Infineon Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

Navigate the complex external forces shaping Infineon Technologies's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are directly impacting the semiconductor giant's operations and strategic decisions. Equip yourself with actionable intelligence to anticipate market shifts and identify new opportunities. Download the full PESTLE analysis now to gain a critical competitive edge.

Political factors

Global geopolitical tensions, especially between the US and China, heavily influence the semiconductor sector. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has implemented export controls on advanced semiconductor technologies, impacting companies like Infineon. These measures can lead to tariffs and restrictions on technology transfers, directly affecting supply chains and market access.

Infineon, operating with a worldwide supply chain and diverse customer base, must skillfully navigate these intricate international trade policies. The company's ability to adapt to evolving regulations and mitigate risks arising from trade disputes is crucial for its continued success. For example, in 2023, the global semiconductor market experienced fluctuations influenced by these geopolitical factors, with some regions seeing increased investment in domestic chip production to reduce reliance on foreign suppliers.

Governments globally are prioritizing semiconductor self-sufficiency, with significant financial backing. The US CHIPS and Science Act, for instance, allocated $52.7 billion to boost domestic manufacturing and research, while the EU's European Chips Act aims to mobilize over €43 billion in public and private investment by 2030. These policies present a dual-edged sword for Infineon; they can unlock opportunities for capacity expansion and R&D investment in key markets, but also intensify competition and introduce requirements for localized production, potentially impacting global supply chain strategies.

Infineon Technologies operates within a global political landscape where regulatory stability is paramount. In 2024, the European Union's continued focus on semiconductor manufacturing, exemplified by the EU Chips Act aiming for 20% global market share by 2030, offers a supportive framework for Infineon's European operations. However, geopolitical tensions, particularly concerning trade relations between the US and China, introduce complexities for supply chain management and market access in key Asian regions.

International Cooperation and Standards

Collaboration among nations on technology standards, intellectual property protection, and supply chain resilience is vital for the semiconductor industry. Infineon, for instance, thrives on harmonized international standards that streamline product development and market access. For example, the European Union's Chips Act, with its €43 billion investment plan by 2030, aims to bolster the continent's semiconductor ecosystem, encouraging international partnerships and adherence to common standards.

Conversely, a deficit in international cooperation or diverging national policies can erect significant hurdles. These can manifest as increased operational complexity and market fragmentation. The ongoing geopolitical tensions and trade restrictions highlight the challenges faced when global cooperation falters, impacting the ability to navigate diverse regulatory landscapes and secure critical resources. In 2023, the global semiconductor market faced headwinds, partly due to these complex international dynamics.

- Harmonized Standards: Infineon benefits from international agreements that simplify global product deployment.

- IP Protection: Robust international intellectual property laws are essential for safeguarding Infineon's innovations.

- Supply Chain Resilience: Global cooperation is key to mitigating risks and ensuring the stability of semiconductor supply chains, a critical factor highlighted by disruptions in recent years.

- Divergent Policies: Nationalistic approaches or trade barriers can increase costs and hinder market access for companies like Infineon.

Cybersecurity and Data Protection Legislation

Governments worldwide are intensifying their focus on cybersecurity and data protection, a trend directly impacting semiconductor manufacturers like Infineon. The increasing reliance on interconnected systems, from automotive to industrial automation, necessitates robust security measures. For instance, the European Union's GDPR (General Data Protection Regulation) sets stringent standards for handling personal data, requiring companies to implement comprehensive data protection strategies. Infineon, as a global player, must navigate these evolving legal landscapes to ensure compliance across its operations and product lifecycles.

Compliance with these regulations often demands substantial investment in secure product design principles and advanced data management practices. This includes safeguarding sensitive customer information and ensuring the integrity of data processed by Infineon's semiconductor solutions. The financial implications are significant, with penalties for non-compliance potentially reaching millions of euros or a percentage of global turnover, as seen with GDPR violations. Therefore, proactive adaptation to these political factors is crucial for maintaining market access and trust.

Key considerations for Infineon include:

- Adapting to evolving national cybersecurity frameworks: Many countries are implementing or updating their own cybersecurity mandates, requiring continuous monitoring and adjustment of internal policies.

- Investing in secure-by-design methodologies: Integrating security considerations from the earliest stages of product development is paramount to meet regulatory requirements and customer expectations.

- Ensuring data privacy across the supply chain: Infineon must ensure that its partners and suppliers also adhere to strict data protection standards to maintain overall compliance.

- Allocating resources for regulatory compliance and audits: Ongoing investment in legal expertise, compliance officers, and auditing processes is necessary to stay ahead of regulatory changes.

Governments are increasingly prioritizing national security and economic resilience through industrial policy, directly impacting semiconductor supply chains. The US CHIPS and Science Act, with its $52.7 billion allocation, and the EU's European Chips Act, aiming for over €43 billion in investment by 2030, underscore this trend. These initiatives aim to boost domestic production and R&D, creating both opportunities and potential competition for Infineon.

Geopolitical tensions, particularly between the US and China, continue to shape global trade policies and export controls on advanced technologies, affecting market access and supply chain stability for companies like Infineon. Navigating these complex international relations and adapting to evolving trade regulations remains critical for operational continuity and market expansion.

Infineon must also contend with diverse national cybersecurity and data protection regulations, such as the EU's GDPR. Compliance demands significant investment in secure product design and data management, with non-compliance penalties potentially impacting financial performance and market reputation.

| Policy/Act | Target Investment (approx.) | Year Announced/Key Period | Focus Area |

|---|---|---|---|

| US CHIPS and Science Act | $52.7 billion | 2022 | Domestic semiconductor manufacturing & R&D |

| EU Chips Act | €43 billion+ | 2022 (mobilization by 2030) | European semiconductor ecosystem growth |

| Global Cybersecurity Regulations (e.g., GDPR) | Varies (significant compliance costs) | Ongoing | Data protection & privacy |

What is included in the product

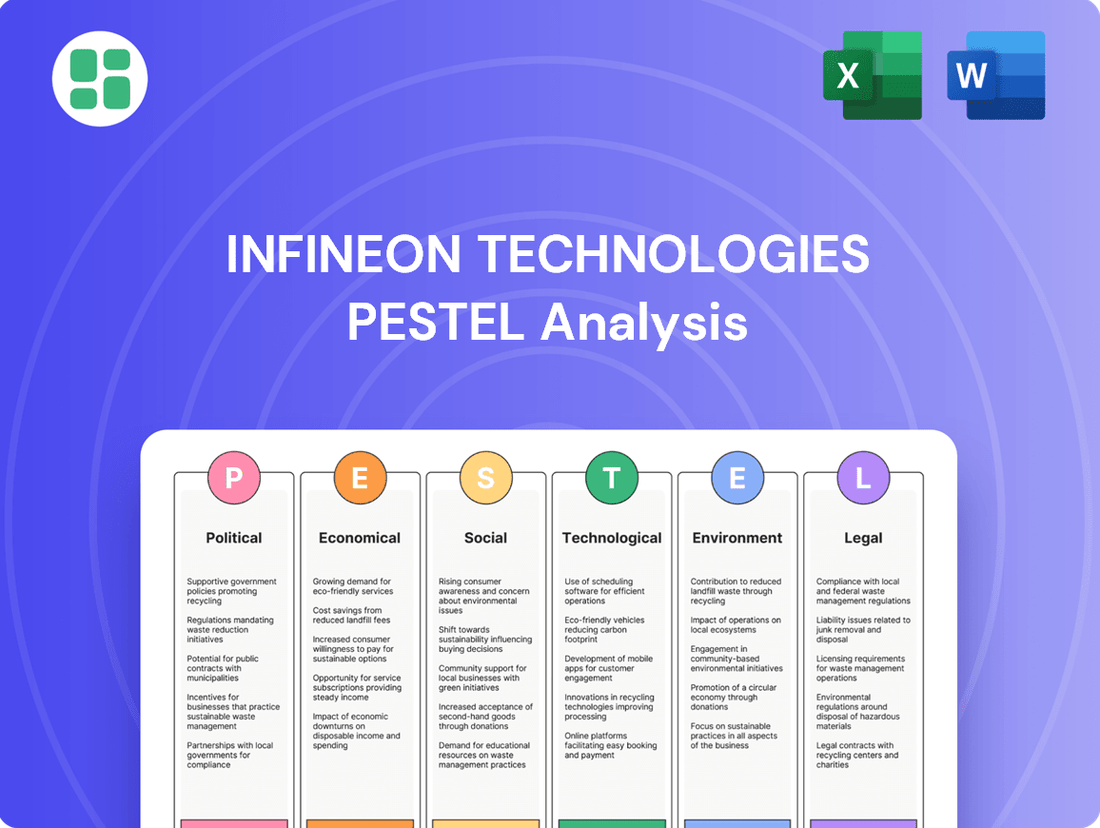

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Infineon Technologies, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate opportunities and mitigate risks in the dynamic semiconductor industry.

A concise, actionable summary of Infineon's PESTLE analysis, designed to quickly identify and address external challenges, thereby alleviating strategic planning pain points.

Economic factors

The global economic outlook significantly shapes demand for Infineon's semiconductor solutions. In 2024, the International Monetary Fund projected global growth at 3.2%, a stable rate that supports continued demand across key sectors like automotive and industrial automation. However, potential slowdowns or recessions can dampen consumer spending and corporate investment, directly impacting Infineon's sales volumes and overall revenue.

Periods of robust economic expansion, such as the anticipated recovery in certain emerging markets throughout 2024 and 2025, typically translate into increased demand for semiconductors. This is especially true for Infineon's products powering electric vehicles, renewable energy systems, and advanced consumer electronics, where growth is closely tied to overall economic prosperity.

Rising inflation directly impacts Infineon's bottom line by increasing expenses for essential inputs like silicon wafers, energy, and skilled workforce compensation. For instance, global inflation rates remained elevated throughout 2023 and into early 2024, with many economies experiencing consumer price index (CPI) increases well above central bank targets, directly feeding into higher production costs for semiconductor manufacturers.

Central banks' aggressive monetary policy responses, including significant interest rate hikes seen in 2023 and potentially continuing into 2024, raise Infineon's cost of capital. This also affects their customers, particularly in the automotive and industrial sectors, who may face higher financing costs for new projects and inventory, potentially dampening demand for Infineon's products.

The semiconductor industry, including players like Infineon, has grappled with significant supply chain challenges. In 2023, while some shortages eased, the cost of critical materials and logistics remained a concern, impacting production efficiency and pricing strategies.

Infineon's operational success hinges on securing consistent and affordable access to essential components like wafers and specialized chemicals. Disruptions in these areas can directly translate to production slowdowns and elevated operational expenses, ultimately affecting the company's bottom line and its ability to offer competitive pricing in 2024 and beyond.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for global players like Infineon Technologies. As a company operating and selling in numerous currencies, fluctuations in exchange rates directly affect its financial performance when converting transactions back to its reporting currency, the Euro. For instance, a strengthening Euro against currencies where Infineon generates substantial revenue could lead to lower reported sales figures.

The impact of these swings can be felt across revenue, costs, and ultimately, profitability. For example, if Infineon sources components from a country with a depreciating currency, but sells finished products in a strengthening currency, the net effect on profit margins can be substantial. Managing this exposure is therefore critical for financial stability and predictable earnings.

Infineon’s financial reports often highlight the effects of currency translation. In its 2023 annual report, the company noted that foreign currency translation adjustments contributed to fluctuations in its equity. Effective currency hedging strategies are a cornerstone of Infineon's risk management, aiming to neutralize the adverse effects of unpredictable currency movements and provide a more stable financial outlook.

- Impact on Revenue: A stronger Euro can reduce the value of sales made in weaker currencies, impacting reported top-line figures.

- Cost Fluctuations: Conversely, a weaker Euro can increase the cost of imported components priced in stronger currencies.

- Profitability Squeeze: Unfavorable currency movements can directly compress profit margins if not adequately hedged.

- Hedging Necessity: Infineon actively employs financial instruments to mitigate currency risks, a strategy vital for maintaining financial predictability.

Automotive and Industrial Sector Performance

Infineon Technologies' financial health is deeply intertwined with the automotive and industrial sectors, as these are its primary markets. The company's revenue streams are directly influenced by global vehicle production figures and the increasing demand for electric vehicles (EVs), which require advanced power semiconductors. For instance, the automotive sector is projected to see continued growth, with global light vehicle production expected to reach approximately 90 million units in 2024, a notable increase from previous years.

Investments in industrial automation and renewable energy projects also play a crucial role in driving demand for Infineon's products. As industries embrace digitalization and sustainability, the need for efficient power management and control solutions escalates. The global industrial automation market is anticipated to expand significantly, with projections suggesting a compound annual growth rate (CAGR) of over 8% from 2024 to 2030, underscoring the positive outlook for companies like Infineon that supply critical components.

- Automotive Sector Growth: Global light vehicle production is forecast to exceed 90 million units in 2024, a key indicator for Infineon's automotive segment.

- EV Adoption: The accelerating adoption of electric vehicles, driven by regulatory support and consumer demand, directly boosts the need for Infineon's power semiconductors.

- Industrial Automation Expansion: The industrial automation market is expected to grow at a CAGR of over 8% through 2030, signaling robust demand for microcontrollers and sensors.

- Renewable Energy Investments: Increased investment in solar and wind energy projects, crucial for decarbonization efforts, further enhances the demand for power electronics.

Global economic stability is paramount for Infineon's performance. While the IMF projected 3.2% global growth for 2024, persistent inflation, as seen in elevated CPI rates throughout 2023 and into early 2024, continues to push up production costs for essential materials and labor. Furthermore, aggressive interest rate hikes by central banks in 2023, potentially continuing into 2024, increase Infineon's cost of capital and may temper customer investment, impacting overall demand.

Currency exchange rate volatility directly impacts Infineon's reported financials. A strengthening Euro, for example, can reduce the value of sales made in weaker currencies, as noted in Infineon's 2023 annual report where currency translation adjustments affected equity. This necessitates robust hedging strategies to maintain financial predictability.

The automotive sector, a key market for Infineon, is expected to see robust performance, with global light vehicle production projected to exceed 90 million units in 2024. This growth, coupled with the accelerating adoption of electric vehicles, directly fuels demand for Infineon's advanced power semiconductors.

Demand for Infineon's products is also bolstered by significant investments in industrial automation and renewable energy. The industrial automation market is forecast to grow at a CAGR exceeding 8% through 2030, highlighting the increasing need for microcontrollers and sensors to drive efficiency and sustainability.

| Economic Factor | 2024 Projection/Status | Impact on Infineon |

| Global Economic Growth | IMF projects 3.2% for 2024 | Stable growth supports demand, but slowdowns dampen sales. |

| Inflation | Elevated CPI rates in 2023/early 2024 | Increases production costs for materials and labor. |

| Interest Rates | Aggressive hikes in 2023, potential continuation | Raises cost of capital; may reduce customer investment. |

| Currency Exchange Rates | Volatile, e.g., Euro strength | Affects reported revenue and profitability; requires hedging. |

| Automotive Production | Forecast > 90 million units in 2024 | Directly drives demand for automotive semiconductors. |

| Industrial Automation Growth | CAGR > 8% (2024-2030) | Increases demand for control and sensor solutions. |

What You See Is What You Get

Infineon Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Infineon Technologies provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the semiconductor industry. It details key insights and strategic considerations for Infineon.

Sociological factors

Societal acceptance of smart technologies is a significant driver for Infineon. For instance, the global Internet of Things (IoT) market was projected to reach $1.6 trillion by 2025, indicating a strong consumer appetite for connected devices, directly benefiting semiconductor providers like Infineon.

The increasing adoption of electric vehicles (EVs) also plays a crucial role. By the end of 2024, it's estimated that over 30 million EVs will be on the road globally, a substantial increase from previous years, highlighting the demand for advanced power semiconductors that Infineon specializes in.

Consumers' growing demand for efficiency, security, and convenience in their daily lives fuels the market for smart home devices, wearables, and connected automotive systems. This trend directly translates into higher sales for Infineon's microcontrollers and sensor solutions, as these are integral to the functionality of such products.

Infineon faces a significant hurdle with an aging workforce in key markets, impacting talent availability. For instance, in Germany, the average age of workers in manufacturing sectors has been steadily increasing, creating a need for proactive succession planning. This demographic shift, coupled with intense global competition for specialized semiconductor engineers, makes attracting and retaining top talent a critical challenge for Infineon's innovation and production capabilities.

To counter these pressures, Infineon is strategically investing in robust training and development programs, aiming to upskill its existing workforce and attract new talent. In 2024, the company highlighted its commitment to employee development, with significant budget allocations for continuous learning initiatives. Offering competitive compensation packages, including performance-based bonuses and comprehensive benefits, alongside fostering a flexible and socially responsible work environment, are key strategies to secure the highly skilled professionals essential for maintaining its technological edge.

Societal pressure for reduced environmental impact is intensifying, driving demand for energy-efficient technologies. Infineon's power semiconductors are key enablers of this shift, found in everything from electric vehicles to smart home devices, contributing to lower energy consumption globally.

This societal focus directly translates into market opportunities for Infineon. For instance, the global market for power semiconductors, crucial for energy efficiency, was projected to reach over $50 billion in 2024, with continued strong growth anticipated through 2025, underscoring the relevance of Infineon's product portfolio.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with projections indicating that by 2050, 68% of the world's population will reside in urban areas, a substantial increase from 56% in 2021. This surge fuels an immense demand for new infrastructure, from smart city components and intelligent transportation networks to more robust and efficient power grids. These advanced urban systems are heavily reliant on sophisticated semiconductor solutions, particularly for critical functions like power management, seamless connectivity, and enhanced security. Infineon's portfolio, which includes advanced power semiconductors and security chips, is directly positioned to capitalize on this trend, offering essential building blocks for the next generation of urban living. The company's commitment to enabling these smart infrastructure projects presents a significant avenue for growth as cities worldwide continue to expand and modernize.

The development of smart cities, a direct consequence of urbanization, necessitates a vast array of interconnected technologies. For instance, intelligent transportation systems, a key component of urban infrastructure, require advanced sensors, microcontrollers, and power management ICs to optimize traffic flow and enhance safety. The global smart city market was valued at approximately $475 billion in 2022 and is expected to reach over $1.7 trillion by 2030, demonstrating a compound annual growth rate of around 17%. Infineon's expertise in areas like automotive electronics and IoT connectivity makes its products crucial for realizing these smart city initiatives.

- Growing Urban Population: The UN estimates that by 2050, 68% of the global population will live in urban areas.

- Smart City Market Growth: The smart city market is projected to grow from $475 billion in 2022 to over $1.7 trillion by 2030.

- Semiconductor Demand: Urban infrastructure development directly drives demand for power management, connectivity, and security semiconductors.

- Infineon's Role: Infineon's product portfolio is integral to enabling smart city technologies and infrastructure upgrades.

Data Privacy Concerns and Trust

Societal concerns regarding data privacy and the ethical application of technology are increasingly shaping how consumers and businesses embrace new solutions. Infineon, a key player in security systems and chip card technology, faces the imperative to foster and sustain user trust through robust data protection and transparent practices. For instance, in 2024, the global data privacy software market was valued at approximately $2.5 billion, with projections indicating significant growth driven by these very concerns.

Infineon's commitment to high data protection standards and ethical product design is therefore paramount for market acceptance and the safeguarding of its reputation. The company's efforts in areas like secure microcontrollers and identity solutions directly address these growing societal expectations. Failure to build and maintain trust can directly impact adoption rates for sensitive applications, such as secure payment systems or digital identity verification, which are core to Infineon's business.

Key considerations for Infineon include:

- Compliance with evolving data protection regulations: Staying ahead of legislation like GDPR and similar frameworks globally is essential.

- Transparency in data handling: Clearly communicating how data is collected, used, and protected builds consumer confidence.

- Security-by-design principles: Integrating robust security features from the initial stages of product development minimizes vulnerabilities.

- Ethical AI and data usage: Ensuring that AI-powered solutions within their products are developed and deployed responsibly.

Societal demand for energy efficiency is a significant tailwind for Infineon, with its power semiconductors crucial for reducing energy consumption across various applications. The global market for power semiconductors, vital for this efficiency drive, was expected to exceed $50 billion in 2024, with continued robust expansion anticipated through 2025.

The accelerating trend of urbanization, projected to see 68% of the world's population living in cities by 2050, directly fuels demand for smart city infrastructure. Infineon's advanced semiconductor solutions are integral to these developments, supporting everything from intelligent transportation to modernized power grids.

Consumer and regulatory focus on data privacy and security is paramount, influencing the adoption of technologies like secure microcontrollers and identity solutions. Infineon's commitment to robust data protection and ethical design is therefore essential for maintaining market trust and driving growth in sensitive applications.

| Sociological Factor | Impact on Infineon | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Demand for Energy Efficiency | Drives sales of power semiconductors. | Global power semiconductor market > $50 billion (2024). |

| Urbanization & Smart Cities | Increases demand for IoT and infrastructure semiconductors. | 68% global population in urban areas by 2050; Smart city market growth significant. |

| Data Privacy & Security Concerns | Requires focus on secure product design and transparent practices. | Global data privacy software market ~$2.5 billion (2024). |

Technological factors

Ongoing research into novel semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) is reshaping power electronics. These wide-bandgap materials offer significant improvements in efficiency and power density, crucial for next-generation technologies.

Infineon Technologies is at the forefront of this material revolution, holding a leading position in SiC and GaN. These advanced materials are indispensable for high-growth sectors, including the rapidly expanding electric vehicle market and the critical renewable energy infrastructure.

Infineon's commitment to continuous investment in SiC and GaN research and development is vital for preserving its technological edge. For instance, the company's SiC revenue saw substantial growth, exceeding €1 billion in 2023, underscoring the market's demand and Infineon's strategic advantage.

The growing integration of artificial intelligence and machine learning across diverse applications, including edge computing and autonomous systems, directly fuels the demand for Infineon's specialized microcontrollers and sensors. Infineon's silicon solutions are instrumental in embedding AI capabilities within automotive and industrial environments, necessitating ongoing advancements in processing power, energy efficiency, and on-chip intelligence to meet these evolving needs.

To maintain its competitive edge, Infineon must remain at the vanguard of AI-enabled hardware development. For instance, the automotive sector, a key market for Infineon, saw significant growth in AI-powered features in 2024, with the global market for AI in automotive projected to reach billions of dollars by 2025, driven by demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies.

The persistent push for smaller, more capable, and integrated semiconductor parts is a defining characteristic of product evolution. Infineon's success hinges on its ability to innovate in advanced packaging and system-on-chip (SoC) architectures, creating compact solutions for today's sophisticated electronics. This ongoing miniaturization necessitates substantial investment in research and development, estimated to be a significant portion of capital expenditure for leading semiconductor firms in 2024 and projected to continue into 2025.

Emergence of New Application Areas

The semiconductor industry thrives on innovation, and Infineon Technologies is well-positioned to capitalize on the emergence of new application areas. For instance, the automotive sector's rapid adoption of advanced driver-assistance systems (ADAS) is a significant growth driver. Infineon's expertise in power semiconductors and sensors is crucial for these complex systems, which are becoming standard in new vehicles.

The industrial Internet of Things (IIoT) also presents a vast opportunity. As factories become smarter and more connected, the demand for reliable and efficient microcontrollers, power management ICs, and security solutions increases. Infineon's product portfolio directly addresses these IIoT needs, enabling greater automation and data processing in industrial settings.

Furthermore, the rollout of next-generation connectivity, such as 5G, is creating entirely new markets. Infineon's components are essential for the infrastructure supporting 5G networks, as well as for the devices that will utilize this faster, more reliable connectivity.

- ADAS Growth: The global ADAS market was projected to reach over $40 billion in 2024, with a compound annual growth rate (CAGR) expected to exceed 15% through 2030.

- IIoT Expansion: The IIoT market is anticipated to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars by the late 2020s, driven by demand for automation and efficiency.

- 5G Infrastructure: Investment in 5G infrastructure continues globally, with ongoing deployments requiring advanced semiconductor solutions for base stations, network equipment, and end-user devices.

Automation and Smart Manufacturing

Infineon Technologies is deeply invested in advanced automation and smart manufacturing, often referred to as Industry 4.0, within its own semiconductor fabrication processes. This adoption directly translates to enhanced operational efficiency, significant cost reductions, and a marked improvement in product quality. For instance, in 2024, Infineon reported continued investments in upgrading its production lines with AI-driven process control and robotic systems, aiming to boost wafer output by a projected 15% by the end of 2025.

The strategic integration of these technologies allows Infineon to optimize its complex manufacturing workflows, leading to faster cycle times and reduced waste. This internal focus on automation not only strengthens Infineon's competitive position but also positions its products as crucial enablers for its customers' own automation initiatives. The company's sensors, microcontrollers, and power semiconductors are integral to the development of smart factories and automated systems across various industries.

This creates a powerful synergistic effect: Infineon's internal efficiency gains are mirrored by the value its products deliver to clients seeking to automate their operations. As of early 2025, Infineon's solutions are powering an increasing number of robotic arms and automated guided vehicles (AGVs) in industrial settings, contributing to a global market for industrial automation that is projected to reach over $250 billion by 2026.

Key aspects of Infineon's technological factor in automation and smart manufacturing include:

- Internal Process Optimization: Implementing AI, robotics, and IoT in fabrication facilities to boost efficiency and quality.

- Customer Enablement: Supplying essential semiconductor components that drive industrial automation for clients.

- Cost Reduction: Leveraging automation to lower manufacturing expenses and improve profitability.

- Market Growth: Benefiting from the expanding global demand for industrial automation solutions.

The rapid advancement of wide-bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) is fundamentally changing power electronics, offering superior efficiency and power density. Infineon is a leader in this space, with SiC revenue surpassing €1 billion in 2023, highlighting the market's strong demand for these materials in electric vehicles and renewable energy.

Artificial intelligence and machine learning are increasingly integrated into edge computing and autonomous systems, driving demand for Infineon's microcontrollers and sensors. The automotive sector's adoption of AI features is a key growth area, with the global market for AI in automotive expected to reach billions by 2025, fueled by ADAS and autonomous driving.

The trend towards smaller, more integrated semiconductor components necessitates continuous innovation in advanced packaging and system-on-chip (SoC) architectures. This miniaturization requires substantial R&D investment, a trend expected to continue for leading semiconductor firms through 2025.

| Technology Area | Infineon's Position/Focus | Market Impact/Growth (2024/2025 Data) |

|---|---|---|

| Wide-Bandgap Materials (SiC, GaN) | Leading supplier, significant R&D investment | SiC revenue > €1 billion (2023); Crucial for EV and renewables markets |

| AI/ML Integration | Microcontrollers & Sensors for AI at the edge | Automotive AI market projected in billions by 2025; ADAS growth driving demand |

| Miniaturization & Integration | Advanced packaging, SoC development | Requires ongoing R&D investment; Essential for sophisticated electronics |

Legal factors

Infineon Technologies, as a global player, navigates a complex web of international trade regulations and export controls. These laws, particularly concerning dual-use technologies like semiconductors, are crucial for maintaining market access and avoiding significant penalties. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) continually updates its Entity List and export control classifications, directly impacting companies like Infineon that supply advanced technology.

Compliance with these diverse and evolving legal frameworks is paramount. Failure to adhere to sanctions or export control laws can result in hefty fines and reputational damage, as seen in past cases involving technology companies and restricted countries. Infineon's commitment to rigorous compliance programs is therefore essential for its continued operations and global market participation.

The dynamic geopolitical landscape presents an ongoing challenge, requiring constant monitoring and adaptation. For example, the increasing focus on supply chain security and national security concerns in major economies like the US and EU leads to frequent regulatory adjustments. Infineon must remain agile, ensuring its practices align with these shifting international trade requirements to mitigate risks and seize opportunities in 2024 and beyond.

Intellectual property (IP) protection is a cornerstone of Infineon's competitive edge in the semiconductor sector. The company relies on patents, trademarks, and trade secrets to safeguard its innovations. As of late 2024, Infineon actively manages a substantial patent portfolio, essential for defending its technological advancements and securing licensing agreements.

Navigating the intricate world of IP licensing and defending against infringement are ongoing legal challenges for Infineon. The company's ability to maintain its technological leadership is directly tied to its success in these areas. Legal battles over IP can significantly impact financial performance and operational stability, underscoring the need for strong legal frameworks.

Infineon Technologies, as a significant global semiconductor manufacturer, operates under stringent antitrust and competition laws across numerous countries. These regulations are designed to ensure fair market practices and prevent monopolistic tendencies.

The company must meticulously align its business strategies, including any mergers, acquisitions, or strategic partnerships, with these legal frameworks to avoid accusations of anti-competitive behavior. For instance, in 2023, the European Commission continued its close examination of the semiconductor industry for potential antitrust concerns.

Increased regulatory oversight from bodies like the U.S. Federal Trade Commission (FTC) and the European Union's Directorate-General for Competition can significantly influence Infineon's strategic planning and its day-to-day market operations, potentially affecting market access and pricing strategies.

Product Liability and Safety Standards

Infineon's semiconductors are foundational to safety-critical sectors such as automotive and industrial automation, placing immense importance on product liability and rigorous safety standards. The company is obligated to ensure its offerings consistently meet a complex web of national and international safety certifications and quality benchmarks. For instance, in 2023, the automotive industry alone saw significant scrutiny on electronic component reliability, with regulatory bodies like the European Union's ECE R157 mandating advanced driver-assistance systems (ADAS) that rely heavily on Infineon's technology, requiring adherence to ISO 26262 functional safety standards.

Failure to comply with these evolving safety mandates can trigger severe consequences, including costly product recalls, protracted litigation, and substantial damage to Infineon's hard-earned reputation. The financial implications of non-compliance are substantial; a single major recall in the automotive sector can cost tens of millions, if not hundreds of millions, of dollars in remediation, legal fees, and lost sales. Infineon's proactive approach involves continuous investment in quality assurance and robust testing protocols to mitigate these risks.

- Automotive Safety Standards: Infineon's automotive-grade semiconductors must comply with standards like ISO 26262 for functional safety, critical for ADAS and autonomous driving systems.

- Industrial Safety Certifications: Products for industrial applications often require certifications such as CE marking in Europe or UL listing in North America, ensuring electrical safety and performance.

- Product Liability Exposure: Given the critical nature of its components, Infineon faces potential liability for failures in end-products, necessitating stringent design and manufacturing controls.

- Regulatory Compliance Costs: Maintaining compliance across diverse global markets involves ongoing investment in testing, documentation, and certification processes, estimated to be a significant portion of R&D budgets for leading semiconductor firms.

Data Privacy and Cybersecurity Regulations

Infineon Technologies operates within a complex web of data privacy and cybersecurity regulations. Beyond general data protection, specific legal frameworks like the GDPR in Europe and the CCPA in California mandate stringent rules for data handling, processing, and security. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Infineon's commitment to compliance extends to both its internal operations and its product portfolio, especially those incorporating features that manage sensitive user data. Navigating these evolving regulations is critical for maintaining customer trust and avoiding significant penalties. The company must continuously adapt its data governance practices to align with these global legal requirements.

- GDPR fines: Up to 4% of global annual turnover or €20 million.

- CCPA impact: Grants California consumers rights regarding their personal information.

- Global trend: Increasing number of countries enacting similar data protection laws.

- Infineon's challenge: Ensuring product designs and internal processes meet diverse regulatory demands.

Infineon Technologies faces significant legal scrutiny regarding intellectual property, with a substantial patent portfolio as of late 2024. Protecting these innovations through patents, trademarks, and trade secrets is vital for its market leadership and revenue generation through licensing. Legal disputes over IP infringement can lead to substantial financial and operational disruptions.

The company must also comply with stringent antitrust and competition laws globally, as evidenced by ongoing examinations of the semiconductor industry by bodies like the European Commission in 2023. Increased oversight from agencies such as the U.S. FTC and the EU's Directorate-General for Competition directly impacts Infineon's strategic decisions, market access, and pricing.

Infineon's product liability and safety standards are critical, especially for automotive and industrial applications. Adherence to standards like ISO 26262 for functional safety, mandated for ADAS systems in 2023, is non-negotiable to avoid recalls, litigation, and reputational harm. For example, a single automotive recall can cost tens of millions of dollars.

Data privacy and cybersecurity regulations, such as GDPR with fines up to 4% of global turnover, pose significant compliance challenges. Infineon must ensure both internal operations and product designs meet these evolving global legal requirements to maintain customer trust and avoid substantial penalties.

Environmental factors

The intensifying global commitment to combating climate change translates into increasingly stringent rules for greenhouse gas emissions, energy usage, and overall carbon footprints. Infineon, with its manufacturing operations, is under pressure to lower its direct emissions and shift towards renewable energy. For instance, in its 2023 sustainability report, Infineon highlighted its goal to achieve climate neutrality in its own operations by 2030, a commitment that necessitates significant investment in emission reduction technologies and renewable energy procurement.

Adhering to these evolving regulations and proactively embracing sustainability initiatives are not just about compliance; they are vital for maintaining a positive corporate image and managing operational expenditures. Failure to adapt could lead to penalties or increased costs, while successful integration of sustainable practices can enhance brand value and attract environmentally conscious investors. Infineon's continued investment in energy efficiency measures across its production sites, aiming for a 15% reduction in energy intensity by 2025 compared to 2019 levels, demonstrates this strategic imperative.

Semiconductor production, crucial for companies like Infineon, heavily depends on specific raw materials, some of which are inherently limited or face intricate supply chain challenges. For instance, the demand for silicon wafers, a primary input, continues to grow, putting pressure on global supply. Infineon's strategic focus must therefore include robust resource management to navigate potential scarcity.

Addressing resource scarcity involves optimizing material consumption in manufacturing processes and actively seeking recycling avenues for materials like precious metals used in components. In 2023, the global semiconductor materials market was valued at approximately $60 billion, highlighting the scale of resources involved. Diversifying suppliers and geographical sourcing is also key to mitigating supply disruptions, ensuring a more resilient production pipeline for Infineon.

Environmental regulations are tightening, pushing companies like Infineon to adopt more rigorous waste management practices, especially concerning electronic waste and manufacturing byproducts. This means a greater focus on responsible disposal and recycling is essential for compliance.

Infineon faces the challenge of integrating circular economy principles, which involves designing products for extended use and easier recycling, and actively reducing waste across its entire operational chain. This proactive approach not only lessens environmental impact but also presents opportunities for cost savings and resource optimization.

For instance, in 2023, the global e-waste generated reached an estimated 62 million metric tons, highlighting the scale of the problem and the increasing regulatory pressure for better solutions. Infineon's commitment to these principles can lead to more sustainable supply chains and product lifecycles.

Water Usage and Pollution Control

Semiconductor fabrication, including Infineon's operations, is notably water-intensive. As global concerns around water scarcity and pollution intensify, particularly in regions where manufacturing hubs are concentrated, Infineon faces increasing pressure to manage its water footprint. For instance, in 2023, the semiconductor industry globally consumed billions of gallons of water, highlighting the scale of this challenge.

Infineon Technologies must therefore prioritize efficient water consumption and robust wastewater treatment to adhere to stringent environmental permits and evolving local regulations. This commitment is not just about compliance; it's crucial for maintaining operational continuity and social license to operate.

To address these environmental factors, Infineon is investing in advanced water-saving technologies and sophisticated pollution control systems. These investments are vital for ensuring sustainable manufacturing practices and mitigating environmental impact.

- Water Consumption: Infineon's manufacturing processes, particularly wafer fabrication, require significant volumes of ultrapure water.

- Wastewater Treatment: Stringent regulations govern the discharge of wastewater containing chemicals and trace metals, necessitating advanced treatment facilities.

- Resource Management: Efforts focus on water recycling and reuse within facilities to reduce overall consumption and operational costs.

- Regulatory Compliance: Adherence to local and international environmental standards is paramount, impacting operational permits and potential liabilities.

Stakeholder Pressure for Sustainability

Stakeholder pressure for sustainability is a significant environmental factor for Infineon Technologies. Customers, investors, and employees are increasingly demanding that companies like Infineon demonstrate genuine environmental responsibility and provide transparent reporting on their efforts. This push is evident in the growing emphasis on ESG (Environmental, Social, and Governance) criteria, which influences investment decisions and consumer choices.

Infineon is therefore under pressure to showcase its commitment to sustainability through robust ESG reporting, obtaining relevant certifications, and implementing tangible environmental initiatives. For instance, as of early 2024, many leading semiconductor companies are setting ambitious targets for reducing their carbon footprint and increasing the use of renewable energy in their operations, a trend Infineon is expected to align with.

- Customer Demand: Consumers and business clients are prioritizing suppliers with strong sustainability credentials, impacting purchasing decisions.

- Investor Scrutiny: Investors are increasingly incorporating ESG factors into their analysis, favoring companies with clear environmental strategies and performance. In 2023, sustainable investment funds saw continued inflows, signaling this trend.

- Employee Expectations: A company's environmental stance influences its ability to attract and retain talent, with many employees seeking to work for organizations that align with their values.

- Public Perception: A strong environmental record enhances brand reputation and can mitigate reputational risks associated with environmental concerns.

The global push for decarbonization and stricter emissions standards directly impacts Infineon's manufacturing operations, requiring significant investments in renewable energy and emission reduction technologies. Infineon aims for climate-neutral operations by 2030, a goal that necessitates continuous innovation in energy efficiency, targeting a 15% reduction in energy intensity by 2025 compared to 2019.

Resource scarcity, particularly for materials like silicon wafers, presents a challenge for semiconductor production, underscoring the need for Infineon to optimize material usage and diversify its supply chain. The semiconductor materials market, valued at approximately $60 billion in 2023, highlights the scale of resources involved and the importance of robust management strategies.

Increasingly stringent regulations on waste management, especially for electronic waste, compel Infineon to adopt circular economy principles and enhance recycling efforts. With global e-waste reaching an estimated 62 million metric tons in 2023, proactive waste reduction and product lifecycle management are critical for compliance and sustainability.

Water scarcity and pollution concerns are paramount for water-intensive semiconductor fabrication, pushing Infineon to prioritize efficient water consumption and advanced wastewater treatment. The industry's substantial water usage, billions of gallons globally in 2023, emphasizes the need for sustainable practices and regulatory adherence.

| Environmental Factor | Infineon's Focus/Challenge | Relevant Data/Target |

|---|---|---|

| Climate Change & Emissions | Reducing greenhouse gas emissions, shifting to renewables | Climate neutrality by 2030; 15% energy intensity reduction by 2025 (vs. 2019) |

| Resource Scarcity | Managing raw material supply chains (e.g., silicon wafers) | Global semiconductor materials market valued at ~$60 billion (2023) |

| Waste Management | Circular economy principles, e-waste reduction, recycling | Global e-waste generation ~62 million metric tons (2023) |

| Water Management | Efficient water consumption, wastewater treatment | Billions of gallons of water used by semiconductor industry globally (2023) |

PESTLE Analysis Data Sources

Our Infineon Technologies PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and leading economic institutions. We incorporate insights from technological trend reports, environmental policy updates, and global industry analyses to ensure comprehensive and accurate assessments.