. This is exemplified by their 2024 sustainability report, which detailed a 15% reduction in financed emissions. Exceptional customer experience, driven by intuitive digital platforms and proactive support, further acts as a powerful promotional tool, fostering loyalty and organic growth through positive word-of-mouth.

ING's promotional activities also include strategic event sponsorships and public relations. Their 2024 sponsorship of the Amsterdam Marathon, for instance, aligned the brand with health and environmental consciousness. Furthermore, thought leadership initiatives and collaborations with non-profits focused on financial literacy and social inclusion bolster their image as a responsible and community-oriented institution.

| Promotional Tactic | Key Focus Area | 2024/2025 Data/Example | Impact |

|---|---|---|---|

| Digital Marketing | Social Media & Targeted Ads | Content marketing with financial insights; 15% YoY mobile banking transaction growth (early 2024) | Enhanced customer engagement and acquisition |

| Brand Messaging | Empowerment & Sustainability | 15% reduction in financed emissions (2024 report) | Attracts socially conscious consumers; builds brand equity |

| Customer Experience | User-friendly platforms & support | Streamlined digital transactions; proactive communication | Drives loyalty and organic growth via referrals |

| Sponsorships & PR | Community & Thought Leadership | Amsterdam Marathon sponsorship; ESG performance reports dissemination | Increased brand visibility and public trust |

Price

ING Groep employs competitive pricing to capture market share and ensure profitability. This involves offering attractive interest rates on savings accounts and loans, often aligning with or slightly undercutting key competitors in major European markets like the Netherlands and Germany. For instance, in early 2024, ING's variable mortgage rates in the Netherlands were typically positioned within the mid-range of major banks, aiming for broad customer appeal.

The bank differentiates its pricing across product tiers, with premium banking services commanding higher fees but offering enhanced benefits, while basic current accounts remain competitively priced to attract high-volume customer acquisition. This tiered approach allows ING to cater to diverse customer segments, balancing the pursuit of market leadership with the need for sustainable profit margins.

ING Groep's pricing strategy for its banking services is deeply rooted in value-based principles, particularly evident in its digital and personalized offerings. Fees for premium accounts or specialized financial tools are set to reflect the enhanced convenience, sophisticated analytics, and tailored advice customers receive, directly linking cost to tangible benefits.

For instance, ING's digital banking platforms often come with features like advanced budgeting tools and personalized investment insights, justifying any associated service fees by the significant value these functionalities add to a customer's financial management. This approach ensures that pricing communicates the solutions and advantages provided, rather than just the cost of a service.

ING Groep prioritizes transparent fee structures, ensuring customers clearly understand charges for accounts, transactions, and various banking services to foster trust. For instance, in early 2024, ING continued to offer competitive pricing on its checking and savings accounts, with many basic services remaining free for customers who met certain digital banking or minimum balance criteria.

The bank actively employs discounts and incentives to encourage customer engagement and channel adoption. This includes promotional offers for new account openings, loyalty benefits for long-term customers, and reduced or waived fees for transactions conducted through their user-friendly mobile app and online banking platforms, driving digital channel usage.

Dynamic Pricing and Market Conditions

ING Groep employs dynamic pricing strategies that are highly responsive to evolving market conditions. This means interest rates on products like mortgages and savings accounts are not static; they adjust based on factors such as central bank policies, inflation, and overall economic trends. For instance, as of early 2024, many central banks continued to manage interest rates in response to persistent inflation, directly impacting the pricing of ING's lending and deposit products.

The bank's agility is a key differentiator. ING actively monitors economic indicators and regulatory shifts to ensure its pricing remains competitive and reflective of the current financial landscape. This proactive approach allows ING to adapt quickly to changes, such as potential interest rate hikes or cuts, ensuring their offerings align with market demand and risk appetites. For example, during periods of economic uncertainty in 2024, ING's pricing models would have been recalibrated to account for increased credit risk and fluctuating liquidity.

- Interest Rate Fluctuations: ING's savings account rates in the Eurozone, for example, have historically followed the European Central Bank's main refinancing operations rate, demonstrating a direct link between monetary policy and retail product pricing.

- Market Demand Responsiveness: In periods of high mortgage demand, ING might adjust its mortgage rates to manage application volumes and maintain profitability, reflecting real-time market pressures.

- Regulatory Impact: Changes in capital requirements or liquidity regulations can influence a bank's cost of funds, which ING would then incorporate into its pricing for various financial products.

Bundling and Tiered Pricing Models

ING Groep leverages bundling and tiered pricing to cater to a wide range of customer needs and optimize revenue. For instance, their current account offerings often come with different tiers, such as basic, standard, and premium, each with distinct features like transaction limits, interest rates, and bundled services like insurance or investment advice.

These tiered models provide customers with flexibility, allowing them to select a package that best suits their financial activity and budget. This approach is crucial in a competitive banking landscape, where personalization drives customer loyalty. For example, in early 2024, ING's digital banking packages in the Netherlands saw increased adoption of premium tiers by customers seeking more comprehensive wealth management tools.

Bundling is also evident in their mortgage and investment products, where customers might receive preferential rates or reduced fees when combining multiple ING services. This strategy not only enhances customer stickiness but also allows ING to cross-sell effectively, increasing the average revenue per user. By offering these structured choices, ING aims to capture a broader market share, from students needing basic banking to high-net-worth individuals requiring sophisticated financial solutions.

- Tiered Account Structures: ING offers various account levels with differing fees, features, and benefits, catering to diverse customer segments.

- Service Bundling: Products like mortgages are often bundled with other financial services, such as insurance or investment accounts, to provide added value and encourage deeper customer relationships.

- Revenue Optimization: These pricing strategies aim to maximize revenue by capturing value across different customer segments and encouraging the uptake of higher-margin products.

- Customer Flexibility: Customers benefit from the ability to choose packages that align with their specific financial needs and preferences, enhancing overall satisfaction.

ING Groep's pricing strategy for its banking services is deeply rooted in value-based principles, particularly evident in its digital and personalized offerings. Fees for premium accounts or specialized financial tools are set to reflect the enhanced convenience, sophisticated analytics, and tailored advice customers receive, directly linking cost to tangible benefits.

For instance, ING's digital banking platforms often come with features like advanced budgeting tools and personalized investment insights, justifying any associated service fees by the significant value these functionalities add to a customer's financial management. This approach ensures that pricing communicates the solutions and advantages provided, rather than just the cost of a service.

ING Groep leverages bundling and tiered pricing to cater to a wide range of customer needs and optimize revenue. For instance, their current account offerings often come with different tiers, such as basic, standard, and premium, each with distinct features like transaction limits, interest rates, and bundled services like insurance or investment advice.

These tiered models provide customers with flexibility, allowing them to select a package that best suits their financial activity and budget. This approach is crucial in a competitive banking landscape, where personalization drives customer loyalty. For example, in early 2024, ING's digital banking packages in the Netherlands saw increased adoption of premium tiers by customers seeking more comprehensive wealth management tools.

| Pricing Strategy Element | Description | Example (Early 2024) |

|---|---|---|

| Competitive Pricing | Aligning with or slightly undercutting competitors for market share. | Variable mortgage rates in the Netherlands positioned mid-range among major banks. |

| Tiered Pricing | Differentiating prices based on service levels and benefits. | Premium banking services with higher fees for enhanced benefits vs. competitively priced basic accounts. |

| Value-Based Pricing | Setting fees to reflect tangible customer benefits from digital/personalized services. | Fees for advanced budgeting tools and personalized investment insights on digital platforms. |

| Transparent Fee Structures | Ensuring clear understanding of all charges. | Many basic services remained free for customers meeting digital banking or minimum balance criteria. |

| Discounts & Incentives | Using offers to drive engagement and channel adoption. | Promotional offers for new accounts, loyalty benefits, reduced fees for mobile/online transactions. |

| Dynamic Pricing | Adjusting prices based on market conditions. | Interest rates on savings and mortgages fluctuating with central bank policies and inflation. |

| Bundling | Combining multiple products for added value and revenue optimization. | Mortgage products bundled with insurance or investment accounts for preferential rates. |

4P's Marketing Mix Analysis Data Sources

Our ING Groep 4P's Marketing Mix Analysis is built upon a foundation of official company disclosures, including annual reports, investor presentations, and press releases. We also leverage insights from credible industry analysis, financial news, and competitive intelligence to ensure a comprehensive understanding of their strategies.