Indus Towers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

Unlock the secrets to Indus Towers's success with our comprehensive PESTLE analysis. Discover how political stability, economic growth, and technological advancements are shaping its strategic landscape. Don't just react to market changes—anticipate them. Download the full analysis now and gain the foresight needed to make informed decisions.

Political factors

The Indian government's 'Digital India' and 'BharatNet' initiatives are significant tailwinds for Indus Towers. These programs are designed to bring digital connectivity to every corner of the nation, especially rural areas. This expansion directly translates into a heightened need for robust telecom infrastructure, which is precisely what Indus Towers provides.

The push for greater internet penetration means more towers are needed to support the network. BharatNet, in particular, aims to connect over 250,000 gram panchayats with broadband. This requires substantial investment in fiber optic networks and the towers to house the necessary equipment, directly benefiting tower companies like Indus Towers.

In 2023-24, the government allocated ₹6,000 crore for BharatNet, signaling a continued commitment to rural digital infrastructure. This ongoing investment underscores the sustained demand for tower infrastructure, a core business for Indus Towers, as the country strives to achieve universal connectivity.

The Telecommunications Act, 2023, and associated rules like the Telecommunications (Telecom Cyber Security) Rules, 2024, are reshaping the Indian telecom landscape. These regulations introduce new guidelines for spectrum allocation, access to infrastructure, and cybersecurity mandates, directly influencing how tower companies like Indus Towers operate.

These changes are expected to streamline processes such as spectrum assignment and right-of-way approvals, potentially reducing operational friction. However, the cybersecurity rules, in particular, may necessitate increased investment in compliance and technology, impacting operational costs and strategic planning for the sector.

India's telecom sector is a prime destination for Foreign Direct Investment (FDI), with a generous 100% allowance under the automatic route. This open policy environment is a significant draw for international capital, crucial for the sector's ongoing infrastructure development. For Indus Towers, these favorable FDI policies translate directly into a more robust environment for attracting the necessary investments to expand and upgrade its extensive network infrastructure.

Spectrum Allocation and Pricing

Government decisions regarding spectrum auctions and pricing are pivotal for mobile network operators, directly impacting their capital expenditure. For instance, the Indian government's spectrum auctions, such as the one held in August 2023 which garnered ₹1.5 lakh crore (approximately $18 billion) in bids, significantly shape operator spending. These decisions influence how much operators invest in expanding their networks and upgrading infrastructure, which in turn affects their need for tower services from companies like Indus Towers.

The allocation of specific spectrum bands, particularly for 5G deployment, is a key political factor. Operators' strategies for rolling out 5G services are heavily dependent on the availability and cost of these frequencies. This directly translates into demand for new tower tenancies and the enhancement of existing tower infrastructure to support advanced technologies, impacting Indus Towers' business development and revenue streams.

The pricing of spectrum can also indirectly influence the overall financial health of telecom operators. Higher spectrum costs might lead to more conservative network expansion plans, potentially slowing down the demand for new tower infrastructure or upgrades. Conversely, favorable pricing could accelerate these investments, benefiting tower companies.

- Spectrum Auction Revenue: India's August 2023 spectrum auction saw bids totaling ₹1.5 lakh crore, highlighting significant operator investment driven by government policy.

- 5G Rollout Impact: Government allocation of mid-band and high-band spectrum is crucial for 5G, directly influencing operator demand for tower capacity.

- Operator Financial Health: Spectrum pricing policies can affect operator cash flows, indirectly impacting their ability to invest in tower infrastructure.

Political Stability and Geopolitics

Political stability in India is a cornerstone for attracting and sustaining the significant long-term infrastructure investments required by tower companies like Indus Towers. A predictable policy environment reduces perceived risk for investors, encouraging capital deployment into network expansion and upgrades. For instance, the Indian government's continued focus on digital infrastructure, as seen in initiatives like Digital India, provides a supportive backdrop.

Geopolitical factors also play a crucial role, influencing the cost and availability of essential telecom equipment. Trade relations, tariffs, and potential supply chain disruptions stemming from global events can directly impact Indus Towers' operational expenses and expansion timelines. The ongoing global semiconductor shortage, for example, has highlighted the vulnerability of supply chains for critical network components.

- Government Support for Digital Infrastructure: The Indian government's commitment to expanding 5G and broadband penetration, as evidenced by the National Broadband Mission, directly benefits tower infrastructure providers.

- Trade Policies and Tariffs: Changes in international trade agreements or the imposition of tariffs on electronic components could increase the cost of equipment for Indus Towers, impacting capital expenditure.

- Geopolitical Tensions: Global geopolitical instability can lead to supply chain disruptions, affecting the timely procurement of tower equipment and raw materials, potentially delaying network deployment.

- Regulatory Stability: Consistent and predictable regulatory frameworks regarding tower infrastructure, spectrum allocation, and right-of-way approvals are vital for long-term investment planning.

Government initiatives like Digital India and BharatNet are creating a strong demand for telecom infrastructure, directly benefiting Indus Towers. The Telecommunications Act of 2023 and related cybersecurity rules are also shaping the operational landscape, potentially increasing compliance costs but also streamlining processes. India's open FDI policy, allowing 100% foreign investment in telecom, is a significant advantage for attracting capital for network expansion.

Spectrum auctions, such as the ₹1.5 lakh crore generated in August 2023, directly influence operator spending on network upgrades and expansion, thereby impacting tower demand. The allocation of spectrum for 5G is particularly critical, driving the need for new tenancies and enhanced existing infrastructure. Favorable spectrum pricing can accelerate these investments, while higher costs might temper expansion plans.

Political stability is crucial for attracting long-term infrastructure investment, with government support for digital infrastructure providing a stable operating environment. Geopolitical factors, including trade policies and global tensions, can affect equipment costs and supply chain reliability, influencing capital expenditure and deployment timelines.

| Political Factor | Impact on Indus Towers | Supporting Data/Example |

|---|---|---|

| Government Digital Initiatives | Increased demand for tower infrastructure | BharatNet aims to connect 250,000+ gram panchayats; ₹6,000 crore allocated for BharatNet in 2023-24. |

| Telecom Regulations | Potential for streamlined processes, increased compliance costs | Telecommunications Act, 2023; Telecommunications (Telecom Cyber Security) Rules, 2024. |

| FDI Policy | Facilitates capital inflow for network development | 100% FDI allowed under automatic route in the telecom sector. |

| Spectrum Auction Outcomes | Influences operator CAPEX and tower demand | August 2023 spectrum auction garnered ₹1.5 lakh crore in bids. |

| Geopolitical Stability & Trade | Affects equipment costs and supply chain | Global semiconductor shortages impacting network component availability. |

What is included in the product

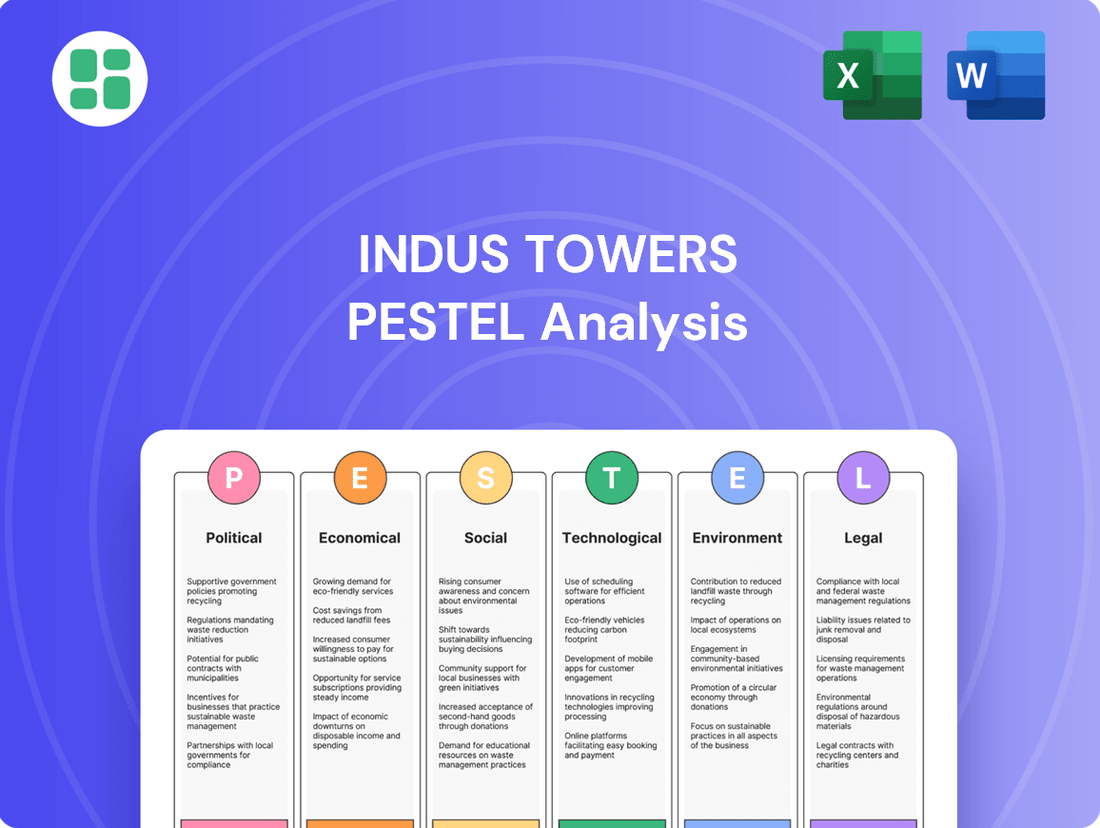

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Indus Towers, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making and identify potential threats and opportunities within the dynamic telecom infrastructure sector.

This PESTLE analysis of Indus Towers provides a clear, summarized version of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

By dissecting the external landscape into Political, Economic, Social, Technological, Legal, and Environmental factors, this analysis offers a structured approach to understanding and mitigating risks, thereby relieving the pain of uncertainty.

Economic factors

India's economy is projected to grow significantly, with the IMF forecasting a 6.5% GDP growth for FY25. This expansion fuels demand for digital services, leading to increased data consumption. For instance, average data consumption per user in India reached approximately 25 GB per month in late 2024, a substantial rise from previous years.

The accelerating digitalization across all sectors, from e-commerce to digital payments, is a key driver for telecom infrastructure. As more Indians adopt smartphones and engage in online activities, the need for robust and widespread network coverage becomes paramount. This trend directly translates into a greater requirement for telecom towers, which is a core business for Indus Towers.

Indus Towers, as a leading telecom tower company, is well-positioned to capitalize on this growth. The company's extensive network of over 400,000 towers across India provides the foundational infrastructure for this digital surge. With the government's push for digital India, the demand for 5G deployment and enhanced connectivity will continue to drive tower infrastructure expansion, benefiting Indus Towers.

The capital expenditure (Capex) plans of major Indian telecom operators, including Reliance Jio, Bharti Airtel, and Vodafone Idea, are pivotal for Indus Towers. These operators' investments directly translate into demand for tower infrastructure.

While the initial 5G rollout phase might see a moderation in new tower construction, the ongoing need for network densification and upgrades, particularly for 4G services, continues to fuel demand. For instance, Bharti Airtel's Capex for FY24 was reported to be around INR 21,000 crore, with a significant portion allocated to network expansion and 5G deployment.

Reliance Jio's aggressive expansion strategies and Vodafone Idea's efforts to revitalize their network also present sustained opportunities for Indus Towers. The continuous investment in network quality and coverage by these MNOs ensures a consistent revenue stream for tower companies.

Average Revenue Per User (ARPU) for Indian telecom operators is a critical metric influencing their financial stability and capacity for network investments. For instance, in the fiscal year ending March 2024, the ARPU for major Indian telcos like Bharti Airtel and Reliance Jio saw continued upward movement, with Airtel reporting an ARPU of ₹200 and Jio around ₹180, reflecting increased data consumption and tariff adjustments.

This trend directly benefits passive infrastructure providers like Indus Towers. As operators generate more revenue per user, their financial health improves, enabling them to allocate greater capital towards expanding their 5G networks and maintaining existing tower infrastructure, which is essential for Indus Towers' business model.

Inflation and Interest Rates

Inflation presents a significant challenge for Indus Towers by increasing operational expenditures. For instance, the Consumer Price Index (CPI) in India, a key indicator of inflation, stood at 4.83% in April 2024, a slight decrease from March's 5.66%. This rise in general prices directly impacts costs for energy, raw materials, and maintenance services essential for tower operations.

Rising interest rates, driven by central bank policies to curb inflation, also pose a risk. The Reserve Bank of India (RBI) has maintained its repo rate at 6.50% since February 2023. Higher borrowing costs can make it more expensive for Indus Towers to finance new infrastructure projects or expand its network. Furthermore, it can impact the financial capacity of telecom operators, their primary clients, to invest in new sites or upgrades, potentially slowing down demand for Indus Towers' services.

- Inflationary pressures on operational costs: Increased expenses for energy and maintenance directly impact Indus Towers' profitability.

- Impact of interest rates on debt financing: A sustained repo rate of 6.50% by the RBI can increase the cost of capital for expansion.

- Client investment capacity: Higher interest rates may reduce telecom operators' willingness to invest in new tower infrastructure, affecting Indus Towers' revenue growth.

- Economic slowdown risk: Persistent inflation and high interest rates could lead to a broader economic slowdown, further dampening demand for telecom services and tower infrastructure.

Competition and Market Dynamics

The competitive intensity among Indian telecom operators directly affects Indus Towers' pricing power and the number of tenants on its towers. As of early 2025, the market remains dominated by a few large players, but the ongoing efforts of these operators to optimize their infrastructure spending create a dynamic environment for tower companies. For instance, the drive for 5G deployment necessitates significant investment, potentially leading to more co-location agreements, but also puts pressure on rental rates.

Indus Towers, with its substantial market share, is well-positioned, but shifts in market structure, such as potential mergers or the emergence of new infrastructure-light models, could alter revenue streams. The industry is constantly adapting, and staying ahead of these competitive pressures is crucial for sustained growth.

- Market Share: Indus Towers operates over 220,000 towers, serving approximately 300,000 tenancies as of late 2024, indicating a dominant position in the Indian market.

- Tenancy Ratio: The average tenancy ratio, a key metric reflecting tower utilization and revenue generation, is influenced by the consolidation and expansion strategies of telecom operators.

- Pricing Pressure: Intense competition among telecom providers can lead to downward pressure on tower rental prices as operators seek cost efficiencies.

- 5G Rollout Impact: The ongoing 5G network expansion is a significant driver, potentially increasing demand for new tower sites and co-location, but also requiring operators to negotiate terms that balance investment needs with operational costs.

India's robust economic growth, projected at 6.5% GDP for FY25 by the IMF, is a significant tailwind for Indus Towers. This expansion fuels digital adoption, with average data consumption per user nearing 25 GB monthly by late 2024, directly increasing demand for telecom infrastructure.

The digitalization trend, from e-commerce to digital payments, necessitates expanded network coverage, a core business for Indus Towers. As telecom operators like Bharti Airtel and Reliance Jio invest heavily in network upgrades and 5G deployment, with Airtel's FY24 Capex around INR 21,000 crore, this translates into sustained demand for tower services.

However, inflationary pressures, with India's CPI at 4.83% in April 2024, increase operational costs for Indus Towers, impacting profitability. Furthermore, the Reserve Bank of India's sustained repo rate of 6.50% raises borrowing costs for expansion and can constrain telecom operators' investment capacity, potentially slowing demand for tower infrastructure.

| Economic Factor | Impact on Indus Towers | Key Data Point (2024-2025) |

| GDP Growth | Increased demand for telecom services and infrastructure | IMF projects 6.5% GDP growth for FY25 |

| Data Consumption | Higher utilization of tower infrastructure | Average data consumption ~25 GB/month (late 2024) |

| Inflation (CPI) | Increased operational expenditures | CPI at 4.83% (April 2024) |

| Interest Rates (Repo Rate) | Higher cost of capital, potential impact on client investment | RBI repo rate maintained at 6.50% (since Feb 2023) |

| Telecom Operator Capex | Direct driver of demand for tower services | Bharti Airtel FY24 Capex ~INR 21,000 crore |

What You See Is What You Get

Indus Towers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Indus Towers' PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Indus Towers.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the strategic landscape for Indus Towers.

Sociological factors

India's population, projected to reach 1.44 billion by mid-2024, presents a significant driver for telecom infrastructure growth. This demographic expansion, coupled with a rising urban population that is expected to constitute 44% of the total by 2030, directly fuels the demand for more robust and widespread mobile network coverage.

Increasing urbanization means more people concentrated in smaller areas, necessitating denser tower deployments to ensure consistent connectivity. This trend translates into continuous opportunities for tower companies like Indus Towers to expand their footprint and upgrade existing infrastructure to meet escalating data consumption needs.

The surge in digital literacy and smartphone penetration across India is a significant sociological driver for Indus Towers. As of early 2024, smartphone user numbers are projected to exceed 700 million, with significant growth in rural areas. This increasing adoption means more people are relying on mobile data for communication, entertainment, and essential services, directly boosting the demand for the network infrastructure that Indus Towers provides.

Consumers are increasingly demanding faster, more reliable internet access to fuel their consumption of high-definition streaming services, online gaming, and a growing array of digital applications. This shift directly translates into a need for enhanced network infrastructure, making fiberization and advanced 5G capabilities crucial for tower companies like Indus Towers.

In India, mobile data consumption has surged, with the average user consuming approximately 20-25 GB of data per month by early 2024, a significant jump from previous years. This escalating demand underscores the importance of tower companies investing in and upgrading their infrastructure to support this data-hungry consumer base.

Rural-Urban Digital Divide

The digital divide between rural and urban areas in India remains a significant sociological factor. While government initiatives and industry investments are actively working to bridge this gap, the pace of progress and the sheer scale of infrastructure required present ongoing challenges. For Indus Towers, this translates into both a potential hurdle in reaching all areas and a substantial opportunity for expansion.

Efforts to improve rural connectivity are crucial for inclusive growth. As of early 2024, reports indicate that while urban internet penetration is significantly higher, rural areas are gradually catching up, though disparities persist. This expansion necessitates substantial infrastructure development, a core business area for Indus Towers.

- Rural Internet Penetration: While urban areas boast higher connectivity, rural internet access is steadily increasing, driven by government programs.

- Infrastructure Investment: Bridging the digital divide requires significant capital expenditure on towers and related infrastructure, creating a growth avenue for tower companies.

- Digital Inclusion: Expanding connectivity empowers rural communities with access to education, healthcare, and economic opportunities, fostering social equity.

- Market Expansion: Indus Towers can leverage this trend by extending its network coverage into underserved rural regions, tapping into a growing user base.

Public Perception and Health Concerns

Public perception of electromagnetic radiation (EMR) from mobile towers remains a significant sociological factor for Indus Towers. Concerns about potential health impacts, though largely unsubstantiated by major health organizations, can lead to community opposition and delays in new tower installations. This resistance can impact the company's ability to expand its network efficiently. For instance, in 2023, reports indicated that several local bodies across India had raised objections to new tower sites due to public apprehension.

Addressing these health concerns proactively is crucial for Indus Towers to maintain smooth infrastructure deployment and expansion. Building trust through transparent communication and adherence to stringent radiation norms is key. The company's ability to secure site approvals often hinges on community acceptance, making public relations and awareness campaigns vital components of its operational strategy. By demonstrating commitment to safety standards and engaging with local communities, Indus Towers can mitigate potential roadblocks.

The ongoing debate around EMR safety, particularly amplified by social media, means that public perception can shift rapidly. This necessitates continuous monitoring and engagement by Indus Towers. The company's success in deploying new sites is directly linked to its capacity to manage these sociological factors effectively. For example, in Q4 FY24, Indus Towers reported that while network expansion continued, localized community issues sometimes presented minor delays in site acquisition.

- Public apprehension regarding EMR from mobile towers can create hurdles for new installations.

- Community acceptance is paramount for Indus Towers' infrastructure expansion plans.

- Proactive communication and adherence to safety standards are essential to address health concerns.

- Localized community objections occasionally caused minor delays in site acquisition during FY24.

India's burgeoning population, projected to exceed 1.44 billion by mid-2024, coupled with increasing urbanization, fuels a constant demand for enhanced telecom infrastructure. This demographic shift necessitates denser tower deployments, creating sustained opportunities for companies like Indus Towers to expand and upgrade their networks. The growing digital literacy and smartphone penetration, with over 700 million users by early 2024, are key drivers, pushing demand for robust mobile data services.

Technological factors

The accelerated 5G rollout by major Indian telecom operators like Reliance Jio and Bharti Airtel is significantly boosting demand for network densification. This translates to a greater need for Indus Towers' services, particularly in deploying small cells and enhancing fiberized backhaul infrastructure to support the increased data traffic and lower latency promised by 5G. For instance, by the end of 2024, India aims to have a substantial portion of its telecom towers upgraded for 5G, creating a robust pipeline for tower companies.

The relentless surge in data consumption and the rollout of 5G technology are fundamentally reshaping the telecom landscape. This evolution directly impacts tower companies like Indus Towers, as it demands a significant upgrade in their infrastructure. Specifically, the need for extensive fiberization of towers is paramount to handle the increased bandwidth and reduced latency that 5G promises. Without this robust fiber backhaul, the full potential of advanced mobile services cannot be realized.

Indus Towers' strategic advantage hinges on its capacity to deliver this high-speed fiber connectivity. As of late 2024, the Indian telecom sector is actively investing in fiber deployment, with companies aiming to connect a substantial portion of their towers to fiber by 2025 to support 5G densification and enterprise services. This infrastructure upgrade is not just about meeting current demand; it's about future-proofing the network for emerging technologies like IoT and advanced mobile applications, directly impacting Indus Towers' revenue streams and competitive positioning.

Technological shifts towards energy efficiency and renewable energy are reshaping the telecom infrastructure landscape. Indus Towers is actively embracing this by integrating solar and wind power at its sites, aiming to cut operational expenses and environmental impact. For instance, by the end of fiscal year 2024, the company had already deployed over 19,000 sites with green energy solutions, significantly contributing to their sustainability goals.

Internet of Things (IoT) and AI Integration

The increasing number of Internet of Things (IoT) devices, projected to reach over 29 billion by 2030, necessitates robust and intelligent network infrastructure. This surge in connected devices places telecom towers at the forefront, acting as essential connection points for everything from smart city sensors to industrial automation. Indus Towers' infrastructure is thus pivotal in supporting this expanding IoT ecosystem.

Furthermore, the integration of Artificial Intelligence (AI) into network management is transforming operational efficiency. AI algorithms can optimize network performance, predict maintenance needs, and enhance data processing capabilities, all of which rely on the underlying physical infrastructure provided by tower companies like Indus Towers. For instance, AI-driven predictive maintenance can reduce downtime, ensuring continuous connectivity for a growing number of IoT applications.

- IoT Growth: Global IoT connections are expected to surpass 29 billion by 2030, demanding advanced connectivity solutions.

- AI in Networks: AI is increasingly used for network optimization, predictive maintenance, and enhanced data analytics in telecommunications.

- Tower Role: Telecom towers are critical for aggregating and backhauling data from a vast array of IoT devices.

- Infrastructure Demand: The need for pervasive and intelligent infrastructure to support AI and IoT integration drives demand for tower services.

Next-Generation Technologies (e.g., 6G)

While the global 5G rollout continues, with significant investment in infrastructure, the horizon is already being shaped by advancements towards 6G. This next generation of wireless technology promises even faster speeds, lower latency, and enhanced connectivity, which will fundamentally alter the demand for robust telecom infrastructure. Indus Towers, by staying abreast of these emerging technologies, can strategically position itself to capitalize on future infrastructure needs.

Early engagement in research and development for 6G and related next-generation technologies is crucial. This proactive approach allows Indus Towers to anticipate the evolving requirements of the telecommunications sector. For instance, 6G is expected to enable truly immersive experiences and advanced AI applications, necessitating a more sophisticated and denser network infrastructure than currently exists.

- Projected 6G Speeds: Anticipated to be up to 100 times faster than 5G, potentially reaching terabits per second.

- Latency Reduction: Expected to achieve sub-millisecond latency, critical for real-time applications like autonomous systems and remote surgery.

- Increased Capacity: Designed to support a massive increase in connected devices, far exceeding current 5G capabilities.

The ongoing 5G expansion in India is a significant driver for Indus Towers, necessitating infrastructure upgrades like fiberization to handle increased data. By late 2024, a substantial number of Indian telecom towers are slated for 5G readiness, creating a strong demand for tower services.

Technological advancements in energy efficiency, such as solar and wind power integration at tower sites, are becoming critical for reducing operational costs. Indus Towers has already implemented green energy solutions across over 19,000 sites by the end of fiscal year 2024, underscoring a commitment to sustainability and cost savings.

The burgeoning Internet of Things (IoT) ecosystem, with projections of over 29 billion connected devices by 2030, highlights the essential role of robust telecom infrastructure. Indus Towers' network is vital for connecting these devices, supporting everything from smart cities to industrial applications.

AI's integration into network management offers substantial benefits, including optimized performance and predictive maintenance, which reduces downtime. This reliance on efficient infrastructure makes tower companies like Indus Towers indispensable for supporting AI-driven applications.

| Technology Trend | Impact on Indus Towers | Key Data/Projection |

|---|---|---|

| 5G Rollout | Increased demand for densification and fiberization | India targeting substantial 5G tower upgrades by end of 2024 |

| Green Energy | Reduced operational costs and environmental footprint | Over 19,000 sites with green energy solutions by FY24 |

| IoT Expansion | Need for robust connectivity infrastructure | Over 29 billion IoT devices projected by 2030 |

| AI in Networks | Enhanced network efficiency and predictive maintenance | AI reduces downtime for critical connectivity |

Legal factors

The Telecommunications Act of 2023, along with its accompanying rules, ushers in a new era by superseding outdated legislation. This modernization effort directly influences key areas for telecom infrastructure providers like Indus Towers, including licensing procedures, spectrum allocation, and the crucial right-of-way processes.

These reforms are designed to streamline operations and foster growth within the sector. For instance, the Act aims to simplify the acquisition of permits for deploying infrastructure, potentially reducing project timelines and costs for companies. Such regulatory shifts are critical for entities managing extensive tower networks across India.

Streamlined Right-of-Way (RoW) regulations are vital for the rapid deployment and expansion of telecom infrastructure, including tower and fiber networks. These policies directly impact the speed and cost of building out essential communication links.

The Indian government, through initiatives like the PM GatiShakti National Master Plan, has been actively working to simplify RoW approval processes. For instance, the Telecom Bill 2023, when enacted, is expected to further rationalize these rules, aiming to reduce project delays and associated costs, a significant benefit for tower companies like Indus Towers.

Telecom tower installations are subject to stringent environmental regulations, requiring clearances for aspects like electromagnetic field (EMF) emissions and visual impact. Adherence to these norms, including noise pollution limits during construction and operation, is critical. Failure to comply can result in significant fines and operational disruptions, impacting companies like Indus Towers.

Data Privacy and Cybersecurity Laws

The Digital Personal Data Protection Act, 2023, and the Telecommunications (Telecom Cyber Security) Rules, 2024, place significant data privacy and cybersecurity obligations on telecom companies like Indus Towers. These regulations mandate robust measures for safeguarding user data and ensuring network security, with non-compliance potentially leading to substantial penalties. Adherence is paramount for maintaining customer trust and avoiding legal liabilities, especially as data breaches become more sophisticated.

Failure to comply with these stringent legal frameworks can result in severe consequences for Indus Towers. For instance, the Digital Personal Data Protection Act, 2023, allows for penalties up to INR 250 crore for data breaches. The Telecom Cyber Security Rules, 2024, further emphasize the need for secure infrastructure and data handling practices.

- Digital Personal Data Protection Act, 2023: Imposes strict data processing and consent requirements.

- Telecom Cyber Security Rules, 2024: Mandates security audits and incident reporting for telecom infrastructure.

- Consumer Trust: Compliance is vital for maintaining user confidence in data handling practices.

- Legal Repercussions: Non-adherence can lead to significant fines and operational disruptions.

Contractual Agreements with Mobile Operators

The legal framework governing Indus Towers' relationships with mobile operators is critical. This includes the specifics of tenancy agreements, which dictate site usage and rental terms, as well as revenue-sharing models that define how income is split. Service Level Agreements (SLAs) are also paramount, setting performance standards for network uptime and maintenance, ensuring the quality of service provided to the operators and their end-users.

Any disputes arising from these contractual agreements, or significant changes to their terms, can directly affect Indus Towers' financial stability. For instance, a major operator renegotiating its tenancy terms or challenging an SLA could lead to reduced revenue streams or increased operational costs. As of the fiscal year ending March 31, 2024, Indus Towers served a substantial base of tenancies, highlighting the sheer volume of these legally binding contracts that underpin its operations.

- Tenancy Agreements: These legally bind Indus Towers and mobile operators for site usage, defining rental payments and contract durations.

- Revenue Sharing: The legal structure of revenue sharing agreements directly impacts Indus Towers' income, often based on co-location fees.

- Service Level Agreements (SLAs): These contracts establish performance benchmarks for network availability and maintenance, with penalties for non-compliance.

- Dispute Resolution: Legal clauses for arbitration or litigation in case of disagreements are crucial for managing potential financial risks.

The Telecommunications Act of 2023 and associated rules are reshaping licensing, spectrum allocation, and right-of-way processes for tower companies like Indus Towers. These reforms aim to simplify infrastructure deployment, potentially cutting project times and costs. Streamlined right-of-way regulations, supported by initiatives like PM GatiShakti, are crucial for rapid network expansion.

Indus Towers must navigate stringent environmental regulations, covering EMF emissions and visual impact, with non-compliance risking fines and disruptions. Furthermore, the Digital Personal Data Protection Act, 2023, and Telecom Cyber Security Rules, 2024, impose significant data privacy and cybersecurity obligations, carrying penalties up to INR 250 crore for data breaches, underscoring the need for robust security measures.

The company's financial health is directly tied to its legal agreements with mobile operators, including tenancy terms, revenue sharing, and Service Level Agreements (SLAs). As of March 31, 2024, Indus Towers managed a vast number of tenancies, highlighting the critical role these contracts play in its operational and financial stability.

| Legal Area | Key Regulations/Acts | Impact on Indus Towers | Potential Consequences of Non-compliance |

|---|---|---|---|

| Licensing & Spectrum | Telecommunications Act, 2023 | Streamlined procedures, potential cost reduction | Delays, fines, operational restrictions |

| Infrastructure Deployment | Right-of-Way (RoW) policies, PM GatiShakti | Faster deployment, reduced project costs | Project delays, increased capital expenditure |

| Environmental Compliance | EMF emission standards, noise pollution limits | Mandatory clearances, operational adherence | Fines, site closures, reputational damage |

| Data Privacy & Security | DPDP Act, 2023; Telecom Cyber Security Rules, 2024 | Strict data handling, security audits | Penalties up to INR 250 crore, loss of customer trust |

| Contractual Agreements | Tenancy, Revenue Sharing, SLAs | Defines revenue streams, performance standards | Reduced revenue, legal disputes, financial penalties |

Environmental factors

Indus Towers is actively pursuing a significant reduction in its carbon footprint, aiming for net-zero emissions by 2050. This commitment is further strengthened by its alignment with the Science Based Targets initiative (SBTi), demonstrating a credible and measurable approach to climate action.

The company's strategy to achieve these ambitious targets involves a two-pronged approach: investing in cutting-edge energy-efficient technologies across its operations and substantially increasing its reliance on renewable energy sources. This focus is crucial for long-term sustainability and operational resilience.

In fiscal year 2023-24, Indus Towers reported a notable reduction in its Scope 1 and Scope 2 emissions, driven by these initiatives. For instance, the company expanded its renewable energy usage to cover over 50% of its total energy consumption, a significant step towards its net-zero goals.

Indus Towers is significantly increasing its use of renewable energy sources, particularly solar power, to lessen reliance on traditional fuels and minimize its environmental footprint. This strategic shift is crucial for meeting sustainability targets and aligning with global climate initiatives.

The company's commitment to green energy is further solidified through collaborations with specialized renewable energy providers. These partnerships are vital for the successful expansion of its solar power infrastructure and the overall achievement of its environmental, social, and governance (ESG) objectives.

By the end of fiscal year 2024, Indus Towers had already achieved a substantial portion of its renewable energy targets, with solar power contributing over 70% of its energy needs at many tower sites. This demonstrates a tangible commitment to reducing carbon emissions and operational costs.

Indus Towers faces significant environmental responsibilities concerning the proper management and recycling of electronic waste (e-waste) generated from its extensive network equipment and batteries. As of 2024, the global e-waste problem continues to escalate, with estimates suggesting over 60 million tonnes generated annually, underscoring the urgency for companies like Indus Towers to implement stringent recycling protocols.

Implementing robust e-waste policies and practices is not just an environmental imperative but also crucial for sustainable operations and regulatory compliance. For instance, the Basel Convention, which regulates the transboundary movement of hazardous wastes and their disposal, impacts how Indus Towers handles its waste streams, requiring responsible disposal methods to prevent environmental harm.

Resource Scarcity and Energy Consumption

Operating a vast telecommunications tower network, like that of Indus Towers, inherently demands substantial energy. In 2023, telecommunications infrastructure globally accounted for approximately 2-3% of total electricity consumption, a figure expected to rise with increasing data traffic and 5G deployment.

Resource scarcity, particularly concerning energy, presents a critical challenge. Indus Towers, with its extensive footprint, must prioritize optimizing energy usage. This involves adopting energy-efficient technologies and exploring renewable energy sources to mitigate operational costs and environmental impact.

Innovative solutions are key to navigating these environmental factors. Companies are increasingly investing in:

- Advanced cooling systems for base stations: Reducing power needed for climate control.

- Smart grid integration: Allowing towers to draw power during off-peak hours or from renewable sources.

- Battery storage solutions: Supplementing grid power and enabling greater use of solar or wind energy.

- Energy-efficient equipment upgrades: Replacing older, power-hungry hardware with newer, more efficient models.

By focusing on these areas, Indus Towers can enhance its long-term sustainability and cost efficiency in an evolving energy landscape.

Climate Change Adaptation and Resilience

Indus Towers recognizes the growing imperative to build climate-resilient infrastructure. This involves designing towers capable of withstanding increasingly frequent and severe extreme weather events, such as cyclones and heavy rainfall, which are projected to intensify in India. For instance, the India Meteorological Department has reported a significant increase in the frequency of extreme weather events in recent years, impacting infrastructure across the country.

Ensuring network continuity during these environmental challenges is paramount for service providers. This necessitates proactive measures like backup power solutions and reinforced tower structures. By investing in resilience, Indus Towers aims to minimize service disruptions and maintain operational stability, safeguarding its revenue streams and client satisfaction amidst a changing climate.

- Infrastructure Hardening: Upgrading tower designs to meet higher wind load standards and seismic resilience requirements.

- Disaster Preparedness: Implementing robust emergency response plans and ensuring availability of backup power sources like generators and advanced battery systems.

- Network Redundancy: Developing strategies for network failover and diversification to maintain connectivity even if individual sites are affected.

- Climate Risk Assessment: Continuously evaluating geographical vulnerabilities and incorporating climate projections into site selection and maintenance protocols.

Indus Towers is committed to reducing its environmental impact, targeting net-zero emissions by 2050 and aligning with the Science Based Targets initiative (SBTi). This involves significant investment in energy-efficient technologies and a substantial increase in renewable energy usage, aiming to cover over 50% of its total energy consumption with renewables by fiscal year 2023-24.

The company is actively increasing its use of solar power, with over 70% of energy needs at many sites met by solar by the end of fiscal year 2024. This strategic shift addresses resource scarcity, particularly energy, and mitigates operational costs and environmental impact.

Indus Towers also faces the challenge of managing electronic waste, with global e-waste escalating annually, necessitating stringent recycling protocols and compliance with international regulations like the Basel Convention.

Furthermore, the company is enhancing climate resilience by designing towers to withstand extreme weather events, as reported by the India Meteorological Department, ensuring network continuity through backup power and reinforced structures.

| Environmental Factor | Indus Towers' Action/Challenge | Supporting Data/Context (2023-2025) |

|---|---|---|

| Carbon Footprint Reduction | Targeting net-zero emissions by 2050; aligned with SBTi. | Aiming for over 50% renewable energy usage by FY2023-24. |

| Renewable Energy Adoption | Increasing solar power usage. | Over 70% of energy needs met by solar at many sites by FY2024. |

| E-Waste Management | Implementing robust recycling protocols. | Global e-waste exceeding 60 million tonnes annually (2024 estimates). |

| Climate Resilience | Building infrastructure to withstand extreme weather. | India Meteorological Department reports increased frequency of extreme weather events. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Indus Towers is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading telecommunications industry reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors affecting the company are both current and credible.