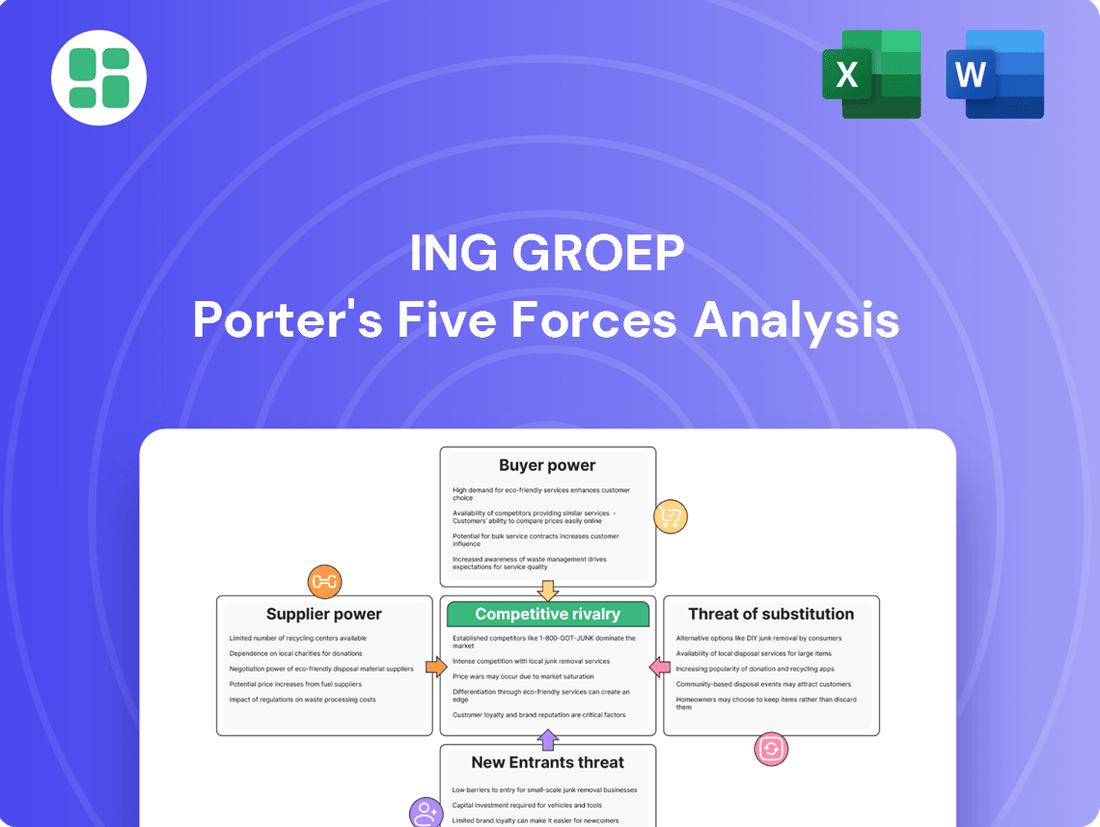

ING Groep Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ING Groep Bundle

ING Groep, a global financial services giant, navigates a complex landscape shaped by intense rivalry and evolving customer expectations. While the threat of new entrants may seem low due to significant capital requirements, the bargaining power of buyers and the availability of substitutes present formidable challenges. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping ING Groep’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ING Groep's push into digital banking significantly increases its reliance on technology and software providers. These suppliers can wield moderate to considerable bargaining power, particularly when offering specialized or proprietary solutions essential for ING's digital transformation and operational performance. For instance, the cost and complexity of switching core banking systems or major cloud infrastructure providers can be very high, granting these vendors substantial leverage. In 2024, the global IT services market, which includes software and cloud solutions, was projected to reach over $1.5 trillion, highlighting the scale and importance of these partnerships.

ING Groep, like many in financial services, is locked in a fierce global competition for specialized talent, especially in areas like technology, cybersecurity, artificial intelligence, and sustainability. This scarcity directly amplifies the bargaining power of professionals possessing these in-demand skills, leading to increased salary expectations and recruitment expenses.

For instance, the demand for AI specialists in the financial sector surged significantly in 2024, with some reports indicating salary increases of up to 20% for experienced professionals in key markets. ING's strategy to counter this involves robust investment in both attracting talent from abroad and nurturing skills internally, ensuring a competitive edge in securing and retaining essential human capital.

ING Groep, as a data-driven digital bank, heavily depends on external providers for crucial market data, credit ratings, and sophisticated analytics. Suppliers that can offer unique, high-quality, or real-time data sets wield considerable bargaining power. For instance, specialized financial data providers, whose platforms are essential for market analysis and trading operations, often command premium pricing due to the proprietary nature of their information and the significant investment required for its compilation and maintenance.

Payment Network Operators

Payment network operators like Visa and Mastercard wield significant bargaining power over ING Groep. These global networks are fundamental to ING's ability to process transactions, making them indispensable partners. Their extensive reach and the strong network effects they benefit from mean ING has limited alternatives. For instance, in 2023, Visa reported processing over 250 billion transactions globally, highlighting the sheer scale and essential nature of their infrastructure.

ING, despite its size, is subject to the terms and fees set by these payment networks. The critical role these networks play in facilitating commerce means that ING must largely accept their operating conditions. This dependence limits ING's ability to negotiate favorable terms, impacting its cost structure for payment services.

- High Dependence: ING relies heavily on Visa and Mastercard for its payment processing capabilities.

- Network Effects: The widespread adoption of these networks creates a barrier to entry for competitors and strengthens their position.

- Fee Structure: ING is often subject to interchange fees and other charges imposed by payment networks, impacting profitability.

Regulatory Bodies and Compliance Service Providers

Regulatory bodies, though not direct suppliers in the traditional sense, wield considerable influence over ING Groep. Their mandates, like the EU's Digital Operational Resilience Act (DORA) and the forthcoming AI Act, necessitate substantial investments in technology and specialized services. This creates a dependency on compliance service providers, effectively enhancing their bargaining power.

ING's expenditure on meeting these evolving regulatory landscapes is significant. For instance, the implementation of DORA alone requires considerable resources for risk management, incident reporting, and third-party oversight. This financial commitment underscores the indirect power of regulators and their chosen service partners.

- Regulatory Imposition: Directives such as DORA and the AI Act mandate specific operational and technological standards for financial institutions like ING.

- Compliance Investment: ING must allocate substantial capital towards meeting these regulatory requirements, often through technology upgrades and external expertise.

- RegTech Dependence: The complexity of compliance drives reliance on specialized RegTech providers, granting them increased leverage in service provision and pricing.

ING Groep's reliance on specialized software and cloud infrastructure providers for its digital transformation grants these suppliers significant bargaining power. The high cost and complexity of switching these essential systems, such as core banking platforms or major cloud providers, mean ING has limited alternatives. In 2024, the global market for IT services, encompassing software and cloud solutions, was estimated to exceed $1.5 trillion, underscoring the critical nature and value of these partnerships.

The bargaining power of suppliers to ING Groep is amplified by the specialized nature of their offerings and the difficulty of switching. For instance, providers of advanced analytics or proprietary financial data platforms hold considerable sway due to the unique insights they deliver, which are vital for ING's market analysis and operational efficiency. The investment required to develop or acquire similar capabilities internally is often prohibitive, reinforcing the suppliers' leverage.

ING's dependence on key technology and data providers is a significant factor in supplier bargaining power. The specialized nature of services like AI development or cybersecurity solutions, coupled with the high switching costs associated with integrated systems, means these suppliers can command premium pricing. The global IT services market's projected value of over $1.5 trillion in 2024 highlights the substantial investment and reliance financial institutions place on these external partners.

What is included in the product

This analysis unpacks the competitive forces shaping ING Groep's banking and financial services environment, highlighting threats from new entrants, the bargaining power of customers and suppliers, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for ING Groep.

Customers Bargaining Power

For many basic retail banking services, customers find it quite simple to switch providers. This is particularly true now with so many digital-only banks and slick mobile apps available. It means customers can easily move their money or look for better deals on interest rates or services without much hassle.

This low barrier to switching significantly boosts the bargaining power of these retail customers. They have more leverage to demand better terms from banks like ING. For instance, in 2023, the average customer retention rate in the retail banking sector remained strong, but the ease of opening new accounts online means even a small improvement in competitor offerings can trigger a shift.

ING's approach to counter this involves a strong focus on improving the overall customer experience. By offering user-friendly digital platforms and personalized services, ING aims to build loyalty and make it less appealing for customers to switch, even with low switching costs.

Customers, especially retail and small to medium-sized enterprises (SMEs), are becoming more attuned to pricing. This is largely thanks to digital tools and comparison websites that make it easy to see how different banks' offers stack up. For instance, in 2024, many consumers actively compared savings account interest rates, with leading banks offering rates around 4.5% to 5% for certain accounts, highlighting a clear price focus.

This increased transparency directly boosts customer bargaining power. They can easily see which institutions offer the best interest rates on loans and deposits, and which ones charge the lowest fees for services like international transfers or account maintenance. ING must therefore ensure its pricing remains competitive, not just on headline rates but also on the overall value proposition it provides to retain these discerning customers.

The growing number of fintech startups and neo-banks provides consumers with a wider array of specialized financial services, from payments to lending and investments. This surge in alternatives directly enhances customer bargaining power. For instance, by mid-2024, the global fintech market was projected to reach over $1.5 trillion, indicating a significant shift in customer options.

Sophistication of Wholesale and Commercial Clients

Large corporate and wholesale clients possess significant bargaining power due to their sophisticated financial needs and substantial transaction volumes. These clients can negotiate highly tailored terms and often demand specialized services, frequently engaging with multiple banking institutions simultaneously. ING's ability to meet these demands through robust, integrated solutions and dedicated relationship management is crucial for retaining and growing this segment.

In 2024, major corporate clients continued to leverage their scale, seeking competitive pricing and innovative financial products. For instance, large-scale syndicated loans and complex derivative transactions are areas where these clients can exert considerable pressure on pricing and service levels. ING's competitive standing in wholesale banking relies on its capacity to offer more than just basic services, focusing instead on value-added solutions that address intricate risk management and capital allocation strategies.

- Sophisticated Needs: Corporate clients require complex treasury management, trade finance, and capital markets access, enabling them to shop for the best providers.

- Transaction Volume: High volumes of transactions give these clients leverage to negotiate lower fees and better execution prices.

- Multiple Banking Relationships: The ability to spread business across several banks weakens any single bank's hold on the client.

- Demand for Specialization: Clients expect bespoke solutions, from customized hedging strategies to specialized financing structures, which ING must deliver.

Demand for Personalized and Integrated Services

Customers across all segments are increasingly seeking highly tailored services and smooth, integrated experiences across various channels. This trend is fueled by rapid progress in artificial intelligence and data analytics, allowing for deeper customer understanding.

This heightened demand significantly boosts customer bargaining power. For instance, in 2024, ING's focus on digital transformation, including AI-powered personalization, is a direct response to this evolving customer expectation. Banks that fail to adapt risk losing market share to more agile competitors.

- Demand for Hyper-Personalization: Customers expect services tailored to their individual needs and preferences.

- Omnichannel Experience: Seamless interaction across all touchpoints (online, mobile, branch) is crucial.

- Technology as a Differentiator: Banks must invest in AI and data analytics to meet these expectations.

- Competitive Pressure: Failure to deliver personalized, integrated services can lead to customer attrition.

Customers, particularly in retail and SME segments, wield significant bargaining power due to the ease of switching providers and increased price transparency. The proliferation of digital banks and comparison tools in 2024, where savings account rates often hovered around 4.5%-5%, empowers customers to demand better terms. ING counters this by enhancing its digital platforms and personalized services to foster loyalty.

Large corporate clients possess even greater leverage, negotiating tailored services and pricing due to their substantial transaction volumes and complex financial needs. In 2024, these clients actively sought competitive pricing on syndicated loans and derivatives, pushing banks like ING to offer value-added solutions beyond basic banking.

| Customer Segment | Key Bargaining Factors | 2024 Market Trend Example |

|---|---|---|

| Retail & SMEs | Ease of switching, price comparison | Savings account rates around 4.5%-5% |

| Corporate & Wholesale | Transaction volume, complex needs | Negotiation on syndicated loans, derivatives |

Full Version Awaits

ING Groep Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, offering a comprehensive Porter's Five Forces analysis of ING Groep. You'll gain detailed insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking and financial services sector. This professionally written analysis is fully formatted and ready for your immediate use.

Rivalry Among Competitors

ING Groep operates in a highly competitive landscape, facing intense rivalry from other major incumbent banks. Giants like BNP Paribas, Deutsche Bank, and Santander are formidable competitors, actively vying for market share across retail, commercial, and wholesale banking sectors.

These established players leverage their vast physical branch networks, deep-rooted customer relationships, and comprehensive product portfolios to challenge ING. For instance, in 2024, the European banking sector continued to see significant competition, with major banks reporting robust earnings, indicating their sustained ability to attract and retain customers through a wide array of financial services and digital offerings.

The increasing prominence of digital-first banks and neo-banks like N26 and Revolut is a major competitive force for ING, especially in the retail banking sector. These agile players often boast lower fees and a smoother digital experience, compelling ING to expedite its own digital advancements to keep pace.

Disruptive fintech companies are a significant force, particularly in areas like payments and lending. For instance, by mid-2024, the global fintech market was projected to reach over $33 billion, demonstrating substantial growth and market penetration. These agile players often offer specialized, user-friendly services that can chip away at traditional banks' market share in profitable segments.

ING faces direct competition from these fintech innovators. Companies focusing on specific niches, such as peer-to-peer lending platforms or digital payment solutions, are attracting customers with lower fees and more streamlined experiences. This competitive pressure necessitates that ING continuously innovate its own digital offerings and explore strategic partnerships to remain competitive and retain its customer base.

Emergence of Tech Giants in Financial Services

Large technology companies, often referred to as Big Tech, are increasingly making inroads into financial services, especially within the payments and digital wallet sectors. These tech giants, such as Apple and Google, leverage their massive existing customer bases and advanced technological infrastructure to offer competitive financial products.

Their entry represents a significant long-term competitive threat to established financial institutions like ING Groep. For example, Apple Pay and Google Pay have seen substantial user adoption, directly competing with traditional banking payment solutions.

The competitive rivalry is intensified by Big Tech's ability to innovate rapidly and their strong brand recognition, which can attract consumers away from traditional banks. In 2024, the digital payments market continued its robust growth, with platforms like Apple Pay and Google Pay processing billions of transactions globally, underscoring their growing influence.

- Big Tech's Market Share Growth: Companies like Apple and Google are expanding their financial service offerings, particularly in digital wallets and payment processing, directly challenging traditional players.

- User Base Advantage: Their existing vast user ecosystems provide an immediate advantage, allowing for rapid adoption of new financial products and services.

- Technological Capabilities: Advanced data analytics and AI capabilities enable Big Tech firms to offer personalized and seamless financial experiences, setting a high bar for incumbents.

- Brand Trust and Recognition: Strong existing brand loyalty translates into consumer trust, making it easier for them to penetrate the financial services market.

Geographic and Segment-Specific Competition

ING Groep faces intense rivalry that shifts based on geography and the specific banking or financial services segment. For example, the mortgage markets in the Netherlands and Germany are particularly crowded, with numerous local and international players vying for market share. This necessitates a nuanced approach, where ING must adapt its strategies to the unique competitive landscape of each region while ensuring a consistent global brand presence.

The intensity of competition can also differ significantly across ING's business lines. While retail banking in mature European markets might be characterized by established players and price sensitivity, other areas like investment banking or specialized lending in emerging markets could present different competitive dynamics. Understanding these segment-specific rivalries is crucial for effective resource allocation and strategic planning.

- Regional Mortgage Market Intensity: In 2024, the Dutch mortgage market, a key area for ING, continued to see robust competition. While specific market share data fluctuates, major banks, credit unions, and specialized mortgage lenders actively compete, often on interest rates and product innovation.

- Cross-Border Competition: ING's presence in multiple European countries means it contends with both local banks and other pan-European financial institutions, creating a complex competitive web.

- Segmental Focus: The competitive pressures ING faces in its retail banking operations might be distinct from those in its wholesale banking or asset management divisions, requiring tailored competitive strategies for each.

ING Groep contends with fierce competition from both traditional banking behemoths and nimble digital challengers. Established players like JPMorgan Chase and HSBC, with their extensive global reach and deep customer loyalty, represent significant rivals.

The rise of fintech firms and Big Tech companies further intensifies this rivalry, particularly in areas like payments and digital banking. For instance, by early 2024, the digital payments sector continued its rapid expansion, with companies like PayPal and Square processing billions of transactions, directly impacting traditional banking revenue streams.

ING's competitive landscape is further shaped by regional market dynamics and segment-specific pressures. The intensity of competition in retail banking in countries like Germany, where ING has a strong presence, often involves aggressive pricing strategies from local savings banks and direct banks.

| Competitor Type | Key Characteristics | Impact on ING | 2024 Data Point |

| Incumbent Banks | Large customer base, extensive branch network, broad product offerings | Direct competition for market share, customer retention challenges | Major European banks reported average net interest margins around 1.5-2.5% in early 2024, indicating strong core profitability and competitive pricing. |

| Digital Banks/Neo-banks | Agile, lower fees, superior digital experience | Erosion of retail market share, pressure to innovate digitally | Neo-banks saw a combined user growth of over 20% in Europe during the first half of 2024, capturing younger demographics. |

| Fintech Companies | Specialized services, disruptive business models | Threat in specific profitable segments (e.g., payments, lending) | The global fintech market was valued at over $33 billion in 2024, with payment solutions accounting for a significant portion. |

| Big Tech Companies | Massive user bases, advanced technology, brand recognition | Long-term threat in payments and digital wallets, potential disintermediation | Apple Pay and Google Pay processed an estimated $2 trillion in transactions globally in 2024, a substantial increase from previous years. |

SSubstitutes Threaten

The rise of digital payment platforms and mobile wallets presents a significant threat of substitution for traditional banking services. These platforms, like PayPal and Apple Pay, offer seamless alternatives for transactions, directly competing with ING's card and transfer services. In 2024, global mobile payment transaction volume was projected to reach over $17 trillion, highlighting the substantial shift away from traditional methods.

Peer-to-peer lending platforms and crowdfunding initiatives present a growing threat of substitutes for traditional banking services offered by ING Groep. These platforms allow individuals and small to medium-sized enterprises (SMEs) to borrow money directly from a pool of investors, bypassing banks altogether. For instance, by mid-2024, the global P2P lending market was projected to reach over $1.1 trillion, indicating a significant alternative to bank loans.

While these alternatives may not fully replace the comprehensive suite of services offered by a large bank like ING, they effectively chip away at specific revenue streams. For borrowers, especially SMEs seeking capital, P2P platforms can offer faster approvals and potentially more competitive rates for certain loan types. In 2023, crowdfunding platforms facilitated billions of dollars in funding for businesses worldwide, demonstrating their capacity to attract capital that might otherwise have gone to traditional lenders.

Robo-advisors and online investment platforms present a significant threat of substitutes for ING's traditional investment services. These digital alternatives offer automated portfolio management and lower fees, attracting a growing segment of investors, particularly those comfortable with technology. For instance, by the end of 2023, the global robo-advisory market was valued at over $17 billion, with projections indicating substantial growth, potentially siphoning assets that might otherwise be managed by ING.

Embedded Finance Solutions

The increasing prevalence of embedded finance solutions poses a substantial threat of substitutes for traditional banking services. These solutions integrate financial functionalities directly into non-financial platforms, such as e-commerce sites or software applications, allowing users to access banking services without a direct bank interaction.

This shift means customers can manage payments, access loans, or obtain insurance directly within their preferred digital environments. For instance, a small business might use an accounting software that also offers integrated payment processing and short-term financing, bypassing the need for a separate business loan from a bank.

The convenience and contextual relevance of embedded finance are driving its adoption. By 2025, the global embedded finance market is projected to reach $7.2 trillion in transaction value, highlighting the significant potential for these solutions to displace traditional banking channels.

- Embedded finance integrates financial services into non-financial platforms.

- This reduces the need for direct customer interaction with banks.

- The global embedded finance market is expected to reach $7.2 trillion in transaction value by 2025.

Cryptocurrencies and Blockchain-based Finance

While still in their nascent stages, cryptocurrencies and decentralized finance (DeFi) present a growing threat of substitution for traditional banking services. These digital assets and platforms offer alternative avenues for payments, lending, borrowing, and asset management, potentially bypassing established financial institutions like ING. As of early 2024, the total market capitalization of cryptocurrencies has fluctuated significantly, demonstrating increasing investor interest and technological development in this space.

ING needs to closely monitor the evolution of blockchain technology and DeFi protocols. The increasing adoption of stablecoins for cross-border payments, for instance, could directly impact ING's remittance services. Furthermore, DeFi lending platforms, which offer competitive interest rates, pose a direct challenge to traditional deposit and loan products. ING's strategic response will be crucial in mitigating the long-term risk of disintermediation.

- Growing DeFi Adoption: The total value locked (TVL) in DeFi protocols, a key metric for platform usage, has seen substantial growth, indicating increasing reliance on these decentralized systems for financial activities.

- Stablecoin Usage: Stablecoins, pegged to fiat currencies, are increasingly used for everyday transactions and remittances, offering a faster and potentially cheaper alternative to traditional payment rails.

- Regulatory Uncertainty: While regulatory frameworks are still developing, this uncertainty can hinder mainstream adoption but also presents an opportunity for ING to shape future compliance standards.

The threat of substitutes for ING Groep is substantial, driven by digital innovations that offer alternative ways to conduct financial transactions and manage wealth. These substitutes often provide greater convenience, lower costs, or specialized services that traditional banking may not match. For instance, the rapid growth of digital payment platforms and the increasing adoption of cryptocurrencies directly challenge ING's core offerings.

The market for alternative financial solutions is expanding rapidly. In 2024, global mobile payment transaction volume was projected to surpass $17 trillion, while the peer-to-peer lending market was expected to exceed $1.1 trillion. Furthermore, the global robo-advisory market, valued at over $17 billion by the end of 2023, demonstrates a clear trend of customers seeking automated and cost-effective investment management.

| Substitute Category | Key Platforms/Technologies | 2024/2025 Projections/Data | Impact on ING |

|---|---|---|---|

| Digital Payments & Wallets | PayPal, Apple Pay, Google Pay | Global mobile payment volume projected > $17 trillion (2024) | Direct competition for transaction and card services |

| Peer-to-Peer (P2P) Lending | LendingClub, Prosper | Global P2P lending market projected > $1.1 trillion (mid-2024) | Alternative for loans, potentially reducing demand for ING's credit products |

| Robo-Advisors | Betterment, Wealthfront | Global robo-advisory market valued > $17 billion (end-2023) | Threat to traditional investment management and wealth advisory services |

| Embedded Finance | Integrated solutions in e-commerce, SaaS | Global embedded finance market projected $7.2 trillion transaction value (2025) | Disintermediation of banking services within non-financial platforms |

| Cryptocurrencies & DeFi | Bitcoin, Ethereum, DeFi protocols | Significant market capitalization and growing TVL in DeFi | Alternative for payments, lending, borrowing, and asset management |

Entrants Threaten

The banking sector, including ING Groep, faces substantial hurdles for new competitors due to stringent regulatory frameworks and significant capital demands. These include extensive licensing processes, rigorous compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, and the need to maintain high capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which for major European banks like ING was around 14.7% as of Q1 2024, according to ECB data.

These high entry barriers effectively deter new entrants, as establishing a bank requires immense financial resources and the capacity to navigate complex legal and operational requirements. Consequently, this limits the threat of new companies entering the market and directly competing with established institutions like ING, reinforcing the stability of existing market players.

Building brand recognition and trust in the financial services industry is a long and costly endeavor. For instance, ING has cultivated customer loyalty over many years, leading to a strong perception of security and reliability among its existing customer base. Newcomers face a significant hurdle in replicating this level of credibility, especially when dealing with core banking services like savings accounts and loans, where trust is paramount.

Incumbent banks, including ING Groep, benefit from substantial economies of scale in areas like technology, operations, and customer acquisition, which are difficult for new players to replicate. For instance, ING’s investment in digital platforms and branch networks creates a cost advantage per customer that emerging fintechs struggle to match. In 2023, ING reported a cost-to-income ratio of 56.7%, reflecting their operational efficiencies gained through scale.

Network effects further solidify ING’s position. The more customers ING serves, the more valuable its services become, attracting even more users through enhanced payment networks and data insights. This creates a powerful barrier to entry, as new entrants must first build a critical mass of users to compete effectively. The rapid growth of digital payment systems underscores the importance of these network effects in the banking sector.

Technological Complexity and Infrastructure Costs

The sheer technological complexity and the immense infrastructure costs associated with modern banking present a formidable barrier to new entrants. Developing and maintaining secure, scalable, and compliant digital banking platforms requires substantial upfront investment, often running into billions of dollars.

For instance, major banks like ING have been investing heavily in digital transformation. In 2023, ING announced a €1 billion investment in its IT infrastructure to enhance digital capabilities and cybersecurity, a sum that would be a significant hurdle for any newcomer. This ongoing expenditure for system upgrades, data management, and regulatory compliance makes it incredibly difficult for new players to compete on a level playing field.

- High Capital Requirements: New entrants need to fund the development or acquisition of sophisticated banking software, secure data centers, and robust cybersecurity measures.

- Ongoing Maintenance and Upgrades: The cost doesn't stop at initial setup; continuous investment is required to keep pace with evolving technology and regulatory demands.

- Economies of Scale: Established players like ING benefit from existing infrastructure and customer bases, allowing them to spread these high fixed costs over a larger operational volume, further disadvantaging new entrants.

Niche Entry and Gradual Expansion by Fintechs

Fintech companies often bypass high entry barriers into full-scale banking by initially focusing on specific, profitable niches. For instance, many entered the payments sector with streamlined digital solutions, bypassing the need for extensive branch networks. This strategy allows them to build customer bases and technological expertise before expanding into broader financial services.

This gradual expansion, often described as 'nibbling at the edges,' poses a significant threat to incumbent banks like ING. By excelling in specific areas, fintechs can attract customers away from traditional offerings, cumulatively eroding market share. For example, the global digital payments market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, highlighting the success of niche fintech entry.

- Niche Specialization: Fintechs target underserved or inefficient segments, like cross-border payments or specific loan types, offering superior user experience and lower costs.

- Gradual Market Penetration: Successful niche players then leverage their established customer base and technology to introduce adjacent services, such as savings accounts or investment platforms.

- Reduced Capital Requirements: By avoiding the need for physical infrastructure and legacy systems, fintechs can enter markets with significantly lower upfront capital compared to traditional banks.

- Customer Acquisition: In 2023, digital-native banks saw a substantial increase in customer acquisition, with some reporting growth rates exceeding 20% year-over-year, demonstrating the effectiveness of this strategy.

The threat of new entrants for ING Groep is generally considered low to moderate, primarily due to substantial barriers to entry in the banking sector. These barriers include high capital requirements, stringent regulatory compliance, and the need for significant technological investment, making it difficult for new players to compete effectively.

Established players like ING benefit from economies of scale and strong brand recognition, which are hard for newcomers to replicate. For instance, ING's 2023 cost-to-income ratio of 56.7% highlights operational efficiencies that new entrants would struggle to achieve initially.

While fintechs can enter specific niches with lower capital, their ability to disrupt core banking services is often limited by regulatory hurdles and the need to build trust, a process that takes considerable time and resources.

The banking industry's high fixed costs, coupled with ongoing technological upgrades, such as ING's €1 billion IT investment in 2023, create a formidable challenge for any new entrant seeking to establish a comparable operational footprint and competitive cost structure.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ING Groep is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. This data is supplemented by insights from reputable financial news outlets, industry-specific publications, and market research reports to provide a comprehensive view of the competitive landscape.