InfuSystem Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InfuSystem Bundle

InfuSystem operates within a dynamic healthcare landscape, facing pressures from powerful buyers and the constant threat of new entrants. Understanding these forces is crucial for navigating its competitive environment.

The complete report reveals the real forces shaping InfuSystem’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The infusion pump and specialized medical equipment sector is highly concentrated, with a handful of global giants like Becton, Dickinson and Company (BD), Baxter, B. Braun, and Fresenius Kabi holding significant market share. This limited number of key manufacturers means they possess substantial leverage in dictating prices and contract terms for both the components and the final products InfuSystem requires.

InfuSystem's dependence on these dominant suppliers for its equipment and services inherently restricts its sourcing flexibility. This reliance grants these few manufacturers considerable bargaining power, impacting InfuSystem's cost structure and operational choices.

Switching suppliers for specialized medical equipment, like the infusion pumps InfuSystem relies on, presents significant hurdles. These aren't just minor inconveniences; they translate into substantial financial outlays. For instance, adopting new pump technology often necessitates extensive retraining for clinical staff, a process that can cost thousands per employee. Furthermore, recalibrating integrated systems and ensuring seamless compatibility with existing hospital IT infrastructure adds further layers of expense and complexity.

These high switching costs effectively lock customers into existing supplier relationships, thereby bolstering the bargaining power of those suppliers. When a company like InfuSystem faces these embedded costs, its ability to negotiate better terms or switch to a more competitive provider is significantly diminished. This dynamic means suppliers can often command higher prices or dictate more favorable contract terms, directly impacting InfuSystem's profitability and operational flexibility.

Suppliers frequently possess proprietary technology or patents for essential components within infusion pumps and related medical equipment. This intellectual property significantly limits InfuSystem’s options for sourcing alternative suppliers for specialized parts or technologies, thereby increasing reliance on existing providers. For example, the semiconductor shortage experienced in 2022-2023 highlighted how limited access to critical components can directly impact manufacturing timelines and costs for medical device companies.

Impact of Regulatory Compliance

Suppliers of medical equipment face rigorous regulatory hurdles, such as FDA and ISO 13485 certifications. The substantial investment and ongoing effort required to meet these standards naturally restrict the pool of qualified manufacturers. This scarcity directly translates into increased leverage for these compliant suppliers.

InfuSystem’s reliance on medical devices that meet these strict regulatory requirements means they must source from a limited, approved vendor base. For instance, in 2024, the average time to obtain FDA clearance for a new medical device can range from several months to over a year, depending on the device's complexity and risk classification. This lengthy and costly process reinforces the bargaining power of established, certified suppliers.

- Regulatory Burden: Compliance with standards like FDA and ISO 13485 creates significant barriers to entry for new medical equipment suppliers.

- Limited Supplier Pool: The high cost and complexity of regulatory adherence reduce the number of qualified vendors, concentrating power.

- InfuSystem's Dependence: InfuSystem's operational necessity for certified equipment makes it beholden to these specialized suppliers.

- Supplier Leverage: The scarcity of compliant suppliers allows them to command higher prices and more favorable terms from buyers like InfuSystem.

Supplier Consolidation and Vertical Integration

Supplier consolidation is a significant factor impacting the bargaining power of suppliers for companies like InfuSystem. When fewer, larger entities dominate the supply chain, their ability to dictate terms and pricing naturally increases. This trend can be observed across various industries, including medical equipment.

For instance, a notable trend in the medical device sector is the increasing consolidation among suppliers. This means fewer independent companies are available to provide essential equipment and services. As of early 2024, reports indicate a continued M&A (mergers and acquisitions) activity within the healthcare supply chain, potentially leading to a more concentrated supplier landscape.

Furthermore, the potential for vertical integration, where manufacturers begin offering their own services, can also shift the power dynamic. If a medical equipment manufacturer decides to provide direct services, this reduces the need for third-party service providers like InfuSystem, thereby diminishing InfuSystem's negotiating leverage. This could translate into less favorable pricing for InfuSystem or more stringent contract terms.

- Supplier Consolidation: A growing trend where fewer, larger companies acquire smaller competitors in the medical equipment supply market.

- Reduced Supplier Options: This consolidation can limit the number of independent suppliers available to InfuSystem, weakening its negotiating position.

- Vertical Integration Threat: Manufacturers offering their own services directly can bypass third-party providers, further concentrating market power and potentially increasing costs for service-dependent companies.

- Impact on InfuSystem: These trends could lead to less favorable pricing and terms for InfuSystem, impacting its operational costs and profitability.

The bargaining power of suppliers for InfuSystem is substantial due to the concentrated nature of the medical equipment market. Key players like Becton, Dickinson and Company (BD) and Baxter hold significant sway, dictating terms and prices for essential components and finished products.

High switching costs, including retraining staff and integrating new systems, lock InfuSystem into existing supplier relationships, further amplifying supplier leverage. Proprietary technology and patents on critical parts also limit sourcing options, making InfuSystem dependent on established providers.

Regulatory burdens, such as FDA and ISO 13485 certifications, create high barriers to entry for new suppliers. This scarcity of compliant vendors, with FDA clearance for new devices averaging several months to over a year in 2024, grants existing certified suppliers considerable power to demand higher prices and more favorable contract terms.

Supplier consolidation, evidenced by ongoing M&A activity in the healthcare supply chain as of early 2024, further reduces InfuSystem's options and strengthens the hand of remaining large suppliers.

| Factor | Description | Impact on InfuSystem | Example Data (2024) |

|---|---|---|---|

| Supplier Concentration | Few dominant global manufacturers in infusion pump market. | Limits InfuSystem's negotiation leverage. | BD, Baxter, B. Braun, Fresenius Kabi hold large market share. |

| Switching Costs | High expenses for retraining, system integration, and compatibility. | Locks InfuSystem into current suppliers. | Thousands of dollars per employee for retraining. |

| Proprietary Technology | Suppliers own patents for critical components. | Restricts InfuSystem's alternative sourcing. | Semiconductor shortages (2022-2023) highlighted component dependency. |

| Regulatory Compliance | Rigorous FDA/ISO certifications for medical devices. | Reduces qualified supplier pool, increasing supplier power. | FDA clearance can take 6-12+ months for new devices. |

| Supplier Consolidation | Increasing mergers and acquisitions in the healthcare supply chain. | Further reduces InfuSystem's supplier choices. | Continued M&A activity observed in early 2024. |

What is included in the product

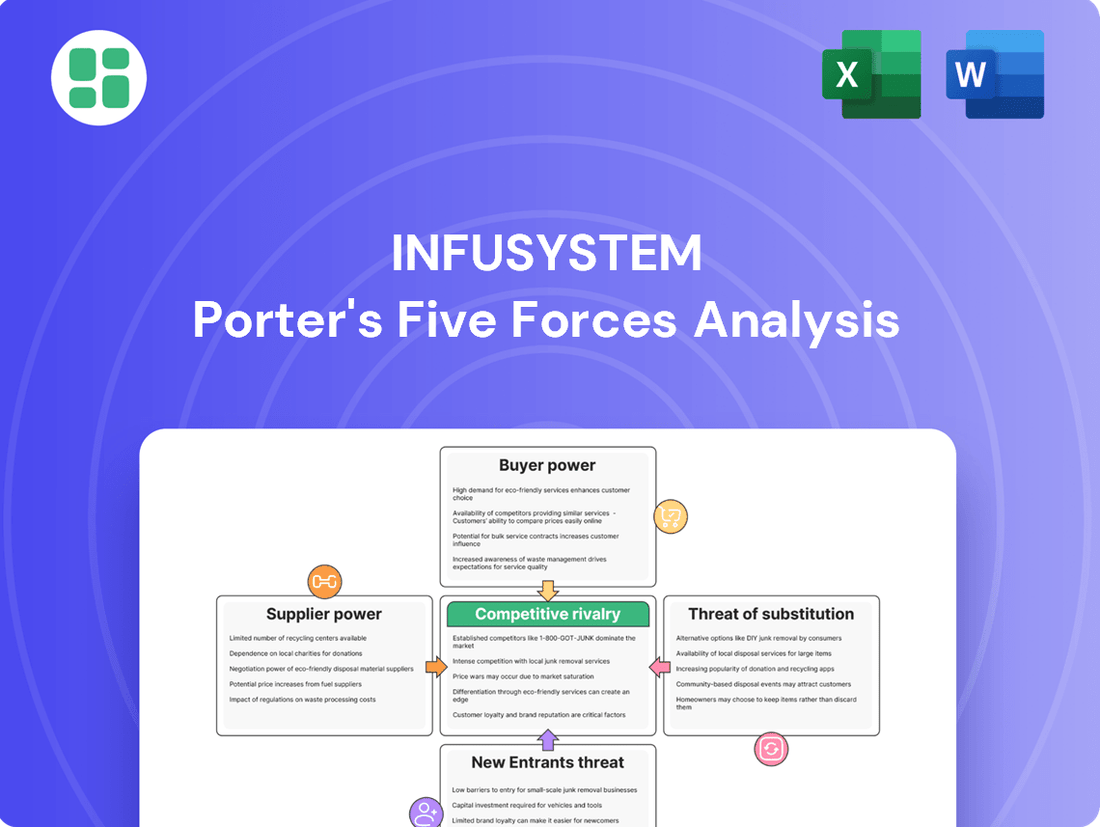

This analysis examines InfuSystem's competitive environment by evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly navigate competitive pressures by visualizing the impact of each force on your business with a dynamic, interactive dashboard.

Customers Bargaining Power

InfuSystem's core clientele, primarily oncology practices and other healthcare providers, are increasingly consolidating into larger health systems or aligning with Group Purchasing Organizations (GPOs). This trend significantly amplifies their bargaining power.

These consolidated entities and GPOs, by pooling their purchasing volume, gain substantial leverage to demand lower prices for InfuSystem's equipment rentals, sales, and essential supplies. For instance, in 2024, many large hospital networks reported significant cost savings through centralized procurement via GPOs, putting pressure on suppliers like InfuSystem to offer competitive pricing.

Consequently, InfuSystem faces intense pressure to differentiate itself not just on price but also on the quality of its service and the reliability of its offerings to win and retain contracts with these formidable buyers.

The healthcare industry is seeing a significant trend towards more affordable outpatient and home-based infusion therapy. This shift is driven by both patient preference and payer mandates, as these settings generally offer lower costs compared to traditional hospital stays. For instance, a 2024 report indicated that outpatient infusion centers can be up to 30% less expensive than hospital-based infusions for certain therapies.

This growing demand for cost-effective care directly impacts InfuSystem by increasing the bargaining power of its customers, who are now actively seeking value-driven solutions. Healthcare providers and patients can more readily compare pricing and service offerings, forcing InfuSystem to adapt its business model and pricing strategies to remain competitive in these evolving care environments. This necessitates a focus on efficiency and tailored service packages that cater to the specific needs of outpatient and home care providers.

The infusion pump and services market is quite competitive, with numerous companies offering equipment rental, sales, supplies, and biomedical support. This abundance of choices means customers aren't tied to a single provider. For instance, in 2024, the U.S. home infusion market alone was valued at approximately $50 billion, indicating a substantial number of players vying for market share.

Customers can readily compare pricing and service quality across these different vendors. If InfuSystem's offerings aren't meeting their expectations, or if a competitor presents a more attractive deal, customers have the leverage to switch. This ease of switching significantly bolsters their bargaining power.

Customer Demand for Integrated Solutions and Technology

Healthcare providers are increasingly looking for integrated solutions that simplify their workflows, boost patient care, and improve how they manage data. Think of smart infusion pumps that can directly connect with Electronic Health Records (EHRs). This demand for seamless technology means InfuSystem faces pressure to keep innovating.

Customers who have specific technological needs or strongly prefer advanced features can indeed push InfuSystem to invest more in developing and offering these cutting-edge solutions. This is a significant aspect of their bargaining power.

- Demand for Integration: 70% of hospitals surveyed in 2024 indicated that EHR integration capabilities are a primary factor when selecting new medical devices.

- Technological Sophistication: 65% of healthcare IT decision-makers prioritize devices with advanced data analytics and remote monitoring features.

- Cost of Switching: High switching costs for integrated IT systems can sometimes limit customer power, but the drive for efficiency often outweighs this.

- Information Availability: Increased transparency in device performance and pricing online empowers customers to compare offerings more effectively.

Price Sensitivity Due to Reimbursement Pressures

Healthcare providers are increasingly feeling the pinch from reimbursement models and the constant need to control expenses. This financial strain directly translates into heightened price sensitivity when they are looking to acquire medical equipment and essential services. Consequently, companies like InfuSystem must remain highly competitive on pricing and clearly articulate the cost-saving benefits of their offerings to attract and retain these customers.

For instance, in 2024, many healthcare systems reported tighter operating margins. A survey of hospital CFOs indicated that over 60% cited reimbursement challenges as a primary concern impacting their ability to invest in new technologies. This environment compels InfuSystem to focus on demonstrating strong value propositions that highlight not just the product itself, but also its contribution to overall cost containment and operational efficiency for their clients.

- Reimbursement Pressure: Healthcare providers face shrinking margins due to complex payment structures and cost-containment mandates.

- Price Sensitivity: This financial pressure makes customers highly attuned to pricing when purchasing medical equipment and services.

- Competitive Pricing: InfuSystem must offer competitive pricing to win business in this cost-conscious market.

- Value Demonstration: Clearly showcasing cost-efficiency and financial benefits is crucial for InfuSystem to succeed.

Customers, particularly large healthcare systems and GPOs, wield significant bargaining power due to their consolidated purchasing volume. This allows them to demand lower prices, as seen in 2024 when many large networks achieved cost savings through centralized procurement. InfuSystem must therefore focus on service quality and reliability to retain these powerful buyers.

The increasing shift towards more affordable outpatient and home-based infusion therapy, driven by patient preference and payer mandates, further empowers customers. These settings are demonstrably less expensive, with outpatient centers being up to 30% cheaper for certain therapies in 2024. This trend forces InfuSystem to adapt its pricing and business model to cater to value-driven solutions.

The competitive landscape, with a $50 billion U.S. home infusion market in 2024, offers customers numerous alternatives. This ease of switching between vendors, who are readily compared on price and service, amplifies customer leverage. Furthermore, the demand for integrated technological solutions, such as EHR-compatible pumps, incentivizes InfuSystem to innovate under customer pressure.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Consolidation & GPOs | Increased purchasing volume leading to price leverage | Many large health systems reported cost savings via GPOs |

| Shift to Outpatient/Home Care | Demand for cost-effective solutions | Outpatient centers up to 30% less expensive than hospital infusions |

| Market Competition | Ease of switching providers | $50 billion U.S. home infusion market value |

| Technological Demands | Pressure for innovation and integration (e.g., EHR) | 70% of hospitals prioritize EHR integration for new devices |

| Reimbursement Pressure | Heightened price sensitivity | Over 60% of hospital CFOs cited reimbursement challenges as a primary concern |

Preview the Actual Deliverable

InfuSystem Porter's Five Forces Analysis

This preview showcases the complete InfuSystem Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently rely on this preview as it represents the entirety of the deliverable, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The infusion pump and related services market is quite fragmented, featuring a blend of large, established medical device manufacturers and smaller, specialized service providers. This means InfuSystem, which operates in both equipment and services, encounters competition from giants like Becton Dickinson (BD) and Baxter, alongside numerous regional or niche service companies. This diverse competitive landscape naturally fuels intense rivalry as each player strives to capture a larger piece of the market.

The global infusion pump market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 6.5% from 2023 to 2030. This expansion is fueled by the rising incidence of chronic diseases and a notable shift towards home healthcare settings.

This strong market growth acts as a magnet for both existing players looking to scale and new entrants eager to capture market share. Companies are actively investing in research and development to enhance their product portfolios and expand their geographical reach, intensifying competition.

For instance, leading manufacturers are focusing on developing smart infusion pumps with advanced connectivity features, anticipating a market segment that could reach over $7 billion by 2028. This innovation drive, coupled with market expansion, directly escalates the rivalry among established and emerging companies in the infusion pump industry.

Competitors in the infusion therapy and biomedical services market actively differentiate themselves by leveraging advanced technology. This includes the implementation of smart pumps with enhanced connectivity features and the integration of artificial intelligence for improved patient care and operational efficiency. For instance, Baxter’s Sigma Spectrum infusion pump offers advanced safety features and connectivity, while Smiths Medical’s Medfusion 3500 pump provides reliable performance and ease of use.

Beyond technological advancements, companies are also building competitive advantages through comprehensive service models. These often encompass last-mile solutions, ensuring timely delivery and setup of equipment, alongside robust biomedical services for maintenance and repair. Patient support programs are also a key differentiator, aiming to enhance patient experience and adherence to treatment protocols. InfuSystem's strategy of offering integrated solutions for infusion therapy and biomedical services places it in direct competition with firms that similarly emphasize a complete value proposition.

Pricing Pressure and Cost-Effectiveness

The healthcare sector's relentless focus on cost containment fuels fierce pricing competition for medical equipment and services. InfuSystem, like its peers, navigates this landscape by balancing affordability with quality, a delicate act that can compress profit margins and mandate ongoing operational efficiency enhancements.

This pressure forces providers to innovate and streamline, seeking ways to deliver value without compromising patient care. For instance, the push for value-based care models, increasingly prevalent in 2024, incentivizes suppliers to demonstrate not just product efficacy but also long-term cost savings for healthcare systems.

- Pricing Pressure: Healthcare providers are under constant pressure to reduce costs, impacting InfuSystem's pricing strategies.

- Cost-Effectiveness: Companies must offer competitive pricing while maintaining high-quality products and services.

- Margin Squeeze: Intense competition can lead to thinner profit margins, requiring efficient operations.

- Efficiency Drive: Continuous improvement in operational efficiency is crucial to remain competitive in this market.

Strategic Partnerships and Acquisitions

The competitive landscape for InfuSystem is characterized by a dynamic interplay of strategic partnerships and acquisitions. Companies are actively pursuing mergers and acquisitions to bolster their market presence, broaden their service capabilities, and consolidate their positions within the industry. This trend is driven by a desire to achieve economies of scale and offer more comprehensive solutions to customers.

A prime example of this consolidation is ICU Medical's acquisition of Smiths Medical, a move that significantly reshaped the market. Such transactions highlight an intensely competitive environment where firms leverage M&A activity to secure a competitive edge. In 2024, the medical device sector, which includes companies like InfuSystem, saw continued M&A activity, with a focus on integrating technologies and expanding product portfolios to meet evolving healthcare demands.

- Market Consolidation: Strategic alliances and M&A are key strategies for gaining market share and diversifying offerings.

- Competitive Advantage: Acquisitions like ICU Medical's purchase of Smiths Medical demonstrate a drive for competitive advantage through scale.

- Industry Trends: The healthcare and medical device sectors, relevant to InfuSystem, experienced significant M&A activity in 2024, emphasizing integration and portfolio expansion.

Competitive rivalry within the infusion pump and services market is intense, driven by a fragmented industry structure and significant market growth. InfuSystem faces competition from large medical device manufacturers like BD and Baxter, as well as numerous specialized service providers. This rivalry is further fueled by companies differentiating through technological advancements, such as smart pumps, and comprehensive service models, including last-mile solutions and biomedical support.

The healthcare sector's focus on cost containment also intensifies pricing competition, forcing companies like InfuSystem to balance affordability with quality, potentially squeezing profit margins. Furthermore, strategic partnerships and acquisitions, such as ICU Medical's purchase of Smiths Medical, are reshaping the competitive landscape as firms seek scale and broader capabilities. This dynamic environment necessitates continuous innovation and operational efficiency to maintain a competitive edge.

| Competitor | Key Offerings | Differentiation Strategy |

|---|---|---|

| Becton Dickinson (BD) | Infusion pumps, medication management systems | Advanced technology, broad product portfolio |

| Baxter International | Infusion pumps, IV solutions, drug delivery systems | Integrated solutions, global presence |

| Smiths Medical (now part of ICU Medical) | Infusion pumps, respiratory care devices | Reliable performance, ease of use |

| InfuSystem | Infusion pumps, biomedical services, home infusion | Comprehensive service models, patient support programs |

SSubstitutes Threaten

Innovations in drug delivery, like micro-robotics and nanotechnology, present a growing threat to traditional infusion pump reliance. These advanced systems aim for more targeted and patient-friendly medication administration. For instance, advancements in controlled-release mechanisms and extracellular vesicles are being explored for more efficient drug transport, potentially bypassing the need for current infusion pump technologies.

The development of subcutaneous and oral formulations for drugs traditionally given via infusion presents a significant threat of substitutes for companies like InfuSystem. These new delivery methods offer greater patient convenience and can reduce the need for specialized infusion equipment and services.

For instance, subcutaneous immunotherapy is gaining traction as a less invasive alternative to IV infusions, potentially impacting the demand for IV administration services. This shift could erode the market share for traditional infusion providers as patients and healthcare systems opt for more accessible treatment options.

Advancements in clinical protocols, such as the development of 10-minute immunotherapy infusions, directly threaten the traditional model of longer infusion sessions. This acceleration in treatment delivery can reduce patient wait times and clinic throughput, potentially impacting the demand for extended infusion pump usage.

While these faster protocols still rely on infusion pumps, they fundamentally alter the economic calculus for infusion services by minimizing the time patients occupy valuable clinic space. This shift could lead to a decrease in the perceived necessity of certain infusion pump services if clinics can achieve similar patient outcomes with less time and fewer resources.

Non-Pharmacological or Surgical Alternatives

The threat of substitutes for InfuSystem’s infusion therapy services is present, particularly from non-pharmacological or surgical alternatives. For certain conditions, advancements in medical treatments could offer patients different pathways that bypass the need for traditional infusion methods.

While direct substitutes might be limited, broader medical innovations can indirectly impact InfuSystem’s market. For example, the development of more effective oral medications or minimally invasive surgical techniques could reduce the patient population requiring infusion services. In 2024, the healthcare industry continued to see significant investment in research and development for novel treatment modalities across various therapeutic areas.

Consider these potential substitute areas:

- Advanced Drug Delivery Systems: Innovations in long-acting injectables or implantable devices could reduce the frequency and duration of traditional IV infusions.

- Minimally Invasive Procedures: For some conditions, new surgical techniques might offer curative or management solutions that eliminate the need for ongoing infusion therapy.

- Non-Pharmacological Therapies: In specific cases, lifestyle modifications, physical therapy, or other non-drug interventions might be developed to manage chronic conditions, thereby decreasing reliance on pharmaceutical infusions.

Patient Preference for Non-Invasive or Home-Based Solutions

Patients are increasingly seeking treatment options that minimize disruption to their daily lives, favoring home-based or less invasive methods. This trend poses a significant threat if alternative therapies or simpler home-administration technologies gain traction and become standard care.

For instance, advancements in oral chemotherapy or subcutaneous drug delivery systems could reduce the need for traditional intravenous infusions. If these substitutes are perceived as equally effective and more convenient, they could divert a substantial portion of InfuSystem's patient base, impacting demand for their services.

- Growing patient demand for convenience: Many patients, particularly those with chronic conditions requiring long-term treatment, actively seek alternatives that allow them to manage their health from the comfort of their homes.

- Technological advancements in drug delivery: Innovations in oral medications, patch-based therapies, and self-administered injectable devices are creating viable substitutes for traditional infusion methods.

- Potential insurance coverage shifts: As non-invasive or home-based options prove effective and cost-efficient, insurers may increasingly favor coverage for these alternatives, further incentivizing patient adoption.

The threat of substitutes for InfuSystem's services is significant, driven by advancements in drug delivery and patient preference for convenience. Innovations like long-acting injectables and implantable devices can reduce the need for frequent IV infusions. Furthermore, the shift towards oral medications and subcutaneous administration for previously IV-dependent drugs directly challenges traditional infusion models.

In 2024, the market saw continued growth in home healthcare solutions and self-administered therapies, directly competing with traditional infusion centers. For example, the global market for subcutaneous injection devices was projected to reach over $10 billion by 2025, indicating a strong trend away from IV-based treatments.

| Substitute Type | Impact on InfuSystem | Example in 2024 |

|---|---|---|

| Oral Medications | Reduces need for IV administration | Increased availability of oral oncology drugs |

| Subcutaneous Delivery | Offers patient convenience, bypasses IV | Growth in self-administered biologics |

| Long-Acting Injectables | Decreases infusion frequency | New formulations for chronic disease management |

| Home Infusion Alternatives | Shifts service delivery location | Expansion of telehealth-supported home therapies |

Entrants Threaten

The medical device and healthcare services sector presents formidable barriers to entry, largely due to stringent regulatory requirements. Companies seeking to operate in this space must navigate complex and expensive processes for FDA approvals, obtain certifications like ISO 13485, and adhere to numerous healthcare policies. For instance, the average cost for FDA 510(k) clearance, a common pathway for medical devices, can range from tens of thousands to hundreds of thousands of dollars, not including the extensive internal resources and time commitment. This significant financial and temporal investment effectively deters many potential new competitors from entering the market, thereby reducing the threat of new entrants for established players like InfuSystem.

The infusion pump and services market presents a formidable barrier to entry due to the substantial capital required. Companies need to invest heavily in research and development for advanced infusion technology, sophisticated manufacturing plants, and maintaining adequate inventory of both pumps and essential consumables.

Furthermore, establishing a comprehensive service and support network, including trained technicians and spare parts, adds another layer of significant upfront cost. This financial hurdle effectively discourages many potential new players from entering the competitive landscape.

Established players like InfuSystem have cultivated significant brand recognition and deep customer relationships within the healthcare sector. These existing ties, built over years of reliable service and support, create a substantial barrier for any new company attempting to enter the market. Displacing these entrenched relationships requires not only offering a competitive product but also overcoming a considerable trust deficit.

Complex Distribution Channels and Logistics

Navigating the complex distribution channels and logistics for infusion pumps and related services, particularly for clinic-to-home transitions, presents a significant barrier for new entrants. Establishing a reliable supply chain and ensuring timely delivery of specialized equipment requires substantial upfront investment.

Developing the necessary infrastructure, including warehousing, transportation, and a skilled biomedical service team for setup and maintenance, is a daunting task. For instance, companies in the home infusion therapy market often manage extensive networks of pharmacies and delivery personnel, a costly endeavor to replicate.

The high capital expenditure associated with building out these capabilities, coupled with the need for specialized biomedical technicians and field support, makes it difficult for newcomers to compete effectively. In 2024, the global home healthcare market, which heavily relies on such logistics, was valued at over $400 billion, underscoring the scale of investment required.

- High Capital Investment: Significant funds are needed for distribution networks, warehousing, and specialized delivery vehicles.

- Biomedical Expertise: A skilled workforce of biomedical technicians for equipment maintenance and patient support is crucial and costly to train and retain.

- Regulatory Compliance: Adhering to stringent healthcare regulations for equipment handling and patient data management adds another layer of complexity and cost.

Intellectual Property and Patent Protection

The medical device sector, where InfuSystem operates, is heavily guarded by intellectual property. Established players possess a substantial portfolio of patents covering their existing devices and proprietary technologies. Newcomers face the daunting task of meticulously navigating this intricate patent maze to prevent infringement, a hurdle that significantly impedes their ability to bring truly competitive offerings to market.

This strong IP protection acts as a formidable barrier. For instance, in 2023, the medical technology sector saw a significant increase in patent filings, with companies investing heavily in R&D to secure their innovations. This trend suggests that any new entrant would need substantial resources and legal expertise to develop novel technologies without infringing on existing patents.

- High Patent Density: The medical device industry is characterized by a dense network of patents held by incumbents.

- R&D Investment Barrier: Developing non-infringing technology requires significant and often lengthy research and development investment.

- Legal Costs: Potential infringement litigation can impose substantial financial and operational burdens on new entrants.

The threat of new entrants for InfuSystem is significantly mitigated by the high capital requirements in the infusion therapy market. Beyond initial R&D and manufacturing, establishing robust distribution and service networks demands substantial investment. For example, the global home healthcare market, a key segment for infusion services, was valued at over $400 billion in 2024, indicating the scale of infrastructure needed.

Moreover, the medical device sector is protected by a dense web of intellectual property. Companies like InfuSystem hold numerous patents, making it costly and time-consuming for new entrants to develop novel, non-infringing technologies. This IP landscape, coupled with the increasing patent filings in medical technology seen in 2023, presents a significant hurdle for potential competitors.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Significant investment needed for R&D, manufacturing, distribution, and service infrastructure. | High barrier, requiring substantial funding to compete. |

| Intellectual Property | Extensive patent portfolios held by incumbents protect existing technologies. | High barrier, demanding significant R&D and legal resources to navigate. |

| Regulatory Hurdles | Stringent FDA approvals and healthcare compliance add complexity and cost. | High barrier, requiring specialized expertise and financial commitment. |

Porter's Five Forces Analysis Data Sources

Our InfuSystem Porter's Five Forces analysis leverages a comprehensive dataset including InfuSystem's annual reports, SEC filings, and investor relations materials. We also incorporate industry-specific market research reports and competitor financial disclosures to provide a robust assessment.