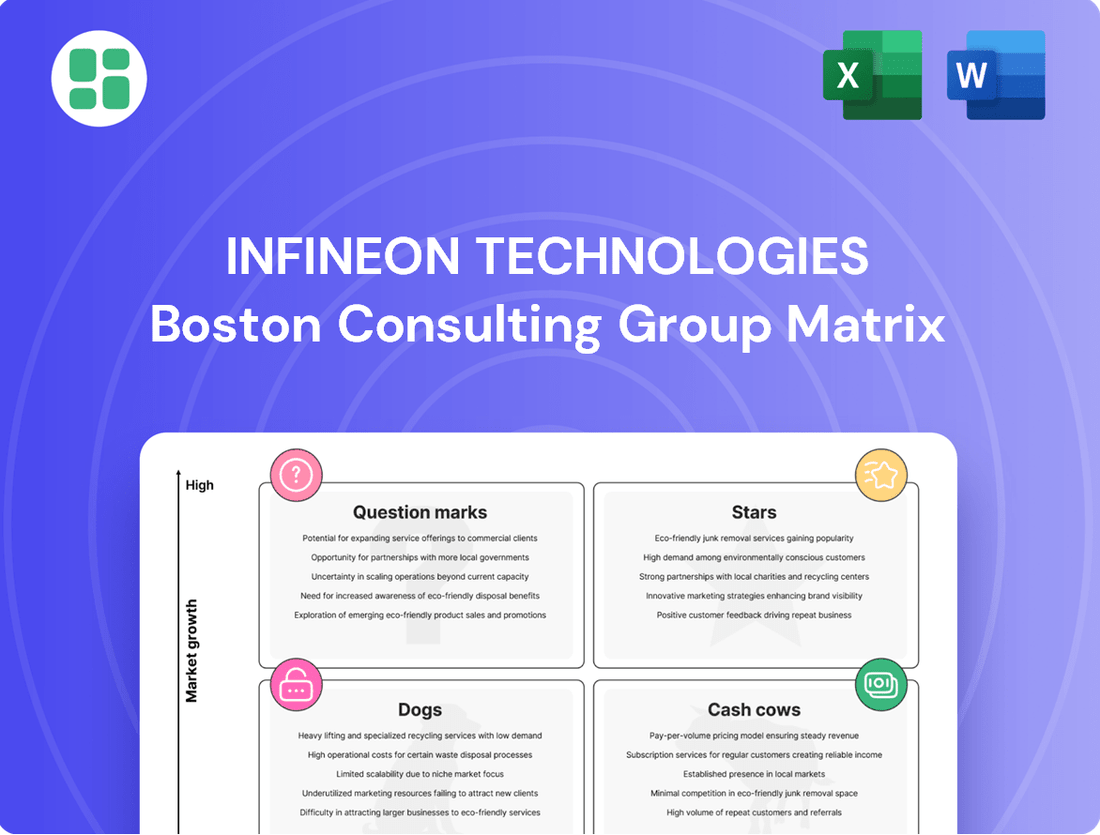

Infineon Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

Curious about Infineon Technologies' product portfolio performance? Our preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks within their offerings.

To truly understand where Infineon Technologies is investing and where its future growth lies, you need the full picture. Purchase the complete BCG Matrix report for detailed quadrant placements, actionable insights, and a clear roadmap for strategic decision-making.

Don't miss out on the critical intelligence needed to navigate the competitive semiconductor landscape. Get the full BCG Matrix and unlock a comprehensive analysis that will empower your investment and product strategies.

Stars

Infineon Technologies' automotive microcontrollers (MCUs) are a clear star in their portfolio. In 2024, the company commanded an impressive 32.0% of the global automotive MCU market, demonstrating a substantial lead over rivals. This strong market position is fueled by the increasing demand for MCUs in critical automotive applications like advanced driver assistance systems (ADAS) and the burgeoning trend of software-defined vehicles, both of which represent high-growth segments.

Even with a slight downturn in the broader automotive semiconductor market during 2024, Infineon's MCU division managed to post growth. This resilience is directly attributable to the accelerating digitalization within vehicles, a trend that necessitates more sophisticated and powerful microcontrollers. The company's strategic focus on these evolving automotive needs has solidified its star status in this segment.

Infineon Technologies is a dominant force in the burgeoning Silicon Carbide (SiC) power semiconductor sector, a market poised for substantial growth fueled by the electric vehicle (EV) and renewable energy industries. SiC's inherent advantages, such as higher efficiency and power density, make it ideal for critical EV components like traction inverters and onboard chargers.

This strategic focus positions Infineon's SiC offerings as a strong contender, likely a Star or Question Mark in its BCG Matrix, given the high growth potential of the EV market. The company’s commitment is underscored by its significant investments in transitioning to 200mm SiC production, with initial product releases anticipated in Q1 2025, signaling a proactive approach to capturing future market share.

The Gallium Nitride (GaN) power semiconductor market is poised for significant expansion, with annual growth rates projected to be robust. Infineon Technologies is strategically increasing its footprint in this high-potential sector.

GaN technology provides distinct advantages, including enhanced power density, quicker switching capabilities, and reduced energy dissipation. These attributes make it exceptionally well-suited for demanding applications such as rapid charging devices, advanced industrial robotics, and efficient solar power inverters.

Infineon's dedication to advancing GaN technology is evident in its plans to commence shipments of 300mm GaN wafer samples by the fourth quarter of 2025. This initiative underscores their commitment to scaling production and meeting the escalating demand for this cutting-edge semiconductor material.

Semiconductors for AI Data Centers

Semiconductors for AI Data Centers are a significant growth area for Infineon, aligning with the booming demand for AI infrastructure. This segment is crucial for the company's future, driven by the increasing need for efficient power management in high-performance computing environments.

Infineon's offerings in this space are critical for powering the complex systems within AI data centers. The market for AI data center semiconductors is projected for substantial growth, with estimates suggesting a compound annual growth rate (CAGR) well into the double digits through 2030.

- Market Growth: The AI data center semiconductor market is anticipated to experience a CAGR exceeding 20% through 2030, driven by the exponential growth of AI workloads.

- Infineon's Role: Infineon provides essential power semiconductors, including MOSFETs and power modules, that are vital for the efficiency and reliability of AI servers and infrastructure.

- Technological Advantage: The company's expertise in advanced packaging and power efficiency technologies directly addresses the critical need for high-density, low-loss power solutions in AI data centers.

- Strategic Focus: This segment represents a key pillar of Infineon's strategy, positioning the company to capitalize on the ongoing digital transformation and the increasing computational demands of artificial intelligence.

Advanced Driver Assistance Systems (ADAS) Semiconductors

Infineon's semiconductors are critical components for advanced driver assistance systems (ADAS) and automotive safety features, a market segment that continues to expand as vehicles become more autonomous. The company's robust position in microcontrollers specifically designed for ADAS applications underscores its significant contribution to the advancement of vehicle electrical/electronic (E/E) architectures.

This focus directly supports the industry-wide shift towards software-defined vehicles, a key trend shaping the future of automotive design and functionality. In 2024, the automotive semiconductor market, particularly for ADAS, saw continued strong demand, with Infineon capturing a notable share.

- Market Growth: The global ADAS market is projected to reach over $60 billion by 2027, driven by increasing safety regulations and consumer demand for driver assistance features.

- Infineon's Share: Infineon holds a leading position in automotive microcontrollers, a key segment for ADAS, with its AURIX family of processors powering many next-generation systems.

- E/E Architecture: The transition to centralized E/E architectures in vehicles, enabled by advanced semiconductors like those from Infineon, is crucial for integrating complex ADAS functionalities.

- Software-Defined Vehicles: Semiconductors are the backbone of software-defined vehicles, allowing for over-the-air updates and new feature deployments, a trend that gained significant momentum in 2024.

Infineon's automotive microcontrollers (MCUs) are a prime example of a Star in their BCG Matrix. In 2024, the company held a significant 32.0% share of the global automotive MCU market, demonstrating strong leadership. This dominance is driven by the increasing adoption of advanced driver assistance systems (ADAS) and the shift towards software-defined vehicles, both high-growth areas.

Despite a slight dip in the overall automotive semiconductor market in 2024, Infineon's MCU division showed growth, highlighting the essential role of these components in vehicle digitalization. The company's strategic focus on meeting these evolving automotive demands solidifies its Star status in this segment.

| Product Segment | Market Growth | Infineon's Market Share (2024) | BCG Category |

| Automotive MCUs | High | 32.0% | Star |

| Silicon Carbide (SiC) | Very High | Significant (growing) | Star/Question Mark |

| Gallium Nitride (GaN) | High | Growing | Question Mark |

| AI Data Center Semiconductors | Very High (CAGR >20%) | Key Supplier | Question Mark |

| ADAS Semiconductors | High (Market >$60B by 2027) | Leading | Star |

What is included in the product

The Infineon Technologies BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides clear guidance on which business units to invest in, hold, or divest based on their market share and growth potential.

Infineon's BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Infineon Technologies is a powerhouse in automotive semiconductors, holding a commanding 13.5% global market share in 2024. Within this, their traditional silicon-based power semiconductors for conventional vehicles are a prime example of a cash cow.

While newer technologies might promise higher growth, these established components are the bedrock of Infineon's automotive revenue. They are mature products, meaning the market isn't expanding rapidly, but Infineon's strong position ensures consistent, substantial cash generation from these essential automotive parts.

Infineon Technologies holds a strong position in industrial power control solutions, particularly within mature applications. These established silicon-based power semiconductors are foundational to sectors like motor drives and traditional power supplies, representing a significant portion of their revenue. In 2023, Infineon's Power and Sensor Systems segment, which includes these industrial applications, generated approximately €5.7 billion in revenue, demonstrating the ongoing demand for these critical components.

The widespread adoption and essential nature of these power semiconductors in diverse industrial machinery contribute to stable and predictable cash flows for Infineon. While the growth rate in these mature segments might be moderate compared to emerging technologies, Infineon's substantial market share ensures consistent profitability and a reliable revenue stream, acting as a true cash cow for the company.

Infineon's 28nm security ICs and smart card solutions are firmly positioned as cash cows. This mature technology, a workhorse in payment, ID, and transit, is projected to be embedded in a staggering 1 billion devices by spring 2025, underscoring its vast market penetration.

The established reliability and deep customer relationships associated with this 28nm technology translate into consistent, high-margin revenue streams. It's a classic example of a product with a dominant market share in a relatively stable, low-growth segment, providing a dependable foundation for Infineon's financial performance.

Standard Microcontrollers (Non-Automotive, Mature Applications)

Infineon's standard microcontrollers, serving mature non-automotive sectors like consumer electronics and basic industrial automation, are strong cash cows. These products, benefiting from long-standing designs and widespread market acceptance, demand minimal new investment for marketing or ongoing development. This allows them to consistently generate significant cash flow for the company.

These cash cow segments likely contributed to Infineon's overall microcontroller revenue, which saw robust growth. For instance, in the fiscal year 2023, Infineon's Power & Sensor Systems segment, which includes microcontrollers, reported significant revenue increases, underscoring the stability and profitability of mature product lines.

- Mature Market Dominance: Standard microcontrollers in established non-automotive applications benefit from deep market penetration and brand loyalty.

- Low Investment Needs: Reduced R&D and marketing expenditure for these mature products translates directly into higher profit margins.

- Consistent Cash Generation: These segments provide a reliable and predictable source of cash flow, supporting investment in growth areas.

- Fiscal Year 2023 Performance: Infineon's overall microcontroller business demonstrated strong performance, with mature product lines being a key driver of this stability.

Power & Sensor Systems (Established Consumer/Computing)

The Power & Sensor Systems (PSS) segment, a cornerstone of Infineon's portfolio, operates within the established consumer and computing markets. While this segment's growth trajectory may be moderate, its products, including power MOSFETs and various sensor integrated circuits, are deeply embedded in a vast array of electronic devices, ensuring consistent revenue generation. These mature offerings function as reliable cash cows, contributing steadily to Infineon's overall financial performance despite the inherent low-growth nature of their respective markets.

Infineon's PSS segment, characterized by its established product lines, demonstrates a stable revenue stream. For instance, in the fiscal year 2023, the PSS segment reported revenues of €4.03 billion, highlighting its significant contribution to the company's top line. This segment is crucial for maintaining profitability due to the high volume and widespread adoption of its components in everyday electronics.

- Established Market Presence: PSS products are integral to consumer electronics and computing, benefiting from long-standing market adoption.

- Consistent Revenue Generation: Power MOSFETs and sensor ICs within this segment continue to be high-volume sellers, contributing significantly to Infineon's financial stability.

- Profitability Driver: Despite lower growth rates, the mature nature of PSS products allows for efficient production and consistent profit margins, solidifying its cash cow status.

- Fiscal Year 2023 Performance: The PSS segment achieved €4.03 billion in revenue, underscoring its importance as a reliable income source for Infineon Technologies.

Infineon's established silicon-based power semiconductors for traditional vehicles are a prime example of a cash cow. These mature components, while not in a high-growth market, form the bedrock of Infineon's automotive revenue, ensuring consistent and substantial cash generation. In 2024, Infineon held a commanding 13.5% global market share in automotive semiconductors, with these traditional components being a significant contributor.

Infineon's 28nm security ICs and smart card solutions are also strong cash cows, deeply embedded in payment, ID, and transit systems. By spring 2025, these are projected to be in 1 billion devices, highlighting their vast market penetration and the consistent, high-margin revenue they provide due to established reliability and customer relationships.

Standard microcontrollers for mature non-automotive sectors, such as consumer electronics and basic industrial automation, represent another cash cow segment. These products require minimal new investment, allowing them to consistently generate significant cash flow for Infineon, supporting growth areas within the company.

The Power & Sensor Systems (PSS) segment, particularly its established consumer and computing products like power MOSFETs, function as reliable cash cows. Despite moderate growth, their deep embedment in numerous electronic devices ensures consistent revenue. In fiscal year 2023, PSS reported €4.03 billion in revenue, underscoring its importance for Infineon's financial stability.

| Product Segment | Market Characteristic | Cash Flow Contribution | Key Metric | Fiscal Year 2023 Revenue (approx.) |

| Automotive Power Semiconductors (Traditional) | Mature, Stable | High & Consistent | 13.5% Global Market Share (2024) | N/A (Part of larger segments) |

| 28nm Security ICs & Smart Cards | Mature, High Penetration | High & Consistent | Projected 1 Billion Devices (Spring 2025) | N/A (Part of larger segments) |

| Standard Microcontrollers (Non-Automotive) | Mature, Low Investment | High & Consistent | Minimal R&D/Marketing Needs | N/A (Part of larger segments) |

| Power & Sensor Systems (Consumer/Computing) | Mature, High Volume | High & Consistent | Deep Device Embedment | €4.03 Billion (PSS Segment) |

What You See Is What You Get

Infineon Technologies BCG Matrix

The preview you see is the exact Infineon Technologies BCG Matrix report you'll receive upon purchase, offering an unwatermarked, fully formatted analysis ready for immediate strategic application. This comprehensive document, meticulously crafted with industry insights, will be delivered directly to you, ensuring no compromises on quality or content. What you're viewing is the final, professional-grade BCG Matrix, complete with all data and strategic commentary, available for download and integration into your business planning. This isn't a sample; it's the actual, analysis-ready BCG Matrix report for Infineon Technologies, empowering you with actionable insights the moment you acquire it.

Dogs

Legacy 8-bit microcontrollers, representing older technology, are likely facing a shrinking market as newer, more capable 16-bit and 32-bit systems become standard. Infineon's position here would be in a low-growth segment where market share may be declining, necessitating minimal investment but yielding low returns. The company may be strategically reducing its focus on these products as they become less competitive in the evolving semiconductor landscape.

Certain highly commoditized standard logic and discrete components, where differentiation is minimal and competition is fierce, could be considered Dogs within Infineon Technologies' BCG Matrix. These products typically have low profit margins and operate in a low-growth market, with the global discrete semiconductor market projected to grow at a modest CAGR of around 4% through 2027. Infineon may continue to offer them to complete a portfolio, but they are unlikely to be strategic growth drivers, contributing a smaller portion to overall revenue compared to their more innovative counterparts.

Older generations of mobile phone RF components, such as those primarily supporting 2G, 3G, and even some 4G technologies, are increasingly facing a declining market as the world rapidly transitions to 5G. Infineon Technologies, while a leader in RF solutions, likely has specific legacy products within this category that now represent a 'Dog' in its BCG matrix. These components, designed for now-outdated cellular standards, are experiencing reduced demand and therefore generate lower revenue in a shrinking market segment.

Certain Low-End Consumer Application Chips

Certain low-end consumer application chips, designed for price-sensitive markets with minimal innovation and fierce competition, particularly from Asian manufacturers, would likely be categorized as Dogs within Infineon Technologies' BCG Matrix. These segments often feature low growth and intense price pressure, leading to limited profitability. For instance, in 2023, the global market for basic microcontrollers, often found in such applications, saw growth rates below 5%, with margins often in the single digits due to intense competition.

Infineon's strategic emphasis is typically on higher-value, more sophisticated semiconductor solutions where its technological expertise can command better margins and differentiation. Products in the Dog quadrant typically offer little competitive advantage and may consume resources without generating significant returns.

- Low Growth Market: These chips operate in segments with minimal technological advancement and slow market expansion.

- High Competition: Intense rivalry, especially from lower-cost producers, squeezes profit margins.

- Low Profitability: Limited pricing power and high production costs result in weak financial performance.

- Strategic Divestment Potential: Companies often consider divesting or minimizing investment in Dog segments to reallocate resources to more promising areas.

General Purpose Diodes and Thyristors (Basic)

General purpose diodes and thyristors, the foundational components of many electronic circuits, represent a mature segment for Infineon Technologies. These devices, while critical, typically operate in markets with modest growth expectations and significant price pressures. Infineon's strategic focus is shifting towards more specialized and high-growth areas within the semiconductor landscape.

In 2024, the market for these basic components remained stable but showed little organic expansion. Companies like Infineon often maintain production to serve existing demand and legacy systems, but significant new investment in these product lines is unlikely. The emphasis is on efficiency and cost management rather than innovation.

- Mature Market: General purpose diodes and thyristors operate in a well-established market with limited room for significant expansion.

- Price Competition: Intense competition among manufacturers drives down prices, impacting profitability for basic components.

- Legacy Systems: Demand persists from older electronic designs and repair markets, ensuring continued, albeit slow, sales.

- Strategic Shift: Infineon's growth strategy prioritizes advanced semiconductor solutions with higher value and future potential.

Infineon's "Dogs" likely include older generations of microcontrollers and certain commoditized discrete components. These products operate in low-growth markets with intense price competition, leading to limited profitability. The company's strategy often involves maintaining these products for legacy support rather than significant investment, with a focus on efficiency and cost management.

| Product Category | Market Growth | Profitability | Infineon's Strategic Approach |

|---|---|---|---|

| Legacy 8-bit Microcontrollers | Shrinking | Low | Minimal Investment, Potential Reduction |

| Commoditized Standard Logic/Discretes | Low (e.g., ~4% CAGR through 2027 for discrete semiconductors) | Low Margins | Portfolio Completeness, Low Strategic Focus |

| Older RF Components (2G/3G/some 4G) | Declining | Low | Reduced Demand, Lower Revenue |

| Low-End Consumer Application Chips | Low (e.g., <5% for basic microcontrollers in 2023) | Low Single Digits | Intense Price Pressure, Fierce Competition |

Question Marks

Infineon is introducing a new line of automotive microcontrollers utilizing the RISC-V architecture, specifically designed to meet the increasing computational demands of software-defined vehicles. This segment of the automotive market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 15% in the coming years, driven by advanced driver-assistance systems (ADAS) and in-car infotainment.

As a new entrant to this competitive landscape, Infineon's RISC-V based microcontrollers currently hold a minimal market share. Developing and marketing these chips requires substantial investment in R&D, software development tools, and ecosystem partnerships to challenge established players like NXP and Renesas, who have a strong foothold in the automotive MCU market.

This strategic move positions Infineon's RISC-V automotive microcontrollers as a classic Question Mark within the BCG matrix. The technology offers significant future potential in a rapidly expanding market, but it necessitates considerable capital expenditure and strategic focus to capture market share and achieve profitability against established competitors.

Infineon is strategically positioning itself in the burgeoning humanoid robot sector, anticipating a significant long-term surge in semiconductor demand. This market, while currently in its early stages, presents a substantial growth trajectory.

Given the nascent nature of this field, Infineon's current market share within the specific humanoid robot segment is likely minimal. However, the potential for future gains is considerable.

Developing and commercializing specialized semiconductor solutions for humanoid robots necessitates significant research and development investment. This makes it a high-risk, high-reward endeavor for Infineon, with the potential to capture substantial market share if successful.

Infineon's advanced AI edge computing hardware, crucial for specialized new applications, likely falls into the Question Mark category of the BCG Matrix. While the edge AI market is experiencing rapid growth, with projections indicating a compound annual growth rate of over 30% through 2028, Infineon faces intense competition and the need for significant R&D investment to develop novel architectures and forge strategic alliances.

The success of Infineon in this segment is not guaranteed, given the high capital expenditure required for innovation and the evolving nature of AI hardware demands. However, the potential rewards are substantial; capturing even a small portion of this burgeoning market could translate into significant revenue streams and establish Infineon as a key player in the next wave of intelligent devices.

Next-Generation IoT Security Solutions for New Verticals

Infineon, a recognized leader in IoT and security, faces a strategic imperative to develop next-generation, highly specialized IoT security solutions for emerging verticals. These new markets, such as advanced healthcare IoT or autonomous vehicle systems, represent significant growth potential but demand tailored security architectures and substantial initial investment for market penetration. The competitive landscape is evolving with agile new entrants, necessitating a proactive approach to innovation and adoption.

The global IoT security market was valued at approximately USD 15.5 billion in 2023 and is projected to reach USD 50.2 billion by 2028, exhibiting a compound annual growth rate of 26.4%.

- Targeting High-Growth Verticals: Focusing on sectors like connected healthcare, smart cities, and automotive IoT, where security is paramount and regulatory demands are increasing.

- Tailored Security Architectures: Developing specialized hardware-based security modules and software solutions that address the unique threat vectors and compliance requirements of each new vertical.

- Strategic Partnerships and Ecosystem Building: Collaborating with key players in emerging verticals to co-develop solutions and accelerate market adoption, mitigating the high cost of entry.

- Addressing Emerging Threats: Investing in research and development for quantum-resistant cryptography and AI-driven threat detection to secure future IoT deployments.

Advanced Radar and Lidar Components for Fully Autonomous Driving

Infineon's strength in Advanced Driver-Assistance Systems (ADAS) is well-established, but its standing in the highly specialized and rapidly evolving market for advanced radar and lidar components essential for Level 4 and Level 5 autonomous driving could be considered a Question Mark within the BCG Matrix. This segment presents a substantial growth opportunity, driven by the increasing demand for sophisticated perception systems in self-driving vehicles.

The development of these cutting-edge components demands significant investment in research and development, coupled with substantial technological challenges that must be addressed for broad market penetration. For instance, the global market for automotive lidar alone was projected to reach over $4.5 billion by 2024, with significant growth anticipated in the years following as autonomous driving technology matures.

- High Growth Potential: The market for autonomous driving sensors is expected to expand dramatically, with projections suggesting a compound annual growth rate (CAGR) exceeding 25% in the coming years for lidar and advanced radar.

- Intense R&D Investment: Companies like Infineon must allocate substantial capital to R&D to develop next-generation sensor technologies that offer superior resolution, range, and reliability for fully autonomous applications.

- Technological Hurdles: Overcoming challenges such as cost reduction, miniaturization, and robust performance in diverse environmental conditions remains critical for widespread adoption of these advanced components.

- Competitive Landscape: The advanced sensor market is highly competitive, with established players and emerging startups vying for market share, necessitating continuous innovation and strategic partnerships.

Infineon's new RISC-V automotive microcontrollers represent a significant investment in a high-growth market, aiming to capture share from established players. Despite current minimal market penetration, the projected 15% CAGR for software-defined vehicles highlights the substantial future potential. This venture requires considerable R&D and ecosystem development to succeed.

The company's ventures into humanoid robot semiconductors and advanced AI edge computing hardware are also classified as Question Marks. These areas, while offering immense future growth, demand substantial upfront investment and face intense competition, making their success uncertain but potentially highly rewarding.

Infineon's specialized IoT security solutions for emerging verticals, such as connected healthcare and autonomous vehicles, are similarly positioned. With the IoT security market projected to reach USD 50.2 billion by 2028, Infineon's tailored architectures and strategic partnerships are crucial for navigating this high-investment, high-potential segment.

The advanced radar and lidar components for Level 4/5 autonomous driving also fall into the Question Mark category. The automotive lidar market alone was expected to exceed $4.5 billion by 2024, underscoring the significant growth potential, yet the substantial R&D and technological hurdles present considerable challenges.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.