InfuSystem PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InfuSystem Bundle

Navigate the complex external forces shaping InfuSystem's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends create both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your market strategy and gain a competitive advantage. Purchase the full PESTLE analysis now for deep-dive insights.

Political factors

Changes in government healthcare policies, especially those affecting oncology, medical device purchasing, and home care, directly impact InfuSystem's market potential and how it operates. For instance, the Medicare Physician Fee Schedule final rule for 2024 saw an increase in reimbursement rates for certain infusion services, potentially benefiting providers like InfuSystem. Conversely, any shifts in regulatory approval pathways for medical devices or changes in home healthcare reimbursement models could alter the landscape.

The U.S. Food and Drug Administration (FDA) imposes rigorous regulations that directly influence InfuSystem's product lifecycle, from development to market availability. These rules govern everything from the safety and efficacy of infusion devices to the services supporting them, making compliance a critical factor for business operations.

Navigating the FDA's approval pathways, which can be lengthy and complex, directly impacts InfuSystem's time-to-market for new technologies. For instance, the FDA's Center for Devices and Radiological Health (CDRH) oversees medical devices, and the specific classification of InfuSystem's products will dictate the required premarket submission process, such as 510(k) or Premarket Approval (PMA).

InfuSystem's commitment to adhering to evolving FDA standards, including post-market surveillance and quality system regulations, is essential for maintaining product viability and market access. Failure to comply can lead to significant delays, product recalls, and reputational damage, underscoring the importance of robust regulatory affairs management.

Government reimbursement policies are a critical political factor for InfuSystem. Changes in Medicare and Medicaid reimbursement rates for infusion therapies, especially those provided in ambulatory settings, directly affect InfuSystem's client base. For instance, a reduction in reimbursement for home infusion services could lead to decreased demand for InfuSystem's equipment and support.

In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed adjustments to payment rates for various healthcare services. While specific impacts on infusion therapy reimbursement are still being finalized, any cuts could pressure InfuSystem's clients, potentially affecting their purchasing power for the company's solutions. Conversely, favorable policy shifts could bolster demand.

Healthcare Funding and Budget Allocations

Government spending on healthcare infrastructure and specific treatment areas like oncology directly impacts InfuSystem's market. For instance, in the US, the Centers for Medicare & Medicaid Services (CMS) projected Medicare spending to reach $963.6 billion in 2024, a 6.3% increase from 2023, indicating potential for increased demand for medical devices and services.

Budgetary decisions at federal and state levels significantly influence healthcare facilities' purchasing power. In 2023, the US federal budget allocated substantial funds to health programs, though specific allocations can shift annually based on legislative priorities, affecting capital investments in new technologies and equipment that InfuSystem provides.

- Federal Healthcare Spending: The US federal government's commitment to healthcare, as evidenced by projected Medicare spending of $963.6 billion in 2024, underpins market demand.

- State Budget Impacts: State-level budget allocations for Medicaid and public health initiatives can vary, creating regional differences in healthcare facility investment capacity.

- Disease-Specific Funding: Increased funding for areas like cancer research and treatment, a key focus for many healthcare providers, can drive demand for specialized infusion therapies and related equipment.

Political Stability and Trade Relations

Geopolitical stability is a significant consideration for InfuSystem, as disruptions to international trade relations can directly impact its global supply chain for medical equipment and components. For instance, a shift in trade policies or increased tariffs, as seen in ongoing trade discussions between major economies in 2024, could lead to higher sourcing costs and extended lead times for essential parts. This necessitates a proactive approach to logistics and sourcing strategies to mitigate potential impacts on product availability and pricing.

InfuSystem's reliance on international suppliers means that changes in trade agreements, such as updates to free trade pacts or the imposition of new import/export regulations, could require swift adjustments. For example, if a key component supplier is located in a region experiencing political instability or facing new trade barriers, InfuSystem might need to identify and qualify alternative suppliers to ensure continuity of operations. This adaptability is crucial for maintaining competitive pricing and timely delivery of their infusion therapy solutions.

- Trade Policy Impact: Fluctuations in global trade policies, including tariffs and import/export restrictions, directly influence the cost and availability of InfuSystem's medical equipment components.

- Supply Chain Resilience: Geopolitical instability in key manufacturing regions can disrupt InfuSystem's supply chain, potentially leading to increased lead times and operational challenges.

- Sourcing Strategy Adjustments: Changes in international trade relations may compel InfuSystem to diversify its supplier base and adapt its logistics network to maintain efficiency and cost-effectiveness.

Government healthcare reimbursement policies are a primary driver for InfuSystem's business. For instance, the Centers for Medicare & Medicaid Services (CMS) projected Medicare spending to reach $963.6 billion in 2024, indicating a robust market for infusion services. Any changes to these reimbursement rates, particularly for ambulatory or home infusion care, directly affect the financial viability of InfuSystem's clients, influencing their purchasing decisions for equipment and services.

Regulatory frameworks, especially those from the U.S. Food and Drug Administration (FDA), dictate product development and market access. The FDA's oversight of medical devices, including infusion pumps and related technologies, means that compliance with safety, efficacy, and quality standards is paramount. Navigating complex approval pathways, such as the 510(k) clearance or Premarket Approval (PMA) for new devices, directly impacts InfuSystem's innovation pipeline and time-to-market.

Government funding and budgetary allocations for healthcare significantly influence the capital expenditure of healthcare providers. In 2023, US federal health programs received substantial funding, though annual shifts based on legislative priorities can impact healthcare facilities' capacity to invest in new medical technologies. Increased government investment in areas like oncology further supports demand for specialized infusion therapies and equipment.

Geopolitical factors, such as trade policies and international relations, affect InfuSystem's global supply chain. Changes in tariffs or import/export regulations in 2024 could increase sourcing costs for components and extend lead times, necessitating agile supply chain management and supplier diversification to maintain operational efficiency and competitive pricing.

| Political Factor | Impact on InfuSystem | Supporting Data/Trend (2024/2025) |

| Healthcare Reimbursement Rates | Directly impacts client revenue and purchasing power for InfuSystem's products and services. | Projected Medicare spending of $963.6 billion in 2024 (CMS). Potential adjustments to infusion therapy reimbursement rates by CMS are under review. |

| FDA Regulations | Governs product safety, efficacy, and market approval, influencing R&D timelines and product lifecycle. | Ongoing FDA review processes for medical devices, with specific pathways (510(k), PMA) dictating market entry for new technologies. |

| Government Healthcare Spending | Influences capital budgets of healthcare facilities, affecting demand for medical equipment. | US federal budget allocations for health programs in 2023 and anticipated shifts in healthcare investment priorities for 2024/2025. Increased funding for oncology research and treatment. |

| Trade Policies & Geopolitics | Affects supply chain costs, lead times, and availability of components for medical devices. | Global trade policy discussions and potential for new tariffs or import/export regulations impacting international sourcing in 2024. |

What is included in the product

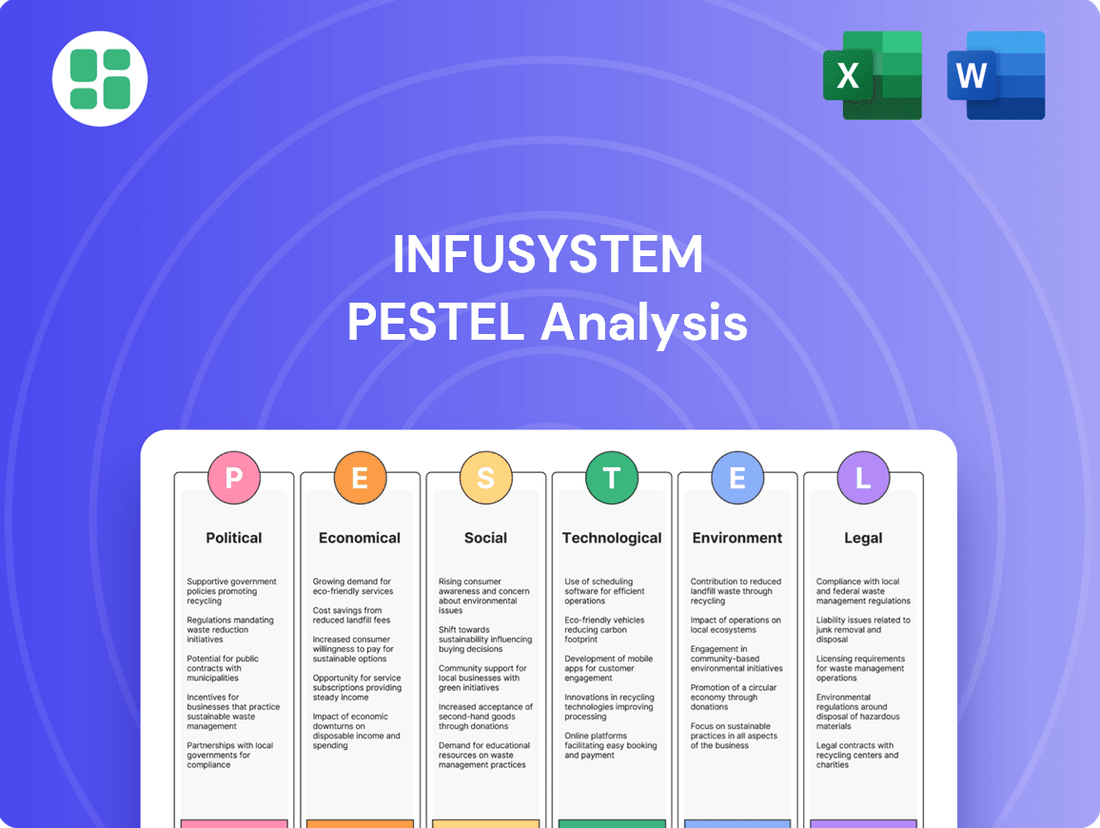

This InfuSystem PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential threats and opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making the InfuSystem PESTLE analysis a valuable tool for strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions, effectively relieving the pain point of uncertainty for InfuSystem's leadership.

Economic factors

National healthcare spending continues its upward trajectory, with projections indicating a significant rise in the coming years. In the United States, healthcare expenditures are expected to reach approximately $7.2 trillion by 2027, a substantial increase from previous years. This growth is driven by factors such as an aging population and advancements in medical technology, directly impacting the demand for specialized medical equipment like InfuSystem's infusion pumps.

The oncology sector, in particular, represents a substantial portion of healthcare spending. As cancer treatments become more sophisticated, often involving complex drug regimens administered via infusion, the need for reliable infusion pumps and related services escalates. This trend is further bolstered by the growing preference for home healthcare, where patients can receive treatments in a more comfortable and cost-effective setting, directly benefiting companies like InfuSystem that cater to this market.

Economic conditions play a crucial role in shaping healthcare spending patterns. During periods of economic growth, individuals and healthcare systems often have more disposable income to invest in advanced treatments and technologies, potentially increasing demand for InfuSystem's offerings. Conversely, economic downturns can lead to budget constraints within healthcare providers and reduced out-of-pocket spending by patients, which could temper demand for non-essential or elective procedures and associated equipment.

Rising inflation, with the US CPI reaching 3.3% in May 2024, directly impacts InfuSystem by increasing the cost of goods and services needed for operations, potentially reducing profitability. This inflationary pressure can also extend to labor costs, making it more expensive to retain and attract skilled employees.

Interest rate hikes, such as the Federal Reserve's decision to maintain rates in mid-2024, influence InfuSystem's borrowing costs for expansion projects and research and development. Furthermore, higher interest rates can make it more challenging for InfuSystem's clients to secure financing for acquiring or upgrading the company's infusion systems, potentially slowing sales cycles.

Robust economic growth, as seen in the projected 2.5% GDP increase for the US in 2024 according to the Congressional Budget Office, typically translates to higher healthcare spending. This increased utilization and investment by healthcare providers creates a more favorable market for InfuSystem's infusion therapy solutions, potentially driving demand for their products and services.

However, the specter of economic slowdown or recession presents a significant risk. Should economic conditions worsen, healthcare facilities might face tighter budgets, leading to postponed capital expenditures on new equipment like infusion pumps. This could directly impact InfuSystem's sales cycle and overall revenue generation.

For instance, if a recessionary environment leads to a 5% reduction in healthcare facility capital budgets, as some analysts predict for a mild downturn, InfuSystem could experience a corresponding dip in new system sales. Furthermore, reduced patient volumes during economic hardship could also lower the demand for disposable infusion supplies.

Competitive Landscape and Pricing Pressure

The medical device and infusion therapy sector is highly competitive, with many players vying for market share. This crowded field naturally leads to significant pricing pressure, forcing companies like InfuSystem to carefully consider their pricing strategies for equipment rentals, sales, and related biomedical services. For instance, in 2024, the global infusion therapy market was valued at approximately $19.5 billion, with projections indicating continued growth, but also highlighting the intense competition among established and emerging providers.

InfuSystem's ability to remain competitive hinges on its strategic pricing. Balancing the need to offer attractive prices to customers with the necessity of maintaining healthy profit margins is a constant challenge. This dynamic is further amplified by the increasing demand for cost-effective healthcare solutions, pushing all providers to optimize their operational efficiencies and pricing models.

- Intense Competition: The medical device and infusion therapy market features a large number of competitors.

- Pricing Pressure: This competitive environment results in significant pressure on pricing for rental, sales, and services.

- Market Value: The global infusion therapy market was valued around $19.5 billion in 2024, indicating a substantial but competitive arena.

- Strategic Imperative: InfuSystem must strategically price its offerings to stay competitive while ensuring profitability.

Healthcare Provider Profitability

The financial health of healthcare providers is a direct driver for InfuSystem's revenue. For instance, a study by the American Medical Association in late 2023 indicated that physician practices, including those in oncology, were experiencing increased operational costs, with inflation impacting everything from supplies to staffing. This financial pressure can limit their capacity to purchase new infusion pumps or expand service lines that rely on InfuSystem's offerings.

Ambulatory infusion centers, a key client segment, are also navigating a complex reimbursement landscape. In early 2024, reports highlighted that Medicare reimbursement rates for certain infusion drugs and services remained a point of concern, potentially squeezing profit margins. When these centers face tighter financial margins, their spending on capital equipment and outsourced services, like those provided by InfuSystem, may be curtailed.

- Increased operational costs for oncology practices due to inflation (late 2023 AMA data).

- Potential limitations on capital expenditure by providers facing financial constraints.

- Concerns over Medicare reimbursement rates impacting ambulatory infusion center profitability (early 2024 reports).

- Direct correlation between provider profitability and their investment in new equipment or services from InfuSystem.

Economic growth directly influences healthcare spending, with a projected 2.5% US GDP increase in 2024 potentially boosting demand for InfuSystem's infusion therapy solutions. Conversely, rising inflation, evidenced by a 3.3% US CPI in May 2024, escalates operational costs for InfuSystem and its clients, potentially squeezing profit margins and impacting investment in new equipment.

Higher interest rates, maintained by the Federal Reserve in mid-2024, increase borrowing costs for expansion and can hinder client financing for InfuSystem's products. Economic downturns pose a risk, potentially leading to reduced healthcare facility budgets and postponed capital expenditures, impacting sales cycles and revenue.

| Economic Factor | Data Point | Implication for InfuSystem |

| US GDP Growth (Projected 2024) | 2.5% | Positive impact on healthcare spending and demand for infusion solutions. |

| US CPI (May 2024) | 3.3% | Increased operational costs, potential impact on profitability and client spending. |

| Federal Reserve Interest Rates (Mid-2024) | Maintained | Higher borrowing costs; potential client financing challenges. |

| Economic Slowdown Risk | Potential reduction in healthcare capital budgets | Risk of postponed capital expenditures and slower sales cycles. |

What You See Is What You Get

InfuSystem PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive InfuSystem PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting InfuSystem.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete PESTLE framework for InfuSystem's strategic planning.

Sociological factors

The world is experiencing a significant demographic shift, with a growing proportion of the population falling into older age brackets. This aging trend, projected to continue through 2025 and beyond, directly correlates with a higher incidence of chronic conditions. For instance, by 2024, it's estimated that over 1.7 million new cancer cases will be diagnosed in the United States alone, a condition often requiring infusion therapy.

The increasing prevalence of chronic diseases such as diabetes, cardiovascular ailments, and autoimmune disorders further amplifies the need for specialized medical services like those offered by InfuSystem. These conditions frequently necessitate ongoing infusion treatments, creating a robust and expanding market. In 2025, global healthcare spending is anticipated to reach trillions, with a substantial portion allocated to managing chronic illnesses.

There's a clear societal shift towards receiving healthcare at home, a trend that directly benefits companies like InfuSystem. This preference for home-based care means more demand for portable infusion solutions and the support services needed to manage them outside of traditional hospitals. In 2024, the home healthcare market in the U.S. was valued at an estimated $390 billion, with projections indicating continued robust growth.

InfuSystem's business model, which centers on helping healthcare providers manage infusion therapy operations, is perfectly positioned to capitalize on this growing patient preference. By providing the necessary technology and support for home infusion, InfuSystem directly addresses the needs of both patients seeking comfort and providers adapting to new care delivery models.

Growing public health awareness, particularly concerning chronic diseases, directly fuels demand for InfuSystem's services. For instance, the Centers for Disease Control and Prevention (CDC) reported in 2024 that over 65% of American adults have at least one chronic condition, a figure expected to rise, necessitating ongoing infusion therapies.

Patients are increasingly proactive in managing their health, seeking out information and demanding personalized treatment plans. This patient engagement translates to a greater willingness to utilize home infusion services, as offered by InfuSystem, for convenience and potentially better outcomes, as evidenced by the projected 8% annual growth in the home healthcare market through 2025.

Workforce Shortages in Healthcare

Persistent shortages of skilled healthcare professionals, particularly nurses trained in infusion therapy, continue to impact the operational capacity of InfuSystem's client facilities. This scarcity directly affects the efficiency of patient care delivery and equipment utilization.

For instance, a 2024 report indicated a projected deficit of over 100,000 nurses nationwide by 2025, with critical care and infusion specialties being particularly affected. This creates a significant opportunity for InfuSystem to offer solutions that streamline equipment management, thereby reducing the burden on limited, highly skilled staff and enhancing their productivity.

- Persistent shortages of skilled healthcare professionals, especially nurses in infusion therapy.

- Impact on operational capacity and efficiency of client facilities.

- Opportunity for InfuSystem to provide solutions that ease staff burden.

- Need for streamlined equipment management due to workforce constraints.

Lifestyle Changes and Disease Incidence

Societal shifts in how people live, particularly concerning diet and exercise, directly impact the prevalence of chronic illnesses. For instance, the increasing rates of obesity, a condition linked to sedentary lifestyles and poor dietary choices, have been a growing concern. In 2023, the World Obesity Federation projected that over half the world's population will be living with obesity by 2035, a trend that could significantly boost demand for infusion therapies related to managing conditions like diabetes and autoimmune disorders.

These evolving lifestyle trends have a ripple effect on healthcare demands, influencing the market for companies like InfuSystem. As chronic diseases become more common, the need for advanced infusion systems to deliver treatments effectively grows. For example, the global diabetes care market, which heavily relies on infusion technologies for insulin delivery, was valued at approximately $65.4 billion in 2023 and is expected to expand further.

- Increased prevalence of chronic diseases like diabetes and cardiovascular conditions due to lifestyle factors.

- Growing demand for home infusion therapies as individuals seek convenient treatment options.

- Shifting consumer preferences towards healthier lifestyles, potentially impacting the incidence of certain infusion-dependent diseases.

- The global infusion therapy market size was valued at USD 22.6 billion in 2023 and is projected to grow, partly driven by these lifestyle-related health trends.

Societal trends are increasingly favoring home-based healthcare, a significant tailwind for InfuSystem. This preference is driven by patient comfort and a desire for more personalized care. The U.S. home healthcare market, valued at approximately $390 billion in 2024, demonstrates this shift, with continued growth projected through 2025.

The aging global population and the rising incidence of chronic diseases directly increase the demand for infusion therapies. By 2025, global healthcare spending is expected to reach trillions, with chronic disease management being a substantial component. This demographic and health trend creates a robust market for InfuSystem's services.

Growing public health awareness and patient proactivity in managing their conditions further fuel the need for convenient treatment options like home infusion. With over 65% of American adults managing at least one chronic condition in 2024, according to the CDC, the demand for ongoing infusion therapies is substantial and expanding.

| Sociological Factor | Impact on InfuSystem | Supporting Data (2024/2025) |

|---|---|---|

| Aging Population & Chronic Diseases | Increased demand for infusion therapy services. | Over 1.7 million new cancer cases diagnosed in the US (2024); Global healthcare spending to reach trillions (2025). |

| Preference for Home Healthcare | Growth in demand for portable infusion solutions and support. | US home healthcare market valued at $390 billion (2024); projected 8% annual growth through 2025. |

| Public Health Awareness & Patient Empowerment | Greater patient adoption of home infusion services. | Over 65% of US adults have at least one chronic condition (2024). |

| Lifestyle Trends (Diet, Exercise) | Potential increase in chronic conditions requiring infusion. | Global diabetes care market valued at $65.4 billion (2023); Global infusion therapy market valued at $22.6 billion (2023). |

Technological factors

Continuous innovation in infusion pump technology is a key driver in the healthcare sector. Smart pumps, incorporating advanced safety features like dose error reduction software (DERS) and barcode medication administration (BCMA) capabilities, are becoming standard. These advancements aim to minimize medication errors, a significant concern in patient care. For instance, by 2024, the global infusion pump market was projected to reach over $10 billion, driven by the increasing adoption of these sophisticated devices.

The development of connected infusion pumps, enabling real-time data transmission and integration with electronic health records (EHRs), directly impacts the efficiency of healthcare operations. This connectivity allows for better patient monitoring, remote management, and data analytics, crucial for optimizing treatment protocols. InfuSystem's ability to leverage these connected technologies will be vital for maintaining its competitive edge in providing infusion therapy services and equipment.

Precision in drug delivery remains paramount, with new pumps offering enhanced accuracy and customizable infusion profiles. This technological evolution supports more personalized patient treatment plans, particularly for complex therapies. As of early 2025, research indicates a growing demand for infusion pumps capable of delivering a wider range of medications with greater accuracy, reflecting a shift towards more specialized and precise patient care.

The growing acceptance of telemedicine and remote patient monitoring presents a significant opportunity for InfuSystem to refine its service offerings. By embedding these technologies, InfuSystem can facilitate virtual patient support, enable remote equipment diagnostics, and streamline data acquisition, ultimately boosting both patient well-being and operational effectiveness.

For instance, the U.S. telemedicine market was projected to reach $200 billion by 2027, indicating a substantial shift towards virtual care solutions. This trend allows InfuSystem to integrate its infusion therapy services more seamlessly into a patient's home environment, potentially reducing hospital readmissions and improving patient convenience.

Big data analytics and AI are revolutionizing healthcare operations. For InfuSystem, this means optimizing equipment maintenance through predictive analytics, which can reduce downtime and associated costs. For instance, AI algorithms can analyze sensor data from infusion pumps to forecast potential failures, allowing for proactive servicing.

Improved inventory management is another key benefit. By analyzing usage patterns and patient demographics, InfuSystem can better predict demand for supplies, minimizing waste and ensuring availability. This data-driven approach can lead to significant cost efficiencies, potentially impacting profit margins positively in the 2024-2025 period.

Furthermore, AI holds the promise of personalizing infusion protocols. Analyzing patient data, including medical history and real-time responses, can help tailor treatment delivery for better patient outcomes. This could enhance InfuSystem's service offerings and competitive edge.

Cybersecurity Threats

As medical devices become increasingly connected, cybersecurity threats pose a significant risk to patient data and device functionality. InfuSystem, like others in the healthcare technology sector, must prioritize robust security measures. The healthcare industry experienced a 20% increase in cyberattacks in 2023, with ransomware being a primary concern, impacting patient care and data privacy.

InfuSystem needs to invest in advanced cybersecurity protocols to safeguard sensitive patient information and ensure the uninterrupted operation of its infusion systems. This includes continuous monitoring, regular software updates, and employee training on best practices to mitigate potential breaches. A 2024 report indicated that the average cost of a healthcare data breach exceeded $10 million, highlighting the financial imperative for strong cybersecurity.

- Increased connectivity of medical devices amplifies vulnerability to cyberattacks.

- Ransomware attacks are a growing concern in the healthcare sector, impacting operations and patient data.

- Robust cybersecurity investment is crucial for InfuSystem to protect sensitive information and ensure device reliability.

- The financial implications of healthcare data breaches are substantial, underscoring the need for proactive security measures.

Biomedical Service Innovations

Advancements in remote diagnostics and predictive analytics are revolutionizing medical equipment maintenance. These technologies allow for proactive identification of potential issues before they cause downtime, a critical factor for service providers like InfuSystem. For example, the global medical equipment maintenance market was valued at approximately $30 billion in 2023 and is projected to grow significantly, driven by the increasing complexity of healthcare technology and the need for efficient asset management.

InfuSystem can leverage these technological shifts to enhance its biomedical services. By integrating AI-powered diagnostic tools and data analytics platforms, the company can offer more efficient repair services and robust preventative maintenance programs. This not only improves operational efficiency but also strengthens client relationships by ensuring higher equipment uptime and reliability, contributing to better patient care outcomes.

Key areas for innovation include:

- AI-driven fault detection: Implementing artificial intelligence to predict equipment failures based on real-time performance data.

- Remote monitoring and diagnostics: Utilizing IoT devices to remotely assess equipment status and diagnose issues, reducing the need for on-site visits.

- Robotics in repair: Exploring the use of robotic systems for routine maintenance tasks or complex repairs, increasing precision and speed.

- Blockchain for asset tracking: Employing blockchain technology for secure and transparent management of medical equipment lifecycles and maintenance records.

Technological advancements in infusion pumps, including smart features like DERS and BCMA, are crucial for patient safety and market growth, with the global market projected to exceed $10 billion by 2024. Connected pumps integrating with EHRs enhance patient monitoring and data analytics, a key competitive factor for InfuSystem. Precision in drug delivery is also advancing, with a rising demand for pumps offering greater accuracy and customizable profiles for personalized treatments as of early 2025.

| Technological Factor | Impact on InfuSystem | 2024-2025 Data/Trend |

|---|---|---|

| Smart Pump Features (DERS, BCMA) | Enhances patient safety, drives market demand | Global infusion pump market > $10 billion (2024 projection) |

| Connectivity & EHR Integration | Improves operational efficiency, data analytics | Growing adoption of connected devices |

| Precision & Personalization | Supports complex therapies, tailored patient care | Increased demand for accuracy and customization |

| Telemedicine & Remote Monitoring | Expands service offerings, virtual support | US telemedicine market projected to reach $200 billion by 2027 |

| AI & Big Data Analytics | Optimizes maintenance, inventory, personalized protocols | AI for predictive maintenance, improved inventory management |

| Cybersecurity | Mitigates risks to patient data and device function | Healthcare cyberattacks increased 20% in 2023; breach cost > $10 million |

| Remote Diagnostics & Predictive Maintenance | Enhances service efficiency, equipment uptime | Medical equipment maintenance market ~$30 billion (2023); growth expected |

Legal factors

InfuSystem operates within a highly regulated healthcare sector, demanding strict adherence to a complex web of laws. Key among these are HIPAA, safeguarding patient privacy, and statutes like the Stark Law and Anti-Kickback Statutes, which govern physician self-referrals and prohibit illicit remuneration. Failure to comply can result in substantial financial penalties and damage to the company's reputation.

InfuSystem, as a provider of infusion pumps and related equipment, operates under stringent medical device product liability laws. This necessitates comprehensive quality control and rigorous safety testing to prevent potential harm to patients and subsequent legal action. Failure to meet these standards can lead to significant financial penalties and reputational damage.

The legal landscape for medical device product liability is constantly evolving, with regulatory bodies like the FDA in the United States issuing updated guidance. For instance, in 2024, the FDA continued to emphasize post-market surveillance and the importance of robust adverse event reporting systems. InfuSystem must ensure its documentation processes are meticulous, covering every stage from design to distribution, to effectively defend against potential claims.

InfuSystem's success hinges on robust protection of its proprietary medical device designs, software, and service methodologies. This includes safeguarding its own innovations and diligently respecting the intellectual property rights of other entities within the healthcare technology landscape.

Effective intellectual property management is crucial for InfuSystem to maintain its competitive edge. For instance, in 2024, the medical device industry saw significant investment in R&D, with companies prioritizing patent filings to secure market share.

Navigating intellectual property law also helps InfuSystem avoid costly legal disputes and potential damages, ensuring operational stability and continued innovation in its specialized field.

Labor Laws and Employment Regulations

InfuSystem's operations are significantly impacted by labor laws and employment regulations, particularly those concerning healthcare workers. Compliance with these evolving rules affects workforce management, hiring, and overall operational expenses. For instance, in the US, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, impacting the cost of employing InfuSystem's field service technicians and administrative staff. Staying current with these regulations is critical for maintaining a stable and legally compliant workforce.

Key considerations for InfuSystem include:

- Compliance with Wage and Hour Laws: Ensuring adherence to federal and state minimum wage and overtime requirements, which can fluctuate based on location and employee classification.

- Healthcare Worker Specific Regulations: Navigating rules like the Health Insurance Portability and Accountability Act (HIPAA) which govern patient data privacy, directly affecting how employees handle sensitive information.

- Worker Classification: Correctly classifying employees versus independent contractors to avoid penalties and ensure proper benefits and tax withholdings.

- Workplace Safety Standards: Adhering to Occupational Safety and Health Administration (OSHA) guidelines to ensure a safe working environment for all employees, especially those in the field.

Data Privacy and Security Laws

Beyond HIPAA, InfuSystem must navigate a complex landscape of state-specific and international data privacy laws, such as the California Consumer Privacy Act (CCPA) and potentially the General Data Protection Regulation (GDPR) if any operations or data handling extend to the EU. The increasing focus on data protection globally means InfuSystem needs robust compliance strategies. For instance, as of 2024, over 15 US states have enacted comprehensive data privacy laws, each with unique requirements for data collection, consent, and breach notification, demanding constant legal monitoring and adaptation.

The sensitive nature of patient health information and proprietary operational data requires InfuSystem to maintain continuous vigilance and adapt its security protocols to evolving legal mandates. Failure to comply can result in significant penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

- Evolving State Laws: Over 15 US states had enacted comprehensive data privacy laws by early 2024, creating a complex compliance environment.

- International Reach: Potential applicability of GDPR necessitates adherence to strict data protection standards for any EU-related data.

- Data Sensitivity: Handling patient and operational data demands stringent security measures aligned with legal requirements.

- Financial Penalties: Non-compliance risks substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue.

InfuSystem faces significant legal hurdles related to healthcare regulations, intellectual property, labor laws, and data privacy. Adherence to HIPAA, Stark Law, and Anti-Kickback Statutes is paramount to avoid severe penalties. The company must also navigate evolving medical device product liability laws, emphasizing rigorous quality control and post-market surveillance, as highlighted by ongoing FDA guidance in 2024. Protecting its intellectual property is crucial for maintaining a competitive edge in a market with substantial R&D investment, as seen with increased patent filings in 2024.

Labor laws, including FLSA, impact operational costs and workforce management, requiring careful attention to wage and hour compliance, worker classification, and workplace safety. Data privacy is another critical area, with InfuSystem needing to comply with a growing number of state-specific laws in the US (over 15 by early 2024) and potentially international regulations like GDPR, where non-compliance can result in fines up to 4% of global annual revenue.

| Legal Area | Key Regulations/Considerations | 2024/2025 Impact | Potential Financial Risk |

| Healthcare Compliance | HIPAA, Stark Law, Anti-Kickback Statutes | Strict adherence required; evolving enforcement trends | Substantial fines, reputational damage |

| Product Liability | FDA regulations, post-market surveillance | Increased focus on adverse event reporting and data integrity | Product recalls, litigation, significant financial penalties |

| Intellectual Property | Patent law, trade secrets | High R&D investment driving patent activity; need for robust protection | Loss of competitive advantage, infringement lawsuits |

| Labor & Employment | FLSA, OSHA, state labor laws | Fluctuating minimum wage, worker classification scrutiny | Back wages, penalties, increased operational costs |

| Data Privacy | CCPA, GDPR, evolving state laws | Complex compliance landscape; over 15 US states with privacy laws by early 2024 | Fines up to 4% of global revenue (GDPR), reputational damage |

Environmental factors

InfuSystem must navigate a complex web of medical waste management regulations, a critical environmental factor impacting its operations. Compliance with these rules, covering everything from used infusion supplies to equipment components, is paramount for both InfuSystem and its client healthcare facilities. Failure to adhere can result in significant fines and reputational damage.

The Environmental Protection Agency (EPA) and state-level bodies set stringent standards for the treatment and disposal of regulated medical waste. For instance, in 2024, the healthcare sector generates an estimated 1.4 million tons of medical waste annually in the U.S., with a significant portion requiring specialized handling. InfuSystem's commitment to proper waste management directly supports environmental protection and ensures it meets these evolving legal requirements.

The healthcare sector is increasingly prioritizing environmental sustainability, influencing how companies like InfuSystem manage their supply chains. This means a closer look at eco-friendly procurement and logistics, aiming to reduce waste and carbon footprint throughout equipment lifecycles. InfuSystem must evaluate its suppliers based on their environmental practices to align with these growing expectations.

InfuSystem's operations, particularly its biomedical service centers and the logistics of equipment delivery and retrieval, inherently involve energy consumption that contributes to its carbon footprint. As of 2024, the global focus on sustainability is intensifying, pushing companies to report and reduce their environmental impact. While specific 2024/2025 data for InfuSystem's energy consumption is not yet publicly detailed, the industry trend indicates a growing emphasis on energy efficiency measures and emission reduction strategies.

Resource Scarcity and Material Sourcing

Potential resource scarcity for materials critical to medical device manufacturing, such as specialized polymers or rare earth metals, could disrupt InfuSystem's supply chain and escalate production costs. For instance, global demand for certain electronic components, vital for infusion pump technology, saw price increases of up to 15% in early 2024 due to geopolitical tensions and increased demand from the automotive sector.

Concerns over the ethical sourcing of materials, particularly those with complex global supply chains, also present a risk. InfuSystem, like many in the medical device industry, relies on a network of suppliers, and ensuring compliance with labor and environmental standards is paramount to maintaining brand reputation and avoiding regulatory penalties. A 2024 report highlighted that 40% of companies in the healthcare sector experienced supply chain disruptions attributed to ethical sourcing issues.

To mitigate these environmental risks, InfuSystem can focus on strategic initiatives:

- Supplier Diversification: Establishing relationships with multiple suppliers across different geographic regions to reduce reliance on any single source.

- Sustainable Material Exploration: Investing in research and development for alternative, more sustainable materials that offer comparable performance and cost-effectiveness.

- Supply Chain Transparency: Implementing robust tracking systems to monitor the origin and ethical sourcing of all raw materials.

- Inventory Management: Optimizing inventory levels for critical components to buffer against short-term supply disruptions.

Environmental Reporting and Corporate Responsibility

Growing stakeholder and regulatory demands for environmental reporting and corporate social responsibility directly affect InfuSystem. Companies are increasingly expected to disclose their environmental footprint and sustainability efforts. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024 for large companies, mandates detailed reporting on environmental, social, and governance (ESG) matters, setting a precedent for global standards.

Transparent reporting on environmental initiatives and impacts can significantly enhance InfuSystem's corporate reputation. This transparency not only builds trust with customers and employees but also attracts environmentally conscious investors. In 2024, ESG funds continued to see substantial inflows, with global sustainable fund assets projected to reach over $50 trillion by 2025, highlighting the financial incentive for strong environmental performance.

- Regulatory Scrutiny: Increased compliance burdens from evolving environmental regulations worldwide.

- Stakeholder Expectations: Growing demand from investors, customers, and employees for demonstrable sustainability.

- Reputational Impact: Positive environmental reporting can boost brand image and attract talent.

- Investment Attraction: Companies with strong ESG performance are increasingly favored by institutional investors.

InfuSystem faces significant environmental pressures, including stringent medical waste disposal regulations and a growing industry focus on sustainability. The company must manage its carbon footprint, especially concerning energy consumption in its service centers and logistics, with global sustainability reporting standards like the EU's CSRD becoming more prevalent in 2024.

Resource scarcity and ethical sourcing of materials are also key concerns. For example, the healthcare sector generates millions of tons of medical waste annually, necessitating careful handling. By 2025, global sustainable fund assets are projected to exceed $50 trillion, underscoring the financial importance of robust environmental, social, and governance (ESG) practices.

InfuSystem's environmental strategy should include supplier diversification and exploring sustainable materials to navigate potential supply chain disruptions, which saw some component prices rise by up to 15% in early 2024. Transparent environmental reporting is crucial for enhancing corporate reputation and attracting investment, as 40% of healthcare companies reported supply chain issues due to ethical sourcing in 2024.

| Environmental Factor | Impact on InfuSystem | 2024/2025 Data/Trend |

|---|---|---|

| Medical Waste Management | Compliance costs, operational efficiency, reputational risk | 1.4 million tons of medical waste generated annually in the U.S. (2024 estimate) |

| Carbon Footprint & Energy Use | Operational costs, regulatory scrutiny, investor perception | Intensifying global focus on sustainability and emissions reduction (2024-2025) |

| Resource Scarcity & Ethical Sourcing | Supply chain stability, material costs, brand reputation | Component price increases up to 15% (early 2024); 40% of healthcare companies faced ethical sourcing disruptions (2024) |

| Sustainability Reporting & ESG Demands | Investor attraction, corporate reputation, regulatory compliance | EU CSRD effective 2024; Global sustainable fund assets projected >$50 trillion by 2025 |

PESTLE Analysis Data Sources

Our InfuSystem PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable market research reports, and leading economic indicators. Each political, economic, social, technological, legal, and environmental insight is rigorously sourced from trusted institutions and current industry publications.