Infineon Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

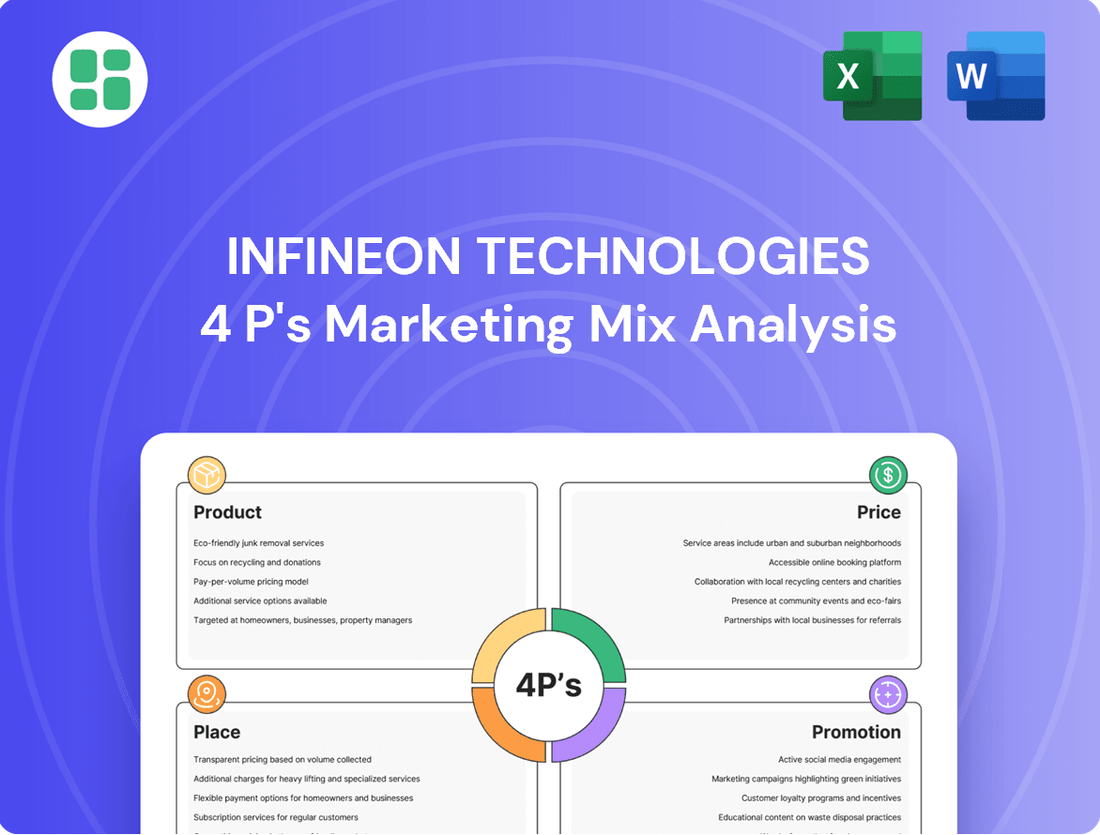

Discover how Infineon Technologies leverages its product innovation, strategic pricing, extensive distribution, and targeted promotions to maintain its leadership in the semiconductor industry. This analysis goes beyond surface-level observations to reveal the intricate interplay of its 4Ps.

Unlock a comprehensive, ready-to-use Marketing Mix Analysis for Infineon Technologies, detailing their product portfolio, pricing strategies, place in the market, and promotional efforts. Ideal for professionals and students seeking actionable insights.

Gain a competitive edge by understanding Infineon Technologies' complete 4Ps strategy. This editable report provides a deep dive into their marketing execution, perfect for strategic planning or academic study.

Product

Infineon Technologies designs, develops, manufactures, and markets a wide array of semiconductors and integrated system solutions. These offerings span power semiconductors, microcontrollers, sensors, and security chips, frequently combined to provide complete solutions tailored for specific industry needs. For instance, their power semiconductors are vital for electric vehicles and renewable energy systems, areas experiencing significant growth.

The company's strategic focus is on delivering components that are not only high-performing but also energy-efficient and exceptionally reliable. These attributes are fundamental to the advancement of modern technology, from automotive safety systems to industrial automation. In 2023, Infineon reported revenue of approximately €16.5 billion, underscoring their significant market presence and the demand for their advanced semiconductor products.

Infineon Technologies strategically targets distinct application segments, focusing on automotive, industrial, and consumer electronics. This segmentation enables the company to cultivate specialized knowledge and craft solutions precisely suited to the unique demands of each sector. Key growth drivers for Infineon in 2024 and 2025 include the burgeoning e-mobility market, where their power semiconductors are crucial for electric vehicles, and industrial automation, a sector experiencing significant investment in efficiency and smart manufacturing.

Further deepening its market penetration, Infineon also dedicates resources to security systems and chip card applications, areas vital for digital trust and secure transactions. The company anticipates strong performance in renewable energy solutions, supporting the global transition to cleaner power sources, and in AI-driven infrastructure, where its advanced chips will power the next generation of intelligent systems. For instance, the automotive segment, a major revenue contributor, saw significant growth in 2023, and projections for 2024 and 2025 remain robust, driven by increasing semiconductor content per vehicle.

Infineon Technologies places a strong emphasis on innovation, channeling substantial resources into research and development. This focus is particularly evident in their work with advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), crucial for next-generation power electronics.

Their R&D efforts also extend to emerging technologies, including AI-optimized microcontrollers, positioning Infineon to capitalize on trends like decarbonization and digitalization. For instance, in fiscal year 2023, Infineon reported R&D expenses of €1.8 billion, underscoring their commitment to staying ahead in these critical areas.

Quality, Reliability, and Security

Infineon Technologies places paramount importance on quality, reliability, and security, recognizing their critical role in the demanding sectors they serve. For instance, their semiconductor solutions are integral to automotive safety systems, where failure is not an option. This commitment is reflected in their rigorous testing and validation processes, ensuring long-term performance even under extreme conditions. In 2023, Infineon reported a significant increase in their automotive segment revenue, reaching €10.2 billion, underscoring the market's trust in their dependable components.

The company's focus on embedded security is a key differentiator, addressing the escalating demand for protected digital infrastructure. Infineon's security controllers are vital for applications ranging from secure vehicle access to industrial IoT devices, safeguarding sensitive data and preventing unauthorized access. This dedication to security fosters trust and enables the seamless integration of their products into complex, connected systems, a crucial factor in the evolving digital landscape.

- Robustness for Demanding Applications: Infineon's components are engineered for resilience in harsh environments, from extreme temperatures in automotive engines to the high-power demands of industrial machinery.

- Long-Term Reliability: The company's emphasis on durability ensures that their semiconductor solutions provide consistent performance over the extended lifecycles expected in automotive and industrial sectors.

- Embedded Security Solutions: Infineon is a leader in providing integrated security features, such as hardware-based encryption and secure boot capabilities, essential for protecting connected devices and data.

- Market Trust and Adoption: The consistent growth in Infineon's revenue, particularly in automotive and industrial markets, demonstrates the high level of trust customers place in the quality, reliability, and security of their offerings.

Contribution to Global Megatrends

Infineon Technologies' products are intrinsically linked to major global shifts like the drive for energy efficiency and the evolution of sustainable mobility. Their semiconductor solutions are critical enablers for reducing carbon footprints and powering the next generation of electric vehicles and advanced driver-assistance systems (ADAS). For instance, Infineon's power semiconductors are vital for the efficiency of electric powertrains, a key area as the automotive industry pivots towards electrification. By 2025, the global electric vehicle market is projected to reach significant growth, underscoring the demand for these components.

Furthermore, Infineon's commitment to security is paramount in an increasingly digital world, protecting everything from connected devices to critical infrastructure. This focus on security is essential as the number of connected devices continues to explode, with billions expected to be online by 2025. Their solutions safeguard digital transactions and data, contributing to a more secure and interconnected future.

- Energy Efficiency: Infineon's power management ICs and MOSFETs enhance energy savings in data centers and industrial applications, contributing to reduced energy consumption.

- Sustainable Mobility: Their advanced semiconductors are integral to the functionality and performance of electric vehicles (EVs) and ADAS, supporting the transition to greener transportation.

- Security: Infineon provides robust security solutions for IoT devices, payment systems, and automotive applications, ensuring data integrity and protection against cyber threats.

- Contribution to Sustainability Goals: By enabling these megatrends, Infineon's products directly support global efforts to combat climate change and foster digital transformation.

Infineon Technologies' product strategy centers on high-performance, energy-efficient, and reliable semiconductor solutions. Their portfolio, including power semiconductors, microcontrollers, and sensors, is crucial for automotive, industrial, and consumer electronics sectors. For instance, their power devices are key to the growing electric vehicle market, a sector projected for substantial expansion through 2025.

The company’s product development emphasizes innovation in advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) for next-generation power electronics. Infineon's commitment to R&D, with €1.8 billion invested in fiscal year 2023, ensures they remain at the forefront of trends like decarbonization and digitalization, powering AI infrastructure and smart manufacturing.

Quality, reliability, and security are paramount in Infineon's product design, particularly for safety-critical automotive applications. Their robust embedded security features protect connected devices and data, fostering trust in an increasingly digital world. This focus is reflected in their automotive segment revenue, which reached €10.2 billion in 2023, highlighting market confidence.

Infineon's products directly enable global megatrends such as sustainable mobility and energy efficiency, with their semiconductors vital for electric vehicles and renewable energy systems. The company's solutions are designed to reduce carbon footprints and enhance the performance of connected technologies, anticipating significant demand as the number of IoT devices is expected to surge by 2025.

| Product Focus | Key Technologies | Target Markets | 2023 Revenue Contribution (Approx.) | Growth Drivers (2024-2025) |

|---|---|---|---|---|

| Power Semiconductors | SiC, GaN | Automotive (EVs), Industrial, Renewables | Significant portion of €16.5B total | E-mobility, Industrial Automation |

| Microcontrollers | AI-optimized | Automotive, Industrial, IoT | Integral to system solutions | Smart Manufacturing, AI Infrastructure |

| Sensors | Advanced | Automotive (ADAS), Industrial | Integral to system solutions | Automotive Safety, Smart Systems |

| Security Chips | Embedded Security | Automotive, IoT, Payment Systems | Integral to system solutions | Digital Trust, Secure Transactions |

What is included in the product

This analysis provides a comprehensive breakdown of Infineon Technologies' Product, Price, Place, and Promotion strategies, offering insights into their marketing positioning and competitive advantages.

It is designed for professionals seeking a deep understanding of Infineon's marketing mix, grounded in actual brand practices and strategic implications.

This analysis distills Infineon's 4Ps into actionable insights, directly addressing the pain point of complex marketing strategies by offering a clear, concise overview for swift decision-making.

Place

Infineon Technologies prioritizes a robust global direct sales network, especially for its crucial key accounts and major clients in the automotive and industrial markets. This direct interaction ensures a thorough grasp of customer needs, facilitating the creation of tailored solutions. This strategy cultivates enduring partnerships and offers immediate technical assistance.

In fiscal year 2024, Infineon reported a significant portion of its revenue derived from direct sales channels, reflecting the importance of these relationships. For instance, the automotive segment, a key focus for direct engagement, saw continued growth, contributing substantially to the company's overall performance, with specific figures expected to be detailed in their upcoming annual reports.

Infineon Technologies boasts an extensive distributor network, a cornerstone of its market penetration strategy. This vast web of authorized partners ensures broad accessibility to Infineon's semiconductor solutions across the globe. In 2023, Infineon continued to strengthen these relationships, with distributors playing a vital role in reaching over 100,000 customers worldwide, a testament to the network's extensive reach.

These distributors are more than just sales channels; they offer crucial localized support. They maintain local inventory, streamline logistics, and provide essential technical assistance. This is particularly important for serving small and medium-sized enterprises (SMEs) and catering to the diverse needs of various application sectors, ensuring that even niche markets have ready access to Infineon's innovative products.

The efficiency of this distributor network directly impacts Infineon's market penetration and its ability to deliver products promptly. By empowering these partners, Infineon can effectively serve a wide range of customers, from large industrial clients to emerging technology startups, solidifying its position as a leading provider of semiconductor solutions.

Infineon Technologies leverages its robust online presence, primarily through its corporate website, to serve its business-to-business clientele. This digital hub acts as a central repository for extensive product catalogs, detailed technical datasheets, and crucial application notes, empowering engineers and designers with the information they need.

The company's digital channels are instrumental in fostering product discovery and providing accessible customer support. By offering online tools and resources, Infineon simplifies the process for potential clients to identify suitable components and address technical queries, thereby streamlining the integration of their semiconductor solutions into various electronic designs.

In 2023, Infineon reported a significant portion of its sales inquiries originating from digital channels, underscoring the importance of its online platform in lead generation and customer engagement. The website also features a dedicated section for design resources and a comprehensive support portal, reflecting a commitment to aiding customers throughout their product development lifecycle.

Strategic Global Manufacturing and Supply Chain

Infineon Technologies strategically positions its manufacturing and assembly sites across the globe to ensure efficient production and swift delivery. This worldwide presence is crucial for minimizing lead times and bolstering supply chain robustness.

By diversifying its manufacturing footprint, Infineon effectively manages geopolitical and logistical risks, ensuring continuity of supply for its diverse customer base. This approach is vital in the fast-paced semiconductor industry.

- Global Fab Network: Infineon operates major fabrication plants in Germany (Dresden), Austria (Villach), and the US (Austin), alongside assembly and test facilities in Asia (Malaysia, Singapore, China).

- Supply Chain Resilience: The company's strategy aims to reduce dependence on single regions, a critical factor highlighted by recent global supply chain disruptions.

- Customer Proximity: Strategic locations allow Infineon to better serve key markets in Europe, North America, and Asia, reducing shipping costs and delivery times.

- Investment in Expansion: In 2024, Infineon announced significant investments to expand its manufacturing capabilities, including a new fab in Dresden and increased capacity in Malaysia, underscoring its commitment to global operational strength.

Customer-Centric Sales Segments and Regional Offices

Infineon Technologies has strategically restructured its sales force into three key customer-centric segments: Automotive, Industrial & Infrastructure, and Consumer, Computing & Communication. This reorganization is supported by an optimized global and regional office network, ensuring customers benefit from streamlined access to Infineon's extensive product range and specialized application knowledge.

This new structure is designed to simplify customer interactions, reduce the number of touchpoints, and significantly speed up the development cycle for research and development initiatives. By aligning sales efforts with distinct market needs, Infineon aims to enhance its responsiveness and deliver more targeted solutions.

- Automotive: Focusing on the rapidly evolving needs of the automotive industry, including electrification and autonomous driving technologies.

- Industrial & Infrastructure: Catering to the demands of industrial automation, power management, and smart grid solutions.

- Consumer, Computing & Communication: Addressing the dynamic requirements of consumer electronics, data centers, and telecommunications infrastructure.

Infineon's place strategy is multifaceted, combining a direct sales force for key accounts with an extensive global distributor network to ensure broad market reach and localized support. This dual approach is complemented by a strong online presence, offering comprehensive product information and technical resources to a business-to-business audience.

Manufacturing and assembly sites are strategically located worldwide to optimize production, reduce lead times, and enhance supply chain resilience. This global footprint is crucial for serving diverse customer needs across key regions.

The sales force is segmented into customer-centric divisions—Automotive, Industrial & Infrastructure, and Consumer, Computing & Communication—to provide specialized expertise and streamline customer engagement.

| Channel | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Direct Sales | Key account management, tailored solutions, direct technical support | Crucial for automotive and industrial sectors; significant revenue driver. |

| Distributor Network | Broad market access, localized support, inventory management | Reached over 100,000 customers globally in 2023; vital for SMEs. |

| Online Presence | Product catalogs, datasheets, technical resources, lead generation | Significant sales inquiries originated from digital channels in 2023. |

| Manufacturing Locations | Global production, supply chain resilience, customer proximity | Major fabs in Germany, Austria, US; expansion investments in 2024. |

Same Document Delivered

Infineon Technologies 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Infineon Technologies' 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Infineon Technologies prioritizes B2B marketing, actively participating in key global industry events like electronica and embedded world. These trade shows are crucial for Infineon to unveil its latest semiconductor innovations and connect directly with its target audience of engineers and product developers. In 2024, Infineon showcased its power semiconductors and IoT solutions, aiming to drive adoption in automotive and industrial sectors.

Infineon Technologies leverages technical content as a cornerstone of its marketing strategy, particularly for its sophisticated semiconductor products. This includes a robust offering of whitepapers, application notes, and design resources tailored for engineers and designers. These materials are crucial for educating the market on complex solutions and demonstrating Infineon's deep technological expertise.

By providing these detailed resources, Infineon effectively showcases the advantages of its products and guides customers through the integration process. This commitment to technical education and support positions Infineon as a thought leader within the competitive semiconductor industry, fostering trust and driving adoption of its innovative technologies.

Infineon Technologies leverages its corporate website and professional social media, particularly LinkedIn, for robust digital marketing and online engagement. These platforms are crucial for disseminating corporate news, announcing new products, and sharing valuable industry insights with a global professional audience.

In 2023, Infineon reported a significant increase in its online presence, with website traffic growing by 18% and LinkedIn engagement up by 25% year-over-year. This digital strategy is vital for reinforcing their brand as a leader in enabling decarbonization and digitalization trends.

Public Relations and Investor Communications

Infineon Technologies strategically leverages public relations to highlight its technological advancements and market position. For instance, their efforts often center on communicating breakthroughs in areas like automotive semiconductors, a sector where they hold significant influence. This includes outreach regarding their contributions to e-mobility and advanced driver-assistance systems (ADAS), crucial for addressing global sustainability and safety challenges.

Investor communications are equally vital, aiming for transparency with stakeholders. Infineon's investor relations team focuses on clearly articulating the company's financial health and strategic roadmap. This is demonstrated through regular financial reports and investor presentations that detail performance metrics and future growth drivers, ensuring informed decision-making by the financial community.

Key aspects of Infineon's Public Relations and Investor Communications include:

- Showcasing Technological Leadership: Communicating innovations in areas like power semiconductors and IoT solutions through targeted media engagement.

- Financial Transparency: Providing clear and consistent updates on financial performance, revenue growth, and profitability to investors. For example, reporting strong revenue growth in their fiscal year 2023, reaching €16.3 billion, underscores their financial stability.

- Strategic Narrative: Articulating Infineon's long-term vision, including its role in the green transition and digitalization, to build investor confidence.

- Stakeholder Engagement: Maintaining open dialogue with investors, analysts, and the media through various channels to foster trust and understanding.

Strategic Partnerships and Collaborations

Strategic partnerships are a cornerstone of Infineon's market approach, extending its influence and validating its technological prowess. These collaborations are crucial for expanding market reach and fostering innovation.

Infineon actively engages in joint development projects and co-marketing initiatives with key industry players, research institutions, and universities. This collaborative strategy amplifies their market presence and reinforces their position as a technological leader. For instance, in 2024, Infineon announced a significant collaboration with a leading automotive manufacturer to develop next-generation power semiconductors, a move expected to open substantial market opportunities.

Participation in industry consortia further strengthens Infineon's market standing. These alliances allow for shared innovation and the development of industry standards, which is vital in rapidly evolving sectors like electric vehicles and renewable energy. In 2025, Infineon is a key participant in several European Union-funded research projects focused on advanced semiconductor manufacturing, aiming to drive future market growth.

- Joint Development Projects: Infineon collaborates with industry leaders on new product development, ensuring market relevance and technological advancement.

- Co-Marketing Initiatives: Partnering with other companies allows Infineon to reach broader customer bases and jointly promote innovative solutions.

- Industry Consortia Participation: Involvement in groups like the European Clean Hydrogen Alliance helps shape industry standards and unlock new market segments for Infineon's technologies.

- University Collaborations: Partnerships with academic institutions foster cutting-edge research and talent development, securing a pipeline of future innovation and expertise.

Infineon's promotional activities focus on showcasing technological leadership through participation in major industry events like electronica and embedded world, where they present innovations in power semiconductors and IoT. Their robust digital marketing strategy, leveraging their website and LinkedIn, saw an 18% increase in website traffic and a 25% rise in LinkedIn engagement in 2023, reinforcing their brand as a leader in decarbonization and digitalization.

Public relations efforts highlight advancements in automotive semiconductors, particularly in e-mobility and ADAS, while investor communications emphasize financial transparency and strategic vision, as seen in their fiscal year 2023 revenue of €16.3 billion. Strategic partnerships and industry consortia, including collaborations on next-generation power semiconductors announced in 2024 and participation in EU research projects in 2025, further solidify their market presence and drive innovation.

| Promotional Activity | Key Focus Areas | 2023/2024/2025 Data/Examples |

|---|---|---|

| Industry Events | Semiconductor innovations, IoT solutions | Showcased power semiconductors at electronica 2024; participation in embedded world. |

| Digital Marketing | Brand reinforcement, industry insights | 18% website traffic growth (2023); 25% LinkedIn engagement increase (2023). |

| Public Relations | Automotive semiconductors, e-mobility, ADAS | Communicating contributions to sustainable automotive tech. |

| Investor Communications | Financial health, strategic roadmap | Reported €16.3 billion revenue (FY2023); focus on green transition and digitalization. |

| Strategic Partnerships | Market reach, technological advancement | Collaboration with automotive manufacturer on power semiconductors (2024); EU research projects (2025). |

Price

Infineon Technologies largely adopts a value-based pricing strategy. This means their pricing is directly tied to the substantial benefits their semiconductor products offer customers, such as improved energy efficiency in automotive systems or enhanced safety features in consumer electronics. For example, their advanced power semiconductors, crucial for electric vehicles, command a premium due to the significant cost savings and performance gains they enable for automakers.

Infineon Technologies actively monitors competitor pricing and market share, particularly in high-volume segments like automotive microcontrollers, to ensure its premium positioning remains attractive. For instance, in the automotive sector, where Infineon holds a significant market share, they analyze rivals' pricing strategies for comparable products to maintain competitive edge. Their leadership in power semiconductors, a market projected to grow substantially, further solidifies their ability to compete effectively.

Infineon Technologies prioritizes long-term contracts and strategic agreements, especially with major players in the automotive and industrial markets. These agreements, often spanning several years, offer customers guaranteed supply and predictable pricing, fostering loyalty and securing substantial revenue for Infineon.

For instance, in 2023, Infineon announced a multi-year agreement with a leading automotive manufacturer to supply advanced power semiconductors, a move expected to contribute significantly to their revenue stability in the coming years. Such partnerships are crucial for managing supply chain complexities and ensuring consistent demand for Infineon's high-volume products.

R&D Cost Recovery and Investment Returns

Infineon Technologies' pricing strategy is heavily influenced by its significant investments in research and development for advanced semiconductor technologies. These R&D expenditures are crucial for maintaining a competitive edge and driving future product innovation.

The company aims to recover these substantial R&D costs through its pricing, ensuring a sustainable cycle of innovation. For instance, in fiscal year 2023, Infineon reported an R&D expense of €1.8 billion, a testament to its commitment to technological advancement.

- R&D Investment: Infineon's R&D spending in FY23 was €1.8 billion.

- Innovation Focus: This investment fuels the development of cutting-edge semiconductor solutions.

- Cost Recovery: Pricing models are designed to recoup these R&D expenditures.

- Market Leadership: Continued R&D is vital for sustaining technological leadership in the semiconductor industry.

Market Demand and Macroeconomic Factors

Infineon Technologies dynamically adjusts its pricing to reflect current market demand, supply chain realities, and overarching economic conditions. This agility is crucial in the semiconductor industry. For instance, during periods of high demand for automotive chips in 2024, prices saw upward pressure, while supply chain disruptions could necessitate premium pricing to secure components.

Broader economic forces and geopolitical events significantly impact Infineon's pricing. Tariff disputes between major economies can lead to increased costs for imported materials or finished goods, prompting price adjustments to offset these expenses. Similarly, currency fluctuations, such as the strength of the Euro against the US Dollar, directly influence the cost of goods and the competitiveness of Infineon's products in different global markets, requiring strategic pricing recalibrations.

- Market Demand: Infineon's pricing is sensitive to demand surges, particularly in sectors like automotive and industrial automation, which experienced robust growth in 2024.

- Supply Chain Costs: Volatility in raw material prices and logistics, exacerbated by global events, can directly translate into higher production costs and, consequently, adjusted selling prices.

- Currency Fluctuations: The Euro's performance against other major currencies impacts Infineon's profitability and pricing strategies in key international markets.

- Geopolitical Factors: Trade policies and tariffs can create cost differentials, forcing Infineon to adapt its pricing to maintain market share and profitability.

Infineon's pricing strategy is fundamentally value-based, reflecting the significant performance and efficiency gains its semiconductors offer, particularly in high-growth sectors like electric vehicles and renewable energy. The company's substantial R&D investment, reaching €1.8 billion in fiscal year 2023, underpins this approach, allowing them to command premium prices for innovative solutions.

| Pricing Factor | Description | Impact on Infineon | Example (2024/2025) |

|---|---|---|---|

| Value-Based Pricing | Price reflects customer benefits (efficiency, safety). | Premium pricing for advanced products. | Higher prices for automotive power semiconductors due to EV demand. |

| Competitive Monitoring | Analysis of rival pricing in key segments. | Ensures market competitiveness. | Adjustments in microcontroller pricing to match competitors in the automotive sector. |

| Long-Term Contracts | Agreements with major clients. | Secures revenue and predictable pricing. | Multi-year supply deals with automotive manufacturers for consistent demand. |

| R&D Investment Recovery | Recouping innovation costs. | Supports continued technological advancement. | Pricing of new-generation chips reflects significant R&D expenditure. |

| Market Dynamics | Response to demand, supply, and economic factors. | Agile price adjustments. | Upward price pressure on chips due to strong 2024 automotive demand; potential cost pass-through from supply chain issues. |

4P's Marketing Mix Analysis Data Sources

Our Infineon Technologies 4P analysis leverages a comprehensive set of data sources, including official company filings, investor relations materials, product datasheets, and industry-specific market research reports. We also incorporate insights from competitor analysis and news releases to ensure a holistic view of their marketing strategies.