InfuSystem Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InfuSystem Bundle

Curious about InfuSystem's product portfolio performance? This glimpse into their BCG Matrix reveals the foundational insights into their market positioning. Understand which products are driving growth and which might need a strategic re-evaluation.

To truly harness this knowledge and make informed decisions, dive into the complete InfuSystem BCG Matrix. Unlock detailed quadrant analysis, strategic recommendations, and a clear roadmap for optimizing your investments and product development.

Don't miss out on the actionable intelligence that the full BCG Matrix provides. Purchase it now to gain a comprehensive understanding and confidently navigate InfuSystem's market landscape.

Stars

InfuSystem's commitment to advanced infusion pump technology, especially for complex therapies, positions these offerings as potential Stars in its BCG portfolio. These technologies cater to high-growth healthcare segments fueled by evolving drug delivery methods and patient care standards.

If InfuSystem has captured substantial market share in these specialized niches, it signifies leadership. For instance, in 2024, the home infusion therapy market was projected to grow significantly, with advanced pumps playing a crucial role in enabling more sophisticated treatments at home, a trend InfuSystem is likely capitalizing on.

The company's ongoing investment in these cutting-edge areas is essential for maintaining its competitive advantage and expanding its market presence. This strategic focus on innovation ensures InfuSystem remains at the forefront of a dynamic and rapidly advancing sector within healthcare.

InfuSystem's expansion into comprehensive home infusion services aligns with the strong healthcare trend favoring home-based care. This strategic move positions their home care solutions as a potential Star in the BCG matrix. The company's aggressive market share capture in this expanding segment necessitates ongoing investment to scale operations and patient referrals.

InfuSystem's Specialized Oncology Infusion Solutions likely represent a Star in the BCG Matrix. The oncology sector is characterized by rapid advancements in treatment, with a growing demand for specialized drug delivery systems to support targeted therapies and immunotherapies. InfuSystem's focus on these high-growth areas, potentially offering unique or dominant solutions for specific treatments, positions it for significant market share gains.

Integrated Biomedical Equipment Management

Integrated biomedical equipment management services are becoming increasingly important as healthcare facilities focus on operational efficiency and cost reduction. If InfuSystem is expanding its offerings to encompass a wider array of medical devices and is successfully securing substantial, multi-year agreements with large healthcare networks, this segment could represent a Star in their BCG Matrix. This necessitates ongoing investment in specialized technicians, advanced technology, and robust service infrastructure to remain competitive and grow market share.

For example, the global medical equipment maintenance market was valued at approximately $37.6 billion in 2023 and is projected to grow significantly. This growth is driven by the increasing complexity of medical technology and the need for specialized maintenance to ensure patient safety and device uptime.

- Market Growth: The expanding healthcare sector and the increasing adoption of sophisticated medical devices fuel demand for comprehensive equipment management.

- Strategic Expansion: InfuSystem's potential broadening of service scope and securing long-term contracts with major healthcare systems are key indicators of a Star.

- Investment Needs: Sustained investment in skilled personnel, cutting-edge technology, and a resilient service network are crucial for maintaining a competitive edge in this high-growth area.

- Competitive Landscape: The sector requires continuous innovation and service excellence to capture and retain market share against other providers.

Strategic Partnerships in Emerging Markets

Forging strategic alliances in emerging markets is a key move for InfuSystem. These partnerships help the company enter new, fast-growing regions or specific healthcare areas where infusion therapy is gaining traction. By teaming up, InfuSystem can tap into local knowledge and established connections, which is crucial for building a solid foothold and gaining early market share.

These collaborations are vital for navigating the complexities of new territories. For instance, in 2024, emerging markets represented a significant portion of global healthcare spending growth, with some regions seeing double-digit increases in medical device adoption. Such partnerships would require substantial initial investment to build a strong presence and secure initial market share in these developing areas.

- Leveraging Local Expertise: Partnerships provide access to on-the-ground knowledge of regulatory landscapes, patient needs, and distribution channels, accelerating market entry.

- Network Access: Collaborating with established local entities grants immediate access to existing healthcare provider networks and patient populations.

- Risk Mitigation: Sharing upfront investment and operational risks with partners can make market entry more feasible and less burdensome for InfuSystem.

- Market Penetration: Strategic alliances are essential for achieving significant market penetration in diverse and often fragmented emerging markets.

InfuSystem's advanced infusion pump technologies, particularly for complex therapies and specialized oncology treatments, are strong candidates for Star status. These segments benefit from high growth driven by evolving drug delivery methods and the increasing demand for targeted therapies.

The company's expansion into comprehensive home infusion services, capitalizing on the shift towards home-based care, also positions these offerings as potential Stars. Capturing significant market share in these expanding areas requires continuous investment to scale operations and patient referrals.

Integrated biomedical equipment management services, especially when InfuSystem secures multi-year agreements with large healthcare networks, represent another potential Star. This segment thrives on operational efficiency and cost reduction within healthcare facilities.

The home infusion therapy market, for instance, saw robust growth in 2024, with advanced pumps being critical enablers of sophisticated at-home treatments. Similarly, the global medical equipment maintenance market, valued around $37.6 billion in 2023, highlights the demand for specialized services in a sector with increasing technological complexity.

What is included in the product

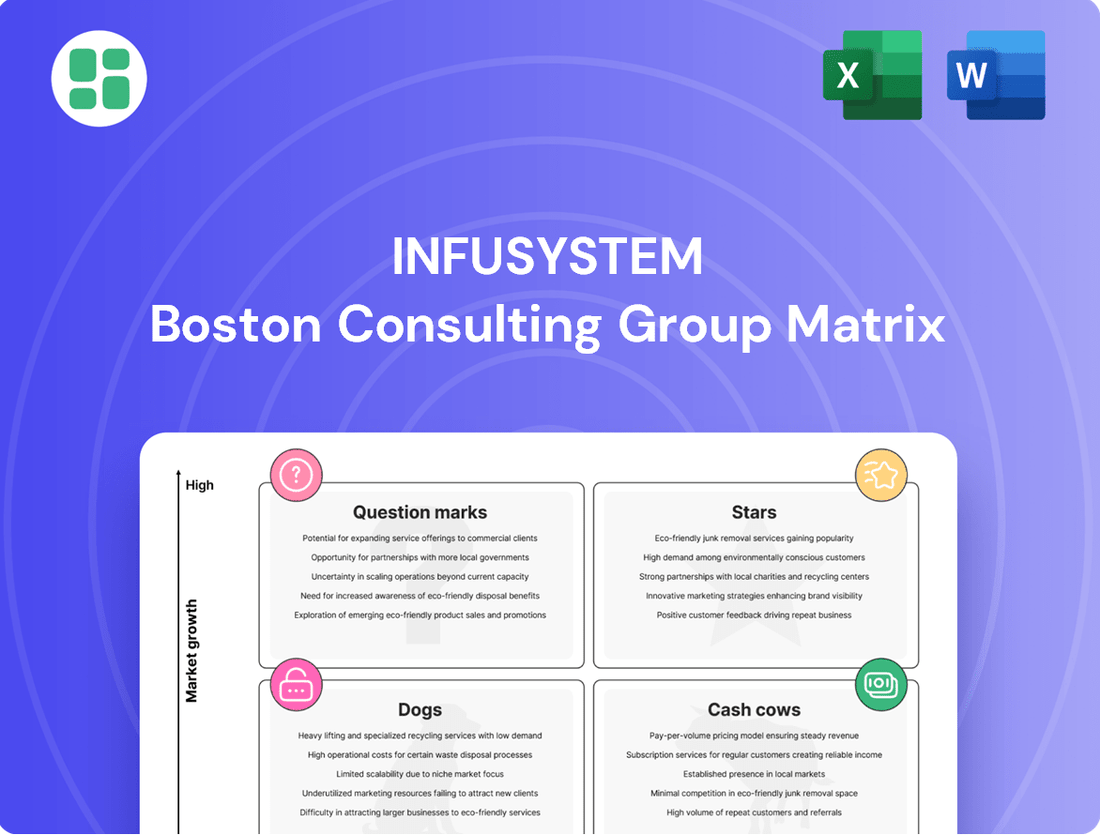

The InfuSystem BCG Matrix analyzes product portfolio performance, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on resource allocation, identifying which units to invest in, hold, or divest for optimal business growth.

Infusion of clarity: The BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

InfuSystem's core oncology practice infusion rental business is a prime example of a Cash Cow within the BCG matrix. This segment benefits from a mature market with consistent demand, where InfuSystem has cultivated a strong and stable market position. The company's extensive experience, dating back over three decades, in supplying infusion pumps and related consumables to established oncology centers underpins this segment's reliability.

This mature business generates substantial, predictable cash flow, a hallmark of Cash Cows. The ongoing investment needed for marketing or innovation in this established service is minimal, allowing InfuSystem to efficiently harvest profits. For instance, the company has consistently reported significant revenue from its infusion services, which formed the bedrock of its financial stability even as it pursued growth in other areas.

Routine Infusion Supplies Distribution for InfuSystem is a classic Cash Cow. This segment focuses on delivering essential consumables like tubing, bags, and needles to their established client base, primarily in oncology and other stable healthcare sectors. It's a high-volume operation, though the profit margins on individual items are typically quite slim.

The strength of this business lies in its predictability. With a large, existing customer base, the demand for these supplies remains consistent, generating reliable revenue streams and solid cash flow for InfuSystem. This stability allows the company to operate efficiently without requiring significant new investment, with capital primarily directed towards optimizing logistics and inventory management to keep costs down and profitability up.

For instance, in 2023, InfuSystem reported that its Infusion Services segment, which includes the distribution of these supplies, generated $125.3 million in revenue. This segment is crucial for supporting the company's overall financial health, providing the steady income needed to fund growth initiatives in other areas.

Standard Biomedical Equipment Maintenance Contracts represent a significant Cash Cow for InfuSystem. These long-term agreements cover routine upkeep and repairs for a broad range of medical devices used in hospitals and clinics, extending beyond their core infusion pump offerings. This segment benefits from a mature market where demand for reliable equipment functionality is constant, ensuring a predictable and stable revenue flow for the company.

InfuSystem's deep-rooted relationships with healthcare providers and their proven efficiency in delivering these maintenance services are key to their reliable cash generation. The mature nature of this market means that substantial new capital investments are not typically required, allowing these contracts to consistently convert service revenue into readily available cash. For instance, in 2023, InfuSystem reported that their service agreements, which encompass these maintenance contracts, represented a substantial portion of their recurring revenue, demonstrating the consistent cash-generating power of this offering.

Legacy Infusion Pump Sales

Legacy infusion pump sales, particularly those from well-established and reliable models, can indeed serve as a cash cow for companies like InfuSystem. These older units often find a consistent market among smaller clinics or for applications that don't require the latest technological advancements, ensuring a steady revenue stream. For instance, in 2024, the demand for dependable, lower-cost medical equipment remained robust, especially as healthcare providers navigated evolving reimbursement landscapes and sought cost-effective solutions.

The profit margins on these legacy products are typically stable. This is because the significant research and development costs have already been absorbed, allowing for consistent cash generation without the need for substantial ongoing investment in new product innovation. This steady cash flow is crucial for supporting other areas of the business, such as the company's Stars or Question Marks.

- Consistent Demand: Smaller clinics and specific use cases continue to rely on proven, less complex infusion pump models.

- Stable Profitability: Mature products have lower R&D overhead, leading to predictable profit margins.

- Cost-Effectiveness: Lower acquisition costs make legacy pumps attractive to budget-conscious healthcare providers.

- Cash Generation: These sales provide a reliable source of cash to fund growth initiatives or other business units.

Established Payer Network Relationships

InfuSystem's established payer network relationships are a cornerstone of its Cash Cow strategy. These deep-rooted connections with major insurance companies and managed care organizations streamline the reimbursement process for infusion services. This ensures a consistent and reliable revenue stream from a well-established patient base, minimizing the need for significant new investments to cultivate these critical partnerships.

These established networks are vital for InfuSystem's financial stability. For instance, in 2023, InfuSystem reported that its revenue from services provided to patients covered by major commercial payers and Medicare Advantage plans represented a significant portion of its total revenue, demonstrating the consistent cash flow generated from these relationships.

- Consistent Revenue: Years of building trust and efficient processing with payers lead to predictable income.

- Reduced Acquisition Costs: Leveraging existing relationships minimizes the expense of acquiring new patient referrals through payer channels.

- Streamlined Operations: Established billing protocols and reimbursement workflows reduce administrative overhead and improve cash cycle times.

- Market Maturity: These relationships tap into a mature market segment where infusion services are a recognized need, ensuring ongoing demand.

InfuSystem's core infusion rental business acts as a robust Cash Cow. This segment thrives in a mature market with consistent demand, where InfuSystem holds a strong, stable position built over three decades of experience supplying infusion pumps and consumables to established oncology centers.

This business generates substantial, predictable cash flow with minimal need for further investment in marketing or innovation, allowing for efficient profit harvesting. For instance, InfuSystem's Infusion Services segment, which includes these rentals, generated $125.3 million in revenue in 2023, highlighting its crucial role in the company's financial stability.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue (Millions USD) | Key Data Point |

|---|---|---|---|---|

| Infusion Rental Business | Cash Cow | Mature market, stable demand, strong market position, low investment needs | 125.3 | Significant portion of total revenue |

What You’re Viewing Is Included

InfuSystem BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed strategic tool ready for immediate application in your business planning and analysis.

Dogs

Outdated infusion pump models represent InfuSystem's potential Dogs in the BCG matrix. These older units, while perhaps still functional, are likely characterized by declining demand as newer, more advanced technologies emerge. For instance, if InfuSystem's 2024 inventory reports show a significant portion of units older than 7 years, these would fall into this category.

Highly commoditized basic supplies represent a segment where InfuSystem might find itself with a low market share and operating in a low-growth environment. These are often undifferentiated products, meaning many other companies offer similar items, leading to intense price competition. For instance, basic IV kits or saline solutions are readily available from a multitude of suppliers, making it difficult for any single company to command premium pricing or significant market dominance without a distinct advantage.

In such a market, InfuSystem's basic supplies could be considered Question Marks or even Dogs in the BCG matrix if they don't possess a unique selling proposition or a significant cost advantage. Companies in this space often struggle to achieve profitability, with margins being razor-thin. In 2024, the market for basic medical supplies continued to be highly competitive, with many distributors reporting single-digit profit margins on these types of goods due to the sheer volume of players and the lack of product differentiation.

Underperforming regional service centers, often found in low-growth geographical markets with a limited market share, can be characterized as Dogs within the InfuSystem BCG Matrix. These hubs may face challenges such as insufficient client volume and high operational costs relative to their revenue, or they might be struggling against intense local competition. For instance, if a particular regional center in a declining industrial area only managed to generate $500,000 in revenue in 2024 while incurring $700,000 in operational expenses, it would represent a clear example of a Dog. Such units consume valuable resources without making a substantial contribution to the company's overall profitability, making them prime candidates for strategic review, which could involve consolidation or even closure to optimize resource allocation.

Niche Biomedical Services with Low Uptake

Niche biomedical services with low uptake represent InfuSystem's Dogs in the BCG matrix. These are specialized offerings that have struggled to gain traction, potentially due to being in niche or stagnant markets, or facing intense competition. For instance, if InfuSystem invested in a highly specialized diagnostic service that saw less than 5% market penetration in its target segment by early 2024, it would fit this category. Such services drain resources without delivering substantial revenue.

These "Dogs" consume valuable capital and management attention that could be better allocated to more promising areas of the business. In 2023, InfuSystem might have reported that a particular niche service line, despite a dedicated marketing budget of $500,000, only generated $150,000 in revenue. This indicates a negative return on investment and a clear cash trap scenario.

- Stagnant Market: Services targeting a very small or declining patient population.

- Lack of Competitive Advantage: Offerings that are not differentiated or are outcompeted by established players.

- High Operational Costs: Specialized services requiring expensive equipment or highly trained personnel, making them unprofitable at low volumes.

- Low Revenue Generation: Minimal client adoption leading to negligible contribution to overall company revenue.

Legacy IT Systems for Client Management

Legacy IT systems for client management often fall into the Dog category within the BCG Matrix framework due to their operational drawbacks. These systems, while functional, are typically outdated, leading to inefficiencies in client management, inventory tracking, and billing processes. Their maintenance costs can be substantial, consuming valuable IT resources that could be allocated to more strategic initiatives.

From an operational efficiency standpoint, these legacy systems are dogs. They not only demand significant IT budget for upkeep but also limit the functionality available to users, thereby hindering productivity. For instance, a 2024 survey by TechTarget found that 60% of organizations still rely on legacy systems, with over half reporting that these systems impede their ability to innovate and respond to market changes.

- High Maintenance Costs: Upgrading and maintaining outdated systems can divert significant capital. For example, some companies report spending up to 70% of their IT budget on maintaining legacy infrastructure.

- Limited Functionality: These systems often lack modern features, impacting client interaction and data management capabilities.

- Hindered Productivity: Inefficient workflows and slow processing times directly affect employee output and customer satisfaction.

- Lack of Competitive Advantage: Unlike modern, agile systems that can drive growth, legacy IT provides no strategic edge and can even be a competitive disadvantage.

InfuSystem's "Dogs" represent business units or products with low market share in low-growth industries. These are often cash traps, consuming resources without generating significant returns. Identifying and managing these "Dogs" is crucial for optimizing InfuSystem's overall portfolio performance.

Outdated infusion pump models and commoditized basic supplies are prime examples of InfuSystem's potential Dogs. These segments face declining demand or intense price competition, limiting profitability. For instance, if basic IV kits in 2024 saw profit margins shrink to 2%, it highlights the challenge.

Underperforming regional service centers and niche biomedical services with low uptake also fit the Dog profile. These areas struggle with low client volume or market penetration, leading to negative returns. A regional center with a 2024 revenue of $500,000 against $700,000 in costs exemplifies this.

Legacy IT systems, despite their functionality, are also Dogs due to high maintenance costs and limited capabilities. These systems hinder productivity and innovation, as noted by a 2024 TechTarget survey where 60% of organizations with legacy systems reported innovation impediments.

| Category | Description | Example for InfuSystem | Market Growth | Market Share |

| Dogs | Low market share in a low-growth market. | Outdated infusion pump models. | Low | Low |

| Dogs | Commoditized products with little differentiation. | Basic IV kits or saline solutions. | Low | Low |

| Dogs | Underperforming regional operations. | A service center in a declining industrial area. | Low | Low |

| Dogs | Niche services with minimal customer adoption. | Specialized diagnostic service with <5% penetration. | Low | Low |

| Dogs | Legacy IT systems. | Outdated client management software. | Low | Low |

Question Marks

Emerging gene therapy infusion support fits squarely into the Question Mark category for InfuSystem. The market is experiencing explosive growth, with the global gene therapy market projected to reach $13.1 billion by 2027, a significant jump from previous years. This rapid expansion signals immense potential, but InfuSystem's current penetration in this specialized niche may be limited, requiring strategic focus to gain traction.

The intricate and often highly specific administration requirements for gene therapies, such as precise temperature control and specialized drug preparation, create a demand for InfuSystem to innovate and offer bespoke infusion solutions. Successfully entering this segment will necessitate substantial investment in advanced infusion pumps, rigorous staff training on handling sensitive biologics, and dedicated research and development to align with evolving clinical protocols.

Expanding into emerging international markets with developing healthcare infrastructure presents InfuSystem with a classic Question Mark scenario. These regions, such as parts of Southeast Asia and Latin America, show promising growth rates in healthcare spending, projected to increase by 7-9% annually through 2028, yet InfuSystem's current market share there is minimal. Navigating diverse regulatory landscapes and establishing brand recognition against established local players will require significant upfront investment.

The key challenge lies in converting this high-potential, low-share position into a dominant market presence. InfuSystem’s strategy must involve deep market analysis, forming strategic alliances with local distributors or healthcare providers, and tailoring its infusion therapy solutions to meet specific regional needs and compliance standards. For instance, adapting product offerings to align with differing reimbursement policies in countries like Brazil or India will be crucial for gaining traction.

Developing advanced analytics for infusion management, like predictive modeling for equipment needs or patient outcomes, is a prime example of a Question Mark for InfuSystem. This area is experiencing rapid growth within healthcare technology, driven by the demand for efficiency and improved patient care.

InfuSystem likely holds a low market share in this specialized, tech-intensive segment. For instance, the global healthcare analytics market was valued at approximately $12.9 billion in 2023 and is projected to reach $38.5 billion by 2028, growing at a CAGR of 24.4%. This indicates a significant opportunity but also intense competition.

To establish a strong foothold, InfuSystem would need substantial investment in software development, hiring data scientists, and ensuring seamless integration with their current systems. This strategic move could position them to capitalize on the increasing reliance on data-driven decision-making in healthcare delivery.

Specialized Clinical Trial Support Services

Specialized clinical trial support services represent a burgeoning market for companies like InfuSystem, particularly in assisting pharmaceutical firms with novel drug trials. This segment demands meticulous logistics, stringent regulatory adherence, and agile service delivery.

InfuSystem's current penetration in this high-growth area may be limited, positioning it as a Question Mark within the BCG matrix. Capturing substantial market share necessitates significant investment in specialized teams and infrastructure.

- Growing Market Demand: The global clinical trial market was valued at approximately $50 billion in 2023 and is projected to grow significantly, with a notable portion dedicated to specialized support services.

- High Investment Requirements: Building the necessary expertise in regulatory affairs, specialized logistics for temperature-sensitive biologics, and patient management systems requires substantial capital outlay.

- Potential for High Returns: Successful entry and expansion into this niche could yield high returns due to the critical nature of these services for drug development and the potential for long-term partnerships with pharmaceutical giants.

- Competitive Landscape: While potentially underserved, the specialized nature of this market may attract established players or require InfuSystem to differentiate through unique service offerings or technological integration.

Direct-to-Patient Telehealth Integration for Infusion

Integrating direct-to-patient telehealth for infusion therapy aligns with a significant healthcare trend, offering remote monitoring and virtual consultations. InfuSystem's current market penetration in this specific niche might be limited, positioning it as a Question Mark within the BCG matrix. This segment represents an opportunity for growth, provided strategic investments are made.

To capitalize on this burgeoning area, InfuSystem would need to focus on developing robust telehealth platforms, enhancing patient engagement tools, and establishing strong remote clinical support. Such advancements could elevate this offering from a Question Mark to a Star performer in the market.

- Telehealth adoption in home healthcare is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years.

- InfuSystem's current telehealth integration for infusion services is likely in its early stages, with a relatively small market share compared to established telehealth providers.

- Key investments would include secure patient data management systems, user-friendly patient portals, and training for clinical staff on virtual care delivery.

- Successful integration could lead to improved patient adherence, reduced hospital readmissions, and a stronger competitive position in the evolving healthcare landscape.

Expanding into the specialized field of infusion support for rare disease treatments presents InfuSystem with a classic Question Mark scenario. The market for rare disease therapies is experiencing substantial growth, with an estimated 7,000 rare diseases identified, impacting millions globally. InfuSystem’s current market share in this highly niche and complex area is likely minimal, requiring significant strategic investment.

The unique logistical and clinical requirements for rare disease infusions, such as specialized handling of biologics and tailored patient support, demand a focused approach. InfuSystem would need to invest in advanced training for its clinical staff and potentially develop bespoke service protocols to meet the exacting standards of these treatments.

The global rare disease drug market was valued at approximately $180 billion in 2023 and is projected to exceed $250 billion by 2028, demonstrating robust growth. This expansion highlights a significant opportunity for InfuSystem to carve out a specialized service offering.

| Category | Market Potential | InfuSystem's Current Position | Strategic Imperative |

|---|---|---|---|

| Rare Disease Infusion Support | High growth, specialized needs | Low market share, emerging | Invest in specialized training and logistics |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial statements, publicly available market research, and competitive landscape analyses to provide a comprehensive view.