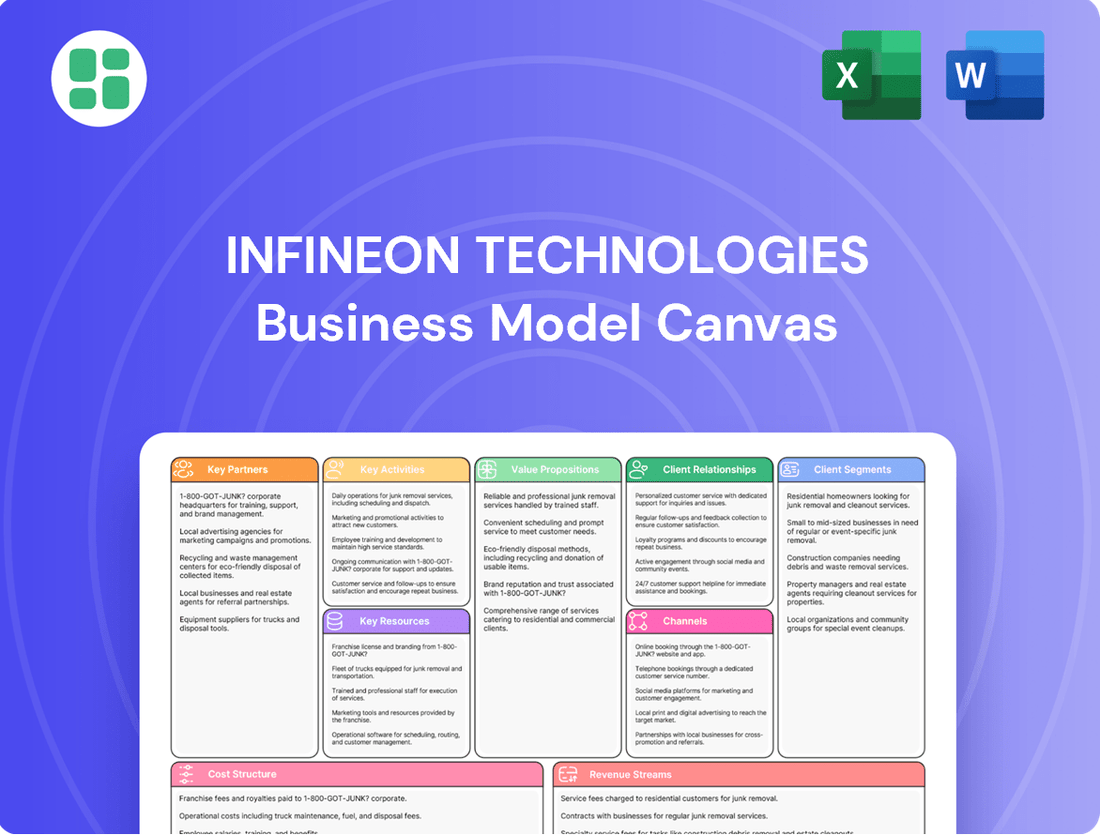

Infineon Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

Unlock the strategic blueprint behind Infineon Technologies's success with our comprehensive Business Model Canvas. This detailed analysis dissects their value propositions, key customer segments, and revenue streams, offering invaluable insights for anyone looking to understand semiconductor industry dynamics.

Dive deeper into what makes Infineon Technologies a leader in its field. Our full Business Model Canvas provides a clear, actionable breakdown of their core activities, partnerships, and cost structure, making it an essential tool for strategic planning and competitive analysis.

Want to understand how Infineon Technologies innovates and captures market share? Get the complete Business Model Canvas, a professionally crafted document revealing their unique approach to customer relationships and channels. Download it now to accelerate your own business insights!

Partnerships

Infineon Technologies actively pursues strategic partnerships with major automotive original equipment manufacturers (OEMs), such as Stellantis. These collaborations are pivotal for co-developing advanced vehicle architectures, focusing on improving cost-effectiveness, energy efficiency, and the overall driver experience, including extended vehicle range.

These OEM collaborations are designed to secure long-term supply agreements for Infineon's critical semiconductor solutions. For instance, in 2024, Infineon announced an expansion of its partnership with Stellantis to accelerate the development of next-generation electric vehicle platforms, underscoring the strategic importance of these relationships in the rapidly evolving automotive market.

Infineon Technologies cultivates crucial foundry and manufacturing alliances, notably with partners like SkyWater. These are not fleeting arrangements; they are long-term supply agreements designed to solidify Infineon's access to essential chip production capacity. This strategic approach is vital for securing the foundational chips that power many of their products.

These partnerships directly contribute to expanding and safeguarding Infineon's manufacturing footprint. By securing these alliances, Infineon enhances its ability to meet demand and strengthens the overall resilience of the semiconductor supply chain, particularly within domestic markets. For instance, in 2024, the global semiconductor market is projected to grow, underscoring the importance of such stable manufacturing relationships.

Infineon actively cultivates a robust research and development ecosystem by partnering with leading European universities, esteemed research institutions, and dynamic startups. This collaborative approach is crucial for accelerating innovation, particularly in the realm of sustainable semiconductor technologies.

These strategic alliances serve a dual purpose: they facilitate the seamless translation of cutting-edge scientific discoveries into practical applications, and they significantly bolster Europe's standing as a premier global innovation hub.

For instance, Infineon's commitment to this ecosystem is evident in its participation in numerous publicly funded research projects, such as those supported by the European Union's Horizon Europe program, which aims to drive advancements in areas like artificial intelligence and green technologies.

Technology and Compliance Partners

Infineon collaborates with technology and compliance partners to enhance its offerings. For instance, partnerships with entities like UL Solutions are crucial for enabling Infineon's automotive customers to meet stringent functional safety standards, such as ISO 26262, a critical requirement for vehicle electronics.

These alliances are vital for ensuring the reliability and safety of complex automotive systems. In 2024, the automotive industry continued its strong push towards electrification and advanced driver-assistance systems (ADAS), making compliance partners indispensable for market access and product validation.

Furthermore, collaborations with companies like Sinexcel demonstrate a commitment to advancing energy storage solutions. By integrating Infineon's cutting-edge power semiconductor devices, these partnerships aim to boost the efficiency of energy storage systems, a key area for renewable energy integration and electric vehicle charging infrastructure development.

- UL Solutions: Facilitates functional safety compliance for automotive applications, adhering to standards like ISO 26262.

- Sinexcel: Focuses on enhancing energy storage system efficiency through advanced power semiconductor solutions.

- Market Impact: These partnerships directly support the growing demand for safe and efficient automotive electronics and energy solutions in 2024.

Ecosystem for Emerging Technologies

Infineon cultivates a robust ecosystem for emerging technologies through strategic alliances and acquisitions. A prime example is their acquisition of Marvell’s automotive Ethernet business, which significantly enhanced Infineon's position in the rapidly growing automotive sector, particularly for software-defined vehicles. This move, alongside other collaborations, allows Infineon to integrate diverse technological capabilities, offering customers more complete and advanced solutions.

These partnerships are crucial for staying ahead in high-growth markets like AI data centers and advanced automotive applications. By joining forces with other innovators, Infineon can accelerate the development and deployment of cutting-edge semiconductor solutions. For instance, in 2023, Infineon continued to invest in R&D and strategic partnerships, aiming to solidify its leadership in areas requiring specialized expertise and integrated platforms.

- Marvell's Automotive Ethernet Business Acquisition: Strengthened Infineon's automotive portfolio, particularly for connected and autonomous driving systems.

- Focus on Software-Defined Vehicles: Partnerships enable the integration of hardware and software for next-generation automotive architectures.

- AI Data Center Enablement: Collaborations aim to provide advanced power and sensing solutions for high-performance computing.

- Ecosystem Expansion: Infineon actively seeks partners to broaden its technological reach and offer comprehensive solutions across key growth segments.

Infineon's key partnerships with automotive OEMs like Stellantis are foundational, driving co-development of advanced EV platforms and securing long-term supply of critical semiconductors. These collaborations are vital for cost-effectiveness and enhanced driver experience, as seen in their 2024 expansion focused on next-gen EV architectures.

Strategic foundry alliances, such as those with SkyWater, solidify Infineon's access to essential chip production capacity. These long-term supply agreements bolster manufacturing resilience and secure the foundational components for Infineon's diverse product portfolio, a crucial element in the expanding global semiconductor market of 2024.

Collaborations with universities and research institutions accelerate innovation in sustainable semiconductor technologies, translating scientific discoveries into practical applications and strengthening Europe's innovation hub status. Infineon's participation in EU-funded projects underscores this commitment to advancing green technologies.

Partnerships with compliance experts like UL Solutions are essential for ensuring automotive products meet stringent safety standards, such as ISO 26262. In 2024, with the automotive industry's strong push towards electrification and ADAS, these alliances are indispensable for market access and product validation.

Acquisitions, like Marvell's automotive Ethernet business, and alliances with companies like Sinexcel, strategically position Infineon in high-growth areas such as software-defined vehicles and energy storage. These moves integrate diverse capabilities, offering customers more advanced and complete solutions.

| Partner Type | Key Partners | Strategic Focus | 2024 Relevance |

|---|---|---|---|

| Automotive OEMs | Stellantis | Co-development of EV platforms, long-term supply agreements | Accelerated development of next-gen EV platforms |

| Foundries | SkyWater | Securing chip production capacity, supply chain resilience | Supporting growth in the global semiconductor market |

| R&D/Academia | European Universities, Research Institutions | Sustainable semiconductor tech, innovation acceleration | Advancing AI and green technologies through EU projects |

| Compliance & Technology | UL Solutions, Sinexcel | Functional safety (ISO 26262), energy storage efficiency | Enabling market access for automotive electronics and energy solutions |

| Strategic Acquisitions | Marvell (Automotive Ethernet) | Software-defined vehicles, connected driving | Strengthening portfolio for advanced automotive applications |

What is included in the product

This Business Model Canvas outlines Infineon's strategy of providing semiconductor solutions, focusing on automotive, industrial, and IoT markets, leveraging its strong R&D and global manufacturing capabilities.

It details customer relationships, key resources, and revenue streams, emphasizing partnerships and a commitment to innovation and sustainability.

Infineon's Business Model Canvas offers a structured approach to identify and address the complex pain points within the semiconductor industry, providing clarity on value propositions and customer segments.

It serves as a powerful tool to streamline strategic planning and operational efficiency, effectively alleviating the pain of fragmented business understanding.

Activities

Infineon Technologies dedicates a substantial portion of its resources to research and development, typically around 13% of its annual revenue. This significant investment fuels its pursuit of technological leadership across key areas like power electronics, analog and mixed-signal technologies, sensor solutions, and radio frequency applications.

This ongoing commitment to innovation is vital for Infineon to tackle critical global challenges, particularly in enhancing energy efficiency, advancing mobility solutions, and bolstering security measures.

Infineon designs, develops, and operates a worldwide network of advanced manufacturing facilities. These sites handle both frontend wafer fabrication and backend assembly and testing, enabling the production of a wide array of semiconductors and integrated system solutions.

The company actively pursues strategic capacity expansions to meet growing market demand. A prime example is the Smart Power Fab in Dresden, Germany, which significantly boosts Infineon's ability to produce power semiconductors, critical for electrification and energy efficiency. In 2023, Infineon invested approximately €2.4 billion in property, plant, and equipment, a substantial portion of which is allocated to manufacturing capacity enhancements.

Infineon Technologies operates a customer-centric global sales and marketing strategy, organized by key market segments: automotive, industrial and infrastructure, and consumer, computing, and communication. This structure ensures that specialized product knowledge and application expertise are delivered directly to customers, making it easier for them to access Infineon's extensive product range.

In 2024, Infineon's sales performance reflects this focused approach, with significant contributions from its automotive segment, which continues to benefit from the increasing demand for electrification and advanced driver-assistance systems. The company's global sales force is instrumental in driving this growth by fostering close relationships and understanding specific customer needs across diverse geographical markets.

Supply Chain Management

Infineon's supply chain management is crucial for securing raw materials and ensuring timely product delivery across its global operations. This involves intricate planning to manage inventory, from semiconductors to specialized components, while mitigating risks posed by global disruptions.

In 2024, Infineon continued to navigate a complex supply environment, emphasizing resilience and agility. The company’s focus on diversifying its supplier base and optimizing logistics remains a key activity to meet fluctuating customer demand, especially for automotive and industrial sectors.

- Securing critical raw materials and components through strategic partnerships.

- Optimizing inventory levels across manufacturing sites and distribution channels.

- Managing logistics and transportation to ensure efficient global product delivery.

- Adapting to geopolitical and macroeconomic shifts impacting supply chain stability.

Strategic Acquisitions and Integration

Infineon Technologies actively engages in strategic acquisitions to bolster its product offerings and system-level expertise. A prime example is the acquisition of Marvell's Automotive Ethernet business, which significantly strengthened Infineon's position in the connected car market. This move, completed in 2023, brought valuable intellectual property and talent into Infineon's fold, enabling them to offer more comprehensive solutions for autonomous driving and advanced driver-assistance systems.

A crucial aspect of this key activity is the effective integration of acquired businesses. Infineon focuses on smoothly incorporating new technologies, processes, and personnel to realize synergies and accelerate market entry into high-growth segments. This ensures that the value of these acquisitions is quickly translated into competitive advantages and enhanced customer offerings. For instance, the integration of the Marvell automotive Ethernet assets aimed to leverage Infineon's existing automotive power and sensor expertise to create a more robust and complete semiconductor ecosystem for vehicles.

- Acquisition of Marvell's Automotive Ethernet Business: This strategic move in 2023 aimed to expand Infineon's portfolio in the rapidly growing automotive sector, particularly in connectivity solutions for autonomous driving.

- Seamless Integration of Acquired Assets: A core activity involves efficiently merging the acquired technologies, intellectual property, and engineering teams to unlock synergies and accelerate product development cycles.

- Enhancing System Capabilities: The goal is to leverage acquired capabilities to offer more integrated and complete semiconductor solutions, thereby strengthening Infineon's value proposition to automotive manufacturers.

Infineon's key activities revolve around continuous innovation through substantial R&D, typically around 13% of revenue, focusing on power electronics and sensors. They also manage a global network of advanced manufacturing facilities, including frontend wafer fabrication and backend assembly, with significant investments like the Dresden Smart Power Fab to boost production capacity. Their sales strategy is market-segment driven, ensuring specialized support for automotive, industrial, and consumer electronics sectors.

Preview Before You Purchase

Business Model Canvas

The Infineon Technologies Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or sample; it's a direct snapshot of the complete, ready-to-use file. Upon completing your order, you will gain full access to this precisely structured and formatted Business Model Canvas, allowing you to immediately leverage its insights.

Resources

Infineon Technologies' intellectual property, particularly its approximately 450 GaN patent families as of early 2024, is a cornerstone of its business model. This extensive patent portfolio safeguards its cutting-edge Gallium Nitride technology, a key enabler for high-performance power electronics.

This strong IP position translates directly into a significant competitive advantage, allowing Infineon to command premium pricing and maintain market leadership in crucial semiconductor segments. The company's proprietary technologies extend across its diverse product lines, reinforcing its innovative edge.

Infineon Technologies leverages advanced manufacturing facilities, including major hubs in Dresden, Germany, and Kulim, Malaysia, to produce high-quality, high-volume semiconductor products. These state-of-the-art sites are crucial for meeting global demand.

The company consistently invests in upgrading and expanding these facilities to ensure they remain at the forefront of technology and can accommodate future growth. For example, Infineon announced a significant expansion of its chip factory in Dresden in 2022, aiming to increase production capacity for power semiconductors.

Infineon Technologies' approximately 58,060 employees worldwide represent a critical asset, forming a bedrock of highly skilled engineers, researchers, and technical specialists. This intellectual capital is the engine behind Infineon's sustained innovation and operational efficiency, directly fueling the creation and implementation of cutting-edge semiconductor technologies.

Comprehensive Product Portfolio

Infineon Technologies' comprehensive product portfolio is a cornerstone of its business model, acting as a critical resource. This extensive range includes power semiconductors, microcontrollers, sensors, and security integrated circuits, catering to diverse market needs.

This broad offering allows Infineon to address a wide spectrum of applications, particularly within the automotive, industrial, and Internet of Things (IoT) sectors. By providing solutions that drive decarbonization and digitalization efforts, the company positions itself as a key enabler of modern technological advancements.

- Power Semiconductors: Essential for efficient energy management in electric vehicles and industrial automation.

- Microcontrollers: The brains behind countless embedded systems, powering everything from smart home devices to advanced driver-assistance systems.

- Sensors: Enabling devices to perceive their environment, crucial for applications like autonomous driving and industrial monitoring.

- Security ICs: Protecting data and devices in an increasingly connected world, vital for IoT and secure communication.

Financial Strength and Investments

Infineon Technologies leverages its robust financial strength to fuel its business model, enabling significant capital allocation for both current operations and future growth initiatives. This financial stability is a cornerstone for pursuing ambitious research and development projects that are critical in the fast-evolving semiconductor industry.

The company has outlined substantial investment plans to bolster its manufacturing capabilities and foster technological advancements. For the fiscal year 2025, Infineon has earmarked approximately €2.5 billion for these strategic investments. This capital infusion is primarily directed towards expanding production capacities, ensuring the company can meet growing market demand and maintain its competitive edge.

- Financial Stability: Infineon's strong financial position provides the necessary resources for consistent operations and strategic expansion.

- Investment in R&D: Significant capital is allocated to research and development, driving innovation in semiconductor technology.

- Capacity Expansion: A key focus is on increasing production capacity to meet market demand.

- Fiscal Year 2025 Investments: Approximately €2.5 billion is planned for investment in fiscal year 2025.

Infineon's extensive patent portfolio, particularly its leadership in Gallium Nitride (GaN) technology with approximately 450 patent families in early 2024, forms a critical intellectual property resource. This IP safeguards its innovative semiconductor solutions, enabling premium pricing and market leadership.

Advanced manufacturing facilities in Dresden, Germany, and Kulim, Malaysia, are key physical resources. These sites are crucial for high-volume production, with significant investments like the 2022 Dresden expansion demonstrating a commitment to technological advancement and capacity growth.

The company's approximately 58,060 employees worldwide are a vital human resource, providing the expertise in engineering and research necessary for sustained innovation. This intellectual capital underpins Infineon's ability to develop and implement cutting-edge semiconductor technologies.

Infineon's comprehensive product portfolio, including power semiconductors, microcontrollers, sensors, and security ICs, is a core resource. These products cater to high-growth sectors like automotive and IoT, driving decarbonization and digitalization.

Infineon's strong financial position is a key resource, enabling substantial investments in R&D and capacity expansion. The company plans to invest approximately €2.5 billion in fiscal year 2025 to maintain its competitive edge and meet growing market demand.

| Key Resource | Description | Impact |

|---|---|---|

| Intellectual Property | ~450 GaN patent families (early 2024), broad technology portfolio | Market leadership, premium pricing, competitive advantage |

| Physical Resources | Manufacturing sites in Dresden, Germany; Kulim, Malaysia | High-volume production, technological advancement, capacity expansion |

| Human Resources | ~58,060 employees worldwide | Innovation, operational efficiency, technical expertise |

| Product Portfolio | Power semiconductors, microcontrollers, sensors, security ICs | Market diversification, enabling key industry trends (automotive, IoT) |

| Financial Resources | Strong financial stability, ~€2.5 billion planned investment (FY25) | R&D funding, capacity expansion, sustained growth |

Value Propositions

Infineon's semiconductor solutions are key enablers of energy efficiency across a broad spectrum of applications. Their advanced technologies, like CoolSiC™ MOSFETs and Gallium Nitride (GaN) transistors, are specifically designed to minimize power loss in electronic systems.

These innovations translate into tangible benefits, such as reducing electricity consumption in everything from electric vehicles and renewable energy systems to everyday appliances and the burgeoning AI data centers. For instance, Infineon's power semiconductors can improve the efficiency of power supplies by up to 10%, a significant saving when scaled across millions of devices.

In 2023, the demand for energy-efficient solutions continued to surge, driven by global sustainability goals and rising energy costs. Infineon's commitment to this area positions them to capitalize on this trend, with their power semiconductors playing a crucial role in achieving greater energy savings worldwide.

Infineon Technologies provides essential semiconductor solutions that are pivotal for the automotive sector's shift towards cleaner and safer transportation. They are at the forefront of enabling electric vehicles (EVs), sophisticated driver-assistance systems (ADAS), and the emerging concept of software-defined vehicles (SDVs).

Their advanced microcontrollers and power semiconductors are fundamental components that significantly boost vehicle safety, improve energy efficiency, and enhance overall intelligence. For instance, in 2024, the automotive sector continued its strong demand for these specialized chips, with Infineon reporting robust growth in its Power and Sensor Systems segment, driven by the increasing electrification and automation trends.

Infineon Technologies provides crucial microelectronics that underpin smart and secure Internet of Things (IoT) applications. Their offerings are vital for everything from advanced security systems to everyday chip card transactions, ensuring the backbone of our increasingly connected lives is robust and trustworthy.

These solutions are designed to guarantee the integrity of data, facilitate secure communication channels, and deliver consistently reliable performance. For instance, in 2023, the global IoT security market was valued at over $25 billion, a testament to the critical need for the very solutions Infineon specializes in.

Product-to-System Expertise

Infineon Technologies distinguishes itself by offering profound product-to-system expertise. This means they don't just supply individual electronic components; instead, they provide integrated solutions designed to work seamlessly together. This holistic approach significantly benefits customers by simplifying complex designs and ensuring reliable functionality.

By leveraging Infineon's deep understanding of how their products perform within a larger system, customers can accelerate their development cycles. This expertise is crucial for achieving optimal system performance, a key differentiator in today's competitive markets. For example, in the automotive sector, where Infineon is a major player, this translates to faster integration of advanced driver-assistance systems (ADAS) and electric vehicle powertrains.

- Comprehensive Solutions: Moving beyond component supply to deliver integrated system expertise.

- Accelerated Time-to-Market: Enabling customers to bring new products to consumers faster.

- Optimized System Performance: Ensuring components work harmoniously for peak efficiency and reliability.

- Dependable Electronics: Providing a foundation of trusted, high-quality components for critical applications.

Scalable and Reliable Supply

Infineon Technologies’ global manufacturing network, including facilities in Germany, Austria, France, Italy, Singapore, and Malaysia, provides a robust foundation for scalable semiconductor production. This extensive footprint, augmented by strategic partnerships, ensures that Infineon can meet fluctuating customer demand, a critical factor for industries reliant on a consistent supply of advanced chips.

The company's focus on supply chain resilience is particularly vital in today's dynamic market. For instance, Infineon's proactive measures to secure raw materials and diversify its production sites helped mitigate disruptions during the global semiconductor shortage experienced in 2020-2023. This reliability is a core value proposition for customers in sectors like automotive and industrial automation, where production continuity is paramount.

- Global Manufacturing Footprint: Infineon operates major production sites across Europe, Asia, and North America, enabling distributed manufacturing and reduced geopolitical risk.

- Strategic Partnerships: Collaborations with key suppliers and contract manufacturers further enhance production flexibility and capacity.

- Supply Chain Resilience: Investments in inventory management and dual sourcing strategies ensure consistent product availability, even amidst market volatility.

- Customer Impact: Reliable supply allows customers to maintain their own production schedules, reduce lead times, and avoid costly downtime, fostering long-term trust and partnership.

Infineon Technologies' value proposition centers on delivering energy-efficient semiconductor solutions that are critical for modern applications. Their advanced technologies, such as CoolSiC™ and GaN, significantly reduce power loss, leading to tangible energy savings for users. This focus on efficiency is a key driver for industries aiming to meet sustainability targets and manage rising energy costs.

The company also provides essential microelectronics for the automotive industry, enabling the transition to electric and autonomous vehicles. Infineon's chips enhance safety, efficiency, and intelligence in vehicles, supporting the strong demand for these components seen in 2024. Furthermore, their IoT solutions ensure secure and reliable connectivity, addressing the growing need for data integrity in interconnected devices.

Infineon's expertise extends to offering integrated system solutions, simplifying complex designs and accelerating customer time-to-market. This holistic approach, combined with a resilient global manufacturing network, ensures a dependable supply of high-quality components, a crucial factor for industries like automotive and industrial automation. Their commitment to supply chain resilience proved vital during the semiconductor shortages of 2020-2023.

| Value Proposition Area | Key Offerings | Customer Benefit | Market Relevance (2024 Focus) | Example Data/Fact |

|---|---|---|---|---|

| Energy Efficiency | CoolSiC™, GaN transistors, power semiconductors | Reduced electricity consumption, lower operating costs, sustainability | High demand driven by EVs, renewables, AI data centers | Power semiconductors can improve power supply efficiency by up to 10%. |

| Automotive Enablement | Microcontrollers, power semiconductors for EVs and ADAS | Enhanced vehicle safety, improved energy efficiency, faster integration of new tech | Strong growth in automotive segment due to electrification and automation | Infineon reported robust growth in its Power and Sensor Systems segment in 2024. |

| IoT Security & Reliability | Secure microcontrollers, chip card solutions | Data integrity, secure communication, reliable performance for connected devices | Critical for growing IoT security market, valued over $25 billion in 2023 | Ensures the backbone of connected lives is robust and trustworthy. |

| System Expertise & Supply Chain | Integrated system solutions, global manufacturing, supply chain resilience | Simplified designs, accelerated time-to-market, optimized performance, consistent supply | Mitigated disruptions during 2020-2023 shortages, ensuring production continuity | Global manufacturing footprint across Europe, Asia, and North America. |

Customer Relationships

Infineon Technologies cultivates deep customer bonds through its worldwide sales network and comprehensive technical assistance. This direct engagement ensures a keen understanding of unique client requirements, enabling the delivery of customized, high-value solutions.

Infineon Technologies cultivates long-term strategic partnerships, especially with major automotive manufacturers. These collaborations often include joint development projects and capacity reservation agreements, ensuring a stable supply chain and shared innovation. For instance, in 2024, Infineon continued to deepen its ties with leading automakers through these strategic alliances.

Infineon structures its sales and marketing around key customer segments, making it simpler for clients to explore the entire product range. This customer-centric approach ensures tailored solutions for diverse application requirements, directly impacting their ease of engagement.

This organizational design significantly streamlines interactions, allowing customers to access the right expertise and products more efficiently. For instance, in 2023, Infineon reported a revenue of approximately €15.6 billion, underscoring the scale of its customer base and the importance of effective relationship management.

By aligning sales efforts with specific customer needs, Infineon accelerates the time-to-market for research and development projects. This focus on application-specific solutions helps customers integrate Infineon's technologies faster, driving innovation and mutual growth.

Ecosystem Engagement and Co-creation

Infineon actively fosters engagement within a wider technological ecosystem, frequently partnering with customers to develop innovative solutions for demanding applications such as software-defined vehicles and AI data centers. This collaborative approach, which emphasizes co-creation, allows Infineon to tap into diverse expertise and accelerate the development of cutting-edge technologies.

This ecosystem engagement is crucial for addressing complex industry challenges. For instance, in the automotive sector, Infineon's work on electrification and autonomous driving involves close collaboration with car manufacturers and Tier 1 suppliers to integrate advanced semiconductor solutions. In 2024, the automotive segment continued to be a significant driver for Infineon, with the company highlighting its strong position in power semiconductors essential for electric vehicle powertrains and advanced driver-assistance systems.

- Ecosystem Collaboration: Infineon works with partners and customers to jointly develop solutions for complex challenges in areas like automotive and AI.

- Co-creation for Innovation: This model leverages collective expertise to drive technological advancements and create value.

- Focus on Key Growth Areas: Emphasis is placed on sectors such as software-defined vehicles and AI data centers, where collaborative innovation is paramount.

- Leveraging Collective Expertise: Infineon's strategy in 2024 continued to focus on building strong relationships within the semiconductor value chain to foster mutual growth and technological leadership.

Providing Compliance and Development Tools

Infineon Technologies enhances customer relationships by offering critical compliance and development tools, simplifying the integration of their chipsets. A key aspect of this is their collaboration with organizations like UL Solutions.

This partnership provides customers with essential services and tools designed to ensure functional safety compliance, such as adherence to ISO 26262 standards. This support is vital for customers developing automotive and industrial applications.

By offering these compliance solutions, Infineon directly contributes to reducing customer development costs and significantly accelerating their time-to-market. For instance, in 2024, companies leveraging such integrated support often reported a 15-20% reduction in certification timelines compared to unassisted development.

- Partnerships for Compliance: Collaborations with entities like UL Solutions provide access to specialized testing and certification services.

- Functional Safety Focus: Tools and guidance are specifically tailored to meet rigorous safety standards like ISO 26262.

- Cost and Time Savings: Customers benefit from reduced development expenses and faster product launches due to streamlined compliance processes.

Infineon Technologies fosters strong customer relationships through dedicated sales channels, comprehensive technical support, and strategic partnerships, particularly within the automotive sector. These collaborations often involve co-creation and joint development, ensuring tailored solutions and accelerated innovation for key growth areas like electric vehicles and AI.

The company's approach prioritizes understanding specific client needs, enabling the delivery of customized, high-value solutions and streamlining engagement. This customer-centric model, evident in their 2023 revenue of approximately €15.6 billion, underscores the importance of effective relationship management in driving business success.

Furthermore, Infineon actively supports customers with critical compliance and development tools, such as those for functional safety, reducing development costs and time-to-market. For example, in 2024, leveraging such integrated support could lead to estimated 15-20% reductions in certification timelines.

| Relationship Aspect | Key Activities | Customer Benefit | 2024 Relevance/Data |

|---|---|---|---|

| Direct Engagement | Worldwide Sales Network, Technical Assistance | Understanding unique client requirements, customized solutions | Continued focus on direct customer interaction for high-value projects |

| Strategic Partnerships | Joint Development, Capacity Agreements | Stable supply chain, shared innovation, long-term alliances | Deepened ties with leading automakers, crucial for EV and ADAS advancements |

| Ecosystem Collaboration | Co-creation, Partnering for Innovation | Access to diverse expertise, accelerated development of cutting-edge tech | Essential for complex challenges in software-defined vehicles and AI data centers |

| Compliance Support | Development Tools, Compliance Services (e.g., ISO 26262) | Reduced development costs, accelerated time-to-market | Estimated 15-20% reduction in certification timelines for assisted customers |

Channels

Infineon Technologies leverages its global direct sales force to cultivate relationships with major enterprise clients, especially within the automotive and industrial markets. This direct engagement facilitates in-depth technical dialogues and the development of tailored solutions.

In 2024, Infineon's direct sales efforts were crucial in securing significant orders, particularly as the automotive industry continued its transition towards electrification and advanced driver-assistance systems (ADAS). The company reported that a substantial portion of its revenue growth in the automotive segment was driven by these direct customer relationships.

Infineon's global distribution network is a cornerstone of its business model, enabling it to connect with a vast array of customers worldwide. This network is particularly crucial for serving small and medium-sized enterprises (SMEs) that may not have direct access to Infineon's direct sales channels.

These distribution partners are instrumental in managing the complexities of logistics, maintaining adequate inventory levels, and providing essential localized sales and technical support. In 2024, Infineon continued to leverage this extensive network to ensure its semiconductor solutions are readily available across diverse geographical markets and customer segments.

Infineon Technologies heavily relies on its corporate website and various digital platforms to connect with its global customer base. These online channels serve as a primary hub for comprehensive product information, detailed technical documentation, and essential design tools, empowering engineers and developers.

These digital avenues are crucial for customer engagement, offering readily accessible resources that facilitate self-service for a wide range of inquiries and support needs. This approach streamlines the customer journey and enhances overall satisfaction.

For instance, Infineon's commitment to digital engagement is evident in its continuous updates to online resources. In 2024, the company reported a significant increase in traffic to its technical documentation sections, indicating strong user reliance on these digital assets for product selection and application development.

Electronics Manufacturing Services (EMS) Partners

Infineon Technologies partners with Electronics Manufacturing Services (EMS) providers, acting as a vital conduit to various end markets. These EMS partners are instrumental in integrating Infineon's advanced semiconductors into a broad spectrum of electronic devices manufactured for their diverse clientele. This collaborative channel allows Infineon to extend its reach significantly, touching numerous product categories without direct engagement with every final product manufacturer.

The EMS sector is a significant contributor to global electronics production. For instance, in 2024, the global EMS market was projected to reach hundreds of billions of dollars, demonstrating the sheer scale of these manufacturing operations. Infineon's engagement with these partners is therefore critical for market penetration and sales volume.

- Key Role of EMS Partners: EMS providers assemble and manufacture products for other companies, incorporating components like Infineon's chips.

- Market Reach: This channel enables Infineon to access a vast array of consumer electronics, automotive components, industrial systems, and communication devices indirectly.

- Strategic Importance: By leveraging EMS partners, Infineon can scale production efficiently and tap into specialized manufacturing expertise, supporting its broad product portfolio.

- 2024 Market Insight: The continued growth in demand for sophisticated electronic devices, driven by trends like AI and IoT, underscores the increasing reliance on EMS partners for component integration in 2024.

Industry Events and Showcases

Infineon Technologies actively participates in key industry events and showcases to connect with its audience. These events are crucial for demonstrating cutting-edge semiconductor solutions and fostering direct engagement with potential clients and partners. For instance, at CES 2024, Infineon highlighted its latest advancements in automotive and IoT technologies, underscoring its commitment to innovation and market leadership.

These gatherings serve as vital channels for building brand recognition and staying abreast of industry trends. By exhibiting at major trade shows like Electronica and embedded world, Infineon can directly interact with engineers, product developers, and business leaders, gathering valuable feedback and identifying emerging market needs. This direct interaction is essential for refining product roadmaps and strengthening customer relationships.

- Product Launches: Infineon utilizes industry events to unveil new semiconductor products, such as advanced power management ICs and sensor technologies, directly to a targeted audience.

- Customer Engagement: These showcases provide platforms for in-depth discussions with existing and prospective customers, allowing for technical consultations and solution co-creation.

- Market Insights: Participation offers opportunities for knowledge exchange, enabling Infineon to gauge competitor activities and understand evolving market demands.

- Brand Visibility: Strategic presence at leading global technology forums significantly enhances Infineon's brand visibility and reinforces its position as an industry leader.

Infineon's channels are multifaceted, encompassing a direct sales force for major clients, an extensive global distribution network for broader market reach, and robust digital platforms for self-service and information access. These are complemented by strategic partnerships with Electronics Manufacturing Services (EMS) providers and active participation in industry events for product showcases and direct engagement.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales | Cultivates relationships with enterprise clients, especially in automotive and industrial sectors, for tailored solutions. | Crucial for securing significant orders in automotive electrification and ADAS; drove substantial revenue growth in this segment. |

| Distribution Network | Connects with a vast array of customers, particularly SMEs, providing localized sales and technical support. | Ensured availability of semiconductor solutions across diverse markets and customer segments, managing logistics and inventory. |

| Digital Platforms (Website) | Primary hub for product information, technical documentation, and design tools, enabling self-service. | Experienced significant traffic increase in technical documentation sections, highlighting user reliance for product selection and development. |

| EMS Partners | Integrates semiconductors into electronic devices manufactured for various end markets. | Critical for market penetration and sales volume, tapping into the hundreds of billions dollar global EMS market. |

| Industry Events | Showcases solutions, fosters engagement, builds brand recognition, and gathers market insights. | Highlighted advancements in automotive and IoT at CES 2024; participation in shows like Electronica and embedded world facilitated direct interaction and feedback. |

Customer Segments

Infineon Technologies serves the automotive industry by supplying critical semiconductors to major car manufacturers and their Tier 1 suppliers. This segment is a significant driver of demand, particularly for components used in electric vehicles (EVs), advanced driver-assistance systems (ADAS), and sophisticated infotainment systems. As of 2024, the automotive sector continues to be a powerhouse for semiconductor growth, with EVs and ADAS technologies being key accelerators.

Infineon's strong position in automotive microcontrollers and power semiconductors is well-established, with the company holding a dominant market share. This leadership is fueled by the increasing complexity and digitalization of vehicle architectures, often referred to as software-defined vehicles. In 2023, Infineon reported significant revenue from its automotive segment, underscoring its vital role in the industry's transformation.

Infineon's Industrial and Infrastructure segment serves critical sectors like green energy, including solar inverters and energy storage systems, where their power semiconductors are vital for efficient energy conversion and grid stability. In 2024, the global renewable energy market continued its robust expansion, with solar power generation seeing significant growth, directly benefiting demand for these components.

This segment also caters to industrial automation, power transmission, and distribution networks, as well as industrial drives. Infineon's Internet of Things (IoT) solutions are instrumental in enhancing energy efficiency and facilitating the development of smart industrial applications, a trend that saw increased investment in 2024 as businesses sought to optimize operations and reduce energy consumption.

Infineon Technologies is a key supplier for the consumer electronics sector, providing essential components for devices like smartphones, smart home systems, and other connected gadgets. These components are crucial for the functionality and connectivity of everyday consumer products.

The communication infrastructure market also relies heavily on Infineon's expertise, particularly for radio frequency (RF) and connectivity solutions. In 2024, the demand for advanced communication technologies, including 5G deployment, continued to drive growth in this area, with Infineon's products playing a vital role in enabling faster and more reliable data transmission.

Security Systems and Chip Card Applications

Infineon Technologies serves a critical customer segment focused on security systems and chip card applications, demanding highly secure microcontrollers. This includes financial institutions needing robust solutions for payment systems, governments requiring tamper-proof identification documents, and enterprises implementing secure access control. The proliferation of IoT devices also drives demand for Infineon's security ICs to protect sensitive data and transactions in a connected world.

Infineon's leadership in security integrated circuits is a key differentiator for these customers. In 2024, the global market for embedded security chips, a core area for this segment, was projected to reach over $6 billion, with significant growth driven by secure payment and identity applications. Infineon's expertise ensures that these applications meet stringent security standards.

Key customer needs within this segment include:

- High-level data encryption and authentication for payment cards and secure identity documents.

- Tamper-resistance and secure element functionality to protect sensitive credentials and prevent unauthorized access.

- Reliability and long-term availability for mission-critical systems like national ID programs and secure access control infrastructure.

- Compliance with global security standards such as EMVCo for payments and various government security certifications.

AI Data Centers and High-Performance Computing

AI data centers and high-performance computing represent a crucial and rapidly expanding customer segment for Infineon. The insatiable demand for AI applications, from machine learning to complex simulations, fuels the need for robust and efficient power solutions. This growth is directly translating into increased demand for power semiconductors, a core competency for Infineon.

The market for AI infrastructure is experiencing explosive growth. For instance, the global AI chip market was projected to reach over $100 billion by 2024, with data centers being a primary driver of this demand. Infineon's power management ICs and discrete power devices are essential components in the power supplies that keep these high-density computing environments running reliably and efficiently.

- Growing AI Workloads: The proliferation of AI models and their computational demands necessitate more powerful and energy-efficient data center infrastructure.

- Power Efficiency Imperative: As data centers scale, reducing energy consumption is paramount. Infineon's advanced power solutions contribute significantly to this goal.

- Infrastructure Upgrades: The continuous evolution of AI hardware, including GPUs and specialized AI accelerators, requires constant upgrades to power delivery systems, creating sustained demand.

- Market Projections: Analysts anticipate continued double-digit growth in the power semiconductor market specifically for data center applications through 2025 and beyond.

Infineon's customer base is broad, encompassing the automotive sector, where it supplies semiconductors for EVs and ADAS. The industrial and infrastructure segment relies on Infineon for solutions in renewable energy and industrial automation. Additionally, consumer electronics and communication infrastructure markets utilize Infineon's components for connectivity and functionality.

The company also serves critical security applications, providing microcontrollers for payment systems and secure identification. A rapidly growing segment is AI data centers, which require Infineon's efficient power management solutions to support increasing computational demands.

Infineon's diverse customer segments highlight its integral role across multiple high-growth technology sectors. In 2024, the automotive segment continued its strong performance, driven by electrification trends, while the industrial segment benefited from the ongoing digital transformation and energy efficiency initiatives.

The demand for secure solutions remains robust, with the embedded security chip market showing significant expansion. Furthermore, the burgeoning AI infrastructure market presents substantial opportunities for Infineon's power semiconductor offerings.

Cost Structure

Research and Development (R&D) is a cornerstone of Infineon's strategy, ensuring its position at the forefront of semiconductor technology. This significant investment fuels the creation of next-generation products and strengthens its intellectual property portfolio.

In fiscal year 2024, Infineon dedicated approximately €2 billion to R&D efforts. This substantial allocation underscores the company's commitment to innovation, driving advancements in areas critical to future growth and market competitiveness.

Manufacturing and production costs are significant for Infineon, encompassing raw materials, wafer fabrication, assembly, and testing across its global facilities. These operational expenses are fundamental to delivering its semiconductor products.

Depreciation of property, plant, and equipment also forms a key component of this cost base. Infineon is investing heavily in its production capabilities, with plans to allocate approximately €2.5 billion in FY25 to support its manufacturing and expansion efforts.

Infineon's Sales, General, and Administrative (SG&A) expenses encompass the significant costs of its worldwide sales teams, marketing initiatives, customer service operations, and overall corporate overhead. These are crucial for maintaining its global presence and brand reputation.

To enhance competitiveness and drive efficiency, Infineon is actively pursuing cost-saving programs. For instance, the 'Step Up' initiative is designed to generate substantial annual savings, demonstrating a commitment to optimizing operational expenditures and bolstering financial performance.

Supply Chain and Logistics Costs

Infineon Technologies navigates a complex global supply chain, incurring significant expenses for sourcing raw materials, manufacturing components, and transporting finished semiconductor products across the globe. These costs are crucial for maintaining competitive pricing and product availability.

In fiscal year 2023, Infineon reported significant investments in its supply chain infrastructure to enhance efficiency and resilience. For example, logistics and warehousing expenses represented a notable portion of their operating costs, directly impacting the cost of goods sold.

- Procurement Costs: Expenses associated with acquiring raw materials, wafers, and specialized equipment necessary for semiconductor manufacturing.

- Logistics and Transportation: Costs incurred for shipping, freight, and international transit of components and finished goods.

- Warehousing and Inventory Management: Expenses related to storing materials and products, including facility upkeep and inventory control systems.

- Distribution Network: Costs associated with managing and operating the network that delivers products to customers worldwide.

Depreciation and Amortization

Depreciation of manufacturing equipment and amortization of intangible assets, especially those from acquisitions such as Cypress, are key components of Infineon's cost structure. These non-cash expenses highlight the significant capital investment required in the semiconductor sector.

For instance, in fiscal year 2023, Infineon reported depreciation and amortization expenses amounting to €1,470 million. This figure underscores the ongoing cost of maintaining and upgrading its advanced manufacturing facilities and integrating acquired technologies.

- Depreciation: Reflects the wear and tear of physical assets like production machinery.

- Amortization: Accounts for the gradual expensing of intangible assets, such as intellectual property and goodwill from acquisitions.

- Capital Intensity: These costs are inherent to the semiconductor industry's need for high-tech, expensive production equipment.

- Impact on Profitability: While non-cash, these expenses directly reduce reported operating income.

Infineon's cost structure is heavily influenced by its capital-intensive manufacturing operations and significant investment in research and development. These factors, combined with global supply chain expenses and administrative overhead, shape its overall financial profile.

In fiscal year 2024, R&D spending reached approximately €2 billion, highlighting a commitment to innovation. Simultaneously, manufacturing and production costs, including depreciation, represent a substantial portion of expenses, with planned capital expenditures of around €2.5 billion for FY25 to support facility growth.

| Cost Category | FY23 Actual (Millions EUR) | FY24 Estimate (Millions EUR) | FY25 Planned (Millions EUR) |

|---|---|---|---|

| Research & Development | 1,900 (approx.) | 2,000 (approx.) | 2,100 (approx.) |

| Depreciation & Amortization | 1,470 | N/A | N/A |

| Capital Expenditures (Manufacturing) | N/A | N/A | 2,500 (approx.) |

Revenue Streams

Infineon Technologies' automotive semiconductor sales are a cornerstone of its revenue, driven by the increasing demand for advanced electronics in vehicles. This segment generates income through the sale of critical components like microcontrollers, power semiconductors essential for electric vehicles (EVs), and sensors that enable advanced driver-assistance systems (ADAS).

In fiscal year 2023, Infineon's Automotive segment achieved revenues of €5.06 billion, marking a significant 12% increase year-over-year. This growth underscores Infineon's leading position in the automotive semiconductor market, a trend expected to continue as vehicle electrification and automation accelerate.

Infineon Technologies generates revenue by selling power semiconductors and integrated solutions specifically designed for industrial applications. This includes critical components for solar inverters, energy storage systems, and machinery used in industrial automation. These products are vital for companies looking to improve energy efficiency and reduce their carbon footprint.

The demand for these green industrial power products is significantly boosted by the global push towards decarbonization and enhanced energy efficiency. For instance, the renewable energy sector, a major consumer of these components, saw significant growth in 2024, with solar power installations continuing to expand worldwide, directly benefiting Infineon's sales in this segment.

Infineon Technologies generates substantial revenue from selling power and sensor systems. This segment encompasses a wide array of semiconductor solutions critical for modern electronics, from efficient power management in consumer devices to advanced sensors enabling new functionalities.

The demand for these components is significantly boosted by the burgeoning AI data center market. These facilities require high-performance power semiconductors to manage the immense energy needs of AI processing units. In fiscal year 2023, Infineon reported a record revenue of €16.3 billion, with its Power and Sensor Systems segment being a major contributor, reflecting the strong market pull for its advanced solutions.

Sales of Connected Secure Systems

Infineon Technologies generates revenue through the sale of sophisticated connected secure systems. This encompasses a range of products like microcontrollers, specialized security integrated circuits (ICs), and various connectivity solutions. These components are critical for applications such as chip cards, secure payment terminals, government identification documents, and a wide array of Internet of Things (IoT) devices.

The demand for enhanced security and seamless connectivity in an increasingly interconnected world drives this revenue stream. Infineon's offerings directly address the market's need for smart and secure systems, ensuring data integrity and reliable communication across diverse platforms.

- Microcontrollers: Essential processing units for embedded systems in secure applications.

- Security ICs: Dedicated chips providing hardware-based security features for data protection and authentication.

- Connectivity Solutions: Components enabling reliable and secure wireless or wired communication for IoT and other networked devices.

Licensing and Service Revenue

Infineon Technologies, while predominantly a semiconductor product vendor, also taps into revenue streams from licensing its extensive intellectual property portfolio. This allows other companies to utilize Infineon's patented technologies, contributing to diversification beyond direct product sales.

Furthermore, Infineon offers specialized services, such as crucial functional safety compliance support. This is particularly valuable for automotive and industrial customers who must adhere to stringent safety regulations, creating a recurring service-based revenue stream.

- Intellectual Property Licensing: Infineon's vast patent library, especially in areas like automotive and power semiconductors, can be licensed to third parties.

- Specialized Services: This includes technical consulting, design support, and compliance assistance, particularly for complex applications like autonomous driving systems.

- Customer Training and Support: Providing advanced training on their product integration and application development can also generate service revenue.

Infineon Technologies generates revenue primarily through the sale of semiconductors across its key segments: Automotive, Industrial, Power & Sensor Systems, and Connected Secure Systems. These segments are driven by strong market trends like vehicle electrification, industrial automation, and the growing demand for AI and IoT solutions.

In fiscal year 2024 (ending September 30, 2024), Infineon's revenue is projected to be around €16.9 billion, with the Automotive segment continuing to be a significant contributor, reflecting the ongoing demand for advanced automotive electronics.

| Segment | FY23 Revenue (€ Billion) | Key Growth Drivers |

|---|---|---|

| Automotive | 5.06 | EVs, ADAS, digitalization |

| Industrial | 3.63 | Renewable energy, industrial automation |

| Power & Sensor Systems | 5.63 | AI data centers, consumer electronics |

| Connected Secure Systems | 1.98 | IoT security, smart cards |

Business Model Canvas Data Sources

The Infineon Technologies Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic analysis of the semiconductor industry. These sources provide the foundation for understanding customer needs, competitive landscapes, and operational efficiencies.