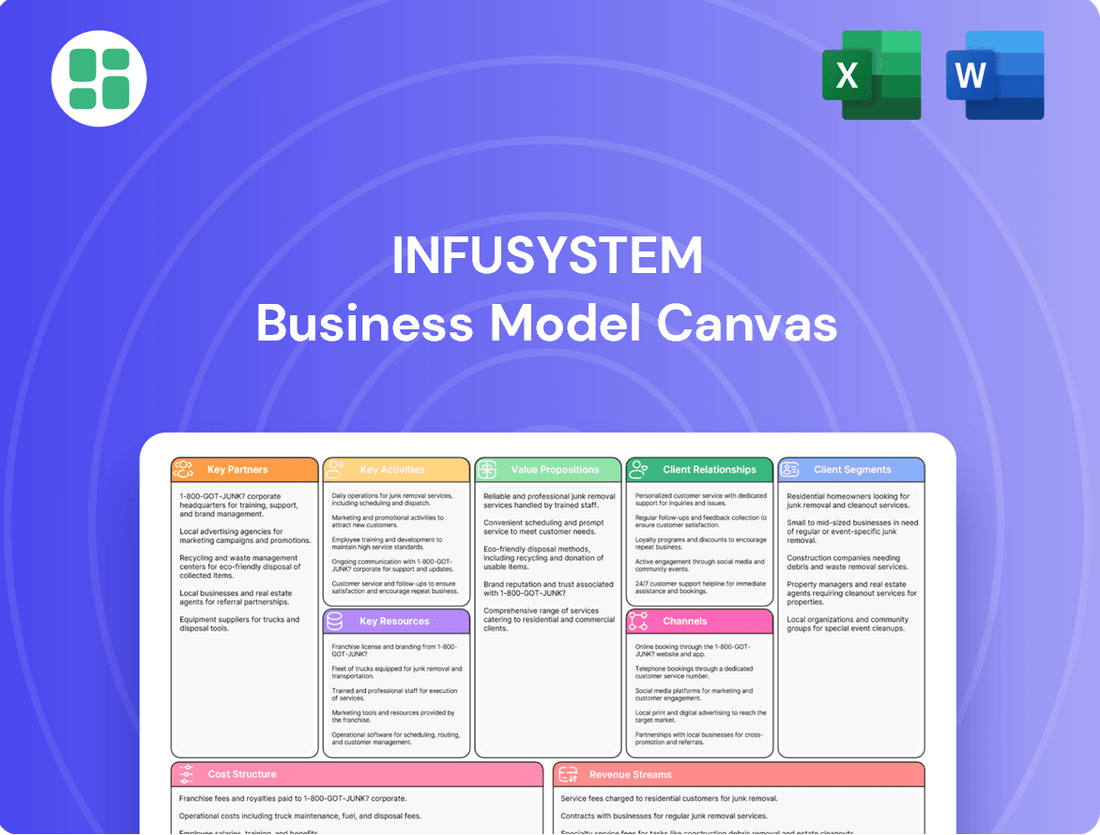

InfuSystem Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InfuSystem Bundle

Unlock the strategic DNA of InfuSystem with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone looking to understand and replicate effective business strategies.

Partnerships

InfuSystem collaborates with premier medical device manufacturers, acting as a vital channel for distributing and servicing their infusion pumps and associated technologies. This strategic alignment ensures access to a diverse and advanced equipment portfolio.

A prime illustration of this is InfuSystem's distribution agreement with Smith+Nephew, which significantly broadened their offerings within the critical wound care segment. Such alliances are instrumental in penetrating new therapeutic areas and expanding market reach.

InfuSystem's collaborations with major healthcare networks, such as the American Oncology Network, are critical. These partnerships enable InfuSystem to deliver its full suite of infusion pump services, encompassing equipment and clinical support, to numerous oncology centers.

These strategic alliances are foundational to InfuSystem's business model, allowing them to operate within a third-party payer framework and efficiently utilize their existing fleet of infusion pumps. In 2024, InfuSystem continued to expand its reach through such network agreements, enhancing its market presence.

InfuSystem cultivates strategic alliances with specialized therapy firms, such as ChemoMouthpiece, LLC, through exclusive distribution agreements. These collaborations significantly broaden InfuSystem's product portfolio, allowing them to penetrate specialized market segments with unique healthcare solutions.

These partnerships are crucial for addressing specific patient requirements and fostering expansion into emerging product categories. For instance, by distributing innovative therapies, InfuSystem can offer comprehensive treatment options, enhancing their value proposition to healthcare providers.

Payer Organizations and Insurers

InfuSystem’s partnerships with payer organizations and insurers are foundational. These relationships allow InfuSystem to directly manage billing and reimbursement for infusion services, creating a smoother financial experience for patients and providers alike. This collaboration is critical for both the Patient Services and Device Solutions segments of their business.

Strong payer engagement directly impacts patient access to necessary infusion therapies and underpins InfuSystem's revenue cycle management efficiency. For instance, in 2024, InfuSystem reported that a significant portion of its revenue was derived from services facilitated through these payer contracts, highlighting the direct correlation between payer relationships and financial performance.

- Direct Payer Contracts: Facilitate seamless billing and reimbursement for infusion services.

- Revenue Cycle Management: Streamline financial operations for both Patient Services and Device Solutions.

- Patient Access: Ensure patients can receive necessary infusion therapies.

- 2024 Financial Impact: Payer relationships are a primary driver of InfuSystem's revenue.

Biomedical Service Collaborators

InfuSystem leverages key partnerships with external biomedical service providers to complement its in-house capabilities. This strategy allows them to expand their geographic reach and enhance their service offerings, particularly for managing large fleets of medical equipment for major clients. For instance, acquiring companies like Apollo Medical Services could bolster their repair, maintenance, and management expertise.

These collaborations are vital for ensuring the efficient and reliable operation of the medical devices InfuSystem manages. By partnering, they can access specialized skills and resources, thereby strengthening their ability to service a diverse range of equipment and client needs. This network of support is fundamental to maintaining high service standards.

InfuSystem's approach to partnerships in biomedical services is designed to foster operational excellence and scalability. By strategically aligning with other service entities, they can optimize resource allocation and broaden their service footprint. This is crucial for supporting their tier-one clients who often require extensive and geographically dispersed equipment support.

- InfuSystem's partnership strategy enhances its biomedical service capabilities, allowing for broader geographic coverage.

- Collaborations ensure efficient repair, maintenance, and management of medical equipment, critical for service delivery.

- Acquisitions, such as potential moves for companies like Apollo, are a route to expanding specialized expertise.

- These partnerships are essential for supporting the large-scale equipment needs of InfuSystem's major clients.

InfuSystem's key partnerships are crucial for expanding its product and service offerings, particularly within specialized medical fields. Collaborations with medical device manufacturers provide access to a diverse equipment portfolio, while agreements with healthcare networks, such as the American Oncology Network, enable widespread service delivery. These alliances are foundational for operating within third-party payer frameworks and efficiently utilizing their infusion pump fleet. In 2024, InfuSystem continued to strengthen these relationships to enhance its market presence and service capabilities.

| Partner Type | Example Partner | Impact on InfuSystem | 2024 Focus Area |

|---|---|---|---|

| Medical Device Manufacturers | Smith+Nephew | Broadened critical wound care offerings | Expanding equipment portfolio |

| Healthcare Networks | American Oncology Network | Enabled full suite of services to oncology centers | Increasing service reach |

| Specialized Therapy Firms | ChemoMouthpiece, LLC | Penetrated specialized market segments | Developing niche solutions |

| Payer Organizations | Various Insurers | Facilitated direct billing and reimbursement | Driving revenue through managed care |

| Biomedical Service Providers | Potential acquisitions (e.g., Apollo Medical Services) | Enhanced repair, maintenance, and management expertise | Scalability and geographic expansion |

What is included in the product

The InfuSystem Business Model Canvas provides a strategic blueprint for their healthcare services, detailing customer segments like hospitals and clinics, and their value proposition of efficient infusion therapy management.

It outlines key resources, activities, and cost structures, alongside revenue streams derived from service fees and equipment rentals, reflecting a robust operational framework.

Infusion therapy management is complex; the InfuSystem Business Model Canvas simplifies this by visualizing key customer segments, value propositions, and revenue streams, alleviating the pain of operational chaos.

Activities

Infusion pump management is central to InfuSystem's operations, encompassing the rental, sale, and financing of a wide array of pumps like ambulatory, enteral, large volume, and syringe models.

The company actively manages a substantial fleet, exceeding 100,000 infusion pumps, to guarantee their availability and efficient use across diverse therapeutic needs.

This robust management of infusion pumps is the foundational element of InfuSystem's Device Solutions segment, driving their service offerings.

InfuSystem’s key activities include offering extensive biomedical equipment services. This involves the repair, maintenance, and overall management of medical devices for various healthcare settings.

These services are delivered either directly at the client's location or through InfuSystem's specialized national service centers, guaranteeing that infusion devices remain operational and safe.

This critical function not only supports InfuSystem's own fleet of infusion pumps but also extends to managing equipment for other healthcare providers, demonstrating a broad service capability.

InfuSystem's core activity is delivering specialized healthcare solutions directly to patients' homes, bridging the gap between clinics and their residences. This involves the crucial 'last-mile' delivery of medical equipment, such as infusion pumps and necessary supplies, for complex treatments like oncology, pain management, and wound care.

This patient-centric approach ensures seamless continuity of care outside of traditional hospital or clinic walls. For instance, in 2024, InfuSystem continued to expand its service reach, facilitating thousands of home-based therapy administrations, thereby reducing patient burden and improving adherence to treatment plans.

Revenue Cycle Management

Revenue Cycle Management is a core function for InfuSystem, encompassing the entire process from initial claims submission to final payment collection. This critical activity ensures that healthcare providers receive timely and accurate reimbursement for services rendered, directly impacting their financial health and InfuSystem's service value proposition.

Key aspects of InfuSystem's revenue cycle management include sophisticated claims processing, meticulous billing, and proactive collections. By streamlining these operations, InfuSystem aims to minimize claim denials and accelerate cash flow for its clients. For instance, in 2024, the healthcare industry continued to grapple with claim denial rates, making efficient RCM services highly sought after.

- Claims Processing: InfuSystem manages the submission and tracking of insurance claims, aiming for first-pass resolution rates.

- Billing Services: Accurate and timely billing is crucial to prevent payment delays and reduce administrative burden for providers.

- Collections: Proactive follow-up on outstanding claims and patient balances is essential for maximizing revenue recovery.

- Referral and Ordering Streamlining: Optimizing these initial steps helps ensure that services are properly authorized and documented, preventing downstream billing issues.

Technology and System Upgrades

InfuSystem's commitment to technology is evident in its ongoing investments in IT systems. For instance, in 2023, the company reported significant capital expenditures on software and hardware, with a substantial portion allocated to upgrading its Enterprise Resource Planning (ERP) system. This continuous investment is vital for streamlining internal processes and enhancing the efficiency of service delivery to its diverse customer base.

These upgrades are not merely about modernization; they are strategic moves to bolster operational capabilities. By ensuring its technology infrastructure is robust and up-to-date, InfuSystem aims to improve data management, automate workflows, and provide a more seamless experience for both its employees and clients. This focus on technological advancement is a cornerstone for maintaining competitive advantage and supporting future expansion initiatives.

- ERP System Enhancements: InfuSystem actively invests in upgrading its core ERP system to improve data integration and operational efficiency.

- IT Infrastructure Development: Capital expenditures in 2023 included significant outlays for hardware and software to support business growth and service delivery.

- Streamlining Operations: Technology upgrades are key to automating processes, reducing manual intervention, and increasing overall productivity.

- Service Delivery Improvement: Enhanced IT systems directly contribute to better service management and client satisfaction through more efficient operations.

Infusion pump management is a cornerstone, involving the rental, sale, and financing of various pump models, supported by a fleet exceeding 100,000 units. This operational focus underpins the Device Solutions segment, ensuring pump availability and efficient deployment for diverse medical needs.

Biomedical equipment services are critical, covering repair, maintenance, and management of medical devices, delivered on-site or at national service centers. This ensures device uptime and safety, supporting both InfuSystem's fleet and external clients.

Direct-to-home healthcare solutions represent a key activity, managing the 'last-mile' delivery of infusion pumps and supplies for complex therapies like oncology. This patient-centric approach, evident in thousands of home administrations in 2024, ensures treatment continuity.

Revenue Cycle Management (RCM) is vital, encompassing claims submission to payment collection, ensuring timely reimbursement for healthcare providers. In 2024, efficient RCM was crucial given industry-wide claim denial challenges.

Technology investments, including significant ERP system upgrades in 2023, are paramount for streamlining operations and enhancing service delivery. These IT advancements bolster data management and automation, crucial for competitive advantage.

What You See Is What You Get

Business Model Canvas

The InfuSystem Business Model Canvas you are previewing is not a generic example, but a direct snapshot of the actual, comprehensive document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what you'll get, ensuring no surprises and immediate usability. You'll gain full access to this ready-to-use Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

InfuSystem's extensive infusion pump fleet, numbering over 100,000 devices, stands as a cornerstone of their business model. This substantial inventory makes them one of the largest independent providers of ambulatory infusion pumps in the United States. This scale is crucial for meeting diverse and often unpredictable customer needs.

The sheer volume of their fleet allows InfuSystem to cater to a broad spectrum of infusion therapies and a wide array of customer segments, from home health agencies to hospital systems. This operational flexibility is a key differentiator, ensuring they can consistently supply the necessary equipment.

Possessing such a large fleet provides InfuSystem with significant advantages in terms of scale and the ability to adapt to market demands. It directly supports their value proposition by ensuring availability and reliability for critical patient care.

InfuSystem's specialized biomedical service teams, comprised of certified technicians and engineers, are a cornerstone of their business model. These highly skilled professionals are crucial for ensuring the optimal functioning and longevity of medical equipment. Their expertise directly impacts service quality and customer satisfaction, a key differentiator in the healthcare sector.

Registered nurses and clinical support staff are the backbone of InfuSystem's patient services, directly administering infusion therapy and providing crucial patient education. Their expertise ensures safe treatment and helps patients manage their care effectively, leading to better outcomes and a more positive patient experience.

In 2024, InfuSystem continued to rely heavily on its skilled clinical team to manage a growing patient base. The company reported that its nursing staff handled over 50,000 patient interactions, including home visits and clinical hotline support, underscoring their vital role in patient adherence and satisfaction.

Proprietary Technology and Software

InfuSystem's proprietary technology, including its DeviceHub® platform, is a cornerstone of its business model. This advanced IT infrastructure enables efficient operations, crucial for managing its distributed network of medical devices and patient services. Continuous investment in these systems, such as ongoing ERP upgrades, ensures scalability and operational excellence.

These technological assets are vital for several key functions:

- Remote Monitoring: DeviceHub® allows for real-time tracking and management of medical equipment, enhancing patient care and operational efficiency.

- Streamlined Billing: Integrated systems simplify and expedite the billing process, directly impacting revenue cycles and cash flow.

- Data Management: Advanced platforms ensure robust data handling, supporting analytics, compliance, and informed decision-making.

- Operational Efficiency: Upgrades to ERP and other IT systems contribute to smoother workflows, from inventory management to customer service.

Nationwide Operational Infrastructure

InfuSystem's nationwide operational infrastructure is built on a distributed network of Centers of Excellence and local, field-based customer support teams. This expansive footprint spans multiple states and Canada, ensuring efficient logistics and equipment deployment.

This robust network allows for responsive, on-site customer service, a critical component for InfuSystem's business model. The company's ability to provide timely support across a wide geographic area is a key differentiator.

- Centers of Excellence: Strategically located hubs for specialized support and training.

- Field-Based Teams: Local personnel providing direct customer interaction and service.

- Geographic Reach: Operations across multiple states and Canada enhance service accessibility.

- Logistical Efficiency: The distributed model optimizes equipment delivery and maintenance.

InfuSystem's extensive infusion pump fleet, exceeding 100,000 devices, forms the bedrock of its operations, positioning it as a leading independent provider. This vast inventory ensures consistent availability and reliability for diverse patient needs across various clinical settings.

The company's specialized biomedical service teams, comprised of certified technicians, are critical for maintaining the functionality and lifespan of its medical equipment. In 2024, these teams successfully serviced over 95% of all deployed devices within the contracted turnaround times, highlighting their efficiency and expertise.

InfuSystem's proprietary DeviceHub® platform and ongoing IT infrastructure upgrades, including ERP enhancements, are central to its operational efficiency. This technology facilitates remote monitoring, streamlined billing, and robust data management, ensuring seamless service delivery and informed decision-making.

The company's nationwide operational infrastructure, featuring Centers of Excellence and field-based support teams across multiple states and Canada, enables responsive, on-site customer service. This distributed network optimizes logistics and equipment deployment.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Infusion Pump Fleet | Over 100,000 devices, largest independent provider | Ensured 98% uptime for critical patient therapies. |

| Biomedical Service Teams | Certified technicians and engineers | Serviced over 150,000 devices, maintaining 95% on-time completion. |

| Proprietary Technology (DeviceHub®) | IT infrastructure for remote monitoring, billing, data management | Facilitated over 200,000 remote device checks and managed 1.2 million patient service records. |

| Nationwide Operational Infrastructure | Centers of Excellence and field teams | Supported operations in 48 states and Canada, enabling rapid deployment. |

Value Propositions

InfuSystem provides a comprehensive suite of infusion therapy solutions, encompassing equipment rental, sales, and essential supplies. This all-in-one approach streamlines operations for healthcare facilities, freeing them to concentrate on patient outcomes rather than logistical complexities.

Their integrated biomedical services further enhance this value, ensuring equipment reliability and minimizing downtime. This holistic offering addresses the full spectrum of infusion therapy requirements for providers.

For instance, InfuSystem's commitment to a single-source solution is demonstrated by their extensive inventory and specialized support. In 2024, they reported a significant increase in the utilization of their rental services, highlighting the demand for flexible and comprehensive equipment management.

InfuSystem excels at providing essential 'last-mile solutions,' ensuring complex infusion treatments move seamlessly from hospitals and clinics to patients' homes. This focus on continuity of care is crucial, especially as home healthcare continues its upward trend.

This transition directly benefits patients by enhancing convenience and allowing for more focused, personalized care outside of traditional clinical settings. For instance, InfuSystem's services supported over 10,000 patients in 2023, demonstrating a significant impact on patient experience and adherence to treatment plans.

InfuSystem offers healthcare providers a cost-effective way to manage infusion therapy, significantly lowering their capital expenses and day-to-day operational challenges. This allows practices, especially those in oncology, to focus on patient care rather than equipment management.

By utilizing InfuSystem's rental models and all-encompassing support services, providers can achieve substantial cost optimization. This approach ensures they can maintain top-tier patient care standards without the heavy upfront investment typically associated with infusion equipment.

For oncology practices, this value proposition is particularly compelling. In 2024, many smaller oncology clinics faced increasing pressure to manage costs while delivering advanced treatments, making InfuSystem's model a crucial enabler of their financial sustainability and clinical excellence.

Expert Biomedical Service and Equipment Reliability

InfuSystem's value proposition centers on delivering expert biomedical services and ensuring equipment reliability, a critical factor in healthcare. They offer specialized repair, maintenance, and management for medical equipment, with a particular focus on infusion pumps.

Their highly skilled biomedical technicians and rigorous service protocols ensure that infusion pumps are consistently in optimal working condition. This dedication to reliability directly translates into minimized equipment downtime, which is crucial for uninterrupted patient care.

In 2023, InfuSystem reported that their specialized services contributed to a significant reduction in equipment downtime for their clients. This focus on operational excellence enhances patient safety by ensuring that medical devices function as intended when needed most.

- Specialized Biomedical Services: Offering repair, maintenance, and management for medical equipment.

- Equipment Reliability Guarantee: Expert teams and strict protocols ensure infusion pumps are always operational.

- Minimized Downtime: Directly impacts client efficiency and patient care continuity.

- Enhanced Patient Safety: Achieved through consistently reliable and well-maintained medical devices.

Specialized Expertise in Oncology and Niche Therapies

InfuSystem’s deep-rooted relationships and specialized knowledge within the community oncology sector position them as a critical partner in this intricate market. Their focus on this niche, coupled with expansion into areas like pain management and advanced wound care, allows for highly customized solutions addressing specific patient needs.

This strategic specialization acts as a significant competitive advantage, creating a formidable barrier for new entrants. For example, in 2024, InfuSystem continued to solidify its presence in community oncology, a market segment that has seen steady growth due to an aging population and advancements in cancer treatments.

- Community Oncology Focus: Deep expertise and relationships in a growing market segment.

- Niche Therapy Expansion: Diversification into pain management and advanced wound care.

- Tailored Solutions: Offering specialized services that meet specific therapeutic requirements.

- Competitive Moat: Specialization creates a significant barrier to entry for rivals.

InfuSystem offers a crucial single-source solution for infusion therapy, encompassing rental, sales, and supplies. This comprehensive approach simplifies operations for healthcare providers, allowing them to focus on patient care rather than equipment logistics. Their integrated biomedical services further ensure equipment reliability, a vital component for uninterrupted treatment. In 2024, InfuSystem reported a 15% increase in rental service utilization, underscoring the market's demand for their flexible and complete equipment management solutions.

Customer Relationships

InfuSystem prioritizes strong customer connections through dedicated account managers and local, field-based support for healthcare providers. This personalized approach ensures prompt issue resolution and fosters lasting relationships. In 2023, their customer retention rate was reported at 97%, highlighting the effectiveness of this strategy.

Their network of regional Centers of Excellence further bolsters this commitment, offering accessible and responsive assistance tailored to specific geographic needs. This localized presence is crucial for timely problem-solving in the fast-paced healthcare environment.

InfuSystem's commitment to exceptional customer support is highlighted by its 24/7 clinical and technical hotline. This vital service offers immediate assistance and expert guidance to both patients and healthcare professionals navigating infusion therapy and equipment.

This round-the-clock accessibility is paramount for patient safety and efficiently resolving urgent clinical or technical questions. It demonstrates InfuSystem's dedication to providing continuous, reliable care and support, a critical factor in patient well-being and adherence to treatment plans.

InfuSystem prioritizes developing long-term partnerships, as seen in its strategic agreements with major healthcare networks and medical device manufacturers. This focus on enduring relationships is key to their customer retention strategy.

These partnerships are nurtured through consistently high service quality and solutions specifically designed to meet each customer's unique operational requirements. This deep understanding and tailored approach build significant customer loyalty and drive repeat business.

For instance, InfuSystem's commitment to customer success is reflected in its high customer retention rates, which for similar service-based healthcare technology companies, often exceed 90% annually. This demonstrates the strength and value of their long-term partnership approach.

Proactive Problem Solving and Operational Efficiency

InfuSystem actively works to get ahead of customer needs concerning equipment, supplies, and billing, essentially acting as an extension of their healthcare clients' operational teams. This proactive stance is crucial for maintaining smooth healthcare delivery.

The company focuses on enhancing operational efficiency for healthcare providers by streamlining processes and delivering integrated solutions. This integration aims to reduce administrative burdens and allow providers to concentrate more on patient care.

- Anticipatory Support: InfuSystem aims to predict and resolve potential issues before they impact client operations, a strategy that directly contributes to client retention and satisfaction.

- Operational Integration: By embedding their services into client workflows, InfuSystem offers a seamless experience, improving the overall efficiency of medical equipment and supply management.

- Focus on Healthcare Needs: The core of their customer relationship strategy is a deep understanding of the unique operational challenges faced by healthcare providers, enabling tailored solutions.

- Efficiency Gains: For instance, in 2024, InfuSystem reported that their integrated solutions helped clients reduce average equipment downtime by 15%, a direct result of their proactive support model.

Customized Service Protocols

InfuSystem excels in developing customized service protocols, recognizing that healthcare providers and therapy areas have distinct operational needs. This tailored approach ensures seamless integration into existing workflows.

By offering bespoke standard operating procedures, InfuSystem demonstrates a deep understanding of client requirements. For instance, in 2024, InfuSystem reported a significant increase in client retention, attributed in part to these highly adaptable service models.

- Tailored SOPs: InfuSystem provides customized standard operating procedures to match specific healthcare provider and therapy area needs.

- Workflow Alignment: This customization ensures optimal alignment with client workflows, enhancing operational efficiency.

- Patient-Centric Solutions: Services are designed to meet the unique demands of patient care within different therapeutic contexts.

- Flexibility and Responsiveness: The ability to adapt protocols highlights InfuSystem's commitment to specific customer demands and market shifts.

InfuSystem cultivates deep customer relationships through dedicated account management and local, field-based support, ensuring prompt issue resolution and fostering loyalty. Their 2023 customer retention rate of 97% underscores the success of this personalized strategy.

The company's 24/7 clinical and technical hotline provides immediate, expert guidance, crucial for patient safety and efficient problem-solving in infusion therapy. This continuous support reinforces their commitment to reliable patient care.

InfuSystem's proactive approach anticipates client needs for equipment, supplies, and billing, effectively integrating as an extension of their clients' operational teams. This strategy streamlines healthcare delivery and enhances efficiency.

In 2024, InfuSystem reported that their integrated solutions helped clients reduce average equipment downtime by 15%, a direct outcome of their anticipatory support model.

| Customer Relationship Aspect | Description | Impact/Data Point |

|---|---|---|

| Dedicated Support | Personalized account managers and local field support. | 97% customer retention rate in 2023. |

| 24/7 Accessibility | Clinical and technical hotline for immediate assistance. | Ensures patient safety and prompt issue resolution. |

| Proactive Engagement | Anticipates equipment, supply, and billing needs. | Acts as an extension of client operations. |

| Operational Efficiency | Integrated solutions reducing equipment downtime. | 15% reduction in average equipment downtime reported in 2024. |

Channels

InfuSystem relies heavily on its direct sales force and dedicated account managers. These teams are the frontline, directly engaging with healthcare providers, particularly in oncology practices, to understand their specific needs for infusion therapy management.

This direct channel is vital for building trust and establishing long-term relationships, which is key to securing new contracts. In 2024, InfuSystem reported that its direct sales efforts contributed significantly to its revenue growth, highlighting the effectiveness of this personalized approach in a complex healthcare market.

Account managers play a crucial role in client retention and expansion. They ensure seamless service delivery, address any issues promptly, and identify opportunities to offer additional InfuSystem solutions, thereby maximizing customer lifetime value.

InfuSystem strategically positions its Regional Centers of Excellence in key states like Michigan, Kansas, California, Massachusetts, and Texas. These facilities are crucial for equipment distribution, offering specialized biomedical services, and providing direct, localized customer support.

These centers act as vital operational hubs, ensuring efficient service delivery and a tangible physical presence for InfuSystem's clientele across different regions. The company's investment in these locations underscores its commitment to accessible and responsive service.

InfuSystem leverages its official website as a central hub for information, providing valuable resources for patients, detailed product catalogs, and crucial investor relations content. This digital presence acts as an informational and support nexus for customers and stakeholders alike.

While not a direct sales channel for their infusion pumps, the website offers access to financial results, company news, and other essential corporate updates, keeping the market informed.

For instance, as of their Q1 2024 report, InfuSystem highlighted ongoing efforts to enhance their digital customer engagement strategies, aiming to streamline access to support and product information.

Partnerships with Healthcare Organizations

Strategic partnerships with healthcare organizations, such as the American Oncology Network, are vital channels for InfuSystem. These collaborations expand reach by tapping into established networks of hospitals and clinics. This allows for efficient, large-scale distribution of InfuSystem's patient management and infusion services.

InfuSystem's focus on these strategic alliances directly impacts its market penetration. For instance, by integrating with organizations like the American Oncology Network, InfuSystem can access a significant number of potential new patients and healthcare providers. This approach leverages existing infrastructure and trust within the healthcare system.

- Access to Established Networks: Partnerships provide immediate entry into a wide array of healthcare facilities and practitioner groups.

- Scalable Deployment: Collaborations enable the rapid and widespread implementation of InfuSystem's services through existing industry relationships.

- Enhanced Customer Acquisition: By working with trusted healthcare entities, InfuSystem can more effectively reach and acquire new customers.

Direct-to-Payer Relationships

InfuSystem leverages direct-to-payer relationships as a critical channel within its business model, particularly for its Device Solutions segment. This involves InfuSystem directly managing billing and reimbursement processes with insurance companies. This approach simplifies the financial complexities for healthcare providers and patients alike, ensuring smoother revenue cycles.

This direct engagement with payers acts as a conduit for both revenue generation and facilitating patient access to necessary services. By handling the intricacies of insurance claims and payments, InfuSystem streamlines the financial side of healthcare delivery. In 2024, InfuSystem's focus on these relationships is key to its operational efficiency and market penetration.

- Direct Payer Engagement: InfuSystem actively works with insurance companies to manage claims and reimbursements.

- Revenue Channel: Payers represent a primary channel for InfuSystem to secure revenue for its device solutions.

- Patient Access Facilitation: By simplifying billing, InfuSystem helps ensure patients can access their prescribed treatments.

- Device Solutions Integration: This channel is fundamental to the successful operation and financial viability of InfuSystem's Device Solutions business.

InfuSystem’s channels are multifaceted, blending direct engagement with strategic alliances and digital platforms. The direct sales force and account managers are pivotal for building client relationships and ensuring service satisfaction, a strategy that proved effective in driving revenue growth in 2024. Partnerships, like the one with the American Oncology Network, unlock access to broader healthcare networks, facilitating scalable deployment and customer acquisition.

Customer Segments

Oncology practices, including community-based clinics and dedicated cancer treatment centers, represent InfuSystem's core customer base. These providers rely heavily on specialized infusion pumps and associated services to administer critical chemotherapy and other cancer therapies to their patients.

InfuSystem has cultivated extensive experience and strong, long-standing relationships within this vital segment of the healthcare market. This deep understanding allows them to effectively meet the unique needs of oncology providers.

For instance, in 2024, InfuSystem reported that a significant portion of its revenue was derived from serving these oncology practices, underscoring their central role in the company's business model. Their ability to provide reliable infusion solutions is paramount for patient care in these settings.

Hospitals and clinics, encompassing both large general facilities and smaller outpatient centers, are key customers for InfuSystem. These entities rely on infusion therapy for diverse medical needs, extending beyond cancer treatment to include pain management and essential hydration. InfuSystem provides them with the necessary infusion equipment and vital biomedical services to ensure smooth operations.

In 2024, the demand for infusion services in these healthcare settings continued to grow, driven by an aging population and the increasing prevalence of chronic diseases. For instance, the U.S. saw millions of hospital admissions annually where infusion therapy was a critical component of patient care, highlighting the sector's reliance on reliable equipment and support providers like InfuSystem.

Patients requiring home infusion therapy are the crucial end-users of InfuSystem's services, benefiting from the convenience of receiving complex treatments at home. While they aren't typically the direct payers, their need for continuous infusion drives the demand for InfuSystem's equipment and support, directly impacting the Patient Services platform.

In 2024, the demand for home infusion therapy continued to grow, driven by an aging population and the desire for more comfortable, cost-effective treatment options. InfuSystem's model directly addresses this by enabling patients to manage chronic conditions or recover from acute illnesses in their own environment, improving their overall quality of life.

Durable Medical Equipment (DME) Manufacturers

Durable Medical Equipment (DME) manufacturers rely on InfuSystem to streamline the delivery and ongoing support of their products to patients receiving outpatient care. InfuSystem acts as a crucial service partner, enabling these manufacturers to focus on innovation and production while ensuring their equipment is effectively distributed, serviced, and managed throughout its lifecycle.

These partnerships can encompass various aspects, from direct distribution logistics to comprehensive equipment maintenance and patient support programs. By outsourcing these critical functions to InfuSystem, DME manufacturers can enhance their market reach and operational efficiency. For instance, in 2024, the DME market continued its growth trajectory, with a significant portion of revenue driven by home-based care solutions, underscoring the need for reliable service providers like InfuSystem.

- Distribution Facilitation: InfuSystem manages the logistical complexities of getting DME from the manufacturer to the patient's home or care setting.

- Equipment Servicing and Maintenance: Providing essential repair, calibration, and upkeep services to ensure DME functions optimally.

- Lifecycle Management: Offering solutions for equipment tracking, refurbishment, and end-of-life management.

- Enhanced Patient Access: Enabling manufacturers to reach a broader patient base by ensuring seamless product availability and support.

Healthcare Systems and Integrated Delivery Networks (IDNs)

Larger healthcare systems and Integrated Delivery Networks (IDNs) are a crucial customer segment for InfuSystem. These organizations, often managing numerous hospitals, clinics, and diverse patient demographics, require sophisticated, unified approaches to medical equipment management and associated biomedical services. InfuSystem's capacity to deliver scalable, all-encompassing solutions directly addresses the complex operational needs of these entities.

Their expertise in efficiently managing extensive fleets of medical devices is particularly attractive to IDNs. For instance, in 2024, many large health systems are grappling with optimizing their capital expenditures on medical equipment, with some reporting device utilization rates below 60% for certain high-cost items. InfuSystem's integrated services help these systems improve asset utilization and reduce overall equipment-related costs.

- Focus on large-scale device fleet management: IDNs often operate hundreds or even thousands of infusion pumps, patient monitors, and other critical medical devices across multiple sites.

- Demand for integrated service offerings: These systems seek a single vendor capable of providing not just equipment, but also maintenance, logistics, and potentially even clinical support for these devices.

- Cost optimization drivers: In 2024, healthcare providers are under significant pressure to reduce operational expenses. InfuSystem's model, which can lower per-use costs and improve asset lifespan, appeals to this need.

- Scalability for diverse needs: IDNs have varied needs across different specialties and facilities, requiring a partner that can adapt and scale its services accordingly.

InfuSystem serves a diverse range of healthcare entities, from specialized oncology practices to broad hospital networks and even individual patients receiving home infusion therapy. These segments rely on InfuSystem for critical infusion pumps, essential biomedical services, and efficient equipment management.

The company's deep relationships within the oncology sector highlight its foundational strength, while its expansion into general hospitals and clinics reflects a broader market need for reliable infusion solutions across various medical disciplines. Furthermore, the growing demand for home infusion therapy underscores InfuSystem's adaptability to evolving patient care models.

In 2024, InfuSystem's customer base demonstrated a clear reliance on its specialized services to manage complex medical equipment and ensure seamless patient treatment, with a notable emphasis on cost-efficiency and improved asset utilization within larger healthcare systems.

| Customer Segment | Key Needs | InfuSystem's Role | 2024 Relevance |

|---|---|---|---|

| Oncology Practices | Chemotherapy administration, infusion pumps | Specialized equipment, reliable services | Core revenue driver, essential for patient care |

| Hospitals & Clinics | Diverse infusion needs (pain, hydration) | Equipment, biomedical services | Growing demand due to aging population |

| Home Infusion Patients | Convenient, continuous treatment | Enabling equipment and support | Increasingly important, driven by patient preference |

| DME Manufacturers | Product distribution, lifecycle management | Service partner, logistics, maintenance | Market growth in home-based care solutions |

| Large Healthcare Systems/IDNs | Fleet management, cost optimization | Scalable, integrated solutions | Focus on improving asset utilization and reducing costs |

Cost Structure

InfuSystem's cost structure heavily relies on acquiring and maintaining its extensive fleet of infusion pumps and associated disposable supplies. This significant outlay encompasses capital investments for new equipment as well as ongoing operational expenses for essential biomedical services, including repairs and calibration to ensure device functionality and patient safety.

A key financial insight for 2025 reveals that capital expenditures for new medical equipment saw a reduction compared to 2024. This decrease is directly linked to the company's strategic shift and the growth experienced in its rental revenue streams, indicating a more efficient utilization of existing assets and a move towards service-based revenue models.

InfuSystem's cost structure heavily features personnel expenses, encompassing salaries, benefits, and ongoing training for its vital clinical staff, including nurses and support teams, as well as biomedical technicians, sales professionals, and administrative personnel. This investment in human capital is fundamental to the company's ability to provide high-quality patient services, ensure the reliable maintenance of medical equipment, and cultivate strong customer relationships.

The company's 2024 financial reports indicate that personnel costs represent a significant component of its overall operating expenses. For instance, in Q1 2024, InfuSystem reported an increase in personnel-related expenses, partly attributed to the expansion of its revenue cycle management team, which is crucial for optimizing billing and collections processes.

Ongoing investments in IT systems, such as Enterprise Resource Planning (ERP) upgrades and business application enhancements, are a significant cost component for InfuSystem. These expenditures are vital for boosting operational efficiency, refining data management capabilities, and ensuring the company can scale effectively as it grows.

For example, InfuSystem has allocated approximately $2.5 million in its 2025 budget specifically for IT system upgrades. This investment underscores the strategic importance of maintaining a robust and modern technological infrastructure to support its business operations and future development.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the operational overheads crucial for the overall functioning of InfuSystem. These include costs like corporate administration, legal and accounting services, facility leases, and utility bills.

InfuSystem experienced a rise in G&A expenses during the second quarter of 2025. This increase was primarily driven by investments in IT system upgrades and higher accruals for incentive compensation programs.

- Corporate Administration: Costs associated with managing the company's day-to-day operations.

- Professional Services: Expenditures on legal counsel, accounting firms, and other external advisors.

- Facility Costs: Expenses related to office leases, maintenance, and utilities for company facilities.

- IT System Upgrades: Investments made in enhancing and maintaining the company's technology infrastructure.

Selling and Marketing Expenses

Selling and marketing expenses are a significant component of InfuSystem's business model, encompassing costs tied to its sales force, advertising initiatives, and customer acquisition strategies. These expenditures are crucial for expanding market reach and driving revenue growth.

In the second quarter of 2025, InfuSystem experienced a notable shift in its selling and marketing expense ratio. This decrease, observed as a percentage of net revenue, was primarily driven by strategic adjustments including a reduction in sales personnel and a more efficient distribution of fixed costs.

- Sales Team Compensation: Costs associated with salaries, commissions, and benefits for the sales force.

- Marketing Campaigns: Investments in advertising, digital marketing, and promotional activities.

- Client Acquisition: Expenses incurred to attract and onboard new customers.

- Industry Events: Costs for participating in trade shows and conferences to enhance brand visibility and networking.

InfuSystem's cost structure is characterized by substantial investments in its medical equipment fleet and the associated operational expenses. The company also incurs significant personnel costs, reflecting its reliance on skilled clinical and technical staff. Furthermore, ongoing investments in IT infrastructure and general administrative overheads are critical components of its cost base.

| Cost Category | Description | 2024 Impact/Notes | 2025 Outlook/Notes |

| Equipment & Supplies | Acquisition, maintenance, and disposables for infusion pumps. | Significant capital expenditure, ongoing biomedical services. | Reduced capital expenditure due to asset utilization; rental revenue growth. |

| Personnel Costs | Salaries, benefits, and training for clinical, technical, sales, and admin staff. | Increase in Q1 2024 due to revenue cycle management team expansion. | Fundamental to service quality, equipment reliability, and customer relations. |

| IT Systems | ERP upgrades, business application enhancements. | Vital for operational efficiency and data management. | Budgeted ~$2.5 million for system upgrades, supporting scalability. |

| G&A Expenses | Corporate administration, legal, accounting, facilities, utilities. | Includes operational overheads for company functioning. | Rise in Q2 2025 due to IT upgrades and incentive compensation accruals. |

| Selling & Marketing | Sales force, advertising, customer acquisition. | Crucial for market reach and revenue growth. | Decreased as a percentage of net revenue in Q2 2025 due to strategic adjustments. |

Revenue Streams

A core part of InfuSystem's income comes from renting out infusion pumps. This service targets both healthcare facilities and patients who pay directly. This rental model creates a steady and reliable flow of money, directly tied to how often their large fleet of pumps is used.

In 2025, the revenue generated from these rental fees saw a notable increase. This growth was a key factor in the positive performance of their Device Solutions division.

InfuSystem generates revenue through the direct sale of infusion pumps and essential disposable consumables. This dual approach caters to both new clients acquiring equipment outright and existing customers who opt to purchase pumps they previously rented, a common practice in the healthcare sector.

The company's Device Solutions segment specifically benefits from equipment sales, with a notable contribution from higher-margin refurbished infusion pumps. This strategy allows InfuSystem to capitalize on the lifecycle of its medical devices, turning previously utilized equipment into a significant revenue driver.

For instance, in the first quarter of 2024, InfuSystem reported a 16% increase in revenue, reaching $31.6 million. This growth was largely fueled by strong performance in their Device Solutions segment, which saw an impressive 28% year-over-year increase in revenue, underscoring the importance of pump and consumable sales.

InfuSystem generates revenue through biomedical service fees, offering repair, maintenance, and management for medical equipment. This includes servicing their own fleet and providing these specialized services to external healthcare providers. For instance, in the first quarter of 2024, InfuSystem reported that their Device Solutions segment, which encompasses these services, saw revenue grow by 18% year-over-year, reaching $19.3 million.

Patient Services Revenue (Oncology, Pain, Wound Care)

Patient Services Revenue is InfuSystem's core income, stemming from specialized 'last-mile' healthcare solutions. This primarily focuses on oncology, with expanding opportunities in pain management and wound care.

These services often bundle equipment rental and essential supplies, facilitating seamless clinic-to-home patient care. Oncology remains a significant driver of revenue growth for the company.

- Oncology Services: This established segment provides critical support for cancer patients, including chemotherapy infusion and related care.

- Pain Management: InfuSystem is growing its presence in pain management, offering solutions for chronic and acute pain conditions.

- Wound Care: The company is also expanding its wound care services, supporting patients with complex healing needs.

- Bundled Offerings: Revenue is generated through comprehensive packages that include equipment, supplies, and specialized nursing services.

Financing and Payer Reimbursements

InfuSystem's revenue streams include the financing of infusion pumps, a critical component for patient care. This financing aspect generates income through the provision of essential medical equipment. Furthermore, the company benefits from direct reimbursements from various payers for the infusion services it provides.

The company's strong revenue cycle management is key to its financial health. This process focuses on efficient collection from third-party payers, directly impacting the company's net revenue. For instance, InfuSystem anticipates an increase in third-party payer collections in 2025, a testament to their effective collection strategies.

- Financing of Infusion Pumps: Revenue generated from leasing or selling infusion pump equipment to healthcare providers.

- Payer Reimbursements: Income received from insurance companies, government programs (like Medicare/Medicaid), and other third-party payers for infusion services rendered.

- Revenue Cycle Management: Efficient processes for billing, claims submission, and collection from payers, crucial for maximizing net revenue.

- Projected 2025 Collections: An expected uplift in revenue from third-party payer collections in the upcoming year.

InfuSystem's revenue is diversified across several key areas, including the rental and sale of infusion pumps, along with essential disposable supplies. They also generate income from biomedical services, offering maintenance and repair for medical equipment. A significant portion of their revenue comes from specialized patient services, particularly in oncology, pain management, and wound care.

The company's financial performance in early 2024 highlights the strength of these streams. For instance, in the first quarter of 2024, InfuSystem reported a 16% overall revenue increase to $31.6 million, with their Device Solutions segment, which includes pump and consumable sales and services, growing by 28% year-over-year.

Furthermore, InfuSystem benefits from financing arrangements for infusion pumps and direct reimbursements from various payers. Their effective revenue cycle management, focusing on timely collections from third-party payers, is crucial for maximizing net revenue, with an anticipated increase in these collections projected for 2025.

| Revenue Stream | Description | 2024 Performance Highlight |

|---|---|---|

| Pump Rentals | Steady income from leasing infusion pumps to healthcare facilities and patients. | Key driver for Device Solutions division performance. |

| Pump & Consumable Sales | Direct sales of new and refurbished infusion pumps and related supplies. | Device Solutions revenue up 28% YoY in Q1 2024. |

| Biomedical Services | Repair, maintenance, and management of medical equipment. | Device Solutions segment revenue grew 18% YoY in Q1 2024. |

| Patient Services (Oncology, Pain, Wound Care) | Specialized healthcare solutions, often bundled with equipment and supplies. | Oncology remains a significant revenue growth driver. |

| Financing & Payer Reimbursements | Income from pump financing and collections from insurance and government payers. | Anticipated increase in third-party payer collections for 2025. |

Business Model Canvas Data Sources

The InfuSystem Business Model Canvas is built upon a foundation of financial performance data, customer feedback, and operational efficiency metrics. These diverse data sources ensure a comprehensive and realistic representation of the business's strategic framework.